Golf Club Manufacturer Business Plan

RA Concepts aims to secure start-up financing to operate as a golf club manufacturer in Southern California.

RA Concepts will meet the growing demand for new golf technology. The company’s initial product is the unique "D" style featherweight putter, with three additional designs to follow in the first year.

The "D" style putter is expected to be popular among women golfers due to its light weight, multiple color options, and custom features. The club’s material technology and precision will appeal to avid golfers looking to personalize their game improvement.

Our technology allows us to create custom clubs for customers and ship them within three working days, unlike traditional manufacturers who take at least four weeks to produce stock or custom clubs.

All clubs will adhere to USGA regulations. The "D" design has already been submitted to the USGA for approval.

We will market our clubs directly to end-users and retail golfing supply shops. Our target audience includes pro shops and high-end golf retailers, offering additional incentives to attract female customers. This strategy will allow us to showcase our clubs in numerous shops and stores across America, facilitating a swift entry into the golf market.

At RA Concepts, our mission is to provide customers with high-quality, customized clubs that exceed the standards set by the USGA. We prioritize accuracy, lightweight design, and stylish aesthetics in our products, utilizing technology to enhance their performance and appearance. We are committed to pushing the boundaries of golf club manufacturing and demonstrating the superiority of new, innovative methods over traditional mass production.

Our keys to success include maintaining a high level of quality in our product line, nurturing referral networks to generate new and repeat sales, and making significant investments in research and development to focus on new technology.

Our objective is to acquire 1% of sales in the United States and 1/2% of the global market for putters.

RA Concepts is a privately-owned start-up specializing in technological advancements in golf equipment. Our target customers span all levels of the golfing community.

The company will be managed by three experienced executives responsible for administration, marketing, sales, and finance. We aim to raise start-up investment capital and initially establish one manufacturing facility in California, with plans for another facility in Colorado Springs in the long term.

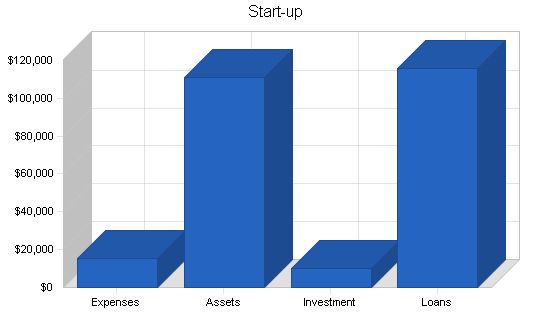

With projected start-up costs of $62,160 for machinery, production equipment, and raw materials, we are well-prepared to meet the expected demand for our D and V putter prototypes, with additional innovative designs in the research and development stages.

We took advantage of price breaks and incentives based on our order of one thousand units, including free logo placement on grips and head covers. Based on our communication with suppliers and retailers, we anticipate becoming fully operational within one month of securing financing.

Contents

Start-up

Requirements

Start-up Expenses

Legal

$7,200

Stationery etc.

$1,800

Brochures

$1,300

Consultants

$500

Insurance

$300

Rent

$1,100

Research and Development

$350

Expensed Equipment

$2,200

Other

$400

Total Start-up Expenses

$15,150

Start-up Assets

Cash Required

$23,490

Start-up Inventory

$25,200

Other Current Assets

$0

Long-term Assets

$62,160

Total Assets

$110,850

Total Requirements

$126,000

Start-up Funding

Start-up Expenses to Fund

$15,150

Start-up Assets to Fund

$110,850

Total Funding Required

$126,000

Assets

Non-cash Assets from Start-up

$87,360

Cash Requirements from Start-up

$23,490

Additional Cash Raised

$0

Cash Balance on Starting Date

$23,490

Total Assets

$110,850

Liabilities and Capital

Liabilities

Current Borrowing

$0

Long-term Liabilities

$116,000

Accounts Payable (Outstanding Bills)

$0

Other Current Liabilities (interest-free)

$0

Total Liabilities

$116,000

Capital

Planned Investment

Randy Comstock

$8,000

Alan Comstock

$2,000

Other

$0

Additional Investment Requirement

$0

Total Planned Investment

$10,000

Loss at Start-up (Start-up Expenses)

($15,150)

Total Capital

($5,150)

Total Capital and Liabilities

$110,850

Total Funding

$126,000

2.2 Company Ownership

RA Concepts is a private partnership owned by:

- Randy Comstock: The designer and head of all manufacturing, research, and the day-to-day operations.

