Children’s Play Program Business Plan

Bees’ Circus is a children’s play and music program that offers parent/child programs for the physical, emotional, and social development of children. We have eight different weekly classes for children newborn through four years, designed to improve balance, coordination, and sensory stimuli while reinforcing good social skills in a group play environment. Bees’ Circus also offers music classes for children 16 months through four years, providing an introduction to different musical beats and rhythms, including jazz, contemporary, and classical tunes. Activities such as instrument exploration, songs, and movement to music create a positive musical experience for parents and young children.

Bees’ Circus is the only program of its kind in the city of Monroe. While the city does offer some classes for children through their parks and recreation department, they do not provide a comprehensive growth program for pre-schoolers.

Located in the new commercial center serving the affluent northwest area of Monroe, Bees’ Circus benefits from the significant housing growth in the area. Over the past five years, 3,500 new housing units have been built to accommodate the city’s population growth, mostly by young families with children. Currently, there is no park program in the area, but it is expected that a new park will be created within the next three years to serve the estimated 10,000 families.

Barbara Miller, co-owner of Bees’ Circus, brings over 20 years of education experience and has played a pivotal role in developing Monroe’s pre-school programs. Bees’ Circus aims to provide parents and children with a nurturing environment for spending quality time together and playing.

Bees’ Circus is dedicated to promoting the physical, emotional, and social development of children, with parents playing a crucial role in their activities. By immersing themselves in their child’s world of play and imagination, parents can help their children grow in confidence, explore, and learn. This not only contributes to healthy emotional development but also builds trust between parent and child.

The objectives of Bees’ Circus are as follows:

– Fill classes to 70% capacity by the end of the first year.

– Retain at least 50% of children moving from one class level to the next.

– Increase the number of participating families by 15% in the second year.

Bees’ Circus is a limited partnership offering a range of parent/child programs focused on the physical, emotional, and social development of children. Barbara Miller manages the daily operations, with oversight responsibilities provided by a silent partner.

Located in the Northtowne Center at 3456 Briggs Road, Bees’ Circus occupies a 7,000 square feet facility that includes a music room and party room. The space can accommodate up to 40 children simultaneously.

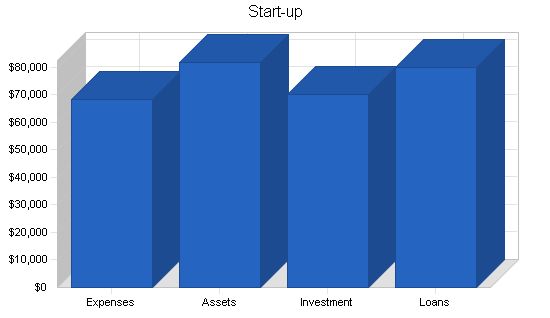

The start-up expenses for Bees’ Circus primarily cover equipment, play surfaces, and materials needed for classes. Barbara Miller and the silent partner will each invest equal amounts, with Barbara obtaining a long-term loan and using credit card debt to secure additional funding.

Start-up

Requirements

Start-up Expenses

Legal: $1,000

Stationery etc.: $200

Brochures: $1,000

Consultants: $3,000

Insurance: $1,000

Rent: $2,000

Expensed Equipment: $60,000

Total Start-up Expenses: $68,200

Start-up Assets

Cash Required: $51,800

Other Current Assets: $0

Long-term Assets: $30,000

Total Assets: $81,800

Total Requirements: $150,000

Start-up Funding

Start-up Expenses to Fund: $68,200

Start-up Assets to Fund: $81,800

Total Funding Required: $150,000

Assets

Non-cash Assets from Start-up: $30,000

Cash Requirements from Start-up: $51,800

Additional Cash Raised: $0

Cash Balance on Starting Date: $51,800

Total Assets: $81,800

Liabilities and Capital

Liabilities

Current Borrowing: $30,000

Long-term Liabilities: $50,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $80,000

Capital

Planned Investment

Barbara Miller: $30,000

Investor 2: $40,000

Additional Investment Requirement: $0

Total Planned Investment: $70,000

Loss at Start-up (Start-up Expenses): ($68,200)

Total Capital: $1,800

Total Capital and Liabilities: $81,800

Total Funding: $150,000

2.2 Company Ownership

Bees’ Circus is owned by Barbara Miller and a silent partner.

