will be a full-service sport complex in Athens, offering unique golf facilities. This business plan outlines our goals, services, and objectives, while also serving as a tool for securing investments.

To ensure success, our focus will be on effective marketing, cultivating a vibrant atmosphere, and hiring qualified staff for our programs and leagues.

The golf industry in Greece is poised for significant expansion in the coming years, and Greek Golf Training Centers anticipates steady growth and profitability.

Contents

1.1 Objectives

The main objectives for Greek Golf Training Centers are:

- Sell 200 memberships in year one, 300 in year two, and 400 by the end of year three.

- Organize and develop various teams, depending on level, business type, available time, etc., to reach maximum capacity.

- Sponsor and/or support one event in year one, two in year two, and four in year three.

- Show a net profit margin in the first year.

1.2 Mission

Greek Golf Training Centers is a single sport and fitness complex for residents of Athens and the surrounding areas.

Our mission is to provide exceptional programs, staff, and equipment to meet the diverse sport and fitness needs of our members while generating profits.

In addition to delivering value to our customers, Greek Golf Training Centers aims to create an unparalleled sporting atmosphere that enhances the experience for all members and employees.

Committed to the community, we strive to support and sponsor events, and host them whenever possible. We hope our facility will enhance members’ enjoyment and appreciation for golf, fitness, and life.

1.3 Keys to Success

- Marketing: Establish Greek Golf Training Centers as a renowned name in Athens and effectively market our services to each market segment.

Company Summary

Greek Golf Training Centers is a golf complex that offers continuous training opportunities to both members and casual users, providing expert help without time limitations.

2.1 Company Ownership

Greek Golf Training Centers will be a Limited Liability Corporation financed partially by direct owner investment and a long-term loan.

Dimitrios Vastarouchas and Helen Brasinika will each own 25% of the company, while the other two limited partners will own 40% and 10%, respectively.

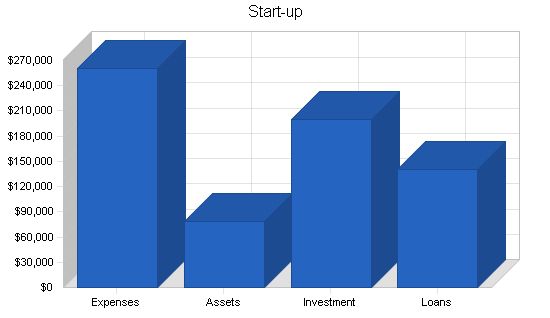

2.2 Start-up Summary

Our start-up costs primarily include equipment purchases, a high-quality pre-fabricated building for the main facility, construction of the training center, golf equipment for the retail store, stationery, legal expenses, advertising, land rent, and office opening expenses. We will finance the start-up costs with direct owner investment. The assumptions are detailed in the following chart and table.

Start-up Funding

Start-up Expenses to Fund: $261,000

Start-up Assets to Fund: $79,000

Total Funding Required: $340,000

Assets

Non-cash Assets from Start-up: $65,000

Cash Requirements from Start-up: $14,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $14,000

Total Assets: $79,000

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $140,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $140,000

Capital

Planned Investment

Investor 1: $160,000

Investor 2: $40,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $200,000

Loss at Start-up (Start-up Expenses): ($261,000)

Total Capital: ($61,000)

Total Capital and Liabilities: $79,000

Total Funding: $340,000

Start-up Requirements

Start-up Expenses

Legal: $6,000

Training center construction (pillars, nets etc): $50,000

Garden & parking: $5,000

Training center equipment: $40,000

Furniture: $30,000

Licenses: $10,000

Land purchase: $0

Administration hardware, software & web: $20,000

Golf equipment for selling: $40,000

Advertising: $30,000

Interior designer: $20,000

Insurance: $10,000

Total Start-up Expenses: $261,000

Start-up Assets

Cash Required: $14,000

Other Current Assets: $0

Long-term Assets: $65,000

Total Assets: $79,000

Total Requirements: $340,000

Products and Services

The Greek Golf Training Centers will provide the following services:

– Golf practice using unlimited number of balls and the best types of feeder. Simulation of various conditions that can be met in a golf course shall be done using sloped mats, tees, sand, targets for pitching and putting training aids.

– Training by professionals.

– Golf equipment shop.

– Lobby for relaxation and discussion with colleagues where brandy, cigars and refreshments will be available.

– Participation in events and activities.

