Contents

Fish Breeder Business Plan

The Company

Candlelight Cichlid Breeders (CCB) will provide rare tropical fish to aquarists without local access. CCB will ship live fish to customers anywhere in the continental United States within one to two days. CCB will also supply fish to local tropical fish retailers, offering convenience and variety not found elsewhere.

CCB’s assets will include livestock watering troughs and aquariums, housed in an insulated steel building.

CCB will operate as a sole proprietorship, owned by founder Shawn Halsey. Initially, Mr. Halsey will manage all aspects of the business alone and later hire a general assistant as sales increase.

The Product

Candlelight Cichlid Breeders will specialize in rare tropical fish from the Cichlidae family, known for their colorful appearance and aggressive behavior. CCB will breed up to 30 cichlid species and import non-breeding fish.

As CCB expands, we plan to offer live plants, more unusual cichlid varieties, newly discovered South American catfish species, and potentially some common cichlid species. Our sales will be limited to the U.S.

The Market

Research shows that fish keeping is the second most popular hobby in the U.S., after photography. We estimate there will be approximately seven million U.S. aquarium owners who are internet users by the end of this year. Of these users, we estimate that 5% (350,000) will visit our site and 2.5% (8,750) will make a purchase.

CCB recognizes the opportunity to serve customers who lack access to retail fish shops with a diverse selection of cichlid species. Additionally, current online fish sellers lack comprehensive care information for the fish they sell. CCB will provide both species information and the ability to order researched fish on our site. We will target a niche market with established customer loyalty, aiming to create a one-stop experience that fosters customer loyalty.

The company will focus on two market segments: direct online sales to tropical fish collectors and local fish retailers. Our largest market segment will be U.S.-based internet users who own an aquarium.

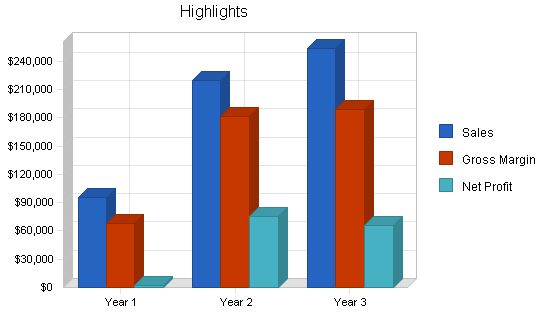

Financial Projections

Our start-up costs include expenses for the building and equipment, which will be financed through an investor, a bank loan, and a small owner investment in initial inventory and equipment.

We anticipate reaching our sales goal by early 2005, when our breeding stock is fully mature. The industry’s high margins and inventory turnover lead us to expect a high level of profitability.

1.1 Objectives

The CCB’s objectives are:

- Find a fast, reliable shipping service.

- Sales of $10,000 per month.

- Maintain an inventory turnover ratio of six.

1.2 Mission

Candlelight Cichlid Breeders (CCB) will provide hard to find tropical fish from the scientific family Cichlidae to aquarists without access to these fish through local pet stores. Up to 30 separate cichlid species will be bred by CCB, in addition to importing fish that do not readily breed in captivity. CCB will ship live fish to customers anywhere in the continental United States within one to two days. CCB will also provide fish to tropical fish retailers within 100 miles of the breeding center. CCB will provide convenience and variety not found in the traditional tropical fish selling industry.

1.3 Keys to Success

- Efficiently breed multiple species of tropical fish.

- Quickly and reliably deliver fish to customers.

- Develop a strong reputation within the fish keeping community.

- Ensure that all major search engines link to our site.

Company Summary

Candlelight Cichlid Breeders will be a privately-owned tropical fish breeding business. We will offer rare cichlid species to customers nationwide. Our customers do not have access to the species we offer through their local fish shops.

Candlelight Cichlid Breeders will consist of eighty 150-gallon livestock watering troughs and forty 40-gallon aquariums, totaling 13,600 gallons of water. The tanks and troughs will be enclosed by an insulated steel building built on a concrete slab. Breeding stock will be housed in the 150-gallon troughs, fertilized eggs will be moved to the 40-gallon aquariums before hatching in most cases. The business location is undetermined.

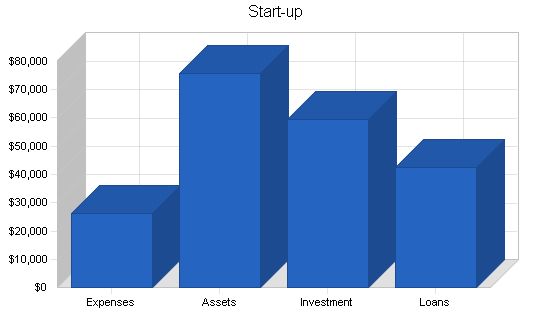

2.1 Start-up Summary

Our start-up costs include expenses for the building purchase and equipment. The costs will be financed by an angel investor, a bank loan, and a small owner investment of initial inventory and equipment. The assumptions are shown in the following table.

