Residential Remodeling Business Plan

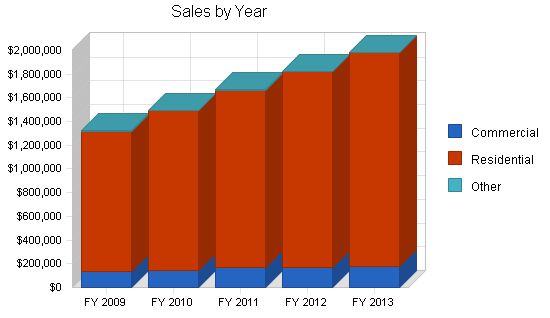

Anywhere Remodeling, Inc. will differentiate itself from fly-by-night contractors and improve its sales and customer service. The goal is to increase sales to over $2 million in three years, while also improving gross profit and working capital. We aim to become recognized as the best quality remodeling company.

This business plan renews our vision and strategic focus: adding value to our target market segments in the local market. It provides a step-by-step plan for improving sales, gross margin, and profitability.

The plan includes this summary and chapters on the company, products and services, market focus, action plans and forecasts, management team, and financial plan, management, and working capital.

1.1 Objectives

– Increase sales to $2 million by June Year 5.

– Improve net profitability to 12% by the end of fiscal year Year 5.

– Allocate 10% of gross sales to the Owner and 10% to the company.

1.2 Mission

Anywhere Remodeling is a full-service remodeling company dedicated to building dream homes for local high-end clients.

We believe that attention to detail and customer service sets us apart from the competition, allowing us to focus on high-end projects. We collaborate with property owners to select top-grade materials and maintain communication even after project completion.

Marketing: Creating desire for our services above competitors and establishing ourselves as the top choice is key to our success. Craftsmanship: Poor-quality work will harm our referral business and remove us from the high-end market. Communication: Effective communication, both internally and with customers, is crucial for completing projects on time, within budget, and to customer satisfaction. We must also ensure responsiveness to customer requests for positive referrals. Building Material prices: Understanding material prices in our area and finding the best deals is essential for profitability.

Anywhere Remodeling, Inc. originally named Right Stuff Construction, was founded in August 1989 in Anywhere, World. Customers pay extra for a sense of trust, which justifies slightly higher prices.

Anywhere Remodeling, Inc. is a majority-owned S corporation. Founder and president Bob Hammer owns the majority shares, with two other part owners, Steve Field and Bill Sales, who are active in management decisions.

Originally a handyman business specializing in house painting, Anywhere Remodeling, Inc. adapted to the market by focusing on remodeling existing homes due to the decrease in new building permits caused by the housing crisis.

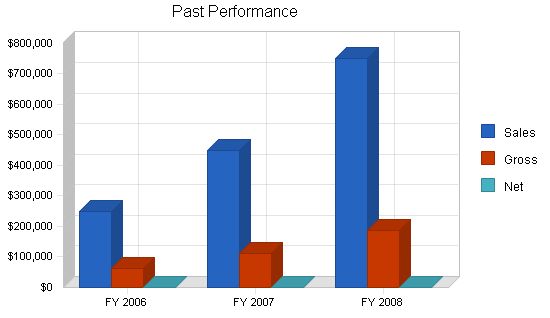

Past Performance:

Sales:

– FY 2006: $250,000

– FY 2007: $450,000

– FY 2008: $750,000

Gross Margin:

– FY 2006: $62,500

– FY 2007: $112,500

– FY 2008: $187,500

Gross Margin %: 25.00%

Operating Expenses:

– FY 2006: $187,500

– FY 2007: $337,500

– FY 2008: $562,500

Collection Period (days):

– FY 2006: 438

– FY 2007: 326

– FY 2008: 472

Balance Sheet:

Current Assets:

Cash:

– FY 2006: $39,748

– FY 2007: $44,165

– FY 2008: $183,428

Accounts Receivable:

– FY 2006: $240,000

– FY 2007: $430,000

– FY 2008: $735,000

Other Current Assets:

– FY 2006: $8,938

– FY 2007: $9,931

– FY 2008: $31,380

Total Current Assets:

– FY 2006: $288,686

– FY 2007: $484,096

– FY 2008: $949,808

Long-term Assets:

Long-term Assets:

– FY 2006: $63,040

– FY 2007: $70,045

– FY 2008: $145,879

Accumulated Depreciation:

– FY 2006: $28,675

– FY 2007: $31,861

– FY 2008: $56,879

Total Long-term Assets:

– FY 2006: $34,365

– FY 2007: $38,184

– FY 2008: $89,000

Total Assets:

– FY 2006: $323,051

– FY 2007: $522,280

– FY 2008: $1,038,808

Current Liabilities:

Accounts Payable:

– FY 2006: $42,731

– FY 2007: $53,000

– FY 2008: $69,720

Current Borrowing:

– FY 2006: $38,458

– FY 2007: $24,965

– FY 2008: $0

Other Current Liabilities (interest free):

– FY 2007: $9,995

– FY 2008: $0

Total Current Liabilities:

– FY 2006: $81,189

– FY 2007: $87,960

– FY 2008: $69,720

Long-term Liabilities:

– FY 2006: $30,143

– FY 2007: $11,492

– FY 2008: $0

Total Liabilities:

– FY 2006: $111,332

– FY 2007: $99,452

– FY 2008: $69,720

Paid-in Capital:

– FY 2006: $15,000

– FY 2007: $7,000

– FY 2008: $20,000

Retained Earnings:

– FY 2006: $196,719

– FY 2007: $415,828

– FY 2008: $949,088

Earnings:

– FY 2006: $0

– FY 2007: $0

– FY 2008: $0

Total Capital:

– FY 2006: $211,719

– FY 2007: $422,828

– FY 2008: $969,088

Total Capital and Liabilities:

– FY 2006: $323,051

– FY 2007: $522,280

– FY 2008: $1,038,808

Other Inputs:

Payment Days: 30

Sales on Credit:

– FY 2006: $200,000

– FY 2007: $375,000

– FY 2008: $450,000

Receivables Turnover:

– FY 2006: 0.83

– FY 2007: 0.87

– FY 2008: 0.61

Products and Services:

Anywhere Remodeling, Inc. is a full-service remodeling contractor specializing in high-end, single room, kitchen/bath, whole house remodels, historic home remodels, wing remodeling, green remodeling, and handyman services.

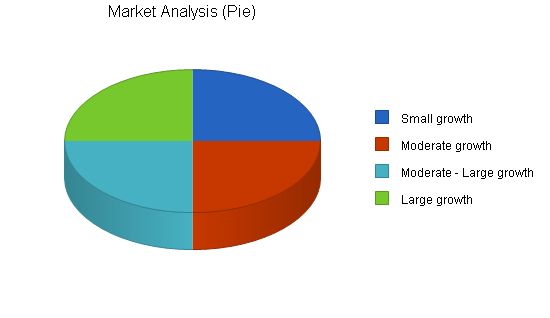

Market Analysis Summary:

Anywhere Remodeling is targeting both the commercial and residential markets in Anytown America, with residential projects comprising 80% of the company’s overall volume. As housing prices decline, homeowners are more likely to remodel their high-end homes rather than selling them.

Market Segmentation:

Anywhere Remodeling, Inc. focuses on two segments of the residential remodeling market. The first segment consists of neighborhoods where homeowners have room in their budget to invest in their homes, but prefer not to sell and incur a larger mortgage payment. The second segment includes run-down neighborhoods targeted for renewal. Additionally, approximately 20% of Anywhere’s projects are for businesses within the community areas undergoing revitalization.

Market Analysis:

2008 2009 2010 2011 2012

Potential Customers Growth CAGR

Small growth 5% 500,000 525,000 551,250 578,813 607,754 5.00%

Moderate growth 7% 500,000 535,000 572,450 612,522 655,399 7.00%

Moderate – Large growth 10% 500,000 550,000 605,000 665,500 732,050 10.00%

Large growth 15% 500,000 575,000 661,250 760,438 874,504 15.00%

Total 9.45% 2,000,000 2,185,000 2,389,950 2,617,273 2,869,707 9.45%

Target Market Segment Strategy:

Anywhere Remodeling’s target market groups were chosen because of the long-term potential for continued sales. Assuming high-quality work and effective word-of-mouth marketing, the targeted neighborhoods offer a continuing supply of work. The business remodels offer an opportunity to build relationships and generate trust with business owners and managers who have homes in the targeted neighborhoods.

