Contents

Engineering Business Plan

Introduction

Compton Geotechnical Associates Inc. (CGA) will provide innovative approaches to geological engineering services in Maine.

CGA will enter this limited geographical area, leveraging staff reputation into long-term contracts centered on excellent service and cost effectiveness. We believe we can serve this market better than larger firms and offer better service packages at a more reasonable cost than competitors of equal size.

The Company

CGA will be a limited liability partnership registered in Delaware for tax purposes. Its founder is Mr. Martin Compton, a former engineering geology department head with Wilson and Brown, Inc. Mr. Compton has brought together a highly respected group of geologists, hydrologists, engineers, and graphic art specialists with 35 years of combined experience.

The company has private investors and does not plan to go public. The main offices are in Augusta, Maine, with a soil/rock and water testing lab, conference rooms, and office spaces. Services are expected to begin in January of Year 1.

The main clients will be major construction companies, governments, real estate companies, and utility and water companies. By focusing on institutions with special needs, we believe we can better serve our clients and provide a superior service compared to other geo-engineering firms.

The Services

CGA offers comprehensive geo-engineering services to diverse clients. Our services fall into two main categories: geotechnical engineering services and construction monitoring/laboratory testing.

Services include surface and groundwater evaluation, slope stability analysis, bluff studies, laboratory analysis of soils, rocks, and groundwater, load testing, and settlement analysis. Each project is customized to our client, with unique scope, length, depth, reach, and cost.

The Market

There are plenty of opportunities in this market, especially since recent local and federal regulations have required geotechnical studies and monitoring before construction.

The geoengineering industry has been growing at a fast rate for the past twenty years. According to the Journal of Hydrology & Geoengineering, the industry has averaged approximately 22% per year over the past five years. The geotechnical consulting business consists of thousands of smaller consulting organizations and individual consultants for every one of the few dozen well-known companies. These companies range from major international firms to tens of thousands of individuals.

Financial Considerations

Start-up assets required are [see Start-up table]. This includes [see Start-up table] in expenses and the rest in cash needed to support operations until revenues reach an acceptable level. Most of the company’s liabilities will come from outside private investors and management investment, however, we have obtained [see Start-up Funding table] in current borrowing from Bank of America Commercial Investments, to be paid off in two years. A long-term loan of [see Start-up Funding table] through Charter Bank of Augusta will be paid off in ten years.

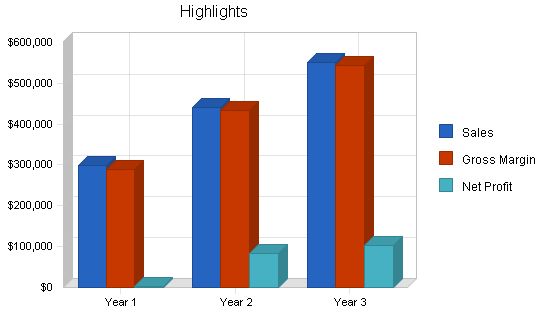

The company expects to reach profitability in year one and does not anticipate any serious cash flow problems. We conservatively believe that during the first three years, average profitability per month per segment will be about $8,000. We expect that about three projects per month will guarantee a break-even point.

1.1 Objectives

The three year goals for Compton Geotechnical Associates (CGA) are:

- Achieve break-even by year two.

- Establish long-term contracts with at least four clients.

- Achieve a minimum 95% customer satisfaction rate to establish long-term relationships with clients and create word-of-mouth marketing.

1.2 Mission

The mission of CGA is to provide innovative approaches to geological engineering services and build effective long-term relationships with clients through excellent, timely, and cost-effective services.

1.3 Keys to Success

CGA’s keys to long-term survival and profitability are:

- Create long-term contracts that demand constant monitoring or on-call services.

- Maintain close contact with clients to generate repeat business and obtain a top-notch reputation.

- Establish a comprehensive service experience for clients that includes consultation, field and laboratory work, in-house design, analysis, and follow-up monitoring of geo-hazards.

Company Summary

CGA is a limited liability partnership registered in Delaware for tax purposes. Its founder, Mr. Martin Compton, is a former engineering geology department head with Wilson and Brown, Inc. The company has a highly respected group of geologists, hydrologists, engineers, and graphic art specialists with a total of 35 years of experience in this industry.

