Tricky Widgets Manufacturing (TWM) is a heavy equipment machinery manufacturer located in Spokane, Washington. TWM is a start-up firm with plans to secure start-up financing to begin operations.

TWM aims to meet the growing demand for heavy equipment machinery products at its location. Initially, the company will offer three products: the “Widget Basic,” “Widget Deluxe,” and “Widget Premium.” These products are highly versatile and offer precise control capabilities, making them popular among commercial construction companies. The company anticipates a swift market entry due to established contact relationships and referral networks with commercial construction company owners.

1.1 Mission

TWM aims to offer high-quality heavy equipment machinery for the commercial construction industry at a competitive price compared to other premium commercial machinery manufacturers. TWM believes there is an untapped market opportunity because existing providers of construction machinery are too diversified to meet the specialized needs of the commercial construction segment. Furthermore, incorporating greater precision controls within their machinery will better serve this segment of the industry.

1.2 Keys to Success

TWM’s keys to success will include:

– Providing a high level of quality in its product line.

TWM is a start-up manufacturing firm managed by four executives in administration, marketing, sales, and finance. These executives bring extensive experience in the equipment manufacturing industry. They see an opportunity to gain market share by focusing on the specific needs of the commercial construction industry and offering greater precision controls in their products compared to competitors. The company will be organized as a closely-held corporation with the majority of shares held by the four principle executives.

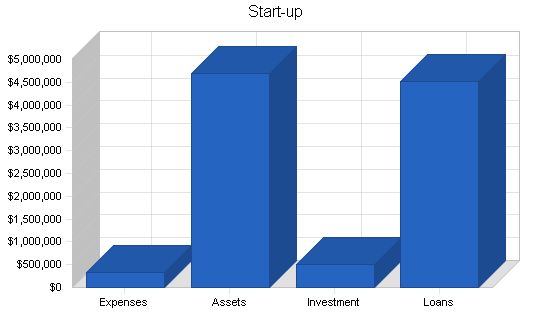

The company aims to raise approximately $4.5 million in loans and another $500,000 from private investors for start-up purposes. TWM will have one manufacturing facility in Spokane, Washington.

2.1 Company Ownership

The company will be a closely-held corporation with six principle shareholders forming the Board of Directors. Within the next five years, the company plans to conduct a public offering to expand its financing capabilities. The principle owners intend to retain the majority of the company’s stock for the foreseeable future. The company is incorporated in Delaware for the most favorable tax conditions.

2.2 Start-up Summary

The following table and chart illustrate projected initial start-up costs for the firm.

Start-up Requirements

Start-up Expenses

Legal $4,000

Rent $24,000

Advertising $15,000

Insurance $12,000

Research and Development $250,000

Office setup $10,000

Other $3,000

Total Start-up Expenses $318,000

Start-up Assets

Cash Required $2,000,000

Start-up Inventory $100,000

Other Current Assets $100,000

Long-term Assets $2,500,000

Total Assets $4,700,000

Total Requirements $5,018,000

Start-up Funding

Start-up Expenses to Fund $318,000

Start-up Assets to Fund $4,700,000

Total Funding Required $5,018,000

Assets

Non-cash Assets from Start-up $2,700,000

Cash Requirements from Start-up $2,000,000

Additional Cash Raised $0

Cash Balance on Starting Date $2,000,000

Total Assets $4,700,000

Liabilities and Capital

Liabilities

Current Borrowing $0

Long-term Liabilities $4,500,000

Accounts Payable (Outstanding Bills) $10,000

Other Current Liabilities (interest-free) $0

Total Liabilities $4,510,000

Capital

Planned Investment

Investor 1 $55,000

Investor 2 $43,000

Investor 3 $160,000

Investor 4 $60,000

Investor 5 $120,000

Investor 6 $70,000

Total Planned Investment $508,000

Loss at Start-up (Start-up Expenses) ($318,000)

Total Capital $190,000

Total Capital and Liabilities $4,700,000

Total Funding $5,018,000

Products

TWM will manufacture heavy equipment machinery for all phases of commercial construction needs. Primary focus will be product engineering and manufacturing processes to ensure the highest quality, product features, and efficient manufacturing process.

