Construction Irrigation Business Plan

Hass Irrigation Systems will meet the irrigation needs of our customers, focusing on the residential construction boom in Monroe’s Lake Charles section. The city has been growing by 9% annually for the past decade, with a population of 900,000. The new construction in the Lake Charles section is valued at $600 million in home sales next year.

Currently, Hass Irrigation Systems is a subcontractor for Bentwood Custom Homes, Greenridge Homes, and Landmark Homes, providing irrigation services for their new homes in the area. From this base, Hass Irrigation Systems will market to homeowners in the Lake Charles area.

The current population of the Lake Charles area is 120,000, with an income range of $100,000-$500,000. Hass Irrigation Systems is well positioned to dominate the irrigation business in this growing residential area.

Contents

1.1 Objectives

The objectives of Hass Irrigation Systems are:

- Capture the majority of the irrigation business in the Lake Charles area.

- Offer customers superior service at a low price.

1.2 Mission

Hass Irrigation Systems’ emphasis will always be customer satisfaction. By putting our customers’ needs first, we will build our customer base. Unlike other irrigation companies, we will not disappear at the end of October and reappear in March. We will be here when our customers need us.

1.3 Keys to Success

The keys to success for Hass Irrigation Systems are:

- Prompt and courteous service.

- An expertise in irrigation unmatched by any other company.

- Competitive pricing.

Company Summary

Hass Irrigation Systems tailors solutions to customers’ irrigation needs. Currently, Hass Irrigation Systems is a subcontractor for Bentwood Custom Homes, Greenridge Homes, and Landmark Homes, providing garden carpentry services to their new homes in the Lake Charles area.

Hass Irrigation Systems firmly believes that "you get what you pay for." This applies not only to customer irrigation systems but also to our staff and equipment. We have handpicked qualified employees and provided them with the necessary tools and support to excel at their jobs. The same level of quality extends to the equipment and hardware we use, all chosen to meet our customers’ high standards.

Andrew Hass, owner of Hass Irrigation Systems, has over 15 years of experience developing his own program and protocols. His expertise allows us to meet customer needs faster than any other company.

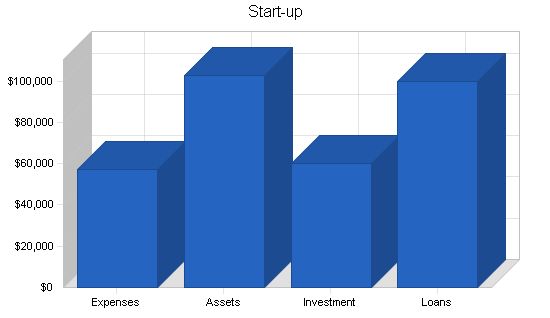

2.1 Start-up Summary

Andrew Hass will invest $60,000 in Hass Irrigation Systems and secure a $100,000 loan.

The following table and chart project the initial start-up costs for Hass Irrigation Systems.

Start-up Funding

Start-up Expenses to Fund: $57,300

Start-up Assets to Fund: $102,700

Total Funding Required: $160,000

Assets

Non-cash Assets from Start-up: $90,000

Cash Requirements from Start-up: $12,700

Additional Cash Raised: $0

Cash Balance on Starting Date: $12,700

Total Assets: $102,700

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $100,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $100,000

Capital

Planned Investment: $60,000

Andrew Hass: $60,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $60,000

Loss at Start-up (Start-up Expenses): ($57,300)

Total Capital: $2,700

Total Capital and Liabilities: $102,700

Total Funding: $160,000

Start-up Requirements

Start-up Expenses

Legal: $2,000

Stationery etc.: $300

Brochures: $3,000

Insurance: $1,000

Rent: $1,000

Equipment and Tools: $20,000

Vans (2): $30,000

Total Start-up Expenses: $57,300

Start-up Assets

Cash Required: $12,700

Start-up Inventory: $40,000

Other Current Assets: $0

Long-term Assets: $50,000

Total Assets: $102,700

Total Requirements: $160,000

Company Ownership

Hass Irrigation Systems is owned by Andrew Hass.