The company has a limited number of private investors and does not plan to go public. Its main offices are in Augusta, Maine, and include a soil/rock and water testing lab, conference rooms, and office spaces. The company expects to begin offering services in January 2003.

The main clients of the company will be major construction companies, local and state governments, real estate companies, and utility and water companies. By focusing on these institutions with special needs, CGA aims to better serve clients and provide superior service compared to other geo-engineering firms.

2.1 Company Ownership

The company will have outside private investors who will own 27% of the company’s shares. The rest will be owned by senior management, including Mr. Martin Compton (25%), Ms. Elizabeth Bathory (20%), Mr. David Gillen (20%), and Mr. Jeremy Leither (8%). All other financing will come from loans.

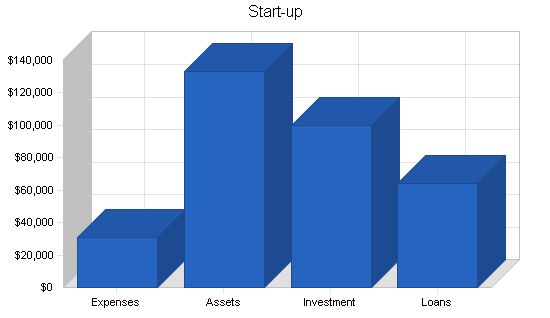

2.2 Start-up Summary

Start-up assets required are shown below. This includes expenses and cash needed to support operations until revenues reach an acceptable level. Most of the company’s liabilities will come from outside private investors and management investment. However, we have obtained current borrowing from Bank of America Commercial Investments, and a long-term loan through Charter Bank of Augusta will be paid off in ten years.

Start-up Requirements

Start-up Expenses:

– Legal: $1,000

– Insurance: $2,000

– Utilities: $200

– Rent: $3,000

– Accounting and bookkeeping fees: $2,000

– Expensed equipment: $8,000

– Advertising: $6,500

– Other: $8,000

– Total Start-up Expenses: $30,700

Start-up Assets:

– Cash Required: $104,800

– Other Current Assets: $3,500

– Long-term Assets: $25,000

– Total Assets: $133,300

Total Requirements: $164,000

Start-up Funding:

– Start-up Expenses to Fund: $30,700

– Start-up Assets to Fund: $133,300

– Total Funding Required: $164,000

Assets:

– Non-cash Assets from Start-up: $28,500

– Cash Requirements from Start-up: $104,800

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $104,800

– Total Assets: $133,300

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $16,000

– Long-term Liabilities: $45,000

– Accounts Payable (Outstanding Bills): $3,000

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $64,000

Capital:

– Planned Investment:

– Mr. Martin Compton: $25,000

– Ms. Elizabeth Bathory: $20,000

– Mr. David Gillen: $20,000

– Mr. Jeremy Leither: $8,000

– Others: $27,000

– Total Planned Investment: $100,000

– Loss at Start-up (Start-up Expenses): ($30,700)

– Total Capital: $69,300

Total Capital and Liabilities: $133,300

Total Funding: $164,000

Services:

CGA offers comprehensive geo-engineering services to diverse clients. Our services include:

– Exploration and characterization of soil and rock.

– Surface and groundwater evaluation.

– Shoring requirements and analysis.

– Slope stability and landslide analysis.

– Forensic studies of failures and/or distress.

For construction monitoring and laboratory testing, we provide:

– Compaction monitoring and testing structural fill.

– Evaluation, tieback, and shoring monitoring.

– Pile and pier installation monitoring.

– Laboratory analysis of soil, rock, and water properties.

– Load testing and settlement analysis.

Each project is customized to our client and its scope, length, depth, reach, and cost are unique.

