E-commerce Internet Business Plan

Popular culture is no longer regional. Cable television, syndicated radio programs, and the Internet have created a world where a fashion statement in New York will reach a small midwestern town within days. Our telecommunication system’s speed has raised young customers’ expectations and demands for products that reflect their cultural identity.

FireStarters aims to provide young customers in small towns and communities across the United States with popular nationwide youth-oriented products and clothing that are not locally available.

Unlike other e-commerce websites targeting young customers, FireStarters focuses exclusively on small-town America. Our target customers, aged 11-18, are enthusiasts of alternative music and participants in youth sports such as skateboarding and snowboarding. They draw inspiration from alternative clothing trends in large urban areas. To reach our target customers, FireStarters will advertise solely in small communities with populations between 100,000 and 150,000 residents. These communities already have existing youth-oriented businesses, such as skateboard shops and alternative CD stores, which FireStarters can utilize to promote its product line.

FireStarters’ mission is to offer youth-oriented fashion and products to small-town America.

The keys to our success include:

– An entertaining and accessible website that is like a trip to your favorite store, always offering something new.

– Excellent vendor relationships to ensure quick shipment of orders.

– An effective advertising strategy targeting youth-oriented businesses in local communities.

– Creating an attractive and trendy store image for our target customers.

FireStarters will provide online access to popular nationwide products and clothing that are not currently available locally. Co-owners Jill Stranton and Bobbi Hanson will efficiently ship purchases to customers.

Our marketing strategy will focus on small cities with populations between 100,000 and 150,000 residents. We will organize events in partnership with local businesses that serve our target customer base to increase the visibility of our online store.

Jill Stranton and Bobbi Hanson are the co-owners of FireStarters.

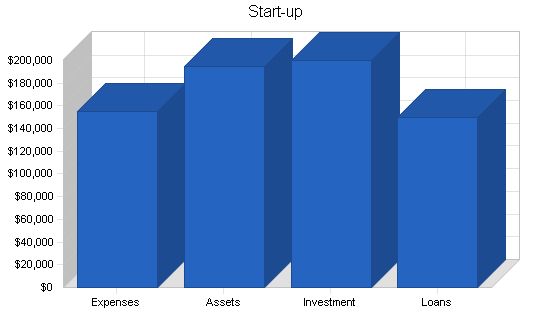

The start-up costs of FireStarters include product inventory, a promotion campaign, and website establishment. Funding for the start-up is a combination of owner investments and a long-term business loan.

Start-up Funding:

Start-up Expenses to Fund: $155,400

Start-up Assets to Fund: $194,600

Total Funding Required: $350,000

Assets:

Non-cash Assets from Start-up: $130,000

Cash Requirements from Start-up: $64,600

Additional Cash Raised: $0

Cash Balance on Starting Date: $64,600

Total Assets: $194,600

Liabilities and Capital:

Liabilities:

Current Borrowing: $0

Long-term Liabilities: $150,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $150,000

Capital:

Planned Investment:

Jill Stranton: $100,000

Bobbi Hanson: $100,000

Additional Investment Requirement: $0

Total Planned Investment: $200,000

Loss at Start-up (Start-up Expenses): ($155,400)

Total Capital: $44,600

Total Capital and Liabilities: $194,600

Total Funding: $350,000

Start-up Requirements:

Start-up Expenses:

Legal: $2,000

Stationery etc.: $400

Website Development: $30,000

Insurance: $1,000

Rent: $2,000

Marketing: $120,000

Expensed Equipment: $0

Other: $0

Total Start-up Expenses: $155,400

Start-up Assets:

Cash Required: $64,600

Start-up Inventory: $80,000

Other Current Assets: $0

Long-term Assets: $50,000

Total Assets: $194,600

Total Requirements: $350,000

Products:

FireStarters will offer young customers the following youth-oriented products and clothing:

– Shoes

– Jackets

– Sweaters

– Shirts

– Pants

– Bags

– Hats

– T-Shirts

– Dresses and skirts

– Shorts

– Eyewear

– Time pieces

Market Analysis Summary:

According to the U.S. Census Bureau, the population of teens (age 12-17) in 1999 was 23.4 million, representing 8.6% of the total U.S. population. Teenagers influence $324 billion in spending annually, have $151 billion in disposable income, spend $24 billion annually, and will spend $1.2 billion online by 2002. Teens spend an average of $82 per week on entertainment, fashion, food, and technology. These young people, dubbed "Generation Y," dominate almost all facets of popular culture and are the fastest-growing demographic under age 65.