Golf Training Facilities

The Greek Golf Training Centers will house a large training area (50 m x 100 m) where members could have continuous practice without interruptions. The advantages include the semi-automatic feeding, the possibility to aim at different targets under various conditions, independence from weather conditions, absence of time limitation, and the use of first-class equipment.

Professional Training

Greek Golf Training Centers will offer professional training (private or group programs), performance analysis once a month for members (using PC, digital video, etc), fitness programs, putting aids, and a library with necessary material such as video tapes, books, and magazines.

Golf Equipment Shop

A golf equipment shop will be strategically placed in Greek Golf Training Centers to attract potential buyers. The shop will sell first-class equipment and training aids.

Lobby and Other Facilities

Other features and services Greek Golf Training Centers will have include full-service locker rooms for both men and women that will accommodate up to 40 lockers, large shower areas, benches, sinks, and bathroom facilities.

Sponsorship

The nets which surround the training area can be used for advertisement and promotion of potential sponsors.

Events and Activities

A series of activities will be scheduled for the members. Through internal competitions, awards shall be earned and teams formed to enjoy golf in Athens golf course. Also, in the future, a golf team could be established. Additionally, special events will be organized for children and schools to promote golf in younger generations.

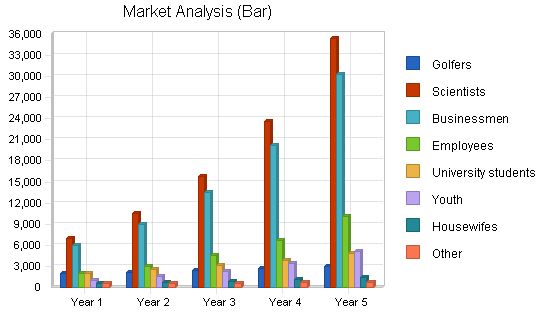

Market Analysis Summary

The Greek Golf Training Centers will be the only golf complex of its kind in Athens and surroundings (more than four million people). Some aspects of the facility will cater mainly to Athens golf course members but will generally appeal to everyone in the area.

Because of the flexibility of the time schedule, the independence of weather conditions, and the comfortable auto feeding system, our market segments vary from dedicated golfers to people who want to learn golf, have stress relief leisure activities, and socialize with other members.

In addition, Greek Golf Training Centers shall develop good relations with well-known golf training schools worldwide to bring golf to youth, advise and urge them to continue for a professional career.

At the moment, people in Athens can enjoy golf only in Athens (Glyfada) Golf Course. There are 700 members, however, the age average is higher than 55 years old. Moreover, the unique training facility in Athens is in very bad condition since there are no ball feeders, it is weather-dependent, and most of all closes at 16:00. Consequently, businessmen, employees, doctors, lawyers, etc. do not have the chance to familiarize with golf.

Market Segmentation

Golfers

A market segment for Greek Golf Training Centers will be the existing golfers (700 members of Athens Golf Club). These people love golf and continuously try to improve their performance.

There are some highly skilled persons, while others are above 90′ (their score), however, most of them are older than 50 years. Provided that they can practice at any time and weather conditions, a part of them will join Greek Golf Training Centers. Nevertheless, due to their age average, they are expected to have more leisure time which does not prevent them from using the existing facilities of Glyfada Golf Course.

Scientists

An important market segment for Greek Golf Training Centers will be the scientists. This market segment includes employees such as doctors, lawyers, managers in private companies and public organizations, economists, etc. These people will be a target market for special promotions and periodic activities.

Businessmen

Another market segment for our facility will be those who shall combine business with entertainment. They will have stress relief where they can enjoy brandy and discuss in a comfortable place with their guests and/or colleagues.

Employees

This is a smaller but important market segment for our facility. Although fees will be high for private employees, there will be some of them who will join our Center. Except the chance to learn golf, develop public relations, join teams to play golf in a course, or arrange golf vacations.

University students

Another small market segment for Greek Golf Training Centers will be the students who are attracted due to golf’s uniqueness, its fitness programs and continuous exercise, competitions, and other events.

Youth

This market segment will be our middle-term growing market and maybe the most important in a few years.

In combination with golf promotion in Greece, cooperation with well-known foreign golf schools, and the proper attitude that will be developed, young people will form teams and take part in competitions, continue golf studies abroad, and become professionals. These people will be the Center’s flag and support it accordingly.

Housewives

Another small market segment is with the housewives. Golf is unknown to them; however, since they have plenty of time, we estimate that a small number will be attracted. They can have some stress relief, especially in the morning time.

