Inspection Connection, a Limited Liability Company owned and operated by Jacques Clouseau, aims to provide high-quality, ethical home inspection services that educate and provide peace of mind to clients while ensuring sufficient profits for the company. The mission is to offer friendly, professional, ethical, and quality-conscious home inspection services to the community. The key to success lies in maintaining visibility and delivering high-quality services in a specific marketing niche.

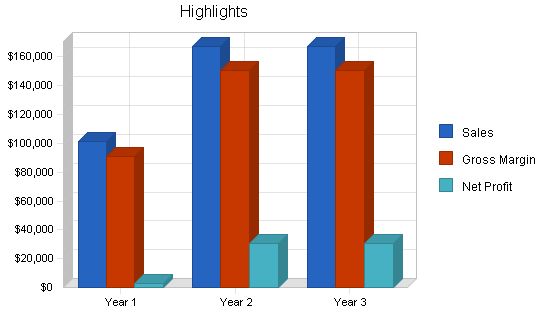

Although the local market for this type of business is not new, there is ample opportunity for new home inspection businesses. The initial financial analysis demonstrates that the venture is viable and has the potential to generate enough profits to sustain operations.

As a service-oriented business, Inspection Connection will have low overhead by operating from Mr. Clouseau’s residence. To promote its high-quality inspection services, the company will use targeted ZIP code bulk mailings, an informative website, and establish a local reputation as a real estate "expert" through writing columns for the local paper and attending real estate association meetings.

The largest expense in the first year, aside from the owner’s payroll, will be a CT licensure internship. This internship will allow Mr. Clouseau to conduct inspections in Connecticut and New York. The expense will be paid using a low-interest-rate credit card and repaid within 2 years from the business’s cash flows.

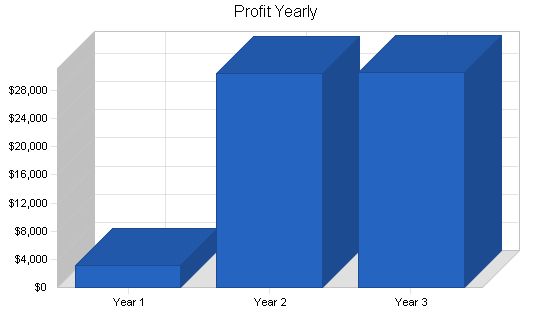

Inspection Connection anticipates reaching the break-even point in July and, despite the internship expense, expects to be very profitable in the second and third years if sales can be maintained at year-end levels. This profitability will allow Mr. Clouseau to receive a reasonable wage.

In conclusion, the plan projects promising net profits over the next three years. Proper marketing and relationship management by Inspection Connection will ensure success.

### Objectives

The objectives of this business plan are:

1. To provide a guide for starting and managing the home inspection business and developing a comprehensive marketing plan.

2. The plan is solely intended for the owner of the business and does not seek financing from external sources.

3. The plan provides detailed monthly projections for the current year and yearly summaries for the following two years.

The objectives of Inspection Connection are:

1. Education: To educate home buyers, sellers, and owners about the systems and components of a home and the importance of maintenance. Additionally, to offer continuing education courses and seminars to the community.

2. Quality: To provide professional home inspections that meet high standards.

3. Profit: To generate sufficient profit for future growth and to support the company’s other objectives and the owner’s needs.

My Home Inspection, LLC aims to provide friendly, professional, ethical, and quality Home Inspection services to the community. We will maintain membership with ASHI (American Society of Home Inspectors) and seek education through accredited organizations. Additionally, we will provide education to the community through Home Inspections and by sponsoring seminars and educational events.

The Keys to Success for Inspection Connection will include visibility through attending Real-Estate functions and providing educational opportunities to professionals and the community. Effective marketing will be crucial.

Inspection Connection will be a start-up venture with the following characteristics:

– A Limited Liability Corporation.

– A goal of starting the venture as inexpensively as possible.

– A home office start-up, utilizing one room in the owner’s home.

Inspection Connection will be owned and operated by Jacques Clouseau as a Limited Liability Corporation.

