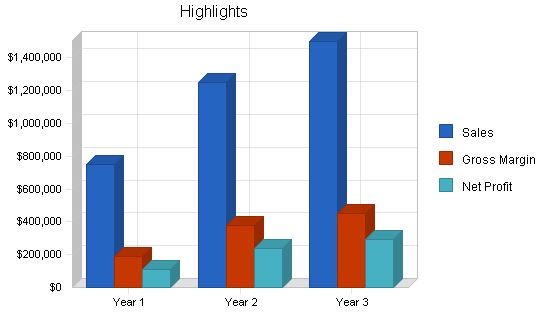

R & R Printing is a new print brokerage firm, formed as a sole proprietorship. The owner has extensive experience as a sales manager in the printing industry. We will offer printing services for various print media, including business cards, letterhead, envelopes, brochures, booklets, business forms, posters, catalogues, and labels. Our objective is to serve all the printing needs of our clients and be a one-stop-shop. While our services, product quality, and prices will be excellent, our marketing strategy focuses on building long-term relationships. By prioritizing our commitment to helping businesses obtain the printing products and services they need, R & R Printing aims to increase sales to over $1.5 million in three years, while improving the gross margin. R & R Printing will distinguish itself by emphasizing reliability, expertise, and competitive pricing. To finance the start-up, the owner will invest $15,000 and seek a five-year loan of $50,000.

1.1 Objectives:

– Sell $750,000 in the first year.

– Increase sales to more than $1.5 million by the third year.

– Bring gross margin above 30% and maintain it.

– Retain client base from previous relationships and obtain 20 new clients by the end of the first year.

1.2 Mission:

R & R Printing helps businesses obtain printing products and services efficiently. With practical experience, know-how, and industry contacts, clients save time and money by relying on professionals for their printing needs. We offer a wide range of services, paper, bindery, and graphics at a reasonable cost while ensuring the highest quality.

R&R Printing prioritizes clients’ needs and delivers high-quality printing with efficiency and reliability. By providing fast response, expertise, and high-quality solutions, we generate loyal customers, leading to consistent profits.

1.3 Keys to Success:

– Consistent, timely, and accurate expertise and information to fulfill clients’ printing needs.

– Offer competitive pricing for quality products and services, providing one-stop-shopping.

– Build long-term relationships with clients for a loyal repeat customer base.

R&R Printing is a new print brokerage firm.

2.1 Company Ownership:

R&R Printing is a sole-proprietorship owned and operated by Robert M. Scott and his wife Ronda E. Scott. The owner has extensive prior experience as a sales manager in the printing industry, and incorporation will be explored as an option in the future.

2.2 Start-up Summary:

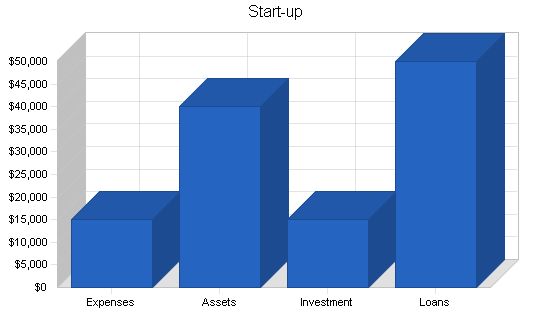

Our initial start-up costs will amount to approximately $65,000. $15,000 will be used for office equipment and up-front manufacturing costs until credit is established with vendors. Additionally, we project a need for a financial commitment of another $50,000 to finance receivables and payroll expenses for the first 12 months of operation.