Others

Tourists, foreigners who work in Greece, guests, etc. will join us; however, they do not like to be locked into long-term commitments but like the freedom to come and go when the opportunity presents itself. Moreover, we expect that segment to reach a peak value during the Olympic Games (Athens 2004).

Market Analysis:

Golf is a booming industry in Greece with three golf courses currently in operation: Athens (Glyfada) Golf Club, Rhodes Island Golf Club, and Corfu Golf Club. However, significant changes have occurred in the past year. Fuji Bank is in negotiations with Rhodes Island Club for further investments, the Crete’s Hotels Association has begun construction on a superior golf course in Crete, and repairs have started at the North Greece Golf Club. Additionally, plans have been approved for a new golf course in Markopoulo, and three golf courses are being developed in the Peloponnisos area. With these expansions, the golf industry in Greece is expected to see rapid growth in the coming years. It should be noted that Greece is one of the few European countries where golf has not yet been promoted, and sales of golf equipment in the country are currently low.

Competition and Buying Patterns:

The only competition for Greek Golf Training Centers in Athens and the surrounding areas is the Athens (Glyfada) Golf Club. The training facilities at this club are in poor condition, lacking automatic ball feeders, mats with slope, areas with sand, and sloped areas. The training place is also exposed to weather conditions and does not offer night training. However, the club has 700 members with long-term memberships. Potential members will compare the training facilities and seek out options that meet their specific needs and offer good value.

Target Market Segment Strategy:

Greek Golf Training Centers will focus its marketing strategies on market segments that align with its offerings. The facility’s size, appearance, and convenient location will attract many people. Early marketing efforts will include offering tours to junior and senior high schools during the building and early completion of the facility. After opening, print and radio media will be utilized to promote the facility and equipment.

Strategy and Implementation Summary:

Greek Golf Training Centers has a large potential market in Greece and aims to become the main golf representative in the country. This will be achieved through continuous promotion, media coverage, and hosting community events.

Competitive Edge:

Greek Golf Training Centers stands out from the competition in three ways. Firstly, it offers unique training facilities not available elsewhere. Secondly, the facility’s location, size, and appearance attract many people. Lastly, the golf shop offers first-class equipment at competitive prices and provides opportunities for testing in real conditions. It is important for the center to stay updated with current trends in golf programs to maintain its competitive edge.

The marketing strategy for Greek Golf Training Centers emphasizes service and support, building relationships, and targeting golf equipment as the key market.

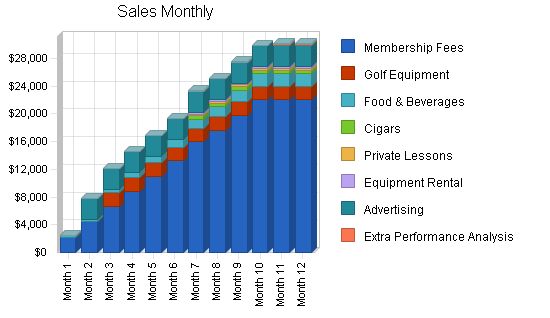

Sales Strategy:

Sales at Greek Golf Training Centers are based on the services and amenities provided. The center aims to offer the best value for customers’ money and will match or beat any competitor offering equal services. Potential members will have the opportunity to sit down with a representative and explore membership options and all the services, programs, and amenities available. Building trust and maintaining customer relationships are crucial for membership retention.

The first year is expected to have incremental growth with 200 members registered. The center anticipates steady growth over the following years, reaching a maximum capacity of 500 members. Equipment sales are expected to be low initially due to limited popularity of golf in Greece, but the opening of a major course in Crete is expected to boost sales in the future. The center’s target of 500 members is considered realistic in a growing market.

