Contents

MLM Water Filter Business Plan

The Water Factory is a network marketing firm that sells Water Genie home water filtration systems. The company has chosen this business model to create a recurring revenue structure in a home business. Aitch Tuoo, the founder and owner, has done significant research and determined that the filtered water market is large and quickly growing. Consumers are willing to pay up to five times more for water than for gasoline.

By using the network marketing model, Aitch Tuoo targets personal contacts. This is advantageous because a bond has already been established with these prospects, making it easier for Aitch to turn them into leads. Network marketing also creates recurring revenue streams through commissions earned from recruited salespeople. Aitch also receives revenue for each salesperson his team recruits. This revenue stream turns his job into a business, providing a way to earn money even when he is not working.

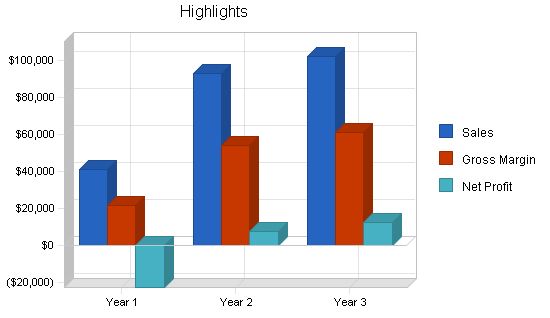

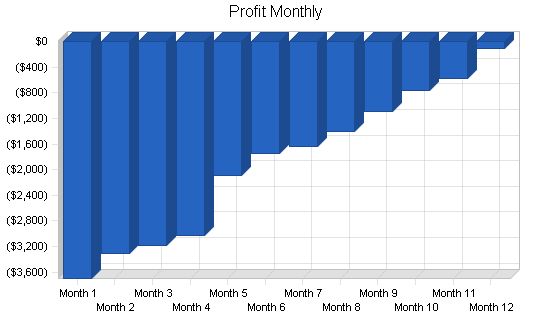

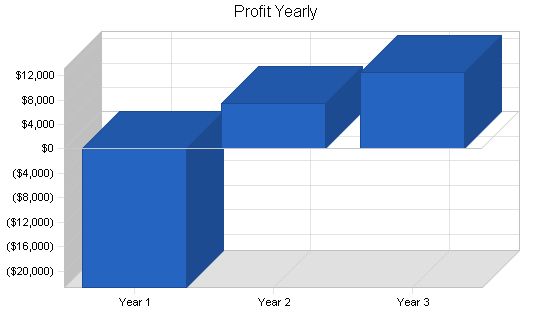

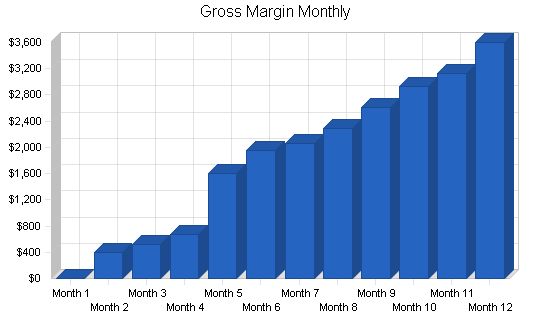

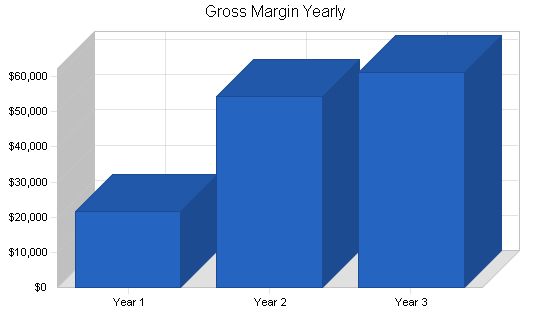

The Water Factory will become profitable by month 12 and will have modest but steady profits by year three.

Objectives

The objectives for the first three years of operation are:

- Create a service-based company that exceeds customers’ expectations.

- Have at least 10% of the local population use The Water Factory products.

- Increase the number of sellers by 20% annually.

- Develop a sustainable home-based business that survives on its own cash flow.

Mission

The Water Factory’s mission is to provide customers with the highest quality water filtration units. We exist to attract and maintain customers. When we follow this principle, everything else will fall into place. Our services will exceed customer expectations.