Service Business Analysis:

The building industry is fragmented, with no single company having as much as a 2% market share. In the remodeling industry, there are only a handful of companies nationwide with annual sales exceeding $10 million. All remodelers fall into the category of a small business.

Competition and Buying Patterns:

The remodeling market is made up of potential customers who consider three competing values: Price, Quality, and Service. A remodeling company can only deliver any two of those values. Some customers prioritize quality and service and then consider price. Others want a fair price but are primarily concerned with getting quality work and superior service.

Strategy and Implementation Summary:

Anywhere Remodeling, Inc. will differentiate its services from fly-by-night contractors, improve sales and customer service functions, and increase work received from past clients and referrals. The marketing challenge is to improve the company’s image, price work more profitably, reduce or eliminate competitive bidding, and raise the perceived value for clients.

Sales Strategy:

1. Sell the company, not the price.

2. Emphasize quality and service, as they are what customers truly need.

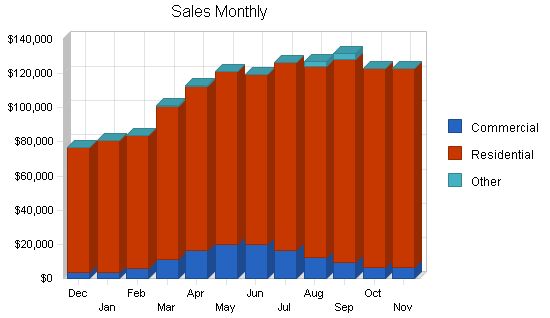

The Total Sales by Month in Year 1 chart shows the important elements of the sales forecast. Sales are expected to increase significantly from $750,000 last year.

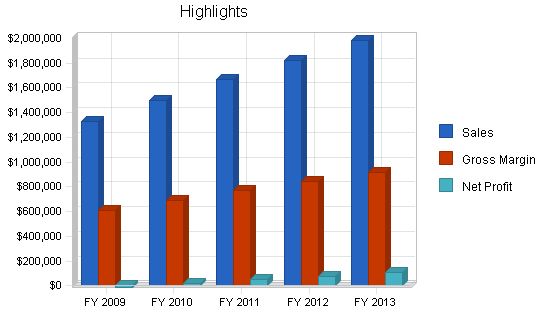

Sales Forecast:

Commercial – $131,791 (FY 2009), $145,000 (FY 2010), $165,000 (FY 2011), $170,000 (FY 2012), $180,000 (FY 2013)

Residential – $1,188,614 (FY 2009), $1,350,000 (FY 2010), $1,500,000 (FY 2011), $1,650,000 (FY 2012), $1,800,000 (FY 2013)

Other – $7,998 (FY 2009), $1,903 (FY 2010), $1,998 (FY 2011), $2,098 (FY 2012), $2,202 (FY 2013)

Total Sales – $1,328,403 (FY 2009), $1,496,903 (FY 2010), $1,666,998 (FY 2011), $1,822,098 (FY 2012), $1,982,202 (FY 2013)

Direct Cost of Sales:

Materials – $225,828 (FY 2009), $254,473 (FY 2010), $283,390 (FY 2011), $309,757 (FY 2012), $336,974 (FY 2013)

Sub Contractor Costs- $464,941 (FY 2009), $523,916 (FY 2010), $583,449 (FY 2011), $637,734 (FY 2012), $693,771 (FY 2013)

Permits & Licensing – $3,385 (FY 2009), $3,554 (FY 2010), $3,732 (FY 2011), $3,919 (FY 2012), $4,115 (FY 2013)

Sales Costs w/commision – $8,369 (FY 2009), $9,730 (FY 2010), $10,835 (FY 2011), $11,844 (FY 2012), $12,884 (FY 2013)