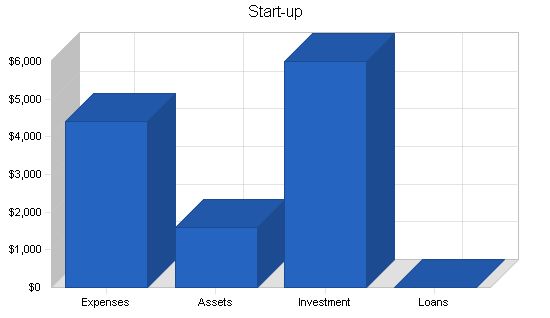

The start-up costs for Inspection Connection will primarily include Legal and Accounting filing fees and paperwork. The largest cost will be the internship process required for the owner to obtain a License in the State of CT.

Start-up Requirements:

– Filing for LLC: $60

– Accounting Software: $325

– Accounting Fees: $175

– Logo Design: $259

– Tools: $2,400

– Website Design: $500

– Postcard Design/Printing: $500

– Other: $200

Total Start-up Expenses: $4,419

Start-up Assets:

– Cash Required: $1,581

– Other Current Assets: $0

– Long-term Assets: $0

Total Assets: $1,581

Total Requirements: $6,000

Services:

Initially, Inspection Connection offers the following services:

– Buyer Home Inspection

– Seller (Pre-Listing) Home Inspection

– Maintenance Inspection

Optional "Add-In" services, available for an additional fee, include:

– Radon Testing (air and water)

– Termite Inspection

– Water Testing

– Well Inspection

– Septic Inspection

– Pool and Spa Inspection

Some services, such as Septic and Well Inspection, may be subcontracted to qualified professionals. All other services will be provided by the owner in a professional and ethical manner.

In the future, Inspection Connection may offer:

– Mold Survey/Sampling

– Home Energy Audit

– New Construction (In-Progress) Inspection

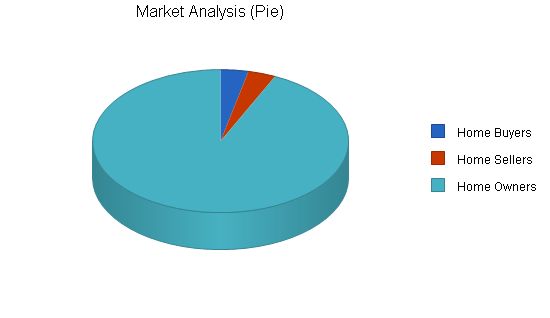

Market Analysis Summary:

Inspection Connection will initially market services in Westchester County, NY while the owner completes the Internship Requirements for Licensure in CT. This will generate income and potentially ease the process of obtaining a NY License.

Once a Connecticut license is obtained, Inspection Connection will primarily market services in New Haven County, CT. Specifically, Inspection Connection has identified 23 towns with sufficient monthly home sales to support the entry into the market.

Market Segmentation:

Inspection Connection has divided the Home Inspection Market into three segments. Most established Home Inspection Businesses focus on the Buyer and Seller segments, offering Buyer Home Inspection and Pre-Listing Inspection services. Inspection Connection aims to capture 2.5% of these segments while primarily targeting the larger and more stable Owner segment. There are 224,883 Owner Occupied Homes in New Haven County, CT.

The "Market Analysis" table provides a summary of the three segments. Information about New Haven County, CT was gathered from www.census.gov/census2000/states/ct/ct.html and www.melissadata.com. A growth rate of 1% per year was assumed due to lack of available data.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Home Buyers 1% 8,400 8,484 8,569 8,655 8,742 1.00%

Home Sellers 1% 8,400 8,484 8,569 8,655 8,742 1.00%

Home Owners 1% 224,883 227,132 229,403 231,697 234,014 1.00%

Total 1.00% 241,683 244,100 246,541 249,007 251,498 1.00%

4.2 Target Market Segment Strategy

As mentioned earlier, Inspection Connection will market in all three segments but focus on the Owners segment. This segment is not widely targeted by existing Home Inspection businesses and presents an attractive niche due to its size and lack of marketing efforts.