Services

Hass Irrigation Systems tailors solutions to customer’s irrigation needs. Through precision system design, our professionals can custom design a system that meets the customer’s landscaping needs, assuring a beautiful, green lawn.

We use products from premier manufacturers, providing our customers with systems customized to their individual property needs. By utilizing products from leading manufacturers, we can definitively meet our customer’s specific needs.

With these tools, our design professionals can meet any design challenge. A beautiful, green lawn is our first objective, but we also consider the unique water requirements of bedding plants, shrubbery, and trees. We understand the strengths and weaknesses of every product manufactured today.

Market Analysis Summary

The city has been growing by 9% annually for the past 10 years. With a population of 900,000, there is $600 million in home sales in the Lake Charles section of the city next year. New construction represents an important customer group for Hass Irrigation Systems.

Another significant customer group are existing home owners in the Lake Charles area. The revitalization of the area has led to increased remodeling of existing homes. Last year, remodeling projects were up 20% and accounted for $15 million paid for remodeling services in the area.

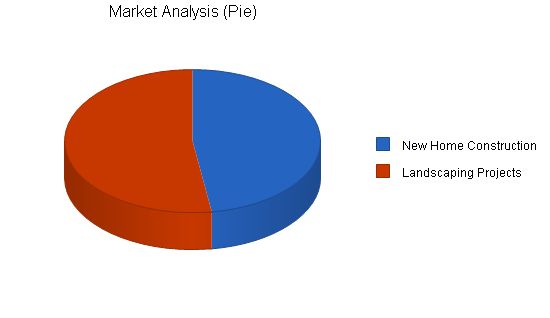

Market Segmentation

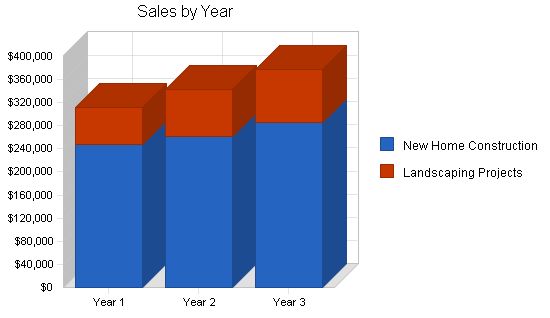

Hass Irrigation Systems will focus on two customer groups:

– New home construction

– Landscaping projects

Market Analysis

| Year | |||||||

| 1 | 2 | 3 | 4 | 5 | |||

| Potential Customers | Growth | CAGR | |||||

| New Home Construction | 7% | 2,000 | 2,140 | 2,290 | 2,450 | 2,622 | 7.00% |

| Landscaping Projects | 5% | 2,200 | 2,310 | 2,426 | 2,547 | 2,674 | 5.00% |

| Total | 5.97% | 4,200 | 4,450 | 4,716 | 4,997 | 5,296 | 5.97% |

4.2 Service Business Analysis

The market for irrigation contracting services is very competitive. Among these, only five are competing for work in the Lake Charles area. These are small businesses with less than four full-time employees, except for J. Dodd Irrigation Services that has a staff of eight. Hass Irrigation Systems’ current niche is its strong relationship with Bentwood Custom Homes, Greenridge Homes, and Landmark Homes.

Andrew Hass’s unique landscaping program and protocols will also be a critical advantage in building Hass Irrigation Systems’ customer base.

Strategy and Implementation Summary

Hass Irrigation Systems’ strategy is simple and ambitious. First, build its base with new home construction that is planned in the Lake Charles area. From this secure footing, Hass Irrigation Systems will begin to market to new customers.

5.1 Competitive Edge

Andrew Hass’ reputation for quality work and excellent customer skills has been a hallmark of his work history in irrigation. Starting his own company is just another step in his quest to deliver services to customers that were second to none.

Andrew began his career in landscaping in 1985 with Burke Landscaping as a member of the installation crew. Within three years, Andrew was a Project Install Foreman. He held this position with Burke Landscaping for five years. His next position was with De Spain Irrigation. His initial position was Project Install Foreman but he was soon promoted to Field Operations Manager. In this position, Andrew began to develop his own program and protocols to improve irrigation services. Over the next five years, De Spain grew to become one of the biggest irrigation/landscaping businesses in Monroe.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis

5.2 Sales Strategy

For the first two months of operation, Hass Irrigation will focus on subcontract work with local builders. During that time period, we will be marketing our services to existing homeowners in the Lake Charles section.