Services

Bees’ Circus offers six weekly classes for children newborn through four years. Activities help children develop balance, coordination, and sensory stimuli in a group play environment.

Bees’ Circus also offers three music classes. Children 16 months through four years sing and move to different musical beats and rhythms. Teachers introduce new musical styles each week such as jazz, contemporary, and classical tunes. Activities like instrument exploration, songs, and movement provide a positive musical experience.

All classes last 45 minutes and are taught in small groups to child-parent pairs. The fee is $100 per class. Parents can choose two weekday sessions to attend each month.

NewBees (newborn) classes stimulate newborns’ learning skills with special toys, singing, and gentle play.

BabyBees (6 – 14 months) encourage curiosity and practice emerging skills through exploration, songs, movement activities, and play.

ToddlerBees (14 – 24 months) promote cause and effect, coordination, balance, and motor skill development. Activities build pre- and early walking skills and enhance emerging language.

RunningBees (24 -30 months) challenge a child’s body with slides, climbers, balls, and tunnels. Activities focus on language skills and social interaction.

BuzzingBees (30- 36 months) focus on themes like “Dinosaur Day,” “Under the Sea,” and “Forest Fun” through movement stories, puppetry, and songs. Playful exploration and imaginative play develop listening skills, body awareness, group interaction, and social development.

JumpingBees (37- 46 months) explore pre-sports and pre-gymnastic skills including kicking, throwing, and catching. Each class builds listening skills, coordination, cooperative play, and new friendships.

The music program has three levels.

HummingBees (16- 24 months) build a repertoire of songs that support awareness of melody, pitch, and rhythm. Children learn musical phrasing, rhythm, and musical rules through playful activities.

DrummingBees (25- 36 months) develop a sense of steady beat through lap rides, dancing, and instrument exploration. Activities explore pitch and tone through songs and listening.

SingingBees (37 – 48 months) encourage singing and making music through instrument exploration and group activities. Children build self-esteem, social skills, imagination, and listening skills.

Bees’ Circus also hosts birthday parties for children. Activities are led by a staff member, creating a memorable celebration.

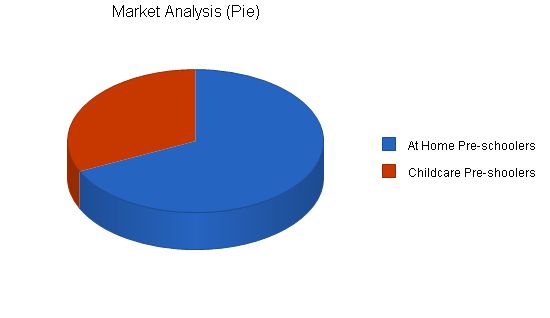

Market Analysis Summary

Over the past five years, housing growth in the affluent northwest area of the city has been significant. 3,500 new housing units have been built to accommodate the city’s population growth. Most of these units are being bought or rented by young families with young children.

Currently, there is no park program serving the area. A new park is anticipated to be created in the next three years to serve the estimated 10,000 families in the area.

The area has 15 private child care centers serving over 1,600 children aged one to four. There are approximately 5,000 children in northwest Monroe under the age of four.

There are currently no other activity or music programs in the area for preschoolers.

Bees’ Circus will target both children at home and children at private child care centers.

Market Segmentation

Bees’ Circus will focus on two target groups:

– At home preschoolers

– Childcare preschoolers

Market Analysis:

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

At Home Pre-schoolers 10% 3,400 3,740 4,114 4,525 4,978 10.00%

Childcare Pre-schoolers 20% 1,600 1,920 2,304 2,765 3,318 20.00%

Total 13.49% 5,000 5,660 6,418 7,290 8,296 13.49%

Strategy and Implementation Summary:

Bees’ Circus will start by sending direct mailings to parents of young children in northwest Monroe. The mailer will announce an open house invitation to visit the facility. In addition, Bees’ Circus will offer a 20% discount on its activity and music classes. Bees’ Circus will also offer a discounted group rate (20%) to the area’s announced centers.

Sales Strategy:

The sales strategy of Bees’ Circus will be to build from a base of satisfied customers. The program will offer a 20% discount on class fees for each successful referral to Bees’ Circus. We will also offer one session free visits for any parent and child interested in exploring our program.