Start-up Requirements Expenses Legal $200 Meet & Greet $600 Business Plan $200 Logo Design $1,500 Stationery $900 Insurance $4,000 Business Cards $500 Establish Credit $2,000 Initial Mailing $100 Process Funding $500 Office Equipment $4,500 Total Start-up Expenses $15,000 Start-up Assets Cash Required $40,000 Other Current Assets $0 Long-term Assets $0 Total Assets $40,000 Total Requirements $55,000 Start-up Funding Start-up Expenses to Fund $15,000 Start-up Assets to Fund $40,000 Total Funding Required $55,000 Assets Non-cash Assets from Start-up $0 Cash Requirements from Start-up $40,000 Additional Cash Raised $10,000 Cash Balance on Starting Date $50,000 Total Assets $50,000 Liabilities and Capital Liabilities Current Borrowing $0 Long-term Liabilities $50,000 Accounts Payable (Outstanding Bills) $0 Other Current Liabilities (interest-free) $0 Total Liabilities $50,000 Capital Planned Investment Owner $15,000 Other $0 Additional Investment Requirement $0 Total Planned Investment $15,000 Loss at Start-up (Start-up Expenses) ($15,000) Total Capital $0 Total Capital and Liabilities $50,000 Total Funding $65,000 2.3 Company Locations and Facilities This is a home office venture, located in a studio in the owner’s home. Products and Services R & R Printing provides print media and related services. We are focused on providing a wide range of print media, in addition to knowledge and expertise of the print industry. 3.1 Product and Service Description 3.2 Competitive Comparison In the competitive print industry, we define our vision as a reliable and informative ally to our clients. We maintain close contact with print manufacturers, paper distributors, and graphic specialists to offer a variety of printing options at a competitive price. This saves our clients time and money. 3.3 Sales Literature We will send an introductory letter to former and prospective clients with our business cards. This letter will be part of our start-up expenses. 3.4 Fulfillment We have relationships with trade-only print companies and paper distribution companies. We capture margins of up to 45% for certain parties. We continually evaluate sourcing opportunities. 3.5 Technology We use QuickBooks Pro™ for accounting, purchasing, taxes, estimating, and invoicing. Act 2000™ is a sales based software that helps us manage client accounts. Talkworks Pro™ is a communication software that allows us to stay in close contact with clients and vendors. These programs integrate to minimize redundancy. We have contacts with vendors who use current versions of graphics, printing, and publishing software. This allows us to recreate artwork to clients’ specifications. 3.6 Future Products and Services Within the next year, we will implement a website for R & R Printing to process quote requests and repeat orders. Market Analysis Summary R & R Printing focuses on local large businesses that need a variety of printed materials. 4.1 Market Segmentation Our target companies are large enough to need a great deal of print products, but not large enough to have in-house printing equipment. Our target market company has at least 50 people. 4.2 Target Market Segment Strategy Our target markets are larger companies that need diverse printed materials. They rely on the expertise of a print vendor. Our marketing strategy will focus on direct face-to-face contact with decision making individuals. 4.2.1 Market Growth Dallas is a growing economy with more than 140,000 businesses. Businesses in Dallas use printed products, and as they grow, their need for printing materials increases. The printing industry is expected to rise in sales by five to six percent. 4.2.2 Market Needs The most important market needs are knowledge, reliability, pricing, timely completion, and high quality. Our strategy focuses on individuals who understand these needs. 4.3 Service Business Analysis The primary distribution pattern in the printing business is from supplier to agent to consumer. Printing is generally bought at the lowest price on a bid basis, but factors such as service, quality, reputation, and timely production also influence the final decision. 4.3.3 Main Competitors Other print brokers and commercial printing companies are our main competitors. Other participants in the printing industry include franchises, large local commercial printing companies, medium sized commercial printing companies, small quick print shops, and print brokers. Strategy and Implementation Summary Our strategy is to emphasize expertise, professionalism, and reliability. We aim to build long-term relationships with our clients and provide solutions, service, and quality printing. 5.1 Strategy Pyramid Our marketing efforts rely on recognition for our expertise, professionalism, and reliability. We maintain regular contact with our contacts and use face-to-face communication to keep our name and reputation in view of the customer. 5.2 Sales Strategy Our sales strategy is focused on customer satisfaction. Happy customers will become repeat customers and provide referrals. Our sales projections show steady growth and estimations of 50% annually for the first three years.

