Truck Stop Business Plan

Interstate Travel Center aims to be the primary travel center in Dallas, Texas. It will include a convenience store, gas/diesel islands, a restaurant, and amenities for the trucking industry. Interstate Travel Center, owned and operated by Steve and Janet Smith, values responsibility and mutual respect in its management philosophy. The company has an environment and structure that promote productivity and respect for customers and employees.

The center consists of two main areas: convenience store-gas/diesel and the restaurant, each with its own on-site management. Steve and Janet Smith, the founders and co-presidents, oversee operations, focusing on product sourcing, sales, marketing, finance, and administration. Each area has a manager responsible for daily operations, reporting to the Smiths.

Three years ago, the U.S. commercial freight transportation market generated $436 billion in revenue, equivalent to five cents of every dollar of U.S. gross domestic product. Approximately 79% of this revenue, around $344 billion, belonged to the trucking business. This market is divided into two sectors: private carriage and for-hire.

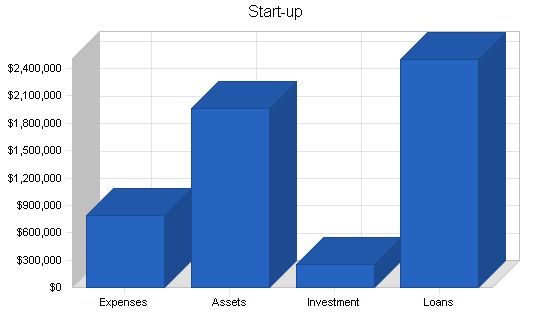

The initial start-up costs for the travel center amount to $2.75 million. This sum will cover land purchase, development, and construction of a 6,000 square foot travel center, complete with gas/diesel islands, scales, and a restaurant. The initial capital injection will be $250,000, with the remaining portion financed through a $2.5 million loan.

The mission of Interstate Travel Center is to start a public travel center that caters to the truck fueling and shopping needs of NAFTA trade, the general traveling public, and local Dallas customers.

Interstate Travel Center is a start-up company that recognizes the increasing demand for commercial vehicle services in the Dallas area. The management team includes Steven Smith, who has extensive experience in the automotive repair industry, and Janet Smith, who has provided budgeting and bookkeeping services to small companies for twenty years. The goal of the company is to create multiple service centers in the southwest area to serve NAFTA commercial traffic and establish a brand presence that extends beyond state borders.

Location:

Interstate Travel Center will be situated between I-45 and I-635 in Dallas, Texas. Access to the travel center will be through these major highways. The advantages of this site are as follows:

– Good visibility

– Low competition in and around the location

– Limited competition

– Good accessibility

– Significant traffic potential during rush hour

– Very low number of houses

– Excellent demographics

– Fair area growth

Company Ownership

Interstate Travel Center is solely owned by Steven and Janet Smith. The company does not plan to seek additional shareholders in the near future.

Start-up Summary

Funding Requirements and Uses:

The initial start-up costs amount to $2.75 million, which will be used to purchase and develop land, and construct a 6,000 sq./ft travel center with gas/diesel islands and a restaurant. The initial capital injection will be $250,000, with the remaining funds coming from a $2.5 million loan. See Figure 1 for a breakdown of the funding usage and Figure 2 for the expenditure outline for Phase I.

Figure 1. Use of Funds

– Working Capital: $250,000

– Inventories (Travel Ctr.): $65,000

– Land: $200,000

– Land Development: $150,000

– Highway Improvements: $350,000

– Building: $500,000

– Pre-Paid Expenses: $250,000

– Gasoline Facility: $200,000

– Diesel Facility: $150,000

– Equipment (Travel Ctr.): $100,000

– Equipment (Restaurant): $200,000

– Contingency: $235,000

– Other fixed Assets: $50,000

– Scales: $50,000

– Total:

Figure 2. Phase I Expenditure Outline

– Land Development: $100,000

– Building (6,000 sq. ft.): $500,000

– Gasoline Facility (includes all equipment): $200,000

– Diesel Facility (includes all equipment): $150,000

– Equipment: Store: $100,000

– Equipment: Restaurant: $200,000

– Highway Improvements*: $50,000

– Miscellaneous: $50,000

– Land Costs: $200,000

– Total Allowable Budget for Phase One: $1.55 million

*Texas Department of Transportation – 50/50 split with state.

Interstate Travel is a travel center/truck stop that offers various goods and services. The center includes a convenience store, gas/diesel fuel pumps, public restrooms, separate trucker entrances and restrooms, showers, telephones, a game room, a trucker lounge/TV room, scales, and a parking lot.

The branding suggestions for the travel center are Chevron, Diamond Shamrock, Texaco, or a private brand.