Warranties – $5,067 (FY 2009), $4,752 (FY 2010), $4,989 (FY 2011), $5,239 (FY 2012), $5,501 (FY 2013)

Trash – $6,365 (FY 2009), $6,683 (FY 2010), $7,017 (FY 2011), $7,368 (FY 2012), $7,736 (FY 2013)

Other – $1,930 (FY 2009), $2,027 (FY 2010), $2,128 (FY 2011), $2,234 (FY 2012), $2,346 (FY 2013)

Subtotal Direct Cost of Sales – $715,885 (FY 2009), $805,135 (FY 2010), $895,541 (FY 2011), $978,094 (FY 2012), $1,063,327 (FY 2013)

1. Emphasize quality and service.

2. Build a relationship business–treat the customers like members of the family.

3. Take care of the customers for the rest of their life.

Competitive Edge:

Anywhere Remodeling, Inc. has a reputation in the community, winning awards for quality and design. Its satisfied customers continue to spread the word.

Milestones:

– Business Plan – 10/1/2008 – $500 – Bob Hammer (Owner)

– Community Involvement Program – 2/15/2008 – $5,000 – Bob Hammer (Owner)

– Sales Brochure – 3/1/2008 – $1,800 – David Designer (Sales)

– Refinance Short Term Debt – 3/1/2008 – $0 – Bob Hammer (Owner)

– New Computer System – 7/15/2008 – $8,000 – Bill Sales (Administration)

– Thank You Cards – 1/15/2008 – $250 – David Designer (Sales)

– Pardon the Dust (door hangers) – 1/15/2008 – $200 – David Designer (Sales)

– New Automatic Nail Guns (2) – 1/1/2008 – $3,200 – Steve Field (Production)

– How to Pick a Contractor Seminars – 6/1/2008 – $1,000 – Bob Hammer (Sales)

– Totals – $19,950

Web Plan Summary:

The Anywhere Remodeling website will serve as the virtual business card and portfolio for the company. It will showcase the company’s construction experience and portfolio of past and current projects. The website will also offer resources such as articles, research, and newsletters.

Management Summary:

Anywhere Remodeling aims to help improve the quality of people’s lives. The company values team work and cooperation in serving customers. It prioritizes employee loyalty and provides them with security and satisfaction.

Personnel Plan:

FY 2009 – $179,829

FY 2010 – $179,829

FY 2011 – $189,294

FY 2012 – $199,257

FY 2013 – $209,744

Total People – 12 in the first year, 17 by the third year

Financial Plan:

Key factors to improve cash flow:

1. Improve collection of deposits and prompt payment from customers.

2. Increase gross margin to 35%, achieved through improved marketing.

Important Assumptions:

– Slow-growth economy without major recession.

– No unforeseen changes in technology that would make services obsolete.

– Access to equity capital and financing as shown in the financial plan.

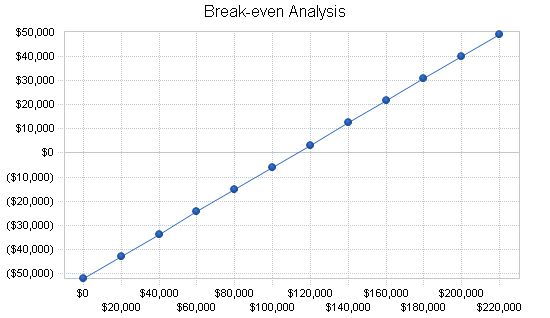

Break-even analysis can be found below.