TWM will manufacture heavy equipment machinery products called the “Widget Basic,” “Widget Deluxe,” and “Widget Premium.” All Widget products will lift 50 tons and are designed for precise control of movement.

The Widget Basic includes a large “grabber” arm for girder installation and placement, and a back-hoe lifter for land clearance.

The Widget Deluxe includes a large “grabber” arm for girder installation and placement, a back-hoe lifter for land clearance, and a wrecker ball attachment for building demolition.

The Widget Premium includes a large “grabber” arm for girder installation and placement, a back-hoe lifter for land clearance, a wrecker ball attachment for building demolition, and an elevating device for lifting up to ten crewpersons up to 10 stories.

The industry is dominated by a few large companies, such as Caterpillar, Komatsu, Ingersoll Rand, and Linde AG. Caterpillar has approximately 40% market share. These companies market products through local distributors and provide financing, servicing, and replacement of equipment.

Customers require reliable, versatile equipment and are influenced by reputation and cost. Equipment purchases are significant long-term assets for customers.

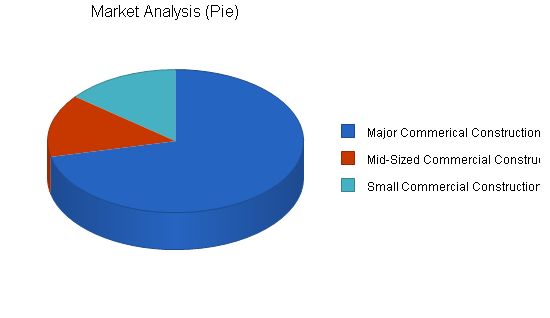

Market Analysis Summary

The construction machinery industry had sales of approximately $15.4 billion last year. Commercial construction companies, equipment rental and leasing companies, and general construction firms are the main customers. Small construction companies are a rapidly growing sub-segment.

The market is influenced by the economy. Recent downturns have affected sales for companies like Caterpillar and Komatsu. TWM aims to be the industry leader in specialized equipment and innovative designs.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Major Commercial Construction Companies 15% 25,000 28,750 33,063 38,022 43,725 15.00%

Mid-Sized Commercial Construction Companies 10% 5,000 5,500 6,050 6,655 7,321 10.00%

Small Commercial Construction Companies 3% 5,000 5,150 5,305 5,464 5,628 3.00%

Total 12.81% 35,000 39,400 44,418 50,141 56,674 12.81%

Market Segmentation

TWM will focus on large commercial construction companies with over $2 billion in annual revenue. These companies are looking for heavy equipment machinery with durability, efficiency, ease of operation, precise control, and safety features.

Mid-size commercial construction companies are a secondary market for TWM. These companies prioritize cost savings and typically choose the Widget Basic and Widget Deluxe products.

TWM primarily focuses on its target market, the large commercial construction company, through direct selling via its various relationship and referral networks. Additionally, investment will be made in advertising to promote product awareness. Direct selling is more effective in closing sales and reducing sales and marketing costs.

TWM uses product demonstrations at its site to close sales. Potential clients’ travel costs for product demonstrations are covered by TWM. Product demonstrations are a critical step in the sales process, allowing the opportunity to prove product capabilities, educate potential clients, and establish a relationship.

The volume of commercial construction activity has been steadily increasing since the mid-1980s. Demand for heavy machinery equipment has also been steadily increasing as new entrants come into the market and current participants grow their operations.

Modern complex designs and other factors have increased demand for higher precision and accuracy in controls of heavy machinery equipment in commercial construction operations.

TWM faces approximately 55 major competitors nationally. The top player is Caterpillar, a trusted name with a 40-year presence in the market.

Large commercial construction companies typically look for widely used equipment with an established name and reputation for quality, durability, and versatility. Product demonstrations are critical in the buying process, especially when working with a smaller, less known company.

Similar competitors offer power equipment that plays a niche role in commercial construction and material movement. This segment’s products include skid-steer loaders, compact hydraulic excavators, industrial vehicles, pavers, compactors, drilling equipment, and rough-terrain material handlers.