Start-up

Requirements

Start-up Expenses

Legal – $500

Stationery etc. – $50

Insurance – $500

Expensed equipment – $25,000

Other – $0

Total Start-up Expenses – $26,050

Start-up Assets

Cash Required – $40,000

Start-up Inventory – $900

Other Current Assets – $0

Long-term Assets – $35,000

Total Assets – $75,900

Total Requirements – $101,950

Start-up Funding

Start-up Expenses to Fund – $26,050

Start-up Assets to Fund – $75,900

Total Funding Required – $101,950

Assets

Non-cash Assets from Start-up – $35,900

Cash Requirements from Start-up – $40,000

Additional Cash Raised – $0

Cash Balance on Starting Date – $40,000

Total Assets – $75,900

Liabilities and Capital

Liabilities

Current Borrowing – $0

Long-term Liabilities – $42,360

Accounts Payable (Outstanding Bills) – $0

Other Current Liabilities (interest-free) – $0

Total Liabilities – $42,360

Capital

Planned Investment

Owner – $9,590

Angel Investor – $50,000

Additional Investment Requirement – $0

Total Planned Investment – $59,590

Loss at Start-up (Start-up Expenses) – ($26,050)

Total Capital – $33,540

Total Capital and Liabilities – $75,900

Total Funding – $101,950

2.2 Company Ownership

CCB will be a sole proprietorship, owned by Shawn Halsey.

Products

Candlelight Cichlid Breeders will provide rare tropical fish from the family cichlidae. These fish are known for their colorful appearance and interesting and aggressive behavior. The fish will be sold as juveniles, ranging in length from one to four inches. As adults, some of these species can grow to almost two feet in length, with the average adult being around eight to ten inches long. Shipping adult-sized cichlids is impractical due to their size.

3.1 Competitive Comparison

Other online businesses offer tropical fish and some common cichlids. The important difference between those businesses and CCB is that we will have the less common cichlids that the other sites do not offer.

The current online fish sellers do not provide background and care requirements information for the fish they sell. If a customer is looking to purchase a particular fish online, they may have to visit one site to read up on the care and behavior of the fish and then go to a different site to make the purchase. CCB will offer both information on the species we carry and the ability to order the researched fish without navigating to another website.

3.2 Future Products

As CCB grows, we may offer live plants, more types of unusual cichlids, newly discovered species of South American catfish, and possibly some of the more common cichlid species.

Market Analysis Summary

CCB’s largest market segment will be Internet users in the continental U.S. who own an aquarium. Other potential customers include tropical fish retailers and walk-in customers. Fish keeping is the second most popular hobby in the U.S., behind photography.

We estimate that by the year 2003, there will be approximately seven million Internet users in the continental U.S. who own an aquarium. This is a conservative estimate. We estimate that 5% (350,000) of these users will visit our site within one year, and that 2.5% (8,750) of those potential customers will make a purchase.

4.1 Market Segmentation

Internet customers: The majority of our customers will be Internet users. Research estimates that this segment consists of seven million Internet users.

4.2 Market Needs

Tropical fish enthusiasts are on the Internet looking for information on particular species and places to obtain them. Most people do not have access to retail fish shops that regularly carry a large variety of different cichlid species. Some of the most beautiful and interesting cichlids cannot be found in these shops at all. CCB will provide these hard-to-find species to hobbyists.

4.3 Competition and Buying Patterns

Competition in the online fish-selling industry is based on customer satisfaction. If the ordered fish arrives as advertised and in good health, the customer is satisfied. If a business can consistently provide customer satisfaction through quality product and quick service, the consumer will become loyal and regard product price as secondary in importance.

Strategy and Implementation Summary

CCB will market to tropical fish hobbyists looking for hard-to-find cichlid species. We will primarily sell our products over the Internet to customers within the continental U.S. These customers are looking for interesting and colorful examples of cichlid species that are not available in their local fish shop.

Our strategy is to offer one-stop shopping for rare and unusual cichlids through the Internet. Customers will be able to browse through pages of information on a particular cichlid species and then purchase the fish.

5.1 Competitive Edge

Our competitive edge will be our site design, on-site product supply, and wide variety within the cichlid family.

