Auto Inspectors Business Plan

Portland Mobile Auto Inspectors is a mobile car inspection service for used car buyers practicing due diligence. Portland Mobile Auto Inspectors travels around Metropolitan Portland with the necessary test equipment to inspect used cars. Service calls are made by appointment during the day, evenings, and weekends. Customers can schedule an appointment and meet the Portland Mobile Auto Inspectors at the vehicle’s location. Within one to one-and-a-half hours, the inspection is complete and the customer is provided with a detailed custom printout indicating the tests performed and the results, indicating the vehicle’s condition.

Portland Mobile Auto Inspectors will solve the dilemma that used car purchasers face when mechanics only offer inspections during normal business hours, which is not accessible to most people who work during the day.

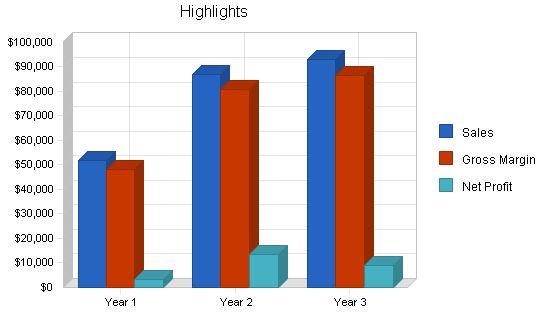

Portland Mobile Auto Inspectors, a sole proprietorship, is projected to reach profitability by month six and generate $93,000 in revenues by year three.

1.1 Objectives

The objectives for the first three years of operation include:

– Creating a service-based company that exceeds customer expectations.

– Increasing the customer base by 20% per year.

– Developing a sustainable start-up business.

1.2 Mission

Portland Mobile Auto Inspectors’ mission is to provide customers with convenient, thorough used car inspections. We aim to attract and maintain customers by surpassing their expectations.

1.3 Keys to Success

Success will be achieved by providing a service in demand that exceeds customer expectations.

Contents

Company Summary

Portland Mobile Auto Inspectors is a mobile used car inspection service. We inspect used cars to determine their actual condition, providing valuable information for buyers. Our service offers peace of mind when purchasing a used car, whether from a private seller or a dealer. We can travel to wherever the car is within Metropolitan Portland.

2.1 Company Ownership

Portland Mobile Auto Inspectors is a sole proprietorship founded and owned by Dan Jalopee.

2.2 Start-up Summary

Portland Mobile Auto Inspectors will incur the following start-up costs:

- A laptop computer system with portable printer, car adaptor, Microsoft Office, and QuickBooks Pro.

- Company van.

- Portable hydraulic lift and wheel ramps.

- Brake disc vernier caliper.

- Coolant system temperature gauge.

- Diagnostic engine analyzer.

| Start-up Funding | |

| Start-up Expenses to Fund | $1,500 |

| Start-up Assets to Fund | $30,500 |

| Total Funding Required | $32,000 |

| Assets | |

| Non-cash Assets from Start-up | $19,000 |

| Cash Requirements from Start-up | $11,500 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $11,500 |

| Total Assets | $30,500 |

| Liabilities and Capital | |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $0 |

| Capital | |

| Planned Investment | |

| Dan | $32,000 |

| Investor 2 | $0 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $32,000 |

| Loss at Start-up (Start-up Expenses) | ($1,500) |

| Total Capital | $30,500 |

| Total Capital and Liabilities | $30,500 |

| Total Funding | $32,000 |

Services

We offer the following tests for used car inspections:

Cranking History Test:

This test checks the battery’s strength and the alternator’s ability to charge the battery.

Electronic Compression Test:

This test measures engine cylinder compression uniformity.

Ignition Primary Test:

This test detects issues with the ignition coil.

Spark Burn Analysis Test:

This test identifies problems with ignition wires and distributor caps.

Power Balance Test:

This test measures each cylinder’s contribution to identify potential issues.

In addition, we determine the life of brake pads, condition of calipers and discs/drums, usable life of tires, temperature range of engine coolant, condition of exterior body, condition of instrument cluster and electric features within the vehicle’s interior, and condition of belts and hoses, CV joints and boots, exhaust, suspension components, and emergency brake.

