Contents

Inline Hockey Service Business Plan

The Skate Zone is a Miami-based company dedicated to promoting and providing inline skate hockey services. Our mission is to make the sport of hockey accessible to all.

Our initial strategy is to focus on Roller Hockey, one of the fastest growing sports leagues in the country. According to the National Sporting Goods Association (NSGA), participation in Roller Hockey has steadily increased since 1993. Our goal is to create a professional and safe environment for inline hockey, while also offering entertainment and physical fitness opportunities for players of all ages. We will also have a snack bar available for players and patrons to enjoy refreshments during games and practices. Additionally, we plan to establish an in-house Pro Shop offering a range of inline hockey products, including skates, body protection equipment, sticks, and jerseys with team logos.

We anticipate generating income through the following areas:

- Registration fees: Players will be required to pay a seasonal fee to participate in the league.

Company Summary

Legal Business Description

The Skate Zone was founded in May 1998 in Miami, Florida by Mr. James Dunn, President and CEO. It is a Florida corporation with offices in Miami.

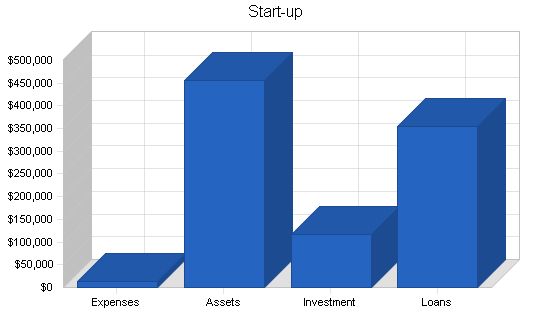

Start-up

Requirements

Start-up Expenses

Legal $500

Stationery etc. $100

Brochures $250

Insurance $3,000

Equipment $9,000

Total Start-up Expenses $12,850

Start-up Assets

Cash Required $45,000

Start-up Inventory $5,000

Other Current Assets $0

Long-term Assets $405,000

Total Assets $455,000

Total Requirements $467,850

Start-up Funding

Start-up Expenses to Fund $12,850

Start-up Assets to Fund $455,000

Total Funding Required $467,850

Assets

Non-cash Assets from Start-up $410,000

Cash Requirements from Start-up $45,000

Additional Cash Raised $3,000

Cash Balance on Starting Date $48,000

Total Assets $458,000

Liabilities and Capital

Liabilities

Current Borrowing $0

Long-term Liabilities $350,000

Accounts Payable (Outstanding Bills) $3,850

Other Current Liabilities (interest-free) $0

Total Liabilities $353,850

Capital

Planned Investment

Owner $117,000

Investor $0

Additional Investment Requirement $0

Total Planned Investment $117,000

Loss at Start-up (Start-up Expenses) ($12,850)

Total Capital $104,150

Total Capital and Liabilities $458,000

Total Funding $470,850

Mission

The Skate Zone’s mission is to promote hockey and make it accessible to all. The facility encourages sports etiquette and provides a healthy environment for individuals to participate in competitive games, promoting inner strength and growth.

Objectives

The Skate Zone aims to establish the first professional inline roller hockey service in Miami. In the next year, the company plans to secure funding, complete building project, initiate league programs, procure inventory, and offer concession catering. Over the next 2-5 years, the goal is to expand programs (such as hockey camps and all-day leagues) and establish a Pro Shop. With the market growth in Miami, the company intends to build facilities in other areas of the city.

Strategic Alliances

The Skate Zone has alliances with Industrial Construction, In-line Hockey, the city of Miami, Dr. Pepper, and Ice Providers. These alliances are crucial for the development and construction of a professional facility for inline hockey. The company also plans to form a strategic alliance with USA Hockey Inline to ensure safe and competitive hockey through knowledge of rules and regulations.

The Skate Zone provides customers with the following advantages:

– Hockey league

– Concession

– Pro Shop

Market Analysis Summary

The company focuses on the sport recreation and entertainment market, taking advantage of the enormous potential in Miami, the fourth largest city in America. The Skate Zone targets the lucrative youth sports and extracurricular activities areas. Figures 2 and 3, in the following sections, provide insights into the inline skate sales and sporting goods industry.

Market Analysis

Figure 1 provides the market statistics for the sporting and recreation goods industry. This includes establishments engaged in wholesale distribution of sporting goods, accessories, billiard and pool supplies, firearms and ammunition, and marine pleasure craft, equipment, and supplies.