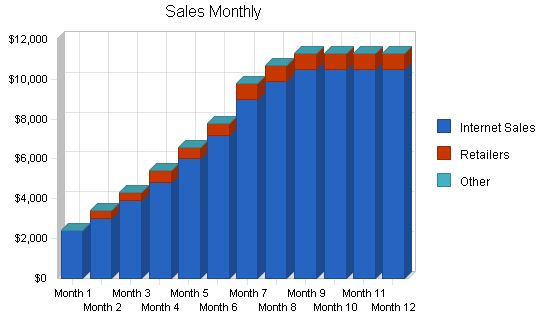

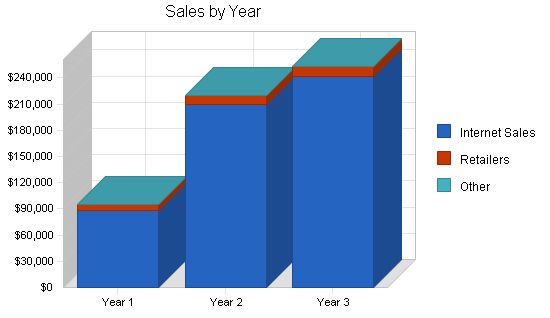

5.2 Sales Forecast

Our sales forecast assumes no change in costs or prices, which is a reasonable assumption for the last few years.

We expect a jump in sales in 2005 due to increased maturity of our breeding stock. We expect our sales to moderately increase in 2006.

Our sales will level off in the latter part of the first year, reaching maximum breeding capacity. Capacity will increase with time.

We expect the product line to change according to our customers’ needs and desires.

Reviewing the provided text and eliminating redundant words or phrases to enhance clarity and impact:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | |||

| Internet Sales | 14,700 | 35,000 | 40,250 |

| Retailers | 3,900 | 4,800 | 6,000 |

| Other | 0 | 0 | 0 |

| Total Unit Sales | 18,600 | 39,800 | 46,250 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Internet Sales | $6.00 | $6.00 | $6.00 |

| Retailers | $1.90 | $2.00 | $2.00 |

| Other | $0.00 | $0.00 | $0.00 |

| Sales | |||

| Internet Sales | $88,200 | $210,000 | $241,500 |

| Retailers | $7,400 | $9,600 | $12,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $95,600 | $219,600 | $253,500 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Internet Sales | $0.50 | $0.50 | $0.50 |

| Retailers | $0.50 | $0.50 | $0.50 |

| Other | $0.00 | $0.00 | $0.00 |

| Direct Cost of Sales | |||

| Internet Sales | $7,350 | $17,500 | $20,125 |

| Retailers | $1,950 | $2,400 | $3,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $9,300 | $19,900 | $23,125 |

Management Summary

CCB will be a small business owned by Shawn Halsey. He will be involved in all aspects of the business until it grows beyond his capacity to manage. Our one employee will have important responsibilities and will be appropriately compensated. The business culture will promote creativity and collaboration.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Production Personnel | |||

| General assistant | $18,000 | $18,000 | $24,000 |

| Second general assistant | $0 | $0 | $18,000 |

| Other | $0 | $0 | $0 |

| Subtotal | $18,000 | $18,000 | $42,000 |

| Sales and Marketing Personnel | |||

| Name or title | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Subtotal | $0 | $0 | $0 |

| General and Administrative Personnel | |||

| Owner | $36,000 | $48,000 | $60,000 |

| Other | $0 | $0 | $0 |

| Subtotal | $36,000 | $48,000 | $60,000 |

| Other Personnel | |||

| Name or title | $0 | $0 | $0 |

| Name or title | $0 | $0 | $0 |

| Name or title | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Subtotal | $0 | $0 | $0 |

| Total People | 2 | 2 | 3 |

| Total Payroll | $54,000 | $66,000 | $102,000 |

Financial Plan

The following topics outline the financial plan for Candlelight Cichlid Breeders.

7.1 Assumptions

The table below shows the general assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

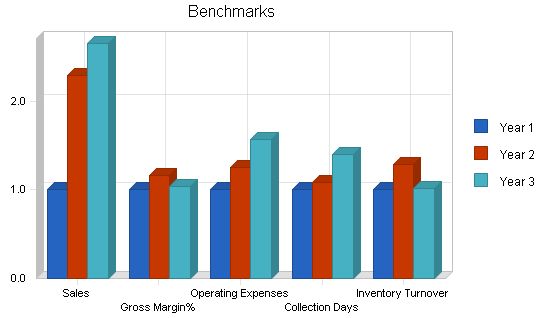

7.2 Key Financial Indicators

The chart below illustrates the key financial indicators.

