Fescue & Sons Yard Care is a residential lawn care service targeting rural middle-class homes with large yards. Many families in our targeted income bracket have chosen to buy larger parcels in the nearby countryside, rather than spending huge amounts on small lots in the city. However, many of them are unprepared for the level of care such large lawns require.

Fescue & Sons Yard Care will start as a partnership, owned jointly by Red and Kikuyu Fescue. Red has worked as head landscaper at ABC Landscaping for five years and has the expertise and management experience to begin his own business. Kikuyu is a graphic designer and master gardener who will contribute to the marketing materials.

Over the first summer, Red will be the primary employee, with some part-time help from his son, Rye. Rye has worked with Red at ABC landscaping and will continue to help out at Fescue & Sons in the summers.

In the spring, we will hire an additional landscaper for seasonal work, and may hire another if demand warrants. In mid-summer of Year 2, we will purchase additional equipment.

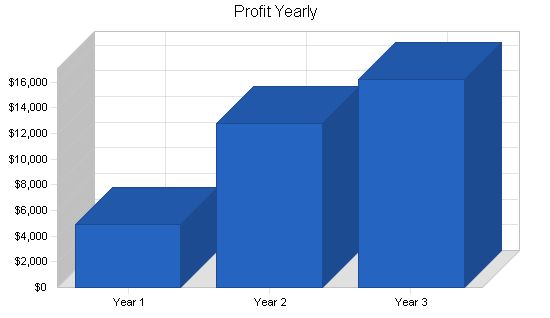

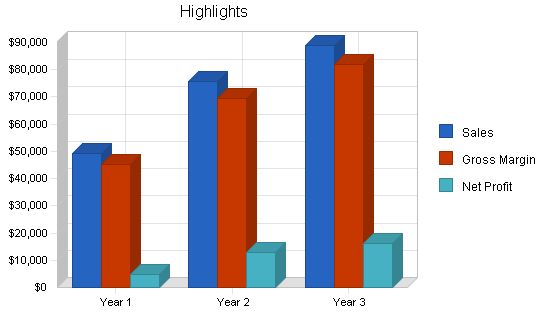

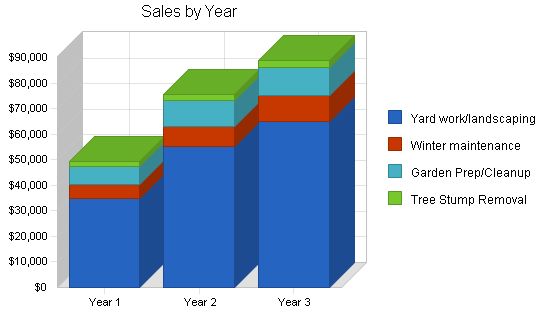

As a business with largely seasonal profits, we will use the high summer revenues to support the business through the winter’s leaner months. We expect profits over $8,000 in the second fiscal year and over $10,000 in the third year.

Contents

1.1 Objectives

Our objectives for the first three years are to:

- Create a service-based company that exceeds customer expectations.

1.2 Mission

The mission of Fescue & Sons Yard Care is to provide top-quality residential and commercial yard care service. We will strive to attract and maintain customers by providing services in a timely manner to ensure 100% customer satisfaction. Our services will exceed customer expectations.

1.3 Keys to Success

- Experienced landscaper with excellent customer-service skills.

- Commitment to high quality and professionalism in every task.

- Small size allowing direct management oversight of every project and employee.

Company Summary

Fescue & Sons Yard Care offers residential and commercial lawn care service, including cutting, trimming, edging, and clippings removal. Most customers use our services once every week or every two weeks, depending on rainfall. Lawn care needs vary in this area due to weather conditions. While this year is likely to be dry, future years will probably see a return to normal rain levels, which means faster-growing grass and weeds, requiring more frequent lawn care.

2.1 Company Ownership

Fescue & Sons Yard Care starts as a partnership, jointly owned by Red and Kikuyu Fescue. As the business grows, the owners will consider re-registering as a limited liability company or corporation, depending on business needs.