Specialty youth clothing and products have grown into a billion-dollar niche in the clothing industry. The popularity of the Internet with young people has generated the launching of online stores by companies selling to that market segment. Most of these stores have retail outlets in large urban areas that serve as the promotional vehicles for online shopping.

The Internet is an accessible shopping tool for our target population. 64% of teens nationwide use the Net at home. The majority of teens, 55%, consider using the Internet better than watching TV. Families with teens are more likely to have Internet access than other households.

Online shopping by teenagers between 13 to 18 years of age is expected to total about $300 million this year (2000) and is accelerating at about twice the rate of online shopping by adults. By 2003, teenagers are expected to spend $2 billion annually online. By 2004, a clear majority of young consumers will shop online. The top five purchases made by teens [online], based on sales volume, are CDs/cassette tapes, clothing, books, computer software, toys, and clothing.

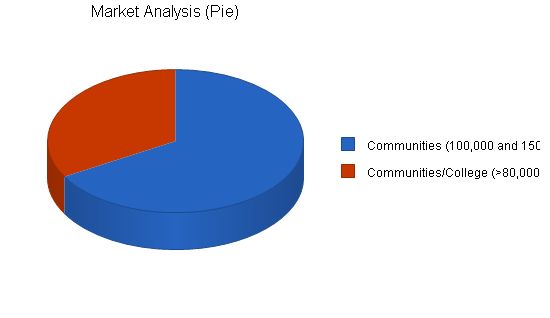

Market Segmentation:

Over the past ten years, there has been a profound change in population dynamics in the U.S. The non-metropolitan population has been growing at almost the same rate as the urban population. The West Coast, Midwest, and the Northeast have the largest growth rate. Today, there are millions of young people who don’t live near a large urban center that offers the diversity in clothing products that the youth culture demands. This has created a small market niche for businesses to sell clothing and products to young people who live outside the urban areas. This is particularly true in communities with a major college located in the community.

Currently, only regional malls offer access to the fashion and styles that young people want. Unfortunately, the focus of these mall stores is only on the mainstream of the youth market. Alternative clothing and products are rarely available outside the urban area. This is true because the companies that create the clothing and products are small and sell primarily through urban specialty shops.

FireStarters will capitalize on the following characteristics of Generation Y:

– Subculture Affiliation: Though rebellious, teens also want to blend in and be accepted by peers. They seek a community of peers to welcome them in, as well as help them stand out.

– Attitude: Teenagers wear attitude like a uniform to give definition to their identity. This extends to clothing, hairstyle, and the type of music listened to in public. They also react to humor, silliness, and irreverence more easily than to other styles.

It is FireStarters’ plan to bring alternative fashion and products to small-town America via the Internet. We will create a business identity that will capitalize on the subculture affiliation and attitude of our target customers.

FireStarters will focus marketing on two types of non-metropolitan communities:

– Non-metropolitan communities with populations between 100,000 and 150,000 residents.

– Non-metropolitan communities with a major college and a population of at least 80,000.

Market Analysis

Potential Customers-Growth-Year 1-Year 2-Year 3-Year 4-Year 5-CAGR

Communities (100,000 and 150,000)-10%-6,000-6,600-7,260-7,986-8,785-10.00%

Communities/College (>80,000)-10%-3,000-3,300-3,630-3,993-4,392-10.00%

Total-10.00%-9,000-9,900-10,890-11,979-13,177-10.00%

Strategy and Implementation Summary

FireStarters’ will have a two track strategy.

