Contents

Coffee Roaster Business Plan

Beanisimo Coffee is a Salem, Oregon-based startup coffee roaster that offers a line of premium coffees and espressos. Founded by Frank Jones, the company incorporates old-world Italian traditions and recipes to meet the demand for high-quality coffees.

Keys to Success

Beanisimo Coffee has identified three crucial factors for its success. Firstly, it aims to develop the finest coffee in the market. Secondly, it emphasizes the importance of exceeding customer expectations by providing exceptional customer service. Lastly, it seeks to ensure financial success through the implementation of strict financial controls.

Target Market Segments

Beanisimo Coffee targets three customer segments: coffee houses, drive-thru establishments, and espresso carts, which make up a potential customer base of 187 and are growing at a rate of 7% annually. The second segment consists of restaurants, with 107 potential customers and an 8% annual growth rate. Lastly, grocery stores that sell unprepared beans, in either whole bean or ground forms, form the third segment, which has 97 potential customers and a 7% growth rate.

Management

Frank Jones leads Beanisimo Coffee. With an impressive educational background and relevant industry experience, Frank holds a Bachelor’s degree and an MBA from Willamette University. He has also worked in various coffee shops and trained as a coffee roaster in Italy under the guidance of a renowned Italian master roaster.

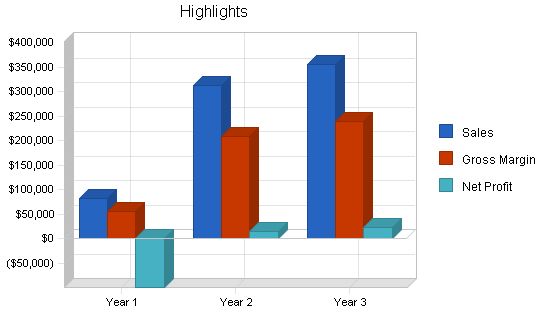

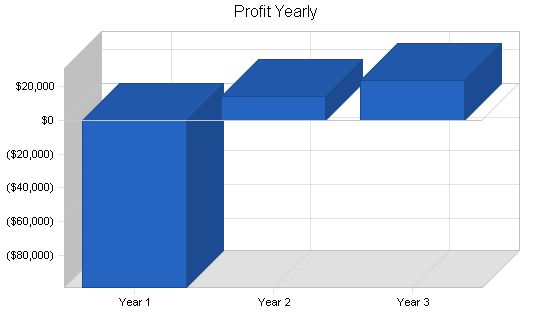

Combining a solid business model, strong educational credentials, and proprietary coffee roasting techniques, Frank aims to position Beanisimo Coffee as a key player in the high-end coffee market in the Willamette River Valley. Sales are projected to reach $312,000 in year two and $355,000 in year three. Net profit is expected to be 7.58% in year two, rising to 9.58% in year three.

Beanisimo Coffee’s mission is to offer the finest selection of coffees using the customs of a 54-year-old Italian master roaster. The company aims to surpass its competition with a strong customer service ethic.

The objectives of Beanisimo Coffee are to build brand awareness, provide excellent customer service, and increase sales. To achieve these objectives, the company will:

– Develop a high-quality menu of different coffee blends

– Anticipate customer needs and deliver excellent service

– Utilize traditional Italian roasting methods to increase market penetration

Beanisimo Coffee has identified several keys to success, including developing the finest product, exceeding customer expectations, and employing strict financial controls.

Beanisimo Coffee is a start-up coffee roaster based in Salem, Oregon. The company offers a line of premium coffees and espressos, applying old-world Italian traditions and recipes.

Company Ownership:

Beanisimo Coffee is an Oregon S Corporation, with Frank Jones as the primary stockholder and founder.

