**Document Shredding Business Plan**

Theft, vandalism, and industrial espionage pose a growing security threat. Confidential information falling into the wrong hands can lead to devastating consequences for businesses. The widespread use of office copiers and computers has generated a staggering amount of sensitive data that is often carelessly discarded.

Security First Shredding is a professional paper shredding company specializing in secure, efficient, and cost-effective destruction of confidential information. We offer both on-site and off-site document destruction services in the Madison area. Our expertise extends to the shredding of microfilm, microfiche, credit cards, computer tapes, and other forms of media storage.

Each invoice will include a certificate of destruction, and we also provide recycling programs for non-confidential documents.

Co-owner Janet Wilson brings ten years of experience in document destruction, having worked for Shredd-All and Capital Shredding in New York before relocating to Madison last year.

Security First Shredding operates two state-of-the-art disposal trucks capable of shredding documents on-site or transporting them to a recycling center for disposal.

Security First Shredding’s mission is to provide a cost-effective document disposal service that protects our customers’ demand for security.

The objectives of Security First Shredding are as follows:

– Achieve sales goal in the first year.

– Build a customer base of 100 companies.

– Increase sales by 15% in the second year.

Security First Shredding is a professional paper shredding company, offering the most secure, efficient, and cost-effective plan for destroying confidential information. They provide on-site and off-site document destruction services. The company operates as a limited partnership.

Security First Shredding has an 8,000 square foot facility in the Westside Industrial Park, conveniently accessible to 80% of potential customers.

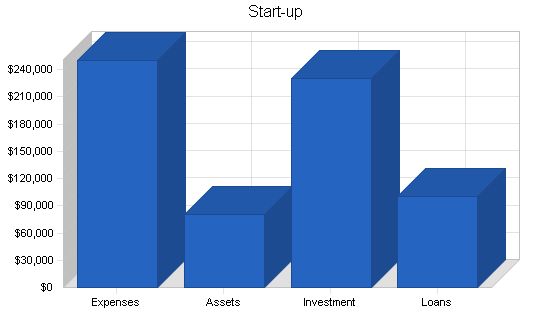

Start-up Summary:

Start-up expenses for Security First Shredding primarily include disposal equipment, bins, and trucks. Janet Wilson and the silent partner will both make substantial investments, and Wilson will secure a long-term business loan.

Start-up Funding:

– Start-up Expenses to Fund: $249,600

– Start-up Assets to Fund: $80,400

– Total Funding Required: $330,000

Assets:

– Non-cash Assets from Start-up: $0

– Cash Requirements from Start-up: $80,400

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $80,400

– Total Assets: $80,400

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $100,000

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $100,000

– Capital:

– Planned Investment:

– Janet Wilson: $80,000

– Silent Partner: $150,000

– Additional Investment Requirement: $0

– Total Planned Investment: $230,000

– Loss at Start-up (Start-up Expenses): ($249,600)

– Total Capital: ($19,600)

– Total Capital and Liabilities: $80,400

– Total Funding: $330,000

Start-up Requirements:

– Start-up Expenses:

– Legal: $2,000

– Stationery etc.: $600

– Brochures: $4,000

– Insurance: $1,000

– Rent: $2,000

– Disposal Trucks: $110,000

– Disposal Bins: $50,000

– Disposal Equipment: $80,000

– Total Start-up Expenses: $249,600

– Start-up Assets:

– Cash Required: $80,400

– Other Current Assets: $0

– Long-term Assets: $0

– Total Assets: $80,400

– Total Requirements: $330,000

Company Ownership:

– Security First Shredding is owned by Janet Wilson and a silent partner.

Services:

– Security First Shredding offers the following services:

– Security:

– On-site document destruction service is the safest, most secure, and convenient means of disposing of your sensitive documents. Our bonded uniformed employees will take a customer’s classified documents from the security bins that we provide for the office directly to the mobile shredding unit where the materials will be destroyed.

– Efficiency:

– The high-speed shredders mounted on our trucks are 40 times faster than most office shredders, reducing a customer’s cost of shredding by over 25%.

– On-site destruction services:

– Security First Shredding will provide security bins to be placed throughout the office area. These bins have a built-in lock to ensure documents cannot be removed without a key. The material will be destroyed on-site and the shredded paper will then be taken to our facility where it will be recycled.