FireStarters will advertise in alternative magazines targeted at customers and with an affordable ad rate. (For girls: Bust, Candy, Chick, and Girl magazines. For Boys: Thrashers and TransWorld.)

Competitive Edge

FireStarters’ competitive advantage is offering product lines that make a statement but won’t leave you broke. Major brands are expensive and not distinctive enough for our target customers’ changing tastes. FireStarters offers products just ahead of the curve and so affordable that our customers will frequently return to the website to see what’s new.

Another competitive factor is that products for this age group are part of a lifestyle statement. FireStarters is focused on serving youth outside metropolitan areas. We want to represent their style and life choices. We believe that we will create a loyal customer base that will see FireStarters as part of their lives. To facilitate that connection, our website will have a chat section where customers can share community happenings and comment on our products and what we should add to our product line in the future.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

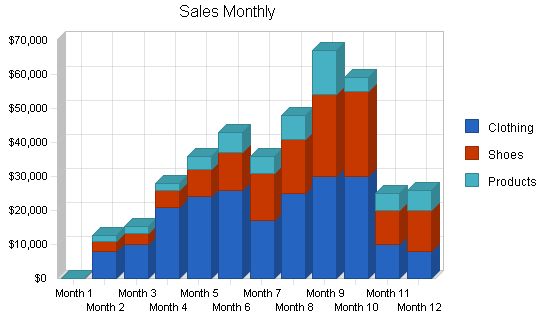

Sales Strategy

Sales will be flat for the first 45 days of operation. We anticipate that sales will begin to increase as our marketing campaign progresses.

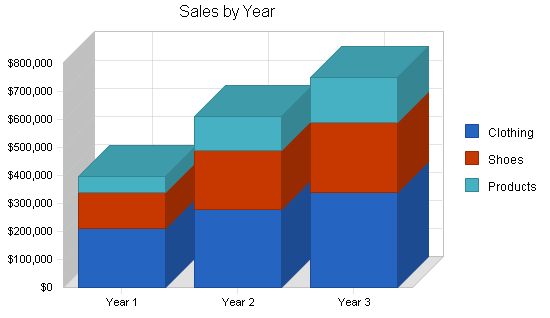

The following is the sales forecast for three years. First-year monthly sales forecast is shown in the appendix.

Sales Forecast:

Year 1 Year 2 Year 3

Clothing $209,000 $280,000 $340,000

Shoes $131,350 $210,000 $250,000

Products $55,300 $120,000 $160,000

Total Sales $395,650 $610,000 $750,000

Direct Cost of Sales:

Year 1 Year 2 Year 3

Clothing $63,000 $90,000 $110,000

Shoes $25,100 $44,000 $60,000

Products $12,640 $30,000 $40,000

Subtotal Direct Cost of Sales $100,740 $164,000 $210,000

Management Summary:

Jill Stranton will manage the daily operations of FireStarters. Bobbi Hanson will be FireStarters’ buyer and responsible for marketing. Jill and Bobbi have over fifteen years of experience in the retail clothing industry.

Jill has been the manager of Wild Women Clothing for five years. Wild Woman Clothing is a mail-order business that focuses on young urban women ages 18 to 35. She supervised a staff of 10 and effectively kept the business cost-effective as sales grew 50% over a two-year period. Prior to Wild Woman Clothing, Jill was the manager of Atomic Age Fashions, a women’s clothing shop, for three years.

Bobbi has been a buyer for Glamour Imports for the past four years. Glamour Imports sells to over 200 women’s shops nationwide and generated over 10 million in sales last year. In addition to her experience as a buyer, Bobbi was a marketing associate for Gap from 1994-1997.

Personnel Plan:

FireStarters will have a staff of five:

– Operations manager

– Buyer/marketing

– Order processor/website manager

– Processing staff (2)

The financial plan for FireStarters is as follows.