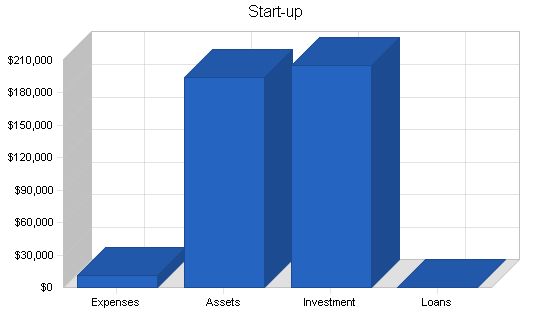

Start-up Summary:

The company will require the following equipment:

– Three workstation computers and one central file server

– Two laser printers

– Microsoft Office and Peachtree Accounting software

– Assorted office furniture and equipment

– Assorted buckets, labels, bags, and hooks

– Topre Izmir perforated drum roaster

– Heat-based bag sealer

– Hobart scale

– Van.

Beanisimo Coffee offers a variety of blended and roasted coffees, using customs passed down from a 54-year-old Italian master coffee roaster. The key to a great bag of roasted beans is blending different types of beans, as they are a global commodity. Beanisimo Coffee has access to decades-old blending recipes and uses a unique roasting technique to ensure the best quality and taste. They offer a wide range of coffees, including Italian Roast, French Roast, Columbian Dark, African Roast, Sumatra, Bistro Blend, Kona, Kenya, and decaf options in various blends. Each coffee is available in one-pound and five-pound packages, whole bean or ground.

Beanisimo Coffee focuses on three customer segments: coffee houses/drive thrus/espresso carts, restaurants, and grocery stores. These segments have distinct needs, with the first two preparing beverages for their customers and the third selling coffee beans. The high-end gourmet coffee market continues to grow due to the maturing and increased sophistication of the American palette. Beanisimo Coffee’s strength lies in its product quality, in contrast to competitors who prioritize convenience or price.

The market segmentation for Beanisimo Coffee includes coffee houses/drive thrus/carts, restaurants, and grocery stores. Coffee houses/drive thrus/carts serve a diverse range of coffee and espresso beverages. Restaurants purchase coffee and espresso for their food customers. Grocery stores sell Beanisimo Coffee either prepackaged or in bulk.

According to the National Coffee Association, 107 million U.S. adults drank coffee every day in 2002, while 108.7 million did so in 2003. Both men and women consume the same number of cups per day, but women are more interested in varieties and consider coffee a source of relaxation, while men appreciate its productivity benefits. Younger consumers (18-25) prefer high-caffeine drinks, while those aged 30-60 prefer premium and espresso with less caffeine. Coffee consumption is highest during breakfast, with 35% of coffee drinkers enjoying their coffee black and 65% adding sweetener or creamer. The average daily coffee drinker consumes 3.1 cups per day, and 29 million people drink gourmet coffee daily.

Overall, Beanisimo Coffee stands out in the market by offering high-quality, blended, and roasted coffee beans to meet the diverse preferences of different customer segments.

The table below shows the growth and CAGR of potential customers in the coffee market analysis for years 1 to 5.

Potential Customers: Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Coffee houses, etc. 7% 120 128 137 147 157 6.95%

Restaurants 8% 107 207 224 242 261 24.97%

Grocery stores 7% 97 104 111 119 127 6.97%

Total 13.88% 324 439 472 508 545 13.88%

Target Market Segment Strategy:

Beanisimo Coffee focuses on three customer segments: coffee houses, restaurants, and grocery stores due to their appreciation for high-quality coffee and constant need for beverages.

Coffee shops/drive thrus/carts segment appreciates high-quality coffee/espresso product. Restaurants serve coffee with meals throughout the year. Grocery stores sell coffee in unprepared forms to a wide range of customers.

The global coffee market is a $56 billion industry, with the top-ten coffee-producing countries being Brazil, Vietnam, Columbia, Indonesia, Mexico, Ethiopia, India, Guatemala, Ivory Coast, and Uganda. Vietnam moved to the second-largest producer of coffee globally in the 1990s. Coffee is available in various forms, with instant coffee being preferred worldwide, except in North America.