TWM will succeed by manufacturing high-quality, durable heavy equipment machinery with numerous precise control options. It will focus on a narrow segment of the market and aim to establish the best reputation in that segment.

TWM’s competitive edge lies in its quality, product features and options, and relationships with major commercial construction companies nationwide.

To develop effective business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

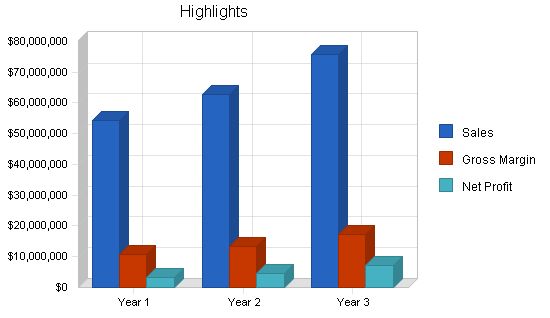

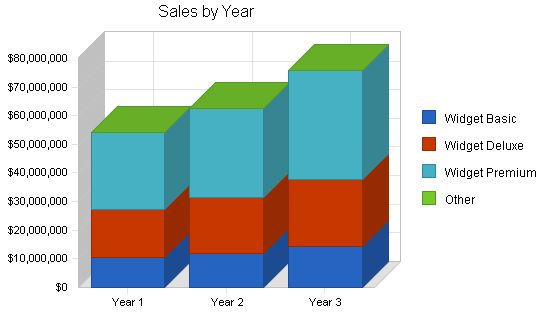

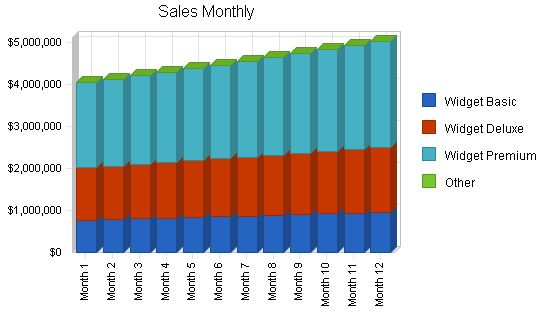

TWM plans to deliver sales of approximately $54 million in the current year, $62 million in the second year, and $75 million in the third year following this plan.

The company will leverage its extensive contacts with major construction companies to secure contracts through direct sales methods and onsite demonstrations. Many of these companies have shown interest in purchasing TWM’s proposed products. The advertising campaign will create product awareness through trade journals, direct mail advertising, and other means. In the future, TWM will seek partnerships with major equipment distributors. The establishment of a post-sales servicing and parts division will provide additional sales and marketing opportunities for new products.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | |||

| Widget Basic | 295 | 310 | 341 |

| Widget Deluxe | 335 | 352 | 387 |

| Widget Premium | 362 | 380 | 418 |

| Other | 0 | 0 | 0 |

| Total Unit Sales | 992 | 1,042 | 1,146 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Widget Basic | $35,000.00 | $38,500.00 | $42,350.00 |

| Widget Deluxe | $50,000.00 | $55,000.00 | $60,500.00 |

| Widget Premium | $75,000.00 | $82,500.00 | $90,750.00 |

| Other | $0.00 | $0.00 | $0.00 |

| Sales | |||

| Widget Basic | $10,327,309 | $11,928,042 | $14,432,931 |

| Widget Deluxe | $16,765,112 | $19,363,705 | $23,430,082 |

| Widget Premium | $27,159,482 | $31,369,201 | $37,956,734 |

| Other | $0 | $0 | $0 |

| Total Sales | $54,251,903 | $62,660,948 | $75,819,747 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Widget Basic | $28,000.00 | $30,240.00 | $32,659.20 |

| Widget Deluxe | $40,000.00 | $43,200.00 | $46,656.00 |

| Widget Premium | $60,000.00 | $64,800.00 | $69,984.00 |

| Other | $0.00 | $0.00 | $0.00 |

| Direct Cost of Sales | |||

| Widget Basic | $8,261,847 | $9,368,935 | $11,130,295 |

| Widget Deluxe | $13,412,090 | $15,209,310 | $18,068,660 |

| Widget Premium | $21,727,585 | $24,639,082 | $29,271,229 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $43,401,522 | $49,217,326 | $58,470,184 |

Contents

Management Summary

Jim Mitchell, Chief Executive Officer: Extensive experience in sales and marketing in the manufacturing industry.