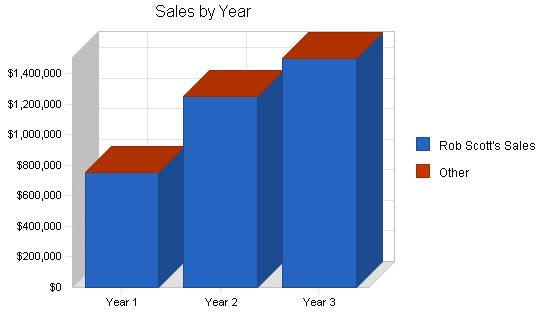

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Rob Scott’s Sales | $750,000 | $1,250,000 | $1,500,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $750,000 | $1,250,000 | $1,500,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Rob Scott’s Sales | $559,600 | $875,000 | $1,050,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $559,600 | $875,000 | $1,050,000 |

Contents

5.3 Value Proposition

Our value proposition must differentiate us from standard printing vendors. We offer clients a vendor who is a trusted ally and will work with them to meet their product and service needs. Our confidence and expertise inspire consumer confidence and foster long-term relationships built on trust.

5.4 Competitive Edge

Our greatest competitive advantage is our strategic alliance with clients. By developing enduring relationships with satisfied clients, we build a strong defense against competition. As these relationships grow, we educate our clients about the value we provide and why they need our services.

5.5 Marketing Strategy

R&R Printing believes that the primary objective of any business is to create and retain customers. Our marketing strategy is designed to reflect this objective as we establish our reputation. Our focus will be on:

- Reliability, expertise, and quality.

- Developing long-term personal relationships with decision-makers who handle printing for companies.

- Maximizing face-to-face contact with clients whenever possible.

5.5.1 Distribution Strategy

R&R Printing will directly target the Dallas area market for distribution.

5.5.2 Marketing Programs

The most critical marketing program for R&R Printing is to generate awareness through the following initiatives:

- Send a letter of announcement with enclosed business cards to all existing contacts. Ronda Scott will be responsible for this program, with a budget of $1,500 and a milestone date of September 5, 2000. The program aims to inform potential clients of our services, generate excitement about our new venture, and prompt requests for printing quotes.

- Establish personal contact by calling and visiting existing contacts. Rob Scott will be responsible for this program, with a budget of $600 and a milestone date of October 10, 2000. The program aims to build personal relationships and inform contacts about our services, ultimately generating printing quote requests.

5.5.3 Positioning Statement

For business professionals who prioritize accuracy, timeliness, and utmost reliability in their printing needs, R&R Printing is a vendor and ally that guarantees high-quality printing, fair pricing, and personalized service. Unlike other printing vendors, R&R Printing establishes enduring personal relationships, goes the extra mile to offer proactive ideas, solutions, services, and exceptional printing quality.

5.5.4 Pricing Strategy

Our pricing is largely determined by market standards. R&R Printing will strive to maintain margins of 30% to 35% and implement a competitive pricing policy.

5.5.5 Promotion Strategy

During the initial weeks of operation, we plan to mail a personalized letter to all previous contacts, expressing our excitement about our new company and offering quality printing and service. Each letter will include our business cards for convenient contact. Additionally, we will personally call and visit previous contacts to emphasize our commitment to personalized service. Ultimately, our most effective means of promotion will be word-of-mouth recommendations from satisfied clients.

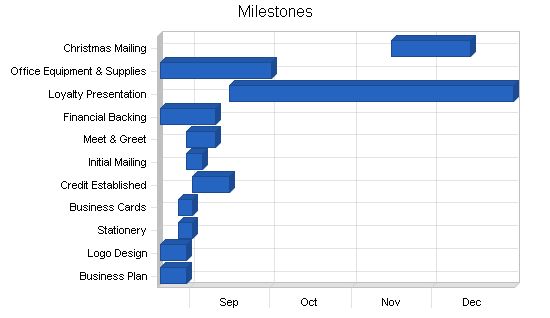

5.6 Milestones

The table lists important program milestones, responsible parties, and budgets. The milestone schedule emphasizes our focus on planning for successful implementation.