We estimate that with current staff, Hass Irrigation can install up to six irrigation systems a month. Each system will, on average, generate $5,000 in sales. In most cases, the new irrigation system will be in place within 15 days of the order being finalized.

5.2.1 Sales Forecast

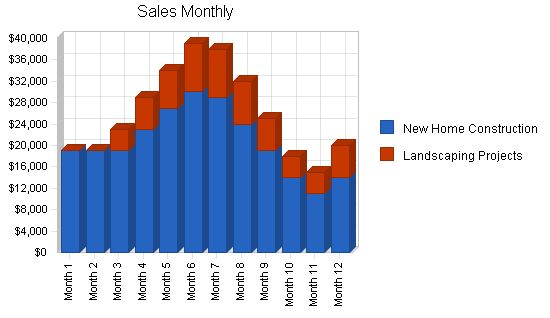

The following table will outline Hass Irrigation Systems sales forecast data.

Sales Forecast

Sales

New Home Construction

$248,000

$262,000

$285,000

Landscaping Projects

$63,000

$81,000

$93,000

Total Sales

$311,000

$343,000

$378,000

Direct Cost of Sales

New Home Construction

$68,600

$73,000

$80,000

Landscaping Projects

$18,400

$22,000

$21,000

Subtotal Direct Cost of Sales

$87,000

$95,000

$101,000

Management Summary

Andrew Hass will manage the daily operations of Hass Irrigation Systems.

6.1 Personnel Plan

Hass Irrigation Systems will have a staff of four.

Personnel Plan

Andrew Hass

$30,000

$34,000

$42,000

Irrigation Crew Members (3)

$90,000

$102,000

$124,000

Total People

0

0

0

Total Payroll

$120,000

$136,000

$166,000

The following is the financial plan for Hass Irrigation Systems.

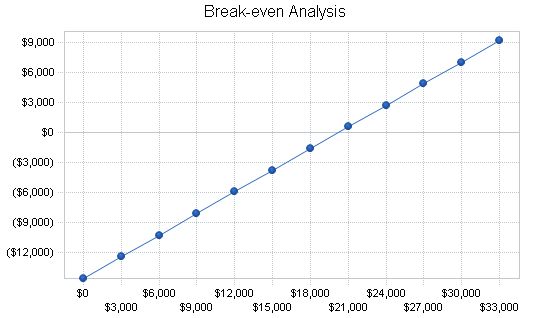

The monthly break-even point is shown below, taking into account monthly running costs.

Break-even Analysis

Monthly Revenue Break-even: $20,211

Assumptions:

Average Percent Variable Cost: 28%

Estimated Monthly Fixed Cost: $14,557

7.2 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 4971, Irrigation Systems, are shown for comparison.

The following is an explanation of the plans divergence with industry ratio profile.

Sales Growth and Profit Before Interest and Taxes will be double the industry average due to increased housing development in the Lake Charles area over the next five years.

Short-term Assets are higher than average due to the size of our start-up inventory.

Long Term Assets are below the industry average but will be more in-line after additional equipment is purchased, planned for the fourth year of operation.

Long Term Liabilities and Expense of Sales are higher than the industry average due to the start-up loan and the maintenance of a year-round staff.