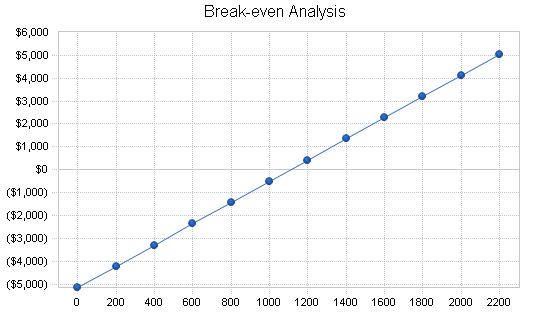

Our break-even analysis calculates the costs necessary to maintain the business. Payroll, mortgage payments, utilities, marketing, Internet costs, accounting expenses, and expenses for aquarium water conditioning are included in the analysis. We have estimated the total monthly fixed costs as shown below.

Break-even Analysis

Monthly Units Break-even: 1,110

Monthly Revenue Break-even: $5,705

Assumptions:

– Average Per-Unit Revenue: $5.14

– Average Per-Unit Variable Cost: $0.50

– Estimated Monthly Fixed Cost: $5,150

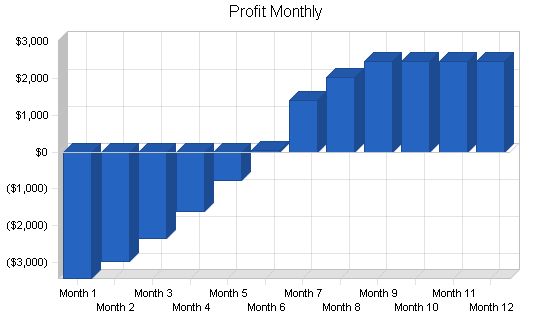

7.4 Projected Profit and Loss

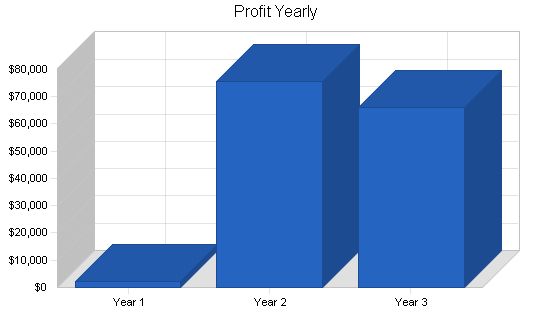

We expect high profitability from this venture due to industry margins and inventory turnover. Profit in the first year (2004) will be lower than projected potential due to the immaturity of two-thirds of the breeding stock and low name recognition. By September 2005, all breeding stock will have matured and 100% of projected profit potential will be realized.

Pro Forma Profit and Loss:

Sales:

– Year 1: $95,600

– Year 2: $219,600

– Year 3: $253,500

Direct Cost of Sales:

– Year 1: $9,300

– Year 2: $19,900

– Year 3: $23,125

Production Payroll:

– Year 1: $18,000

– Year 2: $18,000

– Year 3: $42,000

Other: $0

Total Cost of Sales:

– Year 1: $27,300

– Year 2: $37,900

– Year 3: $65,125

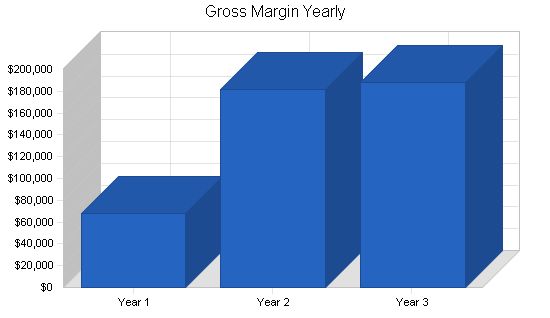

Gross Margin:

– Year 1: $68,300

– Year 2: $181,700

– Year 3: $188,375

Gross Margin %:

– Year 1: 71.44%

– Year 2: 82.74%

– Year 3: 74.31%

Operating Expenses:

Sales and Marketing Expenses:

Sales and Marketing Payroll:

– Year 1: $0

– Year 2: $0

– Year 3: $0

Advertising/Promotion:

– Year 1: $1,440

– Year 2: $2,880

– Year 3: $4,320

Travel:

– Year 1: $1,200

– Year 2: $1,800

– Year 3: $2,400

Miscellaneous:

– Year 1: $1,800

– Year 2: $1,800

– Year 3: $1,800

Total Sales and Marketing Expenses:

– Year 1: $4,440

– Year 2: $6,480

– Year 3: $8,520

Sales and Marketing %:

– Year 1: 4.64%

– Year 2: 2.95%

– Year 3: 3.36%

General and Administrative Expenses:

General and Administrative Payroll:

– Year 1: $36,000

– Year 2: $48,000

– Year 3: $60,000

Sales and Marketing and Other Expenses:

– Year 1: $0

– Year 2: $0

– Year 3: $0

Depreciation:

– Year 1: $12,000

– Year 2: $12,000

– Year 3: $12,000

Leased Equipment:

– Year 1: $0

– Year 2: $0

– Year 3: $0

Utilities:

– Year 1: $1,260

– Year 2: $1,300

– Year 3: $1,400

Rent:

– Year 1: $0

– Year 2: $0

– Year 3: $0

Payroll Taxes:

– Year 1: $8,100

– Year 2: $9,900

– Year 3: $15,300

Other General and Administrative Expenses:

– Year 1: $0

– Year 2: $0

– Year 3: $0

Total General and Administrative Expenses:

– Year 1: $57,360

– Year 2: $71,200

– Year 3: $88,700

General and Administrative %:

– Year 1: 60.00%

– Year 2: 32.42%

– Year 3: 34.99%

Other Expenses:

– Year 1: $0

– Year 2: $0

– Year 3: $0

Other %:

– Year 1: 0.00%

– Year 2: 0.00%

– Year 3: 0.00%

Total Operating Expenses:

– Year 1: $61,800

– Year 2: $77,680

– Year 3: $97,220

Profit Before Interest and Taxes:

– Year 1: $6,500

– Year 2: $104,020

– Year 3: $91,155

EBITDA:

– Year 1: $18,500

– Year 2: $116,020

– Year 3: $103,155

Interest Expense:

– Year 1: $3,873

– Year 2: $3,230

– Year 3: $2,559

Taxes Incurred:

– Year 1: $412

– Year 2: $25,198

– Year 3: $22,518

Net Profit:

– Year 1: $2,215

– Year 2: $75,593

– Year 3: $66,078

Net Profit/Sales:

– Year 1: 2.32%

– Year 2: 34.42%

– Year 3: 26.07%

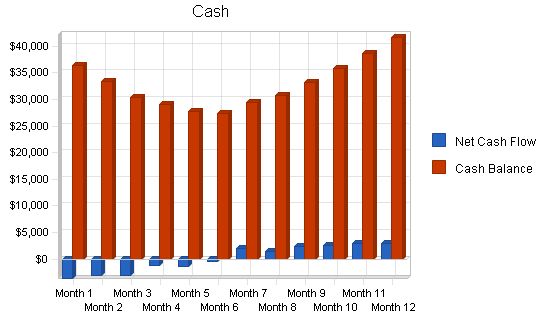

7.5 Projected Cash Flow:

As our breeding stock matures and our reputation grows, our business will experience increased cash flows. We may expand at this time with the construction of another building adjacent to the original structure.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $57,360 | $131,760 | $152,100 |

| Cash from Receivables | $29,351 | $76,310 | $98,248 |

| Subtotal Cash from Operations | $86,711 | $208,070 | $250,348 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $86,711 | $208,070 | $250,348 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $54,000 | $66,000 | $102,000 |

| Bill Payments | $24,437 | $65,049 | $73,300 |

| Subtotal Spent on Operations | $78,437 | $131,049 | $175,300 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $6,708 | $6,708 | $6,708 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $85,145 | $137,757 | $182,008 |

| Net Cash Flow | $1,566 | $70,313 | $68,340 |

| Cash Balance | $41,566 | $111,878 | $180,218 |

Projected Balance Sheet

7.6 Projected Balance Sheet

The following table shows the projected balance sheet for Candlelight Cichlid Breeders.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $41,566 | $111,878 | $180,218 |

| Accounts Receivable | $8,889 | $20,419 | $23,572 |

| Inventory | $1,183 | $2,530 | $2,940 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $51,638 | $134,828 | $206,730 |

| Long-term Assets | |||

| Long-term Assets | $35,000 | $35,000 | $35,000 |

| Accumulated Depreciation | $12,000 | $24,000 | $36,000 |

| Total Long-term Assets | $23,000 | $11,000 | ($1,000) |

| Total Assets | $74,638 | $145,828 | $205,730 |

7.7 Business Ratios

The following table outlines some of the more important ratios from the Breeding of Pets industry. The final column, Industry Profile, details specific ratios based on the industry as it is classified by the NAICS code, 112990.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 129.71% | 15.44% | 3.52% |

| Percent of Total Assets | ||||

| Accounts Receivable | 11.91% | 14.00% | 11.46% | 8.54% |

| Inventory | 1.58% | 1.74% | 1.43% | 11.36% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 30.17% |