The results of the inspection are delivered on the spot in a 100-point inspection regime. Clients will have a clear understanding of the car’s condition, which can help in the decision-making process of purchasing a car or negotiating the price based on necessary repairs.

Market Analysis Summary

The market for used car inspections targets buyers of vehicles priced over $5,000. Although our inspection fee is $100, not all buyers opt for an inspection. Reasons for this include limited availability of traditional mechanics due to their restrictive business hours, or a lack of awareness regarding the cost-benefit analysis of spending $100 to uncover potential issues before purchasing a used car.

We will target these potential customers with a marketing message emphasizing the thoroughness of our inspections and the convenience we offer compared to other service providers.

4.1 Market Segmentation

Our target customer is a used car buyer looking for a vehicle priced above $5,000. Buyers seeking cars below $5,000 usually prioritize basic transportation over potential problems with the vehicle. We cater to buyers who either cannot afford a new car or recognize the value of purchasing a used car. This value is realized as new cars depreciate the most, 20%, within the first year.

Our target customer has typically conducted research and narrowed down their options to a few different vehicles. They have inspected the car and confirmed it meets their needs, with the last step being to ensure the car is in good condition.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Used car purchasers | 9% | 33,457 | 36,468 | 39,750 | 43,328 | 47,228 | 9.00% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00% |

| Total | 9.00% | 33,457 | 36,468 | 39,750 | 43,328 | 47,228 | 9.00% |

4.2 Target Market Segment Strategy

The target segment will focus on:

- Yellow Page advertisement: The ad will advertise Portland Mobile Auto Inspectors to people who need an inspection and do not have a mechanic in mind.

- Website: The website will provide information about Portland Mobile Auto Inspectors services to the public. It will be submitted to popular search engines so that it appears at the top of search results.

- Partnerships with AAA and similar organizations: Portland Mobile Auto Inspectors will develop strategic relationships with automobile associations such as AAA to attract a large number of association members.

4.3 Service Business Analysis

The car inspection business is serviced by two types of companies: mobile inspection companies like Portland Mobile Auto Inspectors and various mechanics/garages. Currently, there is only one other mobile inspection service.

Many mechanics offer inspection services and advertise them to the general public and their customers, aiming to generate revenue. Other mechanics will perform inspections upon request, but it is not a normal service.

The disadvantage of traditional mechanics is their limited availability during business hours, which conflicts with the schedule of those looking for used cars, typically on weekends or evenings.

4.3.1 Competition and Buying Patterns

For information about competitors and consumer buying patterns, please refer to the previous section on Service Business Analysis.

Strategy and Implementation Summary

Portland Mobile Auto Inspectors’ strategy to gain customers will be based on emphasizing their competitive edges, including their expertise in automobile repair and thoroughness of inspections. The sales strategy will revolve around communicating these advantages, with convenience being a clear advantage to consumers.

5.1 Competitive Edge

Portland Mobile Auto Inspectors’ competitive edge lies in the expertise and thoroughness of their inspections. The owner and chief technician, Dan, is certified as a master mechanic, providing the necessary background and knowledge for the inspection. In addition to Dan’s expertise, Portland Mobile Auto Inspectors uses sophisticated test equipment to offer the same level of completeness as a stationary mechanic. Their inspections cover every aspect of the vehicle, giving customers the necessary confidence to purchase a used car.

To develop effective business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis

5.2 Sales Strategy

The sales strategy will focus on communicating Dan’s automobile experience and the thoroughness of the inspection. Overcoming potential customer ambivalence about the thoroughness of a mobile inspection service without a garage will be crucial. Once this information is communicated, convincing prospective customers should not be difficult, as the mobile inspection service offers significantly more convenience than current offerings.