Break-even Analysis:

Monthly Revenue Break-even: $113,038

Assumptions:

– Average Percent Variable Cost: 54%

– Estimated Monthly Fixed Cost: $52,121

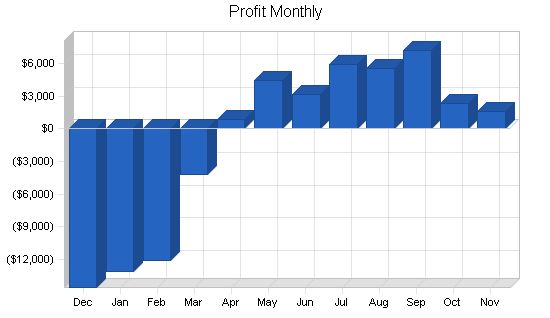

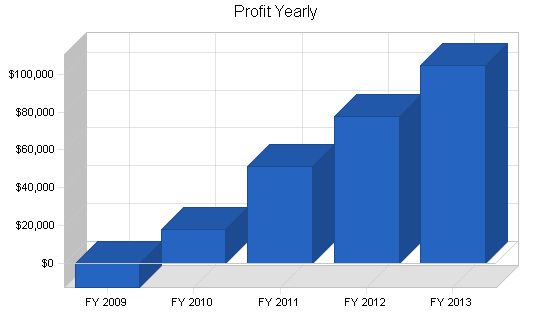

8.3 Projected Profit and Loss:

The most important assumption in the Projected Profit and Loss statement is the gross margin, which is expected to increase significantly compared to last year. This increase is driven by changing our sales mix through targeted marketing with a 5% assumption between years.

Detailed month-by-month assumptions for profit and loss can be found in the appendices.

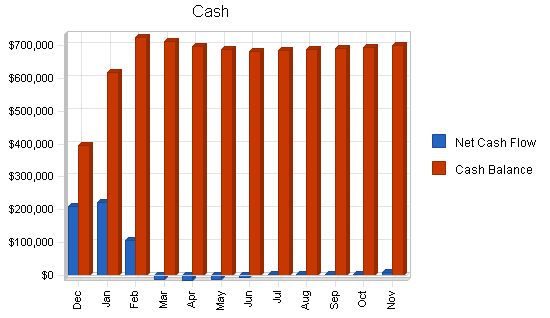

The cash flow depends on assumptions for payment days and accounts receivable management. The projected 75-day collection days is critical and reasonable.

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||||

| FY 2009 | FY 2010 | FY 2011 | FY 2012 | FY 2013 | |

| Cash Received | |||||

| Cash from Operations | |||||

| Cash Sales | $332,101 | $374,226 | $416,749 | $455,524 | $495,551 |

| Cash from Receivables | $1,500,397 | $1,093,388 | $1,220,682 | $1,339,614 | $1,458,822 |

| Subtotal Cash from Operations | $1,832,498 | $1,467,614 | $1,637,432 | $1,795,138 | $1,954,373 |

| Additional Cash Received | |||||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $1,832,498 | $1,467,614 | $1,637,432 | $1,795,138 | $1,954,373 |

| Expenditures | |||||

| Expenditures from Operations | |||||

| Cash Spending | $366,810 | $421,654 | $443,846 | $467,206 | $491,796 |

| Bill Payments | $948,152 | $1,049,306 | $1,152,871 | $1,258,223 | $1,365,979 |

| Subtotal Spent on Operations | $1,314,962 | $1,470,960 | $1,596,716 | $1,725,429 | $1,857,775 |

| Additional Cash Spent | |||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $1,314,962 | $1,470,960 | $1,596,716 | $1,725,429 | $1,857,775 |

| Net Cash Flow | $517,536 | ($3,346) | $40,715 | $69,709 | $96,598 |

| Cash Balance | $700,964 | $697,618 | $738,333 | $808,042 | $904,640 |

Projected Balance Sheet:

The Projected Balance Sheet is quite solid. We do not project any real trouble meeting our debt obligations – as long as we can achieve our specific objectives.

