Bicycle Courier Business Plan

Two Wheeled Oracle is a bicycle courier service in Portland, Oregon, catering to law firms. The Oracle can transport documents and small parcels to clients, other law firms, and file documents with the clerk of courts. Law firms will be the primary customers, and while non-law firm customers will be served, they will not be targeted.

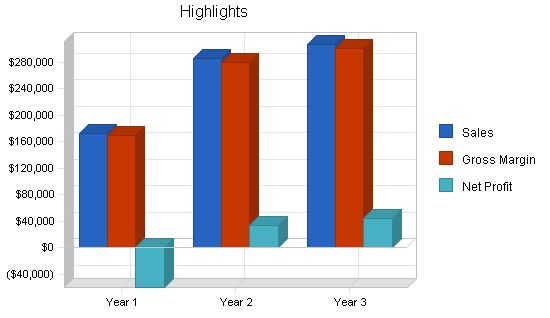

The Oracle will offer reliability and industry insight to law firms, providing superior service compared to current providers. This will enable the company to rapidly gain market share. Profitability will be reached by month nine, and revenue in year three will be comfortable.

1.1 Objectives

The objectives for the first three years of operation include:

- Create a service-based company that exceeds customer expectations.

- Utilize The Oracle for at least 30 different law firms.

- Increase the number of clients served by 20% per year through superior service.

- Develop a profitable start-up business within the first year.

1.2 Mission

Two Wheeled Oracle’s mission is to provide law firms with an environmentally friendly, expedient delivery service. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed customer expectations.

Company Summary

The Oracle is a bicycle courier service that serves downtown law firms in Portland, Oregon. The company offers document delivery to other law firms, clients, or court filings. The company provides both scheduled and spontaneous runs. The business will be profitable within nine months.

2.1 Company Ownership

The company will be an Oregon Corporation, owned entirely by Alwy Laate.

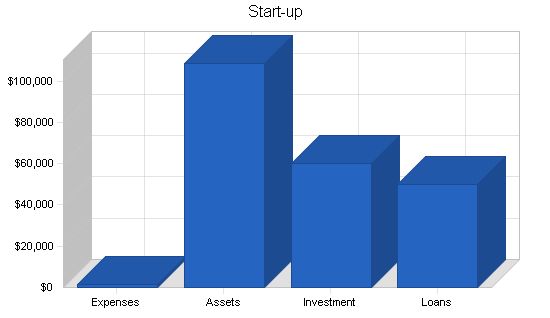

2.2 Start-up Summary

Two Wheeled Oracle will incur the following start-up costs:

- Office furniture: two desks, two chairs, and two file cabinets.

- Two computer systems: printer, CD-RW, and broadband Internet connection.

- Three phone lines.

- Fax machine and copier.

- Development of a website for online delivery orders received every five minutes.

- Legal fees for business incorporation.

- Brochures.

- Nextel cellular phones for communication between mobile units and the base. Nine handsets will be needed initially.

- Messenger bags with company logo.

Start-up Funding

Start-up Expenses to Fund: $1,300

Start-up Assets to Fund: $108,700

Total Funding Required: $110,000

Assets

Non-cash Assets from Start-up: $7,500

Cash Requirements from Start-up: $101,200

Additional Cash Raised: $0

Cash Balance on Starting Date: $101,200

Total Assets: $108,700

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $50,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $50,000

Capital

Planned Investment

Alwy: $60,000

Investor 2: $0

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $60,000

Loss at Start-up (Start-up Expenses): ($1,300)

Total Capital: $58,700

Total Capital and Liabilities: $108,700

Total Funding: $110,000

Start-up Requirements

Start-up Expenses

Legal: $1,000

Stationery etc.: $150

Brochures: $150

Consultants: $0

Insurance: $0

Rent: $0

Research and development: $0

Expensed equipment: $0

Other: $0

Total Start-up Expenses: $1,300

Start-up Assets

Cash Required: $101,200

Other Current Assets: $0

Long-term Assets: $7,500

Total Assets: $108,700

Total Requirements: $110,000

Services

Two Wheeled Oracle will provide a bicycle messenger service that targets law firms. The service can be used to serve notice on a lawsuit, transport documents to a client or opposing counsel, or file a document with the court clerk. In addition to responding to immediate calls for delivery, The Oracle will set up a subscription basis with law firms for daily pick-up to file documents with the court clerk.