Company Summary

The Water Factory, located in Albany, Oregon, is a network marketing business that sells water filtration units to consumers. We exclusively sell Water Genie Brand filters for home use through the multi-level marketing system. The company will use personal contact recruiting to develop a sales force to increase product sales.

The business will operate from the owner’s home. We expect to achieve profitability by month 12 and modest profits by year three.

Company Ownership

The Water Factory is a sole proprietorship founded and owned by Aitch Tuoo.

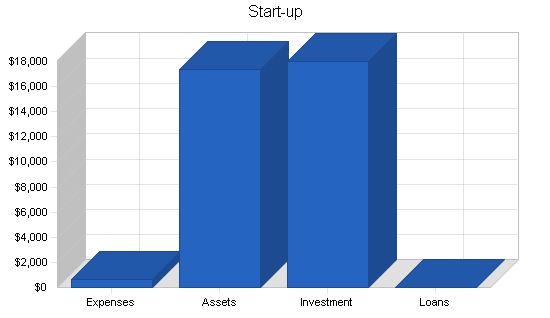

Start-up Summary

The start-up costs for The Water Factory include:

- Office furniture (desk, chair, filing cabinets)

- Computer system (printer, CD-RW, Internet connections, Microsoft Office)

- Stationery

- Brochures

- Legal fees

- Phone line, pager, cell phone

Start-up Requirements—————————————————–

Start-up Expenses

Legal: $200

Stationery etc.: $200

Brochures: $200

Other: $0

Total Start-up Expenses: $600

Start-up Assets

Cash Required: $15,100

Other Current Assets: $0

Long-term Assets: $2,300

Total Assets: $17,400

Total Requirements: $18,000

Start-up Funding——————————————————–

Start-up Expenses to Fund: $600

Start-up Assets to Fund: $17,400

Total Funding Required: $18,000

Assets——————————————————

Non-cash Assets from Start-up: $2,300

Cash Requirements from Start-up: $15,100

Additional Cash Raised: $0

Cash Balance on Starting Date: $15,100

Total Assets: $17,400

Liabilities and Capital—————————————————

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital

Planned Investment:

Investor 1: $18,000

Investor 2: $0

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $18,000

Loss at Start-up (Start-up Expenses): ($600)

Total Capital: $17,400

Total Capital and Liabilities: $17,400

Total Funding: $18,000

Products——————————————————–

The Water Factory exclusively sells Water Genie brand home water filtration systems. Home water filters improve taste quality and remove impurities from the water. Three models will be sold:

1. The Carafe – This model is a large water pitcher with a filter. When you pour the pitcher, only filtered water comes out. Price per gallon: $0.26.

2. The Faucet Mount – This model is a large bulb that mounts on the end of the faucet. When you rotate the filter toward you, filtered water comes out. When you rotate it away, unfiltered water comes out. Price per gallon of filtered water: $0.12.

3. The Counter Mount – This model is a 12-inch tall cylinder that sits on the counter. You push a button to allow filtered water to flow. Price per gallon of filtered water: $0.06.

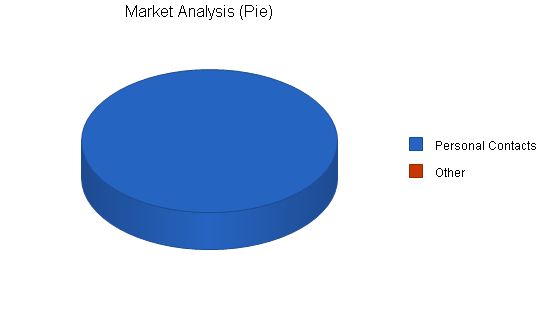

Market Analysis Summary————————————————————-

The Water Factory will target personal contacts as prospective customers. This is ideal because there is already a positive relationship with these contacts, making selling easier.

Market Segmentation——————————————————–

As a network marketing business, The Water Factory has an unusual target market. Sales and recruitment are done through personal contacts. The market will be segmented into personal contacts, including past classmates, neighbors, landlords, tenants, repair people, grocers, club members, sport partners, children’s teachers, children’s playmate parents, spouse contacts, and fellow congregation members. This market segment makes up the majority of the market.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Personal Contacts | 9% | 560 | 610 | 665 | 725 | 790 | 8.98% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00% |

| Total | 8.98% | 560 | 610 | 665 | 725 | 790 | 8.98% |

Target Market Segment Strategy

The Water Factory is focused on this market segment because a trust relationship has already been developed between personal contacts. Selling directly to consumers is more effective with an established relationship, as it lowers skepticism and allows for an explanation of the cost advantages of home water filters compared to bottled water.