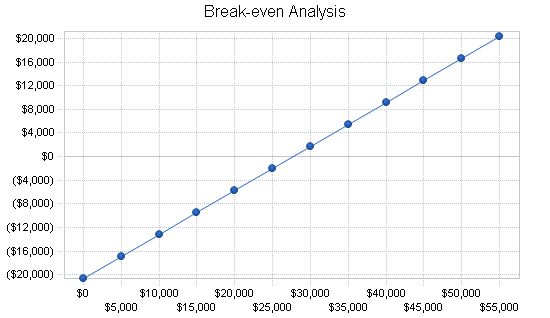

The monthly break-even point, based on forecasted expenses and costs, is shown below.

Break-even Analysis

Monthly Revenue Break-even: $27,657

Assumptions:

– Average Percent Variable Cost: 25%

– Estimated Monthly Fixed Cost: $20,615

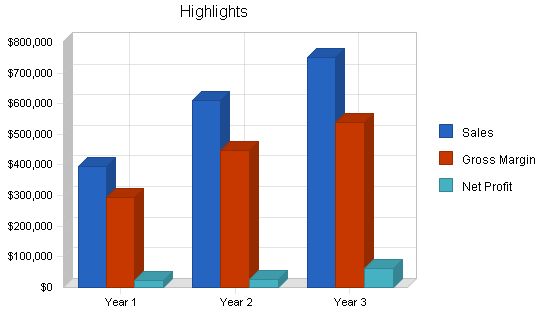

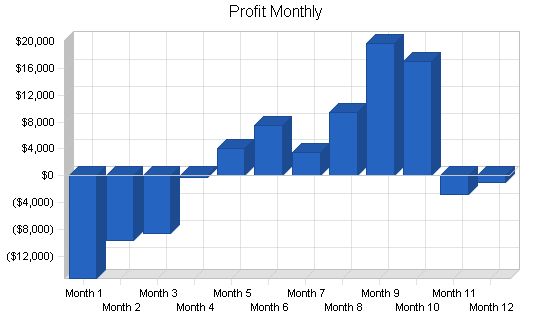

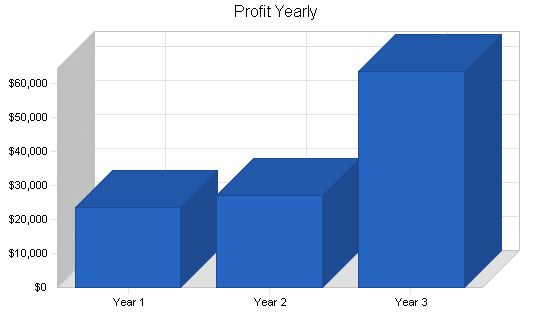

7.2 Projected Profit and Loss

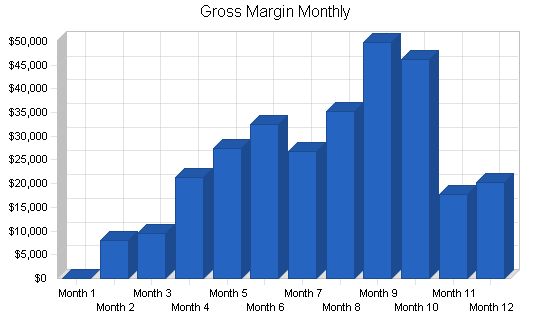

The table and charts below present the projected profit and loss for three years. Monthly data for the first year can be found in the appendix.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $395,650 | $610,000 | $750,000 |

| Direct Cost of Sales | $100,740 | $164,000 | $210,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $100,740 | $164,000 | $210,000 |

| Gross Margin | $294,910 | $446,000 | $540,000 |

| Gross Margin % | 74.54% | 73.11% | 72.00% |

| Expenses | |||

| Payroll | $177,600 | $192,600 | $212,000 |

| Sales and Marketing and Other Expenses | $0 | $130,000 | $150,000 |

| Depreciation | $7,140 | $7,140 | $7,140 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $6,000 | $6,000 | $6,000 |