Although The Oracle will target law firms, the company will accept jobs from other companies/individuals that require a messenger service in downtown Portland, these jobs will be accepted but not solicited. The messenger service offers delivery times ranging from one to three hours.

In addition to document delivery, small packages can be delivered. It is rare that a law firm needs to deliver packages, so this will generally apply to the ancillary business. The maximum dimensions for package delivery are 12x8x8.

Market Analysis Summary

The Oracle will primarily be serving Portland-based law firms. This is a particularly attractive segment because law firms have a constant need for delivery services. Most firms are sending things consistently during the day. The Oracle will be able to set up contracts with firms to provide multiple scheduled pick-ups each day.

The Oracle will also serve non law firm customers who are in need of a courier service. In addition to documents, the company can transport small parcels.

As a former practicing attorney, Alwy will be able to leverage his vast industry knowledge as well as his network of colleagues to gain market share.

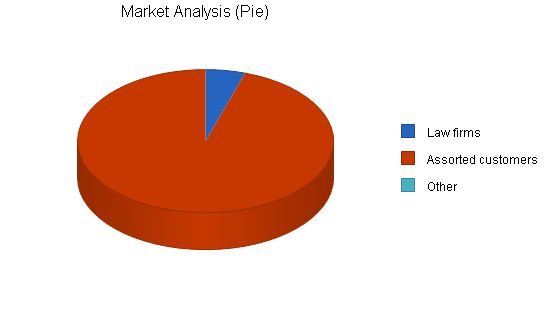

4.1 Market Segmentation

Two Wheeled Oracle will service two distinct groups. The first group is the main group of customers: law firms. This will be the group that is targeted primarily. Law firms are constantly in need of document delivery, whether it is to clients, other law firms, or to the court. This regularity of needed delivery is the reason that law firms are targeted. Once a law firm has become a satisfied customer, it is likely that they will begin to increase their delivery needs. This then becomes a steady, high frequency, long-term customer. Law firms have constant delivery activity, many firms require pick-ups throughout the day and require dependability, which is one of The Oracle’s competitive advantages.

The second customer group is assorted deliveries needed in the city. This could come from a wide variety of businesses that require delivery within the city.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Law firms 9% 287 313 341 372 405 8.99%

Assorted customers 6% 5,487 5,816 6,165 6,535 6,927 6.00%

Other 0% 0 0 0 0 0 0.00%

Total 6.15% 5,774 6,129 6,506 6,907 7,332 6.15%

4.2 Target Market Segment Strategy

The Oracle will target its market through channels that all law firms typically see. The first is the Oregon Bar Journal. Advertisements will be placed in the journal to increase visibility of The Oracle. Additionally, there will be a yellow pages advertisement and brochures passed out.

This market will also be targeted through a networking scheme based on Alwy’s contacts as a practicing attorney. Although Alwy no longer practices, he maintains membership on several bar committees. Through his activity on the bar, as well as contact made during his practice, Alwy will leverage his network to create initial clients. This will not be difficult because a trust bond has already been formed with many attorneys, and these attorneys will recognize that Alwy is keenly aware of the needs of attorneys in regards to delivery services. Because Alwy is aware of the attorney’s perspective, it will be easy for him to gain the trust of his former colleagues and sign them up as clients.

4.3 Service Business Analysis

There are approximately 20 different delivery services in the Portland area, a quarter of these are taxi services that also make deliveries. The rest are courier or messenger services. Some use cars and a few use bicycles as the means of transportation. In general, the bicycle messengers are less expensive because they have lower overhead. In downtown, the bicycle messengers can be as fast or faster than the car-based courier services because of the automobile traffic.