Additionally, this market is targeted because customers can easily be converted into sales agents for The Water Factory, creating an extra income stream for the company. Becoming a sales representative also provides customers with lower costs for their own product and a revenue stream from the sales of filters to their clients. Lastly, for every new recruit that Aitch’s recruits bring in, Aitch gets a commission, creating multiple revenue channels.

Industry Analysis

Network marketing, or multi-level marketing, is a growing industry with companies like Amway, Shaklee, and Herbalife at the forefront. Other well-known companies that participate in the industry include AT&T, Proctor & Gamble, and Coca Cola.

Network marketing should not be confused with pyramid schemes, which lack a viable product or service. In network marketing, personal care products, household products, and other services and products such as travel arrangements, insurance services, pet care supplies, and phone services are sold.

Competition and Buying Patterns

There are several sources of competition:

- Other network marketing companies selling water filters. Several firms sell water filtration units, which can result in competitive pricing.

- Water filters sold through traditional retailers. There are approximately ten manufacturers of home filtration units. These units offer competitive pricing, but lack the option to become a sales agent and receive lower purchase prices as well as a future revenue stream.

- Office style water dispenser (typically leased). Several companies lease large, stand-alone water coolers with more expensive equipment and higher cost per gallon.

- Bottled water. Hundreds of companies sell bottled water at significantly higher prices compared to home water filters.

- Soft drinks. While not a direct substitute for water, people consume soft drinks when thirsty. Soft drinks are as pricey as bottled water and have negative health effects.

Over the last five years, the market for filtered water, typically in the form of bottled water, has exploded. Demand for filtered water has steadily grown, and home water filtration units offer significant price advantages compared to bottled water alternatives.

Strategy and Implementation Summary

The Water Factory will aggressively court personal contacts, aiming to turn them into customers and eventually sales agents. By offering products at wholesale pricing and providing commissions for sales, the company creates a win-win situation and a competitive advantage.

Competitive Edge

The Water Factory’s competitive advantage is the ability to generate revenue streams for sellers through network marketing. Buyers can become sellers, receive products at wholesale pricing, and earn commissions for their own sales and the sales of their recruits. This creates a recurring revenue stream and helps gain market share.

Performing a SWOT analysis can help develop effective business strategies. Learn how to perform a SWOT analysis with our free guide and template.

Sales Strategy

The Water Factory’s sales strategy relies on leveraging personal contacts. An informal meeting will be set up with prospective customers, showcasing product information and explaining the cost savings of using a water filter compared to buying bottled water. Aitch Tuoo will handle all concerns, delivery, and billing, aiming to sign up customers during the initial meeting. The option of becoming a member and receiving products at cost will be introduced to interested prospects.

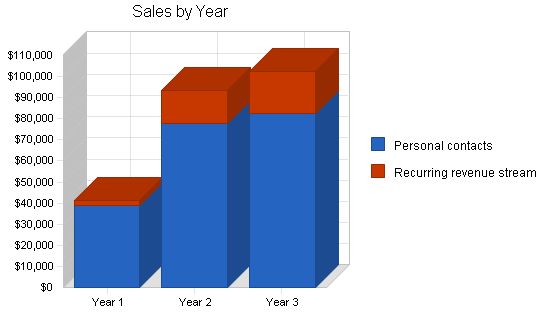

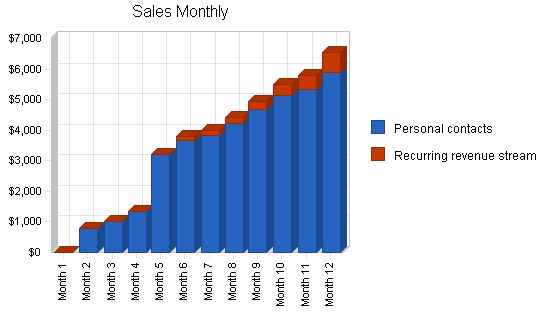

Sales Forecast

The first month will be spent setting up the home office, with no sales activity. The second month will mark the beginning of sales, gradually increasing over time. Recurring revenue from recruited salespeople will start in month six.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Personal contacts | $39,091 | $77,854 | $82,547 |

| Recurring revenue stream | $2,189 | $15,447 | $19,874 |

| Total Sales | $41,280 | $93,301 | $102,421 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Personal contacts | $19,546 | $38,927 | $41,274 |

| Recurring revenue stream | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $19,546 | $38,927 | $41,274 |

Milestones

The Water Factory will have several milestones early on:

- Business plan completion. This will be done as a road map for the organization. While we do not need a business plan to raise capital, it will be an indispensable tool for the ongoing performance and improvement of the company.