4.3 Service Business Analysis

The Home Inspection Industry sells time and knowledge. Inspectors spend time reviewing properties and educating clients about them. The resulting Inspection Report represents a transfer of knowledge.

4.3.1 Competition and Buying Patterns

Most competition in the Home Inspection Industry occurs in the Buyer and Seller segments. Inspection Companies need to maintain relationships with Real Estate professionals and rely on word of mouth to obtain business in these segments.

Selling to the Owner segment offers the advantage of direct marketing through targeted postcards, informative newspaper columns and advertisements, and organizing educational events within the target communities.

Strategy and Implementation Summary

Inspection Connection will focus on the following to establish and grow the business:

– Acquiring associations in the Real Estate industry

– Offering Niche services

– Direct marketing

– Community involvement

5.1 Competitive Edge

Currently, in the Home Inspection industry, specifically in Connecticut, there is not much need for a competitive edge due to the high ratio of Home Sales to Licensed Inspectors. Inspection Connection aims to gain a competitive edge by offering Maintenance Inspection services for the Owner Segment, which is relatively new and not heavily marketed by existing Home Inspection Businesses.

Performing a SWOT analysis can help develop effective business strategies.

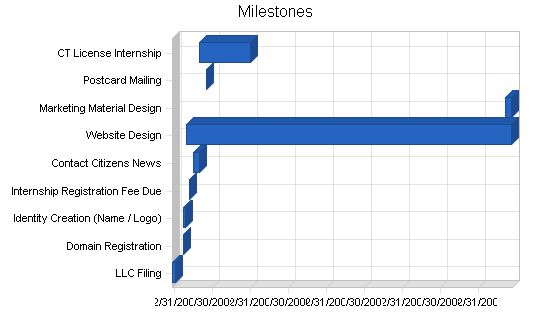

5.2 Milestones

The following table and chart indicate the milestones that have been or need to be met before Inspection Connection is fully operational. The CT License Internship is necessary only for providing services in CT, but Inspection Connection intends to offer services in NY while completing the CT Internship.

Milestones:

– LLC Filing: 12/23/2004 – 1/3/2005, $60, Clouseau

– Domain Registration: 2/11/2005 – 2/12/2005, $35, Clouseau

– Identity Creation (Name / Logo): 2/12/2005 – 2/21/2005, $259, Clouseau

– Internship Registration Fee Due: 3/15/2005, $14,000, Clouseau

– Contact Citizens News: 4/1/2005 – 4/30/2005, $0, Clouseau

– Website Design: 2/26/2005 – 6/6/2009, $500, Clouseau

– Marketing Material Design: 5/7/2009 – 6/6/2009, $500, Clouseau

– Postcard Mailing: 6/1/2005 – 6/5/2005, $500, Clouseau

– CT License Internship: 5/1/2005 – 12/31/2005, $0, Clouseau

– Totals: $15,854

Inspection Connection will adopt the following marketing strategy:

– Maintain a website with useful information and links for Buyers, Sellers, and Owners, possibly including an online scheduling system for Inspection Services

– The owner will write a column for the local Citizens News and possibly maintain an advertising block.

– The owner will attend ASHI meetings and Real Estate Association events to promote visibility.

– Bulk Mailing of postcards to specific ZIP codes to market Maintenance Inspections

– Become active in the community by sponsoring educational seminars and attending community events.

5.4 Sales Strategy

My Home Inspection, LLC’s sales strategy is simple; the prospective client MUST speak with a person when they call. Inspection Connection will contract with an answering service so that every call is handled by a live person who can answer questions and complete the scheduling.

In the future, Inspection Connection may offer an online scheduling option. If implemented, the following details will be addressed:

– The scheduling application will be secure.

– Clients who schedule a service through the website will be contacted via phone and email to verify the appointment.

