Driving School Business Plan

Markam Driving School (MDS) offers a variety of driver services. The company aims to be a one-stop facility for all driver needs, including registration and licensing. Currently, MDS mainly provides private and commercial driver education in the Seattle, WA area. MDS is known for its low-cost services and excellent customer service.

Contents

1.1 Objectives

Over the next three years, Markam Driving School (MDS) aims to:

- Achieve sales revenues of approximately $2.1 million by year three.

- Start two additional facilities in Portland, OR and Tacoma.

- Become the leading provider of comprehensive driving education services in the Pacific Northwest.

1.2 Mission

The mission of Markam Driving School is to offer high quality, convenient, and comprehensive driver education courses at the lowest cost. Safety is paramount in driver education. MDS aims to produce graduates with the safest driving records in the Pacific Northwest and leverage this reputation to increase market share.

1.3 Keys to Success

Markam Driving School is at a pivotal point in its history. With a proven track record of providing affordable, high-quality driver education in the Seattle area, the company plans to expand into the Pacific Northwest region. MDS intends to open facilities in Portland, OR and Tacoma, WA.

When the company was founded six years ago, the owners identified an untapped opportunity in the industry. Existing companies were either charging exorbitant prices or offering inadequate programs and services. MDS saw the potential for synergy with other organizations, enabling cost reduction, competitive advantage, and market share growth. This strategy has fueled MDS’s steady growth in a mature market. Now, with plans for expansion, the keys to success over the next three years are as follows:

- Lower costs to achieve a 66% gross margin.

- Appoint cost control officers for each new facility, reporting to the president and general manager.

- Implement a comprehensive cost reduction program throughout the company.

- Strengthen partnerships and strategic alliances with suppliers to further reduce costs.

- Pursue contracts with organizations that require driving services, such as police departments, high schools, and trucking agencies.

Company Summary

Markam Driving School was started by four individuals who saw untapped potential in the driver education industry. They aimed to create a new low-cost position that could compete with larger companies on quality. This strategy was achieved through strategic alliances and partnerships with local suppliers and buyers. The company has experienced steady growth in a mature market, reflecting its viable business strategy. With eight investors, mostly employees, Markam Driving School is incorporated in Delaware but domiciled in Washington state. The company has achieved revenues of approximately $185,000 with a gross margin of 37%, as well as a customer satisfaction rate of 92%.

2.1 Company History

The company was founded by Greg Markam, a longtime driving school manager, and William S. Harper, a cost control manager. At the time, there was no low-cost leader in the industry providing comprehensive high-quality education with modern teaching techniques, such as classroom computer simulations and testing equipment. National chains overlooked the fact that customers couldn’t differentiate the value provided by competitors and only sought the cheapest option. On the other hand, many smaller companies were not adapting to the latest teaching techniques. Additionally, the Washington Department of Transportation had begun outsourcing services like vehicle registration to private firms, presenting a great opportunity for risk-taking companies.

Soon after its inception, Markam Driving School added Jane Wilkes, a traffic safety analyst, and Ken Thomas, an expert in writing training manuals and procedures, to their team. Over the past six years, the company has shown consistent growth and established crucial partnerships. The industry typically incurs high capital costs for gas, training equipment, and vehicle acquisition/repair. However, Markam Driving School has achieved low-cost leadership through special relationships with suppliers and buyers. For instance, the company secured discounts with Tesoro Gasoline stations, F & F auto repair, and Pullman Printers. With revenues of approximately $746,000 and a gross margin of 67%, the company maintains a customer satisfaction rate of 92%.

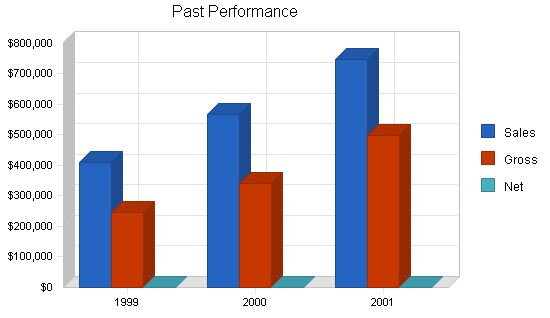

Past Performance:

1999 2000 2001

Sales $410,000 $567,000 $746,000

Gross Margin $246,000 $340,200 $499,820

Gross Margin % 60.00% 60.00% 67.00%

Operating Expenses $24,000 $24,000 $65,000

1999 2000 2001

Current Assets

Cash $7,512 $5,714 $12,938

Other Current Assets $5,000 $5,000 $2,000

Total Current Assets $12,512 $10,714 $14,938

Long-term Assets

Long-term Assets $74,000 $70,000 $74,000

Accumulated Depreciation $8,000 $10,000 $12,000

Total Long-term Assets $66,000 $60,000 $62,000

Total Assets $78,512 $70,714 $76,938

Current Liabilities

Accounts Payable $4,002 $3,974 $3,716

Current Borrowing $5,000 $0 $0

Other Current Liabilities (interest free) $0 $0 $0

Total Current Liabilities $9,002 $3,974 $3,716

Long-term Liabilities $35,000 $29,000 $23,000

Total Liabilities $44,002 $32,974 $26,716

Paid-in Capital $30,000 $30,000 $30,000

Retained Earnings $4,510 $7,740 $20,222

Earnings $0 $0 $0

Total Capital $34,510 $37,740 $50,222

Total Capital and Liabilities $78,512 $70,714 $76,938

Other Inputs

Payment Days 30 30 30

2.2 Company Locations and Facilities

The company’s original facility in Seattle is located at 1312 1st Ave NW in the Greenlake Industrial Park. It includes office space, 3 fifteen person and 4 ten person classrooms, simulators, storage space, a garage, and an outdoor driving course. The facilities are modern and comfortable, creating a relaxing atmosphere for students.

The future facility in Tacoma, located at 3671 Dearborn St, was previously a marine supply store. It will have the same equipment and layout as the original facility once renovations are complete. The third facility in Portland, OR is still being decided, and the company is currently considering multiple options.

2.3 Company Ownership

The company has eight investors, most of whom are employees. They collectively own 100% or 3,000 privately owned shares. Markam Driving School is incorporated in Delaware and operates under the state’s rules. According to the company’s charter, no investor can trade, sell, or dispose of shares without notifying the board of directors.

Markam Driving School is seeking new investors to support its planned expansion. The strategy involves issuing 4,000 shares to these new shareholders.

Services

Markam Driving School provides a range of services, aiming to be a one-stop facility for all driver needs, including registration and licensing. The industry is competitive, with suppliers holding significant power in setting prices. Customers perceive the service as undifferentiated and a commodity, resulting in high buyer power. Barriers to entry are moderately low, and there are many competitors, including substitutes like in-house training at high schools. The company focuses on low-cost leadership to gain an advantage.

The company employs trained and certified instructors and maintains a fleet of ten cars and five computer simulators. Equipment is regularly maintained and replaced to ensure quality.

The company plans to launch a commercial driver’s training program with higher margins. They are also negotiating with the Washington state DOT to have an outreach office within their facilities.

3.1 Service Description

Markam Drivers School offers a variety of state-certified courses, including adult evening and noon classes, high school programs, street safe courses, court-approved defensive driving courses, and brush-up courses. Each course requires students to purchase their own reading and studying material and can last up to five weeks for beginners.

3.2 Competitive Comparison

The driver education industry is highly competitive, with high capital costs, low margins, and intense competition. Suppliers, such as petroleum and auto manufacturers, have significant power in setting prices. Customers perceive the service as undifferentiated and a commodity, leading to high buyer power. Barriers to entry and exit are moderately low, but economies of scale provide an advantage. Pricing for services is very competitive due to the large number of competitors, including substitutes like in-house training at high schools. Low-cost leadership is the key to success.

3.3 Fulfillment

Markam Driving School employs trained and certified instructors and maintains a fleet of ten cars and five computer simulators. The equipment is regularly maintained and replaced to ensure quality.

3.4 Technology

The company utilizes computer simulators and remote web-accessed study materials to enhance teaching. They aim to provide a better and more convenient teaching environment through technology, including virtual classrooms in the near future.

3.5 Future Services

The company plans to launch a division for training commercial drivers and motorcycle licenses in the Seattle office. This program will include comprehensive indoor training classes, job placement assistance, and rented vehicles for practice and testing. They are also exploring the possibility of integrating a Washington state DMV outreach office within their facilities.

Market Analysis Summary

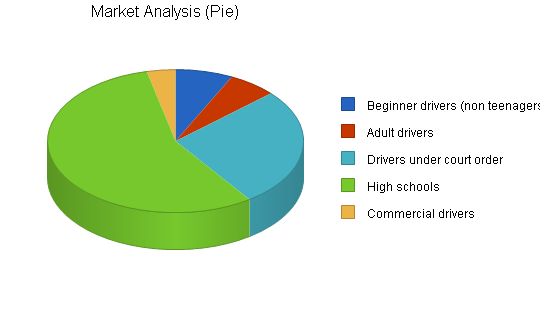

The potential market for Markam Driving School includes every individual aged 15 and above in the Seattle, WA area. Market segmentation is based on different needs and demographics, including beginner drivers, adult drivers, drivers under court order, high schools, and commercial drivers. Each segment has specific requirements based on lifestyle and past driving experience.