- Alan Comstock: Financial Manager, working with the day-to-day operation.

Products

RA Concepts has several different putter designs in the works. We have several prototypes of our D model, one each of our V model and Scorpion putters, and another (the W) is in the design phase. The D model design and prototype have already been submitted to the USGA for approval and should be ready for production soon.

Details of each follow:

“D” Putters

These clubs are a new concept in material and design. The material is an acrylic polymer and polyester polymer blend. By using these materials, we can control perimeter weighting. These materials are available in different colors, allowing us to customize the putter to almost any color combination. Our technology uses state of the art CNC machines, enabling us to make hundreds of putters at the same time that are exactly the same in color and weight or completely customized to individual orders.

The design of the “D” putter has a parameter ring that houses the acrylic and tungsten weighting. Placing the weight in this area allows the putter to have a larger sweet spot, increasing accuracy. To decrease the twisting of the head when the ball impacts the putter head, our technology allows us to run the shaft insert across the face of the putter. The design also has a large center area behind the face of the club, allowing for additional weight if desired and an area for a ball marker or acrylic filled logo.

This design has been submitted to the USGA for technical approval and we have several prototypes manufactured.

“V” Putters

These clubs utilize the same polymer blends in material and CNC technology as the “D” putter. The “V” putter includes three vertical bars that attach at the rear with a slight bending bar. The two outer bars with the offsetting tungsten weight help with head twisting and increase the sweet spot and accuracy. The center bar allows for additional weight and a longer sightline. The shaft insert is used for head twisting and to transfer the impact energy of the ball to the outer bars, allowing the club head to remain balanced during the shot.

We have one prototype made and are in testing. This putter should be available two months after start up.

“W” Putters

These putters utilize the same polymer blends in material and CNC technology as the “D” and “V” putters. They are being designed primarily for use as belly putters or long putters. The design is currently in development and should be available five months after start up.

We have one other putter on the drawing board, radical in both design and material. This design will bring our materials and technology to the category of the Irons.

The “Scorpion”

This putter will use CNC technology, but the material is a urethane blend and tungsten. The design pushes the limits of USGA regulations and with its unique look, could be our best seller. The Scorpion is still in research and development. Approval of this club by the USGA will hinge on the definition of “the impact area.” We are working with USGA officers to introduce this new design and prepare the groundwork for re-examining the details of the Iron rules.

We have one prototype of the Scorpion that is currently being tested.

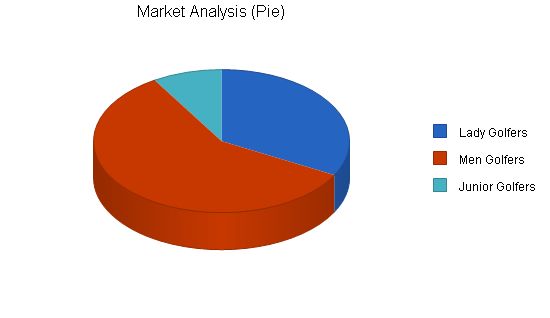

Market Analysis Summary

Our target market wants to have a fine putter with the latest technology, combined with the ability to be fully customized. This includes golfers of all skill levels, from beginners to touring professionals. Initially, our primary target segment will be female golfers, as they appreciate the featherweight touch, different colors, and personalization we can provide.

With millions of golfers and our new technology, we have an opportunity to reach a market of approximately 26 million recreational and professional golfers.

The golfing consumer is currently exploring the benefits of items made with new technology. They also desire personalized sporting equipment. RA Concepts’ high-tech, customized putters meet these needs, and consumers will demand access to our high-quality putters.

From the distribution side, our target market is high-end retail golf shops catering to these targeted end-users. They want high-profit margin goods that draw customers into the store and practically sell themselves. They also want quality products that demonstrate the retailer’s superior knowledge of the sport, which builds consumer trust and encourages repeat business for accessories and other golfing purchases.

