Contents

Yoga Center Business Plan

Hatha Yoga is an ancient discipline that explores, develops, and integrates the body, mind, and spirit. It systematically stretches and strengthens muscles throughout the body, increases circulation to internal organs and glands, quiets the nervous system, and improves concentration. This system of self-care brings vitality, health, relaxation, and peace of mind.

The style of Hatha Yoga taught is the Anusara method. Anusara Yoga is a heart-oriented, spiritually inspiring style that emphasizes optimal body alignment in the poses. Instructors encourage students to listen to their body, respect its wisdom, and progress at their own pace.

Deep relaxation is taught in each class after the postures. The intention of the instructors at Garden Way Yoga Center (GWYC) is to assist students in developing physical, mental, and spiritual well-being, providing a truly priceless health advantage.

Garden Way Yoga Center offers 8 eight-week sessions of classes per year. Courses include Anusara-style Hatha Yoga and workshops in related topics. The Yoga Center features well-trained, professional instructors, progressive teaching methods, a non-competitive and encouraging atmosphere, and a beautiful light-filled facility.

The Yoga Center also has a boutique that sells workshop clothing and yoga training aides.

Jill Gordon, Ph.D., founder of The Garden Way Yoga Center, is one of Anusara Yoga’s leading teachers. She conducts workshops and teacher trainings nationally and internationally, and has previously established yoga training centers in Santa Barbara, CA; Denver, CO; and Charlottesville, VA. She co-founded and co-developed the Four Winds Yoga Center in Portland, OR, which offered instruction to nearly 1,000 students per week. Jill is a certified Anusara instructor and one of the few Designated Teacher Trainers in the Anusara style of Hatha Yoga. She is registered with the national Yoga Alliance at the highest 500-hour level.

1.1 Objectives

The objectives of Garden Way Yoga Center are:

- Acquire 300 customers by the end of the first year.

- Achieve sales in excess of $60,000 from the boutique.

- Increase customer base by 25% by the end of the second year.

- Increase sales by 15% by the end of the second year.

1.2 Mission

The mission of Garden Way Yoga Center is to provide a place for students, regardless of experience, to practice Anusara. We aim to maintain the authenticity of Anusara teachings and act responsibly with our students’ best interests in mind. Ultimately, we believe that the true teacher resides within each individual.

Company Summary

Garden Way Yoga Center offers Anusara-style Hatha Yoga and workshops on related topics. We have highly trained instructors, progressive teaching methods, a non-competitive and encouraging environment, and a beautiful, well-lit facility.

The center will be located in the commercial downtown section of Monroe, in the renovated Millman Center. Our target audience includes the office workers employed downtown.

In addition to our training programs, Garden Way Yoga Center also has a boutique selling workshop clothing and yoga training aids.

The center will operate as a sole proprietorship.

2.1 Company Ownership

Garden Way Yoga Center is owned by Jill Gordon.

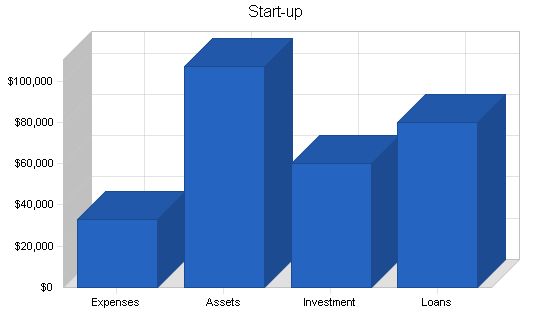

2.2 Start-up Summary

The start-up expenses for Garden Way Yoga Center primarily include workshop setup and equipment, and inventory for the boutique and bookstore. Jill will invest $60,000, and the center will secure a $80,000 long-term loan.

The Garden Way Yoga Center is located in downtown Monroe, in the renovated Millman Center. It is easily accessible to over 50,000 urban professionals who could be potential members. With five large workshop rooms, men and women’s dressing rooms, and a boutique, GWYC offers ample floor space for simultaneous classes. Parking is not an issue, as GWYC is within walking distance of any downtown building and has parking for up to 2,000 vehicles.