Figure 1. Market Size Statistics

Estimated number of U.S. establishments: 9,906

Number of people employed in this industry: 60

Total annual sales in this industry: $15 million

Average employees per establishment: 6

Average sales per establishment: $1.6 million

Figure 2. Inline skate sales

Year Skates Sold Total Sales

1996 5.4 million pairs $374 million

1997 6.4 million pairs $418 million

Figure 3 provides the breakdown of the top 20 inline skating areas in the United States. The number of skaters shown is in thousands, and inline hockey totals include players who also skate in other disciplines.

Figure 3. Top 20 Inline Skating Areas in the United States

Area Rec/Fitness All Skating Hockey only Total Skaters

New York City 1,438 255 657 1,503

Los Angeles 1,435 217 56 1,491

Chicago 911 153 39 950

Detroit 827 189 48 875

Washington DC 711 67 17 728

Philadelphia 577 84 21 598

San Francisco 502 46 13 515

Phoenix 459 65 17 476

Boston 463 32 8 471

Dallas/Fort Worth 406 79 21 427

Atlanta 429 24 6 435

South Florida 369 37 10 379

Minneapolis 360 25 7 367

Buffalo 311 21 6 317

San Diego 301 38 10 311

Houston 298 20 5 303

St. Louis 287 57 15 302

Tampa Bay Area 264 32 8 272

Denver 248 50 13 261

Cleveland 247 12 3 250

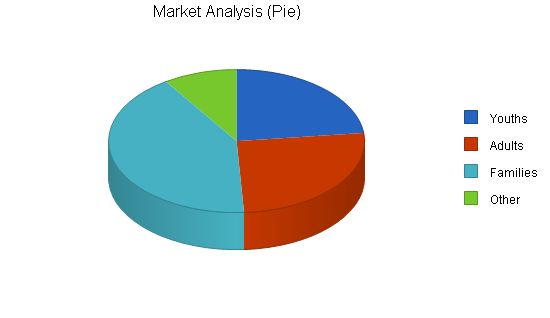

Market Segmentation

The company’s target customers are as follows:

Youths: Elementary, middle, and high school youth aged 8 to 18 years old. Potential new customers in this industry include Miami and its surrounding cities.

Customer Buying Criteria

The company believes that customers will choose The Skate Zone based on the following criteria:

Price: The league fee is price sensitive, and players typically pay between $20 and $60 per season.

Products and Services

League Fees

A person involved in a practice or game must fill out an application form and pay a fee to participate for one season of inline hockey. This fee covers charges incurred for insurance and regulatory practices by USA Hockey Inline. The application form will be used for databases to create marketing statistics and mailings for future enrollment.

Concessions

The snack bar is an essential part of the entertainment and recreation industry. The Skate Zone will offer a variety of food items and snacks without requiring certain licenses. This provides convenience for customers during athletic events.

Professional Hockey Shop

The Skate Zone plans to respond to market needs by offering products for purchase. This operation is expected to be introduced within one year from the start of business.

Competitive Comparison

Competitive threats come from roller skating rinks and ice skating rinks scattered throughout Miami.

Competitive Edge

The Skate Zone’s competitive advantage is its arena designed exclusively for inline hockey. Its size, dasher boards, and flooring give it the realism of true hockey play. Safety is the top priority to protect players and patrons from injury or dangers. The location and in-house facility also contribute to its competitive advantage.

Strategy and Implementation Summary

The Skate Zone plans to promote and facilitate one of the country’s fastest-growing sport leagues, Roller Hockey. The target market includes children, young adults aged 8 to 18, and adults aged 19 to 55. The company aims to create a family environment where players and their relatives contribute to the market as a whole.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Registration Fees | $76,500 | $100,000 | $150,000 |

| Skate Rentals | $22,300 | $50,000 | $75,000 |

| Concessions | $71,500 | $100,000 | $150,000 |

| Pro Shop | $5,500 | $15,000 | $25,000 |

| Special Functions | $5,700 | $6,500 | $10,000 |

| Total Sales | $181,500 | $271,500 | $410,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Registration Fees | $0 | $0 | $0 |

| Skate Rentals | $0 | $0 | $0 |

| Concessions | $35,750 | $50,000 | $75,000 |

| Pro Shop | $2,750 | $7,500 | $12,500 |

| Special Functions | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $38,500 | $57,500 | $87,500 |

Marketing Communications

The Skate Zone plans to be the first amateur inline hockey facility in Miami, Florida. Due to inline hockey’s overwhelming growth throughout the United States, the company’s promotional plans are open to various media and marketing communications. The following is a list of available options.