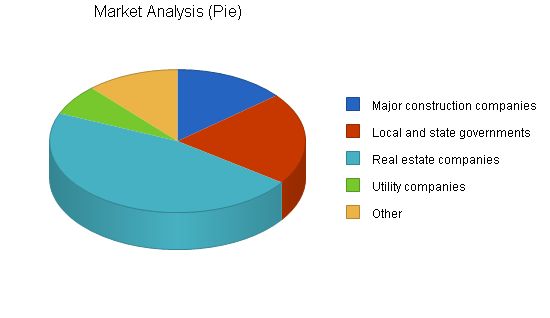

Market Analysis Summary:

CGA will focus on four main market segments: major construction companies, local and state governments, real estate companies, and water and utility companies. The geo-engineering industry has grown at approximately 22% per year over the past five years. The greatest threat is from new entrants to the market. Our main competitors are Goldner Geotechnical and Earth Sciences Consultants, who have higher capitalization or geographical proximity.

Companies enter into contracts with geotechnical companies based on reputation and past services. Price and scope also influence contract acceptance, especially for small companies.

Market Segmentation:

CGA will concentrate on the following market segments in Maine:

– Major construction companies

– Local and state governments

– Real estate companies

– Utility and water companies

– Others

These segments have specific needs, such as certifications of safe practices, earth science reviews, bluff studies, and soil and water analysis. Some segments have a small number of potential clients but high profitability levels.

(Note: The provided tables and graphs were not modified as they seem to contain numerical data or specific formatting.)

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Major construction companies | 2% | 12 | 12 | 12 | 12 | 12 | 0.00% |

| Local and state governments | 3% | 18 | 19 | 20 | 21 | 22 | 5.14% |

| Real estate companies | 4% | 40 | 42 | 44 | 46 | 48 | 4.66% |

| Utility companies | 0% | 6 | 6 | 6 | 6 | 6 | 0.00% |

| Other | 5% | 10 | 11 | 12 | 13 | 14 | 8.78% |

| Total | 4.36% | 86 | 90 | 94 | 98 | 102 | 4.36% |

4.2 Service Business Analysis

The geoengineering industry has been growing rapidly for the past twenty years. According to the Journal of Hydrology & Geoengineering, the industry has averaged a 22% growth rate over the past five years due to increased environmental awareness and resulting legislation.

The geotechnical consulting business consists of numerous smaller consulting organizations and individual consultants. These companies range from major international firms to individual consultants.

CGA believes that the greatest threat is from new entrants to the market, specifically small consulting companies. However, firms face significant switching costs when bringing on a consulting partner in this industry. Additionally, there is a significant learning curve that lowers costs as firms gain more experience.

Rivalry among geotechnical companies is moderated by the high growth rate. Competitors can improve profitability by keeping up with industry growth.

Clients have significant bargaining power in this industry due to their concentration in the geographical area and the high cost of services. Some market segments, such as governments, have specific profitability restraints that pressure companies for superior terms.

4.2.1 Competition and Buying Patterns

Competition

The geoengineering industry is highly fragmented, with many small companies that cater to small firms and a few large companies that seek the largest contracts. CGA’s most serious competitors are Goldner Geotechnical and Earth Sciences Consultants. Goldner is an established company that has been in operation for ten years and has contracts with the city of Damrascotta and the Skowhegan River Water District. Earth Sciences Consultants is one of the largest geotechnical firms on the east coast and is expected to expand nationally within the next five years.

Buying Patterns and Needs

Companies enter into contracts with geotechnical companies based on reputation, professionalism, and past quality of services rendered. Price and scope are also important considerations, especially for small companies.

Strategy and Implementation Summary

Compton Geotechnical Associates’ strategy is to enter a limited geographical area and leverage its staff’s existing reputation into long-term contracts focused on service and cost effectiveness. CGA believes it can service this market better than larger firms by offering better service packages at a more reasonable cost.

5.1 Marketing Strategy

To attract clients, CGA will offer free consultations and initial contracts at reduced prices to promising organizations. Additionally, CGA’s founders will attend conventions across the eastern part of the country to advertise services. Cold calls to potential clients and advertisements in relevant publications will also be used to attract business.

5.2 Sales Strategy

CGA’s management will leverage contacts in various market segments to generate contracts. The company is aggressively pursuing a long-term geotechnical contract with the Wiscasset Utility District, which is expected to generate revenue and reputation. Other contracts through contacts with real estate companies are also being pursued.