– Off-site destruction services:

– Security First Shredding also offers off-site document destruction. We will still supply the customer with security bins but the materials will be brought back to our facility to be shredded. In addition to the security consoles for the office, we offer 65-gallon schafer containers. These schaefer containers are used for high volume areas. Customers with large volumes of paper find this to be the most economical way to handle classified materials.

– A certificate of destruction will be provided with each invoice.

Market Analysis Summary:

– Theft, vandalism, and industrial espionage are becoming increasingly significant security problems. There are too many horror stories resulting from confidential information getting into the wrong hands. Today’s information explosion can be devastating to a business. With the increased use of office copiers and computers, staggering amounts of sensitive information is being generated and carelessly discarded.

– Outdated or inactive company files can also become damaging once they have reached their legal limit of retention. Shredding this information protects a company against potential lawsuits.

– The Supreme Court has ruled that information in the trash is “fair game” to anyone. Privacy laws make any company vulnerable to lawsuits when personal records are disclosed to outsiders–even by accident.

– The 1974 federal privacy act was established to ensure that government agencies protect the privacy of individuals and businesses with regard to information held by them and to hold these agencies liable if any information is released without authorization.

– It is estimated that corporate espionage costs U.S. businesses over $7 billion in losses yearly. It’s believed that one in four American adults have been defrauded in various identity theft schemes.

– A company’s trash is a great source of financial and personal catastrophe. It’s an unimaginable nightmare for most people, and a nefarious windfall for the growing ranks of corporate scavengers and identity thieves currently farming America’s trash.

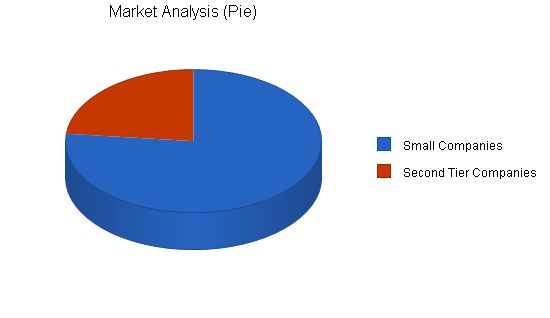

– Large corporations have internal disposal systems to protect themselves, but small to second-tier companies typically have poor or inefficient systems in place. Madison has 3,000 businesses and companies that have the potential need for a document disposal service.

Market Segmentation:

– Security First Shredding will focus on the following target customers:

– Small Businesses and Companies:

– These companies have 10 to 25 employees. They represent a significant market since internal document disposal is not cost-effective or efficient. Outsourcing disposal services are an excellent solution that will reduce the business disposal costs by 25%.

– Second Tier Companies:

– These companies have over 100+ employees. Record disposal is quickly becoming an important concern and is usually poorly organized and inefficient. Outsourcing disposal services can cap costs and improve the efficiency of the process.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Small Companies 4% 2,300 2,392 2,488 2,588 2,692 4.01%

Second Tier Companies 1% 700 707 714 721 728 0.99%

Total 3.33% 3,000 3,099 3,202 3,309 3,420 3.33%

Strategy and Implementation Summary

Security First Shredding will market an annual service contract at a 20% discount to small companies and a 15% discount to medium-size companies. We will offer a free on-site survey of the company’s facility to determine their exact needs.

Competitive Edge

Security First Shredding’s competitive edge is our quick response to customer requests for services. We will respond within 24 hours of a request for record shredding services. Our disposal trucks shred documents twice as fast as our competitors and have a greater load capacity.

Janet Wilson’s leadership is also a tremendous advantage. She was the top salesperson for both Shredd-All and Capital Shredding. Her strength lies in using assessments as a sales tool to demonstrate savings and promote our company’s services.

To develop effective business strategies, perform a SWOT analysis. Use our free guide and template to learn how to perform a SWOT analysis.

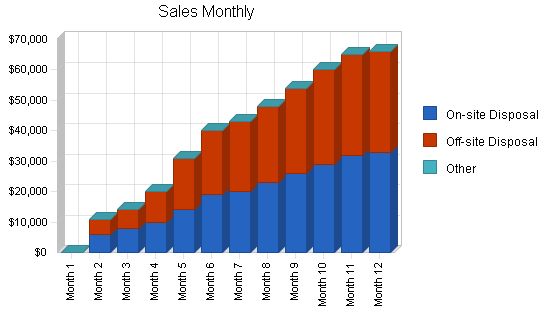

Sales Strategy

Security First Shredding’s sales strategy is to offer a free on-site disposal survey of the company’s facility. Janet Wilson, who performed such surveys with both Shredd-All and Capital Shredding in New York, will supervise the assessment. We anticipate that sales will be flat in the first month but will pick up quickly in the second month.

