Contents

Locksmith Business Plan

South Kelleton Keys and Locksmith (SKelleton Keys) is a locksmith shop owned and managed by Padraic Lawkse, a certified locksmith. The business will establish a store in South Kelleton to sell lock hardware and services to building management companies, businesses, homeowners, and renters through direct selling and advertising.

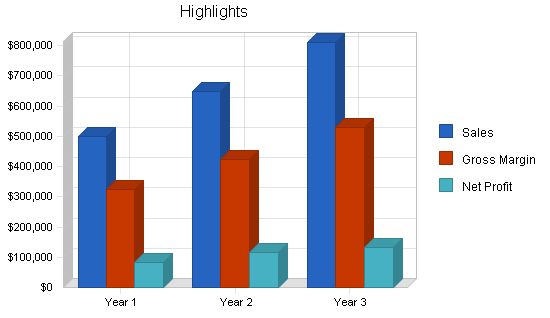

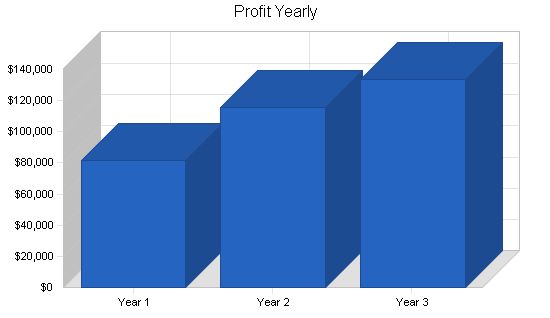

Net profit will significantly increase from the first year to the third year with projected sales almost doubling. The business will expand by selling products and services and providing referrals to security product vendors when necessary. In the third year, an additional locksmith will join the business to apprentice under Pad Lawkse and expand the company.

South Kelleton Keys and Locksmith is seeking a three-year business loan to fund initial operations, along with Pad Lawkse’s capital investment.

1.1 Objectives

The objectives for South Kelleton Keys and Locksmith are:

- Launch a store in a highly visible location in South Kelleton

- Establish relationships with ten apartment buildings as a preferred vendor for locks in the first year

- Achieve a doubling of sales by its third year, with gross margins better than 40%

1.2 Mission

South Kelleton Keys and Locksmith will increase security in its neighborhood by providing quality locks, skilled installation, and repair.

1.3 Keys to Success

To succeed as a locksmith business, SKelleton Keys must:

- Develop relationships with building owners

- Create community awareness of their proximity, quality, and reasonable prices

- Respond quickly to requests

- Sell “security and peace” of mind rather than “locks”

Company Summary

South Kelleton Keys and Locksmith will establish a new locksmith shop in South Kelleton. This residential community requires locks and security products ranging from simple locks to advanced products. SKelleton Keys will provide deadbolts, padlocks, cylinder locks, camlocks, safes, and key copying services.

2.1 Company Ownership

South Kelleton Keys and Locksmith is an LLC owned by Padraic Lawkse, an experienced locksmith.

2.2 Start-up Summary

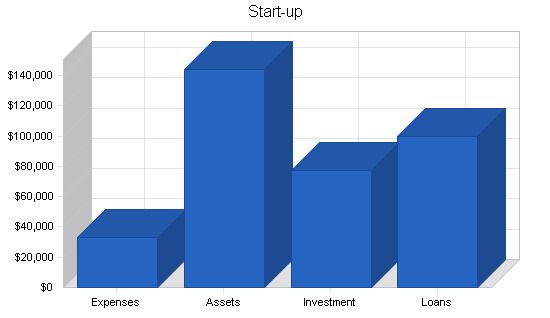

Start-up expenses include liability insurance premiums, rent, legal fees, licensing fees, and stationery. A $25,000 surety bond must also be secured. Pre-launch marketing expenses include website creation, brochure design, flyers, and ads.

$40,000 in inventory must be purchased prior to opening. Current assets include shelves, display cases, a computer, and software systems. Long-term assets include a cash register system, key cutting machines, outdoor signage, and store improvements. Additional tools include hand tools, power tools, letter and number hand stamps, and a ladder. $10,000 is reserved for the purchase of a used van and its outfitting.