- Office set up.

- First recurring revenue to come in.

- Profitability solely from recurring revenue.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 2/1/2001 | $0 | ABC | Marketing |

| Office set up | 1/1/2001 | 2/1/2001 | $0 | ABC | Department |

| First recurring revenue to come in. | 1/1/2001 | 5/1/2001 | $0 | ABC | Department |

| Profitability solely from recurring revenue | 1/1/2001 | 9/1/2001 | $0 | ABC | Department |

| Totals | $0 | ||||

Management Summary

Aitch Tuoo, the founder and owner, pursued his undergraduate business degree from the University of Washington. While at UW, Aitch worked for Circuit City as a sales representative because he thought the skill of sales was important.

Throughout his undergraduate studies, Aitch was unsure of what type of business he wanted to pursue. He decided on business as a major as he thought it would be a universal degree. During his third year he took an entrepreneur class. This class pointed out the distinction between having a job and having a business. The difference is that with a job you earn money when you work, compared to when you own a business, you make money while the business is operating, regardless if you are actually working or not. This point really sank in for him. Aitch was interested in having a business instead of a job. He wanted to make money regardless of whether he was working or not. This ideology truly appealed to him. Upon graduating, Aitch conducted significant research to determine the most promising market. He was surprised to learn that the market for filtered water was huge and growing each year. He also came across the network marketing business model and decided to combine the two to create a business for himself.

Personnel Plan

As a home-based business, Aitch will be the only person working and will receive a monthly salary.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Aitch Tuoo | $36,000 | $36,000 | $36,000 |

| Other | $0 | $0 | $0 |

| Total People | 0 | 0 | 0 |

| Total Payroll | $36,000 | $36,000 | $36,000 |

The following sections will outline the important financial details.

Important Assumptions

The following table details the important financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

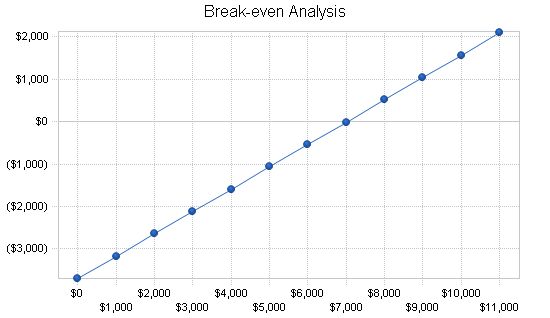

The Break-even Analysis indicates what is needed in monthly revenue to break even.

Break-even Analysis:

Monthly Revenue Break-even: $7,025

Assumptions:

– Average Percent Variable Cost: 47%

– Estimated Monthly Fixed Cost: $3,699

Projected Profit and Loss:

The table below shows the projected profit and loss.

Pro Forma Profit and Loss

Sales:

– Year 1: $41,280

– Year 2: $93,301

– Year 3: $102,421

Direct Cost of Sales:

– Year 1: $19,546

– Year 2: $38,927

– Year 3: $41,274

Other: $0

Total Cost of Sales:

– Year 1: $19,546

– Year 2: $38,927

– Year 3: $41,274

Gross Margin:

– Year 1: $21,735

– Year 2: $54,374

– Year 3: $61,148

Gross Margin %:

– Year 1: 52.65%

– Year 2: 58.28%

– Year 3: 59.70%

Expenses:

Payroll:

– Year 1: $36,000

– Year 2: $36,000

– Year 3: $36,000

Sales and Marketing and Other Expenses:

– Year 1: $600

– Year 2: $600

– Year 3: $600

Depreciation:

– Year 1: $768

– Year 2: $768

– Year 3: $764

Leased Equipment: $0

Utilities:

– Year 1: $900

– Year 2: $900

– Year 3: $900

Insurance:

– Year 1: $720

– Year 2: $720

– Year 3: $720

Rent: $0

Payroll Taxes:

– Year 1: $5,400

– Year 2: $5,400

– Year 3: $5,400

Other: $0

Total Operating Expenses:

– Year 1: $44,388

– Year 2: $44,388

– Year 3: $44,384

Profit Before Interest and Taxes:

– Year 1: ($22,654)

– Year 2: $9,986

– Year 3: $16,764

EBITDA:

– Year 1: ($21,886)

– Year 2: $10,754

– Year 3: $17,528

Interest Expense: $0

Taxes Incurred:

– Year 1: $0

– Year 2: $2,497

– Year 3: $4,261

Net Profit:

– Year 1: ($22,654)

– Year 2: $7,490

– Year 3: $12,503

Net Profit/Sales:

– Year 1: -54.88%

– Year 2: 8.03%

– Year 3: 12.21%

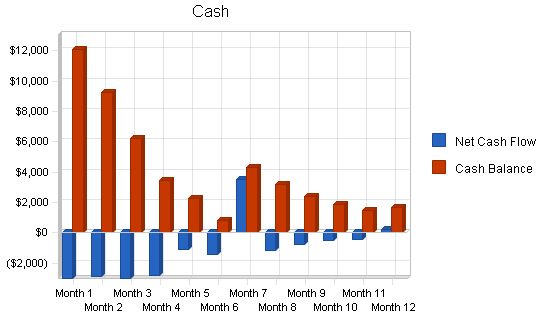

Projected Cash Flow

The following chart and table indicate projected cash flow.

Pro Forma Cash Flow

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $41,280 | $93,301 | $102,421 |

| Subtotal Cash from Operations | $41,280 | $93,301 | $102,421 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $5,000 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $46,280 | $93,301 | $102,421 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $36,000 | $36,000 | $36,000 |

| Bill Payments | $23,711 | $48,467 | $52,816 |

| Subtotal Spent on Operations | $59,711 | $84,467 | $88,816 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $2,500 | $2,500 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $59,711 | $86,967 | $91,316 |

| Net Cash Flow | ($13,431) | $6,334 | $11,105 |

| Cash Balance | $1,669 | $8,003 | $19,108 |

Projected Balance Sheet

The following table indicates the projected balance sheet.

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $1,669 | $8,003 | $19,108 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $1,669 | $8,003 | $19,108 |

| Long-term Assets | |||

| Long-term Assets | $2,300 | $2,300 | $2,300 |

| Accumulated Depreciation | $768 | $1,536 | $2,300 |

| Total Long-term Assets | $1,532 | $764 | $0 |

| Total Assets | $3,201 | $8,767 | $19,108 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $3,455 | $4,031 | $4,369 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $5,000 | $2,500 | $0 |

| Subtotal Current Liabilities | $8,455 | $6,531 | $4,369 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $8,455 | $6,531 | $4,369 |

| Paid-in Capital | $18,000 | $18,000 | $18,000 |

| Retained Earnings | ($600) | ($23,254) | ($15,764) |

| Earnings | ($22,654) | $7,490 | $12,503 |

| Total Capital | ($5,254) | $2,236 | $14,739 |

| Total Liabilities and Capital | $3,201 | $8,767 | $19,108 |

| Net Worth | ($5,253) | $2,236 | $14,739 |

The following table contains ratios from the home water purification equipment industry, as defined by the Standard Industry Classification (SIC) Index code 3589, Service Industry Machinery, Not Elsewhere Classified.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | n.a. | 126.02% | 9.77% | 8.10% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 25.80% |

| Total Current Assets | 52.15% | 91.29% | 100.00% | 72.50% |

| Long-term Assets | 47.85% | 8.71% | 0.00% | 27.50% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 264.10% | 74.50% | 22.86% | 35.50% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 21.30% |

| Total Liabilities | 264.10% | 74.50% | 22.86% | 56.80% |

| Net Worth | -164.10% | 25.50% | 77.14% | 43.20% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 52.65% | 58.28% | 59.70% | 32.10% |

| Selling, General & Administrative Expenses | 94.45% | 45.91% | 43.48% | 17.80% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.90% |

| Profit Before Interest and Taxes | -54.88% | 10.70% | 16.37% | 3.40% |

| Main Ratios | ||||

| Current | 0.20 | 1.23 | 4.37 | 2.12 |

| Quick | 0.20 | 1.23 | 4.37 | 1.20 |

| Total Debt to Total Assets | 264.10% | 74.50% | 22.86% | 56.80% |

| Pre-tax Return on Net Worth | 431.21% | 446.60% | 113.74% | 4.50% |

| Pre-tax Return on Assets | -707.62% | 113.90% | 87.73% | 10.40% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -54.88% | 8.03% | 12.21% | n.a |

| Return on Equity | 0.00% | 334.95% | 84.83% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 7.86 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 28 | 29 | n.a |

| Total Asset Turnover | 12.89 | 10.64 | 5.36 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.00 | 2.92 | 0.30 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net