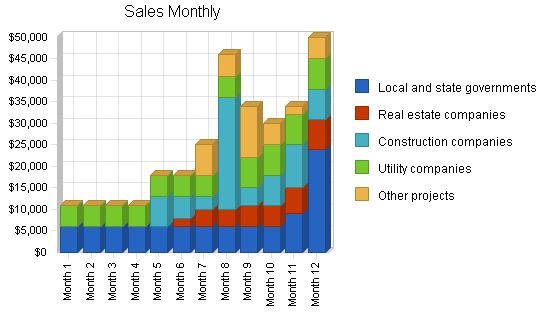

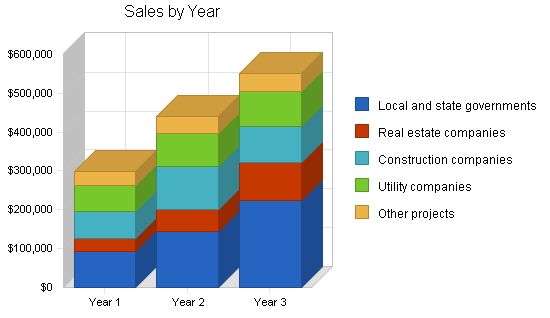

5.2.1 Sales Forecast

Sales are based on anticipated contract projects in various market segments. Revenues are calculated based on estimated time and complexity of each project, along with an undisclosed profit margin. The company has no significant direct costs of sales.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Local and state governments | $93,000 | $145,000 | $224,000 |

| Real estate companies | $33,000 | $56,000 | $98,000 |

| Construction companies | $69,000 | $110,000 | $93,000 |

| Utility companies | $68,000 | $85,000 | $90,000 |

| Other projects | $36,000 | $45,000 | $45,000 |

| Total Sales | $299,000 | $441,000 | $550,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Row 1 | $1,200 | $0 | $0 |

| Other | $1,200 | $0 | $0 |

| Subtotal Direct Cost of Sales | $2,400 | $0 | $0 |

Management Summary

The company will have four officers, including our president, Mr. Martin Compton. Our head of operations will be Mr. David Gillen, and we will have two initial geotechnical consultants and a CAD draftsperson. Finances and general admin will be handled by Ms. Bathory.

The company plans to hire additional consultants, design support, and administrative personnel as we begin to get large numbers of contracts.

6.1 Personnel

CGA’s management brings strong capabilities in creative flair, research, and a unique combination of skills drawn from other businesses.

Key Personnel

Mr. Martin Compton is a graduate of the University of Kansas where he obtained his civil engineering degree in 1971. Since then, Mr. Compton has had extensive experience in site-specific municipal, commercial, and residential construction projects. This includes experience in budgeting, project oversight, and resolving engineering issues. In 1996, he obtained a graduate degree in geoengineering from MIT. Mr. Compton spent the last four years as the engineering geology department head with Wilson and Brown, Inc.

Mr. David Gillen graduated from Penn State University with a bachelor’s degree in Hydrology in 1975. From 1978-1988, Mr. Danielson worked for The USGS as a key figure in its groundbreaking National Water/Soil Suitability Survey. In 1989, he went to work for Anderson Consulting in their geotechnical division where he worked on sub-bottom acoustic profiling, tunnel and shaft rehabilitation, and designing procedures for testing ground water infiltration rates.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Mr. Martin Compton – president | $36,000 | $40,000 | $60,000 |

| Mrs. Elizabeth Bathory – office manager | $36,000 | $40,000 | $60,000 |

| Mr. David Gillen – projects manager | $36,000 | $39,000 | $45,000 |

| Mr. Jeremy Leither – staff engineer | $36,000 | $39,000 | $45,000 |

| Geo-engineering consultant | $36,000 | $38,000 | $42,000 |

| CAD draftsperson P/T | $10,500 | $13,000 | $16,000 |

| Total People | 6 | 6 | 6 |

| Total Payroll | $190,500 | $209,000 | $268,000 |

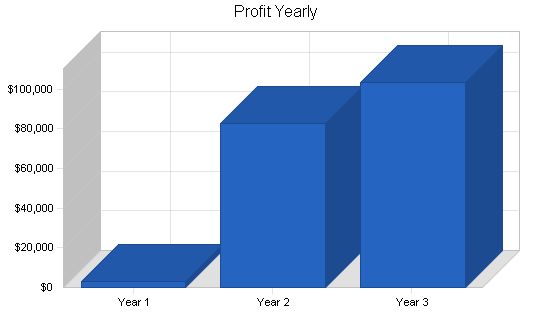

Financial Plan

Our financial plan anticipates one year of negative profits as we gain sales volume. We have budgeted enough investment to cover these losses and have an additional credit line available if sales do not match predictions.