The company offers classes that cater to the needs of adults with tight work schedules and offers compressed courses for those needing brush up or defensive driving courses. Beginner drivers, primarily teenagers, have courses available during summer, after school, and at their schools. Commercial drivers require more technical and detailed courses.

Market Analysis:

-2002 2003 2004 2005 2006

-Potential Customers Growth CAGR

-Beginner drivers (non teenagers) 1% 80,000 80,640 81,285 81,935 82,590 0.80%

-Adult drivers 1% 68,000 68,510 69,024 69,542 70,064 0.75%

-Drivers under court order 2% 300,000 305,400 310,897 316,493 322,190 1.80%

-High schools 3% 625,000 642,500 660,490 678,984 697,996 2.80%

-Commercial drivers 3% 40,000 41,280 42,601 43,964 45,371 3.20%

-Total 2.28% 1,113,000 1,138,330 1,164,297 1,190,918 1,218,211 2.28%

4.2 Service Business Analysis

-This section is covered in the Competitive Comparison section of the Plan.

4.2.1 Competition and Buying Patterns

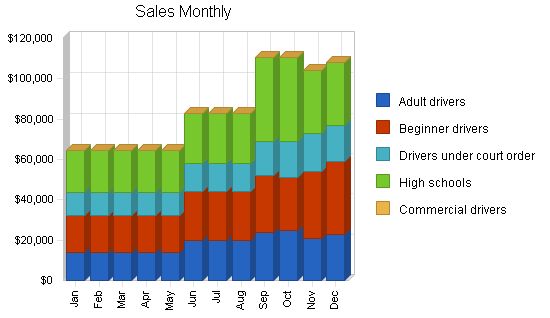

-This industry is highly seasonal. Most of our students attend classes during the fall or spring, with winter being the slowest months. The summer sees a good number of students seeking our services, but not as many as in spring or fall.

-Most customers of driver education services discover their provider through referral, such as another education institution, the state DOT, or something else. For this reason, MDS and other providers seek to make as many community contacts as possible.

4.2.2 Main Competitors

-MDS’s major national competitors are Sears Driver Education Schools and Defensive Driving, Inc. These companies hold about 45% market share, while the rest is taken up by “mom and pop” outfits.

4.2.3 Business Participants

-The driver education industry is fragmented into two types of businesses. The largest group consists of “mom and pop” companies that are local, have low capitalization, and range in the quality of education from poor to excellent.

-The other group consists of regional or national companies like Sears Driver Education School and Defensive Driving. These competitors are well-funded, have excellent facilities and services, and high quality. The two companies listed above are MDS’s major competitors in the Seattle area. These companies often try to buy out smaller competitors and consolidate the market.

Strategy and Implementation Summary

-The following subsections outline the marketing, pricing, and promotion strategies, and competitive edges for Markam Driving School.

-Currently, the company is focusing on its core market segment, the beginner students. This means creating closer ties with school districts and pursuing contracts. Additionally, the company is focusing on web, magazine, newspaper, and TV advertisements with a teen focus. Starting next year, MDS hopes to have advertisements or booths in shopping malls frequented by our target market.

-The company has focused on creating a detailed report on the lifestyles of our target market to further hone marketing efforts, go forward with the best possible client organizations and partnerships, promote sales, and fill classes to capacity.

5.1.1 Pricing Strategy

-MDS prices its services based on the accumulated total cost to provide such services and adds a flat profit margin to arrive at a final net profit/sales ratio of 7%. In Washington state, the government regulates how much a company can charge for classes where the student must attend to remove or reduce some form of traffic violation. This margin is 4%. Therefore, we usually see lower sales figures for this category.

5.1.2 Promotion Strategy

-Currently, about half of MDS’s sales promotions are through information-related media such as the web, Yellow Pages, teen magazines, and TV. The other half is done through creating a network of referrals and other relationships to provide information to prospective students. The company uses its own printed literature and collects testimonials from as many students as possible. Every three to six months, the company reviews the effectiveness of the promotion tool and determines its viability.