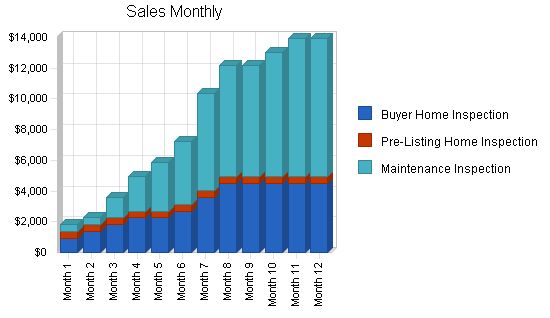

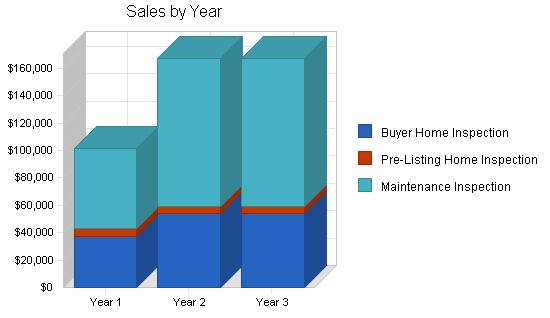

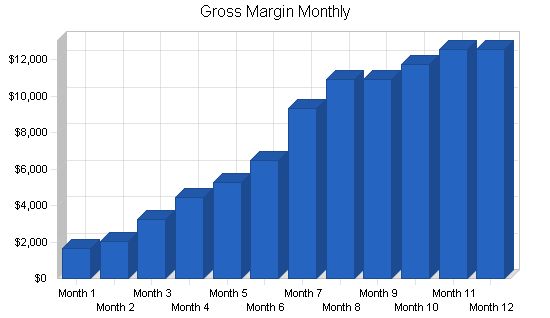

5.4.1 Sales Forecast

The Sales Forecast is based on a minimum dollar amount of $450 per inspection. A percentage of clients may choose add-on services, increasing the total price of the Inspection. Thus, the projected monthly and annual sales could be higher than indicated in the table.

Sales Forecast:

Year 1 | Year 2 | Year 3

——-|——-|——-

Unit Sales

Buyer Home Inspection | 83 | 120 | 120

Pre-Listing Home Inspection | 12 | 12 | 12

Maintenance Inspection | 130 | 240 | 240

Total Unit Sales | 225 | 372 | 372

Unit Prices:

Year 1 | Year 2 | Year 3

——-|——-|——-

Buyer Home Inspection | $450.00 | $450.00 | $450.00

Pre-Listing Home Inspection | $450.00 | $450.00 | $450.00

Maintenance Inspection | $450.00 | $450.00 | $450.00

Sales:

Year 1 | Year 2 | Year 3

——-|——-|——-

Buyer Home Inspection | $37,350 | $54,000 | $54,000

Pre-Listing Home Inspection | $5,400 | $5,400 | $5,400

Maintenance Inspection | $58,500 | $108,000 | $108,000

Total Sales | $101,250 | $167,400 | $167,400

Direct Unit Costs:

Year 1 | Year 2 | Year 3

——-|——-|——-

Buyer Home Inspection | $45.00 | $45.00 | $45.00

Pre-Listing Home Inspection | $45.00 | $45.00 | $45.00

Maintenance Inspection | $45.00 | $45.00 | $45.00

Direct Costs of Sales:

Buyer Home Inspection | $3,735 | $5,400 | $5,400

Pre-Listing Home Inspection | $540 | $540 | $540

Maintenance Inspection | $5,850 | $10,800 | $10,800

Subtotal Direct Costs of Sales | $10,125 | $16,740 | $16,740

Web Plan Summary:

The domain name is [Proprietary and Confidential Information Removed]. The site will contain information about the Owner, services offered, and general information and links applicable to every homeowner. In the future, the website may offer online scheduling of services. The site will be designed to be Browser Independent and easy to navigate. The intent is to offer useful information and links for homeowners so that they have a reason to visit the site even if they are not requesting services.