7.1 Important Assumptions

We are assuming approximately 75% sales on credit and average interest rates of 10%. These are considered conservative in case our predictions are erroneous.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

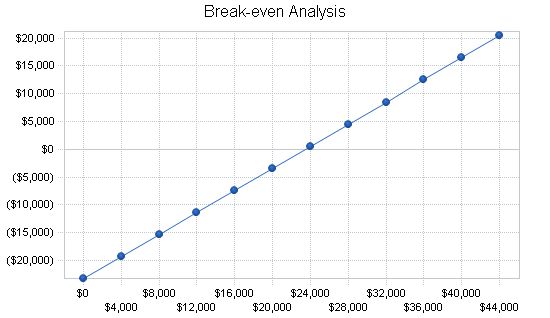

7.2 Break-even Analysis

Our Break-even Analysis is based on the assumption that our gross margin is 100%. In other words, we will have insignificant direct cost of sales. Since each project will be of different scope, length, and complexity, it is difficult to assign an average per unit revenue figure. However, it is conservatively believed that during the first three years, average profitability per month per segment will be about $8,000. This is because we will be dealing with smaller companies at first that have smaller projects. We expect that about three projects per month will guarantee a break-even point.

Break-even Analysis:

Monthly Revenue Break-even: $23,444.

Assumptions:

– Average Percent Variable Cost: 1%.

– Estimated Monthly Fixed Cost: $23,256.

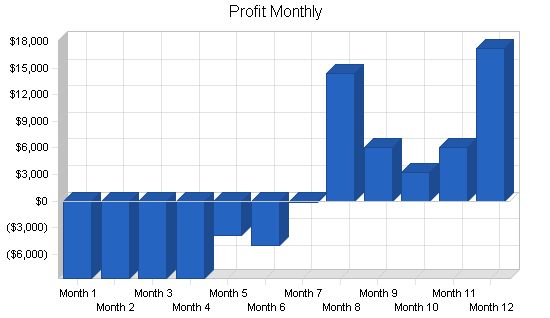

7.3 Projected Profit and Loss:

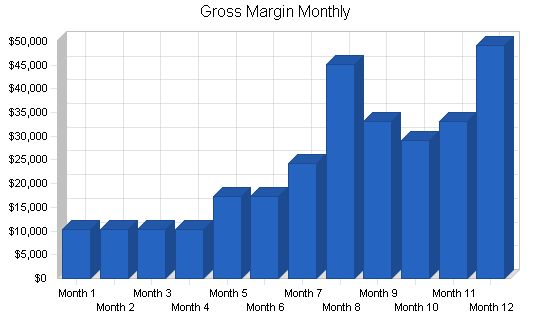

The table below shows our revenues and costs. We anticipate higher expenses in marketing and advertising compared to other companies, as we aim to increase sales volume. Monthly profits are projected to start in the fourth quarter of 2003 (refer to the appendix for the monthly Profit and Loss table).

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3

Sales: $299,000 $441,000 $550,000

Cost of Sales: $9,400 $7,000 $7,000

Gross Margin: $289,600 $434,000 $543,000

Gross Margin %: 96.86% 98.41% 98.73%

Expenses:

Payroll: $190,500 $209,000 $268,000

Sales and Marketing and Other Expenses: $6,000 $10,000 $14,000

Depreciation: $0 $2,500 $2,500

Rent: $18,000 $20,000 $22,000

Utilities: $3,600 $3,600 $4,000

Insurance: $13,200 $14,000 $15,000

Payroll Taxes: $28,575 $31,350 $40,200

Travel: $12,000 $12,000 $15,000

Other: $7,200 $8,000 $10,000

Total Operating Expenses: $279,075 $310,450 $390,700

Profit Before Interest and Taxes: $10,525 $123,550 $152,300

EBITDA: $10,525 $126,050 $154,800

Interest Expense: $6,100 $5,500 $4,300

Taxes Incurred: $1,328 $35,415 $44,400

Net Profit: $3,097 $82,635 $103,600

Net Profit/Sales: 1.04% 18.74% 18.84%

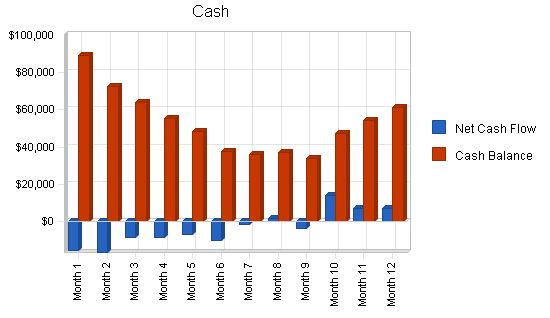

Projected Cash Flow:

The following is our cash flow chart and diagram. We do not expect to have any short-term cash flow problems even though we will be operating at a loss for the first nine months. Our short-term loan will be repaid in two equal payments in 2004-2005. Our long-term loan will be paid off in ten years.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $74,750 | $110,250 | $137,500 |

| Cash from Receivables | $162,100 | $301,234 | $389,843 |

| Subtotal Cash from Operations | $236,850 | $411,484 | $527,343 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $3,000 | $0 | $0 |

| Subtotal Cash Received | $239,850 | $411,484 | $527,343 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $190,500 | $209,000 | $268,000 |

| Bill Payments | $92,676 | $150,520 | $173,514 |

| Subtotal Spent on Operations | $283,176 | $359,520 | $441,514 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $8,000 | $8,000 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $4,000 | $4,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $283,176 | $371,520 | $453,514 |

| Net Cash Flow | ($43,326) | $39,964 | $73,830 |

| Cash Balance | $61,474 | $101,438 | $175,267 |

7.5 Projected Balance Sheet

The following table shows the projected balance sheet for Compton Geotechnical.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $61,474 | $101,438 | $175,267 |

| Accounts Receivable | $62,150 | $91,666 | $114,323 |

| Other Current Assets | $3,500 | $3,500 | $3,500 |

| Total Current Assets | $127,124 | $196,604 | $293,090 |

| Long-term Assets | |||

| Long-term Assets | $25,000 | $25,000 | $25,000 |

| Accumulated Depreciation | $0 | $2,500 | $5,000 |

| Total Long-term Assets | $25,000 | $22,500 | $20,000 |

| Total Assets | $152,124 | $219,104 | $313,090 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $15,726 | $12,071 | $14,458 |

| Current Borrowing | $16,000 | $8,000 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $31,726 | $20,071 | $14,458 |

| Long-term Liabilities | $45,000 | $41,000 | $37,000 |

| Total Liabilities | $76,726 | $61,071 | $51,458 |

| Paid-in Capital | $103,000 | $103,000 | $103,000 |

| Retained Earnings | ($30,700) | ($27,603) | $55,032 |

| Earnings | $3,097 | $82,635 | $103,600 |

| Total Capital | $75,398 | $158,033 | $261,633 |

| Total Liabilities and Capital | $152,124 | $219,104 | $313,090 |

| Net Worth | $75,398 | $158,033 | $261,633 |

7.6 Business Ratios

We have included industry standard ratios from the construction and civil engineering industry to compare with ours. These ratios are as closely matched to our industry as management could find, however there are some significant differences, especially in sales growth, financing ratios, long-term asset investments and net worth. However, our projections indicate a healthy company that will be able to obtain and retain long-term profitability.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 47.49% | 24.72% | 6.39% |

| Percent of Total Assets | ||||

| Accounts Receivable | 40.85% | 41.84% | 36.51% | 39.28% |

| Other Current Assets | 2.30% | 1.60% | 1.12% | 34.90% |

| Total Current Assets | 83.57% | 89.73% | 93.61% | 77.16% |

| Long-term Assets | 16.43% | 10.27% | 6.39% | 22.84% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 20.86% | 9.16% | 4.62% | 38.24% |

| Long-term Liabilities | 29.58% | 18.71% | 11.82% | 13.12% |

| Total Liabilities | 50.44% | 27.87% | 16.44% | 51.36% |

| Net Worth | 49.56% | 72.13% | 83.56% | 48.64% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 96.86% | 98.41% | 98.73% | 100.00% |