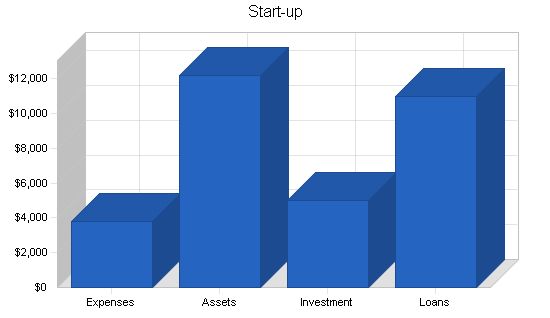

2.2 Start-up Summary

Fescue & Sons Yard Care’s start-up costs include:

- Home office equipment: file cabinet, computer system (printer, scanner, and fax software)

- Vehicle: The owners contribute a 1998 Toyota pickup to the business.

- Two commercial mowers

- Trimmer: used to reach grass around trees and other hard-to-reach areas

- Edger: cuts grass that grows over the border of the lawn and driveway

- Blowers: blasts stray clippings that litter the sidewalk and driveway

- Hedge trimming equipment

- Two rakes

- Two shovels

- Two pruners

- Two loppers

- Safety equipment: steel-toed shoes, goggles, gloves

- Standard tool box with tools for simple repairs

Start-up Requirements

– Legal/LLC: $500

– Ad: $50

– Brochures/Business Cards: $150

– Home Office: $3,000

– Accounting Software: $100

– Other: $0

– Total Start-up Expenses: $3,800

Start-up Assets

– Cash Required: $6,200

– Other Current Assets: $2,500

– Long-term Assets: $3,500

– Total Assets: $12,200

Total Requirements: $16,000

Services

Fescue & Sons Yard Care provides residential lawn care service including cutting, edging, and trimming. Optional services are available upon request. The service is offered once a week during the season, but we can adjust the schedule based on clients’ needs.

Market Analysis Summary

Fescue & Sons Yard Care targets rural middle-class families with larger lawns or properties who need lawn care services. These families often have more acreage than they can manage on their own.

We will advertise our services by canvassing neighborhoods, posting flyers, and placing advertisements in the local rural newspaper to increase visibility.

In the second year, we plan to expand our services to the urban area located 15 miles east.

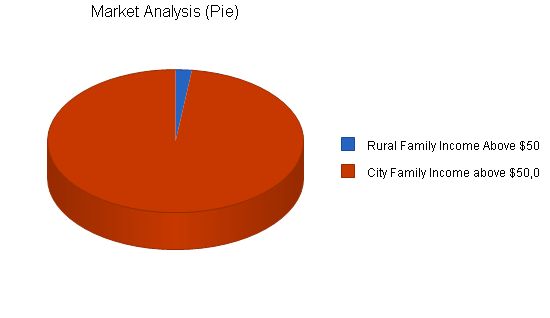

Market Segmentation

Fescue & Sons Yard Care focuses on families with an annual income over $50,000. This target group has more disposable income to invest in lawn care compared to lower-income families.

Many families in our target income bracket have chosen to purchase larger parcels of land in the nearby countryside due to the high prices of homes in the urban area. However, they often lack the knowledge and resources to properly maintain their lawns.

By targeting customers with large lawns and properties, we fill the niche created by urban flight and can maintain higher profit margins. Transportation costs make it more profitable to focus on a few large lawns rather than many small ones.

By providing exceptional service to rural lawns in the first year, we aim to build a positive reputation and generate word-of-mouth referrals from customers in their former urban neighborhoods. When we expand to urban areas, our focus will be on high-end houses and large, older lots to maximize our efficiency and profits.

Market Analysis

Potential Customers Growth CAGR

Rural Family Income Above $50,000 3% 300 309 318 328 338 3.03%

City Family Income above $50,000 3% 14,500 15,000 15,450 15,914 16,391 3.11%

Total 3.11% 14,800 15,309 15,768 16,242 16,729 3.11%

4.2 Target Market Segment Strategy

Initially, we will canvass nearby homes in our rural town. Red will be basing the business out of our home, very close to the target market. Red will start by speaking with his own neighbors. Although some people are put off by solicitors, Red is their neighbor, so they will be more comfortable with him and he will be able to make his sales pitch. We will also put some small signs on our own lawn advertising our service.

