Contents

How to Write a Convincing Business Plan for Investors

Raising money for your business is a major effort. You need lists of investors to reach out to and be prepared for your investor meetings to increase your chances of getting funded. You need to practice your pitch and intelligently answer any questions about your business.

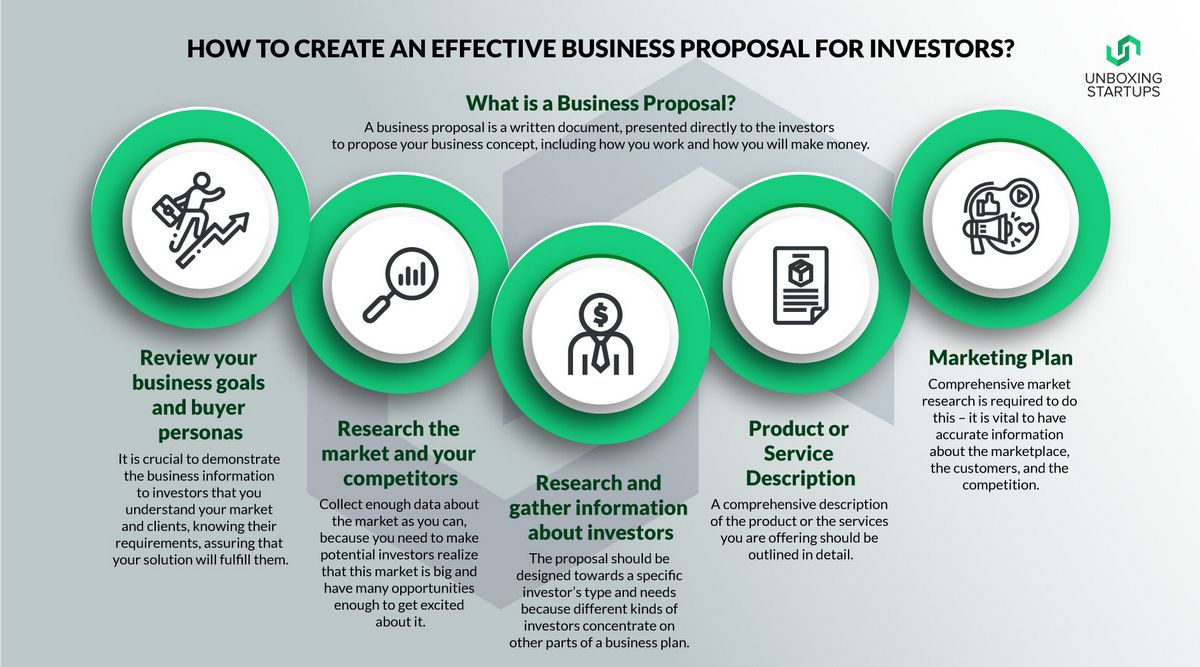

Investors want to see a business plan because it shows that you’ve thought through every aspect of your business and are ready to answer any questions that come up. It’s not about the document itself—it’s the knowledge and preparation that matters. A business plan helps you think about your target market, sales and marketing strategy, the problem you solve, and your key competitors. It provides structure and documents your answers, so you’re prepared for investor questions.

Even if investors don’t ask for your business plan, the work you’ve done will ensure you can intelligently answer their questions. And if they do ask for it, you’ll have it ready. It’s important to understand your business strategy and financial forecasts. You need to explain your business model, profitability, and how you’ll use the funding to grow your business.

When writing a business plan, investors want to see:

A vision for the future

Investors want to understand your long-term vision, your target market, and the problems you solve. Your vision may change, but investors want to know you’re thinking beyond tomorrow.

Product/market fit and traction

Investors want evidence that you’re solving a problem for customers and that you’ll be able to sell your products. If you have early sales and customers, even better.

Funding needed and use of funds

You need to know how much funding you’re asking for and explain how you’ll use it. A detailed financial plan is essential.

A strong management team

Investors want to know you can execute your idea. If you have gaps in your team, communicate your needs.

An exit strategy

Investors are looking for a return on their investment. They want to know your thoughts on an eventual exit strategy.

While investors may not ask for a detailed business plan, be prepared with a cover letter, pitch deck, executive summary or one-page plan, and financial forecasts. A cover letter sparks investor interest, a pitch deck presents your idea, an executive summary or one-page plan provides more detail, and financial forecasts show your business’s financial perspective.

Your investor business plan should include an executive summary, opportunity, market analysis, marketing and sales plan, milestones/roadmap, company and management details, financial plan, and an appendix for additional information.

Writing a business plan prepares you to pitch your business. You may never be asked for the plan itself, but the process will help you answer any investor questions with confidence.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!