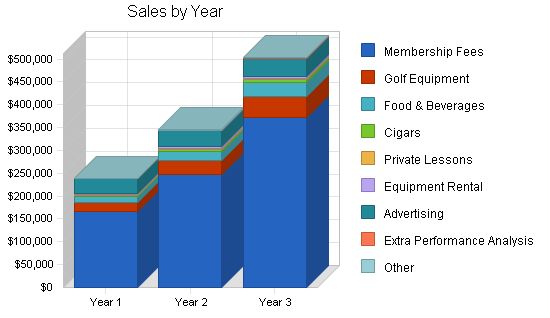

Sales Forecast

Membership Fees Year 1: $165,550 Year 2: $248,325 Year 3: $372,488

Golf Equipment Year 1: $20,000 Year 2: $30,000 Year 3: $45,000

Food & Beverages Year 1: $13,500 Year 2: $20,250 Year 3: $30,375

Cigars Year 1: $3,000 Year 2: $4,500 Year 3: $6,750

Private Lessons Year 1: $1,500 Year 2: $2,250 Year 3: $3,375

Equipment Rental Year 1: $1,500 Year 2: $2,250 Year 3: $3,375

Advertising Year 1: $33,000 Year 2: $36,300 Year 3: $39,930

Extra Performance Analysis Year 1: $500 Year 2: $750 Year 3: $1,125

Other Year 1: $600 Year 2: $900 Year 3: $1,350

Total Sales Year 1: $239,150 Year 2: $345,525 Year 3: $503,768

Direct Cost of Sales

Membership Fees Year 1: $8,275 Year 2: $12,420 Year 3: $18,625

Golf Equipment Year 1: $15,000 Year 2: $22,500 Year 3: $33,750

Food & Beverages Year 1: $2,700 Year 2: $4,050 Year 3: $6,075

Cigars Year 1: $750 Year 2: $1,125 Year 3: $1,690

Private Lessons Year 1: $1,140 Year 2: $1,800 Year 3: $2,700

Equipment Rental Year 1: $0 Year 2: $0 Year 3: $0

Advertising Year 1: $0 Year 2: $0 Year 3: $0

Extra Performance Analysis Year 1: $0 Year 2: $0 Year 3: $0

Other Year 1: $300 Year 2: $450 Year 3: $600

Subtotal Direct Cost of Sales Year 1: $28,165 Year 2: $42,345 Year 3: $63,440

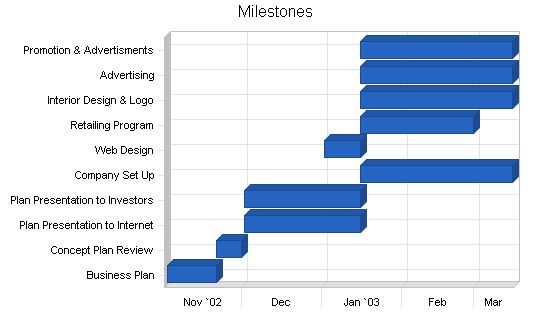

5.4 Milestones

The accompanying table lists important program milestones, with dates, managers in charge, and budgets. The milestone schedule emphasizes planning for implementation. The most important programs are the sales and marketing programs detailed in the previous topics.

The table doesn’t show the commitment behind it. Our business plan includes provisions for planned vs. actual analysis, and we will hold monthly follow-up meetings to discuss variances and course corrections.

Web Plan Summary:

The Greek Golf Training Centers’ website is the company’s virtual business card and portfolio, showcasing their products, services, and current activities. The website should be simple but classy, following the latest trends in user interface design. Flashy or excessive use of Shockwave or Flash technology may cause client dissatisfaction. A golfers forum may be added in the future. The website’s strategy is to combine a well-designed front end with a back end that records leads and proposal requests.

Website Marketing Strategy:

The website network has four main strategies:

1. A resource site for brochures, activities, reviews, and tips.

2. A sales/rental site for planning and booking golf equipment and training aids.

3. A golfers forum as a future support tool for the golf team.

4. Information about professional golf studies.

Development Requirements:

The Greek Golf Training Centers website will be developed with a simple hosting provider, Hellas On-Line services, and a contracted user interface designer. The designer will work with a graphic artist to create the website logo and graphics. The maintenance of the site will be done by the Greek Golf Training Centers’ staff. They can also consider pre-packaged solutions through Hellas On-Line hosting or equivalent.

Management Summary:

The management team for Greek Golf Training Centers consists of the general partners, who handle day-to-day operations, scheduling, marketing, sales, and promotions. Additional staff members will be hired to compensate for the founders’ lack of experience in specific areas. The staff will be hired on a need basis as the facility’s user base grows.

Personnel Plan:

In the first year of operation, Greek Golf Training Centers will have a total of seven people. This number is projected to increase by two people each year for the next two years. Salaries are expected to increase slightly each year.

The start-up will be financed by investors, with continued financing through a long-term loan. The financial plan is based on conservative assumptions, including a slow-growth economy and continued growth in the number of golf memberships.