The convenience store will have two registers and checkout areas, a walk-in cooler with 16-20 quantity, 16-20 quantity fountain drink selections, coffee based on customer mix, heavy snack items, travel grocery items, extra-heavy oil, and other items based on the customer mix.

The travel center will also have a fast food section that includes national brand fast food in Phase III and a privately-owned full-service restaurant (Interstate Travel) in Phase I. Other amenities include indoor seating for 64-69 patrons, a drive-thru window and order station in Phase III, an interior menu board and order line, additional fast food offerings in Phase III, and increased seating for 120 patrons in Phase III.

The facility will have high-rise highway signage, brand pole/street family sign, store name sign, gas/diesel price sign, fast food sign, building sign, highway billboards (North, South, East, and West of site, 20-25 miles), and directional signage. Miscellaneous services include auto parking, truck parking, air and water, and signage per brand.

The gasoline installation will have multiple pump dispensers at gas islands (four in Phase I), diesel offering at one or more gasoline islands, TV monitors and credit card acceptance on MPDs. The gasoline canopy will have 100% coverage and will be branded. The gasoline configuration will be head-in/drive-in (cars face building when fueling). The diesel facility will have four fueling lanes for large trucks (Phase I), diesel pumps with slaves (clones), single fuel lanes for smaller vehicles (Phase III), high-speed pumps at dual fueling lanes, air, water, and window cleaning equipment at fueling islands, un-branded diesel, charge/pay systems associated with the trucking industry, and truck parking capabilities for 50-75 trucks (Phase I only).

In Phase III of the project, a motel and full-service trailer/truck repair shop are planned, as well as other lease spaces for services such as shoeshines, haircuts, a medical center, and other kiosk centers.

Based on the value of service, trucking accounted for 79% of U.S. commercial freight revenues in 1998. Truckers specialize in higher-value freight that moves 750 miles or less. The trucking industry consists of private and for-hire segments, with for-hire truckers falling into truckload (TL) and less-than-truckload (LTL) carriers.

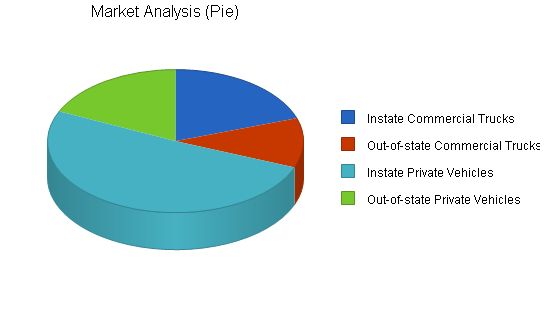

The potential customers for Interstate Travel Center include in-state commercial trucks (both TL and LTL segments), in-state private vehicles, interstate and NAFTA-based commercial business passing through Texas, and out-of-state private vehicles such as tourists. The market analysis table reflects growth rates based on figures from the U.S. Department of Transportation.

Although the market analysis table indicates that the largest market segment is in-state private vehicles, the actual percentage is likely to be lower. The largest percentage of vehicles serviced by truck stops is in the commercial truck segment.

Market Analysis

The trucking business claims 79% of the U.S. commercial freight transportation market, with $344 billion in 1998 revenues. The market is divided into private carriage and for-hire sectors.

Figure 3: Commercial Freight Distribution (In billions of dollars)

Transportation Billion $ % of Total

Trucking, Total $344 63.6%

Private, Interstate $115 21.3%

Private, Local $85 15.7%

Truckload $65 12.0%

Local For-Hire $40 7.4%

LTL, National $9 1.7%

LTL, Regional $11 2.0%

Package/Express (ground) $19 3.5%

Railroad $36 6.7%

Pipeline (oil & gas) $26 4.8%

Air freight, Package Domestic $17 3.1%

Air freight, Heavy Domestic $6 1.1%

Water (Great Lakes/rivers) $7 1.3%

Transportation Total* $436 80.6%

Distribution

Warehousing $70 12.9%

Logistics Administration $35 6.5%

Distribution Total $105 19.4%

Total $541 100.0%

*Excluding $5 billion in international cargo.

Private Carriers

Private carriers make up the largest component of the motor carrier industry, with an estimated $200 billion in annual services. Over three million trucks operated by private fleets transport 3.5 billion tons of freight annually.

For-Hire Carriers

The for-hire category generated $144 billion in 1998, with $105 billion from truckload shipments and $39 billion from less-than-truckload and package/express delivery.

Truckload (TL)

The national for-hire truckload segment had total revenues of $65 billion in 1998. The largest TL operator is Schneider National Carriers, followed by J.B. Hunt Transport Services and the Landstar family of truckload carriers.

Less-than-truckload (LTL)

The LTL market had estimated revenues of $20 billion in 1998. Roadway Express Inc. was the largest national LTL carrier, followed by Yellow Freight System. In the regional LTL market, Con-Way Transportation was the largest player.