| Pro Forma Balance Sheet | |||||

| FY 2009 | FY 2010 | FY 2011 | FY 2012 | FY 2013 | |

| Assets | |||||

| Current Assets | |||||

| Cash | $700,964 | $697,618 | $738,333 | $808,042 | $904,640 |

| Accounts Receivable | $230,904 | $260,193 | $289,760 | $316,719 | $344,549 |

| Other Current Assets | $31,380 | $31,380 | $31,380 | $31,380 | $31,380 |

| Total Current Assets | $963,249 | $989,191 | $1,059,473 | $1,156,141 | $1,280,569 |

| Long-term Assets | |||||

| Long-term Assets | $145,879 | $145,879 | $145,879 | $145,879 | $145,879 |

| Accumulated Depreciation | $65,735 | $75,057 | $84,870 | $95,199 | $106,072 |

| Total Long-term Assets | $80,144 | $70,822 | $61,009 | $50,680 | $39,807 |

| Total Assets | $1,043,393 | $1,060,013 | $1,120,482 | $1,206,821 | $1,320,376 |

| Liabilities and Capital | |||||

| Current Liabilities | |||||

| Accounts Payable | $87,239 | $86,155 | $95,527 | $104,122 | $113,002 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $87,239 | $86,155 | $95,527 | $104,122 | $113,002 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $87,239 | $86,155 | $95,527 | $104,122 | $113,002 |

| Paid-in Capital | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 |

| Retained Earnings | $949,088 | $936,153 | $953,858 | $1,004,955 | $1,082,699 |

| Earnings | ($12,935) | $17,705 | $51,097 | $77,744 | $104,675 |

| Total Capital | $956,153 | $973,858 | $1,024,955 | $1,102,699 | $1,207,374 |

| Total Liabilities and Capital | $1,043,393 | $1,060,013 | $1,120,482 | $1,206,821 | $1,320,376 |

| Net Worth | $956,153 | $973,858 | $1,024,955 | $1,102,699 | $1,207,374 |

The table follows with our main business ratios. We do intend to improve gross profit and collection days.

| Ratio Analysis | |||||

| FY 2009 | FY 2010 | FY 2011 | FY 2012 | FY 2013 | Industry Profile |

|

Sales Forecast: Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Sales $3,237 $3,699 $5,780 $11,098 $16,416 $20,116 $19,884 $16,647 $12,486 $9,249 $6,705 $6,474 Commercial $3,237 $3,699 $5,780 $11,098 $16,416 $20,116 $19,884 $16,647 $12,486 $9,249 $6,705 $6,474 Residential $73,410 $76,879 $77,746 $89,884 $96,243 $101,156 $99,711 $109,827 $111,850 $119,075 $116,301 $116,532 Other $151 $151 $151 $151 $151 $151 $151 $151 $2,900 $3,587 $151 $151 Total Sales $76,798 $80,729 $83,677 $101,133 $112,810 $121,423 $119,746 $126,625 $127,236 $131,911 $123,157 $123,157 Personnel Plan: Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Labor $14,986 $14,986 $14,986 $14,986 $14,986 $14,986 $14,986 $14,986 $14,986 $14,985 $14,985 $14,985 Prod. Manager $3,153 $3,153 $3,153 $3,153 $3,153 $3,153 $3,153 $3,153 $3,153 $3,154 $3,154 $3,154 Design $887 $887 $887 $887 $887 $887 $887 $888 $888 $888 $888 $888 Prod Mgr (office) $773 $773 $773 $773 $773 $773 $773 $773 $773 $773 $773 $773 Sales (salaried/draw) $712 $713 $713 $713 $713 $713 $713 $713 $713 $713 $713 $713 Office $3,555 $3,555 $3,555 $3,555 $3,555 $3,555 $3,555 $3,555 $3,555 $3,555 $3,555 $3,555 Owners $6,500 $6,500 $6,500 $6,500 $6,500 $6,500 $6,500 $6,500 $6,500 $6,500 $6,500 $6,500 Total People 12 12 12 12 1 12 12 12 12 12 12 12 Total Payroll $30,566 $30,567 $30,567 $30,567 $30,567 $30,567 $30,567 $30,568 $30,568 $30,568 $30,568 $30,568 General Assumptions: Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss |

| Pro Forma Profit and Loss | |||||||||||||

| Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | ||

| Sales | $76,798 | $80,729 | $83,677 | $101,133 | $112,810 | $121,423 | $119,746 | $126,625 | $127,236 | $131,911 | $123,157 | $123,157 | |