5.2 Competitive Edge

-MDS possesses two competitive edges. The first one is its excellent ability to create strategic alliances that reduce costs, allow it to become the low-cost provider, and create its vision of the one-stop driver support center. In addition, the company has a very aggressive marketing executive in the person of Ellen James, whose goal is to proactively discover how best to provide our services, when to provide them, and where to provide them. Ms. James’s work has spawned new service ideas such as Driver’s Ed Housecalls, a program that is now being evaluated where a driver educator could provide hands-on teaching at a person’s home. Other ideas like this are also in the works to improve service.

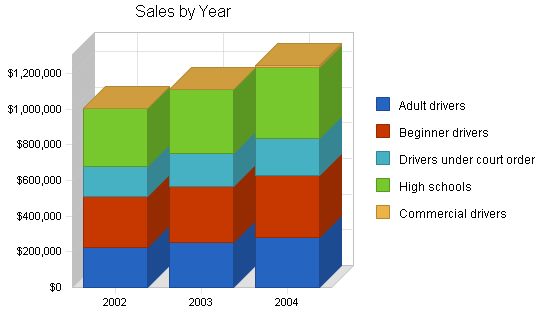

| Sales Forecast | |||

| 2002 | 2003 | 2004 | |

| Sales | |||

| Adult drivers | $223,000 | $253,164 | $281,012 |

| Beginner drivers | $285,000 | $312,075 | $346,403 |

| Drivers under court order | $171,388 | $187,670 | $208,314 |

| High schools | $324,650 | $355,492 | $394,596 |

| Commercial drivers | $0 | $0 | $12,000 |

| Total Sales | $1,004,038 | $1,108,401 | $1,242,325 |

Management Summary:

MDS has a strong management team led by Mr. Markam, the president and general manager. The team includes Ellen James, the marketing executive, William Harper, the company’s controller, and Jane Wilkes and Ken Tomas, who are responsible for education planning and coordination. Except for Ms. James, all these individuals have been with the company since its inception and are principal shareholders. The company operates with a hierarchical structure, with each manager heading a department or section and reporting to Mr. Markam. Mr. Tomas oversees the individual educators.

Personnel Plan:

The expansion of the company to two additional offices will put significant strain on the existing management team. The four principal officers, excluding the marketing coordinator and the controller, are expected to take on the responsibilities of facilities managers for the existing or proposed sites, in addition to their current duties. At this time, the company prefers not to hire new managers for these positions. Once the profitability of each site becomes evident, the general manager will consider the need for additional personnel.

| Personnel Plan | |||

| 2002 | 2003 | 2004 | |

| President and General Manager | $48,000 | $48,000 | $48,000 |

| Controller | $48,000 | $48,000 | $48,000 |

| Education Planner | $36,000 | $48,000 | $48,000 |

| Education Coordinator | $36,000 | $48,000 | $48,000 |

| Facilities Managers | $0 | $35,000 | $35,000 |

| Office Manager | $24,000 | $36,000 | $36,000 |

| Marketing Executive (Contract work) | $15,000 | $15,000 | $15,000 |

| Educators | $128,500 | $180,000 | $250,000 |

| Total People | 15 | 20 | 26 |

| Total Payroll | $335,500 | $458,000 | $528,000 |

The following subsections outline the financial plan for Markam Driving School.

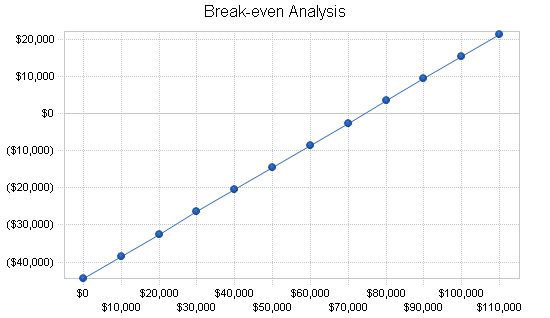

The company’s break-even analysis is based on its operational costs, including payroll, and current fixed costs, excluding expenses associated with planned expansion.