The table, however, does not fully illustrate the commitment behind it. We will hold monthly follow-up meetings to discuss achievements, variances, and course corrections.

Milestones:

| Milestone | Start Date | End Date | Budget | Manager | Department |

|———–|————|———-|——–|———|————|

| Business Plan | 8/20/2000 | 8/30/2000 | $200 | Ronda | Department |

| Logo Design | 8/20/2000 | 8/30/2000 | $1,500 | Rob | Department |

| Stationery | 8/27/2000 | 9/1/2000 | $900 | Rob & Ronda | Department |

| Business Cards | 8/27/2000 | 9/1/2000 | $500 | Rob & Ronda | Department |

| Credit Established | 9/1/2000 | 9/15/2000 | $2,000 | Rob & Ronda | Department |

| Initial Mailing | 8/30/2000 | 9/5/2000 | $100 | Ronda | Department |

| Meet & Greet | 8/30/2000 | 9/10/2000 | $600 | Rob | Department |

| Financial Backing | 8/20/2000 | 9/10/2000 | $500 | Rob & Ronda | Department |

| Loyalty Presentation | 9/15/2000 | 12/31/2000 | $1,500 | Rob & Ronda | Department |

| Office Equipment & Supplies | 8/20/2000 | 10/1/2000 | $4,500 | Rob & Ronda | Department |

| Christmas Mailing | 11/15/2000 | 12/15/2000 | $250 | Ronda | Department |

| Totals | | | $12,550 | | |

Management Summary:

The initial management team depends on the founders themselves. Our management philosophy is based on responsibility and mutual respect. Our team includes Rob Scott and Ronda Scott. Rob will handle sales responsibilities, and Ronda will handle all administrative tasks.

6.1 Management Team:

Rob Scott, owner: 36 years old, B.A. Geology with Business minor, Southwest Texas State. Rob has 10 years experience in direct selling, including five years as sales manager at Montgomery Press. As a printing sales person at Montgomery Press he increased his sales on an average of 45% per year for five consecutive years, yielding a 640% increase in his overall sales.

Ronda Scott, president: 36 years old, B.S. Biology, Texas Woman’s University. Ronda has seven years experience in sales and service industries.

Donna Elston, accounting consultant: Retired comptroller for Rodger Meier Cadillac. Over 25 years experience in business accounting. Donna will act as consultant and advisor for R & R Printing accounting and administrative needs.

6.2 Personnel Plan:

The founder is the sole paid employee.

Personnel Plan:

| | Year 1 | Year 2 | Year 3 |

|-|——–|——–|——–|

| Rob Scott | $20,004 | $20,500 | $20,500 |

| Other | $0 | $0 | $0 |

| Total People | 1 | 1 | 1 |

| Total Payroll | $20,004 | $20,500 | $20,500 |

Financial Plan:

R & R Printing’s financial plan is detailed in the following sections. Preliminary estimates suggest that we will experience steady growth in the first year of operation. Income estimates are based, in part, on anticipated revenues from accounts secured by Rob Scott in his prior sales position. R & R Printing also anticipates an increase in gross margin and sales volume. Thus, the overall financial plan presents a conservative but realistic depiction of R & R Printing’s financial position.

7.1 Important Assumptions:

R & R Printing assumes the following:

– Market growth projections for the printing industry are accurate.

– National economic conditions, favorable to the printing industry, will not experience significant decline in the next three years.

– Conditions will remain favorable for service providers, and R & R Printing will be able to maintain those relationships.