4.1 Market Segmentation

With a steadily growing world golfer market of more than 26 million, our aim is to expand by promoting new technology. The breakdown of participation in golf is as follows: 1% Professional, 63% men, 22% women, and 4% youth, with 81% recreational golfers. Our primary target segment is female golfers, as they are the fastest growing segment in the golfing industry. Since our target is the female golfing market, we are looking to gain 2% of the American female golfing market, 1% of the male golfing market, and .5% of the junior golfing market.

The following table outlines our potential market segments over the next five years. This is a very conservative estimate based on the number of American golfers in each segment:

- Female golfers: 5.76 million

- Male golfers: 20.44 million

- Junior golfers (5-17 years old): 6.1 million

| Market Analysis | ||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | CAGR | |

| 115,200 | 124,416 | 134,369 | 145,119 | 156,728 | 8.00% | |

| 204,400 | 214,620 | 225,351 | 236,619 | 248,449 | 5.00% | |

| 30,500 | 31,110 | 31,732 | 32,367 | 33,014 | 2.00% | |

| 350,100 | 370,146 | 391,452 | 414,104 | 438,192 | 5.77% | |

4.2 Target Market Segment Strategy

Our segment definition is strategic. We only satisfy the needs of demanding, high-end golfers who value quality. We target buyers who appreciate club workmanship, design excellence, and new technology.

According to the National Golf Foundation, "Avid golfers (25+ rounds annually) make up the smallest player segment (23 percent) but accounted for 63 percent of all golf-related spending in 2002." Our high-quality clubs provide superior performance, prestige value, and enhanced enjoyment. We aim to persuade avid golfers to choose our products over competitors’.

Our marketing will appeal to good taste, commitment to the sport, and vanity. We will advertise our clubs with flair, akin to custom-tailored clothing and custom-designed houses. We will target retail shops with demographics matching our end-users, leveraging their existing knowledge of their client base.

The industry is dominated by a few large companies such as Callaway, Ping, Taylormade, and Titleist. These giants have multi-segment marketing strategies that cater to various customer segments.

Golf equipment customers prioritize reliability, reputation, and cost since purchases can range from under twenty to thousands of dollars.

4.3.1 Competition and Buying Patterns

RA Concepts has no direct competition as there are no comparable golf clubs currently available. Our inventor, Randy Comstock, holds exclusive global rights to the patent (pending) which protects our revolutionary materials and club-making process. Golf clubs made from steel and other metal alloys offer the closest competition.

For our target market, there is no trade-off between price and performance; performance is always the goal. However, their performance needs vary based on skill level and preferences.

Our target market consists of avid golfers who seek products that enhance their game. While a large sweet spot is desirable, designing for the largest sweet spot can limit corrections for other swing errors. Most of our new designs accommodate both features.

Accomplished golfers seek clubs that accurately transmit subtle nuances in their swings. The Scorpion caters to these consumers.

Gender-based preferences create a significant division in our target market. Female golfers typically seek lighter clubs with different shaft stiffness than their male counterparts. Our lightweight products offer compatibility with various custom shafts to suit individual golfers.

Strategy and Implementation Summary

We focus on customers who desire high-quality, customized golf clubs. Our customers are attracted by the club’s aesthetics but use them for their superior technology-enabled performance.

To address customer needs, we will conduct free seminars and demonstrations for retail managers and buyers. We will also organize special events in retail shops to directly engage with our target consumers.

Our sales strategy relies on the exceptional quality of our products, derived from our technical design expertise and premium materials.

Our material, known for its high-quality sanding process, enhances the sense of quality and feel, offering a distinct competitive advantage.

5.1 Competitive Edge

Our competitive edge lies in our high-technology design and manufacturing process. Our products surpass our competitors in quality, ease of production, and customization. We have combined technology and design in ways that no other golf manufacturer has.

RA Concepts’ revolutionary proprietary technology and materials position us as a leader in new putter design. Our approach delivers significant value to retail shops and end users.

In marketing to retail stores, we offer in-house seminars, cost comparisons with competitors, and companion advertising to increase consumer interest.