Once Red has built up a steady list of customers, he will begin running advertisements in the local paper to gain access to different neighborhoods. In the second year, we will continue running ads and begin outreach to more affluent city customers with large lawns.

4.3 Service Business Analysis

Fescue & Sons Yard Care will be working in the lawn care industry. The industry includes residential areas (individual homes) and commercial areas (apartment complexes, business parks, schools, etc.).

The commercial side is generally serviced by larger landscaping services. The residential side is serviced by both landscaping companies and basic lawn care service companies.

The lawn care business is made up of many small companies due to the high labor intensity and low start-up costs of the industry. The industry is vulnerable to recession, as lawn care is a luxury. Lastly, the lawn care industry is seasonal, with the high season being spring through fall. There is usually little activity in the winter, but some can be achieved by acquiring a clientele that will utilize monthly maintenance through the winter months.

4.3.1 Competition and Buying Patterns

The lawn care business can be divided into two types: residential and commercial. As a start-up or one-person business, it is much easier to enter the residential market compared with the commercial market. The commercial market is dominated by larger, established companies.

Within the residential market, there are two competitors: full-scale landscaping companies and basic lawn care services. The full-scale landscaping companies generally handle jobs outside of Fescue & Sons’ range. They service larger homes that require other landscaping activities, more equipment, and multiple employees. The margins are larger for full-scale companies because they can charge more for higher-skilled work. The other competitor is basic lawn care services, similar to Fescue & Sons Yard Care. The current competition in the residential market lacks basic quality and professionalism.

The trend among residential customers is making purchasing decisions based on referrals and perceived professionalism and quality of service.

Strategy and Implementation Summary

Fescue and Sons will rely on Red’s knowledge of the local community and top-quality landscaping skills. Initial outreach will involve direct canvassing of the neighborhood. This will be supplemented by ads showing properties we have worked on, as well as brochures and fliers hung up in local businesses.

We will also rely on word of mouth, so part of our strategy is to treat every job as if it were the most important client we have ever had. Phone calls will be returned promptly, services will be done professionally and on time, and customers will be treated with respect.

5.1 Competitive Edge

Fescue & Sons Yard Care’s competitive edges will be our high-quality work and unflagging professionalism.

During the first summer, Red will do all of the lawn care and other work, with some help from his son, Rye. Starting in May of 2006, we will hire a second, part-time employee as a landscaper. Red, Rye, and the landscaper will always work as a team, allowing for direct supervision of all workers and direct involvement with the job at hand to ensure customers receive the high quality they expect.

Fescue & Sons Yard Care’s second competitive edge is professionalism. In our business, this means returning customer inquiries promptly, showing up on time, bringing all necessary equipment, reserving breaks for times away from the customers’ yards, and cleaning up thoroughly when we leave. To facilitate communication, Red will have a cell phone at all times, where he can be reached directly or receive messages. Cell phone reception in most of the town is quite good, despite being a rural area.

All of these things will help us stand out from the local competition.

Our marketing strategy in the first year relies largely on face-to-face contact between Red and potential customers, as well as word-of-mouth from satisfied clients. In the second year, we will place more ads, in different papers such as in the nearby city, and continue generating word-of-mouth from our customers.

5.3 Sales Strategy

Fescue & Sons Yard Care’s sales strategy will be based on one-on-one communications with potential customers. By going door to door in his own neighborhood, Red can become more familiar with these folks and take advantage of his outgoing personality.

In the startup period, we will set up the office and purchase the necessary lawn care equipment. At the same time, Red will spend three to four afternoons a week, especially on weekends, going around the neighborhood to scout out problem lawns and talk to potential customers. There are at least two upcoming weekends that are likely to be scorchers when potential customers will look outside and think that the last thing they want to do is go out and mow the lawn. These are our best days to canvass the neighborhood, offering a service many do not realize they want.