Website Marketing Strategy:

– Design the site to be Browser Independent

– Maintain useful content and links that will invite people to the site

– Structure and change content frequently for search engine "Web crawlers" to rank the site within the top ten

– Possibly offer an online scheduling system in the future

Development Requirements:

The site will be designed by a reputable Web design firm. The focus will be on designing a Browser Independent site without requests for user-plug-in components. The layout will be simple, and information will be well organized. There will be limited use of databases, with MySQL used as the database engine if needed. The site will not track users on an individual basis or customize content based on the user. Site development is estimated to take 3 months, with an additional 6 months for building the scheduling application.

Management Summary:

Inspection Connection is a single member Limited Liability Corporation owned and operated by Jacques Clouseau. There are no plans to expand or hire additional employees or inspectors.

Personnel Plan:

Year 1 | Year 2 | Year 3

——-|——-|——-

Jacques Clouseau – Owner / Operator | $28,600 | $61,200 | $61,200

Name or Title or Group | $0 | $0 | $0

Total People | 1 | 1 | 1

Total Payroll | $28,600 | $61,200 | $61,200

The following sections include the annual estimates for the standard set of financial tables. Detailed monthly pro-forma tables are included in the appendices. The plan is to start with owner investment only and pay all expenses and direct costs from the cash flows of the business. The only exception is the fee for the CT license internship, which will be paid with a credit card in March, with a 7% interest rate. This credit card bill will be repaid within two years.

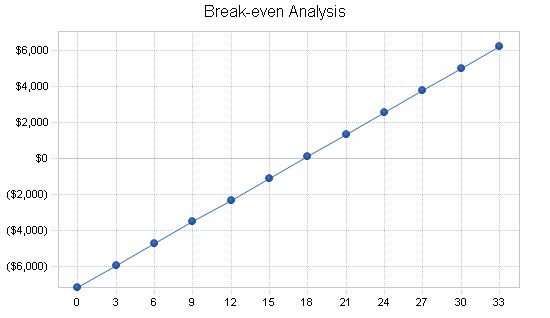

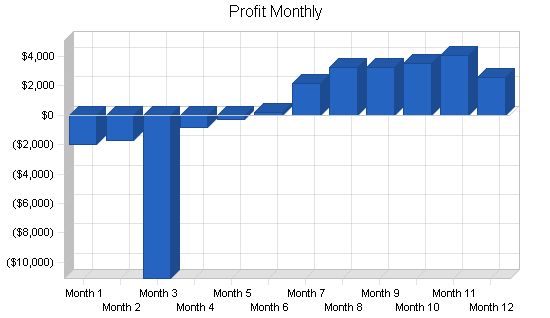

Inspection Connection will break-even in the seventh month and generate steady profits thereafter, even as the owner’s salary increases.

Start-up Funding:

Start-up Expenses to Fund | $4,419

Start-up Assets to Fund | $1,581

Total Funding Required | $6,000

Assets:

Non-cash Assets from Start-up | $0

Cash Requirements from Start-up | $1,581

Additional Cash Raised | $0

Cash Balance on Starting Date | $1,581

Total Assets | $1,581

Liabilities and Capital:

Liabilities |

————|——–

Current Borrowing | $0

Long-term Liabilities | $0

Accounts Payable (Outstanding Bills) | $0

Other Current Liabilities (interest-free) | $0

Total Liabilities | $0

Capital:

Planned Investment |

—————|——–

Owner | $6,000

Investor | $0

Additional Investment Requirement | $0

Total Planned Investment | $6,000

Loss at Start-up (Start-up Expenses) | ($4,419)

Total Capital | $1,581

Total Capital and Liabilities | $1,581

Total Funding | $6,000

Important Assumptions:

Inspection Connection assumes a continued reasonable rate of home sales in the selected towns.

General Assumptions:

Year 1 | Year 2 | Year 3

——-|——-|——-

Plan Month | 1 | 2 | 3

Current Interest Rate | 7.00% | 7.00% | 7.00%

Long-term Interest Rate | 10.00% | 10.00% | 10.00%

Tax Rate | 30.00% | 30.00% | 30.00%

Other | 0 | 0 | 0

Break-even Analysis:

Based on the Break Even table and chart, Inspection Connection will reach a break-even point after 7 months. The average unit price of $450 is a conservative figure. Most inspections will include at least a radon test, which will significantly increase the unit price. Therefore, there is a good chance that the break-even point could be reached much earlier than 7 months.