Ike Smith, Chief Financial Officer: Brings heavy focus in finance.

Pat Hyder, VP of Sales: Strong background in manufacturing sales, business development, and strategic partnership development.

Pamela Jules, VP of Marketing: Strong background in marketing within the heavy equipment manufacturing industry. Extensive experience in business development and strategic partnership development.

6.1 Personnel Plan

The personnel plan shows TWM’s significant investments in research and development.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Executives | $480,000 | $504,000 | $529,200 |

| Managers | $960,000 | $1,008,000 | $1,058,400 |

| Manufacturing Process Workers | $720,000 | $756,000 | $793,800 |

| Engineering | $3,000,000 | $3,150,000 | $3,307,500 |

| Total People | 115 | 127 | 175 |

| Total Payroll | $5,160,000 | $5,418,000 | $5,688,900 |

Financial Plan

TWM expects to raise $4.5 million in loans along with $.5 million in private investment for start-up costs in the first three years. An additional $50 million in financing is expected to be raised in an initial public offering scheduled between years three-five, providing most of the required funding for growth.

7.1 Important Assumptions

Important assumptions for this plan are found in the following table.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

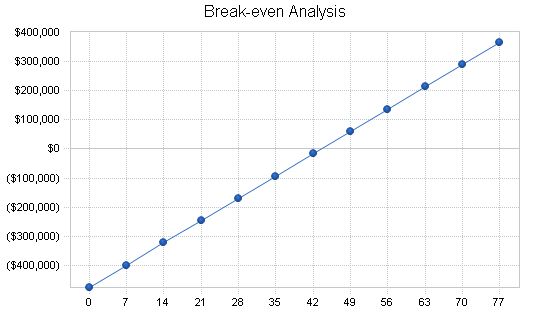

7.2 Break-even Analysis

TWM’s break-even analysis is based on the first-year average figures for total sales and operating expenses. These are presented as per-unit revenue, per-unit cost, and fixed costs. These conservative assumptions provide a more accurate estimate of real risk.

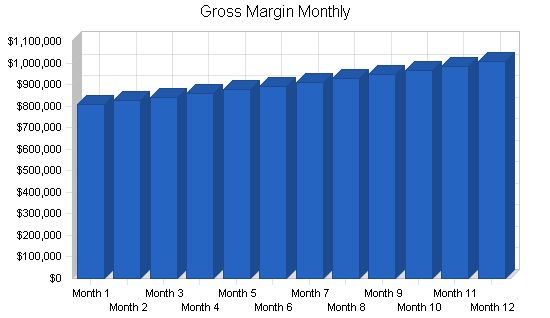

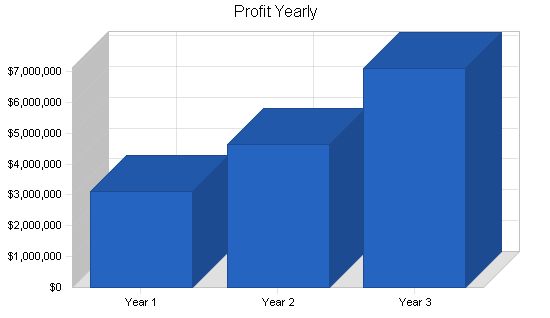

As the profit and loss table shows, TWM expects to continue its steady growth in profitability over the next three years.