| Total Current Assets | 69.18% | 92.46% | 100.49% | 50.07% |

| Long-term Assets | 30.82% | 7.54% | -0.49% | 49.93% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 3,230 | 5,536 | 6,068 | 24.29% |

| Current Borrowing | $0 | $0 | $0 | |

| Other Current Liabilities | $0 | $0 | $0 | |

| Subtotal Current Liabilities | $3,230 | $5,536 | $6,068 | |

| Long-term Liabilities | $35,652 | $28,944 | $22,236 | |

| Total Liabilities | $38,882 | $34,480 | $28,304 | |

| Paid-in Capital | $59,590 | $59,590 | $59,590 | |

| Retained Earnings | ($26,050) | ($23,835) | $51,758 | |

| Earnings | $2,215 | $75,593 | $66,078 | |

| Total Capital | $35,755 | $111,348 | $177,426 | |

| Total Liabilities and Capital | $74,638 | $145,828 | $205,730 | |

| Net Worth | $35,755 | $111,348 | $177,426 | |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Unit Sales | |||||||||||||

| Internet Sales | 0% | 400 | 500 | 650 | 800 | 1,000 | 1,200 | 1,500 | 1,650 | 1,750 | 1,750 | 1,750 | 1,750 |

| Retailers | 0% | 200 | 200 | 200 | 300 | 300 | 300 | 400 | 400 | 400 | 400 | 400 | 400 |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Unit Sales | 600 | 700 | 850 | 1,100 | 1,300 | 1,500 | 1,900 | 2,050 | 2,150 | 2,150 | 2,150 | 2,150 | |

| Unit Prices | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Internet Sales | $6.00 | $6.00 | $6.00 | $6.00 | $6.00 | $6.00 | $6.00 | $6.00 | $6.00 | $6.00 | $6.00 | $6.00 | |

| Retailers | $0.00 | $2.00 | $2.00 | $2.00 | $2.00 | $2.00 | $2.00 | $2.00 | $2.00 | $2.00 | $2.00 | $2.00 | |

| Other | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |

| Sales | |||||||||||||

| Internet Sales | $2,400 | $3,000 | $3,900 | $4,800 | $6,000 | $7,200 | $9,000 | $9,900 | $10,500 | $10,500 | $10,500 | $10,500 | |

| Retailers | $0 | $400 | $400 | $600 | $600 | $600 | $800 | $800 | $800 | $800 | $800 | $800 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Sales | $2,400 | $3,400 | $4,300 | $5,400 | $6,600 | $7,800 | $9,800 | $10,700 | $11,300 | $11,300 | $11,300 | $11,300 | |

| Direct Unit Costs | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Internet Sales | 0.00% | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 |

