Contents

Airport Shuttle Business Plan

Valley Airporter plans to transport over 20,000 passengers this year. We will purchase three brand new 20-passenger buses to replace older 14-passenger buses to accommodate those passengers.

The new buses are necessary due to the expansion of airport service. The schedule has expanded from three times a day, Monday through Friday, to ten trips each weekday and nine trips on Saturday and Sunday, 365 days per year.

Valley Airporter operates out of Corvallis, home to Oregon State University, with over 18,000 students, and over 120 high-tech businesses. While Corvallis has a small airport and Eugene, a regional airport 50 miles south, most travelers prefer the Portland International Airport, which is 70 miles north of Corvallis.

Bob and Mary Wilson, co-owners of Valley Airporter, will invest in the purchase of the new vans. They will also secure a long-term commercial loan.

The mission of Valley Airporter is to ensure safety, convenience, and comfort for every customer. Valley Airporter’s chauffeurs are experienced, professional, and commercially certified drivers. The office staff is professional, friendly, and helpful, going above and beyond for customers. Valley Airporter is a caring company that regularly donates time and services to community schools and organizations.

Valley Airporter is a successful airport shuttle service that transports passengers between the Portland International Airport and Corvallis. They have office space in the Clairmont Inn and offer long-term parking for customers.

Bob and Mary Wilson are the co-owners of Valley Airporter.

In April 1998, Valley Airporter began its operation with three 14-passenger vans that were converted to 11-passenger vans with rear luggage area. Valley Airporter plans to travel over 2,000 miles per day and transport over 20,000 passengers. To accommodate these passengers, they plan to purchase three brand new 20-passenger replacement buses. All buses are equipped with seat belts and high back reclinable seats for comfort and safety. The schedule has continually expanded over the years from three times a day on weekdays to ten trips each weekday and nine trips on Saturday and Sunday, operating 365 days per year.

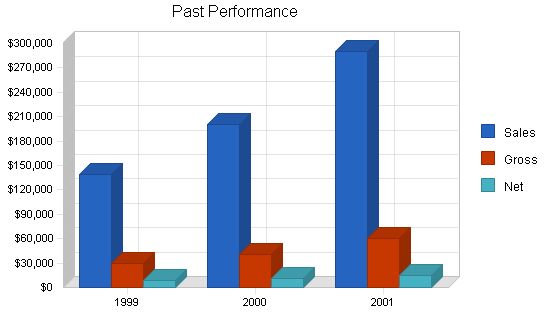

| Past Performance | |||

| 1999 | 2000 | 2001 | |

| Sales | $138,600 | $200,000 | $290,000 |

| Gross Margin | $30,000 | $40,000 | $60,000 |

| Gross Margin % | 21.65% | 20.00% | 20.69% |

| Operating Expenses | $75,000 | $90,000 | $120,000 |

| Balance Sheet | |||

| 1999 | 2000 | 2001 | |

| Current Assets | |||

| Cash | $20,000 | $30,000 | $50,000 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $20,000 | $30,000 | $50,000 |

| Long-term Assets | |||

| Long-term Assets | $60,000 | $60,000 | $130,000 |

| Accumulated Depreciation | $8,000 | $16,000 | $24,000 |

| Total Long-term Assets | $52,000 | $44,000 | $106,000 |

| Total Assets | $72,000 | $74,000 | $156,000 |

| Current Liabilities | |||

| Accounts Payable | $10,000 | $14,000 | $16,000 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities (interest free) | $0 | $0 | $0 |

| Total Current Liabilities | $10,000 | $14,000 | $16,000 |

| Long-term Liabilities | $20,000 | $10,000 | $80,000 |

| Total Liabilities | $30,000 | $24,000 | $96,000 |

| Paid-in Capital | $0 | $0 | $0 |

| Retained Earnings | $33,000 | $38,400 | $45,500 |

| Earnings | $9,000 | $11,600 | $14,500 |

| Total Capital | $42,000 | $50,000 | $60,000 |

| Total Capital and Liabilities | $72,000 | $74,000 | $156,000 |

| Other Inputs | |||

| Payment Days | 0 | 0 | 0 |

Services

Valley Airporter provides airport shuttle between Corvallis and Portland International Airport. The shuttle makes ten trips Monday through Friday and nine trips on Saturday and Sunday, 365 days per year.

Departure Times To Portland International Airport:

- 3:00 a.m. (Monday to Friday only)

- 4:30 a.m.

- 6:30 a.m.

- 8:30 a.m.

- 10:30 a.m.

- 12:30 p.m.

- 2:30 p.m.