There are five different companies that target law firms by catering to their special needs. All of these are car-based services.

The buying habits of law firms are based on price, convenience, and reliability.

Strategy and Implementation Summary

The Oracle’s strategy for gaining market share will be based on its competitive advantages: reliability and industry knowledge. Reliability is very important to law firms and will make The Oracle attractive. Additionally, Alwy’s industry knowledge will be helpful in convincing firms to try this company because it understands and caters to law firm’s needs.

Portland has been chosen as the headquarters for this service because it is an environmentally-friendly city. The citizens are interested in environmental health and are welcoming to new businesses with the same doctrine. The Oracle is proud to be a messenger service on bikes and to help keep the environment safe and healthy in Oregon.

5.1 Competitive Edge

The Oracle has two competitive edges: reliability and industry insight. Reliability is very important to law firms, which require reliability of delivery. The Oracle achieves reliability through a redundant back-up system that provides an alternative method of delivery if the specific bicycle messenger encounters difficulty. By having a back-up system, the company ensures that even if the primary messenger fails, there is a back-up ready to complete the delivery.

The second competitive advantage is industry insight. It is a true advantage for Alwy to have worked as an attorney for several years. This work gave him industry insight that is not replicable without actually doing the work. The insight is valuable because Alwy knows intimately what attorneys need in regards to document delivery. While other companies will gain some insight by serving the attorney market over time, it will not compare in breadth to Alwy’s.

To develop good business strategies, perform a SWOT analysis of your business.

5.2 Sales Strategy

Two Wheeled Oracle recognizes that it is difficult to break into many law firms and displace their current service provider and will offer a 20% discount for a month’s worth of services. While this is a bit of a hit in terms of profitability, it is only a short-term concern. The long-term gain is securing a repeat customer.

In addition to this economic incentive, The Oracle will employ Alwy’s powers of persuasion when speaking with prospective clients and firms. He will directly target the company’s reliability and fool-proof back-up systems, as well as impress his recognition of the needs of his clients based on his own years of practicing law. He will use these two features to attract new clientele.

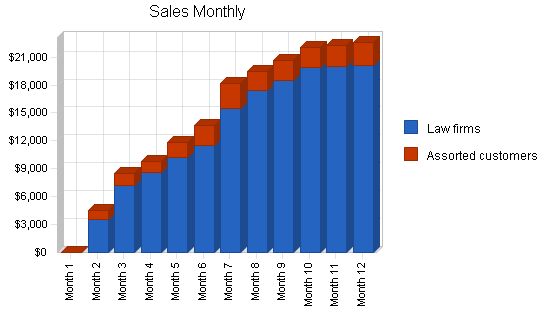

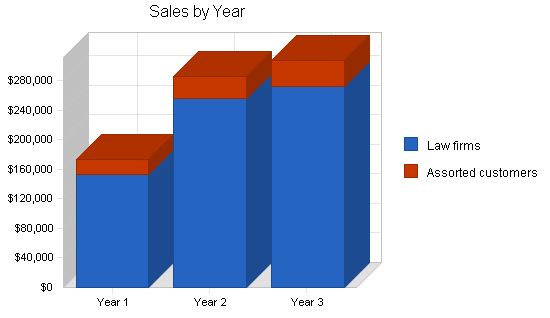

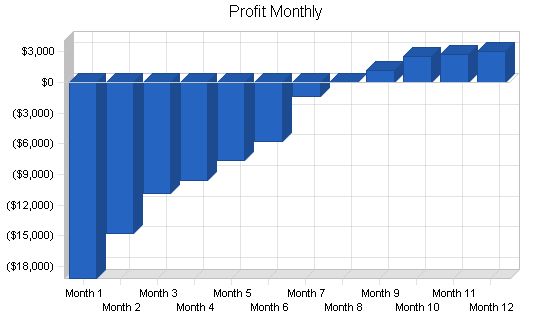

5.2.1 Sales Forecast

The first month will be used to set up the office, hire and train messengers. The second month will begin to see some sales activity. Sales will ramp up from the third month onwards. There will be an incremental increase each month as more and more firms become aware of the company’s services.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Law firms | $152,459 | $255,458 | $271,554 |