To attract end users (golfers), we will place ads in specialty golfing magazines, send free clubs to top golfers and magazine editors, and offer facility tours for interested golfers. We also aim to secure documentary spots on sports channels to highlight our technological processes.

5.3 Sales Strategy

Our strategy focuses on maintaining our relationship with high-end buyers who appreciate the best quality and demand excellence in their golf game. We will work closely with golf shops and retail stores, aiming to establish a strong presence and gain position in pro shops. Specialty retail is a potential channel for future growth.

Establishing long-term relationships with retail buyers is crucial, as they make significant decisions for their stores daily. Our affiliation with Van Russel, our pro-golfing sales associate, enhances our credibility during initial contacts. Furthermore, the design, price, turnaround time for custom work, and quality of our clubs compared favorably with other high-end options.

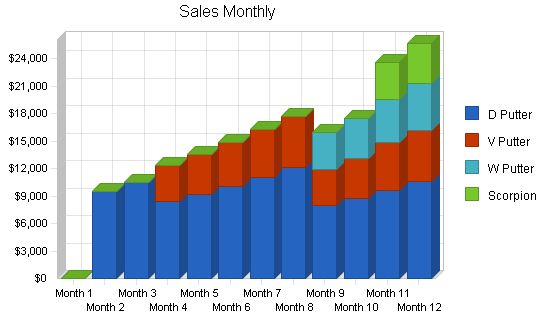

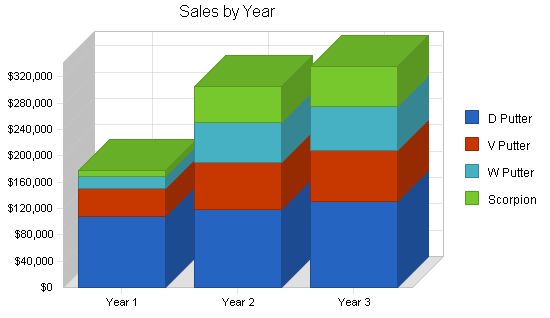

Our sales forecast conservatively estimates selling approximately 2230 putters (~$79.60 each) to retailers in the first year. We expect to reach full production capacity in year 2, doubling sales. These estimates are conservative, considering the interest we have already received from high-end retail golfing shops.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| D Putter | $107,775 | $118,552 | $130,407 |

| V Putter | $42,984 | $70,923 | $78,015 |

| W Putter | $18,308 | $60,416 | $66,457 |

| Scorpion | $8,358 | $55,162 | $60,678 |

| Total Sales | $177,425 | $305,053 | $335,557 |

Management Summary

Randy Comstock

Randy has twenty years in the golf club manufacturing industry, with the last ten years in design and project management. Randy is in charge of design and production.

Alan Comstock

Alan has a degree in accounting and experience as a controller in the golfing retail industry. Twelve years ago, he started an air pollution control business, then sold it as a profitable entity ten years later to a larger corporation; Alan is coming out of retirement to run the financial aspects of RA Concepts. Alan will organize marketing operations with our retail agents.

Van Russell

Van is a PGA golf professional who has been teaching for fifteen years. He owns a golf club refurbishing and retail sales company in the Colorado Springs area and brings a large amount of knowledge of the golfing industry. Van Russell will be in charge of sales and will work with Alan on marketing.

6.1 Personnel Plan

Randy Comstock is the only full-time employee. Alan Comstock is a part-time employee, with a base salary plus incentives as sales increase.

Van Russell’s salary will be based on sales in his region, starting at a part-time base salary.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Randy Comstock | $30,000 | $33,000 | $36,300 |