| Direct Cost of Sales | $41,769 | $43,846 | $45,406 | $54,601 | $60,754 | $65,295 | $64,421 | $68,050 | $68,381 | $70,850 | $66,252 | $66,261 | |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $41,769 | $43,846 | $45,406 | $54,601 | $60,754 | $65,295 | $64,421 | $68,050 | $68,381 | $70,850 | $66,252 | $66,261 | |

| Gross Margin | $35,029 | $36,883 | $38,271 | $46,532 | $52,056 | $56,128 | $55,325 | $58,575 | $58,855 | $61,061 | $56,905 | $56,896 | |

| Gross Margin % | 45.61% | 45.69% | 45.74% | 46.01% | 46.14% | 46.22% | 46.20% | 46.26% | 46.26% | 46.29% | 46.21% | 46.20% | |

| Expenses | |||||||||||||

| Payroll | $30,566 | $30,567 | $30,567 | $30,567 | $30,567 | $30,567 | $30,567 | $30,568 | $30,568 | $30,568 | $30,568 | $30,568 | |

| Advertising | $556 | $612 | $673 | $740 | $814 | $895 | $985 | $1,084 | $1,192 | $1,311 | $1,442 | $1,586 | |

| Depreciation | $738 | $738 | $738 | $738 | $738 | $738 | $738 | $738 | $738 | $738 | $738 | $738 | |

| Marketing | $643 | $707 | $778 | $856 | $942 | $1,036 | $1,140 | $1,254 | $1,379 | $1,517 | $1,669 | $1,836 | |

| Bad Debts | $187 | $187 | $187 | $187 | $187 | $187 | $187 | $187 | $187 | $187 | $187 | $187 | |

| Donations | $197 | $197 | $197 | $197 | $197 | $197 | $197 | $197 | $197 | $197 | $197 | $197 | |

| Entertainment 50% | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | |

| Employee Benefits | $4,129 | $4,335 | $4,552 | $4,780 | $5,019 | $5,270 | $5,534 | $5,811 | $6,102 | $6,407 | $6,727 | $7,063 | |

| Equipment Buy/Rental | $244 | $256 | $269 | $282 | $296 | $311 | $327 | $343 | $360 | $378 | $397 | $417 | |

| Interest/Bank Charges | ($17) | ($17) | ($17) | ($17) | ($17) | ($17) | ($17) | ($17) | ($17) | ($17) | ($17) | ($17) | |

| Tool Repair/Replacement | $230 | $230 | $230 | $230 | $230 | $230 | $230 | $230 | $230 | $230 | $230 | $230 | |

| Computer/Hardware/Software Consultants | $541 | $568 | $596 | $626 | $657 | $690 | $724 | $760 | $798 | $838 | $880 | $924 | |

| Dues/Sub/Licenses/Royalties/Trade Assoc | $237 | $237 | $237 | $237 | $237 | $237 | $237 | $237 | $237 | $237 | $237 | $237 | |

| Corp & Business Taxes | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | |

| Legal Expenses | $109 | $109 | $109 | $109 | $109 | $109 | $109 | $109 | $109 | $109 | $109 | $109 | |

| Accounting Expenses | $194 | $194 | $194 | $194 | $194 | $194 | $194 | $194 | $194 | $194 | $194 | $194 | |

| Rent of Office/Warehouse Space | $1,210 | $1,210 | $1,210 | $1,210 | $1,210 | $1,210 | $1,210 | $1,210 | $1,210 | $1,210 | $1,210 | ||

| Repairs/Maintenance | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $95 | |

| Communications | $780 | $780 | $780 | $780 | $780 | $780 | $780 | $780 | $780 | $780 | $780 | $780 | |

| Utilities | $77 | $77 | $77 | $77 | $77 | $77 | $77 | $77 | $77 | $77 | $77 | $77 | |

| Office Expenses | $

Pro Forma Cash Flow and Pro Forma Balance Sheet Pro Forma Cash Flow |

||||||||||||

| Pro Forma Cash Flow | |||||||||||||

| Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | ||

| Cash Received | |||||||||||||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $19,200 | $20,182 | $20,919 | $25,283 | $28,203 | $30,356 | $29,937 | $31,656 | $31,809 | $32,978 | $30,789 | $30,789 | |