General Assumptions:

| | Year 1 | Year 2 | Year 3 |

|-|——–|——–|——–|

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

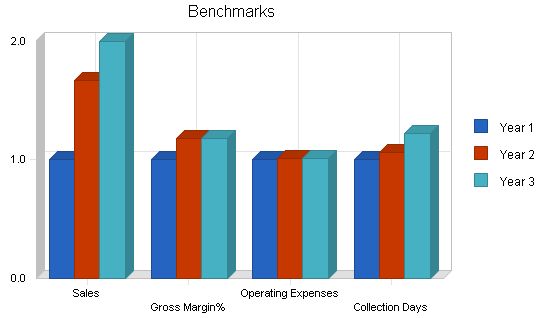

7.2 Key Financial Indicators:

The following chart indicates R & R Printing’s key financial indicators for the first three years of business. R & R Printing anticipates growth in sales with relatively stable operating expenses. Favorable economic conditions and forecasts of continued growth in the printing market support R & R Printing’s planned financial success.

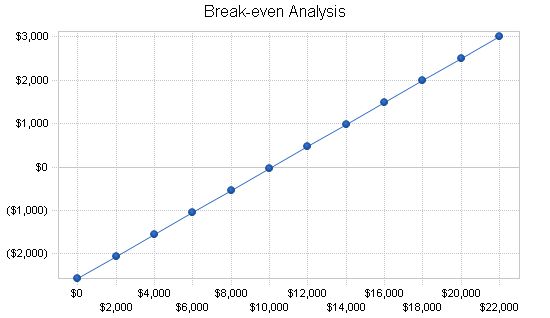

The table below shows R & R Printing’s break-even analysis. This analysis assumes a 25% to 30% gross margin, which is a conservative estimate. As strategic relationships develop and customers realize the benefits of R & R Printing offerings, this estimate will improve.

Break-even Analysis:

Monthly Revenue Break-even: $10,112.

Assumptions:

– Average Percent Variable Cost: 75%

– Estimated Monthly Fixed Cost: $2,567

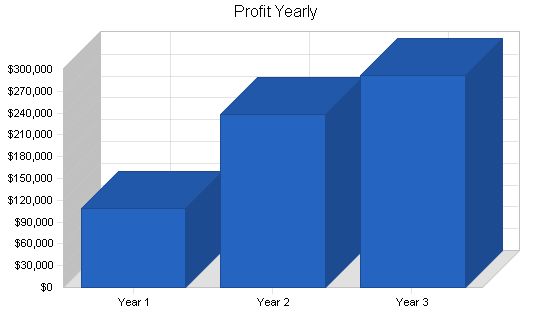

Projected Profit and Loss:

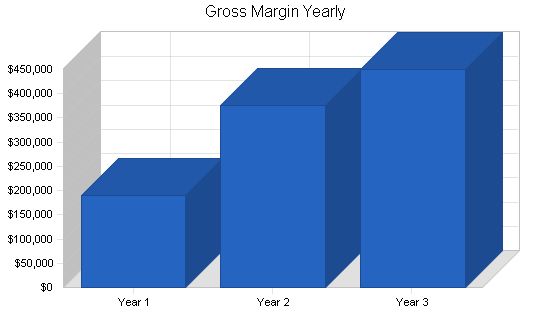

R & R Printing’s profit improves in the second quarter of operation. The gross margin is expected to increase from 25% in year one to 30% in year two. Annual profit and loss estimates are provided in the table below.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $750,000 $1,250,000 $1,500,000