Break-even Analysis

Monthly Units Break-even: 18

Monthly Revenue Break-even: $7,965

Assumptions:

Average Per-Unit Revenue: $450.00

Average Per-Unit Variable Cost: $45.00

Estimated Monthly Fixed Cost: $7,168

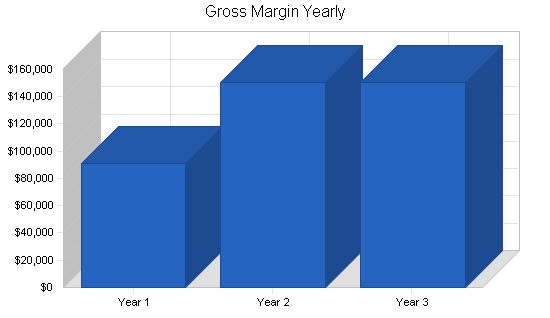

Projected Profit and Loss

The Profit and Loss table below is based on an estimated average of 19 unit sales per month at a price of $450 per unit. Most sales will be greater than the minimum of $450, which helps offset slower months where the year-end goal of 31 unit sales may not be attainable.

We will not show a profit in the first year, primarily due to deductible training expenses for licensing in a second state to expand the business.

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3

Sales: $101,250 $167,400 $167,400

Direct Cost of Sales: $10,125 $16,740 $16,740

Other Costs of Sales: $0 $0 $0

Total Cost of Sales: $10,125 $16,740 $16,740

Gross Margin: $91,125 $150,660 $150,660

Gross Margin %: 90.00% 90.00% 90.00%

Expenses:

Payroll: $28,600 $61,200 $61,200

Marketing/Promotion: $6,000 $6,000 $6,000

Depreciation: $0 $0 $0

Answering Service: $4,800 $4,800 $4,800

Liability / E&O Insurance: $4,800 $4,800 $4,800

Healthcare: $9,000 $9,000 $9,000

Auto Insurance: $1,440 $1,440 $1,440

Auto Fuel: $2,500 $3,600 $3,600

Accounting/Legal Fees: $1,800 $1,800 $1,800

Membership/Licensing Fees: $1,200 $1,200 $1,200

Vehicle Maintenance: $240 $240 $240

Local/Toll Free Phone Numbers: $840 $840 $840

Training/Internship: $14,000 $0 $0

Supplies: $8,400 $9,600 $9,600

Payroll Taxes: $0 $0 $0

Other: $2,400 $2,400 $2,400

Total Operating Expenses: $86,020 $106,920 $106,920

Profit Before Interest and Taxes: $5,105 $43,740 $43,740

EBITDA: $5,105 $43,740 $43,740

Interest Expense: $683 $326 $0

Taxes Incurred: $1,327 $13,024 $13,122

Net Profit: $3,095 $30,390 $30,618

Net Profit/Sales: 3.06% 18.15% 18.29%

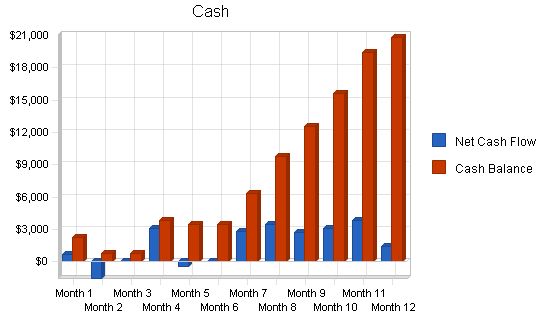

8.5 Projected Cash Flow:

The Cash Flow chart and table demonstrate sufficient cash flow to support operations and accommodate growth, as well as manage credit card debt and internship repayment.