Pro Forma Profit and Loss:

Sales: $54,251,903 (Year 1) | $62,660,948 (Year 2) | $75,819,747 (Year 3)

Direct Cost of Sales: $43,401,522 (Year 1) | $49,217,326 (Year 2) | $58,470,184 (Year 3)

Other: $0 (Year 1) | $0 (Year 2) | $0 (Year 3)

Total Cost of Sales: $43,401,522 (Year 1) | $49,217,326 (Year 2) | $58,470,184 (Year 3)

Gross Margin: $10,850,381 (Year 1) | $13,443,622 (Year 2) | $17,349,563 (Year 3)

Gross Margin %: 20.00% (Year 1) | 21.45% (Year 2) | 22.88% (Year 3)

Expenses:

Payroll: $5,160,000 (Year 1) | $5,418,000 (Year 2) | $5,688,900 (Year 3)

Sales and Marketing and Other Expenses: $242,400 (Year 1) | $540,800 (Year 2) | $829,200 (Year 3)

Depreciation: $300,000 (Year 1) | $300,000 (Year 2) | $300,000 (Year 3)

Utilities: $12,000 (Year 1) | $14,000 (Year 2) | $15,000 (Year 3)

Payroll Taxes: $0 (Year 1) | $0 (Year 2) | $0 (Year 3)

Other: $0 (Year 1) | $0 (Year 2) | $0 (Year 3)

Total Operating Expenses: $5,714,400 (Year 1) | $6,272,800 (Year 2) | $6,833,100 (Year 3)

Profit Before Interest and Taxes: $5,135,981 (Year 1) | $7,170,822 (Year 2) | $10,516,463 (Year 3)

EBITDA: $5,435,981 (Year 1) | $7,470,822 (Year 2) | $10,816,463 (Year 3)

Interest Expense: $673,381 (Year 1) | $538,595 (Year 2) | $380,991 (Year 3)

Taxes Incurred: $1,338,780 (Year 1) | $1,989,668 (Year 2) | $3,040,642 (Year 3)

Net Profit: $3,123,819 (Year 1) | $4,642,559 (Year 2) | $7,094,831 (Year 3)

Net Profit/Sales: 5.76% (Year 1) | 7.41% (Year 2) | 9.36% (Year 3)

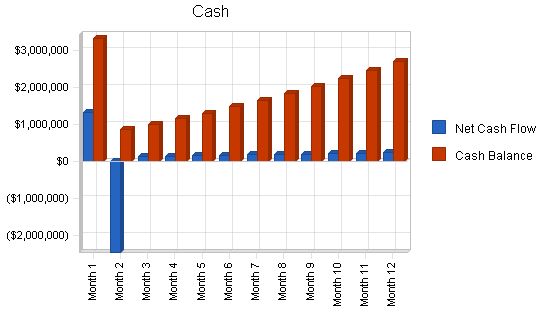

7.4 Projected Cash Flow:

The cash flow projection shows that provisions for ongoing expenses are adequate to meet TWM’s needs as the business generates sufficient cash flow to support operations. The second and third month decrease in cash flow reflects the payment of initial cost of goods sold prior to a large number of receipts being paid. TWM has anticipated this decrease and has arranged a line of credit to cover cash shortages.

Pro Forma Cash Flow

| Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $27,125,951 | $31,330,474 | $37,909,873 |

| Cash from Receivables | $22,227,991 | $30,571,290 | $36,721,873 |

| Subtotal Cash from Operations | $49,353,943 | $61,901,764 | $74,631,747 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $2,600,000 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $51,953,943 | $61,901,764 | $74,631,747 |

| Expenditures | |||

| Year 1 | Year 2 | Year 3 | |

| Expenditures from Operations | |||

| Cash Spending | $5,160,000 | $5,418,000 | $5,688,900 |

| Bill Payments | $45,818,085 | $52,731,967 | $62,793,055 |

| Subtotal Spent on Operations | $50,978,085 | $58,149,967 | $68,481,955 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $2,600,000 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $276,036 | $276,038 | $276,038 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $51,254,121 | $61,026,005 | $68,757,993 |

| Net Cash Flow | $699,822 | $875,759 | $5,873,754 |

| Cash Balance | $2,699,822 | $3,575,580 | $9,449,334 |

7.5 Projected Balance Sheet

TWM’s projected company balance sheet:

| Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $2,699,822 | $3,575,580 | $9,449,334 |