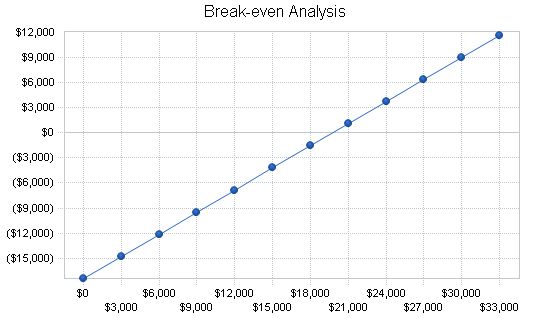

The break-even analysis assumes monthly running costs, including payroll, rent, utilities, and other expenses. The table shows the monthly sales needed to break even, which is about two-thirds of the planned sales level. Revenue from equipment sales, beverages, sponsorship, and equipment rental is not taken into account for the worst-case scenario.

Break-even Analysis

Monthly Revenue Break-even: $19,756

Assumptions:

– Average Percent Variable Cost: 12%

– Estimated Monthly Fixed Cost: $17,429

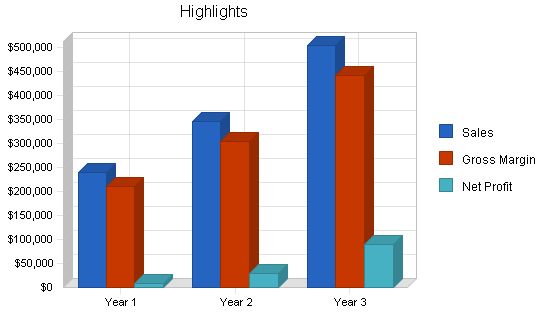

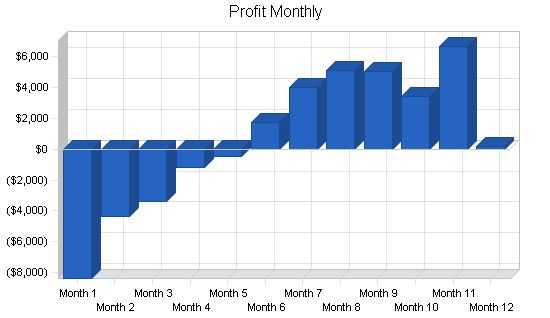

Projected Profit and Loss

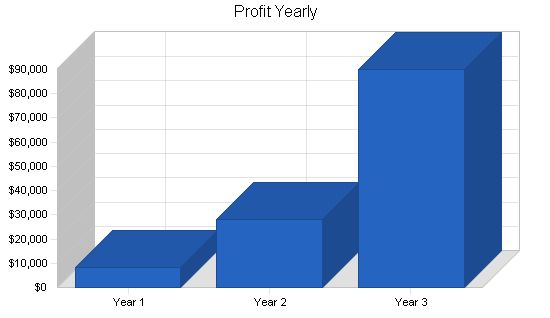

Our projected profit and loss is shown on the Profit and Loss table. We show a conservative estimated net profit in the first year. According to the research carried out by our team, these projections are conservative and easily attainable. The monthly estimates are included in the appendix.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $239,150 | $345,525 | $503,768 |

| Direct Cost of Sales | $28,165 | $42,345 | $63,440 |

| Other Costs of Goods | $0 | $0 | $0 |

| Total Cost of Sales | $28,165 | $42,345 | $63,440 |

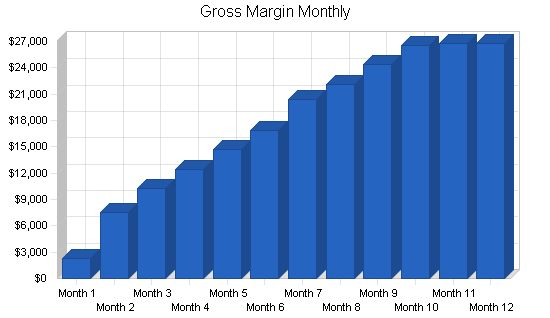

| Gross Margin | $210,985 | $303,180 | $440,328 |

| Gross Margin % | 88.22% | 87.74% | 87.41% |

| Expenses | |||

| Payroll | $109,000 | $157,650 | $194,231 |

| Sales and Marketing and Other Expenses | $6,000 | $12,000 | $18,000 |

| Depreciation | $15,000 | $15,000 | $15,000 |

| Rent (site) | $48,000 | $48,000 | $48,000 |

| Supplies (Office & Janitorial) | $1,200 | $1,200 | $1,200 |

| Web Site Expenses | $600 | $660 | $725 |

| Utilities | $3,000 | $3,300 | $3,630 |

| Insurance (fire, damages, loss) | $10,000 | $3,300 | $3,630 |

| Payroll Taxes | $16,350 | $9,545 | $10,022 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $209,150 | $250,655 | $294,438 |