Start-up

Requirements

Start-up Expenses

– Legal & Licenses – $3,000

– Surety Bond – $750

– Stationery – $2,000

– Insurance – $10,000

– Rent – $6,000

– Pre-Launch Marketing – $10,000

– Other – $1,000

– Other – $0

– Total Start-up Expenses – $32,750

Start-up Assets

– Cash Required – $44,250

– Start-up Inventory – $40,000

– Other Current Assets – $20,000

– Long-term Assets – $40,000

– Total Assets – $144,250

Total Requirements – $177,000

Products and Services

Products will be from brand names in lock and security products, such as Schlage and Master Lock, with inexpensive options as well.

Products will include:

– deadbolts

– padlocks

– cylinderlocks

– camlocks

– safes

– key rings

– key chains

– locking display cases

– locking file cabinets

– tool chests

Large and customizable items like display cases will not be held in inventory, but will be ordered to client specifications from vendors. Catalogs will be available in store for customers to choose from.

Services will include:

– cutting copies of keys

– installing all lock products sold

– on-site security consultations

– product repair (when possible)

– referrals to security system sellers who provide sales, installation and repair for more advanced security technologies (electronic and video locks, keypads, camera security systems)

Services will be executed by Padraic Lawkse, a locksmith with technical college and professional experience.

Market Analysis Summary

The locksmith industry sells to consumers and businesses, with goals of securing residential and commercial real estate and property. This market ranges from individuals securing a gym locker, to renters adding security to their rented space, to landlords, homeowners, and business owners securing buildings.

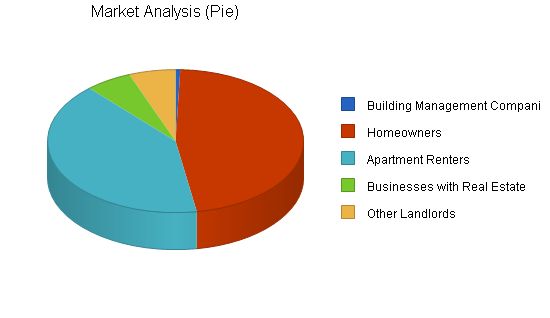

4.1 Market Segmentation

The market for locksmith products and services in South Kelleton has been segmented as shown in the Market Analysis. It is growing at a slow rate, as South Kelleton is built up and not undergoing much new development.

Building management companies work for landlords, providing management services for buildings ranging from single-family homes to large apartment complexes. The managers are tasked with reducing the risks of their landlords, providing good service for their tenants to attract and retain the best tenants, and keeping service costs down. They look for ongoing relationships with local vendors to receive relationship rates for the high volume of business they provide. Locks must be changed frequently for new apartments, front doors, mailboxes, and other rooms in buildings, both when tenants leave and when locks malfunction or are damaged. Robberies or robbery attempts may increase security concerns in buildings or areas and lead to a spree of lock upgrades.

Homeowners seek basic security for their homes, but consider locksmiths as involved in a single transaction. They will look for the reputation and experience of a company but will not spend much time comparing locksmiths. They will pick the first of the two or three they contact, and they will find those based on their visibility in the community or on the internet/Yellow Pages.

Apartment renters generally add a deadbolt to their apartments for greater security, but look for the lowest prices. They think of this work with a locksmith as a single transaction and will not spend too much time comparing prices.

Businesses with real estate may have large amounts of property to protect (inventory and assets) and look for security systems and gates as well as locks. Business owners will seek good prices, but not at the expense of quality and security. They will generally need consultation services as well. Some have large holdings and may work to create ongoing relationships, much like building managers.

Other landlords include absent owners of homes and buildings who do not use a management company. They may not work as professionally as building management companies and may choose locksmiths through simple searches.