| Accounts Receivable | $4,897,960 | $5,657,144 | $6,845,144 |

| Inventory | $4,425,915 | $5,018,988 | $5,962,558 |

| Other Current Assets | $100,000 | $100,000 | $100,000 |

| Total Current Assets | $12,123,697 | $14,351,712 | $22,357,036 |

| Long-term Assets | |||

| Long-term Assets | $2,500,000 | $2,500,000 | $2,500,000 |

| Accumulated Depreciation | $300,000 | $600,000 | $900,000 |

| Total Long-term Assets | $2,200,000 | $1,900,000 | $1,600,000 |

| Total Assets | $14,323,697 | $16,251,712 | $23,957,036 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $4,185,913 | $4,347,408 | $5,233,939 |

| Current Borrowing | $2,600,000 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $6,785,913 | $4,347,408 | $5,233,939 |

| Long-term Liabilities | |||

| $4,223,964 | $3,947,926 | $3,671,888 | |

| Total Liabilities | $11,009,877 | $8,295,334 | $8,905,827 |

| Paid-in Capital | $508,000 | $508,000 | $508,000 |

| Retained Earnings | ($318,000) | $2,805,819 | $7,448,378 |

| Earnings | $3,123,819 | $4,642,559 | $7,094,831 |

| Total Capital | $3,313,819 | $7,956,378 | $15,051,209 |

| Total Liabilities and Capital | $14,323,697 | $16,251,712 | $23,957,036 |

| Net Worth | $3,313,819 | $7,956,378 | $15,051,209 |

7.6 Business Ratios

Business ratios for the years of this plan:

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 15.50% | 21.00% | 0.10% |

| Percent of Total Assets | ||||

| Accounts Receivable | 34.19% | 34.81% | 28.57% | 31.10% |

| Inventory | 30.90% | 30.88% | 24.89% | 29.10% |

| Other Current Assets | 0.70% | 0.62% | 0.42% | 20.00% |

| Total Current Assets | 84.64% | 88.31% | 93.32% | 80.20% |

| Long-term Assets | 15.36% | 11.69% | 6.68% | 19.80% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 47.38% | 26.75% | 21.85% | 38.00% |

| Long-term Liabilities | 29.49% | 24.29% | 15.33% | 16.80% |

| Total Liabilities | 76.86% | 51.04% | 37.17% | 54.80% |

| Net Worth | 23.14% | 48.96% | 62.83% | 45.20% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 20.00% | 21.45% | 22.88% | 28.00% |

| Selling, General & Administrative Expenses | 14.59% | 14.37% | 13.73% | 15.20% |

| Advertising Expenses | 0.11% | 0.13% | 0.15% | 0.50% |

| Profit Before Interest and Taxes | 9.47% | 11.44% | 13.87% | 3.30% |

| Main Ratios | ||||

| Current | 1.79 | 3.30 | 4.27 | 2.11 |

| Quick | 1.13 | 2.15 | 3.13 | 1.14 |

| Total Debt to Total Assets | 76.86% | 51.04% | 37.17% | 54.80% |

| Pre-tax Return on Net Worth | 134.67% | 83.36% | 67.34% | 7.30% |

| Pre-tax Return on Assets | 31.16% | 40.81% | 42.31% | 16.20% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 5.76% | 7.41% | 9.36% | n.a |

| Return on Equity | 94.27% | 58.35% | 47.14% | n.a |

| Activity Ratios | ||||

| Sales Forecast | |||||||||||||

| Month 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | ||

| Unit Sales | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 34 | |

| Total Unit Sales | 74 | 75 | 77 | 79 | 80 | 82 | 83 | 85 | 87 | 88 | 90 | 92 | |

Unit Prices

| Unit Prices | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Widget Basic | $35,000.00 | $35,000.00 | $35,000.00 | $35,000.00 | $35,000.00 | $35,000.00 | $35,000.00 | $35,000.00 | $35,000.00 | $35,000.00 | $35,000.00 | ||

| Widget Deluxe | $50,000.00 | $50,000.00 | $50,000.00 | $50,000.00 | $50,000.00 | $50,000.00 | $50,000.00 | $50,000.00 | $50,000.00 | $50,000.00 | $50,000.00 | ||

| Widget Premium | $75,000.00 | $75,000.00 | $75,000.00 | $75,000.00 | $75,000.00 | $75,000.00 | $75,000.00 | $75,000.00 | $75,000.00 | $75,000.00 | $75,000.00 | ||