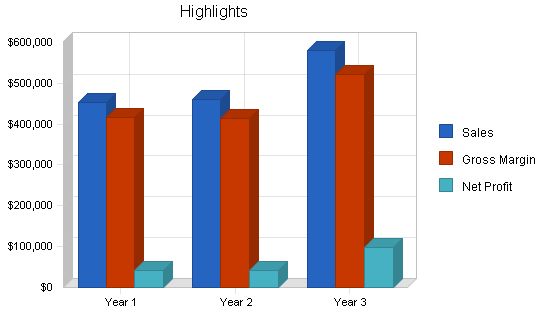

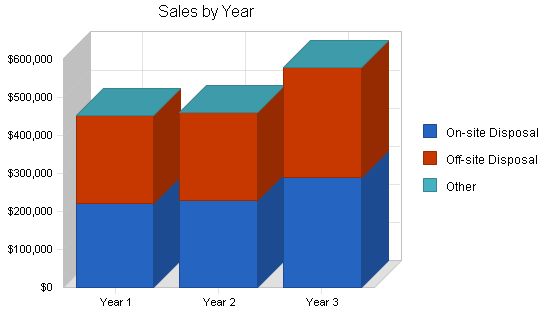

The following is the sales forecast for three years.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| On-site Disposal | $220,000 | $230,000 | $290,000 |

| Off-site Disposal | $232,000 | $230,000 | $290,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $452,000 | $460,000 | $580,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| On-site Disposal | $17,200 | $23,000 | $29,000 |

| Off-site Disposal | $17,400 | $23,000 | $29,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $34,600 | $46,000 | $58,000 |

Management Summary

Security First Shredding’s management system:

- Janet Wilson will manage the facility operations and the sales team.

- An off-site facility team will manage record disposal at the Security First Shredding facility.

- An on-site team will manage disposal at customer sites.

6.1 Personnel Plan

Security First Shredding’s personnel:

- Janet Wilson

- Off-site disposal manager

- Facility staff (4)

- On-site staff/drivers (4)

- Customer service staff (1)

- Sales staff (1)

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Janet Wilson | $36,000 | $36,000 | $38,000 |

| Off-site Facility Manager | $30,000 | $32,000 | $34,000 |

| Off-site Facility Staff | $78,000 | $86,000 | $94,000 |

| On-site Staff/Drivers | $78,000 | $86,000 | $94,000 |

| Customer Service Staff | $19,200 | $21,000 | $23,000 |

| Sales Staff | $24,000 | $26,000 | $28,000 |

| Other | $0 | $0 | $0 |

| Total People | 12 | 12 | 12 |

| Total Payroll | $265,200 | $287,000 | $311,000 |

Financial Plan

The financial plan for Security First Shredding.

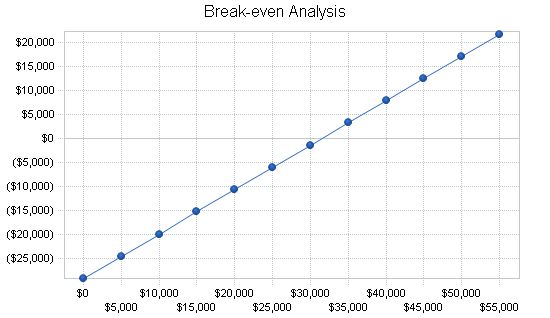

7.1 Break-even Analysis

The monthly break-even point is shown below.