GWYC offers various yoga classes, including Yoga 1/Beginner, Fundamentals of Vinyasa Yoga, Gentle Yoga, Yoga 1-2/Continuing Beginner, Yoga 2/Intermediate, and Yoga 3/Advanced. Workshop clothing, equipment, and yoga training aides are also available.

Downtown Monroe has experienced a revival after the recent recession, becoming the heart of the city once again. The growth can be attributed to increased employment in high-tech companies. GWYC believes that offering a program that fits the time constraints of professionals’ jobs will make it attractive to customers. The convenient location and lunch-hour workshops will be appealing to the target audience. Jill Gordon’s expertise in yoga instruction will also be a draw. Attracting new people to yoga instruction is vital for the success of GWYC.

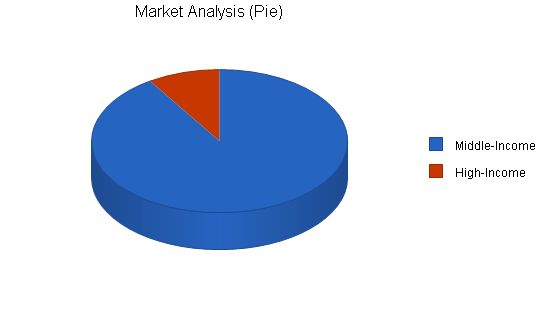

The Garden Way Yoga Center targets two customer groups: middle-income urban professionals and upper-income individuals. The core segment of potential students are middle-income urban professionals aged 26-40, with 30% males and 70% females. Their family income ranges from $30,000 to $50,000. They are active individuals focused on healthy food and dieting, with over 70% being members of gyms and 40% having taken yoga classes before. They are more likely to attend yoga as a group activity to reduce stress and because it is conveniently located near their workplace.

The secondary target group is upper-income individuals aged 40-60, with similar demographic characteristics as the core segment. However, their family income is $60,000+ and their yoga attendance is likely to be solo.

Potential Customers:

– Middle-Income: 15% growth – Year 1: 15,000, Year 2: 17,250, Year 3: 19,838, Year 4: 22,814, Year 5: 26,236, CAGR: 15.00%

– High-Income: 9% growth – Year 1: 1,500, Year 2: 1,635, Year 3: 1,782, Year 4: 1,942, Year 5: 2,117, CAGR: 9.00%

– Total: CAGR: 14.49% – Year 1: 16,500, Year 2: 18,885, Year 3: 21,620, Year 4: 24,756, Year 5: 28,353

4.2 Target Market Segment Strategy:

GWYC must tailor everything to the time constraints of the target customer. Yoga classes must be no longer than 45 minutes and fit the break and rolling lunch schedules in downtown businesses. The instruction must focus on maximum relief from work pressure. Creating a noticeable difference in customers’ well-being will lead to word-of-mouth referrals and more first-time students.

4.3 Service Business Analysis:

GWYCs are less focused on serving a large number of beginners and are more focused on obtaining long-term students. Students are attracted to a specific type of yoga and the reputation and skills of GWYC’s leader.

4.3.1 Competition and Buying Patterns:

"Stars do it. Sports do it. Judges in the highest courts do it. Let’s do it: that yoga thing. A path to enlightenment that winds back 5,000 years in its native India, yoga has suddenly become so hot, so cool, so very this minute. It’s the exercise cum meditation for the new millennium, one that doesn’t so much pump you up as bliss you out. Yoga now straddles the continent – from Hollywood, where $20 million-a-picture actors queue for a session with their guru du jour, to Washington, where, in the gym of the Supreme Court, Justice Sandra Day O’Connor and 15 others faithfully take their class each Tuesday morning."

– The Power Of Yoga, Time.com, April 15, 2001.

Yoga is a growing trend, popular in the seventies and back in vogue in the 21st century. Movie stars like Madonna, Meg Ryan, Julia Roberts, and Sting advocate for the discipline.

The quality of the instructor is the key to competition within the yoga business. Garden Way Yoga will strive to attract well-respected instructors to its facility. The location, quality, and ambiance of the facility are the real competitive advantages for Garden Way. It is the best and most attractive facility in town, creating the perfect place to learn yoga skills and reduce daily work stress.

Other "schools" in the area may match the quality of instruction but often lack a relaxing ambiance, which is crucial to the discipline.