Pro Forma Cash Flow

| Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $101,250 | $167,400 | $167,400 |

| Subtotal Cash from Operations | $101,250 | $167,400 | $167,400 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $14,000 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $115,250 | $167,400 | $167,400 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $42,600 | $61,200 | $61,200 |

| Bill Payments | $48,720 | $76,414 | $75,601 |

| Subtotal Spent on Operations | $91,320 | $137,614 | $136,801 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $4,680 | $9,320 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $96,000 | $146,934 | $136,801 |

| Net Cash Flow | $19,250 | $20,466 | $30,599 |

| Cash Balance | $20,831 | $41,297 | $71,896 |

Projected Balance Sheet

The Balance Sheet shows that Inspection Connection will increase its Net Worth steadily as a service-oriented business without a large asset base.

| Balance Sheet | |||

| Assets | Year 1 | Year 2 | Year 3 |

| Current Assets | |||

| Cash | $20,831 | $41,297 | $71,896 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $20,831 | $41,297 | $71,896 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $20,831 | $41,297 | $71,896 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $6,835 | $6,231 | $6,212 |

| Current Borrowing | $9,320 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $16,155 | $6,231 | $6,212 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $16,155 | $6,231 | $6,212 |

| Paid-in Capital | $6,000 | $6,000 | $6,000 |

| Retained Earnings | ($4,419) | ($1,324) | $29,066 |

| Earnings | $3,095 | $30,390 | $30,618 |

| Total Capital | $4,676 | $35,066 | $65,684 |

| Total Liabilities and Capital | $20,831 | $41,297 | $71,896 |

| Net Worth | $4,676 | $35,066 | $65,684 |

The following table shows standard ratios for our business, and a comparison with standard ratios for the Building Inspection Services Industry, SIC Code 7389.0203.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 65.33% | 0.00% | 2.53% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 47.92% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 75.32% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 24.68% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable Turnover | 8.13 | 12.17 | 12.17 | n.a |

| Payment Days | 31 | 31 | 30 | n.a |

| Total Asset Turnover | 4.86 | 4.05 | 2.33 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 3.45 | 0.18 | 0.09 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $4,676 | $35,066 | $65,684 | n.a |

| Interest Coverage | 7.47 | 134.09 | 0.00 | n.a |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

"

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Unit Sales | |||||||||||||

| Buyer Home Inspection | 0% | 2 | 3 | 4 | 5 | 5 | 6 | 8 | 10 | 10 | 10 | 10 | 10 |

| Pre-Listing Home Inspection | 0% | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Maintenance Inspection | 0% | 1 | 1 | 3 | 5 | 7 | 9 | 14 | 16 | 16 | 18 | 20 | 20 |

| Total Unit Sales | 4 | 5 | 8 | 11 | 13 | 16 | 23 | 27 | 27 | 29 | 31 | 31 | |

| Unit Prices | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Buyer Home Inspection | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | |

| Pre-Listing Home Inspection | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | |

| Maintenance Inspection | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | $450.00 | |

| Sales | |||||||||||||

| Buyer Home Inspection | $900 | $1,350 | $1,800 | $2,250 | $2,250 | $2,700 | $3,600 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | |

| Pre-Listing Home Inspection | $450 | $450 | $450 | $450 | $450 | $450 | $450 | $450 | $450 | $450 | $450 | $450 | |

| Maintenance Inspection | $450 | $450 | $1,350 | $2,250 | $3,150 | $4,050 | $6,300 | $7,200 | $7,200 | $8,100 | $9,000 | $9,000 | |

| Total Sales | $1,800 | $2,250 | $3,600 | $4,950 | $5,850 | $7,200 | $10,350 | $12,150 | $12,150 | $13,050 | $13,950 | $13,950 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Jacques Clouseau – Owner / Operator | 0% | $1,000 | $1,000 | $1,500 | $2,000 | $2,000 | $2,500 | $2,500 | $2,500 | $2,500 | $3,000 | $3,000 | $5,100 |

| Name or Title or Group | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| Total Payroll | $1,000 | $1,000 | $1,500 | $2,000 | $2,000 | $2,500 | $2,500 | $2,500 | $2,500 | $3,000 | $3,000 | $5,100 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | |||||