Zenergy Medical Industries is a start-up company specializing in the distribution of therapeutic systems for residents of Homecare and Assisted Living facilities at risk of complications from X disease. Our goal is to establish ourselves in this market and expand our product offerings to further treat and manage complications of the disease.

Currently, the market for these products is underserved and inconsistent, with local pharmacies and distributors filling the gaps. Our plan is to create a regional and eventually national network of clinical sales professionals, making us the preferred partner for large Homecare and Assisted Living chains, as well as attractive to potential suppliers.

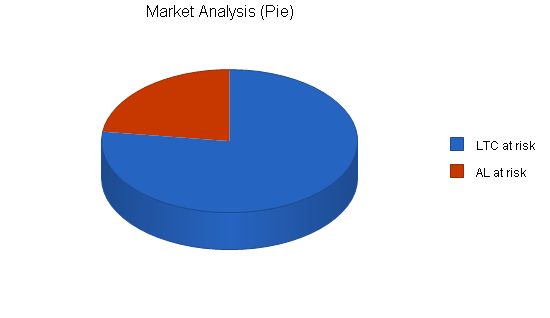

In terms of market potential, there are approximately 345,784 Homecare at risk residents, with a revenue potential of $59.6 million, and around 66,671 Assisted Living at risk residents, with a revenue potential of $17.6 million.

What sets us apart is our distribution strategy, comprehensive product lines, and programs that make working with us incredibly easy. We have strong corporate account relationships, the ability to quickly build a field clinical sales team, and create compelling marketing programs. Our competition consists mostly of smaller local distributors and pharmacists who lack a sophisticated and coordinated approach.

Our strategy involves leveraging relationships with decision-makers at major homecare chains to gain access to their facilities. This will provide us with pre-qualified sales opportunities for our clinical sales team. Additionally, we will build a strong national clinical sales team capable of establishing relationships with clinical decision-makers at the facility level. We will also implement marketing strategies to position ourselves as leaders in providing clinical product solutions for managing complications of the disease. Lastly, we will establish distribution relationships with top suppliers to build a comprehensive line of product solutions. This will create an indispensable distribution channel for suppliers to penetrate the post-acute market.

Our organization will utilize the therapeutic system offering to enter the market and build our presence. We will then expand by adding complementary products for managing complications of the disease, as well as products related to managing complications of heart disease and aging.

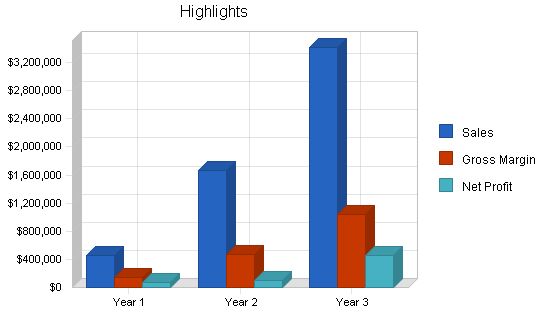

In terms of finances, the owners will invest personal savings in the business, and we will seek short-term loans to supplement initial cash flows from sales in the first year. We anticipate a net profit in the first year, which will substantially grow by year three. This will result in a very respectable net worth for Zenergy Medical Industries.

Our objectives are to achieve sales growth targets by month six and by the end of year one. We aim for aggressive gains in market share and average monthly revenues in year two.

Our mission is to provide post-acute care facilities with product solutions for managing complications of X disease. We take pride in alleviating patient suffering associated with these conditions.

The keys to our success lie in offering a comprehensive line of innovative, top-quality products. We also provide unrivaled clinical support on a regional and national level to post-acute facilities. We have strong relationships with key decision-makers in top post-acute chains, as well as with facility-level administrators and clinicians. Our ability to effectively articulate the value of our products and solutions sets us apart in the marketplace. Additionally, our unique organizational spirit attracts talented individuals to join us and create a thriving business.

Zenergy Medical Industries is the go-to source for post-acute-care providers seeking product solutions to manage complications of X disease. As a start-up company, we will initially distribute a full line of disease therapies and medications, followed by additional complimentary products. Our headquarters will be in Charleston, S.C.