Top coffee-importing countries as a % of world supplies:

USA 55.6%

Germany 14.0%

Japan 7.7%

France 7.5%

Italy 6.2%

Spain 3.8%

Holland 3.4%

UK 3.4%

Sweden 2.2%

Top coffee-consuming regions (by pounds consumed per capita per year):

Northern Europe* 23

Central Europe 16

South America 7

Southern Europe 10

North America 10

Australia 5

Japan 5

*Does not include the UK, which only consumes 5 pounds per capita per year.

The total U.S. coffee market is projected to exceed $25 billion in 2002, with gourmet coffee consumption increasing. Specialty coffee sales grew 38% from $7.76 billion in 2000 to $10.71 billion in 2001, comprising 30% of the total U.S. coffee market.

Competition and Buying Patterns:

Beanisimo Coffee’s competitors include Allan Brothers, Caffetto, and assorted varieties distributed by food service vendors. Customer buying patterns are based on convenience, cost, and quality. Some customers prioritize individual servings, while others prioritize quality.

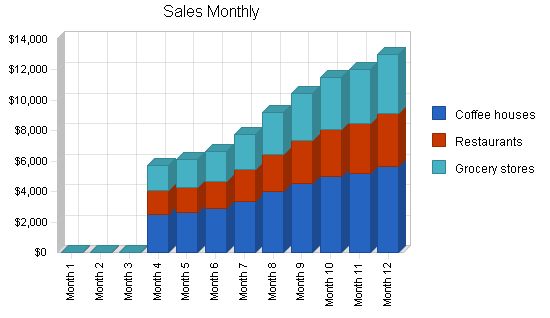

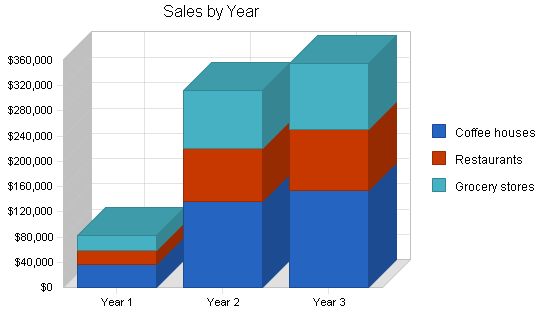

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Coffee houses | $35,824 | $136,004 | $154,545 |

| Restaurants | $22,211 | $84,322 | $95,818 |

| Grocery stores | $24,360 | $92,483 | $105,091 |

| Total Sales | $82,395 | $312,809 | $355,454 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Coffee houses | $11,822 | $44,881 | $51,000 |

| Restaurants | $7,330 | $27,826 | $31,620 |

| Grocery stores | $8,039 | $30,519 | $34,680 |

| Subtotal Direct Cost of Sales | $27,190 | $103,227 | $117,300 |

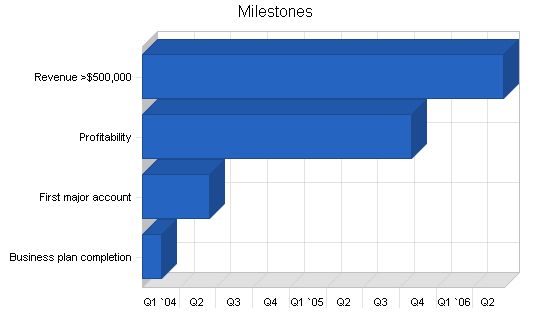

5.4 Milestones

Beanisimo Coffee has established milestones for the entire organization to achieve. All milestones are measurable, allowing departments to track progress and assess their ability to reach each milestone.

- Business plan completion.

- First major account: This will be the initial large account that provides the company with recurring revenue.

- Profitability: A significant milestone for the accounting/finance department.

- Revenue exceeding $300,000.

Milestones:

– Business plan completion: 1/1/2004 – 2/15/2004, $0 budget, Frank (Operations)

– First major account: 1/1/2004 – 6/15/2004, $0 budget, Sales Manager (Sales)

– Profitability: 1/1/2004 – 10/30/2005, $0 budget, Frank (Accounting)

– Revenue >$500,000: 1/1/2004 – 6/15/2006, $0 budget, Sales Manager (Sales)

– Totals: $0 budget

Web Plan Summary:

A website will provide information regarding Beanisimo Coffee and its products to current and prospective customers. The site will be used for informational purposes and may consider selling coffee in the future.