- 4:30 p.m.

- 6:30 p.m.

- 8:30 p.m.

Departure Times To Corvallis from the Portland International Airport:

- 5:05 a.m.

- 9:00 a.m.

- 11:00 a.m.

- 1:00 p.m.

- 3:00 p.m.

- 5:00 p.m.

- 7:00 p.m.

- 9:00 p.m.

- 11:10 p.m.

Market Analysis Summary

There are several environmental factors that create an increasing demand for shuttle services between Corvallis and Portland International Airport:

- The city of Portland has the state’s only international airport. The regional airport in Eugene (50 miles south of Corvallis) has flights to Portland but those flights cost more than the shuttle service from Corvallis.

- The city of Corvallis has experienced significant growth during the past three years with a 20% increase in enrollment at Oregon State University. Moreover, the city is home to several high-tech businesses serving an international market.

- The cost of long-term parking at Portland International Airport has increased by 20% to $10 per day.

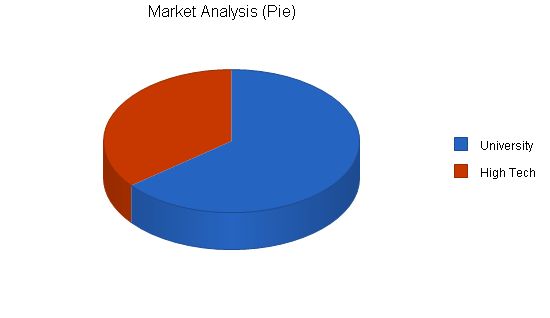

4.1 Market Segmentation

Valley Airporter will focus on two customer groups:

- University students, staff, faculty, and visitors.

- Employees of high-tech companies.

| Market Analysis | |||||||

| 2002 | 2003 | 2004 | 2005 | 2006 | |||

| Potential Customers | Growth | CAGR | |||||

| University | 15% | 18,000 | 20,700 | 23,805 | 27,376 | 31,482 | 15.00% |

| High Tech | 10% | 10,000 | 11,000 | 12,100 | 13,310 | 14,641 | 10.00% |

| Total | 13.29% | 28,000 | 31,700 | 35,905 | 40,686 | 46,123 | 13.29% |

Strategy and Implementation Summary:

Valley Airporter has developed a strong customer support base at Oregon State University and numerous high-tech companies in Corvallis. The expansion of services responds to growing demand for additional shuttle times and greater bus capacity.

To increase sales at Oregon State University, the shuttle will pick up and deliver customers in front of the university’s bookstore on campus.

To increase ridership with high-tech companies, Valley Airporter offers a round-trip fare package of $60 when a company purchases 10 or more advance round-trip tickets.

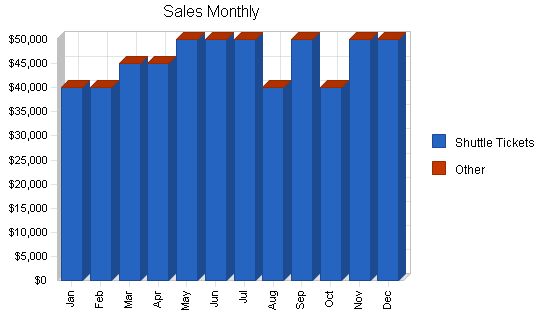

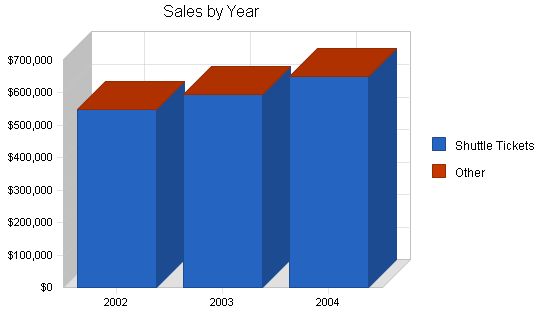

The following is the sales forecast for three years.

To develop effective business strategies, perform a SWOT analysis of your business. Use our free guide and template to learn how.

Sales Forecast

| Sales Forecast | |||

| 2002 | 2003 | 2004 | |

| Shuttle Tickets | $550,000 | $595,000 | $650,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $550,000 | $595,000 | $650,000 |

Management Summary

Bob and Mary Wilson, co-owners of Valley Airporter, perform management duties. Mary is the office manager and bookkeeper, supervising the office staff and overseeing customer service. Bob supervises and schedules shuttle drivers and is responsible for vehicle repair and maintenance.