Strategy and Implementation Summary:

The Garden Way Yoga Center will market through downtown fitness clubs, beauty salons, tanning salons, and boutiques. They will offer a free open workshop for beginners and initiate a program providing a 25% session discount to members who successfully recruit new members.

5.1 Competitive Edge:

The competitive advantage of Garden Way Yoga Center is its location and the quality and ambiance of the facility. It offers excellent instruction that fits into members’ busy day, providing a sanctuary from daily pressure. The facility is a perfect complement to the brand image.

To develop good business strategies, perform a SWOT analysis of your business.

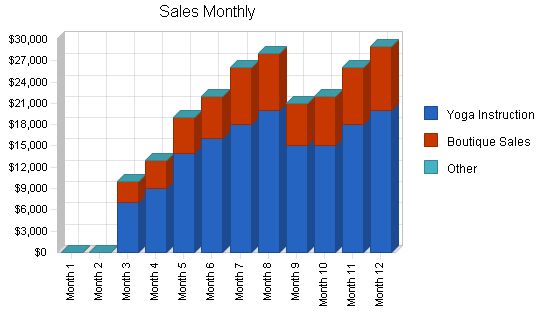

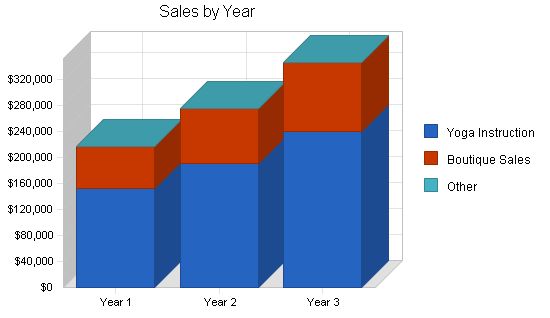

5.2 Sales Forecast:

The sales forecast outlines sales of instruction time and products through the boutique in the facility. Instruction is sold through private lessons, eight-week courses, and drop-in sessions. The boutique will sell clothing, books, posters, DVDs and videos, mats, and other props. It will also sell healthy pre-bottled drinks and energy food. All food will be pre-packaged initially, with the possibility of adding a cafe in the future. Sales are expected to be slow for the first and second month, increasing as membership grows.

The following is the sales forecast for three years.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Yoga Instruction | $152,000 | $190,000 | $240,000 |

| Boutique Sales | $64,000 | $85,000 | $106,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $216,000 | $275,000 | $346,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Yoga Instruction | $0 | $0 | $0 |

| Boutique Sales | $20,150 | $26,000 | $32,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $20,150 | $26,000 | $32,000 |

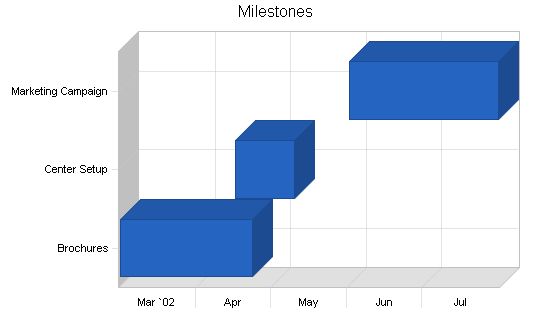

5.3 Milestones

The table lists program milestones, dates, managers, and budgets. The schedule shows our emphasis on implementation planning.

However, the table doesn’t capture the commitment behind it. Our business plan includes provisions for plan-vs.-actual analysis, and we will hold monthly follow-up meetings to discuss variance and course corrections.

Milestones:

Brochures

– Start Date: 3/1/2002

– End Date: 4/23/2002

– Budget: $8,000

– Manager: Jill Gordon

– Department: Marketing

Center Setup

– Start Date: 4/16/2002

– End Date: 5/10/2002

– Budget: $20,000

– Manager: Jill Gordon

– Department: Department

Marketing Campaign

– Start Date: 6/1/2002

– End Date: 7/31/2002

– Budget: $5,000

– Manager: Jill Gordon

– Department: Department

Totals

– Budget: $33,000

The key to the marketing strategy is to attract downtown lunch traffic to GWYC by offering free instruction and refreshments. The instruction sessions will be 45 minutes long and focus on exercises that release tension.