| Assorted customers | $20,841 | $30,254 | $35,125 |

| Total Sales | $173,300 | $285,712 | $306,679 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Law firms | $3,049 | $5,109 | $5,431 |

| Assorted customers | $417 | $605 | $703 |

| Subtotal Direct Cost of Sales | $3,466 | $5,714 | $6,134 |

5.3 Milestones

The Oracle will have several milestones early on:

- Business plan completion. This will be done as a roadmap for the organization. While we do not need a business plan to raise capital, it will be an indispensable tool for the ongoing performance and improvement of the company.

- Set up office.

- Hire and train staff.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 2/1/2001 | $0 | Laate | Owner |

| Set up office | 1/1/2001 | 2/1/2001 | $0 | Laate | Owner |

| Hire and train staff | 1/1/2001 | 2/1/2001 | $0 | Laate | Owner |

| Totals | $0 | ||||

Management Summary

Alwy Laate, the founder and owner received his bachelor’s degree in philosophy from Washington & Jefferson College. During the summers, Alwy worked for a bicycle messenger service in Pittsburgh. Upon graduation, Alwy managed a bicycle shop, pursuing his interest in the bicycling industry. After two years of work in the bicycle industry, Alwy was no longer challenged. In addition to a lack of challenge, Alwy was pressured by his parents to achieve a graduate education. Alwy took the LSAT’s and moved to Oregon for Law School.

During his first year of law school, Alwy was interested in law but unsure about practicing it. He heard about the joint degree program that added an extra year to school and included an MBA. Intrigued, Alwy entered the joint degree program. Alwy graduated with a JD/MBA and had to figure out his next steps. Alwy was intrigued by public interest law, so he worked for a large firm in Portland that allowed associates to bill 20% of their required hours to pro bono causes. Alwy chose environmental organizations.

After three years of practicing law, Alwy decided to find a job that he found enjoyable. He brainstormed a way to combine his business skills from his MBA, networking contacts from his law practice, and his love of cycling. The business model of the Two Wheeled Oracle came to him, and the rest is history.

6.1 Personnel Plan

The Oracle will consist of Alwy completing HR functions, marketing functions, and general business management. The company will hire a full-time dispatcher and eight bicycle messengers. While bicycle messengers may leave, they can be quickly and cheaply replaced due to the fast training process.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Alwy Laate | $36,000 | $42,000 | $48,000 |

| Dispatcher | $20,400 | $20,400 | $20,400 |

| Messenger | $17,280 | $17,280 | $17,280 |

| Messenger | $17,280 | $17,280 | $17,280 |

| Messenger | $17,280 | $17,280 | $17,280 |

| Messenger | $17,280 | $17,280 | $17,280 |

| Messenger | $17,280 | $17,280 | $17,280 |

| Messenger | $17,280 | $17,280 | $17,280 |

| Messenger | $17,280 | $17,280 | $17,280 |

| Total People | 0 | 0 | 0 |

| Total Payroll | $177,360 | $183,360 | $189,360 |

Financial Plan

The following sections outline the important financial data.

7.1 Important Assumptions

The table below details important financial assumptions for The Oracle.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

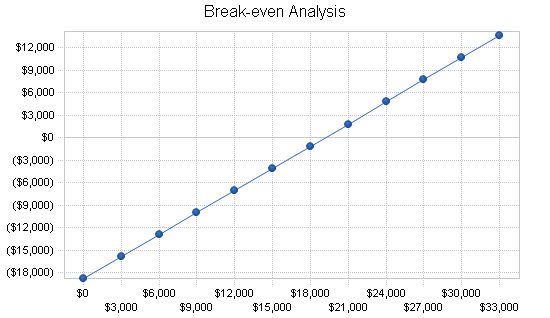

7.2 Break-even Analysis

The Break-even Analysis indicates what The Oracle needs to achieve in monthly revenue to reach their break-even point.