After getting in the door, Red’s challenge will be to effectively communicate his experience and skills in lawn care and related work. He will bring a portfolio of some of the nicest lawns he has worked on in the past when working as head landscaper for ABC landscapers, as well as photos of our own lawn, which is more similar to the ones in the neighborhood. He is also willing to offer a free estimate and cutting for those interested in a possible contract. Although some of the free cuttings will not turn out to be long-term customers, our competitive prices and superior service will turn most of the leads into customers.

By year two, the business will be ready to expand outside of the neighborhood. At that point, we will place more advertisements in the local paper to generate business. Red will have already built up a loyal following of customers who can serve as an effective referral system.

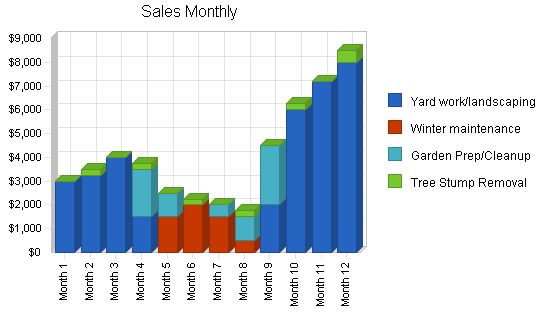

5.3.1 Sales Forecast

We will consider ourselves "open for business" and start our fiscal year in July 2005. We anticipate working on an average of 21 lawns per week in July, starting at around 10 the first week and up to 30 by the end of the month. These are reasonable initial forecasts for our area and our prices. We expect good feedback and word-of-mouth, as well as continued canvassing, to increase our customer base each month through the end of the season.

In September, we will begin advertising our end-of-year garden prep and winter maintenance services, which will supply revenue over the winter. Since the climate here is mild, many gardeners put off their seasonal clean-up and garden prep until it is too late. Weeds continue to grow all winter, long past when gardeners want to be out in the yard, and uncompleted garden prep forces them to do much more labor in the spring to get the garden back in shape.

Winter maintenance includes things like trellis and shed repairs, helping gardeners organize their supplies and seeds, and fixing or building cold frames for early vegetables.

Direct cost of sales for all of these projects includes gas for powered equipment and transportation costs, most equipment repair and maintenance, and the cost of any items used up in the process, like mower blades or edging strings. Unlike most big lawn care services, we are tracking direct labor costs as operating expenses, not direct cost of sales. These amounts can be found in the Personnel plan and are reflected in the Profit and Loss statement.

We also plan to do occasional tree stump removal, for which the direct cost of sales is higher since it includes the cost to rent the equipment. If this becomes a larger part of our business, we may buy our own equipment.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Yard work/landscaping | $34,954 | $55,000 | $65,000 |

| Winter maintenance | $5,500 | $8,000 | $10,000 |

| Garden Prep/Cleanup | $7,000 | $10,000 | $11,000 |

| Tree Stump Removal | $1,750 | $2,500 | $3,000 |

| Total Sales | $49,204 | $75,500 | $89,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Yards/Winter Maint/Gardens | $3,322 | $5,110 | $6,020 |

| Other | $700 | $1,000 | $1,200 |

| Subtotal Direct Cost of Sales | $4,022 | $6,110 | $7,220 |

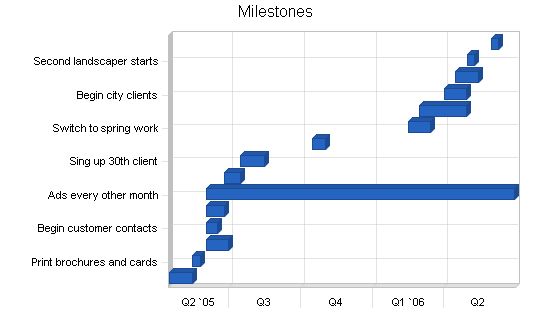

5.4 Milestones

We have established basic milestones to prioritize the business plan. Red is in charge of goals related to yard care and employee practices, while Kikuyu will oversee our marketing materials – brochures, business cards, ads, etc.

We have sketched out a few milestones past the first year, as details of that implementation will become clearer in the spring of 2006. For now, we are focused on setting up the office and acquiring customers.