Personnel Plan

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Executives | 40,000 | 40,000 | 40,000 | 40,000 | 40,000 | 40,000 | 40,000 | 40,000 | 40,000 | 40,000 | 40,000 | 40,000 | |

| Managers | 80,000 | 80,000 | 80,000 | 80,000 | 80,000 | 80,000 | 80,000 | 80,000 | 80,000 | 80,000 | 80,000 | 80,000 | |

| Manufacturing Process Workers | 60,000 | 60,000 | 60,000 | 60,000 | 60,000 | 60,000 | 60,000 | 60,000 | 60,000 | 60,000 | 60,000 | 60,000 | |

| Engineering | 250,000 | 250,000 | 250,000 | 250,000 | 250,000 | 250,000 | 250,000 | 250,000 | 250,000 | 250,000 | 250,000 | 250,000 | |

| Total People | 75 | 75 | 75 | 75 | 85 | 85 | 85 | 100 | 100 | 100 | 100 | 115 | |

| Total Payroll | 430,000 | 430,000 | 430,000 | 430,000 | 430,000 | 430,000 | 430,000 | 430,000 | 430,000 | 430,000 | 430,000 | 430,000 | |

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $4,045,000 | $4,125,900 | $4,208,418 | $4,292,586 | $4,378,438 | $4,466,007 | $4,555,327 | $4,646,434 | $4,739,362 | $4,834,149 | $4,930,832 | $5,029,449 | |

| Total Cost of Sales | $3,236,000 | $3,300,720 | $3,366,734 | $3,434,069 | $3,502,750 | $3,572,805 | $3,644,262 | $3,717,147 | $3,791,490 | $3,867,320 | $3,944,666 | $4,023,559 | |

| Gross Margin | $809,000 | $825,180 | $841,684 | $858,517 | $875,688 | $893,201 | $911,065 | $929,287 | $947,872 | $966,830 | $986,166Pro Forma Cash Flow

Cash Received Cash from Operations Cash Sales Cash from Receivables Subtotal Cash from Operations Additional Cash Received Sales Tax, VAT, HST/GST Received New Current Borrowing New Other Liabilities (interest-free) New Long-term Liabilities Sales of Other Current Assets Sales of Long-term Assets New Investment Received Subtotal Cash Received Expenditures Expenditures from Operations Cash Spending Bill Payments Subtotal Spent on Operations Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out Principal Repayment of Current Borrowing Other Liabilities Principal Repayment Long-term Liabilities Principal Repayment Purchase Other Current Assets Purchase Long-term Assets Dividends Subtotal Cash Spent Net Cash Flow Cash Balance Monthly Pro Forma Cash Flow: Month 1: Cash Received: – Cash Sales: $2,022,500 – Cash from Receivables: $0 – Subtotal Cash from Operations: $2,022,500 – Additional Cash Received: $0 – Sales Tax, VAT, HST/GST Received: $0 – New Current Borrowing: $0 – New Other Liabilities (interest-free): $0 – New Long-term Liabilities: $0 – Sales of Other Current Assets: $0 – Sales of Long-term Assets: $0 – New Investment Received: $0 – Subtotal Cash Received: $2,022,500 Expenditures: – Expenditures from Operations: $0 – Cash Spending: $430,000 – Bill Payments: $238,092 – Subtotal Spent on Operations: $668,092 – Additional Cash Spent: $0 – Sales Tax, VAT, HST/GST Paid Out: $0 – Principal Repayment of Current Borrowing: $0 – Other Liabilities Principal Repayment: $0 – Long-term Liabilities Principal Repayment: $23,003 – Purchase Other Current Assets: $0 – Purchase Long-term Assets: $0 – Dividends: $0 – Subtotal Cash Spent: $691,095 Net Cash Flow: $1,331,405 Cash Balance: – Month 1: $3,331,405 – Month 2: $876,140 – Month 3: $1,009,831 – Month 4: $1,153,781 – Month 5: $1,308,190 – Month 6: $1,473,266 – Month 7: $1,649,220 – Month 8: $1,836,266 – Month 9: $2,034,623 – Month 10: $2,244,515 – Month 11: $2,466,171 – Month 12: $2,699,822 |

||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!