| Retailers | 0.00% | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 |

| Other | 0.00% | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

|

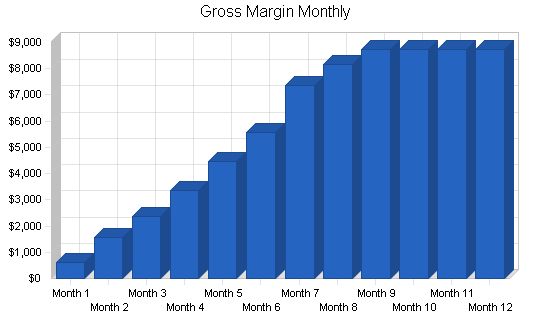

Sales: Month 1: $2,400 Month 2: $3,400 Month 3: $4,300 Month 4: $5,400 Month 5: $6,600 Month 6: $7,800 Month 7: $9,800 Month 8: $10,700 Month 9: $11,300 Month 10: $11,300 Month 11: $11,300 Month 12: $11,300 Direct Cost of Sales: Month 1: $300 Month 2: $350 Month 3: $425 Month 4: $550 Month 5: $650 Month 6: $750 Month 7: $950 Month 8: $1,025 Month 9: $1,075 Month 10: $1,075 Month 11: $1,075 Month 12: $1,075 Production Payroll: Month 1: $1,500 Month 2: $1,500 Month 3: $1,500 Month 4: $1,500 Month 5: $1,500 Month 6: $1,500 Month 7: $1,500 Month 8: $1,500 Month 9: $1,500 Month 10: $1,500 Month 11: $1,500 Month 12: $1,500 Other: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Total Cost of Sales: Month 1: $1,800 Month 2: $1,850 Month 3: $1,925 Month 4: $2,050 Month 5: $2,150 Month 6: $2,250 Month 7: $2,450 Month 8: $2,525 Month 9: $2,575 Month 10: $2,575 Month 11: $2,575 Month 12: $2,575 Gross Margin: Month 1: $600 Month 2: $1,550 Month 3: $2,375 Month 4: $3,350 Month 5: $4,450 Month 6: $5,550 Month 7: $7,350 Month 8: $8,175 Month 9: $8,725 Month 10: $8,725 Month 11: $8,725 Month 12: $8,725 Gross Margin %: Month 1: 25.00% Month 2: 45.59% Month 3: 55.23% Month 4: 62.04% Month 5: 67.42% Month 6: 71.15% Month 7: 75.00% Month 8: 76.40% Month 9: 77.21% Month 10: 77.21% Month 11: 77.21% Month 12: 77.21% Operating Expenses: Sales and Marketing Expenses: Sales and Marketing Payroll: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Advertising/Promotion: Month 1: $120 Month 2: $120 Month 3: $120 Month 4: $120 Month 5: $120 Month 6: $120 Month 7: $120 Month 8: $120 Month 9: $120 Month 10: $120 Month 11: $120 Month 12: $120 Travel: Month 1: $100 Month 2: $100 Month 3: $100 Month 4: $100 Month 5: $100 Month 6: $100 Month 7: $100 Month 8: $100 Month 9: $100 Month 10: $100 Month 11: $100 Month 12: $100 Miscellaneous: Month 1: $150 Month 2: $150 Month 3: $150 Month 4: $150 Month 5: $150 Month 6: $150 Month 7: $150 Month 8: $150 Month 9: $150 Month 10: $150 Month 11: $150 Month 12: $150 Total Sales and Marketing Expenses: Month 1: $370 Month 2: $370 Month 3: $370 Month 4: $370 Month 5: $370 Month 6: $370 Month 7: $370 Month 8: $370 Month 9: $370 Month 10: $370 Month 11: $370 Month 12: $370 Sales and Marketing %: Month 1: 15.42% Month 2: 10.88% Month 3: 8.60% Month 4: 6.85% Month 5: 5.61% Month 6: 4.74% Month 7: 3.78% Month 8: 3.46% Month 9: 3.27% Month 10: 3.27% Month 11: 3.27% Month 12: 3.27% General and Administrative Expenses: General and Administrative Payroll: Month 1: $3,000 Month 2: $3,000 Month 3: $3,000 Month 4: $3,000 Month 5: $3,000 Month 6: $3,000 Month 7: $3,000 Month 8: $3,000 Month 9: $3,000 Month 10: $3,000 Month 11: $3,000 Month 12: $3,000 Sales and Marketing and Other Expenses: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Depreciation: Month 1: $1,000 Month 2: $1,000 Month 3: $1,000 Month 4: $1,000 Month 5: $1,000 Month 6: $1,000 Month 7: $1,000 Month 8: $1,000 Month 9: $1,000 Month 10: $1,000 Month 11: $1,000 Month 12: $1,000 Leased Equipment: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Utilities: Month 1: $105 Month 2: $105 Month 3: $105 Month 4: $105 Month 5: $105 Month 6: $105 Month 7: $105 Month 8: $105 Month 9: $105 Month 10: $105 Month 11: $105 Month 12: $105 Rent: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Payroll Taxes: Month 1: 15% Month 2: $675 Month 3: $675 Month 4: $675 Month 5: $675 Month 6: $675 Month 7: $675 Month 8: $675 Month 9: $675 Month 10: $675 Month 11: $675 Month 12: $675 Other General and Administrative Expenses: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Total General and Administrative Expenses: Month 1: $4,780 Month 2: $4,780 Month 3: $4,780 Month 4: $4,780 Month 5: $4,780 Month 6: $4,780 Month 7: $4,780 Month 8: $4,780 Month 9: $4,780 Month 10: $4,780 Month 11: $4,780 Month 12: $4,780 General and Administrative %: Month 1: 199.17% Month 2: 