Direct Cost of Sales $559,600 $875,000 $1,050,000

Other $0 $0 $0

Total Cost of Sales $559,600 $875,000 $1,050,000

Gross Margin $190,400 $375,000 $450,000

Gross Margin % 25.39% 30.00% 30.00%

Expenses

Payroll $20,004 $20,500 $20,500

Marketing/Promotion $6,000 $6,000 $6,000

Depreciation $0 $0 $0

Leased Equipment $0 $0 $0

Insurance $4,800 $4,800 $4,800

Payroll Taxes $0 $0 $0

Other $0 $0 $0

Total Operating Expenses $30,804 $31,300 $31,300

Profit Before Interest and Taxes $159,596 $343,700 $418,700

EBITDA $159,596 $343,700 $418,700

Interest Expense $4,533 $3,470 $2,450

Taxes Incurred $46,519 $102,069 $124,875

Net Profit $108,544 $238,161 $291,375

Net Profit/Sales 14.47% 19.05% 19.43%

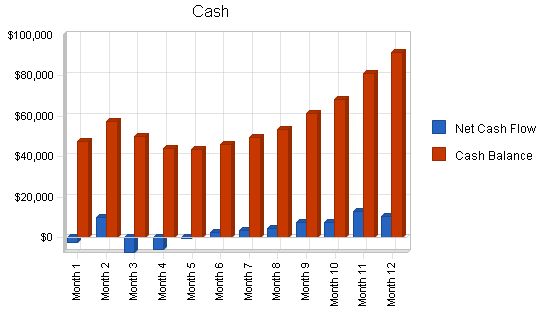

7.5 Projected Cash Flow

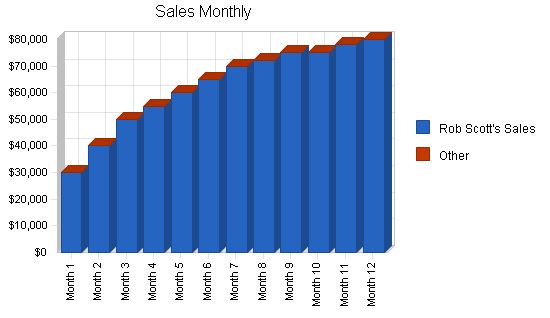

Monthly cash flow is shown in the following illustration. Annual cash flow figures are estimated based on collection days included in the table. Annual cash flow for the first year of operation becomes positive in the second quarter of operation.

Pro Forma Cash Flow:

– Cash Received

– Cash from Operations

– Cash Sales: $0, $0, $0

– Cash from Receivables: $594,600, $1,146,400, $1,448,200

– Subtotal Cash from Operations: $594,600, $1,146,400, $1,448,200

– Additional Cash Received

– Sales Tax, VAT, HST/GST Received: $0, $0, $0

– New Current Borrowing: $0, $0, $0

– New Other Liabilities (interest-free): $0, $0, $0

– New Long-term Liabilities: $0, $0, $0

– Sales of Other Current Assets: $0, $0, $0

– Sales of Long-term Assets: $0, $0, $0

– New Investment Received: $37,000, $0, $0

– Subtotal Cash Received: $631,600, $1,146,400, $1,448,200

– Expenditures

– Expenditures from Operations

– Cash Spending: $20,004, $20,500, $20,500

– Bill Payments: $560,008, $971,302, $1,171,951

– Subtotal Spent on Operations: $580,012, $991,802, $1,192,451

– Additional Cash Spent

– Sales Tax, VAT, HST/GST Paid Out: $0, $0, $0

– Principal Repayment of Current Borrowing: $0, $0, $0

– Other Liabilities Principal Repayment: $0, $0, $0

– Long-term Liabilities Principal Repayment: $10,200, $10,200, $10,200

– Purchase Other Current Assets: $0, $0, $0

– Purchase Long-term Assets: $0, $0, $0

– Dividends: $0, $0, $0

– Subtotal Cash Spent: $590,212, $1,002,002, $1,202,651

– Net Cash Flow: $41,388, $144,398, $245,549

– Cash Balance: $91,388, $235,785, $481,335

Projected Balance Sheet:

The Projected Balance Sheet is quite solid. We do not project any trouble meeting our debt obligations — as long as we can achieve our specific objectives.