| Break-even Analysis | |

| Monthly Revenue Break-even | $19,155 |

| Assumptions: | |

| Average Percent Variable Cost | 2% |

| Estimated Monthly Fixed Cost | $18,772 |

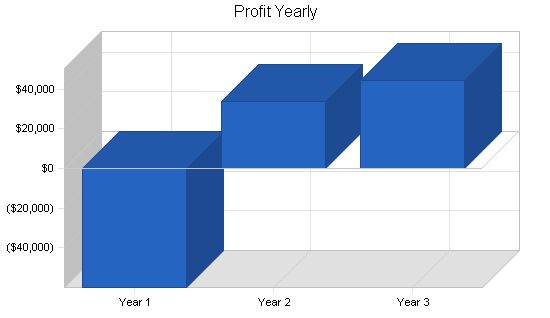

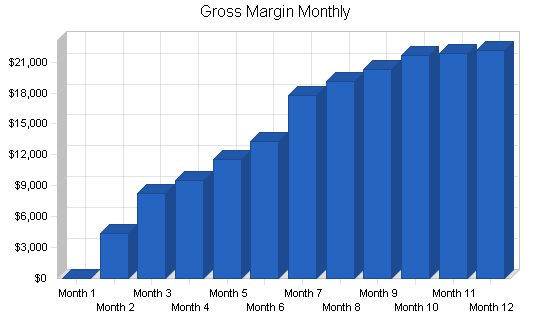

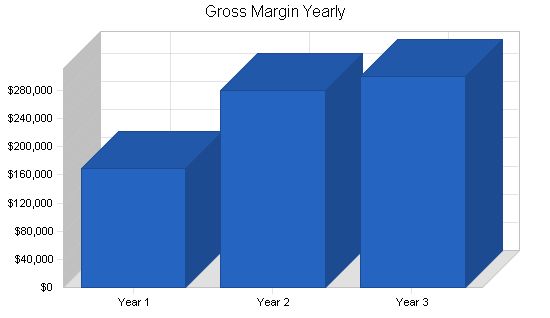

7.3 Projected Profit and Loss

The table below shows projected profit and loss.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $173,300 | $285,712 | $306,679 |

| Direct Cost of Sales | $3,466 | $5,714 | $6,134 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $3,466 | $5,714 | $6,134 |

| Gross Margin | $169,834 | $279,998 | $300,545 |

| Gross Margin % | 98.00% | 98.00% | 98.00% |

| Expenses | |||

| Payroll | $177,360 | $183,360 | $189,360 |

| Sales and Marketing and Other Expenses | $3,000 | $3,000 | $3,000 |

| Depreciation | $1,500 | $1,500 | $1,500 |

| Cellular service | $4,200 | $4,200 | $4,200 |

| Utilities | $1,200 | $1,200 | $1,200 |

| Insurance | $1,800 | $1,800 | $1,800 |

| Rent | $9,600 | $9,000 | $9,000 |

| Payroll Taxes | $26,604 | $27,504 | $28,404 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $225,264 | $231,564 | $238,464 |

| Profit Before Interest and Taxes | ($55,430) | $48,434 | $62,081 |

| EBITDA | ($53,930) | $49,934 | $63,581 |

| Interest Expense | $4,517 | $3,596 | $2,546 |

| Taxes Incurred | $0 | $11,210 | $15,132 |

| Net Profit | ($59,947) | $33,629 | $44,404 |

| Net Profit/Sales | -34.59% | 11.77% | 14.48% |

Projected Cash Flow

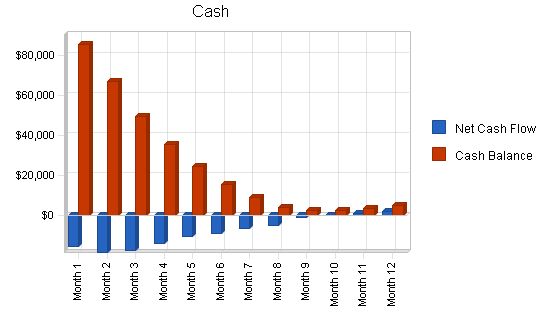

7.4 Projected Cash Flow

The following chart and table will indicate projected cash flow.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $43,325 | $71,428 | $76,670 |