140.59% Month 3: 111.16% Month 4: 88.52% Month 5: 72.42% Month 6: 61.28% Month 7: 48.78% Month 8: 44.67% Month 9: 42.30% Month 10: 42.30% Month 11: 42.30% Month 12: 42.30% Other Expenses: Other Payroll: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Consultants: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Contract/Consultants: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Total Other Expenses: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Other %: Month 1: 0.00% Month 2: 0.00% Month 3: 0.00% Month 4: 0.00% Month 5: 0.00% Month 6: 0.00% Month 7: 0.00% Month 8: 0.00% Month 9: 0.00% Month 10: 0.00% Month 11: 0.00% Month 12: 0.00% Total Operating Expenses: Month 1: $5,150 Month 2: $5,150 Month 3: $5,150 Month 4: $5,150 Month 5: $5,150 Month 6: $5,150 Month 7: $5,150 Month 8: $5,150 Month 9: $5,150 Month 10: $5,150 Month 11: $5,150 Month 12: $5,150 Profit Before Interest and Taxes: Month 1: ($4,550) Month 2: ($3,600) Month 3: ($2,775) Month 4: ($1,800) Month 5: ($700) Month 6: $400 Month 7: $2,200 Month 8: $3,025 Month 9: $3,575 Month 10: $3,575 Month 11: $3,575 Month 12: $3,575 EBITDA: Month 1: ($3,550) Month 2: ($2,600) Month 3: ($1,775) Month 4: ($800) Month 5: $300 Month 6: $1,400 Month 7: $3,200 Month 8: $4,025 Month 9: $4,575 Month 10: $4,575 Month 11: $4,575 Month 12: $4,575 Interest Expense: Month 1: $348 Month 2: $344 Month 3: $339 Month 4: $334 Month 5: $330 Month 6: $325 Month 7: $320 Month 8: $316 Month 9: $311 Month 10: $306 Month 11: $302 Month 12: $297 Taxes Incurred: Month 1: ($1,470) Month 2: ($986) Month 3: ($779) Month 4: ($534) Month 5: ($257) Month 6: $19 Month 7: $470 Month 8: $677 Month 9: $816 Month 10: $817 Month 11: $818 Month 12: $819 Net Profit: Month 1: ($3,429) Month 2: ($2,958) Month 3: ($2,336) Month 4: ($1,601) Month 5: ($772) Month 6: $56 Month 7: $1,410 Month 8: $2,032 Month 9: $2,448 Month 10: $2,451 Month 11: $2,455 Month 12: $2,458 Net Profit/Sales: Month 1: -142.87% Month 2: -86.99% Month 3: -54.31% Month 4: -29.64% Month 5: -11.70% Month 6: 0.72% Month 7: 14.38% Month 8: 18.99% Month 9: 21.66% Month 10: 21.69% Month 11: 21.73% Month 12: 21.76% Pro Forma Cash Flow Cash Received Cash from Operations – Cash Sales: $1,440, $2,040, $2,580, $3,240, $3,960, $4,680, $5,880, $6,420, $6,780, $6,780, $6,780, $6,780 – Cash from Receivables: $0, $32, $973, $1,372, $1,735, $2,176, $2,656, $3,147, $3,932, $4,288, $4,520, $4,520 Subtotal Cash from Operations: $1,440, $2,072, $3,553, $4,612, $5,695, $6,856, $8,536, $9,567, $10,712, $11,068, $11,300, $11,300 Additional Cash Received – Sales Tax, VAT, HST/GST Received: $0 – New Current Borrowing: $0 – New Other Liabilities (interest-free): $0 – New Long-term Liabilities: $0 – Sales of Other Current Assets: $0 – Sales of Long-term Assets: $0 – New Investment Received: $0 Subtotal Cash Received: $1,440, $2,072, $3,553, $4,612, $5,695, $6,856, $8,536, $9,567, $10,712, $11,068, $11,300, $11,300 Expenditures Expenditures from Operations Cash Spending: $4,500, $4,500, $4,500, $4,500, $4,500, $4,500, $4,500, $4,500, $4,500, $4,500, $4,500, $4,500 Bill Payments: $1, $78, $1,481, $752, $1,960, $2,198, $1,546, $3,067, $3,256, $3,405, $3,348, $3,345 Subtotal Spent on Operations: $4,501, $4,578, $5,981, $5,252, $6,460, $6,698, $6,046, $7,567, $7,756, $7,905, $7,848, $7,845 Additional Cash Spent – Sales Tax, VAT, HST/GST Paid Out: $0 – Principal Repayment of Current Borrowing: $0 – Other Liabilities Principal Repayment: $0 – Long-term Liabilities Principal Repayment: $559, $559, $559, $559, $559, $559, $559, $559, $559, $559, $559, $559 – Purchase Other Current Assets: $0 – Purchase Long-term Assets: $0 – Dividends: $0 Subtotal Cash Spent: $5,060, $5,137, $6,540, $5,811, $7,019, $7,257, $6,605, $8,126, $8,315, $8,464, $8,407, $8,404 Net Cash Flow: ($3,620), ($3,065), ($2,987), ($1,199), ($1,324), ($401), $1,931, $1,441, $2,397, $2,604, $2,893, $2,896 Cash Balance: $36,380, $33,315, $30,328, $29,129, $27,805, $27,404, $29,335, $30,776, $33,173, $35,777, $38,670, $41,566 |

|||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!