| Alan Comstock | $9,147 | $14,501 | $16,711 |

| Van Russell | $19,671 | $16,153 | $17,678 |

| Total People | 3 | 3 | 3 |

| Total Payroll | $58,819 | $63,654 | $70,689 |

Financial Plan

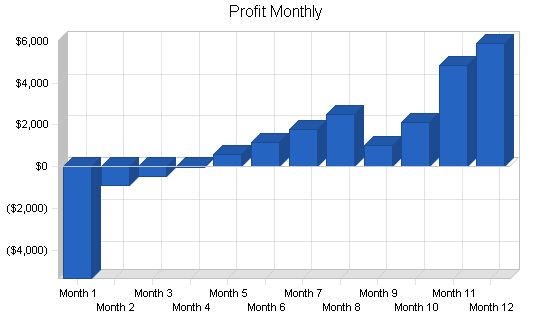

We do not expect cash flow to be a problem. Since initial sales (first 6 months) will not cover expenses, we have budgeted a cash reserve to take us through the first year and have additional resources for short-term, no-interest loans if necessary. We expect to generate a profit within the first six months, and even with this conservative forecast, we expect modest profits in the second year.

We plan to pace growth slowly at first until we have a larger, more stable cash balance. RA Concepts’ growth is based on internal financial resources.

7.1 Important Assumptions

- 100% of sales are on credit, with collection days for Receivables at 60.

- Payment days for Accounts Payable at 30.

- No unforeseen changes in technology to make our products obsolete.

- Only moderate increases or decreases in our raw material costs over time.

- A 5% annual raise in prices, typical for the golfing industry.

Due to the initial limited production in comparison to the market size, RA Concepts assumes that even a slow-growth economy will not affect our plan for the next five years.

RA Concepts assumes no substantial increases in our material costs, given the recent history of those supplies. In addition, as we buy raw materials in greater quantities in years 2 and 3, we should start to see economies of scale.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 6.00% | 6.00% | 6.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

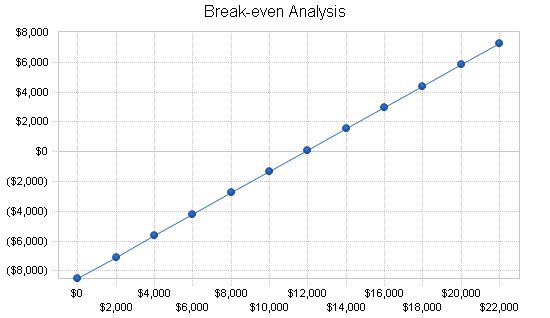

7.2 Break-even Analysis

RA Concepts’ break-even analysis is based on the average of the first-year figures for total sales, costs, and operating expenses. Our variable cost here consists of inventory (raw materials). We expect to surpass the break-even point by July.

Break-even Analysis

Monthly Revenue Break-even: $11,862

Assumptions:

– Average Percent Variable Cost: 28%

– Estimated Monthly Fixed Cost: $8,517

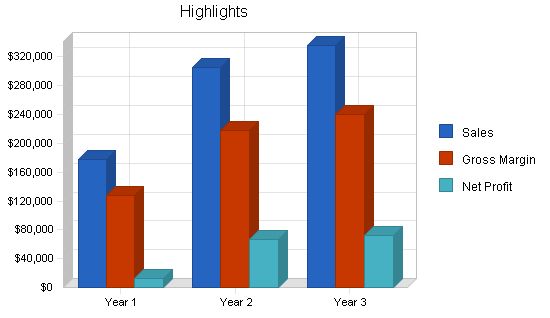

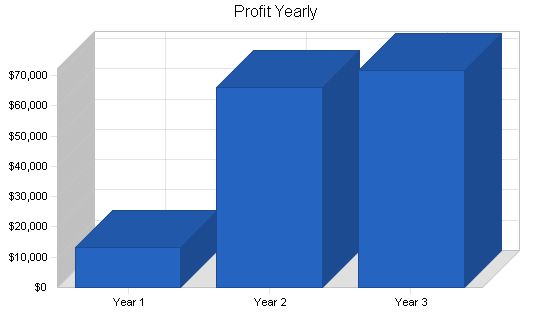

Projected Profit and Loss

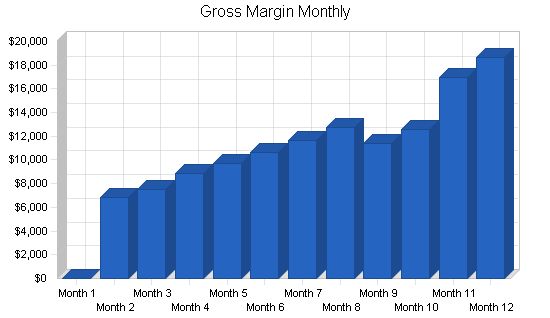

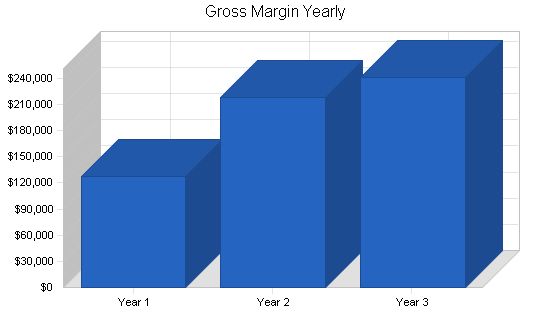

RA Concepts forecasts steady profitability growth over the next three years of operations. R&D costs will increase in years 2 and 3 due to the ever-changing nature of putters. Customer feedback and special requests will drive the generation of ideas for new designs. Customers are expected to prefer the "newest" designs over existing ones.

Pro Forma Profit and Loss

Table

Year 1 Year 2 Year 3

Sales $177,425 $305,053 $335,557

Direct Cost of Sales $50,034 $86,603 $95,259

Other Costs of Goods $0 $0 $0

Total Cost of Sales $50,034 $86,603 $95,259

Gross Margin $127,391 $218,450 $240,298

Gross Margin % 71.80% 71.61% 71.61%

Expenses

Payroll $58,819 $63,654 $70,689

Sales and Marketing and Other Expenses $17,900 $19,360 $21,296

Depreciation $1,200 $1,100 $1,100

Rent $13,200 $12,100 $12,100

Research and Development $4,000 $10,000 $12,000

Equipment Maintenance and Repair $0 $5,000 $8,500

Utilities $4,380 $4,416 $4,857

Insurance $1,200 $1,100 $1,100

Payroll Taxes $0 $0 $0

Other $1,500 $1,512 $1,663

Total Operating Expenses $102,199 $118,242 $133,305

Profit Before Interest and Taxes $25,192 $100,208 $106,993

EBITDA $26,392 $101,308 $108,093

Interest Expense $6,489 $5,655 $4,785

Taxes Incurred $5,611 $28,366 $30,662

Net Profit $13,093 $66,187 $71,546

Net Profit/Sales 7.38% 21.70% 21.32%

7.4 Projected Cash Flow

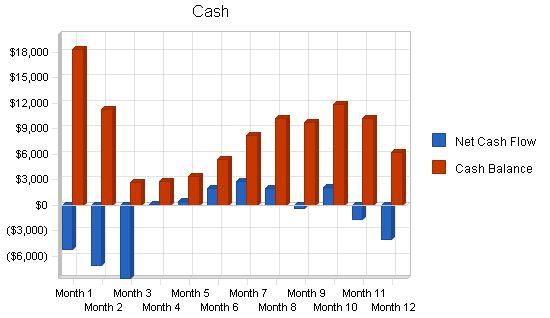

The table presents our projected cash flow balances. The critical first year reflects positive cash flow. Monthly cash balances are positive, indicating adequate financial reserves and correct planning for the required working capital. The estimated results permit a margin of error and still appear strong, even though the numbers remain conservative. We expect that the low cash balance in the final month of the first year will be offset by spring sales to retailers in the next month. We do not plan to collect dividends until the fourth year.

The chart below shows the cash availability for the next 12 months. The bar labeled "Cash Balance" shows our projected cash balance for the first 12 months of the project. The second set of bars, labeled "Net Cash Flow," indicates the change in the Cash Balance for each month.