| Selling, General & Administrative Expenses | 96.06% | 79.67% | 79.89% | 81.87% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.32% |

| Profit Before Interest and Taxes | 3.52% | 28.02% | 27.69% | 2.33% |

| Main Ratios | ||||

| Current | 4.01 | 9.80 | 20.27 | 1.73 |

| Quick | 4.01 | 9.80 | 20.27 | 1.43 |

| Total Debt to Total Assets | 50.44% | 27.87% | 16.44% | 5.72% |

| Pre-tax Return on Net Worth | 5.87% | 74.70% | 56.57% | 57.36% |

| Pre-tax Return on Assets | 2.91% | 53.88% | 47.27% | 13.43% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 1.04% | 18.74% | 18.84% | n.a |

| Return on Equity | 4.11% | 52.29% | 39.60% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 3.61

Personnel Plan: Mr. Martin Compton – president 0% $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Mrs. Elizabeth Bathory – office manager 0% $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Mr. David Gillen – projects manager 0% $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Mr. Jeremy Leither – staff engineer 0% $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Geo-engineering consultant 0% $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 CAD draftsperson P/T 0% $0 $0 $0 $0 $0 $0 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Total People 0% 5 5 5 5 5 6 6 6 6 6 6 6 6 Total Payroll $15,000 $15,000 $15,000 $15,000 $15,000 $16,500 $16,500 $16,500 $16,500 $16,500 $16,500 $16,500 $16,500 General Assumptions: Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Sales $11,000 $11,000 $11,000 $11,000 $18,000 $18,000 $25,000 $46,000 $34,000 $30,000 $34,000 $50,000 Direct Cost of Sales $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 Other Costs of Sales $500 $500 $500 $500 $500 $500 $500 $700 $700 $700 $700 $700 $700 Total Cost of Sales $700 $700 $700 $700 $700 $700 $700 $900 $900 $900 $900 $900 $900 Gross Margin $10,300 $10,300 $10,300 $10,300 $17,300 $17,300 $24,300 $45,100 $33,100 $29,100 $33,100 $49,100 Gross Margin % 93.64% 93.64% 93.64% 93.64% 96.11% 96.11% 97.20% 98.04% 97.35% 97.00% 97.35% 98.20% Expenses Payroll $15,000 $15,000 $15,000 $15,000 $15,000 $16,500 $16,500 $16,500 $16,500 $16,500 $16,500 $16,500 Pro Forma Cash Flow Pro Forma Cash Flow Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Cash Received Cash Received Cash Sales $2,750 $2,750 $2,750 $2,750 $4,500 $4,500 $6,250 $11,500 $8,500 $7,500 $8,500 $12,500 Cash from Receivables $0 $275 $8,250 $8,250 $8,250 $8,425 $13,500 $13,675 $19,275 $34,200 $25,400 $22,600 Subtotal Cash from Operations $2,750 $3,025 $11,000 $11,000 $12,750 $12,925 $19,750 $25,175 $27,775 $41,700 $33,900 $35,100 Additional Cash Received Sales Tax, VAT, HST/GST Received 0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Other Liabilities (interest-free) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Long-term Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Sales of Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Sales of Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Investment Received $0 $0 $0 $0 $0 $0 $1,500 $1,500 $0 $0 $0 $0 $0 Subtotal Cash Received $2,750 $3,025 $11,000 $11,000 $12,750 $12,925 $21,250 $26,675 $27,775 $41,700 $33,900 $35,100 Expenditures Expenditures Expenditures from Operations Cash Spending $15,000 $15,000 $15,000 $15,000 $15,000 $16,500 $16,500 $16,500 $16,500 $16,500 $16,500 $16,500 $16,500 Bill Payments $3,157 $4,721 $4,721 $4,721 $4,791 $6,811 $6,598 $8,843 $14,948 $11,428 $10,308 $11,628 Subtotal Spent on Operations $18,157 $19,721 $19,721 $19,721 $19,791 $23,311 $23,098 $25,343 $31,448 $27,928 $26,808 $28,128 Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Principal Repayment of Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other Liabilities Principal Repayment $0 $0 $0 $0 |

|||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!