Public relations. Press releases are issued to technical trade journals and major business publications.

Tournaments. The Skate Zone will showcase its services at championship tournaments held annually across the United States.

Print advertising and article publishing. The company’s print advertising program includes advertisements in The Yellow Pages, Miami Express News, The Skate Zone Mailing, school flyers, and inline hockey trade magazines.

Internet. The Skate Zone currently has a website and has received several inquiries. Plans are underway to upgrade it to a more professional and effective site. In the future, this is expected to be one of the company’s primary marketing channels.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis

Distribution Strategy

At The Skate Zone, the sales process is different for each of the company’s three areas: League fees, concessions, and the future Pro Shop. Sales processes are described below.

League fees. Sales are made by a person’s payment to participate in a planned program of games and practices. The sales process involves several steps that include completion and acceptance of an application form, yearly membership fees, and season league fees. This approach is used because of The Skate Zone’s legal and liability requirements to protect and guarantee safety in all areas.

Concessions. Sales are made by a person purchasing products from the snack bar facility. Individuals will have a variety of choices to buy with the ability to sit and enjoy their food or drink while watching the game.

Pro Hockey Shop. This is a future enterprise that The Skate Zone will develop within a year of its first day of operation. Sales are made by patrons purchasing products available in the store. Products offered will include hockey equipment, hockey memorabilia, and other mementos.

Pricing Strategy

The company sets pricing based on market and competitive rates. League fees will be a set charge for each season of play. The exception will be for the yearly membership fee every player, coach, and referee will render for insurance purpose. Concessions and the future Pro Shop prices will be subject to taxes and rate increases from each respective business or enterprise associated with The Skate Zone.

| Product/Service | Price Range |

| Fee: Membership | $10 |

| Fee: League | $60 |

| Concessions | $.50-$5 |

| Accessories | $.50-$250 |

| Rental (Arena) | $300-$500/day |

Management Summary

The company’s management philosophy is based on responsibility and mutual respect. The Skate Zone has an environment and structure that encourages productivity and respect for customers and fellow employees.

Officers and Key Employees

The Skate Zone’s management is highly experienced and qualified. Key members of The Skate Zone’s management teams, their backgrounds, and responsibilities are as follows.

Mr. James Dunn, President and CEO. Mr. Dunn will oversee all operations of the company and co-ordinate professional recruitment.

Mr. Joe Bailey, Vice President.

Note: Backgrounds have been removed for confidentiality.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Manager | $38,000 | $40,000 | $50,000 |

| Asst Manager | $12,250 | $21,600 | $25,000 |

| Concessions/Pro Shop | $21,500 | $25,000 | $37,500 |

| Janitor/Maintenance | $12,000 | $15,000 | $15,000 |

| Total People | 6 | 6 | 7 |

| Total Payroll | $83,750 | $101,600 | $127,500 |

Financial Plan

The following sections describe the financial information of The Skate Zone.

Important Assumptions

The detailed assumptions to the company’s financial projections can be found in the table below.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 8.50% | 8.50% | 8.50% |