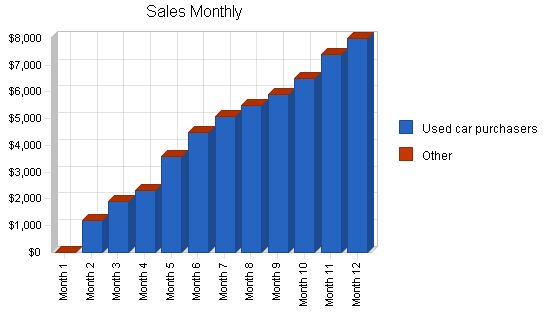

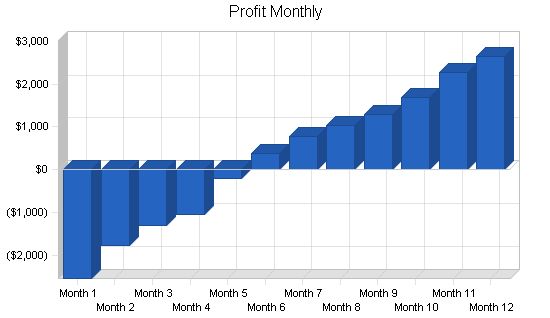

5.2.1 Sales Forecast

The first month will be used to set up the mobile office, with no sales activity during this time. Starting from the second month, sales activity will gradually increase, and profitability is expected to be reached by the sixth month.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Used car purchasers | $51,900 | $87,000 | $93,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $51,900 | $87,000 | $93,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Used car purchasers | $3,633 | $6,090 | $6,510 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $3,633 | $6,090 | $6,510 |

5.3 Milestones

Portland Mobile Auto Inspectors will have several milestones early on:

- Business plan completion. This will be done as a roadmap for the organization, providing ongoing performance and improvement.

- Set up of the mobile office.

- Profitability.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 2/1/2001 | $0 | ABC | Marketing |

| Set up of the mobile office | 1/1/2001 | 2/1/2001 | $0 | ABC | Department |

| Profitability | 1/1/2001 | 6/31/2001 | $0 | ABC | Department |

| Totals | $0 | ||||

Web Plan Summary

The website will describe the services offered by Portland Mobile Auto Inspectors, including Dan’s background and the various tests performed during inspections. Prospective clients can schedule appointments through email or phone call.

6.1 Website Marketing Strategy

The website will be submitted to various search engines, tailoring each submission to the specific engine.

6.2 Development Requirements

Dan will hire a computer science major from the University of Portland to develop the website.

Management Summary

Dan Jalopee received his BS in communication from the University of Portland. He worked as a mechanic at a European car clinic, starting from the bottom and quickly moving up. After three years, Dan became interested in running his own business and found the untapped market of mobile car inspections for used car buyers.

7.1 Personnel Plan

Portland Mobile Auto Inspectors will be a one-man operation. Dan will use a laptop and mobile phone to make appointments and serve customers independently.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Owner | $36,000 | $54,000 | $66,000 |

| Name or Title | $0 | $0 | $0 |

| Name or Title | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total People | 0 | 0 | 0 |

| Total Payroll | $36,000 | $54,000 | $66,000 |

Financial Plan

The following sections outline important financial information.

8.1 Important Assumptions

The following table details important financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

8.2 Projected Profit and Loss

The following table indicates projected profit and loss.

Pro Forma Profit and Loss:

| Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $51,900 | $87,000 | $93,000 |

| Direct Cost of Sales | $3,633 | $6,090 | $6,510 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $3,633 | $6,090 | $6,510 |

| Gross Margin | $48,267 | $80,910 | $86,490 |

| Gross Margin % | 93.00% | 93.00% | 93.00% |

| Expenses | |||

| Payroll | $36,000 | $54,000 | $66,000 |

| Sales, Marketing, and Other Expenses | $1,200 | $1,200 | $1,200 |

| Depreciation | $3,804 | $3,804 | $3,804 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $1,500 | $1,500 | $1,500 |

| Insurance | $1,200 | $1,200 | $1,200 |

| Rent | $0 | $0 | $0 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $43,704 | $61,704 | $73,704 |

| Profit Before Interest and Taxes | $4,563 | $19,206 | $12,786 |

| EBITDA | $8,367 | $23,010 | $16,590 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $1,369 | $5,762 | $3,836 |

| Net Profit | $3,194 | $13,444 | $8,950 |

| Net Profit/Sales | 6.15% | 15.45% | 9.62% |

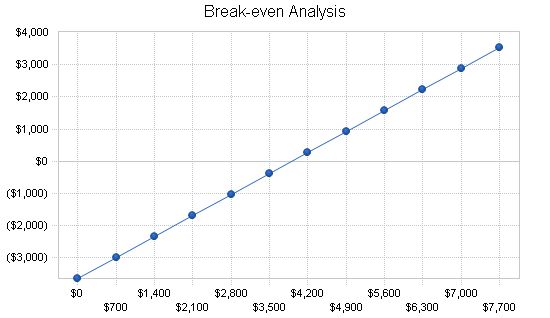

Break-even Analysis:

The Break-even Analysis indicates that a monthly revenue of $4,400 is needed to reach the break-even point.