Website Marketing Strategy:

The marketing strategy aims to develop awareness for the website, directing people to learn more about Beanisimo Coffee’s line of coffees and espressos. Beanisimo Coffee will submit to search engines like Google! to improve visibility. In addition to search engine submissions, all promotional material will include the website URL.

Development Requirements:

Since the website is primarily for information, development requirements are minimal. Beanisimo Coffee will utilize the technical expertise of a computer science graduate student to create the site.

Management Summary:

Frank Jones, the founder of Beanisimo Coffee, will lead the management team. Frank has a Bachelor of Arts and MBA from Willamette University, with experience as a barista and training with an Italian master roaster.

Personnel Plan:

– Frank: Business development, accounting, sales, roasting.

– Sales manager: Account management and new sales development.

– Sales: Account management and new sales development.

– Shipping: Order fulfillment coordination.

– Support staff: Support operations in various capacities.

– Administrative support: Accounting and other administrative support functions.

Important Assumptions:

– General Assumptions:

– Plan Month: Year 1, Year 2, Year 3

– Current Interest Rate: 10.00%

– Long-term Interest Rate: 10.00%

– Tax Rate: 30.00%

– Other: 0

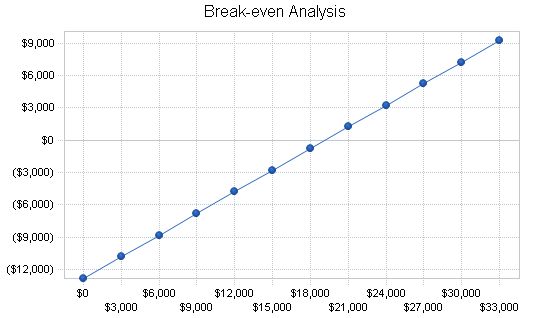

Break-even Analysis:

Approximately $19,000 in monthly revenue is needed to reach the break-even point.

Break-even Analysis

Monthly Revenue Break-even: $19,170

Assumptions:

– Average Percent Variable Cost: 33%

– Estimated Monthly Fixed Cost: $12,844

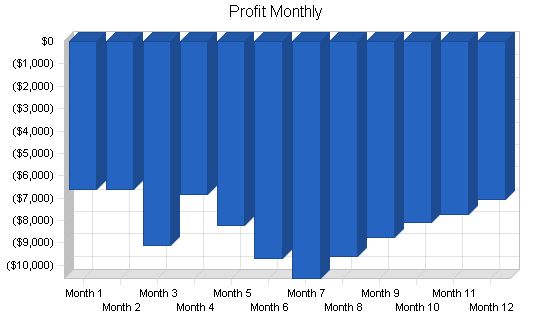

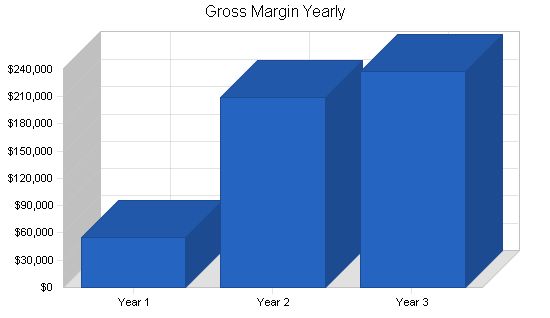

Projected Profit and Loss:

The table below shows the projected profit and loss.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $82,395 $312,809 $355,454