Milestones:

| Design brochures | 4/15/2005 | 5/15/2005 | $0 | Kikuyu | G&A |

| Print brochures and cards | 5/15/2005 | 5/25/2005 | $150 | Red | G&A |

| Set up the office | 6/1/2005 | 6/30/2005 | $3,100 | Red | G&A |

| Begin customer contacts | 6/1/2005 | 6/15/2005 | $0 | Red | G&A |

| Sign up the 10th client | 6/1/2005 | 6/25/2005 | $0 | Red | G&A |

| Ads every other month | 6/1/2005 | 6/30/2006 | $175 | Kikuyu | G&A |

| Sign up 20th client | 6/25/2005 | 7/15/2005 | $0 | Red | G&A |

| Sing up 30th client | 7/15/2005 | 8/15/2005 | $0 | Red | G&A |

| Switch to fall/winter work | 10/15/2005 | 10/31/2005 | $0 | Red | G&A |

| Switch to spring work | 2/15/2006 | 3/15/2006 | $0 | Red | G&A |

| Interview potential landscapers | 3/1/2006 | 4/30/2006 | $0 | Red | G&A |

| Begin city clients | 4/1/2006 | 4/30/2006 | $50 | Red | G&A |

| Purchase additional equipment | 4/15/2006 | 5/15/2006 | $7,000 | Red | G&A |

| Second landscaper starts | 5/1/2006 | 5/10/2006 | $1,500 | Red | G&A |

| Rye returns from school | 6/1/2006 | 6/10/2006 | $0 | Red | G&A |

| Totals | $11,975 |

Management Summary:

Red and Kikuyu have over 10 years of experience in landscaping and outdoor design. Red, the head landscaper at ABC Landscaping for the past five years, has the design, lawn-care, and management skills to start his own business. In the spring of 2006, Red will manage the day-to-day operations while his son, Rye, and a second landscaper work under his supervision. Kikuyu, a graphic designer and master gardener, will contribute to marketing materials while maintaining her current job.

Personnel Plan:

Rye has worked part-time at ABC Landscaping with his dad for over a year and will assist in the family business during summer breaks. In the spring of 2006, we will hire at least one additional landscaper with a minimum of two years of lawn care experience and strong attention to detail. Rye is already considering potential candidates from his network. This may be a seasonal position depending on the demand for winter work.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Red | $29,500 | $35,000 | $40,000 |

| Rye | $1,300 | $2,000 | $2,500 |

| Landscaper | $2,700 | $8,000 | $10,000 |

| Total People | 3 | 3 | 3 |

| Total Payroll | $33,500 | $45,000 | $52,500 |

The following sections provide important financial information.

Start-up Funding:

The owners will contribute a truck worth $3,500 as a long-term asset to the business and $1,500 in cash for short-term assets. We are also seeking a loan of $11,000, which will be secured by the Fescues’ home equity.

| Start-up Funding | |

| Start-up Expenses to Fund | $3,800 |

| Start-up Assets to Fund | $12,200 |

| Total Funding Required | $16,000 |

| Assets | |

| Non-cash Assets from Start-up | $6,000 |

| Cash Requirements from Start-up | $6,200 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $6,200 |

| Total Assets | $12,200 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $11,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $11,000 |

| Capital | |

| Planned Investment | |

| Owners | $5,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $5,000 |

| Loss at Start-up (Start-up Expenses) | ($3,800) |

| Total Capital | $1,200 |

Important Assumptions:

The following table presents key financial assumptions for Fescue & Sons.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

Projected Balance Sheet:

The projected balance sheet shows an increase in net worth from $1,200 at start-up to over $21,000 by year three as we retain earnings and repay the long-term loan.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $13,048 | $19,632 | $37,538 |