| Long-term Interest Rate | 8.50% | 8.50% | 8.50% |

| Tax Rate | 2.50% | 0.00% | 2.50% |

| Other | 0 | 0 | 0 |

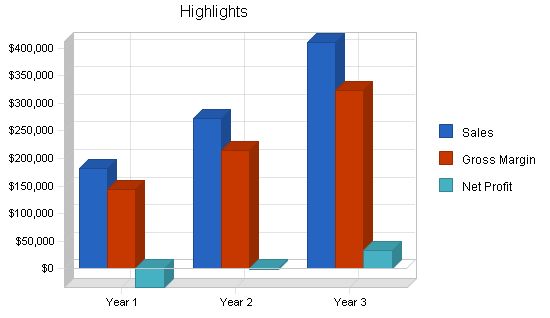

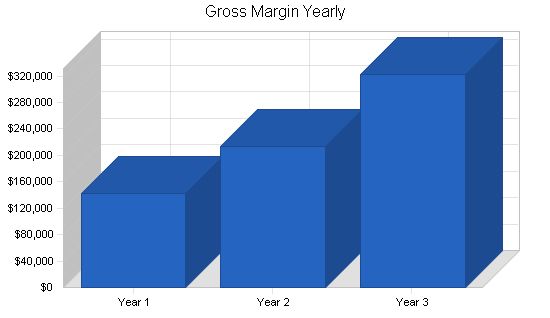

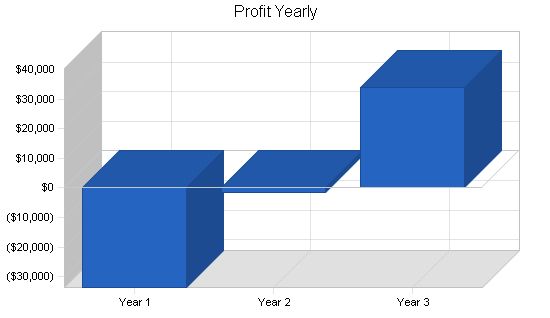

Projected Profit and Loss

The following table contains the profit and loss information for The Skate Zone.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $181,500 | $271,500 | $410,000 |

| Direct Cost of Sales | $38,500 | $57,500 | $87,500 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $38,500 | $57,500 | $87,500 |

| Gross Margin | $143,000 | $214,000 | $322,500 |

| Gross Margin % | 78.79% | 78.82% | 78.66% |

| Expenses | |||

| Payroll | $83,750 | $101,600 | $127,500 |

| Sales and Marketing and Other Expenses | $32,000 | $42,700 | $75,000 |

| Depreciation | $12,000 | $20,000 | $25,000 |

| Telephone | $1,800 | $1,800 | $2,000 |

| Cleaning Supplies | $3,000 | $4,000 | $7,500 |

| Contract Referees | $3,000 | $3,000 | $6,000 |

| Payroll Taxes | $12,563 | $15,240 | $19,125 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $148,113 | $188,340 | $262,125 |

| Profit Before Interest and Taxes | ($5,113) | $25,660 | $60,375 |

| EBITDA | $6,888 | $45,660 | $85,375 |

| Interest Expense | $28,535 | $27,379 | $25,551 |

| Taxes Incurred | $0 | $0 | $871 |

| Net Profit | ($33,647) | ($1,719) | $33,953 |

| Net Profit/Sales | -18.54% | -0.63% | 8.28% |

Projected Cash Flow

The Skate Zone’s cash flow projections for the next three years:

Pro Forma Cash Flow

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $181,500 | $271,500 | $410,000 |

| Subtotal Cash from Operations | $181,500 | $271,500 | $410,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $22,000 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $2,000 | $0 | $0 |

| Subtotal Cash Received | $183,500 | $293,500 | $410,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $83,750 | $101,600 | $127,500 |

| Bill Payments | $112,137 | $153,311 | $221,968 |

| Subtotal Spent on Operations | $195,887 | $254,911 | $349,468 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $15,000 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $26,400 | $25,000 | $25,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $20,000 | $20,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $222,287 | $299,911 | $409,468 |

| Net Cash Flow | ($38,787) | ($6,411) | $532 |

| Cash Balance | $9,213 | $2,802 | $3,334 |

Projected Balance Sheet

The Skate Zone’s projected Balance Sheet follows.

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $9,213 | $2,802 | $3,334 |

| Inventory | $6,050 | $8,223 | $12,750 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $15,263 | $11,025 | $16,084 |

| Long-term Assets | |||

| Long-term Assets | $405,000 | $425,000 | $445,000 |

| Accumulated Depreciation | $12,000 | $32,000 | $57,000 |

| Total Long-term Assets | $393,000 | $393,000 | $388,000 |

| Total Assets | $408,263 | $404,025 | $404,084 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $12,160 | $12,640 | $18,746 |

| Current Borrowing | $0 | $22,000 | $7,000 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $12,160 | $34,640 | $25,746 |

| Long-term Liabilities | $323,600 | $298,600 | $273,600 |

| Total Liabilities | $335,760 | $333,240 | $299,346 |

| Paid-in Capital | $119,000 | $119,000 | $119,000 |

| Retained Earnings | ($12,850) | ($46,497) | ($48,216) |

| Earnings | ($33,647) | ($1,719) | $33,953 |

| Total Capital | $72,503 | $70,785 | $104,738 |

| Total Liabilities and Capital | $408,263 | $404,025 | $404,084 |

| Net Worth | $72,503 | $70,785 | $104,738 |

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7941, Sporting and Recreation Goods industry, are shown for comparison.