Our differentiation will lie in our distribution and marketing strategies. We will leverage corporate account relationships and create marketing programs to drive demand for our product solutions at the corporate level. Additionally, we will establish a unique network of clinical sales professionals, starting in the Southeast and expanding nationwide. These professionals will build relationships at the facility level by providing value-added service and expertise to caregivers.

In terms of regulatory issues, our compliance is limited to adhering to CMS’s supplier standards regulated by the DMERCs and HIPAA regulations regarding patient data.

Zenergy Medical Industries is a division of Finkelstein and Acropolis, LLC., equally owned by Acropolis, Finkelstein, and Aktum. The start-up costs will be funded by Acropolis, Finkelstein, and Aktum, with supplementary funding sought through an SBA Micro-Loan.

The key elements of our start-up plan are as follows:

– Create the strategic business plan.

– Establish a corporate identity and positioning strategy.

– Establish a location and place of doing business.

– Obtain a Medicare provider number.

– Build a field clinical sales organization, initially focused on the Southern U.S.

– Define key business processes.

– Build relationships with key decision makers in targeted Homecare and Assisted Living chains.

– Cover costs of raising capital through private placement.

Specific start-up requirements include:

– Legal fees for employment agreements and company legal documents.

– Purchase of office supplies and stationery.

– Cost of obtaining general liability insurance.

– Rental expenses.

– Lease of office equipment.

– Costs related to telecommunications.

– Accounting expenses.

– Surety bond (waived).

– Investment in marketing materials.

– Budget for unanticipated expenses.

– Start-up assets, including working capital, product inventory, and office furniture.

In summary, Zenergy Medical Industries aims to serve as the primary resource for post-acute-care providers in managing complications of X disease. We have strategically planned our start-up to ensure success in this endeavor.

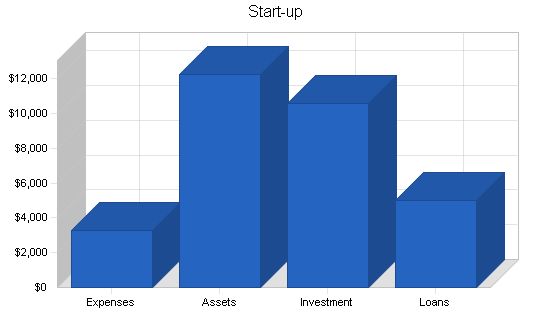

Start-up Requirements

Start-up Expenses

– Legal: $500

– Stationery and Office Supplies: $250

– Liability Insurance: $60

– Rent: $900

– Office Equipment Leases: $125

– Telecommunications: $320

– Accounting: $150

– Surety Bond: $0

– Marketing Materials: $500

– Travel: $0

– Other: $500

– Total Start-up Expenses: $3,305

Start-up Assets

– Cash Required: $9,500

– Start-up Inventory: $2,500

– Other Current Assets: $275

– Long-term Assets: $0

– Total Assets: $12,275

Total Requirements: $15,580

Products

Zenergy Medical Industries sells disease therapy systems for homecare and assisted living residents diagnosed with an ICD-9 code of X disease. We provide value-added services such as initial consultations, order placement, billing and reimbursement management, delivery training, and annual reorder management.

Market Analysis Summary

Our primary customers are elderly residents in homecare or post-acute care facilities at risk for complications from X disease. These residents can be divided into two major markets: homecare residents and assisted living residents. They fall into one of three payor classifications: Medicare, Private Pay, or Medicaid.

A profile of the homecare market today:

1. There are 16,121 facilities with 1,683,068 patients.

2. Average utilization rate is 85.6%, meaning there are about 1,440,768 patients.

3. Disease prevalence is estimated at 18% in the general population over 60, and 24% within homecare.

4. Medicare covers 12% of residents, private sources cover 20%, and Medicaid covers 68%.

5. 60-70% of these patients have related symptoms, increasing their risk for complications.

6. 15-25% of these patients will experience complications in their lifetime.

7. 86,000 surgeries occur annually, with 50% considered preventable. Managing complications can cost $2000-$13,500 per year, or up to $27,000 in the two years following surgery.