Market Trends

The truckload sector faces a driver shortage, while LTL carriers have adapted to market changes. Intermodal shippers and the growth of e-commerce will increase competition among carriers.

E-commerce is Big Business

Consumer-level e-commerce was estimated at $7.8 billion in 1998 and projected to reach $108 billion in 2003. Total worldwide e-commerce, including business-to-business transactions, was estimated at $43 billion in 1998 and projected to hit $127 billion in 1999.

Market Growth

The Dallas region has $1 billion in recommended transportation projects, with the potential to become a major port of entry to Mexico.

Business Participants

The trucking terminal facilities industry has 1,386 establishments and employs 64,105 people. Gasoline service stations have 71,159 establishments and employ 471,041 people.

Market Analysis by Specialty

The gasoline service stations segment is divided as follows:

SIC Code SIC Description Number of Businesses % of Total Total Employees

5541-0000 Gasoline Service Stations 50,544 71% 286,062

5541-9901 Filling Stations, Gasoline 18,844 26.5% 137,897

5541-9902 Marine Service Station 171 0.2% 1,123

5541-9903 Truck Stops 1,600 2.2% 45,959

Total/Average 71,159 100% 471,041

Branding

Branding the travel center will draw more customers and enable the owner to take advantage of rebate programs. Diamond Shamrock is the recommended brand for its incentives, advertising allowances, flexibility, and acceptance of major credit cards.

Advertising through local media and billboards, promoting customer service, and generating repeat business will be the main marketing strategies.

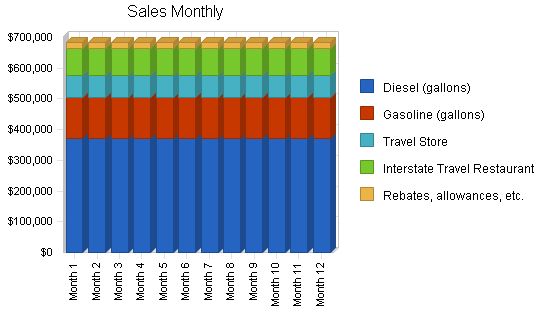

Sales Strategy

Sales projections are based on vehicle traffic and market growth rates. Gas/diesel growth is projected at 5% annually for the first three years, restaurant growth at 7% annually, and travel store growth at 4% annually.

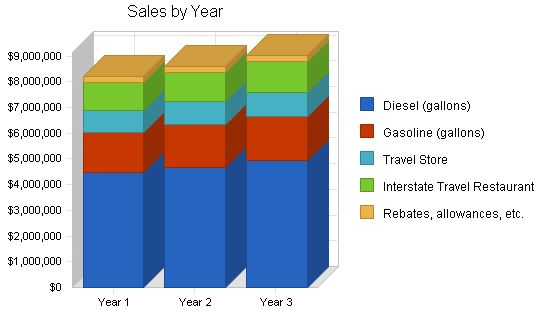

The following table and chart show the sales forecast.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | |||

| Diesel (gallons) | 2,550,000 | 2,677,500 | 2,811,375 |

| Gasoline (gallons) | 1,050,000 | 1,102,500 | 1,157,625 |

| Travel Store | 230,004 | 236,904 | 244,011 |

| Interstate Travel Restaurant | 81,276 | 86,965 | 93,052 |

| Rebates, allowances, etc. | 246,600 | 246,600 | 246,600 |

| Total Unit Sales | 4,157,880 | 4,350,469 | 4,552,663 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Diesel (gallons) | $1.75 | $1.75 | $1.75 |

| Gasoline (gallons) | $1.50 | $1.50 | $1.50 |

| Travel Store | $3.75 | $3.75 | $3.75 |

| Interstate Travel Restaurant | $13.00 | $13.00 | $13.00 |

| Rebates, allowances, etc. | $1.00 | $1.00 | $1.00 |

| Sales | |||

| Diesel (gallons) | $4,462,500 | $4,685,625 | $4,919,906 |

| Gasoline (gallons) | $1,575,000 | $1,653,750 | $1,736,438 |

| Travel Store | $862,515 | $888,390 | $915,041 |

| Interstate Travel Restaurant | $1,056,588 | $1,130,545 | $1,209,676 |

| Rebates, allowances, etc. | $246,600 | $246,600 | $246,600 |

| Total Sales | $8,203,203 | $8,604,910 | $9,027,661 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Diesel (gallons) | $1.67 | $1.67 | $1.67 |

| Gasoline (gallons) | $1.40 | $1.40 | $1.40 |

| Travel Store | $0.75 | $0.75 | $0.75 |

| Interstate Travel Restaurant | $2.00 | $2.00 | $2.00 |

| Rebates, allowances, etc. | $0.00 | $0.00 | $0.00 |

| Direct Cost of Sales | |||

| Diesel (gallons) | $4,258,500 | $4,471,425 | $4,694,996 |

| Gasoline (gallons) | $1,470,000 | $1,543,500 | $1,620,675 |

| Travel Store | $172,503 | $177,678 | $183,008 |

| Interstate Travel Restaurant | $162,552 | $173,930 | $186,104 |

| Rebates, allowances, etc. | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $6,063,555 | $6,366,533 | $6,684,784 |