To develop effective business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

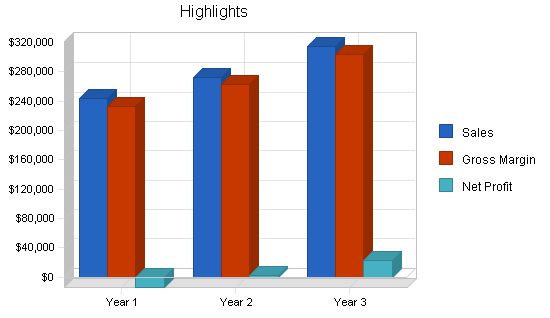

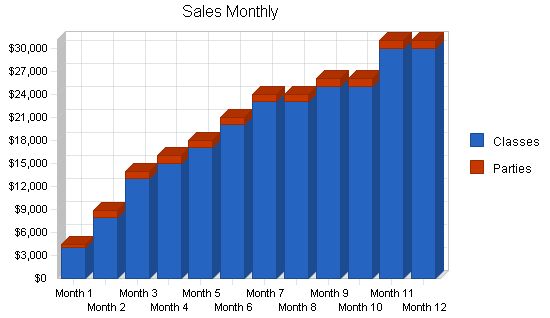

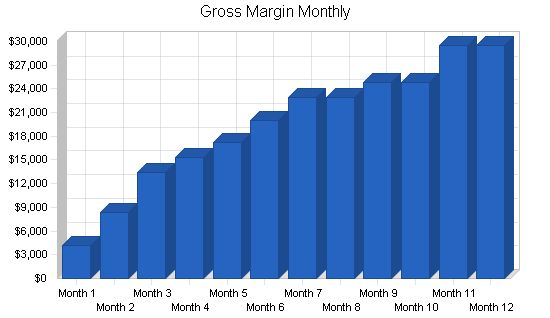

Bees’ Circus anticipates May will be a weak month for classes. Enrollment will increase steadily from June onwards. The following is the sales forecast for Bees’ Circus.

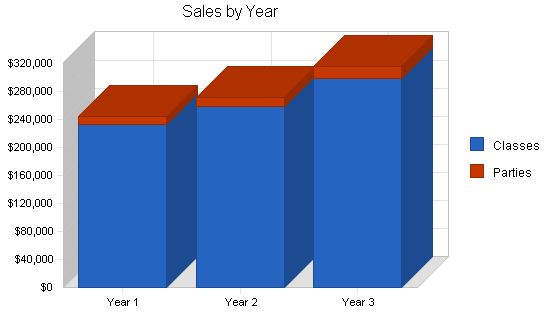

Sales Forecast:

Year 1 Year 2 Year 3

Sales

Classes $233,000 $258,000 $299,000

Parties $11,200 $14,000 $16,000

Total Sales $244,200 $272,000 $315,000

Direct Cost of Sales:

Year 1 Year 2 Year 3

Classes $11,500 $9,800 $11,300

Parties $0 $0 $0

Subtotal Direct Cost of Sales $11,500 $9,800 $11,300

Management Summary:

Barbara Miller, an educator for over 20 years and instrumental in the development of Monroe’s pre-school programs, will be the Director of the program. Recently, Barbara was the youth activity planner and coordinator for the city of Monroe’s park and recreation department, managing a team of ten that organized and scheduled all youth activity classes.

Personnel Plan:

Director Year 1 Year 2 Year 3

$36,000 $38,000 $40,000

Teachers Year 1 Year 2 Year 3

$90,000 $96,000 $102,000

Aides Year 1 Year 2 Year 3

$54,000 $57,000 $60,000

Total People 7 7 7

Total Payroll $180,000 $191,000 $202,000

The following is the financial plan for Bees’ Circus.

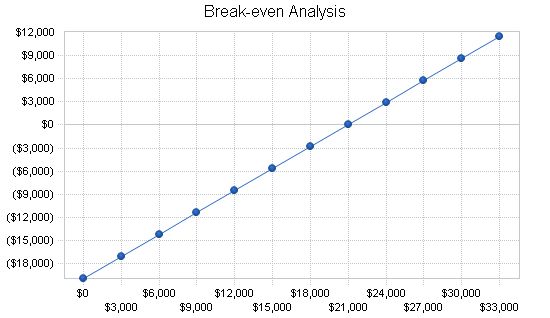

Break-even Analysis:

The monthly break-even point is presented in the following table and chart.