Break-even Analysis:

Monthly Revenue Break-even: $3,916.

Assumptions:

Average Percent Variable Cost: 7%.

Estimated Monthly Fixed Cost: $3,642.

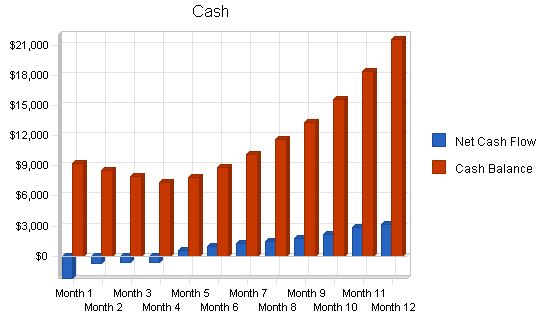

8.4 Projected Cash Flow:

The chart and table below show the projected cash flow.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $51,900 | $87,000 | $93,000 |

| Subtotal Cash from Operations | $51,900 | $87,000 | $93,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $51,900 | $87,000 | $93,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $36,000 | $54,000 | $66,000 |

| Bill Payments | $5,765 | $17,594 | $14,370 |

| Subtotal Spent on Operations | $41,765 | $71,594 | $80,370 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $41,765 | $71,594 | $80,370 |

| Net Cash Flow | $10,135 | $15,406 | $12,630 |

| Cash Balance | $21,635 | $37,041 | $49,671 |

8.5 Projected Balance Sheet

The following table indicates the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $21,635 | $37,041 | $49,671 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $21,635 | $37,041 | $49,671 |

| Long-term Assets | |||

| Long-term Assets | $19,000 | $19,000 | $19,000 |

| Accumulated Depreciation | $3,804 | $7,608 | $11,412 |

| Total Long-term Assets | $15,196 | $11,392 | $7,588 |

| Total Assets | $36,831 | $48,433 | $57,259 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $3,137 | $1,295 | $1,171 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $3,137 | $1,295 | $1,171 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $3,137 | $1,295 | $1,171 |

| Paid-in Capital | $32,000 | $32,000 | $32,000 |

| Retained Earnings | ($1,500) | $1,694 | $15,138 |

| Earnings | $3,194 | $13,444 | $8,950 |

| Total Capital | $33,694 | $47,138 | $56,089 |

| Total Liabilities and Capital | $36,831 | $48,433 | $57,259 |

| Net Worth | $33,694 | $47,138 | $56,088 |

8.6 Business Ratios

The following table shows our ratios in comparison to our industry classification, Automotive services, nec (SIC#7549).

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 67.63% | 6.90% | 6.10% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 30.69% |

| Total Current Assets | 58.74% | 76.48% | 86.75% | 55.12% |

| Long-term Assets | 41.26% | 23.52% | 13.25% | 44.88% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 8.52% | 2.67% | 2.04% | 21.25% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 29.25% |

| Total Liabilities | 8.52% | 2.67% | 2.04% | 50.50% |

| Net Worth | 91.48% | 97.33% | 97.96% | 49.50% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 93.00% | 93.00% | 93.00% | 100.00% |

| Selling, General & Administrative Expenses | 95.77% | 67.89% | 65.31% | 74.40% |

| Advertising Expenses | 2.31% | 1.38% | 1.29% | 1.76% |

| Profit Before Interest and Taxes | 8.79% | 22.08% | 13.75% | 2.09% |

| Main Ratios | ||||

| Current | 6.90 | 28.61 | 42.42 | 2.06 |

| Quick | 6.90 | 28.61 | 42.42 | 1.37 |

| Total Debt to Total Assets | 8.52% | 2.67% | 2.04% | 54.70% |

| Pre-tax Return on Net Worth | 13.54% | 40.74% | 22.80% | 6.05% |

| Pre-tax Return on Assets | 12.39% | 39.65% | 22.33% | 13.36% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 6.