– Assets

– Current Assets

– Cash: $91,388, $235,785, $481,335

– Accounts Receivable: $155,400, $259,000, $310,800

– Other Current Assets: $0, $0, $0

– Total Current Assets: $246,788, $494,785, $792,135

– Long-term Assets

– Long-term Assets: $0, $0, $0

– Accumulated Depreciation: $0, $0, $0

– Total Long-term Assets: $0, $0, $0

– Total Assets: $246,788, $494,785, $792,135

Liabilities and Capital:

Year 1, Year 2, Year 3

– Current Liabilities

– Accounts Payable: $61,443, $81,480, $97,654

– Current Borrowing: $0, $0, $0

– Other Current Liabilities: $0, $0, $0

– Subtotal Current Liabilities: $61,443, $81,480, $97,654

– Long-term Liabilities: $39,800, $29,600, $19,400

– Total Liabilities: $101,243, $111,080, $117,054

– Paid-in Capital: $52,000, $52,000, $52,000

– Retained Earnings: ($15,000), $93,544, $331,705

– Earnings: $108,544, $238,161, $291,375

– Total Capital: $145,544, $383,705, $675,080

– Total Liabilities and Capital: $246,788, $494,785, $792,135

The following table details our primary business ratios. Initial analysis indicates that R & R Printing ratios for profitability, risk, and return are financially favorable and will improve greatly in year two of operation. Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 2752, Commercial Printing, Lithographic, are shown for comparison.

– Ratio Analysis

– Sales Growth: 0.00%, 66.67%, 20.00%, 1.00%

– Percent of Total Assets

– Accounts Receivable: 62.97%, 52.35%, 39.24%, 25.80%

– Other Current Assets: 0.00%, 0.00%, 0.00%, 24.00%

– Total Current Assets: 100.00%, 100.00%, 100.00%, 57.90%

– Long-term Assets: 0.00%, 0.00%, 0.00%, 42.10%

– Total Assets: 100.00%, 100.00%, 100.00%, 100.00%

– Current Liabilities: 24.90%, 16.47%, 12.33%, 32.20%

– Long-term Liabilities: 16.13%, 5.98%, 2.45%, 25.40%

– Total Liabilities: 41.02%, 22.45%, 14.78%, 57.60%

– Net Worth: 58.98%, 77.55%, 85.22%, 42.40%

– Percent of Sales

– Sales: 100.00%, 100.00%, 100.00%, 100.00%

– Gross Margin: 25.39%, 30.00%, 30.00%, 30.00%

– Selling, General & Administrative Expenses: 9.05%, 9.80%, 9.62%, 15.60%

– Advertising Expenses: 0.48%, 0.29%, 0.24%, 0.50%

– Profit Before Interest and Taxes: 21.28%, 27.50%, 27.91%, 2.30%

– Main Ratios

– Current: 4.02, 6.07, 8.11, 1.61

– Quick: 4.02, 6.07, 8.11, 1.19

– Total Debt to Total Assets: 41.02%, 22.45%, 14.78%, 57.60%

– Pre-tax Return on Net Worth: 106.54%, 88.67%, 61.66%, 4.20%

– Pre-tax Return on Assets: 62.83%, 68.76%, 52.55%, 10.00%

– Additional Ratios

– Net Profit Margin: 14.47%, 19.05%, 19.43%, n.a

– Return on Equity: 74.58%, 62.07%, 43.16%, n.a

– Activity Ratios

– Accounts Receivable Turnover: 4.83, 4.83, 4.83, n.a

– Collection Days: 57, 61, 69, n.a

– Accounts Payable Turnover: 10.11, 12.17, 12.17, n.a

– Payment Days: 27, 26, 28, n.a

– Total Asset Turnover: 3.04, 2.53, 1.89, n.a

– Debt Ratios

– Debt to Net Worth: 0.70, 0.29, 0.17, n.a

– Current Liab. to Liab.: 0.61, 0.73, 0.83, n.a

– Liquidity Ratios

– Net Working Capital: $185,344, $413,305, $694,480, n.a

– Interest Coverage: 35.21, 99.05, 170.90, n.a

– Additional Ratios

– Assets to Sales: 0.33, 0.40, 0.53, n.a

– Current Debt/Total Assets: 25%, 16%, 12%, n.a

– Acid Test: 1.49, 2.89, 4.93, n.a

– Sales/Net Worth: 5.15, 3.26, 2.22, n.a

– Dividend Payout: 0.00, 0.00, 0.00, n.a

Appendix:

– Sales Forecast

– Rob Scott’s Sales: 0%, $30,000, $40,000, $50,000, $55,000, $60,000, $65,000, $70,000, $72,000, $75,000, $75,000, $78,000, $80,000

– Other: 0%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

– Total Sales: $30,000, $40,000, $50,000, $55,000, $60,000, $65,000, $70,000, $72,000, $75,000, $75,000, $78,000, $80,000

– Personnel Plan

– Rob Scott: 0%, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667

– Other: 0%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

– Total People: 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1

– Total Payroll: $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667, $1,667

General Assumptions:

Plan Month: 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate: 10.00%

Long-term Interest Rate: 10.00%

Tax Rate: 30.00%

Other: 0

Pro Forma Profit and Loss:

Sales: $30,000 $40,000 $50,000 $55,000 $60,000 $65,000 $70,000 $72,000 $75,000 $75,000 $78,000 $80,000

Direct Cost of Sales: $24,000 $32,000 $40,000 $44,000 $45,000 $48,750 $52,500 $54,000 $56,250 $52,500 $54,600 $56,000

Other: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales: $24,000 $32,000 $40,000 $44,000 $45,000 $48,750 $52,500 $54,000 $56,250 $52,500 $54,600 $56,000

Gross Margin: $6,000 $8,000 $10,000 $11,000 $15,000 $16,250 $17,500 $18,000 $18,750 $22,500 $23,400 $24,000

Gross Margin %: 20.00% 20.00% 20.00% 20.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 30.00% 30.00% 30.00%

Expenses:

Payroll: $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667

Marketing/Promotion: $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500

Depreciation: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Leased Equipment: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Insurance: $400 $400 $400 $400 $400 $400 $400 $400 $400 $400 $400 $400

Payroll Taxes: 15% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Operating Expenses: $2,567 $2,567 $2,567 $2,567 $2,567 $2,567 $2,567 $2,567 $2,567 $2,567 $2,567 $2,567

Profit Before Interest and Taxes: $3,433 $5,433 $7,433 $8,433 $12,433 $13,683 $14,933 $15,433 $16,183 $19,933 $20,833 $21,433

EBITDA: $3,433 $5,433 $7,433 $8,433 $12,433 $13,683 $14,933 $15,433 $16,183 $19,933 $20,833 $21,433

Interest Expense: $417 $417 $408 $400 $391 $383 $374 $366 $357 $349 $340 $332

Taxes Incurred: $905 $1,505 $2,107 $2,410 $3,613 $3,990 $4,368 $4,520 $4,748 $5,875 $6,148 $6,330

Net Profit: $2,111 $3,511 $4,917 $5,623 $8,429 $9,310 $10,191 $10,547 $11,078 $13,709 $14,345 $14,771

Net Profit/Sales: 7.04% 8.78% 9.83% 10.22% 14.05% 14.32% 14.56% 14.65% 14.77% 18.28% 18.39% 18.46%

Pro Forma Cash Flow:

Cash Received:

Cash from Operations:

Cash Sales: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Cash from Receivables: $0 $1,000 $30,333 $40,333 $50,167 $55,167 $60,167 $65,167 $70,067 $72,100 $75,000 $75,100

Subtotal Cash from Operations: $0 $1,000 $30,333 $40,333 $50,167 $55,167 $60,167 $65,167 $70,067 $72,100 $75,000 $75,100

Additional Cash Received:

Sales Tax, VAT, HST/GST Received: 0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Current Borrowing: $0 $0 $0 $0 $0 $

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!