6.1 Personnel Plan

The staff for Valley Airporter consists of:

– Office manager

– Shuttle manager

– Full-time drivers (3)

– Part-time drivers (2)

– Office staff (2)

| Personnel Plan | |||

| 2002 | 2003 | 2004 | |

| Bob Wilson | $30,000 | $32,000 | $34,000 |

| Mary Wilson | $30,000 | $32,000 | $34,000 |

| Drivers | $192,000 | $200,000 | $210,000 |

| Office Staff/Sales | $36,000 | $38,000 | $40,000 |

| Total People | 9 | 9 | 9 |

| Total Payroll | $288,000 | $302,000 | $318,000 |

The financial plan for Valley Airporter is as follows.

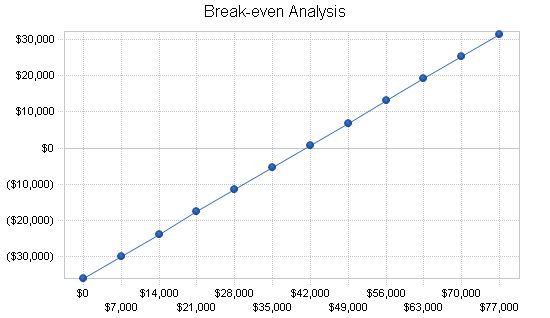

7.1 Break-even Analysis

The following table and chart show the break-even analysis for Valley Airporter.

Break-even Analysis:

Monthly Revenue Break-even: $41,161

Assumptions:

Average Percent Variable Cost: 12%

Estimated Monthly Fixed Cost: $36,147

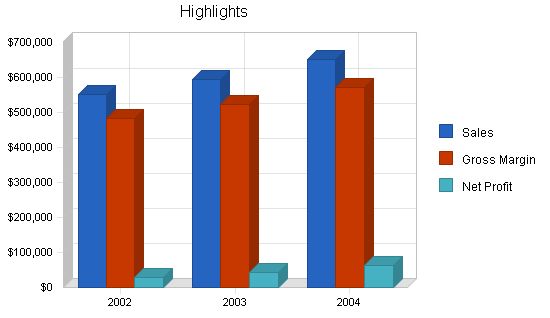

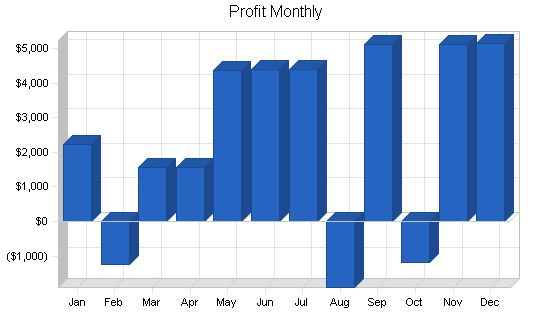

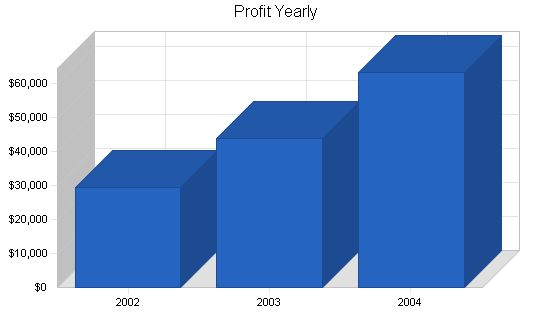

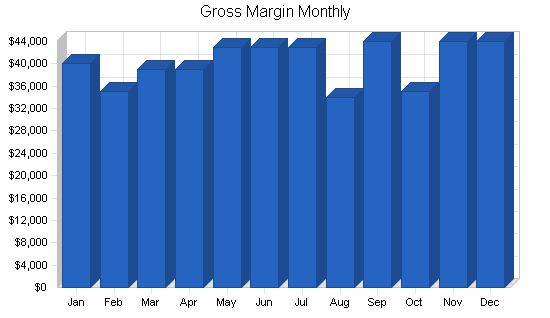

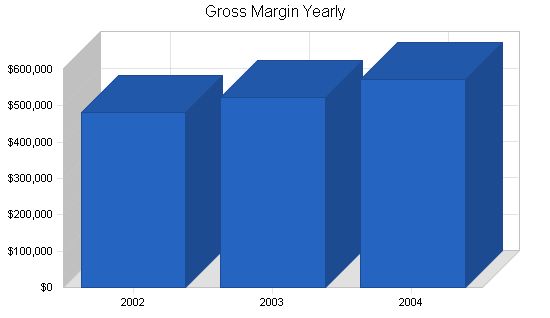

Projected Profit and Loss:

The table and charts below show the projected profit and loss for three years.