| Insurance | $6,000 | $6,000 | $6,000 |

| Rent | $24,000 | $24,000 | $24,000 |

| Payroll Taxes | $26,640 | $28,890 | $31,800 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $247,380 | $394,630 | $436,940 |

| Profit Before Interest and Taxes | $47,530 | $51,370 | $103,060 |

| EBITDA | $54,670 | $58,510 | $110,200 |

| Interest Expense | $13,830 | $12,750 | $12,570 |

| Taxes Incurred | $10,110 | $11,586 | $27,147 |

| Net Profit | $23,590 | $27,034 | $63,343 |

| Net Profit/Sales | 5.96% | 4.43% | 8.45% |

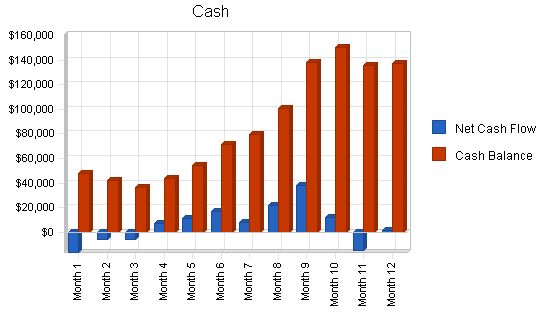

7.3 Projected Cash Flow

The following table and chart detail the projected cash flow for three years. The appendices include monthly estimates for the first year cash flow.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $395,650 $610,000 $750,000

Subtotal Cash from Operations $395,650 $610,000 $750,000

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $395,650 $610,000 $750,000

Expenditures

Expenditures from Operations

Cash Spending $177,600 $192,600 $212,000

Bill Payments $103,957 $364,975 $463,540

Subtotal Spent on Operations $281,557 $557,575 $675,540

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $21,600 $1,800 $1,800

Purchase Other Current Assets $19,800 $19,800 $19,800

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $322,957 $579,175 $697,140

Net Cash Flow $72,693 $30,825 $52,860

Cash Balance $137,293 $168,118 $220,978

Projected Balance Sheet

Assets

Current Assets

Cash $137,293 $168,118 $220,978

Inventory $6,270 $10,207 $13,070

Other Current Assets $19,800 $39,600 $59,400

Total Current Assets $163,363 $217,926 $293,448

Long-term Assets

Long-term Assets $50,000 $50,000 $50,000

Accumulated Depreciation $7,140 $14,280 $21,420

Total Long-term Assets $42,860 $35,720 $28,580

Total Assets $206,223 $253,646 $322,028

Liabilities and Capital

Current Liabilities

Accounts Payable $9,633 $31,822 $38,661

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $9,633 $31,822 $38,661

Long-term Liabilities $128,400 $126,600 $124,800

Total Liabilities $138,033 $158,422 $163,461

Paid-in Capital $200,000 $200,000 $200,000

Retained Earnings ($155,400) ($131,810) ($104,776)

Earnings $23,590 $27,034 $63,343

Total Capital $68,190 $95,224 $158,567

Total Liabilities and Capital $206,223 $253,646 $322,028

Sales Growth 0.00% 54.18% 22.95% 7.56%

Percent of Total Assets

Inventory 3.04% 4.02% 4.06% 37.60%

Other Current Assets 9.60% 15.61% 18.45% 29.04%

Total Current Assets 79.22% 85.92% 91.13% 78.59%

Long-term Assets 20.78% 14.08% 8.87% 21.41%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 4.67% 12.55% 12.01% 38.50%

Long-term Liabilities 62.26% 49.91% 38.75% 19.42%

Total Liabilities 66.93% 62.46% 50.76% 57.92%

Net Worth 33.07% 37.54% 49.24% 42.08%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 74.54% 73.11% 72.00% 34.85%