Based on these statistics, the estimated market size is as follows:

– Homecare "At Risk" Segment

– Total number of homecare residents: 1,440,768

– Disease prevalence rate: 24%

– Number of patients in payor category: 345,784

– Percentage with related symptoms: 65%

– Number of at risk patients in homecare market: 224,760

– Reimbursement per year: $264.04

– Homecare revenue potential: $59,345,524

A profile of the assisted living market today:

1. There are 32,886 facilities with 987,000 beds.

2. Average occupancy rate is 80%, meaning there are about 789,000 residents.

3. Disease prevalence is estimated at 18% in the general population over 60, and 13% within assisted living facilities.

4. Private sources cover 91% of residents, while Medicaid covers 9%.

5. 60-70% of these patients have related symptoms, increasing their risk for complications.

6. 15-25% of these patients will experience complications in their lifetime.

7. 86,000 surgeries occur annually, with 50% considered preventable. Managing complications can cost $2000-$13,500 per year, or up to $27,000 in the two years following surgery.

Based on these statistics, the estimated market size is as follows:

– Assisted Living "At Risk" Segment

– Total number of assisted living residents: 789,000

– Disease prevalence rate: 13%

– Number of patients in payor category: 102,570

– Percentage with related symptoms: 65%

– Number of at risk patients in assisted living market: 66,671

– Reimbursement per year: $264.04

– Assisted living revenue potential: $17,603,678

Elderly and diseased growth projections:

– Between 2002 and 2020, the population with the disease will grow by 44% due to increased heart disease, an aging population, and above-average growth in high-risk segments such as African American and Hispanic.

– The homecare and assisted living markets will also grow due to the projected increase in the elderly population (65+). The Census Bureau estimates a 53% increase from 34.7 million in 2000 to 53.2 million by 2020.

– During the same period, the total number of elderly patients with the disease is projected to increase by 130%, from 4.6 million to 10.6 million.

– These factors will drive demand for products that manage disease complications.

Market Segmentation

Our three highest priority target markets are:

1. "At risk" residents in homecare chains.

2. "At risk" residents in assisted living chains.

By targeting homecare and assisted living chains, we can efficiently gain access to member facilities at the corporate office level.

Homecare Market Potential:

– Total number of homecare residents: 375,000

– Disease prevalence rate: 24%

– Number of patients in top 50 homecare chains: 90,000

– Percentage with related symptoms: 65%

– Number of at risk patients in top 50 homecare chains: 58,500

– Reimbursement per year: $264.04

– Homecare revenue potential: $15,446,340

Assisted Living Market Potential:

– Total number of assisted living residents: 167,700

– Disease prevalence rate: 13%

– Number of patients in top 30 assisted living chains: 21,801

– Percentage with related symptoms: 65%

– Number of at risk patients in top 30 assisted living chains: 14,171

– Reimbursement per year: $264.04

– Assisted living revenue potential: $3,741,618

Market Analysis

Potential Customers: Growth

LTC at risk: 2.00%: 224,760 / 229,255 / 233,840 / 238,517 / 243,287 (CAGR: 2.00%)

AL at risk: 4.00%: 66,671 / 69,338 / 72,112 / 74,996 / 77,996 (CAGR: 4.00%)

Total: 2.47%: 291,431 / 298,593 / 305,952 / 313,513 / 321,283 (CAGR: 2.47%)

Target Market Segment Strategy

Geographically, our focus will be on Southern U.S. facilities that fit our top priority segments.

We will leverage our relationships with these chains to gain faster access for our field clinical sales team. This should result in cost savings and increased efficiency.

The Southern U.S. DMERC Region C will be our focus due to higher prevalence rates and a high number of chain facilities.

In year one, we will target Homecare and AL chains in Tennessee, North Carolina, South Carolina, Alabama, Georgia, and Florida. In years two and three, we will expand further into Virginia, Louisiana, Mississippi, Oklahoma, and Texas. In years three and four, we will expand nationwide.

Our industry is Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS), focusing on elder care markets.