Personnel Plan:

Jill Gordon, Ph.D., founder of The Garden Way Yoga Center, is a renowned teacher of Anusara Yoga. She conducts workshops and teacher trainings globally.

Furthermore, Jill has extensive business experience, having established yoga training centers in Santa Barbara, CA; Denver, CO; and Charlottesville, VA. She also co-founded and co-developed the Four Winds Yoga Center in Portland, OR, which caters to nearly 1,000 weekly students. Jill has been practicing yoga since 1985 and meditation since 1989.

Jill is a certified Anusara instructor and one of the few Designated Teacher Trainers in the Anusara style of Hatha Yoga. She is registered with the national Yoga Alliance at the highest 500-hour level.

Previously, Jill served as the business manager of Four Winds Yoga Center. GWYC initially started with four employees and 20 students. Within three years, it grew to have a staff of 25 and over 1,000 students. Jill effectively managed the growth of Four Winds Yoga Center.

The Garden Way Yoga Center’s personnel are as follows:

– Jill Gordon: Director

– Teachers (5 half-time)

– Boutique Staff (1)

Personnel Plan:

Year 1 Year 2 Year 3

Jill Gordon $36,000 $36,000 $39,000

Teachers (5) $54,000 $65,000 $75,000

Boutique Staff $19,200 $22,000 $25,000

Total People 7 7 7

Total Payroll $109,200 $123,000 $139,000

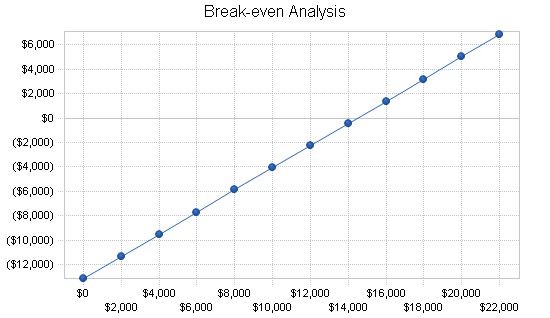

The following is the financial plan for Garden Way Yoga Center.

The monthly break-even point is $14,492.

BREAK-EVEN ANALYSIS

Monthly Revenue Break-even: $14,492

Assumptions:

– Average Percent Variable Cost: 9%

– Estimated Monthly Fixed Cost: $13,140

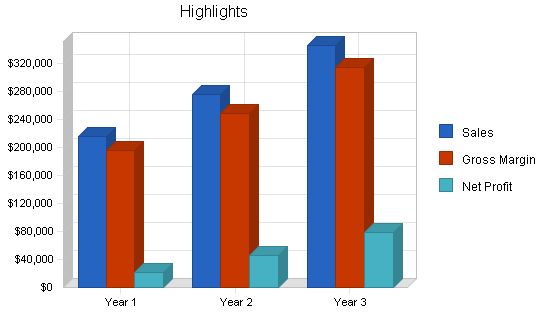

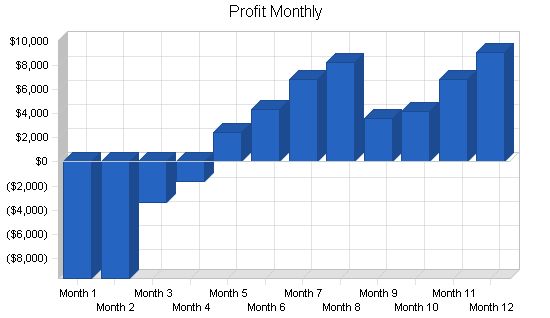

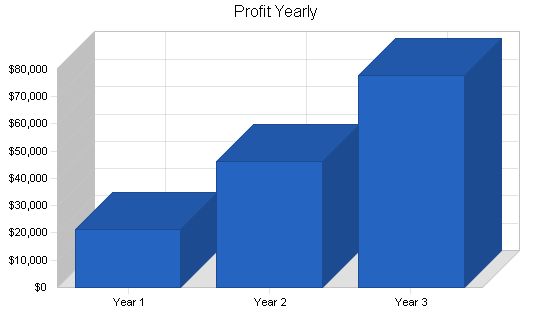

7.2 PROJECTED PROFIT AND LOSS

The table and charts below display the projected profit and loss for three years.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $216,000 | $275,000 | $346,000 |