Break-even Analysis

Monthly Revenue Break-even: $20,918

Assumptions:

– Average Percent Variable Cost: 5%

– Estimated Monthly Fixed Cost: $19,933

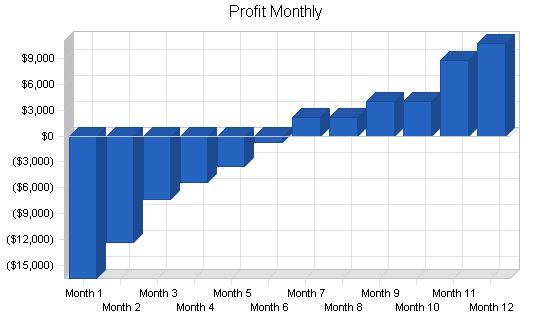

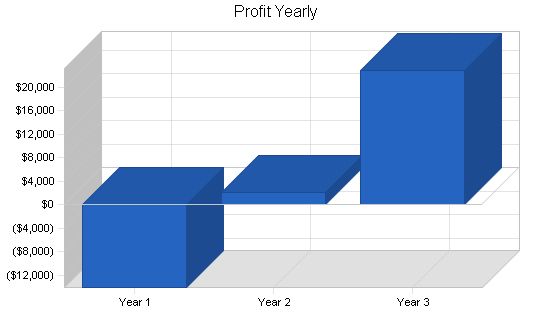

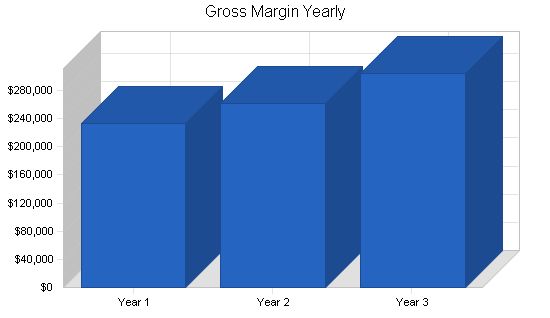

7.2 Projected Profit and Loss

The table and chart below display the projected profit and loss for three years.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $244,200 | $272,000 | $315,000 |

| Direct Cost of Sales | $11,500 | $9,800 | $11,300 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $11,500 | $9,800 | $11,300 |

| Gross Margin | $232,700 | $262,200 | $303,700 |

| Gross Margin % | 95.29% | 96.40% | 96.41% |

| Expenses | |||

| Payroll | $180,000 | $191,000 | $202,000 |

| Sales and Marketing and Other Expenses | $2,400 | $3,000 | $3,000 |

| Depreciation | $0 | $0 | $0 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $3,000 | $3,000 | $3,000 |

| Insurance | $4,800 | $4,800 | $4,800 |

| Rent | $22,000 | $22,000 | $22,000 |

| Payroll Taxes | $27,000 | $28,650 | $30,300 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $239,200 | $252,450 | $265,100 |

| Profit Before Interest and Taxes | ($6,500) | $9,750 | $38,600 |

| EBITDA | ($6,500) | $9,750 | $38,600 |

| Interest Expense | $7,549 | $6,751 | $5,918 |

| Taxes Incurred | $0 | $900 | $9,805 |

| Net Profit | ($14,049) | $2,099 | $22,877 |

| Net Profit/Sales | -5.75% | 0.77% | 7.26% |

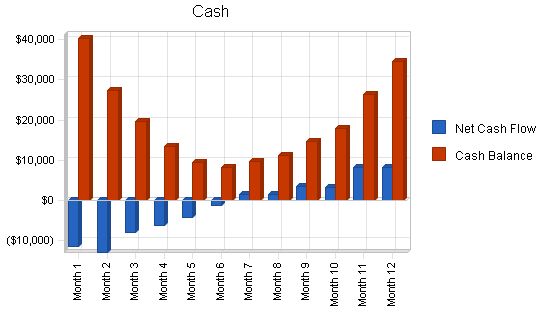

Projected Cash Flow:

Contents

7.3 Projected Cash Flow

The table and chart below show the projected cash flow for three years.