Market Analysis:

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Building Management Companies 1% 100 101 102 103 104 0.99%

Homeowners 1% 8,000 8,080 8,161 8,243 8,325 1.00%

Apartment Renters 1% 7,000 7,070 7,141 7,212 7,284 1.00%

Businesses with Real Estate 1% 1,000 1,010 1,020 1,030 1,040 0.99%

Other Landlords 1% 1,000 1,010 1,020 1,030 1,040 0.99%

Total 1.00% 17,100 17,271 17,444 17,618 17,793 1.00%

4.2 Target Market Segment Strategy

To seek profitable market segments in South Kelleton overall, SKelleton Keys will focus on building management companies, homeowners, and businesses with real estate. Each spend more on locks and generally have multiple installations sold with every deal.

Furthermore, apartment renters may be referred to SKelleton Keys by their building management companies, creating future revenues if building managers are sought out first.

4.3 Service Business Analysis

ALOA (Associated Locksmiths of America) provides the following information:

A locksmith may install locks to safeguard property, modify or repair such devices, rekey locks, make duplicate keys or cards, generate or program new keys/cards for lost keys/cards, and respond to emergency calls to unlock vehicles, homes, and businesses.

Some locksmiths also install and service electronic alarm and surveillance systems. Many locksmiths specify, design, install, and service electronic access control systems and closed circuit television (CCTV) systems. Some locksmiths maintain security hardware and software for computer systems.

A locksmith helps customers determine the correct types of locks based on security risk and provides installation services using manufacturer’s templates and/or industry specifications.

A locksmith may sell, service, and install safes for home and business use. They may also service locking devices in banks.

A locksmith repairs locks and replaces worn or malfunctioning parts.

A locksmith makes duplicate keys using a key-duplicating machine.

A locksmith may respond to emergency calls for customers locked out of a home, business, or vehicle.

For security reasons or because keys are stolen or misplaced, many businesses, hotels/motels, and apartment complex owners contract with locksmiths to provide new master key systems and reset combinations.

In our state alone, over 290 locksmith businesses are registered with ALOA, and South Kelleton includes 20.

4.3.1 Competition and Buying Patterns

Neighborhood locksmiths with shops depend on street traffic and are susceptible to aggressive marketing by other locksmith businesses. Customers choose locksmith shops based on location, range of security options, helpfulness of sales staff, and price. Some prefer hardware stores with locksmiths while others look for specialists.

Web Plan Summary

The South Kelleton Keys and Locksmith website will offer basic information about the business and details on the product line but will not offer e-commerce. Customers will be referred to the store to purchase items and to call to schedule consultations. The website will act as an extended brochure for the business.

5.1 Website Marketing Strategy

The South Kelleton Keys and Locksmith website will be marketed through search engine marketing, mentioning the website URL on business cards, brochures, ads, and flyers.

5.2 Development Requirements

The South Kelleton Keys and Locksmith website should offer functions like describing the business and the owner, showcasing store products, detailing services offered, listing partner security businesses, providing store hours, location/directions, and contact information.

Strategy and Implementation Summary

To launch South Kelleton Keys and Locksmith, credibility will be established through a quality product line and expert knowledge. Visibility will be achieved through direct selling to businesses and street/community visibility to homeowners.

6.1 Competitive Edge

South Kelleton Keys and Locksmith will compete by specializing in locks and security, establishing relationships with other security businesses, and maintaining expertise through ALOA training.

6.2 Marketing Strategy

South Kelleton Keys and Locksmith will focus on business sales to building management companies and businesses with real estate, as well as consumer sales to homeowners. Brochures, direct mail, trade publications, search engine marketing, and website development will be used for business sales. Signage, local newsletters, flyers, and website development will be used for consumer sales.

6.3 Sales Strategy

Padraic Lawkse will direct the sales efforts, focusing on qualifying potential customers through phone calls and site visits.