Direct Cost of Sales $27,190 $103,227 $117,300

Other Costs of Goods $0 $0 $0

Total Cost of Sales $27,190 $103,227 $117,300

Gross Margin $55,205 $209,582 $238,154

Gross Margin % 67.00% 67.00% 67.00%

Expenses

Payroll $83,940 $112,080 $124,080

Sales and Marketing and Other Expenses $8,394 $11,208 $12,408

Depreciation $15,600 $15,600 $15,600

Rent $14,400 $14,400 $14,400

Utilities $7,800 $7,800 $7,800

Insurance $9,000 $9,000 $9,000

Payroll Taxes $12,591 $16,812 $18,612

Other $2,400 $2,400 $2,400

Total Operating Expenses $154,125 $189,300 $204,300

Profit Before Interest and Taxes ($98,920) $20,282 $33,854

EBITDA ($83,320) $35,882 $49,454

Interest Expense $0 $0 $0

Taxes Incurred $0 $6,085 $10,156

Net Profit ($98,920) $14,198 $23,698

Net Profit/Sales -120.06% 4.54% 6.67%

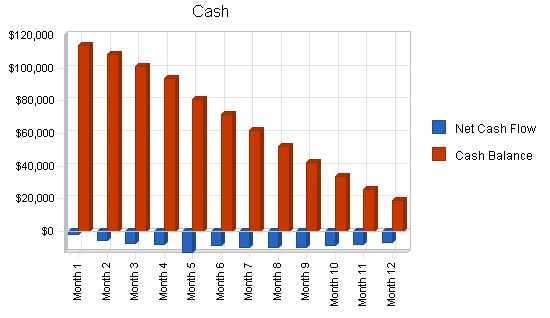

8.4 Projected Cash Flow

The following table and chart will detail information regarding Cash Flow.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $20,599 | $78,202 | $88,863 |

| Cash from Receivables | $43,327 | $182,958 | $257,031 |

| Subtotal Cash from Operations | $63,926 | $261,161 | $345,895 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $20,000 | $0 |

| Subtotal Cash Received | $63,926 | $281,161 | $345,895 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $83,940 | $112,080 | $124,080 |

| Bill Payments | $77,036 | $178,464 | $193,666 |

| Subtotal Spent on Operations | $160,976 | $290,544 | $317,746 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $160,976 | $290,544 | $317,746 |

| Net Cash Flow | ($97,050) | ($9,383) | $28,148 |

| Cash Balance | $18,950 | $9,567 | $37,715 |

Projected Balance Sheet

8.5 Projected Balance Sheet

The following table displays the Projected Balance Sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $18,950 | $9,567 | $37,715 |

| Accounts Receivable | $18,469 | $70,118 | $79,677 |

| Inventory | $4,722 | $17,928 | $20,372 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $42,141 | $97,612 | $137,763 |

| Long-term Assets | |||

| Long-term Assets | $78,000 | $78,000 | $78,000 |

| Accumulated Depreciation | $15,600 | $31,200 | $46,800 |

| Total Long-term Assets | $62,400 | $46,800 | $31,200 |

| Total Assets | $104,541 | $144,412 | $168,963 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $9,461 | $15,135 | $15,988 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $9,461 | $15,135 | $15,988 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $9,461 | $15,135 | $15,988 |

| Paid-in Capital | $205,000 | $225,000 | $225,000 |

| Retained Earnings | ($11,000) | ($109,920) | ($95,723) |

| Earnings | ($98,920) | $14,198 | $23,698 |

| Total Capital | $95,080 | $129,277 | $152,975 |

| Total Liabilities and Capital | $104,541 | $144,412 | $168,963 |

| Net Worth | $95,080 | $129,277 | $152,975 |

8.6 Business Ratios

The following table shows important Business Ratios, specific to Beanisimo as well as the industry as a whole.

| Ratio Analysis | |||||||||||||||

| Year 1 | Year 2 | Year 3 | Industry Profile | ||||||||||||

| Sales Growth | 0.00% | 279.64% | 13.63% | -2.25% | |||||||||||

| Percent of Total Assets | |||||||||||||||

| Accounts Receivable | 17.67% | 48.55% | 47.16% | 20.65% | |||||||||||

| Inventory | 4.52% | 12.41% | 12.06% | 16.07% | |||||||||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 21.35% | |||||||||||