| Direct Cost of Sales | $20,150 | $26,000 | $32,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $20,150 | $26,000 | $32,000 |

| Gross Margin | $195,850 | $249,000 | $314,000 |

| Gross Margin % | 90.67% | 90.55% | 90.75% |

| Expenses | |||

| Payroll | $109,200 | $123,000 | $139,000 |

| Sales and Marketing and Other Expenses | $24,000 | $26,000 | $28,000 |

| Depreciation | $2,400 | $2,400 | $2,400 |

| Utilities | $3,300 | $3,300 | $3,300 |

| Insurance | $2,400 | $2,400 | $2,400 |

| Payroll Taxes | $16,380 | $18,450 | $20,850 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $157,680 | $175,550 | $195,950 |

| Profit Before Interest and Taxes | $38,170 | $73,450 | $118,050 |

| EBITDA | $40,570 | $75,850 | $120,450 |

| Interest Expense | $7,721 | $7,226 | $6,710 |

| Taxes Incurred | $9,135 | $19,867 | $33,402 |

| Net Profit | $21,315 | $46,357 | $77,938 |

| Net Profit/Sales | 9.87% | 16.86% | 22.53% |

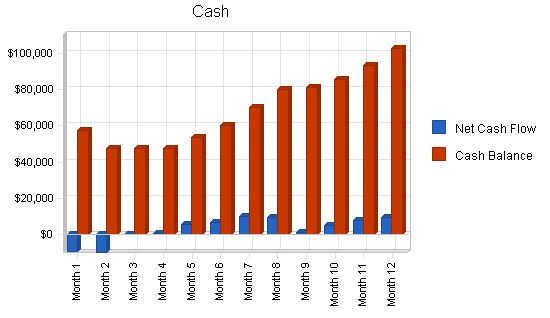

7.3 Projected Cash Flow

The following table and chart highlights the projected cash flow for three years.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $216,000 | $275,000 | $346,000 |

| Subtotal Cash from Operations | $216,000 | $275,000 | $346,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $216,000 | $275,000 | $346,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $109,200 | $123,000 | $139,000 |

| Bill Payments | $65,490 | $105,836 | $125,554 |

| Subtotal Spent on Operations | $174,690 | $228,836 | $264,554 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $5,160 | $5,160 | $5,160 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $179,850 | $233,996 | $269,714 |

| Net Cash Flow | $36,150 | $41,004 | $76,286 |

| Cash Balance | $103,050 | $144,054 | $220,340 |

7.4 Projected Balance Sheet

The following table highlights the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $103,050 | $144,054 | $220,340 |

| Inventory | $2,750 | $3,548 | $4,367 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $105,800 | $147,603 | $224,707 |

| Long-term Assets | |||

| Long-term Assets | $30,000 | $30,000 | $30,000 |

| Accumulated Depreciation | $2,400 | $4,800 | $7,200 |

| Total Long-term Assets | $27,600 | $25,200 | $22,800 |

| Total Assets | $133,400 | $172,803 | $247,507 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7997, Membership Sport and Recreation Club, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 27.31% | 25.82% | 15.20% |

| Percent of Total Assets | ||||

| Inventory | 2.06% | 2.05% | 1.76% | 4.00% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 31.80% |

| Total Current Assets | 79.31% | 85.42% | 90.79% | 40.90% |

| Long-term Assets | 20.69% | 14.58% | 9.21% | 59.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 10.345 | 8,551 | 10,478 | 31.60% |

| Current Borrowing | $0 | $0 | $0 | |

| Other Current Liabilities | $0 | $0 | $0 | |

| Subtotal Current Liabilities | $10,345 | $8,551 | $10,478 | |

| Long-term Liabilities | $74,840 | $69,680 | $64,520 | |

| Total Liabilities | $85,185 | $78,231 | $74,998 | |

| Paid-in Capital | $60,000 | $60,000 | $60,000 | |

| Retained Earnings | ($33,100) | ($11,785) | $34,571 | |

| Earnings | $21,315 | $46,357 | $77,938 | |

| Total Capital | $48,215 | $94,571 | $172,509 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!