6.3.1 Sales Forecast

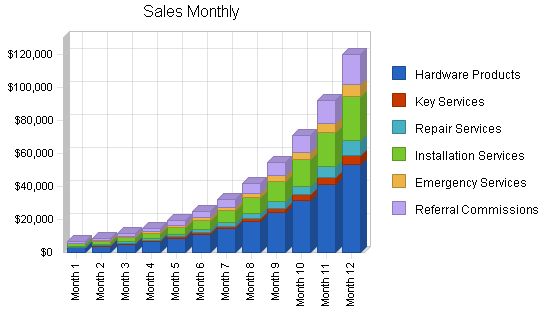

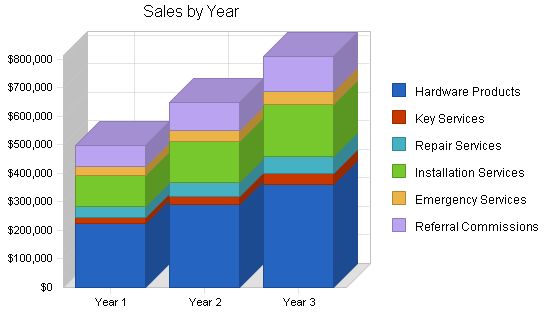

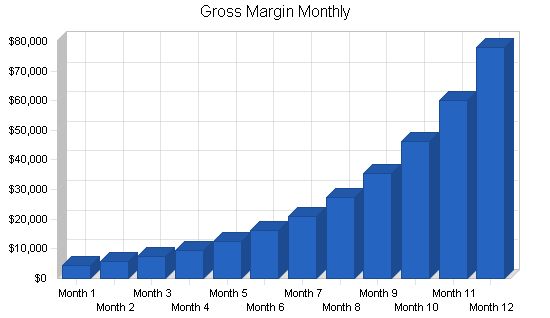

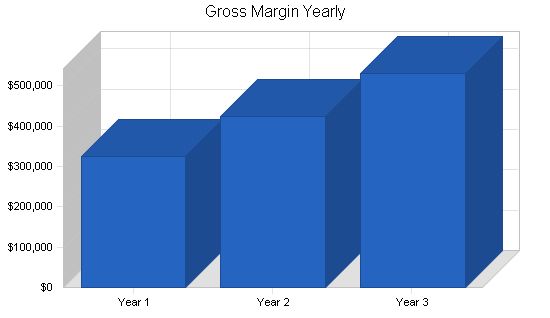

Hardware sales and installations will drive revenue. Services will provide a higher gross margin. Commissions on referrals will be profitable. Significant growth is expected in the first year, followed by annual growth of 30% in year 2 and 25% in year 3.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Hardware Products | $222,964 | $289,853 | $362,317 |

| Key Services | $22,296 | $28,985 | $36,231 |

| Repair Services | $37,147 | $48,291 | $60,364 |

| Installation Services | $111,499 | $144,949 | $181,186 |

| Emergency Services | $29,756 | $38,683 | $48,354 |

| Referral Commissions | $74,329 | $96,628 | $120,785 |

| Total Sales | $497,991 | $647,388 | $809,235 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Hardware Cost | $133,778 | $171,013 | $213,767 |

| Services Cost | $40,140 | $52,181 | $65,227 |

| Subtotal Direct Cost of Sales | $173,918 | $223,195 | $278,994 |

6.4 Milestones

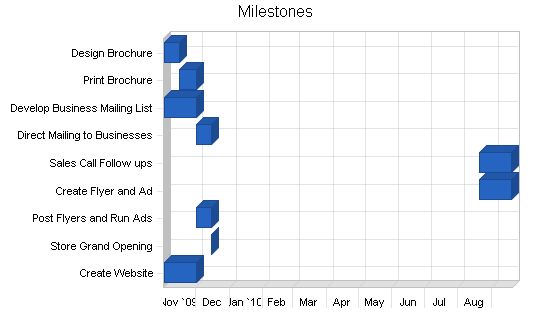

The milestone chart shows the execution of pre-launch marketing activities and the use of $10,000 in marketing funding. The expense for the grand opening is to order store-branded key chains as gifts for customers who visit the store while supplies last.