| Other Current Assets | $2,500 | $2,500 | $2,500 |

| Total Current Assets | $15,548 | $22,132 | $40,038 |

| Long-term Assets | |||

| Long-term Assets | $3,500 | $10,500 | $10,500 |

| Accumulated Depreciation | $1,152 | $3,704 | $6,256 |

| Total Long-term Assets | $2,348 | $6,796 | $4,244 |

| Total Assets | $17,896 | $28,928 | $44,282 |

| Liabilities

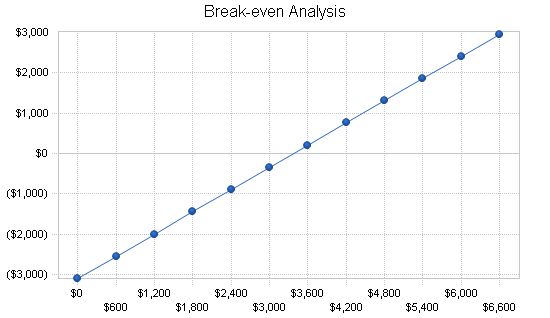

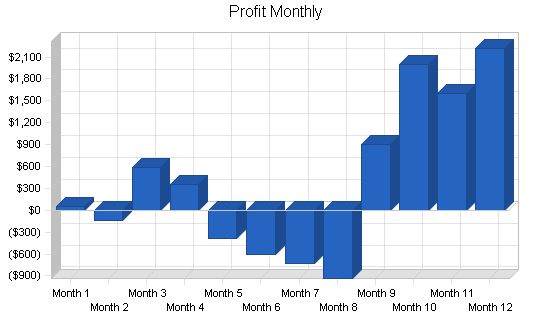

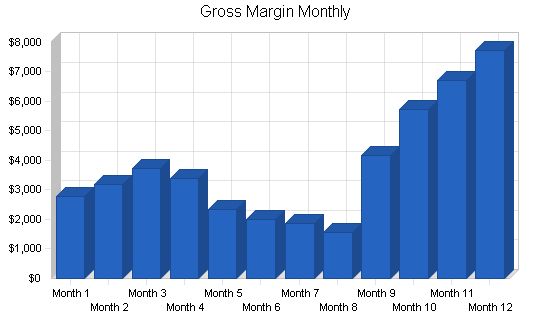

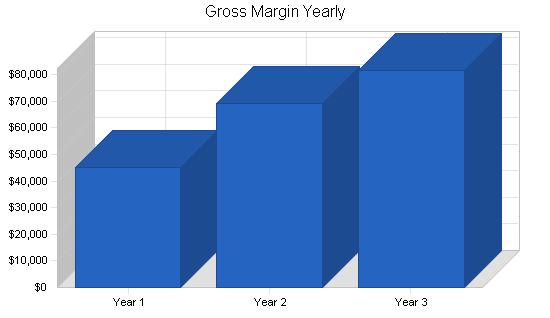

Monthly Revenue Break-even: $3,374. Assumptions: – Average Percent Variable Cost: 8%. – Estimated Monthly Fixed Cost: $3,098. 7.5 Projected Profit and Loss: The table and charts below display our projected profit and loss. After paying salaries, we will make a modest profit in the first year, which will increase in future years. Our gross margins will remain at approximately 91 or 92%. Payroll and payroll taxes are our primary expenses as a service business.

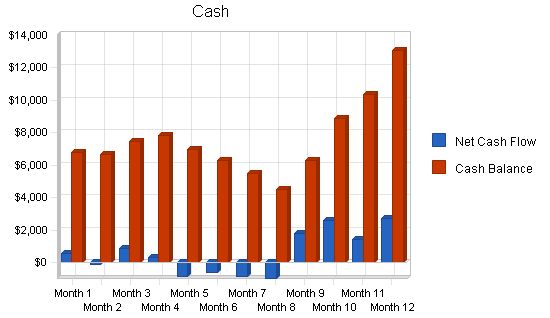

Pro Forma Profit and Loss Year 1 Year 2 Year 3 Sales $49,204 $75,500 $89,000 Direct Cost of Sales $4,022 $6,110 $7,220 Other $0 $0 $0 Total Cost of Sales $4,022 $6,110 $7,220 Gross Margin $45,182 $69,390 $81,780 Gross Margin % 91.83% 91.91% 91.89% Expenses Payroll $33,500 $45,000 $52,500 Marketing/Promotion $125 $200 $300 Depreciation $1,152 $2,552 $2,552 Insurance $1,200 $1,200 $1,200 Licenses + bonded fees $1,200 $1,200 $1,200 Payroll Taxes $0 $0 $0 Other $0 $0 $0 Total Operating Expenses $37,177 $50,152 $57,752 Profit Before Interest and Taxes $8,005 $19,238 $24,028 EBITDA $9,157 $21,790 $26,580 Interest Expense $1,040 $935 $825 Taxes Incurred $2,090 $5,491 $6,961 Net Profit $4,876 $12,812 $16,242 Net Profit/Sales 9.91% 16.97% 18.25% 7.6 Projected Cash Flow The following chart and table display our projected cash flow. We will repay the loan over ten years. The table also shows planned purchases of additional long-term assets in the second fiscal year.