| Cash from Receivables | $96,883 | $192,819 | $226,006 |

| Subtotal Cash from Operations | $140,208 | $264,247 | $302,675 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $140,208 | $264,247 | $302,675 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $177,360 | $183,360 | $189,360 |

| Bill Payments | $49,882 | $66,203 | $71,071 |

| Subtotal Spent on Operations | $227,242 | $249,563 | $260,431 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $9,055 | $9,976 | $11,026 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $236,297 | $259,539 | $271,457 |

| Net Cash Flow | ($96,089) | $4,707 | $31,218 |

| Cash Balance | $5,111 | $9,818 | $41,036 |

7.5 Projected Balance Sheet

The following table indicates the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $5,111 | $9,818 | $41,036 |

| Accounts Receivable | $33,092 | $54,557 | $58,561 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $38,203 | $64,375 | $99,597 |

| Long-term Assets | |||

| Long-term Assets | $7,500 | $7,500 | $7,500 |

| Accumulated Depreciation | $1,500 | $3,000 | $4,500 |

| Total Long-term Assets | $6,000 | $4,500 | $3,000 |

| Total Assets | $44,203 | $68,875 | $102,597 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $4,505 | $5,525 | $5,870 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $4,505 | $5,525 | $5,870 |

| Long-term Liabilities | $40,945 | $30,969 | $19,942 |

| Total Liabilities | $45,450 | $36,494 | $25,812 |

| Paid-in Capital | $60,000 | $60,000 | $60,000 |

| Retained Earnings | ($1,300) | ($61,247) | ($27,618) |

| Earnings | ($59,947) | $33,629 | $44,404 |

| Total Capital | ($1,247) | $32,382 | $76,785 |

| Total Liabilities and Capital | $44,203 | $68,875 | $102,597 |

| Net Worth | ($1,247) | $32,382 | $76,785 |

7.6 Business Ratios

The following table contains important business ratios from the courier services industry, SIC 4513, as determined by the Standard Industry Classification (SIC) Index.

| Ratio Analysis | |||||||||||||

| Year 1 | Year 2 | Year 3 | Industry Profile | ||||||||||

| Sales Growth | 0.00% | 64.87% | 7.34% | 4.50% | |||||||||

| Percent of Total Assets | |||||||||||||

| Accounts Receivable | 74.86% | 79.21% | 57.08% | 27.40% | |||||||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 21.80% | |||||||||

| Total Current Assets | 86.43% | 93.47% | 97.08% | 50.30% | |||||||||

| Long-term Assets | 13.57% | 6.53% | 2.92% | 49.70% | |||||||||

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||

| Current Liabilities | 10.19% | 8.02% | 5.72% | 29.80% | |||||||||

| Long-term Liabilities | 92.63% | 44.96% | 19.44% | 27.90% | |||||||||

| Total Liabilities | 102.82% | 52.99% | 25.16% | 57.70% | |||||||||

| Net Worth | -2.82% | 47.01% | 74.84% | 42.30% | |||||||||

| Percent of Sales | |||||||||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||

| Gross Margin | 98.00% | 98.00% | 98.00% | 100.00% | |||||||||

| Selling, General & Administrative Expenses | 132.59% | 86.23% | 83.44% | 79.50% | |||||||||

| Advertising Expenses | 0.69% | 0.42% | 0.39% | 0.20% | |||||||||

| Profit Before Interest and Taxes | -31.98% | 16.95% | 20.24% | 1.30% | |||||||||