Milestones:

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Design Brochure | 11/1/2009 | 11/15/2009 | $500 | Owner | SKLK |

| Print Brochure | 11/15/2009 | 12/1/2009 | $2,000 | Owner | SKLK |

| Develop Business Mailing List | 11/1/2009 | 12/1/2009 | $0 | Owner | SKLK |

| Direct Mailing to Businesses | 12/1/2009 | 12/15/2009 | $2,000 | Owner | SKLK |

| Sales Call Follow ups | 8/20/2010 | 9/19/2010 | $0 | Owner | SKLK |

| Create Flyer and Ad | 8/20/2010 | 9/19/2010 | $500 | Owner | SKLK |

| Post Flyers and Run Ads | 12/1/2009 | 12/15/2009 | $3,000 | Owner | SKLK |

| Store Grand Opening | 12/15/2009 | 12/15/2009 | $1,000 | Owner | SKLK |

| Create Website | 11/1/2009 | 12/1/2009 | $1,000 | Owner | SKLK |

| Totals | $10,000 | ||||

Management Summary:

Padraic Lawkse, CEO, will manage store operations, sales and marketing, employee hiring, training, and supervision, and service provision. An assistant store manager will be hired for the first year to handle bookkeeping, purchasing, basic cleaning, and store opening and closing. Pad Lawkse will run the store on weekends and be present during the week when not on service calls.

Store staff will be increased in subsequent years. An additional locksmith apprentice will be hired in the third year to handle basic services and installations, allowing Pad Lawkse to focus on on-site consultations and more complex services.

Personnel Plan:

As the business is an LLC and Pad Lawkse is the sole member, he will receive all profits but is not required to take a salary. However, a salary is shown for tax planning and budgeting purposes. The assistant store manager will be paid a competitive salary with a bonus based on performance. Additional store staff will be hired in the second year and paid hourly. The assistant locksmith will be hired part way through the third year, receiving a salary plus bonus and encouraged to seek additional certifications.

The business will provide health insurance, paid sick leave, and paid vacation for full-time employees.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Owner | $51,000 | $72,000 | $84,000 |

| Assistant Store Manager | $48,000 | $52,000 | $56,000 |

| Store Staff | $0 | $15,000 | $35,000 |

| Assistant Locksmith | $0 | $0 | $20,000 |

| Total People | 2 | 3 | 4 |

| Total Payroll | $99,000 | $139,000 | $195,000 |

South Kelleton Keys and Locksmith will launch using the owner’s savings and a long-term loan. The business will generate healthy profits and maintain a good cash balance for future growth. Additional staff will be hired, but the same basic assets (store, inventory, equipment, etc.) will be utilized. As locksmiths primarily work at customer sites, a larger facility is not necessary. The owner will maintain a cash balance in the business for emergencies and may withdraw additional cash as dividends.

Start-up Funding:

Padraic Lawkse will invest startup funding from his savings and a credit card line-of-credit. A business loan will be obtained against the assets of the business and repaid over the first three years.

| Start-up Funding | |

| Start-up Expenses to Fund | $32,750 |

| Start-up Assets to Fund | $144,250 |

| Total Funding Required | $177,000 |

| Assets | |

| Non-cash Assets from Start-up | $100,000 |

| Cash Requirements from Start-up | $44,250 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $44,250 |

| Total Assets | $144,250 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $10,000 |

| Long-term Liabilities | $70,000 |

| Accounts Payable (Outstanding Bills) | $20,000 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $100,000 |

| Capital | |

| Planned Investment | |

| Owner | $77,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $77,000 |

| Loss at Start-up (Start-up Expenses) | ($32,750) |

| Total Capital | $44,250 |

| Total Capital and Liabilities | $144,250 |

| Total Funding | $177,000 |

Important Assumptions:

This business plan assumes a favorable job market for potential staff and the availability of storefronts to launch the business.

Break-even Analysis:

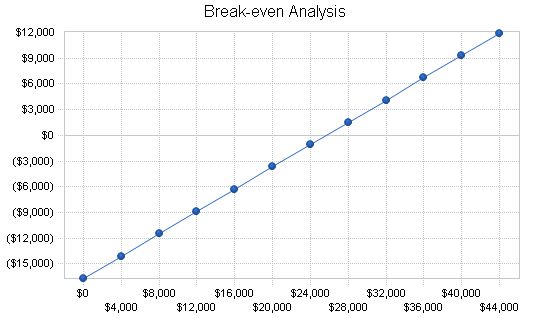

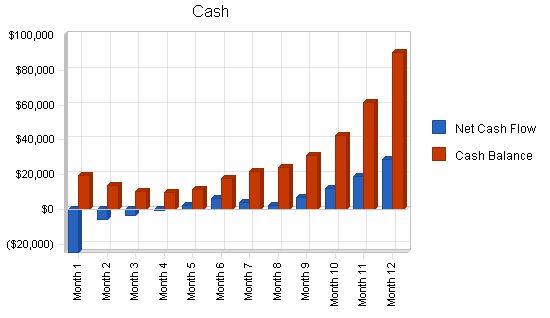

The business is expected to reach break-even from a profit perspective in the seventh month of the first year.

Break-even Analysis

Monthly Revenue Break-even: $25,681

Assumptions:

– Average Percent Variable Cost: 35%

– Estimated Monthly Fixed Cost: $16,713

Projected Profit and Loss

The primary operating expenses for the business will be marketing and promotion. This includes advertising, producing direct mail pieces and brochures, ongoing website hosting and maintenance, and attending events.

Depreciation of long-term assets includes equipment in the store and tools for services. This includes both the equipment and tools purchased at start-up and allowances for additional purchases (shown on the cash flow statement).

Rent is expected to rise, and the business will seek a 5+ year lease on an appropriate storefront space of at least 1,000 square feet.

Insurance and bonding includes ongoing insurance payment for general liability for the store and work at client sites, as well as renewals of the surety bond each year.

Payroll taxes include payments for health insurance for full-time employees.

Store supplies include all supplies (not inventory) expensed immediately for store cleaning, maintenance, and operation.

Van fuel, maintenance, and parking cover the cost of fuel, ongoing maintenance and upkeep of the van, and parking at customer sites when only pay parking is available.

Training and education include subscriptions and coursework for Padraic Lawkse and the assistant locksmith to seek expertise in locksmith work.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $497,991 | $647,388 | $809,235 |

| Direct Cost of Sales | $173,918 | $223,195 | $278,994 |

| Other Costs of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $173,918 | $223,195 | $278,994 |

| Gross Margin | $324,073 | $424,193 | $530,242 |

| Gross Margin % | 65.08% | 65.52% | 65.52% |

| Expenses | |||

| Payroll | $99,000 | $139,000 | $195,000 |

| Marketing/Promotion | $36,000 | $40,000 | $50,000 |

| Depreciation | $18,000 | $18,000 | $18,000 |

| Rent | $24,000 | $26,000 | $28,000 |

| Utilities | $2,400 | $2,500 | $2,600 |

| Insurance & Bonding | $3,600 | $3,800 | $4,000 |

| Payroll Taxes | $0 | $0 | $0 |

| Store Supplies | $6,000 | $10,000 | $15,000 |

| Van Fuel, Maintenance & Parking | $5,550 | $7,200 | $7,800 |

| Training and Education | $6,000 | $8,000 | $15,000 |

| Total Operating Expenses | $200,550 | $254,500 | $335,400 |

| Profit Before Interest and Taxes | $123,523 | $169,693 | $194,842 |

| EBITDA | $141,523 | $187,693 | $212,842 |

| Interest Expense | $7,354 | $5,010 | $3,670 |

| Taxes Incurred | $34,851 | $49,405 | $57,352 |

| Net Profit | $81,318 | $115,278 | $133,820 |

| Net Profit/Sales | 16.33% | 17.81% | 16.54% |

8.5 Projected Cash Flow:

Cash flow will consistently become positive by month 6, eliminating the need for additional funding to start the store and business. The business will maintain a healthy cash balance for the potential repair or replacement of equipment or other assets. The projections include steady investments in business assets to account for equipment replacement.

The cash flow table budgets for the purchase of additional tools and equipment as they wear out, break, or get lost, as well as for purchasing tools to install and maintain new security devices. This ensures that South Kelleton Keys and Locksmith can stay up to date with market releases.

The owner will take dividends from the business when cash flow allows, while keeping a cash reserve of around $50,000 during the second and third year.