| Profit Before Interest and Taxes | $23,435 | $52,525 | $145,890 |

| EBITDA | $38,435 | $67,525 | $160,890 |

| Interest Expense | $9,573 | $9,030 | $8,330 |

| Taxes Incurred | $5,451 | $15,223 | $47,573 |

| Net Profit | $8,411 | $28,272 | $89,987 |

| Net Profit/Sales | 3.52% | 8.18% | 17.86% |

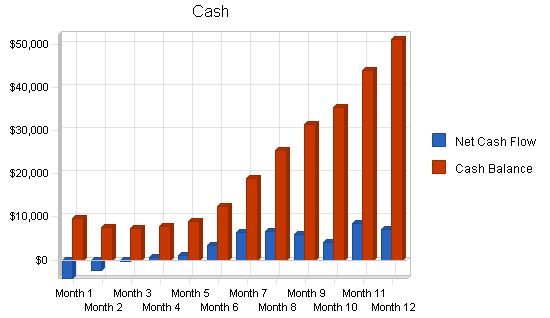

8.4 Projected Cash Flow

The following cash flow projections show our annual amounts only. For more detailed monthly projections please see the appendix.

Cash flow projections are critical to our success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month, and the other the monthly balance. The annual cash flow figures are included here and the more important detailed monthly numbers are included in the appendix.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $239,150 | $345,525 | $503,768 |

| Subtotal Cash from Operations | $239,150 | $345,525 | $503,768 |

| Additional Cash Received | |||

| Non Operating (Other) Income | $21,600 | $0 | $0 |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $260,750 | $345,525 | $503,768 |

Projected Balance Sheet

8.5 Projected Balance Sheet

The balance sheet shows managed but sufficient growth of net worth, and a sufficiently healthy financial position. The monthly estimates are included in the appendix.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $51,081 | $76,568 | $176,482 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $51,081 | $76,568 | $176,482 |

| Long-term Assets | |||

| Long-term Assets | $65,000 | $65,000 | $65,000 |

| Accumulated Depreciation | $15,000 | $30,000 | $45,000 |

| Total Long-term Assets | $50,000 | $35,000 | $20,000 |

| Total Assets | $101,081 | $111,568 | $196,482 |

8.6 Business Ratios

The table shows our main business ratios compared with the Industry Profile ratios for the Golf Course Industry, NAICS code 713910. We intend to improve gross margin and inventory turnover.

| Ratio Analysis | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales Growth | 0.00% | 44.48% | 45.80% | 4.07% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Percent of Total Assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 35.65% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Current Assets | 50.53% | 68.63% | 89.82% | 46.58% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term Assets | 49.47% | 31.37% | 10.18% | 53.42% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current Liabilities | 19.46% | 10.65% | 8.56% | 25.61% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term Liabilities | 132.57% | 111.14% | 58.02% | 35.91% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities | 152.03% | 121.80% | 66.58% | 61.52% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Worth | -52.03% | -21.80% | 33.42% | 38.48% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Percent of Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross Margin | 88.22% | 87.74% | 87.41% | 100.00% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Selling, General & Administrative Expenses | 81.36% | 79.71% | 69.85% | 72.53% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 3.68% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit Before Interest and Taxes | 9.80% | 15.20% | 28.96% | 1.60% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Main Ratios | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current | 2.60 | 6.44 | 10.50 | 1.32 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quick | 2.60 | 6.44 | 10.50 | 0.85 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt to Total Assets | 152.03% | 121.80% | 66.58% | 65.83% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax Return on Net Worth | -26.36% | -178.87% | 209.47% | 2.41% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax Return on Assets | 13.71% | 38.99% | 70.01% | 7.06% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional Ratios | Year 1 | Year 2 | Year 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Profit Margin | 3.52% | 8.18% | 17.86% | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on Equity | 0.00% | 0.00% | 137.03% | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Activity Ratios | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounts Payable Turnover | 6.52 | 12.17 | 12.17 | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Days | 27 | 40 | 26 | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Asset Turnover | 2.37 | 3.10 | 2.56 | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt Ratios | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt to Net Worth | 0.00 | 0.00 | 1.99 | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current Liab. to Liab. | 0.13 | 0.09 | 0.13 | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liquidity Ratios | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Working Capital | $31,411 | $64,683 | $159,670 | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Coverage | 2.45 | 5.82 | 17.51 | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional Ratios | READ MORE How to Write a Nonprofit Business Plan -

Personnel Plan

Hello! I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com. My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals. Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success! | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||