Break-even Analysis

Monthly Revenue Break-even: $31,528

Assumptions:

– Average Percent Variable Cost: 8%

– Estimated Monthly Fixed Cost: $29,115

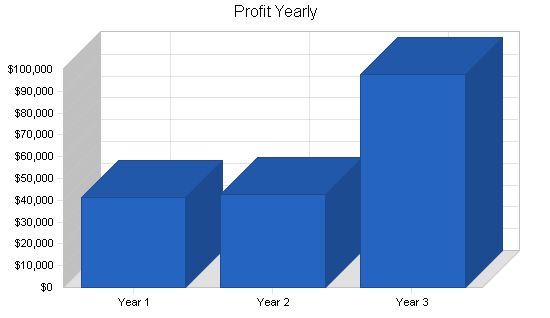

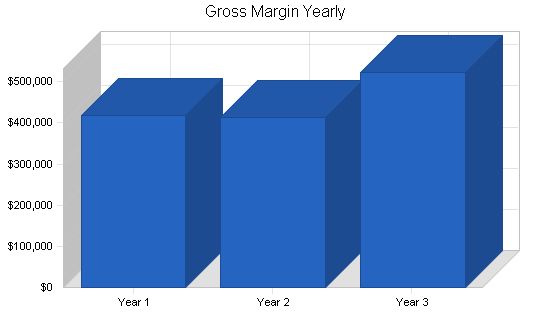

7.2 Projected Profit and Loss

The following table and charts highlight the projected profit and loss for three years.

Pro Forma Profit and Loss:

Sales:

Year 1: $452,000

Year 2: $460,000

Year 3: $580,000

Direct Cost of Sales:

Year 1: $34,600

Year 2: $46,000

Year 3: $58,000

Other Production Expenses:

Year 1: $0

Year 2: $0

Year 3: $0

Total Cost of Sales:

Year 1: $34,600

Year 2: $46,000

Year 3: $58,000

Gross Margin:

Year 1: $417,400

Year 2: $414,000

Year 3: $522,000

Gross Margin %:

Year 1: 92.35%

Year 2: 90.00%

Year 3: 90.00%

Expenses:

Payroll:

Year 1: $265,200

Year 2: $287,000

Year 3: $311,000

Sales and Marketing and Other Expenses:

Year 1: $12,000

Year 2: $15,000

Year 3: $18,000

Depreciation:

Year 1: $0

Year 2: $0

Year 3: $0

Leased Equipment:

Year 1: $0

Year 2: $0

Year 3: $0

Utilities:

Year 1: $4,800

Year 2: $0

Year 3: $0

Insurance:

Year 1: $3,600

Year 2: $0

Year 3: $0

Rent:

Year 1: $24,000

Year 2: $0

Year 3: $0

Payroll Taxes:

Year 1: $39,780

Year 2: $43,050

Year 3: $46,650

Other:

Year 1: $0

Year 2: $0

Year 3: $0

Total Operating Expenses:

Year 1: $349,380

Year 2: $345,050

Year 3: $375,650

Profit Before Interest and Taxes:

Year 1: $68,020

Year 2: $68,950

Year 3: $146,350

EBITDA:

Year 1: $68,020

Year 2: $68,950

Year 3: $146,350

Interest Expense:

Year 1: $9,350

Year 2: $8,200

Year 3: $7,000

Taxes Incurred:

Year 1: $17,601

Year 2: $18,225

Year 3: $41,805

Net Profit:

Year 1: $41,069

Year 2: $42,525

Year 3: $97,545

Net Profit/Sales:

Year 1: 9.09%

Year 2: 9.24%

Year 3: 16.82%

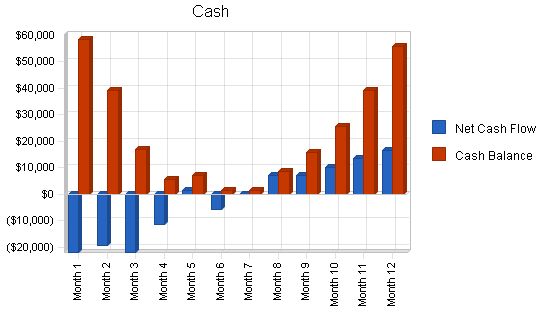

7.3 Projected Cash Flow:

The following table and chart highlight the projected cash flow for three years.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $113,000 | $115,000 | $145,000 |

| Cash from Receivables | $242,375 | $343,290 | $409,347 |

| Subtotal Cash from Operations | $355,375 | $458,290 | $554,347 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $10,000 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $10,000 | $0 | $0 |

| Subtotal Cash Received | $375,375 | $458,290 | $554,347 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $265,200 | $287,000 | $311,000 |