Credit card debt will be paid off within the first year.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $373,493 | $485,541 | $606,927 |

| Cash from Receivables | $83,703 | $149,609 | $189,051 |

| Subtotal Cash from Operations | $457,196 | $635,150 | $795,977 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $457,196 | $635,150 | $795,977 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $99,000 | $139,000 | $195,000 |

| Bill Payments | $279,896 | $407,988 | $465,862 |

| Subtotal Spent on Operations | $378,896 | $546,988 | $660,862 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $10,000 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $13,200 | $13,400 | $13,400 |

| Purchase Other Current Assets | $6,000 | $8,000 | $10,000 |

| Purchase Long-term Assets | $3,000 | $15,000 | $20,000 |

| Dividends | $0 | $45,000 | $65,000 |

| Subtotal Cash Spent | $411,096 | $628,388 | $769,262 |

| Net Cash Flow | $46,100 | $6,762 | $26,715 |

| Cash Balance | $90,350 | $97,112 | $123,828 |

8.6 Projected Balance Sheet

The business will pay off its current borrowing in its first year of operation and its long-term liabilities over the first three years. Aside from a contingency fund, the business will not retain a great deal of cash in the business, but will pay profits out as dividends for the most part. Net worth will grow steadily, but not radically, over the first three years of operation for this reason.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $90,350 | $97,112 | $123,828 |

| Accounts Receivable | $40,795 | $53,033 | $66,291 |

| Inventory | $83,869 | $62,147 | $75,666 |

| Other Current Assets | $26,000 | $34,000 | $44,000 |

| Total Current Assets | $241,014 | $246,292 | $309,785 |

| Long-term Assets | |||

| Long-term Assets | $43,000 | $58,000 | $78,000 |

| Accumulated Depreciation | $18,000 | $36,000 | $54,000 |

| Total Long-term Assets | $25,000 | $22,000 | $24,000 |

| Total Assets | $266,014 | $268,292 | $333,785 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $83,646 | $29,046 | $39,118 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $83,646 | $29,046 | $39,118 |

| Long-term Liabilities | $56,800 | $43,400 | $30,000 |

| Total Liabilities | $140,446 | $72,446 | $69,118 |

| Paid-in Capital | $77,000 | $77,000 | $77,000 |

| Retained Earnings | ($32,750) | $3,568 | $53,847 |

| Earnings | $81,318 | $115,278 | $133,820 |

| Total Capital | $125,568 | $195,847 | $264,667 |

| Total Liabilities and Capital | $266,014 | $268,292 | $333,785 |

| Net Worth | $125,568 | $195,847 | $264,667 |

8.7 Business Ratios

South Kelleton Keys and Locksmith’s business ratios are compared here to SIC code 7699 for locksmith businesses with annual sales of $500,000 to $1 million. Due to its ownership of a store, SKelleton Keys’ ratios will differ from the average locksmith of a similar volume of sales, as many locksmiths work only from a van. It will carry more inventory and will hold more accounts receivables due to its higher level of business sales. The gross margin is driven higher due to the revenue stream of referral commissions which is almost entirely gross profit.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | n.a. | 30.00% | 25.00% | -1.05% |

| Percent of Total Assets | ||||

| Accounts Receivable | 15.34% | 19.77% | 19.86% | 12.28% |

| Inventory | 31.53% | 23.16% | 22.67% | 13.40% |

| Other Current Assets | 9.77% | 12.67% | 13.18% | 36.14% |

| Total Current Assets | 90.60% | 91.80% | 92.81% | 61.83% |

| Long-term Assets | 9.40% | 8.20% | 7.19% | 38.17% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 83.646% | 29.046% | ||

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Owner | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $5,000 | $6,000 | ||

| Assistant Store Manager | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | ||

| Store Staff | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Assistant Locksmith | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Total People | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | ||

| Total Payroll | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $9,000 | $10,000 | ||