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 10.29% 10.20% 4.70%

Percent of Total Assets

Accounts Receivable 18.84% 17.96% 18.26% 11.20%

Inventory 4.64% 4.38% 4.30% 1.40%

Other Current Assets 0.00% 0.00% 0.00% 36.30%

Total Current Assets 66.72% 73.93% 78.43% 48.90%

Long-term Assets 33.28% 26.07% 21.57% 51.10%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 8.57% 9.01% 8.87% 26.90%

Long-term Liabilities 65.52% 50.34% 40.65% 22.20%

Total Liabilities 74.09% 59.36% 49.52% 49.10%

Net Worth 25.91% 40.64% 50.48% 50.90%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 72.03% 72.30% 73.28% 64.10%

Selling, General & Administrative Expenses 63.05% 63.85% 67.37% 45.40%

Advertising Expenses 3.86% 4.37% 4.76% 0.20%

Profit Before Interest and Taxes 15.86% 14.55% 10.43% 5.20%

Main Ratios

Current 7.79 8.20 8.84 1.79

Quick 7.24 7.71 8.36 1.44

Total Debt to Total Assets 74.09% 59.36% 49.52% 49.10%

Pre-tax Return on Net Worth 111.96% 64.12% 36.71% 4.70%

Pre-tax Return on Assets 29.01% 26.06% 18.53% 9.30%

Additional Ratios

Year 1 Year 2 Year 3

Net Profit Margin 8.97% 8.45% 5.91%

Return on Equity 78.37% 44.88% 25.70%

Activity Ratios

Accounts Receivable Turnover 9.01 9.01 9.01

Collection Days 58 39 39

Inventory Turnover 6.00 14.24 14.05

Accounts Payable Turnover 10.64 12.17 12.17

Payment Days 27 27 29

Total Asset Turnover 2.26 2.16 2.19

Debt Ratios

Debt to Net Worth 2.86 1.46 0.98

Current Liab. to Liab. 0.12 0.15 0.18

Liquidity Ratios

Net Working Capital $79,888 $103,167 $119,795

Interest Coverage 5.21 5.87 5.25

Additional Ratios

Assets to Sales 0.44 0.46 0.46

Current Debt/Total Assets 9% 9% 9%

Acid Test 5.05 5.72 6.30

Sales/Net Worth 8.74 5.31 4.35

Dividend Payout 0.00 0.00 0.00

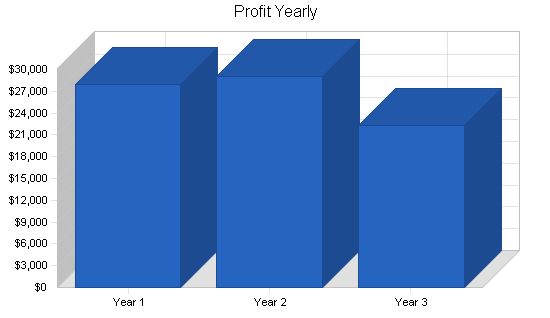

7.3 Projected Profit and Loss

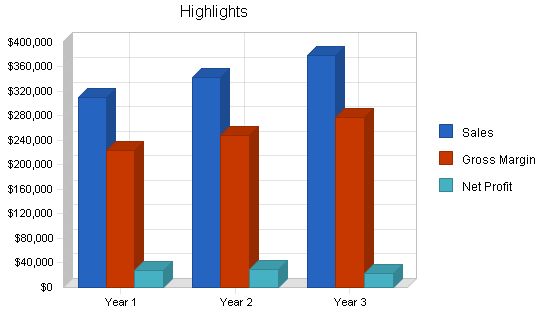

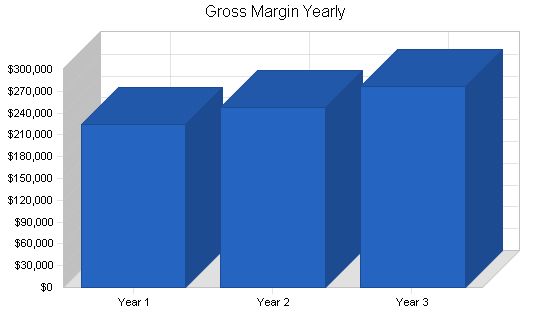

The following table and chart highlight the projected profit and loss for three years.