The elder care market is influenced by conflicting dynamics. While advancements allow more elderly patients to be cared for at home, the aging population and associated disease states require intensive care in institutional settings.

HIDA estimates 4-5% annual growth in the DME market’s revenue from 2002-2004, with total national spending on elder care growing approximately 5% per year.

Competition and Buying Patterns

The market is served inconsistently by pharmacies, DME manufacturers, rehab facilities, therapists, and local dealers. We aim to take market share by offering a comprehensive, regional clinical sales channel.

Our competitors lack a national presence, clear marketing strategy, and corporate chain relationships. They mainly function as order takers.

One study in 1995 indicated low utilization of the Medicare therapeutic disease benefit, which could be improved with a coordinated marketing approach.

Currently, residents purchase therapeutic disease systems for medical reasons, Medicare coverage, direct mail, word-of-mouth, or disease-related complications.

Our organization effectively approaches this market on a regional level with a unique strategy.

Strategy and Implementation Summary

Our strategy is to market to Homecare and AL corporate account chains in the Southeast, focusing on arthritic residents covered under Medicare Part B.

We will leverage our corporate account relationships to open doors and use our marketing expertise to build a compelling program.

We will grow our clinical sales team and develop streamlined processes.

Our initial entry into the market will be through therapeutic systems, followed by other products for managing complications.

Competitive Edge

Our competitive edge lies in our industry relationships, ability to build a strong clinical sales team, comprehensive marketing strategy, and distribution relationships.

Marketing Strategy

Our primary market is residents of Homecare agencies and post-acute care facilities covered and at risk for complications.

Success hinges on building relationships, leveraging national accounts, and effectively marketing our value proposition.

Key elements of our brand platform include vision, attributes, essence, image, promise, and positioning statement.

Our company name is Zenergy Medical Industries, and our logo and color scheme will be finalized by May 7th.

Sales Strategy

Our sales strategy is to educate Homecare and AL chains on the benefits of our therapeutic system program.

We will leverage national accounts, field sales presence, and compelling marketing programs.

Our sales process varies based on payor status, including Medicare, private insurance, resident payment, or facility payment.

Pricing and Compensation

Medicare reimbursement for standard systems is $264.04 per year.

Our compensation plan is a straight 16% commission on reimbursement received.

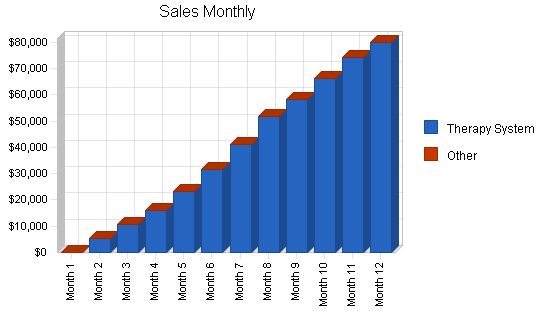

In year one, we will have seven reps, with increasing unit volume each month. Net sales will be based on an average sales price of $211.32.

Direct costs include unit cost, shipping, Medicare billing, and commissions.

In year two, we will have fifteen reps, and in year three, we will have twenty-five reps. Costs will increase accordingly.

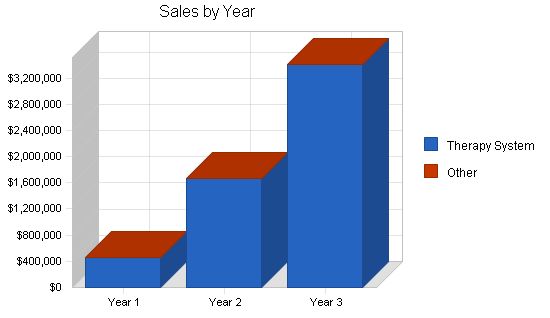

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Therapy System | $458,374 | $1,670,845 | $3,408,228 |

| Other | $0 | $0 | $0 |

| Total Sales | $458,374 | $1,670,845 | $3,408,228 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Inventory Used | $112,840 | $454,930 | $834,900 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $112,840 | $454,930 | $834,900 |

Recruitment and Training

Recruitment:

We will focus on contracting clinicians with two or more years of sales or customer service experience, who desire part-time or flexible work schedules and are willing to work under contract employee status. They will have minimum call activity requirements of three to five calls per week, and we anticipate the average revenue generated per year will be approximately $120,000 for someone working 15-20 hours per week and meeting the minimum sales call guidelines. Over time we will add additional products related to supporting the complications of X disease. Mitch Finkelstein has been involved in clinical salesforce management and recruiting for 15+ years in this area, and Yanni Acropolis has 15+ years of clinical sales experience in the Southeast as well. We plan to leverage our relationships in the clinical sales arena to recruit top caliber sales reps, focusing first in the Southeast. Our goal in year one will be to fill at least seven positions by December 1st in the following territories:

- Tennessee – Chattanooga, Knoxville, Memphis, Nashville

- North Carolina – Charlotte, Raleigh, Greensboro,

- South Carolina – Charleston

- Florida – Miami, Tampa, Orlando, Jacksonville

- Georgia – Atlanta

The remaining unfilled territories will be filled early in year two, and we will also begin to look at the following markets for years two and three to reach at least 25 territories by early in year three.

- Alabama – Birmingham

- Texas – Dallas, San Antonio, Houston

- Mississippi – Jackson, Gulfport

- Louisiana – Baton Rouge, New Orleans

- Oklahoma – Tulsa, Oklahoma City

- Arkansas – Little Rock, Fort Smith

- Virginia – Richmond, Norfolk

Training:

The product is straightforward and limited in scope (initially), and we will be hiring clinicians with experience in the post-acute marketplace who are generally familiar with Medicare reimbursement, so we anticipate the ramp-up time to full productivity to be brief (30-60 days). Training will be provided in the following areas:

- A review of the company strategy, job expectations, and internal processes for ordering, billing, collecting, commissions, record keeping, etc. (one-half day required)

- Product-related training from the manufacturer (one day required)

- Reimbursement-related training from the appropriate DMERC Region C ombudsman (one-half to full day required)

- A review of the basics of disease care, ideally conducted by a qualified physician (one-half to full day required)

Sales Process

Sales Process at Facility Level:

- Qualified Medicare residents must have a disease diagnosis.

- Resident must have one of the following conditions:

- [Proprietary and Confidential Information Removed.]

- Resident must be currently being treated under a comprehensive disease care plan by a physician. The patient’s medical records must reflect the need for the care.

- To place an order, the sales rep must submit:

- A statement of certifying physician for therapeutic systems form reviewed and signed by the M.D. or D.O. overseeing the disease treatment plan.

- A signed prescription form from the prescribing physician (M.D., or D.O.).

- An order for the systems signed and dated by the physician.

- A completed Medicare claim form (HCFA 1500).

We plan to contract with an experienced part B biller who will handle the electronic claims submission, billing, and collection of co-pay amounts for a flat charge per every six line items on an order. This will minimize the time our field sales people spend chasing paperwork and allow them to maximize their time spent building relationships, selling, and providing extraordinary service.

Milestones

Notes relating to some of the key milestones:

- Determine cash needs and draw up partnership: We estimate $15,580 will be required to fund start-up and initial operations. Finkelstein, Acropolis, and Aktum plan to contribute equally to fund these cash needs, and Finkelstein will create a partnership agreement with a plan for financially accounting for the investment capital.

- Find part B biller and sign agreement: This biller will also serve as our EDI filer.

- Rent facility:

- Sign lease agreement with target of 3 months guaranteed, 90-day out clause, out clause if provider number delayed or we move operations out of state.

- Secure computer, printer, DSL line, phone and phone line, answering system as back-up to forward calls the receptionist misses, secure filing system, office furniture, signage with company name and hours of operation.

- Sign supply contracts with Lotus Industries and Sutra Corp: Must show that we can order product directly on credit terms (not COD) and receive immediately, reducing need for inventory.

- Get inventory and samples: Enough to demonstrate the range of products offered. Create starter kits for reps with product samples, name tags, lab coats, a heat gun, and DPM training.

- Get liability insurance: We will see if the landlord’s policy covers us adequately (we will need a copy of the entire policy with the specific verbiage showing we are covered under their facility insurance for at least $300K).