Pro Forma Cash Flow |

|||

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $49,204 | $75,500 | $89,000 |

| Subtotal Cash from Operations | $49,204 | $75,500 | $89,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $49,204 | $75,500 | $89,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $33,500 | $45,000 | $52,500 |

| Bill Payments | $7,752 | $15,816 | $17,494 |

| Subtotal Spent on Operations | $41,252 | $60,816 | $69,994 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $1,104 | $1,100 | $1,100 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $7,000 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $42,356 | $68,916 | $71,094 |

| Net Cash Flow | $6,848 | $6,584 | $17,906 |

| Cash Balance | $13,048 | $19,632 | $37,538 |

The following table outlines important ratios from the Lawn and Garden Services industry. The final column, Industry Profile, details specific ratios based on the industry’s Standard Industry Classification (SIC) code, 0782.

The major difference between our ratios and the industry standard is in gross margin. The Lawn and Garden Service industry is labor intensive, and most businesses include manual labor expenses in their direct cost of sales. As a small, family-owned business without a large staff, I am treating these as operating expenses instead. If personnel costs are included, our gross margin in the first year falls around 23%, and by year three it is up around 32%, roughly the industry average.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 53.44% | 17.88% | 9.12% |

| Percent of Total Assets | ||||

| Other Current Assets | 13.97% | 8.64% | 5.65% | 32.14% |

| Total Current Assets | 86.88% | 76.51% | 90.42% | 51.33% |

| Long-term Assets | 13.12% | 23.49% | 9.58% | 48.67% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 10.75% | 4.30% | 3.29% | 25.79% |

| Long-term Liabilities | 55.30% | 30.41% | 17.38% | 24.81% |

| Total Liabilities | 66.05% | 34.71% | 20.67% | 50.60% |

| Net Worth | 33.95% | 65.29% | 79.33% | 49.40% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 91.83% | 91.91% | 91.89% | 32.95% |

| Selling, General & Administrative Expenses | 81.92% | 74.94% | 73.64% | 18.41% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.34% |

| Profit Before Interest and Taxes | 16.27% | 25.48% | 27.00% | 2.04% |

| Main Ratios | ||||

| Current | 8.08 | 17.79 | 27.51 | 1.38 |

| Quick | 8.08 | 17.79 | 27.51 | 0.88 |

| Total Debt to Total Assets | 66.05% | 34.71% | 20.67% | 62.84% |

| Pre-tax Return on Net Worth | 114.64% | 96.91% | 66.05% | 4.79% |

| Pre-tax Return on Assets | 38.92% | 63.27% | 52.40% | 12.89% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 9.91% | 16.97% | 18.25% | n.a |

| Return on Equity | 80.25% | 67.83% | 46.23% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 5.03 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 38 | 28 | n.a |

| Total Asset Turnover | 2.75 | 2.61 | 2.01 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 1.95 | 0.53 | 0.26 | n.a |

| Current Liab. to Liab. | 0.16 | 0.12 | 0.16 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $13,624 | $20,888 | $38,582 | n.a |

| Interest Coverage | 7.70 | 20.58 | 29.14 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.36 | 0.38 | 0.50 | n.a |

| Current Debt/Total Assets | 11% | 4% | 3% | n.a |

| Acid Test | 8.08 | 17.79 | 27.51 | n.a |

| Sales/Net Worth | 8.10 | 4.00 | 2.53 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