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | n.a. | 49.59% | 51.01% | 15.90% |

| Percent of Total Assets | ||||

| Inventory | 1.48% | 2.04% | 3.16% | 2.80% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 34.10% |

| Total Current Assets | 3.74% | 2.73% | 3.98% | 45.20% |

| Long-term Assets | 96.26% | 97.27% | 96.02% | 54.80% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 12.16% | 12.64% | 18.75% | 39.60% |

| Current Debt/Total Assets | 3% | 9% | 6% | n.a |

| Acid Test | 0.76 | 0.08 | 0.13 | n.a |

Appendix

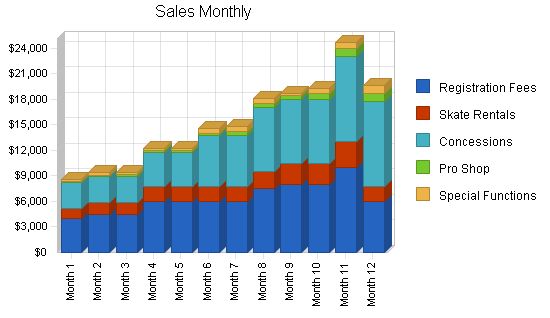

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $8,600 | $9,350 | $9,400 | $12,250 | $12,250 | $14,600 | $14,800 | $18,100 | $18,700 | $19,250 | $24,600 | $19,600 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Registration Fees | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Skate Rentals | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Concessions | $1,500 | $1,500 | $1,500 | $2,000 | $2,000 | $3,000 | $3,000 | $3,750 | $3,750 | $3,750 | $5,000 | $5,000 | |

| Pro Shop | $50 | $75 | $100 | $125 | $125 | $150 | $250 | $250 | $250 | $375 | $500 | $500 | |

| Special Functions | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Direct Cost of Sales | $1,550 | $1,575 | $1,600 | $2,125 | $2,125 | $3,150 | $3,250 | $4,000 | $4,000 | $4,125 | $5,500 | $5,500 | |

Personnel Plan:

Manager: 0%, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $4,500, $4,500, $4,500, $4,500

Assistant Manager: 0%, $0, $0, $0, $0, $0, $1,750, $1,750, $1,750, $1,750, $1,750, $1,750, $1,750

Concessions/Pro Shop: 0%, $1,500, $1,500, $1,500, $1,500, $1,500, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000

Janitor/Maintenance: 0%, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000

Total People: 4, 4, 4, 4, 4, 6, 6, 6, 6, 6, 6, 6

Total Payroll: $5,000, $5,000, $5,000, $5,000, $5,000, $7,250, $7,250, $7,250, $9,250, $9,250, $9,250, $9,250

General Assumptions:

Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

Current Interest Rate: 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%

Long-term Interest Rate: 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%, 8.50%

Tax Rate: 30.00%, 0.00%, 0.00%, 0.00%, 0.00%, 0.00%, 0.00%, 0.00%, 0.00%, 0.00%, 0.00%, 0.00%, 0.00%

Other: 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0

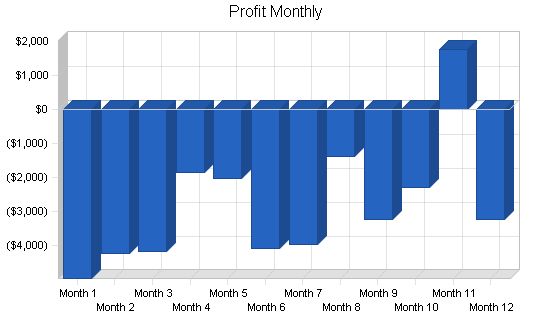

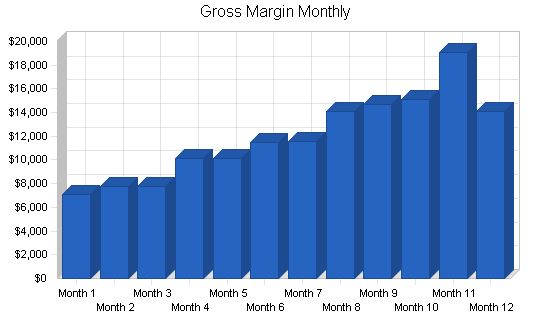

Pro Forma Profit and Loss:

Sales: $8,600, $9,350, $9,400, $12,250, $12,250, $14,600, $14,800, $18,100, $18,700, $19,250, $24,600, $19,600

Direct Cost of Sales: $1,550, $1,575, $1,600, $2,125, $2,125, $3,150, $3,250, $4,000, $4,000, $4,125, $5,500, $5,500

Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Cost of Sales: $1,550, $1,575, $1,600, $2,125, $2,125, $3,150, $3,250, $4,000, $4,000, $4,125, $5,500, $5,500

Gross Margin: $7,050, $7,775, $7,800, $10,125, $10,125, $11,450, $11,550, $14,100, $14,700, $15,125, $19,100, $14,100

Gross Margin %: 81.98%, 83.16%, 82.98%, 82.65%, 82.65%, 78.42%, 78.04%, 77.90%, 78.61%, 78.57%, 77.64%, 71.94%

Expenses:

Payroll: $5,000, $5,000, $5,000, $5,000, $5,000, $7,250, $7,250, $7,250, $9,250, $9,250, $9,250, $9,250

Sales and Marketing and Other Expenses: $2,400, $2,400, $2,400, $2,400, $2,600, $3,100, $3,100, $3,100, $3,100, $2,600, $2,400, $2,400

Depreciation: $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000, $1,000

Telephone: $150, $150, $150, $150, $150, $150, $150, $150, $150, $150, $150, $150

Cleaning Supplies: $250, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250

Contract Referees: $0, $0, $0, $0, $0, $300, $300, $300, $450, $450, $600, $600

Payroll Taxes: 15%, $750, $750, $750, $750, $750, $1,088, $1,088, $1,088, $1,388, $1,388, $1,388, $1,388

Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Operating Expenses: $9,550, $9,550, $9,550, $9,550, $9,750, $13,138, 13,138, $13,138, $15,588, $15,088, $15,038, $15,038

Profit Before Interest and Taxes: ($2,500), ($1,775), ($1,750), $575, $375, ($1,688), ($1,588), $963, ($888), $38, $4,063, ($938)

EBITDA: ($1,500), ($775), ($750), $1,575, $1,375, ($688), ($588), $1,963, $113, $1,038, $5,063, $63

Interest Expense: $2,464, $2,448, $2,432, $2,417, $2,401, $2,386, $2,370, $2,355, $2,339, $2,323, $2,308, $2,292

Taxes Incurred: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Net Profit: ($4,964), ($4,223), ($4,182), ($1,842), ($2,026), ($4,073), ($3,958), ($1,392), ($3,226), ($2,286), $1,755, ($3,230)

Net Profit/Sales: -57.72%, -45.17%, -44.49%, -15.04%, -16.54%, -27.90%, -26.74%, -7.69%, -17.25%, -11.87%, 7.13%, -16.48%

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $8,600 | $9,350 | $9,400 | $12,250 | $12,250 | $14,600 | $14,800 | $18,100 | $18,700 | $19,250 | $24,600 | $19,600 | |

| Subtotal Cash from Operations | $8,600 | $9,350 | $9,400 | $12,250 | $12,250 | $14,600 | $14,800 | $18,100 | $18,700 | $19,250 | $24,600 | $19,600 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $2,000 | $0 | $0 | |

| Subtotal Cash Received | $8,600 | $9,350 | $9,400 | $12,250 | $12,250 | $14,600 | $14,800 | $18,100 | $18,700 | $21,250 | $24,600 | $19,600 | |

| Expenditures | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $7,250 | $7,250 | $7,250 | $9,250 | $9,250 | $9,250 | $9,250 | |

| Bill Payments | $4,050 | $6,013 | $6,047 | $7,507 | $8,656 | $8,385 | $11,520 | $10,666 | $12,054 | $11,668 | $11,513 | $14,057 | |

| Subtotal Spent on Operations | $9,050 | $11,013 | $11,047 | $12,507 | $13,656 | $15,635 | $18,770 | $17,916 | $21,304 | $20,918 | $20,763 | $23,307 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $11,250 | $13,213 | $13,247 | $14,707 | $15,856 | $17,835 | $20,970 | $20,116 | $23,504 | $23,118 | $22,963 | $25,507 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!