Break-even Analysis

Monthly Revenue Break-even: $74,087

Assumptions:

– Average Percent Variable Cost: 40%

– Estimated Monthly Fixed Cost: $44,452

8.2 Projected Profit and Loss

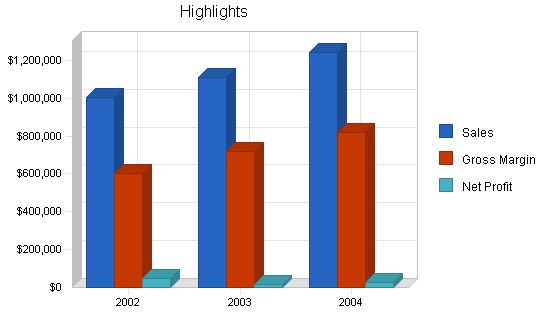

The projected Profit and Loss statement for Markam is as follows:

Pro Forma Profit and Loss

Year: 2002 2003 2004

Sales: $1,004,038 $1,108,401 $1,242,325

Direct Cost of Sales: $401,615 $387,940 $422,390

Other Production Expenses: $0 $0 $0

Total Cost of Sales: $401,615 $387,940 $422,390

Gross Margin: $602,423 $720,460 $819,934

Gross Margin %: 60.00% 65.00% 66.00%

Expenses:

– Payroll: $335,500 $458,000 $528,000

– Sales and Marketing and Other Expenses: $52,000 $58,000 $66,000

– Depreciation: $3,200 $5,000 $5,000

– Leased Equipment: $22,000 $16,000 $10,000

– Utilities: $4,600 $8,000 $8,000

– Insurance: $13,800 $14,400 $14,400

– Rent: $52,000 $72,000 $72,000

– Payroll Taxes: $50,325 $68,700 $79,200

– Other: $0 $0 $0

Total Operating Expenses: $533,425 $700,100 $782,600

Profit Before Interest and Taxes: $68,998 $20,360 $37,334

EBITDA: $72,198 $25,360 $42,334

Interest Expense: $1,975 $1,400 $800

Taxes Incurred: $20,107 $5,688 $10,960

Net Profit: $46,916 $13,272 $25,574

Net Profit/Sales: 4.67% 1.20% 2.06%

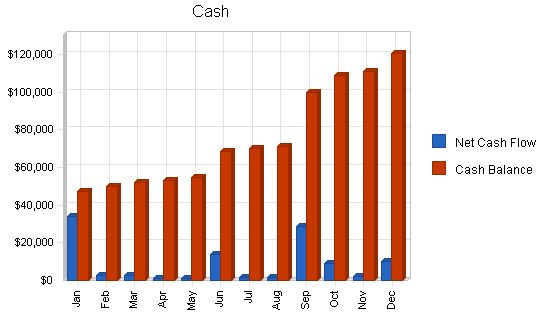

8.3 Projected Cash Flow

The projected cash flow and cash balance figures for Markam Driving School are shown in the table and chart below.

| Pro Forma Cash Flow | |||

| 2002 | 2003 | 2004 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $1,004,038 | $1,108,401 | $1,242,325 |

| Subtotal Cash from Operations | $1,004,038 | $1,108,401 | $1,242,325 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $1,004,038 | $1,108,401 | $1,242,325 |

| Expenditures | 2002 | 2003 | 2004 |

| Expenditures from Operations | |||

| Cash Spending | $335,500 | $458,000 | $528,000 |

| Bill Payments | $554,858 | $647,453 | $679,508 |

| Subtotal Spent on Operations | $890,358 | $1,105,453 | $1,207,508 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $6,000 | $6,000 | $6,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $40,000 | $40,000 |

| Subtotal Cash Spent | $896,358 | $1,151,453 | $1,253,508 |

| Net Cash Flow | $107,680 | ($43,052) | ($11,183) |

| Cash Balance | $120,618 | $77,566 | $66,383 |

8.4 Projected Balance Sheet

The following table contains the projected balance sheet.

| Pro Forma Balance Sheet | |||

| 2002 | 2003 | 2004 | |

| Assets | |||

| Current Assets | |||

| Cash | $120,618 | $77,566 | $66,383 |

| Other Current Assets | $2,000 | $2,000 | $2,000 |

| Total Current Assets | $122,618 | $79,566 | $68,383 |

| Long-term Assets | |||

| Long-term Assets | $74,000 | $74,000 | $74,000 |

| Accumulated Depreciation | $15,200 | $20,200 | $25,200 |

| Total Long-term Assets | $58,800 | $53,800 | $48,800 |

| Total Assets | $181,418 | $133,366 | $117,183 |

| Liabilities and Capital | 2002 | 2003 | 2004 |

| Current Liabilities | |||

| Accounts Payable | $67,280 | $51,956 | $56,199 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $67,280 | $51,956 | $56,199 |