General Assumptions: Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Sales Month 1 2 3 4 5 6 7 8 9 10 11 12 $0 $1,200 $1,900 $2,300 $3,600 $4,500 $5,100 $5,500 $5,900 $6,500 $7,400 $8,000 Direct Cost of Sales $0 $84 $133 $161 $252 $315 $357 $385 $413 $455 $518 $560 Other Production Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales $0 $84 $133 $161 $252 $315 $357 $385 $413 $455 $518 $560 Gross Margin $0 $1,116 $1,767 $2,139 $3,348 $4,185 $4,743 $5,115 $5,487 $6,045 $6,882 $7,440 Gross Margin % 0.00% 93.00% 93.00% 93.00% 93.00% 93.00% 93.00% 93.00% 93.00% 93.00% 93.00% 93.00% 93.00% Expenses Payroll $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Sales and Marketing and Other Expenses $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 Depreciation $317 $317 $317 $317 $317 $317 $317 $317 $317 $317 $317 $317 Leased Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Utilities $125 $125 $125 $125 $125 $125 $125 $125 $125 $125 $125 $125 Insurance $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 Rent $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Payroll Taxes 15% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other $0 $0 $0 $ Pro Forma Balance Sheet |

|||

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $11,500 | $9,268 | $8,558 | $7,900 | $7,300 | $7,850 | $8,850 | $10,141 | $11,624 | $13,367 | $15,569 | $18,457 | $21,635 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $11,500 | $9,268 | $8,558 | $7,900 | $7,300 | $7,850 | $8,850 | $10,141 | $11,624 | $13,367 | $15,569 | $18,457 | $21,635 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 |

| Accumulated Depreciation | $0 | $317 | $634 | $951 | $1,268 | $1,585 | $1,902 | $2,219 | $2,536 | $2,853 | $3,170 | $3,487 | $3,804 |

| Total Long-term Assets | $19,000 | $18,683 | $18,366 | $18,049 | $17,732 | $17,415 | $17,098 | $16,781 | $16,464 | $16,147 | $15,830 | $15,513 | $15,196 |

| Total Assets | $30,500 | $27,951 | $26,924 | $25,949 | $25,032 | $25,265 | $25,948 | $26,922 | $28,088 | $29,514 | $31,399 | $33,970 | $36,831 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $0 | $742 | $1,079 | $1,214 | $1,653 | $1,956 | $2,159 | $2,294 | $2,429 | $2,631 | $2,935 | $3,137 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $0 | $742 | $1,079 | $1,214 | $1,653 | $1,956 | $2,159 | $2,294 | $2,429 | $2,631 | $2,935 | $3,137 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $0 | $742 | $1,079 | $1,214 | $1,653 | $1,956 | $2,159 | $2,294 | $2,429 | $2,631 | $2,935 | $3,137 |

| Paid-in Capital | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 | $32,000 |

| Retained Earnings | ($1,500) | ($1,500) | ($1,500) | ($1,500) | ($1,500) | ($1,500) | ($1,500) | ($1,500) | ($1,500) | ($1,500) | ($1,500) | ($1,500) | ($1,500) |

| Earnings | $0 | ($2,549) | ($4,318) | ($5,630) | ($6,682) | ($6,888) | ($6,508) | ($5,737) | ($4,706) | ($3,415) | ($1,733) | $535 | $3,194 |

| Total Capital | $30,500 | $27,951 | $26,182 | $24,870 | $23,818 | $23,612 | $23,992 | $24,763 | $25,794 | $27,085 | $28,768 | $31,036 | $33,694 |

| Total Liabilities and Capital | $30,500 | $27,951 | $26,924 | $25,949 | $25,032 | $25,265 | $25,948 | $26,922 | $28,088 | $29,514 | $31,399 | $33,970 | $36,831 |

| Net Worth | $30,500 | $27,951 | $26,182 | $24,870 | $23,818 | $23,612 | $23,992 | $24,763 | $25,794 | $27,085 | $28,768 | $31,036 | $33,694 |

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Web Plan Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!