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $244,200 | $272,000 | $315,000 |

| Subtotal Cash from Operations | $244,200 | $272,000 | $315,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $244,200 | $272,000 | $315,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $180,000 | $191,000 | $202,000 |

| Bill Payments | $73,225 | $77,440 | $89,200 |

| Subtotal Spent on Operations | $253,225 | $268,440 | $291,200 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $8,328 | $8,328 | $8,328 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $261,553 | $276,768 | $299,528 |

| Net Cash Flow | ($17,353) | ($4,768) | $15,472 |

| Cash Balance | $34,447 | $29,680 | $45,151 |

Projected Balance Sheet:

7.4 Projected Balance Sheet

The following table highlights the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $34,447 | $29,680 | $45,151 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $34,447 | $29,680 | $45,151 |

| Long-term Assets | |||

| Long-term Assets | $30,000 | $30,000 | $30,000 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $30,000 | $30,000 | $30,000 |

| Total Assets | $64,447 | $59,680 | $75,151 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $5,024 | $6,485 | $7,407 |

| Current Borrowing | $30,000 | $30,000 | $30,000 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $35,024 | $36,485 | $37,407 |

| Long-term Liabilities | $41,672 | $33,344 | $25,016 |

| Total Liabilities | $76,696 | $69,829 | $62,423 |

| Paid-in Capital | $70,000 | $70,000 | $70,000 |

| Retained Earnings | ($68,200) | ($82,249) | ($80,149) |

| Earnings | ($14,049) | $2,099 | $22,877 |

| Total Capital | ($12,249) | ($10,149) | $12,728 |

| Total Liabilities and Capital | $64,447 | $59,680 | $75,151 |

| Net Worth | ($12,249) | ($10,149) | $12,728 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 8351, Child Day Care Services, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 11.38% | 15.81% | 9.50% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 26.80% |

| Total Current Assets | 53.45% | 49.73% | 60.08% | 44.70% |

| Long-term Assets | 46.55% | 50.27% | 39.92% | 55.30% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 54.35% | 61.13% | 49.78% | 31.80% |

| Long-term Liabilities | 64.66% | 55.87% | 33.29% | 31.00% |

| Total Liabilities | 119.01% | 117.01% | 83.06% | 62.80% |

| Net Worth | -19.01% | -17.01% | 16.94% | 37.20% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 95.29% | 96.40% | 96.41% | 0.00% |

| Selling, General & Administrative Expenses | 101.04% | 95.63% | 89.15% | 75.60% |

| Advertising Expenses | 0.98% | 1.10% | 0.95% | 0.70% |

| Profit Before Interest and Taxes | -2.66% | 3.58% | 12.25% | 2.60% |

| Main Ratios | ||||

| Current | 0.98 | 0.81 | 1.21 | 1.27 |

| Quick | 0.98 | 0.81 | 1.21 | 1.14 |

| Total Debt to Total Assets | 119.01% | 117.01% | 83.06% | 62.80% |

| Pre-tax Return on Net Worth | 114.70% | -29.55% | 256.77% | 5.40% |

| Pre-tax Return on Assets | -21.80% | 5.03% | 43.49% | 14.60% |

| Additional Ratios | ||||

| Net Profit Margin | -5.75% | 0.77% | 7.26% | n.a |

| Return on Equity | 0.00% | 0.00% | 179.74% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 15.57 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 27 | 28 | n.a |

| Total Asset Turnover | 3.79 | 4.56 | 4.19 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.00 | 0.00 | 4.90 | n.a |

| Current Liabilities to Liabilities | 0.46 | 0.52 | 0.60 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | ($577) | ($6,805) | $7,744 | n.a |

| Interest Coverage | ||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $4,400 | $8,800 | $14,000 | $16,000 | $18,000 | $21,000 | $24,000 | $24,000 | $26,000 | $26,000 | $31,000 | $31,000 | |

| Subtotal Cash from Operations | $4,400 | $8,800 | $14,000 | $16,000 | $18,000 | $21,000 | $24,000 | $24,000 | $26,000 | $26,000 | $31,000 | $31,000 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $4,400 | $8,800 | $14,000 | $16,000 | $18,000 | $21,000 | $24,000 | $24,000 | $26,000 | $26,000 | $31,000 | $31,000 |

Pro Forma Balance Sheet

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | |||||||||||||

| Current Assets | |||||||||||||

| Cash | $51,800 | $40,307 | $27,446 | $19,590 | $13,544 | $9,403 | $8,165 | $9,734 | $11,164 | $14,597 | $17,938 | $26,277 | $34,447 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $51,800 | $40,307 | $27,446 | $19,590 | $13,544 | $9,403 | $8,165 | $9,734 | $11,164 | $14,597 | $17,938 | $26,277 | $34,447 |

| Long-term Assets |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!