- Create forms, checklist, processes:

- Forms – certificate of necessity, prescription, product order form with patient info, proof of delivery, CMS reimbursement form.

- Checklist – an easy-to-follow list of things the rep must cover (paperwork, reviewing Medicare reimbursement and the resident’s co-pay, warranty, etc.)

- Processes – flowchart the order, reimbursement, and complaint processes with electronic tracking sheets.

- Review with Yanni’s wife: Make sure the forms make sense and we haven’t missed anything.

- Train receptionist: She needs to know how to handle calls or in-person inquiries and be properly coached for the initial site inspection and what to do if there is a random inspection later.

- Create audit/QA process: Define a process for auditing field Medicare claims to ensure only legitimate claims are being processed.

- Create sales recruitment packet:

- Hiring profile and job description.

- Compensation plan and employment contract.

- Territories defined with listings of accounts.

- Recruitment brochure and PowerPoint presentation, including a letter, press release, and corporate marketing brochure.

- Receive provider number: This is estimated to take 60 days if we have everything right the first time.

- Begin recruiting reps: Identify top priority territories and begin networking.

- Contract seven reps: Goal is to hire one by the first of the month in April, May, June, August, September, October, November.

- Sales training program (to be done in the first 30 days):

- Product training by the manufacturers.

- Reimbursement training by the ombudsman.

- Order process training by the management team.

- Company orientation from the management team.

- Basics of anatomy, pathology, and therapeutic system fitting from MD consultants in each major market.

- Identify corporate account targets: Determine which key chains have the biggest presence in our initial seven territories.

- First marketing pieces:

- Mailers to be distributed by the corporate accounts to the member facilities.

- Mailers directly to other facilities in the initial seven territories.

- Brochures for use by facilities or corporate offices.

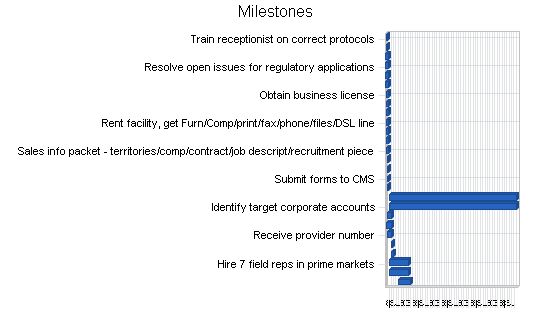

Milestones:

– Train receptionist on correct protocols: 3/1/2005 – 3/7/2005, $0 budget, Manager: Finkelstein, Department: Department

– Create Audit/QA process for checking for bad Medicare claims: 3/1/2005 – 3/7/2005, $0 budget, Manager: Steiner, Department: Department

– Complete Business plan: 2/15/2005 – 3/18/2005, $0 budget, Manager: Aktum, Department: Department

– Resolve open issues for regulatory applications: 2/15/2005 – 3/18/2005, $0 budget, Manager: Mutka, Department: Department

– Define Company Name, Logo, Tag line, Brand Platform: 2/15/2005 – 3/18/2005, $0 budget, Manager: Aktum, Department: Department

– Determine cash needs and draw up partnership agreement: 2/15/2005 – 3/18/2005, $0 budget, Manager: Finkelstein, Department: Department

– Obtain business license: 2/25/2005 – 3/18/2005, $0 budget, Manager: Finkelstein, Department: Department

– Sign agreement with a Medicare part B biller service: 2/25/2005 – 3/18/2005, $0 budget, Manager: Finkelstein, Department: Department

– Set up a checkbook and establish accountant relationship: 2/25/2005 – 3/18/2005, $0 budget, Manager: Finkelstein, Department: Department

– Rent facility, get Furn/Comp/print/fax/phone/files/DSL line: 3/1/2005 – 3/18/2005, $0 budget, Manager: Finkelstein, Department: Department

– Sign supplier contracts: 3/1/2005 – 3/18/2005, $0 budget, Manager: Acropolis, Department: Department

– Get liability insurance: 3/1/2005 – 3/18/2005, $0 budget, Manager: Finkelstein, Department: Department