Pro Forma Profit and Loss

Year | 2002 | 2003 | 2004

— | —– | —– | —–

Sales | $550,000 | $595,000 | $650,000

Direct Cost of Sales | $67,000 | $73,000 | $78,000

Other Production Expenses | $0 | $0 | $0

Total Cost of Sales | $67,000 | $73,000 | $78,000

Gross Margin | $483,000 | $522,000 | $572,000

Gross Margin % | 87.82% | 87.73% | 88.00%

Expenses |

Payroll | $288,000 | $302,000 | $318,000

Sales and Marketing and Other Expenses | $24,000 | $27,000 | $30,000

Depreciation | $18,564 | $18,564 | $18,564

Leased Equipment | $0 | $0 | $0

Utilities | $0 | $0 | $0

Insurance | $12,000 | $12,000 | $12,000

Rent | $48,000 | $48,000 | $48,000

Payroll Taxes | $43,200 | $45,300 | $47,700

Other | $0 | $0 | $0

Total Operating Expenses | $433,764 | $452,864 | $474,264

Profit Before Interest and Taxes | $49,236 | $69,136 | $97,736

EBITDA | $67,800 | $87,700 | $116,300

Interest Expense | $7,090 | $6,680 | $7,400

Taxes Incurred | $12,644 | $18,737 | $27,101

Net Profit | $29,502 | $43,719 | $63,235

Net Profit/Sales | 5.36% | 7.35% | 9.73%

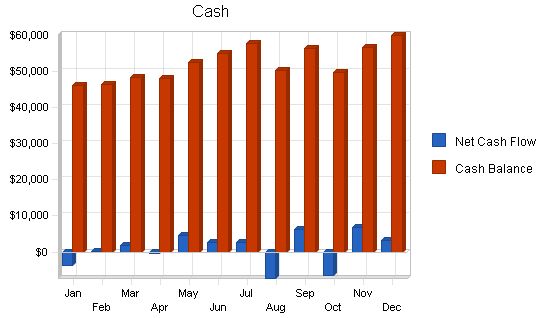

7.3 Projected Cash Flow

The following table and chart show the projected cash flow for three years.

| Pro Forma Cash Flow | |||

| 2002 | 2003 | 2004 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $550,000 | $595,000 | $650,000 |

| Subtotal Cash from Operations | $550,000 | $595,000 | $650,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $24,000 | $24,000 | $24,000 |

| New Long-term Liabilities | $0 | $24,000 | $24,000 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $574,000 | $643,000 | $698,000 |

| Expenditures | 2002 | 2003 | 2004 |

| Expenditures from Operations | |||

| Cash Spending | $288,000 | $302,000 | $318,000 |

| Bill Payments | $211,253 | $230,434 | $248,599 |

| Subtotal Spent on Operations | $499,253 | $532,434 | $566,599 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $16,800 | $16,800 | $16,800 |

| Purchase Other Current Assets | $24,000 | $24,000 | $24,000 |

| Purchase Long-term Assets | $24,000 | $24,000 | $24,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $564,053 | $597,234 | $631,399 |

| Net Cash Flow | $9,947 | $45,766 | $66,601 |

| Cash Balance | $59,947 | $105,712 | $172,313 |

7.4 Projected Balance Sheet

The following table is the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| 2002 | 2003 | 2004 | |

| Assets | |||

| Current Assets | |||

| Cash | $59,947 | $105,712 | $172,313 |

| Other Current Assets | $24,000 | $48,000 | $72,000 |

| Total Current Assets | $83,947 | $153,712 | $244,313 |

| Long-term Assets | |||

| Long-term Assets | $154,000 | $178,000 | $202,000 |

| Accumulated Depreciation | $42,564 | $61,128 | $79,692 |

| Total Long-term Assets | $111,436 | $116,872 | $122,308 |

| Total Assets | $195,383 | $270,584 | $366,621 |

| Liabilities and Capital | 2002 | 2003 | 2004 |

| Current Liabilities | |||

| Accounts Payable | $18,680 | $18,963 | $20,564 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $24,000 | $48,000 | $72,000 |

| Subtotal Current Liabilities | $42,680 | $66,963 | $92,564 |

| Long-term Liabilities | $63,200 | $70,400 | $77,600 |

| Total Liabilities | $105,880 | $137,363 | $170,164 |

| Paid-in Capital | $0 | $0 | $0 |

| Retained Earnings | $60,000 | $89,502 | $133,221 |

| Earnings | $29,502 | $43,719 | $63,235 |

| Total Capital | $89,502 | $133,221 | $196,457 |

| Total Liabilities and Capital | $195,383 | $270,584 | $366,621 |

| Net Worth | $89,502 | $133,221 | $196,457 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 4119, Local Passenger Transportation, are shown for comparison.