Selling, General & Administrative Expenses 68.58% 68.68% 63.55% 16.95%

Advertising Expenses 0.00% 21.31% 20.00% 2.50%

Profit Before Interest and Taxes 12.01% 8.42% 13.74% 1.10%

Main Ratios

Current 16.96 6.85 7.59 1.79

Quick 16.31 6.53 7.25 0.70

Total Debt to Total Assets 66.93% 62.46% 50.76% 65.04%

Pre-tax Return on Net Worth 49.42% 40.56% 57.07% 2.65%

Pre-tax Return on Assets 16.34% 15.23% 28.10% 7.59%

Additional Ratios

Net Profit Margin 5.96% 4.43% 8.45% n.a

Return on Equity 34.59% 28.39% 39.95% n.a

Activity Ratios

Inventory Turnover 2.45 19.91 18.04 n.a

Accounts Payable Turnover 11.79 12.17 12.17 n.a

Payment Days 27 20 27 n.a

Total Asset Turnover 1.92 2.40 2.33 n.a

Debt Ratios

Debt to Net Worth 2.02 1.66 1.03 n.a

Current Liab. to Liab. 0.07 0.20 0.24 n.a

Liquidity Ratios

Net Working Capital $153,730 $186,104 $254,787 n.a

Interest Coverage 3.44 4.03 8.20 n.a

Additional Ratios

Assets to Sales 0.52 0.42 0.43 n.a

Current Debt/Total Assets 5% 13% 12% n.a

Acid Test 16.31 6.53 7.25 n.a

Sales/Net Worth 5.80 6.41 4.73 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales

Clothing $0 $8,000 $10,000 $21,000 $24,000 $26,000 $17,000 $25,000 $30,000 $30,000 $10,000 $8,000

Shoes $0 $3,000 $3,350 $5,000 $8,000 $11,000 $14,000 $16,000 $24,000 $25,000 $10,000 $12,000

Products $0 $1,500 $1,800 $2,000 $4,000 $6,000 $5,000 $7,000 $13,000 $4,000 $5,000 $6,000

Total Sales $0 $12,500 $15,150 $28,000 $36,000 $43,000 $36,000 $48,000 $67,000 $59,000 $25,000 $26,000

Direct Cost of Sales

Clothing $0 $3,000 $4,000 $5,000 $6,000 $7,000 $5,000 $7,000 $10,000 $10,000 $4,000 $2,000

Shoes $0 $1,000 $1,200 $1,000 $1,500 $2,000 $3,000 $4,000 $5,200 $2,000 $2,000 $2,200

Products $0 $400 $500 $600 $1,000 $1,500 $1,250 $1,800 $2,000 $890 $1,200 $1,500

Subtotal Direct Cost of Sales $0 $4,400 $5,700 $6,600 $8,500 $10,500 $9,250 $12,800 $17,200 $12,890 $7,200 $5,700

Personnel Plan

Manager $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500

Buyer/Marketing $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500

Order Processor/Website Manager $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800

Processing Staff (2) $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000

Total People 5 5 5 5 5 5 5 5 5 5 5 5

Total Payroll $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800

General Assumptions:

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss:

Sales Month 1 2 3 4 5 6 7 8 9 10 11 12

Sales $0 $12,500 $15,150 $28,000 $36,000 $43,000 $36,000 $48,000 $67,000 $59,000 $25,000 $26,000

Direct Cost of Sales $0 $4,400 $5,700 $6,600 $8,500 $10,500 $9,250 $12,800 $17,200 $12,890 $7,200 $5,700

Other Production Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales $0 $4,400 $5,700 $6,600 $8,500 $10,500 $9,250 $12,800 $17,200 $12,890 $7,200 $5,700

Gross Margin Month 1 2 3 4 5 6 7 8 9 10 11 12

Gross Margin $0 $8,100 $9,450 $21,400 $27,500 $32,500 $26,750 $35,200 $49,800 $46,110 $17,800 $20,300