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

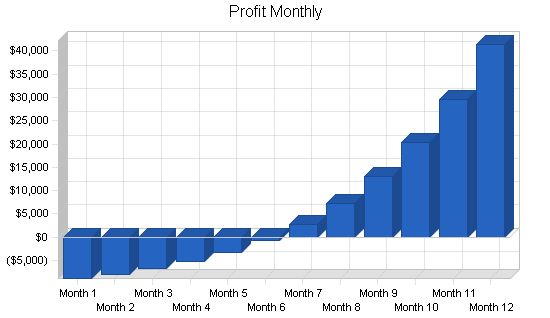

| Sales | $6,700 | $8,710 | $11,323 | $14,720 | $19,136 | $24,876 | $32,339 | $42,041 | $54,655 | $71,051 | $92,365 | $120,075 | |

| Direct Cost of Sales | $2,340 | $3,042 | $3,955 | $5,141 | $6,683 | $8,688 | $11,294 | $14,682 | $19,087 | $24,814 | $32,257 | $41,935 | |

| Other Costs of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $2,340 | $3,042 | $3,955 | $5,141 | $6,683 | $8,688 | $11,294 | $14,682 | $19,087 | $24,814 | $32,257 | $41,935 | |

| Gross Margin | $4,360 | $5,668 | $7,368 | $9,579 | $12,453 | $16,188 | $21,045 | $27,359 | $35,568 | $46,237 | $60,108 | $78,140 | |

| Gross Margin % | 65.07% | 65.07% | 65.07% | 65.07% | 65.08% | 65.08% | 65.08% | 65.08% | 65.08% | 65.08% | 65.08% | 65.08% | |

| Expenses | |||||||||||||

| Payroll | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $9,000 | $10,000 | ||

| Marketing/Promotion | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | ||

| Depreciation | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | ||

| Rent | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | ||

| Utilities | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | ||

| Insurance & Bonding | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | ||

| Payroll Taxes | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Store Supplies | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | ||

| Van Fuel, Maintenance & Parking | 15.00% | $300 | $350 | $400 | $450 | $475 | $500 | $500 | $500

Pro Forma Cash Flow |

||||

| Pro Forma Cash Flow | |||||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $5,025 | $6,533 | $8,492 | $11,040 | $14,352 | $18,657 | $24,254 | $31,531 | $40,991 | $53,288 | $69,274 | $90,056 | |

| Cash from Receivables | $0 | $893 | $1,943 | $2,526 | $3,284 | $4,269 | $5,549 | $7,214 | $9,378 | $12,192 | $15,850 | $20,605 | |

| Subtotal Cash from Operations | $5,025 | $7,426 | $10,435 | $13,566 | $17,636 | $22,926 | $29,804 | $38,745 | $50,370 | $65,480 | $85,124 | $110,661 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $5,025 | $7,426 | $10,435 | $13,566 | $17,636 | $22,926 | $29,804 | $38,745 | $50,370 | $65,480 | $85,124 | $110,661 | |

| Expenditures | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $9,000 | $10,000 | |

| Bill Payments | $20,124 | $3,721 | $4,146 | $4,690 | $5,388 | $6,506 | $14,937 | $25,531 | $32,431 | $41,406 | $53,074 | $67,941 | |

| Subtotal Spent on Operations | $28,124 | $11,721 | $12,146 | $12,690 | $13,388 | $14,506 | $22,937 | $33,531 | $40,431 | $49,406 | $62,074 | $77,941 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $500 | $500 | $1,000 | $1,000 | $1,000 | $2,000 | $2,000 | $2,000 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $1,100 | $1,100 | $1,100 | $1,100 | $1,100 | $1,100 | $1,100 | $1,100 | $1,100 | $1,100 | $1,100 | $1,100 | |

| Purchase Other Current Assets | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $29,724 | $13,321 | $13,746 | $14,290 | $15,488 | $16,606 | $26,037 | $36,631 | $43,531 | $53,506 | $66,174 | $82,041 | |

| Net Cash Flow | ($24,699) | ($5,896) | ($3,311) | ($724) | $2,148 | $6,320 | $3,767 | $2,114 | $6,838 | $11,974 | $18,949 | $28,620 | |

| Cash Balance | $19,551 | $13,656 | $10,345 | $9,620 | $11,768 | $18,088 | $21,855 | $23,969 | $30,807 | $42,781 | $61,730 | $90,350 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!