| Ratio Analysis | ||||

| 2002 | 2003 | 2004 | Industry Profile | |

| Sales Growth | 89.66% | 8.18% | 9.24% | 3.70% |

| Percent of Total Assets | ||||

| Other Current Assets | 12.28% | 17.74% | 19.64% | 47.00% |

| Total Current Assets | 42.97% | 56.81% | 66.64% | 64.90% |

| Long-term Assets | 57.03% | 43.19% | 33.36% | 35.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 21.84% | 24.75% | 25.25% | 30.00% |

| Long-term Liabilities | 32.35% | 26.02% | 21.17% | 26.20% |

| Total Liabilities | 54.19% | 50.77% | 46.41% | 56.20% |

| Net Worth | 45.81% | 49.23% | 53.59% | 43.80% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 87.82% | 87.73% | 88.00% | 78.20% |

| Selling, General & Administrative Expenses | 82.45% | 80.38% | 78.27% | 55.40% |

| Advertising Expenses | 1.09% | 1.34% | 1.54% | 0.70% |

| Profit Before Interest and Taxes | 8.95% | 11.62% | 15.04% | 2.10% |

| Main Ratios | ||||

| Current | 1.97 | 2.30 | 2.64 | 1.96 |

| Quick | 1.97 | 2.30 | 2.64 | 1.51 |

| Total Debt

Pro Forma Profit and Loss |

||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Sales | $40,000 | $40,000 | $45,000 | $45,000 | $50,000 | $50,000 | $50,000 | $40,000 | $50,000 | $40,000 | $50,000 | $50,000 |

| Direct Cost of Sales | $0 | $5,000 | $6,000 | $6,000 | $7,000 | $7,000 | $7,000 | $6,000 | $6,000 | $5,000 | $6,000 | $6,000 |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $5,000 | $6,000 | $6,000 | $7,000 | $7,000 | $7,000 | $6,000 | $6,000 | $5,000 | $6,000 | $6,000 |

| Gross Margin | $40,000 | $35,000 | $39,000 | $39,000 | $43,000 | $43,000 | $43,000 | $34,000 | $44,000 | $35,000 | $44,000 | $44,000 |

| Gross Margin % | 100.00% | 87.50% | 86.67% | 86.67% | 86.00% | 86.00% | 86.00% | 85.00% | 88.00% | 87.50% | 88.00% | 88.00% |

| Expenses | ||||||||||||

| Payroll | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 |

| Sales and Marketing and Other Expenses | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Depreciation | $1,547 | $1,547 | $1,547 | $1,547 | $1,547 | $1,547 | $1,547 | $1,547 | $1,547 | $1,547 | $1,547 | $1,547 |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Utilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Insurance | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| Rent | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 |

| Payroll Taxes | 15% | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Operating Expenses | $36,147 | $36,147 | $36,147 | $36,147 | $36,147 | $36,147 | $36,147 | $36,147 | $36,147 | $36,147 | $36,147 | $36,147 |

| Profit Before Interest and Taxes | $3,853 | ($1,147) | $2,853 | $2,853 | $6,853 | $6,853 | $6,853 | ($2,147) | $7,853 | ($1,147) | $7,853 | $7,853 |

| EBITDA | $5,400 | $400 | $4,400 | $4,400 | $8,400 | $8,400 | $8,400 | ($600) | $9,400 | $400 | $9,400 | $9,400 |

| Interest Expense | $655 | $643 | $632 | $620 | $608 | $597 | $585 | $573 | $562 | $550 | $538 | $527 |

| Taxes Incurred | $959 | ($537) | $666 | $670 | $1,873 | $1,877 | $1,880 | ($816) | $2,187 | ($509) | $2,194 | $2,198 |

| Net Profit | $2,239 | ($1,253) | $1,555 | $1,563 | $4,371 | $4,379 | $4,388 | ($1,904) | $5,104 | ($1,188) | $5,120 | $5,128 |

| Net Profit/Sales | 5.60% | -3.13% | 3.46% | 3.47% | 8.74% | 8.76% | 8.78% | -4.76% | 10.21% | -2.97% | 10.24% | 10.26% |

Pro Forma Cash Flow

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| Cash Sales | $40,000 | $40,000 | $45,000 | $45,000 | $50,000 | $50 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!