– Sales info packet – territories/comp/contract/job descript/recruitment piece: 3/1/2005 – 3/18/2005, $0 budget, Manager: Aktum, Department: Department

– Get inventory and samples – create starter kits for reps: 3/7/2005 – 3/18/2005, $0 budget, Manager: Acropolis, Department: Department

– Create forms, checklist order/reimb/complaint processes: 3/7/2005 – 3/18/2005, $0 budget, Manager: Aktum, Department: Department

– Submit forms to CMS: 3/7/2005 – 3/18/2005, $0 budget, Manager: Mutka, Department: Department

– Review forms/checklists/processes with Yanni’s wife: 3/14/2005 – 3/18/2005, $0 budget, Manager: Aktum, Department: Department

– Sales training program – product, reimb, order process, strategy, recuit docs: 8/26/2009 – 4/1/2005, $0 budget, Manager: Aktum, Department: Department

– Identify target corporate accounts: 8/26/2009 – 4/1/2005, $0 budget, Manager: Acropolis, Department: Department

– Site inspection: 3/7/2005 – 4/30/2005, $0 budget, Manager: Steiner, Department: Department

– Begin recruiting sales team members: 3/1/2005 – 5/1/2005, $0 budget, Manager: Finkelstein, Department: Department

– Receive provider number: 3/7/2005 – 5/7/2005, $0 budget, Manager: Team, Department: Department

– Officially “go live” selling to facilities: 5/7/2005 – 5/8/2005, $0 budget, Manager: Team, Department: Department

– Send out first marketing pieces (mailer); website goes live: 5/7/2005 – 5/30/2005, $0 budget, Manager: Aktum, Department: Department

– Hire 7 field reps in prime markets: 4/1/2005 – 12/1/2005, $0 budget, Manager: Finkelstein, Department: Department

– Call on targeted corporate accounts: 4/1/2005 – 12/1/2005, $0 budget, Manager: Acropolis, Department: Department

– Identify future product lines; become fabulously wealthy: 8/1/2005 – 12/31/2005, $0 budget, Manager: Team, Department: Department

– Totals: $0 budget

Web Plan Summary:

Our website will serve as an informational repository with password-accessible pages for critical company information. We will ensure that the public-facing pages are fast, user-friendly, and align with our brand image as clinical professionals offering solutions for complications of X disease in the elderly. The website will have the following content:

1. Product information

2. Contact info for representatives

3. Information about comprehensive programs

4. Research articles on disease care

5. Links to disease websites and suppliers’ websites

6. Customer testimonials and sales success stories

7. Information about Medicare guidelines for therapeutic system programs

8. Expanded content on homecare, post-acute care, and disease complications

9. Links to other disease product companies

10. Customer Web portals for corporate office executives to track member facility progress in implementing therapeutic system programs

Website Marketing Strategy:

We will encourage customers and sales reps to use the website as the primary source of company and disease-related information. We will explore using Web portals to drive program compliance among corporate office decision makers.

Development Requirements:

We will initially develop a basic website in-house using standard packages. The basic site will go live by early May, and we will enhance it as needed.

Management Summary:

Zenergy Medical Industries is founded by three individuals with over 50 years of healthcare sales and marketing experience.

– Mitch Finkelstein: Over 20 years of clinical sales and technical service in disease care prevention and treatment. Past experience as Area VP of Sales, VP of Sales and Marketing, and Director of Corporate Accounts.

– Yanni Acropolis, RN: Over 20 years of nursing and clinical sales experience. Consistently a top performer and recipient of sales awards.

– Ekim Aktum, MBA: Over 15 years of experience in healthcare sales, marketing, and business unit leadership. Held positions as VP of Sales and Marketing and Senior VP of Sales and Marketing.

Personnel Plan:

During the start-up phase, the three founding management team members will be the only employees, operating under a profit-sharing agreement. Starting in May, one sales rep will be added per month until reaching 15 by mid-year 2006 and 25 by mid-year 2007. Sales team members will be contracted employees paid on commission. A part-time office manager will be hired from a temp agency starting in September 2005 and transitioning to full-time in year three.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!