Table: Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $311,000 $343,000 $378,000

Direct Cost of Sales $87,000 $95,000 $101,000

Other Production Expenses $0 $0 $0

Total Cost of Sales $87,000 $95,000 $101,000

Gross Margin $224,000 $248,000 $277,000

Gross Margin % 72.03% 72.30% 73.28%

Expenses

Payroll $120,000 $136,000 $166,000

Sales and Marketing and Other Expenses $18,000 $23,000 $28,000

Depreciation $4,284 $4,284 $4,284

Leased Equipment $0 $0 $0

Utilities $2,400 $2,400 $2,400

Insurance $0 $0 $0

Rent $12,000 $12,000 $12,000

Payroll Taxes $18,000 $20,400 $24,900

Other $0 $0 $0

Total Operating Expenses $174,684 $198,084 $237,584

Profit Before Interest and Taxes $49,316 $49,916 $39,416

EBITDA $53,600 $54,200 $43,700

Interest Expense $9,459 $8,501 $7,501

Taxes Incurred $11,957 $12,425 $9,575

Net Profit $27,900 $28,991 $22,341

Net Profit/Sales 8.97% 8.45% 5.91%

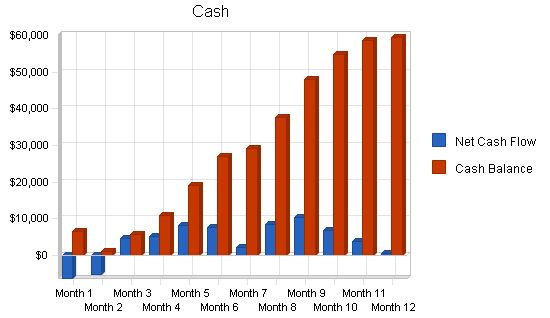

Projected Cash Flow

The following is the projected cash flow for three years.

Pro Forma Cash Flow Review:

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $77,750 $85,750 $94,500

Cash from Receivables $207,375 $254,588 $280,588

Subtotal Cash from Operations $285,125 $340,338 $375,088

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $5,000 $0 $0

Subtotal Cash Received $290,125 $340,338 $375,088

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $120,000 $136,000 $166,000

Bill Payments $113,424 $171,757 $184,870

Subtotal Spent on Operations $233,424 $307,757 $350,870

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $9,996 $9,996 $9,996

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $243,420 $317,753 $360,866

Net Cash Flow $46,705 $22,585 $14,222

Cash Balance $59,405 $81,990 $96,212

7.5 Projected Balance Sheet

The projected balance sheet for three years is as follows:

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $59,405 $81,990 $96,212

Accounts Receivable $25,875 $28,537 $31,449

Inventory $6,380 $6,967 $7,407

Other Current Assets $0 $0 $0

Total Current Assets $91,660 $117,494 $135,068

Long-term Assets

Long-term Assets $50,000 $50,000 $50,000

Accumulated Depreciation $4,284 $8,568 $12,852

Total Long-term Assets $45,716 $41,432 $37,148

Total Assets $137,376 $158,926 $172,216

Liabilities and Capital

Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $11,772 $14,327 $15,273

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $11,772 $14,327 $15,273

Long-term Liabilities $90,004 $80,008 $70,012

Total Liabilities $101,776 $94,335 $85,285

Paid-in Capital $65,000 $65,000 $65,000

Retained Earnings ($57,300) ($29,400) ($409)

Earnings $27,900 $28,991 $22,341

Total Capital $35,600 $64,591 $86,931

Total Liabilities and Capital $137,376 $158,926 $172,216

Net Worth $35,600 $64,591 $86,931

Appendix

Sales Forecast

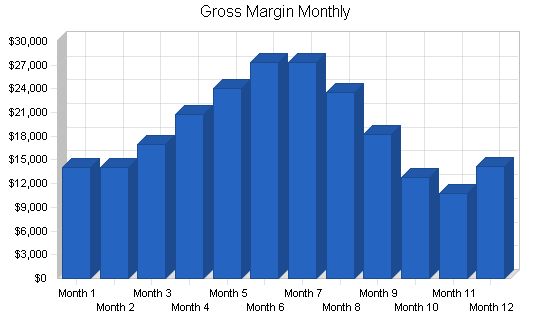

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales

New Home Construction $19,000 $19,000 $19,000 $23,000 $27,000 $30,000 $29,000 $24,000 $19,000 $14,000 $11,000 $14,000

Landscaping Projects $0 $0 $4,000 $6,000 $7,000 $9,000 $9,000 $8,000 $6,000 $4,000 $4,000 $6,000