| Main Ratios | |||||||||||||

| Current | 8.48 | 11.65 | 16.97 | 1.64 | |||||||||

| Quick | 8.48 | 11.65 | 16.97 | 1.43 | |||||||||

| Total Debt to Total Assets | 102.82% | 52.99% | 25.16% | 57.70% | |||||||||

| Pre-tax Return on Net Worth | 4807.12% | 138.47% | 77.54% | 2.50% | |||||||||

| Pre-tax Return on Assets | -135.62% | 65.10% | 58.03% | 5.90% | |||||||||

| Additional Ratios | |||||||||||||

| Net Profit Margin | -34.59% | 11.77% | 14.48% | n.a | |||||||||

| Return on Equity | 0.00% | 103.85% | 57.83% | n.a | |||||||||

| Activity Ratios | |||||||||||||

| Accounts Receivable Turnover | 3.93 | 3.93 | 3.93 | n.a | |||||||||

| Collection Days | 56 | 75 | 90 | n.a | |||||||||

| Accounts Payable Turnover | 12.07 | 12.17 | 12.17 | n.a | |||||||||

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Alwy Laate | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Dispatcher | $1,700 | $1,700 | $1,700 | $1,700 | $1,700 | $1,700 | $1,700 | $1,700 | $1,700 | $1,700 | $1,700 | $1,700 | |

| Messenger | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | |

| Messenger | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | |

| Messenger | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | |

| Messenger | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | |

| Messenger | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | |

| Messenger | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | |

| Total People | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Total Payroll | $14,780 | $14,780 | $14,780 | $14,780 | $14,780 | $14,780 | $14,780 | $14,780 | $14,780 | $14,780 | $14,780 | $14,780 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $4,479 | $8,459 | $9,754 | $11,801 | $13,612 | $18,113 | $19,472 | $20,671 | $22,074 | $22,266 | $22,599 | |

| Direct Cost of Sales | $0 | $90 | $169 | $195 | $236 | $272 | $362 | $389 | $413 | $441 | $445 | $452 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $90 | $169 | $195 | $236 | $272 | $362 | $389 | $413 | $441 | $445 | $452 | |

| Gross Margin | $0 | $4,389 | $8,290 | $9,559 | $11,565 | $13,340 | $17,751 | $19,083 | $20,258 | $21,633 | $21,821 | $22,147 | |

| Gross Margin % | 0.00% | 98.00% | 98.00% | 98.00% | 98.00%Pro Forma Cash Flow

Cash Received: – Cash Sales: $0, $1,120, $2,115, $2,439, $2,950, $3,403, $4,528, $4,868, $5,168, $5,519, $5,567, $5,650 – Cash from Receivables: $0, $0, $112, $3,459, $6,377, $7,367, $8,896, $10,322, $13,619, $14,634, $15,538, $16,560 Subtotal Cash from Operations: – $0, $1,120, $2,227, $5,897, $9,327, $10,770, $13,424, $15,190, $18,786, $20,152, $21,105, $22,210 Additional Cash Received: – Sales Tax, VAT, HST/GST Received: 0.00%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – New Current Borrowing: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – New Other Liabilities (interest-free): $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – New Long-term Liabilities: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Sales of Other Current Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Sales of Long-term Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – New Investment Received: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Subtotal Cash Received: – $0, $1,120, $2,227, $5,897, $9,327, $10,770, $13,424, $15,190, $18,786, $20,152, $21,105, $22,210 Expenditures: – Expenditures from Operations: – Cash Spending: $14,780 – Bill Payments: $143, $4,280, $4,364, $4,435, $4,456, $4,490, $4,522, $4,604, $4,624, $4,642, $4,663, $4,660 Subtotal Spent on Operations: – $14,923, $19,060, $19,144, $19,215, $19,236, $19,270, $19,302, $19,384, $19,404, $19,422, $19,443, $19,440 Additional Cash Spent: – Sales Tax, VAT, HST/GST Paid Out: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Principal Repayment of Current Borrowing: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $ |

||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!