| Bill Payments | $122,728 | $142,754 | $168,087 |

| Subtotal Spent on Operations | $387,928 | $429,754 | $479,087 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $12,000 | $12,000 | $12,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $399,928 | $441,754 | $491,087 |

| Net Cash Flow | ($24,553) | $16,536 | $63,261 |

| Cash Balance | $55,847 | $72,383 | $135,643 |

7.4 Projected Balance Sheet

The following table highlights the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $55,847 | $72,383 | $135,643 |

| Accounts Receivable | $96,625 | $98,335 | $123,988 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $152,472 | $170,718 | $259,631 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $152,472 | $170,718 | $259,631 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $23,003 | $10,724 | $14,092 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $10,000 | $10,000 | $10,000 |

| Subtotal Current Liabilities | $33,003 | $20,724 | $24,092 |

| Long-term Liabilities | $88,000 | $76,000 | $64,000 |

| Total Liabilities | $121,003 | $96,724 | $88,092 |

| Paid-in Capital | $240,000 | $240,000 | $240,000 |

| Retained Earnings | ($249,600) | ($208,531) | ($166,006) |

| Earnings | $41,069 | $42,525 | $97,545 |

| Total Capital | $31,469 | $73,994 | $171,539 |

| Total Liabilities and Capital | $152,472 | $170,718 | $259,631 |

| Net Worth | $31,469 | $73,994 | $171,539 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7389, Business Services, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 1.77% | 26.09% | 8.20% |

| Percent of Total Assets | ||||

| Accounts Receivable | 63.37% | 57.60% | 47.76% | 26.30% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 44.20% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 74.30% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 25.70% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 21.65% | 12.14% | 9.28% | 49.00% |

| Long-term Liabilities | 57.72% | 44.52% | 24.65% | 13.80% |

| Total Liabilities | 79.36% | 56.66% | 33.93% | 62.80% |

| Net Worth | 20.64% | 43.34% | 66.07% | 37.20% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100