General Assumptions: Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 30.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Sales $0 $784 $1,025 $1,354 $3,204 $3,779 $3,976 $4,402 $4,952 $5,489 $5,783 $6,532 Direct Cost of Sales $0 $392 $513 $677 $1,602 $1,827 $1,921 $2,108 $2,344 $2,562 $2,663 $2,939 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales $0 $392 $513 $677 $1,602 $1,827 $1,921 $2,108 $2,344 $2,562 $2,663 $2,939 Gross Margin $0 $392 $513 $677 $1,602 $1,952 $2,056 $2,295 $2,609 $2,927 $3,121 $3,593 Gross Margin % 0.00% 50.00% 50.00% 50.00% 50.00% 51.65% 51.70% 52.12% 52.68% 53.32% 53.96% 55.01% Expenses Payroll $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Sales and Marketing and Other Expenses $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 Depreciation $64 $64 $64 $64 $64 $64 $64 $64 $64 $64 $64 $64 Leased Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Utilities $75 $75 $75 $75 $75 $75 $75 $75 $75 $75 $75 $75 Insurance $60 $60 $60 $60 $60 $60 $60 $60 $60 $60 $60 $60 Rent $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Payroll Taxes 15% $450 $450 $450 $450 $450 $450 $450 $450 $450 $450 $450 $450 Other $0 $0 $0 $0 $0 $0 Pro Forma Balance Sheet |

||||

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $15,100 | $12,079 | $9,215 | $6,209 | $3,410 | $2,271 | $805 | $4,316 | $3,157 | $2,358 | $1,861 | $1,444 | $1,669 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $15,100 | $12,079 | $9,215 | $6,209 | $3,410 | $2,271 | $805 | $4,316 | $3,157 | $2,358 | $1,861 | $1,444 | $1,669 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 |

| Accumulated Depreciation | $0 | $64 | $128 | $192 | $256 | $320 | $384 | $448 | $512 | $576 | $640 | $704 | $768 |

| Total Long-term Assets | $2,300 | $2,236 | $2,172 | $2,108 | $2,044 | $1,980 | $1,916 | $1,852 | $1,788 | $1,724 | $1,660 | $1,596 | $1,532 |

| Total Assets | $17,400 | $14,315 | $11,387 | $8,317 | $5,454 | $4,251 | $2,721 | $6,168 | $4,945 | $4,082 | $3,521 | $3,040 | $3,201 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $614 | $993 | $1,109 | $1,268 | $2,162 | $2,380 | $2,470 | $2,651 | $2,879 | $3,090 | $3,188 | $3,455 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Subtotal Current Liabilities | $0 | $614 | $993 | $1,109 | $1,268 | $2,162 | $2,380 | $7,470 | $7,651 | $7,879 | $8,090 | $8,188 | $8,455 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $614 | $993 | $1,109 | $1,268 | $2,162 | $2,380 | $7,470 | $7,651 | $7,879 | $8,090 | $8,188 | $8,455 |

| Paid-in Capital | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 |

| Retained Earnings | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) |

| Earnings | $0 | ($3,699) | ($7,006) | ($10,193) | ($13,215) | ($15,312) | ($17,059) | ($18,702) | ($20,107) | ($21,197) | ($21,969) | ($22,548) | ($22,654) |

| Total Capital | $17,400 | $13,701 | $10,394 | $7,208 | $4,186 | $2,089 | $342 | ($1,302) | ($2,707) | ($3,797) | ($4,569) | ($5,148) | ($5,254) |

| Total Liabilities and Capital | $17,400 | $14,315 | $11,387 | $8,317 | $5,454 | $4,251 | $2,721 | $6,168 | $4,945 | $4,082 | $3,521 | $3,040 | $3,201 |

| Net Worth | $17,400 | $13,701 | $10,394 | $7,208 | $4,186 | $2,089 | $342 | ($1,302) | ($2,706) | ($3,797) | ($4,569) | ($5,147) | ($5,253) |

Business Plan Outline

- Executive Summary

- Company Summary

- Products

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!