Total Sales $19,000 $19,000 $23,000 $29,000 $34,000 $39,000 $38,000 $32,000 $25,000 $18,000 $15,000 $20,000

Direct Cost of Sales

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

New Home Construction $5,000 $5,000 $5,000 $6,400 $7,800 $9,000 $8,000 $6,400 $5,000 $4,000 $3,000 $4,000

Landscaping Projects $0 $0 $1,000 $1,800 $2,200 $2,700 $2,700 $2,000 $1,800 $1,200 $1,200 $1,800

Subtotal Direct Cost of Sales $5,000 $5,000 $6,000 $8,200 $10,000 $11,700 $10,700 $8,400 $6,800 $5,200 $4,200 $5,800

Personnel Plan

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Andrew Hass $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500

Irrigation Crew Members (3) $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500

Total People 0 0 0 0 0 0 0 0 0 0 0 0

Total Payroll $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000

General Assumptions

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $19,000 | $19,000 | $23,000 | $29,000 | $34,000 | $39,000 | $38,000 | $32,000 | $25,000 | $18,000 | $15,000 | $20,000 | |

| Direct Cost of Sales | $5,000 | $5,000 | $6,000 | $8,200 | $10,000 | $11,700 | $10,700 | $8,400 | $6,800 | $5,200 | $4,200 | $5,800 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $5,000 | $5,000 | $6,000 | $8,200 | $10,000 | $11,700 | $10,700 | $8,400 | $6,800 | $5,200 | $4,200 | $5,800 | |

| Gross Margin | $14,000 | $14,000 | $17,000 | $20,800 | $24,000 | $27,300 | $27,300 | $23,600 | $18,200 | $12,800 | $10,800 | $14,200 | |

| Gross Margin % | 73.68% | 73.68% | 73.91% | 71.72% | 70.59% | 70.00% | 71.84% | 73.75% | 72.80% | 71.11% | 72.00% | 71.00% | |

| Expenses | |||||||||||||

| Payroll | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Sales and Marketing and Other Expenses | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |

| Depreciation | $357 | $357 | $357 | $357 | $357 | $357 | $357 | $357 | $357 | $357 | $357 | $357 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Insurance | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Rent | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | |

| Payroll Taxes | 15% | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | |

| Profit Before Interest and Taxes | ($557) | ($557) | $2,443 | $6,243 | $9,443 | $12,743 | $12,743 | $9,043 | $3,643 | ($1,757) | ($3,757) | ($357) | |

| EBITDA | ($200) | ($200) | $2,800 | $6,600 | $9,800 | $13,100 | $13,100 | $9,400 | $4,000 | ($1,400) | ($3,400) | $0 | |

| Interest Expense | $826 | $819 | $813 | $806 | $799 | $792 | $785 | $778 | $771 | $764 | $757 | $750 | |

| Taxes Incurred | ($415) | ($413) | $489 | $1,631 | $2,593 | $3,585 | $3,587 | $2,480 | $862 | ($756) | ($1,354) | ($332) | |

| Net Profit | ($968) | ($964) | $1,141 | $3,806 | $6,051 | $8,366 | $8,371 | $5,786 | $2,010 | ($1,765) | ($3,160) | ($775) | |

| Net Profit/Sales | -5.10% | -5.07% | 4.96% | 13.12% | 17.80% | 21.45% | 22.03% | 18.08% | 8.04% | -9.80% | -21.07% | -3.87% | |

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $4,750 | $4,750 | $5,750 | $7,250 | $8,500 | $9,750 | $9,500 | $8,000 | $6,250 | $4,500 | $3,750 | $5,000 | |

| Cash from Receivables | $0 | $475 | $14,250 | $14,350 | $17,400 | $21,875 | $25,625 | $29,225 | $28,350 | $23,825 | $18,575 | $13,425 | |

| Subtotal Cash from Operations | $4,750 | $5,225 | $20,000 | $21,600 | $25,900 | $31,625 | $35,125 | $37,225 | $34,600 | $28,325 | $22,325 | $18,425 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | ||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!