"Personnel Plan: Janet Wilson – $3,000 (Months 1-12) Off-site Facility Manager – $2,500 (Months 1-12) Off-site Facility Staff – $6,500 (Months 1-12) On-site Staff/Drivers – $6,500 (Months 1-12) Customer Service Staff – $1,600 (Months 1-12) Sales Staff – $2,000 (Months 1-12) Other – $0 (Months 1-12) Total People – 12 (Months 1-12) Total Payroll – $22,100 (Months 1-12) General Assumptions: Plan Month 1-12 Current Interest Rate – 10.00% (Months 1-12) Long-term Interest Rate – 10.00% (Months 1-12) Tax Rate – 30.00% (Months 1-12) Other – 0 (Months 1-12) Pro Forma Profit and Loss: Sales – $0 (Month 1), $11,000 (Month 2), $14,000 (Month 3), $20,000 (Month 4), $31,000 (Month 5), $40,000 (Month 6), $43,000 (Month 7), $48,000 (Month 8), $54,000 (Month 9), $60,000 (Month 10), $65,000 (Month 11), $66,000 (Month 12) Direct Cost of Sales – $0 (Month 1), $700 (Month 2), $900 (Month 3), $1,200 (Month 4), $2,300 (Month 5), $3,100 (Month 6), $3,200 (Month 7), $3,200 (Month 8), $4,200 (Month 9), $4,800 (Month 10), $5,200 (Month 11), $5,800 (Month 12) Other Production Expenses – $0 (Months 1-12) Total Cost of Sales – $0 (Month 1), $700 (Month 2), $900 (Month 3), $1,200 (Month 4), $2,300 (Month 5), $3,100 (Month 6), $3,200 (Month 7), $3,200 (Month 8), $4,200 (Month 9), $4,800 (Month 10), $5,200 (Month 11), $5,800 (Month 12) Gross Margin – $0 (Month 1), $10,300 (Month 2), $13,100 (Month 3), $18,800 (Month 4), $28,700 (Month 5), $36,900 (Month 6), $39,800 (Month 7), $44,800 (Month 8), $49,800 (Month 9), $55,200 (Month 10), $59,800 (Month 11), $60,200 (Month 12) Gross Margin % – 0.00% (Month 1), 93.64% (Month 2), 93.57% (Month 3), 94.00% (Month 4), 92.58% (Month 5), 92.25% (Month 6), 92.56% (Month 7), 93.33% (Month 8), 92.22% (Month 9), 92.00% (Month 10), 92.00% (Month 11), 91.21% (Month 12) Expenses: Payroll – $22,100 (Months 1-12) Sales and Marketing and Other Expenses – $1,000 (Months 1-12) Depreciation – $0 (Months 1-12) Leased Equipment – $0 (Months 1-12) Utilities – $400 (Months 1-12) Insurance – $300 (Months 1-12) Rent – $2,000 (Months 1-12) Payroll Taxes – 15% ($3,315 each month) Other – $0 (Months 1-12) Total Operating Expenses – $29,115 (Months 1-12) Profit Before Interest and Taxes – ($29,115) (Month 1), ($18,815) (Month 2), ($16,015) (Month 3), ($10,315) (Month 4), ($415) (Month 5), $7,785 (Month 6), $10,685 (Month 7), $15,685 (Month 8), $20,685 (Month 9), $26,085 (Month 10), $30,685 (Month 11), $31,085 (Month 12) EBITDA – ($29,115) (Month 1), ($18,815) (Month 2), ($16,015) (Month 3), ($10,315) (Month 4), ($415) (Month 5), $7,785 (Month 6), $10,685 (Month 7), $15,685 (Month 8), $20,685 (Month 9), $26,085 (Month 10), $30,685 (Month 11), $31,085 (Month 12) Interest Expense – $825 (Month 1), $817 (Month 2), $808 (Month 3), $800 (Month 4), $792 (Month 5), $783 (Month 6), $775 (Month 7), $767 (Month 8), $758 (Month 9), $750 (Month 10), $742 (Month 11), $733 (Month 12) Taxes Incurred – ($8,982) (Month 1), ($5,890) (Month 2), ($5,047) (Month 3), ($3,335) (Month 4), ($362) (Month 5), $2,101 (Month 6), $2,973 (Month 7), $4,476 (Month 8), $5,978 (Month 9), $7,601 (Month 10), $8,983 (Month 11), $9,106 (Month 12) Net Profit – ($20,958) (Month 1), ($13,742) (Month 2), ($11,776) (Month 3), ($7,781) (Month 4), ($845) (Month 5), $4,901 (Month 6), $6,937 (Month 7), $10,443 (Month 8), $13,949 (Month 9), $17,735 (Month 10), $20,960 (Month 11), $21,246 (Month 12) Net Profit/Sales – 0.00% (Month 1), -124.93% (Month 2), -84.12% (Month 3), -38.90% (Month 4), -2.72% (Month 5), 12.25% (Month 6), 16.13% (Month 7), 21.76% (Month 8), 25.83% (Month 9), 29.56% (Month 10), 32.25% (Month 11), 32.19% (Month 12)" Pro Forma Cash Flow: Cash Received: – Cash Sales: $0, $2,750, $3,500, $5,000, $7,750, $10,000, $10,750, $12,000, $13,500, $15,000, $16,250, $16,500 – Cash from Receivables: $0, $0, $275, $8,325, $10,650, $15,275, $23,475, $30,075, $32,375, $36,150, $40,650, $45,125 Subtotal Cash from Operations: $0, $2,750, $3,775, $13,325, $18,400, $25,275, $34,225, $42,075, $45,875, $51,150, $56,900, $61,625 Additional Cash Received: Expenditures: – Cash Spending: $22,100 for each month – Bill Payments: ($1,142), ($1,016), $2,677, $3,743, $5,816, $9,853, $13,031, $14,013, $15,540, $18,025, $20,225, $21,963 Subtotal Spent on Operations: $20,958, $21,084, $24,777, $25,843, $27,916, $31,953, $35,131, $36,113, $37,640, $40,125, $42,325, $44,063 Subtotal Cash Spent: $21,958, $22,084, $25,777, $26,843, $28,916, $32,953, $36,131, $37,113, $38,640, $41,125, $43,325, $45,063 Net Cash Flow: ($21,958), ($19,334), ($22,002), ($11,518), $1,484, ($5,678), $94, $6,962, $7,235, $10,025, $13,575, $16,562 Cash Balance: $58,442, $39,108, $17,106, $5,588, $7,072, $1,394, $1,488, $8,450, $15,685, $25,710, $39,285, $55,847 |

|

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!