| Total Current Assets | 40.31% | 67.59% | 81.53% | 58.07% | |||||||||||

| Long-term Assets | |||||||||||||||

| Long-term Assets | 59.69% | 32.41% | 18.47% | 41.93% | |||||||||||

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||||

| Current Liabilities | |||||||||||||||

| Accounts Payable | 9.05% | 10.48% | 9.46% | 21.87% | |||||||||||

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 19.28% | |||||||||||

| Total Liabilities | 9.05% | 10.48% | 9.46% | 41.15% | |||||||||||

| Net Worth | 90.95% | 89.52% | 90.54% | 58.85% | |||||||||||

| Percent of Sales | |||||||||||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||||

| Gross Margin | 67.00% | 67.00% | 67.00% | 32.41% | |||||||||||

| Selling, General & Administrative Expenses | 187.06% | 62.46% | 60.33% | 21.65% | |||||||||||

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 1.81% | |||||||||||

| Profit Before Interest and Taxes | -120.06% | 6.48% | 9.52% | 1.84% | |||||||||||

| Main Ratios | Personnel Plan | ||||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||||

| Frank | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |||

| Sales manager | $0 | $0 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |||

| Sales | $0 | $0 | $0 | $0 | $0 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |||

| Support | $0 | $0 | $0 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | |||

| Shipping | $0 | $0 | $0 | $0 | $0 | $0 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | |||

| Administration | $0 | $0 | $0 | $0 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | |||

| Total People | 1 | 1 | 2 | 2 | 3 | 5 | 6 | 6 | 6 | 6 | 6 | 6 | |||

| Total Payroll | $2,000 | $2,000 | $4,000 | $5,280 | $6,560 | $8,060 | $9,340 | $9,340 | $9,340 | $9,340 | $9,340 | $9,340 | |||

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $0 | $0 | $5,750 | $6,109 | $6,668 | $7,740 | $9,175 | $10,454 | $11,475 | $12,018 | $13,009 | |

| Direct Cost of Sales | $0 | $0 | $0 | $1,898 | $2,016 | $2,200 | $2,554 | $3,028 | $3,450 | $3,787 | $3,966 | $4,293 | |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $0 | $1,898 | $2,016 | $2,200 | $2,554 | $3,028 | $3,450 | $3,787 | $3,966 | $4,293 | |

| Gross Margin | $0 | $0 | $0 | $3,853 | $4,093 | $4,467 | $5,185 | $6,147 | $7,004 | $7,688 | $8,052 | $8,

Pro Forma Cash Flow Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Cash Received: Cash from Operations: Cash Sales $0 $0 $0 $1,438 $1,527 $1,667 $1,935 $2,294 $2,613 $2,869 $3,004 $3,252 Cash from Receivables: $0 $0 $0 $0 $144 $4,321 $4,596 $5,028 $5,841 $6,913 $7,866 $8,620 Subtotal Cash from Operations: $0 $0 $0 $1,438 $1,671 $5,988 $6,530 $7,321 $8,454 $9,782 $10,870 $11,872 Additional Cash Received: Sales Tax, VAT, HST/GST Received: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Current Borrowing: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Other Liabilities (interest-free): $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Long-term Liabilities: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Sales of Other Current Assets: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Sales of Long-term Assets: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Investment Received: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Subtotal Cash Received: $0 $0 $0 $1,438 $1,671 $5,988 $6,530 $7,321 $8,454 $9,782 $10,870 $11,872 Expenditures: Expenditures from Operations: Cash Spending: $2,000 $2,000 $4,000 $5,280 $6,560 $8,060 $9,340 $9,340 $9,340 $9,340 $9,340 $9,340 Bill Payments: $110 $3,300 $3,317 $3,943 $8,054 $6,607 $7,247 $8,098 $8,696 $9,057 $9,293 $9,314 Subtotal Spent on Operations: $2,110 $5,300 $7,317 $9,223 $14,614 $14,667 $16,587 $17,438 $18,036 $18,397 $18,633 $18,654 Additional Cash Spent: Sales Tax, VAT, HST/GST Paid Out: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Principal Repayment of Current Borrowing: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other Liabilities Principal Repayment: $0 $0 $0 $0 |

|

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!