| Long-term Liabilities | $17,000 | $11,000 | $5,000 |

| Total Liabilities | $84,280 | $62,956 | $61,199 |

| Paid-in Capital | $30,000 | $30,000 | $30,000 |

| Retained Earnings | $20,222 | $27,138 | $410 |

| Earnings | $46,916 | $13,272 | $25,574 |

| Total Capital | $97,138 | $70,410 | $55,984 |

| Total Liabilities and Capital | $181,418 | $133,366 | $117,183 |

| Net Worth | $97,138 | $70,410 | $55,984 |

8.5 Business Ratios

The industry business ratios given in the table are for vocational schools based on the Standard Industrial Classification (SIC) code 8299. Most of the ratios are similar to our own. The only major difference between our company and others is our reliance on long-term assets due to having the majority of our investment in a fleet of cars. Overall, the ratios reflect a healthy and growing company with few danger signs.

| Ratio Analysis | ||||

| 2002 | 2003 | 2004 | Industry Profile | |

| Sales Growth | 34.59% | 10.39% | 12.08% | 9.50% |

| Percent of Total Assets | ||||

| Other Current Assets | 1.10% | 1.50% | 1.71% | 44.20% |

| Total Current Assets | 67.59% | 59.66% | 58.36% | 70.80% |

| Long-term Assets | 32.41% | 40.34% | 41.64

Personnel Plan: |

|

| Personnel Plan | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| President and General Manager | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | |

| Controller | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | |

| Education Planner | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Education Coordinator | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Facilities Mangers | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Office Manager | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| Marketing Executive (Contract work) | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | |

| Educators | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $13,000 | $13,000 | $13,000 | $13,000 | $13,000 | $13,000 | $13,000 | |

| Total People | 11 | 11 | 11 | 11 | 11 | 15 | 15 | 15 | 15 | 15 | 15 | 15 | |

| Total Payroll | $24,750 | $24,750 | $24,750 | $24,750 | $24,750 | $30,250 | $30,250 | $30,250 | $30,250 | $30,250 | $30,250 | $30,250 | $30,250 |

General Assumptions:

| General Assumptions | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | ||

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| $64,350 | $64,350 | $64,350 | $64,350 | $64,350 | $83,000 | $83,000 | $83,000 | $110,700 | $110,700 | $103,888 | $108,000 | ||

| $25,740 | $25,740 | $25,740 | $25,740 | $25,740 | $33,200 | $33,200 | $33,200 | $44,280 | $44,280 | $41,555 | $43,200 | ||

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| $25,740 | $25,740 | $25,740 | $25,740 | $25,740 | $33,200 | $33,200 | $33,200 | $44,280 | $44,280 | $41,555 | $43,200 | ||

| $38,610 | $38,610 | $38,610 | $38,610 | $38,610 | $49,800 | $49,800 | $49,800 | $66,420 | $66,420 | $62,333 | $64,800 | ||

| 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | ||

| 4.42% | 4.42% | 2.25% | 2.25% | 2.26% | 2.15% | 2.15% | 2.15% | 8.02% | 8.02% | 5.79% | 7.18% | ||

Pro Forma Cash Flow

Cash Received:

– Jan – Dec

Cash from Operations:

– Cash Sales

– Subtotal Cash from Operations

Additional Cash Received:

– Sales Tax, VAT, HST/GST Received

– New Current Borrowing

– New Other Liabilities (interest-free)

– New Long-term Liabilities

– Sales of Other Current Assets

– Sales of Long-term Assets

– New Investment Received

– Subtotal Cash Received

Expenditures:

– Jan – Dec

Expenditures from Operations:

– Cash Spending

– Bill Payments

– Subtotal Spent on Operations

Additional Cash Spent:

– Sales Tax, VAT, HST/GST Paid Out

– Principal Repayment of Current Borrowing

– Other Liabilities Principal Repayment

– Long-term Liabilities Principal Repayment

– Purchase Other Current Assets

– Purchase Long-term Assets

– Dividends

– Subtotal Cash Spent

Net Cash Flow:

– Jan – Dec

Cash Balance:

– Jan – Dec

Pro Forma Balance Sheet

Assets:

– Starting Balances

– Current Assets

– Cash

– Other Current Assets

– Total Current Assets

– Long-term Assets

– Accumulated Depreciation

– Total Long-term Assets

– Total Assets

Liabilities and Capital:

– Current Liabilities

– Accounts Payable

– Current Borrowing

– Other Current Liabilities

– Subtotal Current Liabilities

– Long-term Liabilities

– Total Liabilities

– Paid-in Capital

– Retained Earnings

– Earnings

– Total Capital

– Total Liabilities and Capital

– Net Worth

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Strategic Alliances

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!