Pro Forma Cash Flow

| Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $0 | $0 | $0 |

| Cash from Receivables | $128,939 | $270,176 | $327,221 |

| Subtotal Cash from Operations | $128,939 | $270,176 | $327,221 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $128,939 | $270,176 | $327,221 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $58,819 | $63,654 | $70,689 |

| Bill Payments | $72,830 | $173,380 | $191,356 |

| Subtotal Spent on Operations | $131,649 | $237,034 | $262,045 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $14,500 | $14,500 | $14,500 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $146,149 | $251,534 | $276,545 |

| Net Cash Flow | ($17,209) | $18,642 | $50,676 |

| Cash Balance | $6,281 | $24,923 | $75,599 |

7.5 Projected Balance Sheet

Our projected Balance Sheet shows a steadily increasing net worth, as we pay off loans and increase production over the first three years. Even with these conservative estimates, our balances are good.

| Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $6,281 | $24,923 | $75,599 |

| Accounts Receivable | $48,486 | $83,363 | $91,699 |

| Inventory | $7,780 | $7,251 | $7,976 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $62,547 | $115,537 | $175,274 |

| Long-term Assets | |||

| Long-term Assets | $62,160 | $62,160 | $62,160 |

| Accumulated Depreciation | $1,200 | $2,300 | $3,400 |

| Total Long-term Assets | $60,960 | $59,860 | $58,760 |

| Total Assets | $123,507 | $175,397 | $234,034 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $14,064 | $14,267 | $15,859 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $14,064 | $14,267 | $15,859 |

| Long-term Liabilities | $101,500 | $87,000 | $72,500 |

| Total Liabilities | $115,564 | $101,267 | $88,359 |

| Paid-in Capital | $10,000 | $10,000 | $10,000 |

| Retained Earnings | ($15,150) | ($2,057) | $64,130 |

| Earnings | $13,093 | $66,187 | $71,546 |

| Total Capital | $7,943 | $74,130 | $145,675 |

| Total Liabilities and Capital | $123,507 | $175,397 | $234,034 |

| Net Worth | $7,943 | $74,130 | $145,675 |

7.6 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification for the Sporting Goods Manufacturing industry (SIC code 3069).

Our technological advances allow us to waste less raw material during production, changing ratios related to inventory. Our asset and liability structure is comparable to industry standards, but we are a smaller company than most golf club manufacturers, and the industry comparison is very broad – across all equipment categories. The ratios table shows an important steady increase in working capital, and reasonable net profit margin for all years.

| Ratio Analysis | |||||||||||||

| Year 1 | Pro Forma Cash Flow | ||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Cash from Receivables | $0 | $0 | $318 | $9,584 | $10,568 | $12,378 | $13,574 | $14,853 | $16,288 | $17,689 | $15,973 | $17,714 | |

| Subtotal Cash from Operations | $0 | $0 | $318 | $9,584 | $10,568 | $12,378 | $13,574 | $14,853 | $16,288 | $17,689 | $15,973 | $17,714 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $0 | $0 | $318 | $9,584 | $10,568 | $12,378 | $13,574 | $14,853 | $16,288 | $17,689 | $15,973 | $17,714 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $3,900 | $4,378 | $4,425 | $4,764 | $4,847 | $4,936 | $5,037 | $5,143 | $5,014 | $5,126 | $5,549 | $5,700 | |

| Bill Payments | $45 | $1,428 | $3,275 | $3,475 | $4,029 | $4,189 | $4,490 | $6,558 | $10,454 | $9,255 | $10,818 | $14,814 | |

| Subtotal Spent on Operations | $3,945 | $5,806 | $7,701 | $8,238 | $8,876 | $9,125 | $9,526 | $11,700 | $15,468 | $14,381 | $16,368 | $20,514 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $1,208 | $1,208 | $1,208 | $1,208 | $1,208 | $1,208 | $1,208 | $1,208 | $1,208 | $1,208 | $1,208 | $1,208 | $1,208 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $5,154 | $7,014 | $8,909 | $9,447 | $10,084 | $10,333 | $10,735 | $12,908 | $16,676 | $15,589 | $17,576 | $21,722 | |

| Net Cash Flow | ($5,154) | ($7,014) | ($8,591) | $137 | $484 | $2,044 | $2,840 | $1,944 | ($388) | $2,100 | ($1,603) | ($4,009) | |

| Cash Balance | $18,336 | $11,322 | $2,731 | $2,868 | $3,352 | $5,396 | $8,236 | $10,180 | $9,793 | $11,893 | $10,290 | $6,281 | |

“>

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!