Gross Margin % 0.00% 64.80% 62.38% 76.43% 76.39% 75.58% 74.31% 73.33% 74.33% 78.15% 71.20% 78.08%

Expenses:

Payroll Month 1 2 3 4 5 6 7 8 9 10 11 12

Payroll $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800 $14,800

Sales and Marketing and Other Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Depreciation $595 $595 $595 $595 $595 $595 $595 $595 $595 $595 $595 $595

Leased Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Utilities $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500

Insurance $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500

Rent $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000

Payroll Taxes 15% $2,220 $2,220 $2,220 $2,220 $2,220 $2,220 $2,220 $2,220 $2,220 $2,220 $2,220 $2,220

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Operating Expenses Month 1 2 3 4 5 6 7 8 9 10 11 12

Total Operating Expenses $20,615 $20,615 $20,615 $20,615 $20,615 $20,615 $20,615 $20,615 $20,615 $20,615 $20,615 $20,615

Profit Before Interest and Taxes Month 1 2 3 4 5 6 7 8 9 10 11 12

Profit Before Interest and Taxes ($20,615) ($12,515) ($11,165) $785 $6,885 $11,885 $6,135 $14,585 $29,185 $25,495 ($2,815) ($315)

EBITDA Month 1 2 3 4 5 6 7 8 9 10 11 12

EBITDA ($20,020) ($11,920) ($10,570) $1,380 $7,480 $12,480 $6,730 $15,180 $29,780 $26,090 ($2,220) $280

Interest Expense Month 1 2 3 4 5 6 7 8 9 10 11 12

Interest Expense $1,235 $1,220 $1,205 $1,190 $1,175 $1,160 $1,145 $1,130 $1,115 $1,100 $1,085 $1,070

Taxes Incurred Month 1 2 3 4 5 6 7 8 9 10 11 12

Taxes Incurred ($6,555) ($4,121) ($3,711) ($122) $1,713 $3,218 $1,497 $4,037 $8,421 $7,319 ($1,170) ($416)

Net Profit Month 1 2 3 4 5 6 7 8 9 10 11 12

Net Profit ($15,295) ($9,615) ($8,659) ($284) $3,997 $7,508 $3,493 $9,419 $19,649 $17,077 ($2,730) ($970)

Net Profit/Sales Month 1 2 3 4 5 6 7 8 9 10 11 12

Net Profit/Sales 0.00% -76.92% -57.16% -1.01% 11.10% 17.46% 9.70% 19.62% 29.33% 28.94% -10.92% -3.73%

Pro Forma Cash Flow

| Pro Forma Cash Flow | ||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Cash Sales | $0 | $12,500 | $15,150 | $28,000 | $36,000 | $43,000 | $36,000 | $48,000 | $67,000 | $59,000 | $25,000 | $26,000 |

| Subtotal Cash from Operations | $0 | $12,500 | $15,150 | $28,000 | $36,000 | $43,000 | $36,000 | $48,000 | $67,000 | $59,000 | $25,000 | $26,000 |

| Additional Cash Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $0 | $12,500 | $15,150 | $28,000 | $36,000 | $43,000 | $36,000 | $48,000 | $67,000 | $59,000 | $25,000 | $26,000 |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| Cash Spending | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 |

| Bill Payments | ($100) | ($19) | $2,333 | $2,833 | $6,349 | $8,158 | $9,540 | $7,946 | $10,994 | $28,398 | $21,266 | $6,259 |

| Subtotal Spent on Operations | $14,700 | $14,781 | $17,133 | $17,633 | $21,149 | $22,958 | $24,340 | $22,746 | $25,794 | $43,198 | $36,066 | $21,059 |

| Additional Cash Spent | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $16,500 | $18,381 | $20,733 | $21,233 | $24,749 | $26,558 | $27,940 | $26,346 | $29,394 | $46,798 | $39,666 | $24,659 |

| Net Cash Flow | ($16,500) | ($5,881) | ($5,583) | $6,767 | $11,251 | |||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!