Sales Forecast

| Sales Forecast | ||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Pro Forma Profit and Loss | |||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Sales | $3,000 | $3,504 | $4,000 | $3,750 | $2,500 | $2,250 | $2,000 | $1,750 | $4,500 | $6,250 | $7,200 | $8,500 |

| Direct Cost of Sales | $210 | $328 | $280 | $345 | $175 | $240 | $140 | $205 | $315 | $520 | $504 | $760 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $210 | $328 | $280 | $345 | $175 | $240 | $140 | $205 | $315 | $520 | $504 | $760 |

| Gross Margin | $2,790 | $3,176 | $3,720 | $3,405 | $2,325 | $2,010 | $1,860 | $1,545 | $4,185 | $5,730 | $6,696 | $7,740 |

| Gross Margin % | 93.00% | 90.65% | 93.00% | 90.80% | 93.00% | 89.33% | 93.00% | 88.29% | 93.00% | 91.68% | 93.00% | 91.06% |

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $3,000 | $3,504 | $4,000 | $3,750 | $2,500 | $2,250 | $2,000 | $1,750 | $4,500 | $6,250 | $7,200 | $8,500 | |

| Subtotal Cash from Operations | $3,000 | $3,504 | $4,000 | $3,750 | $2,500 | $2,250 | $2,000 | $1,750 | $4,500 | $6,250 | $7,200 | $8,500 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $3,000 | $3,504 | $4,000 | $3,750 | $2,500 | $2,250 | $2,000 | $1,750 | $4,500 | $6,250 | $7,200 | $8,500 | |

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $2,300 | $3,000 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $4,000 | $4,200 | ||

| Bill Payments | $18 | $550 | $564 | $819 | $790 | $294 | $261 | $136 | $120 | $1,030 | $1,654 | $1,516 | |

| Subtotal Spent on Operations | $2,318 | $3,550 | $3,064 | $3,319 | $3,290 | $2,794 | $2,761 | $2,636 | $2,620 | $3,530 | $5,654 | $5,716 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $6,200 | $6,790 | $6,652 | $7,496 | $7,835 | $6,953 | $6,317 | $5,464 | $4,486 | $6,274 | $8,902 | $10,356 | $13,048 |

| Other Current Assets | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| Total Current Assets | $8,700 | $9,290 | $9,152 | $9,996 | $10,335 | $9,453 | $8,817 | $7,964 | $6,986 | $8,774 | $11,402 | $12,856 | $15,548 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 |

| Accumulated Depreciation | $0 | $96 | $192 | $288 | $384 | $480 | $576 | $672 | $768 | $864 | $960 | $1,056 | $1,152 |

| Total Long-term Assets | $3,500 | $3,404 | $3,308 | $3,212 | $3,116 | $3,020 | $2,924 | $2,828 | $2,732 | $2,636 | $2,540 | $2,444 | $2,348 |

| Total Assets | $12,200 | $12,694 | $12,460 | $13,208 | $13,451 | $12,473 | $11,741 | $10,792 | $9,718 | $11,410 | $13,942 | $15,300 | $17,896 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $531 | $536 | $792 | $780 | $285 | $256 | $133 | $87 | $975 | $1,604 | $1,450 | $1,925 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $531 | $536 | $792 | $780 | $285 | $256 | $133 | $87 | $975 | $1,604 | $1,450 | $1,925 |

| Long-term Liabilities | |||||||||||||

| Long-term Liabilities | $11,000 | $10,908 | $10,816 | $10,724 | $10,632 | $10,540 | $10,448 | $10,356 | $10,264 | $10,172 | $10,080 | $9,988 | $9,896 |

| Total Liabilities | $11,000 | $11,439 | $11,352 | $11,516 | $11,412 | $10,825 | $10,704 | $10,489 | $10,351 | $11,147 | $11,684 | $11,438 | $11,821 |

| Paid-in Capital | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Retained Earnings | ($3,800) | ($3,800) | ($3,800) | ($3,800) | ($3,800) | ($3,800) | ($3,800) | ($3,800) | ($3,800) | ($3,800) | ($3,800) | ($3,800) | ($3,800) |

| Earnings | $0 | $55 | ($92) | $492 | $839 | $448 | ($164) | ($897) | ($1,832) | ($937) | $1,058 | $2,662 | $4,876 |

| Total Capital | $1,200 | $1,255 | $1,108 | $1,692 | |||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!