| Cash from Receivables | $294,000 | $294,000 | $177,719 | $59,171 | $61,726 | $69,740 | $80,521 | $88,053 | $90,396 | $92,561 | $95,213 | $97,297 | |

| Subtotal Cash from Operations | $313,200 | $314,182 | $198,638 | $84,454 | $89,928 | $100,096 | $110,457 | $119,709 | $122,205 | $125,539 | $126,002 | $128,086 | |

| Additional Cash Received | |||||||||||||

| Additional Cash Received | |||||||||||||

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $30,566 | $30,567 | $30,567 | $30,567 | $30,567 | $30,567 | $30,567 | $30,568 | $30,568 | $30,568 | $30,568 | $30,568 | |

| Bill Payments | $71,721 | $60,124 | $62,550 | $64,755 | $74,265 | $80,810 | $85,646 | $85,430 | $89,493 | $90,475 | $93,331 | $89,552 | |

| Subtotal Spent on Operations | $102,288 | $90,691 | $93,117 | $95,322 | $104,832 | $111,377 | $116,213 | $115,998 | $120,061 | $121,044 | $123,899 | $120,120 | |

| Additional Cash Spent | |||||||||||||

| Additional Cash Spent | |||||||||||||

| Net Cash Flow | $210,912 | $223,491 | $105,522 | ($10,868) | ($14,904) | ($11,281) | ($5,756) | $3,710 | $2,144 | $4,495 | $2,103 | $7,967 | |

| Cash Balance | $394,340 | $617,831 | $723,353 | $712,485 | $697,581 | $686,300 | $680,544 | $684,255 | $686,399 | $690,894 | $692,997 | $700,964 | |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $183,428 | $394,340 | $617,831 | $723,353 | $712,485 | $697,581 | $686,300 | $680,544 | $684,255 | $686,399 | $690,894 | $692,997 | $700,964 |

| Accounts Receivable | $735,000 | $498,599 | $265,145 | $150,184 | $166,863 | $189,744 | $211,071 | $220,360 | $227,276 | $232,307 | $238,679 | $235,834 | $230,904 |

| Other Current Assets | $31,380 | $31,380 | $31,380 | $31,380 | $31,380 | $31,380 | $31,380 | $31,380 | $31,380 | $31,380 | $31,380 | $31,380 | $31,380 |

| Total Current Assets | $949,808 | $924,318 | $914,356 | $904,916 | $910,728 | $918,705 | $928,751 | $932,284 | $942,911 | $950,086 | $960,953 | $960,211 | $963,249 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $145,879 | $145,879 | $145,879 | $145,879 | $145,879 | $145,879 | $145,879 | $145,879 | $145,879 | $145,879 | $145,879 | $145,879 | $145,879 |

| Accumulated Depreciation | $56,879 | $57,617 | $58,355 | $59,093 | $59,831 | $60,569 | $61,307 | $62,045 | $62,783 | $63,521 | $64,259 | $64,997 | $65,735 |

| Total Long-term Assets | $89,000 | $88,262 | $87,524 | $86,786 | $86,048 | $85,310 | $84,572 | $83,834 | $83,096 | $82,358 | $81,620 | $80,882 | $80,144 |

| Total Assets | $1,038,808 | $1,012,580 | $1,001,880 | $991,702 | $996,776 | $1,004,015 | $1,013,323 | $1,016,118 | $1,026,007 | $1,032,444 | $1,042,573 | $1,041,093 | $1,043,393 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $69,720 | $58,041 | $60,402 | $62,286 | $71,577 | $77,955 | $82,803 | $82,448 | $86,481 | $87,360 | $90,347 | $86,543 | $87,239 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $69,720 | $58,041 | $60,402 | $62,286 | $71,577 | $77,955 | $82,803 | $82,448 | $86,481 | $87,360 | $90,347 | $86,543 | $87,239 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $69,720 | $58,041 | $60,402 | $62,286 | $71,577 | $77,955 | $82,803 | $82,448 | $86,481 | $87,360 | $90,347 | $86,543 | $87,239 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!