Management Summary:

Steven and Janet Smith will be the sole owners of Interstate Travel Center. A management staff, including a full-time manager and a part-time assistant manager, will be hired to handle the day-to-day operations of the gas/diesel service and the restaurant. Management will grow as the company expands.

Personnel Plan:

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Steve Smith | $50,000 | $50,000 | $50,000 |

| Janet Smith | $50,000 | $50,000 | $50,000 |

| Convenience store/Gas station Manager | $31,200 | $31,200 | $31,200 |

| Restaurant Manager | $36,000 | $36,000 | $36,000 |

| Assist Manager – Cook | $28,800 | $28,800 | $28,800 |

| Cook 2 | $26,880 | $26,880 | $26,880 |

| Cook 3 | $26,880 | $26,880 | $26,880 |

| Cook 4 | $26,880 | $26,880 | $26,880 |

| Cook 5 | $26,880 | $26,880 | $26,880 |

| Cook 6 | $26,880 | $26,880 | $26,880 |

| Waitress/Waiter | $11,808 | $11,808 | $11,808 |

| Waitress/Waiter | $7,680 | $7,680 | $7,680 |

| Assist. Manager – Cashier | $9,000 | $9,000 | $9,000 |

| Cashier | $6,000 | $6,000 | $6,000 |

| Cashier | $6,000 | $6,000 | $6,000 |

| Cashier | $6,000 | $6,000 | $6,000 |

| Cashier | $6,000 | $6,000 | $6,000 |

| Maintenance | $9,600 | $9,600 | $9,600 |

| Total People | 0 | 0 | 0 |

| Total Payroll | $481,672 | $481,672 | $481,672 |

The following topics outline the financials for Interstate Travel Center.

7.1 Important Assumptions:

The projected cash account does not consider the investment needed for Phases II-IV. The General Assumptions table provides important business assumptions for the company.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

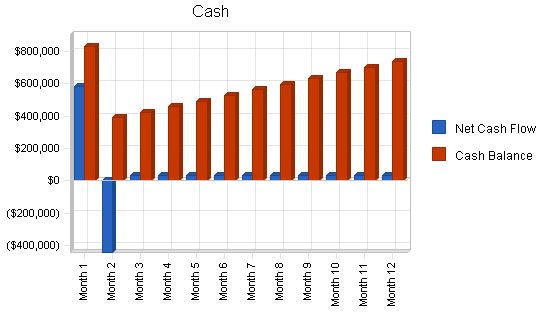

7.2 Projected Cash Flow:

The following table and chart show the projected cash flow for Interstate Travel Center for fiscal years 2001, 2002, and 2003.

Pro Forma Cash Flow:

Year 1 Year 2 Year 3

Cash Received:

Cash from Operations:

Cash Sales: $8,203,203 $8,604,910 $9,027,661

Subtotal Cash from Operations: $8,203,203 $8,604,910 $9,027,661

Additional Cash Received:

Sales Tax, VAT, HST/GST Received: $0 $0 $0

New Current Borrowing: $0 $0 $0

New Other Liabilities (interest-free): $0 $0 $0

New Long-term Liabilities: $0 $0 $0

Sales of Other Current Assets: $0 $0 $0

Sales of Long-term Assets: $0 $0 $0

New Investment Received: $0 $0 $0

Subtotal Cash Received: $8,203,203 $8,604,910 $9,027,661

Expenditures:

Year 1 Year 2 Year 3

Expenditures from Operations:

Cash Spending: $481,672 $481,672 $481,672

Bill Payments: $6,956,862 $7,367,638 $7,785,173

Subtotal Spent on Operations: $7,438,534 $7,849,310 $8,266,845

Additional Cash Spent:

Sales Tax, VAT, HST/GST Paid Out: $0 $0 $0

Principal Repayment of Current Borrowing: $0 $0 $0

Other Liabilities Principal Repayment: $0 $0 $0

Long-term Liabilities Principal Repayment: $275,000 $275,000 $275,000

Purchase Other Current Assets: $0 $0 $0

Purchase Long-term Assets: $0 $0 $0

Dividends: $0 $0 $0

Subtotal Cash Spent: $7,713,534 $8,124,310 $8,541,845

Net Cash Flow: $489,669 $480,600 $485,816

Cash Balance: $739,669 $1,220,269 $1,706,085

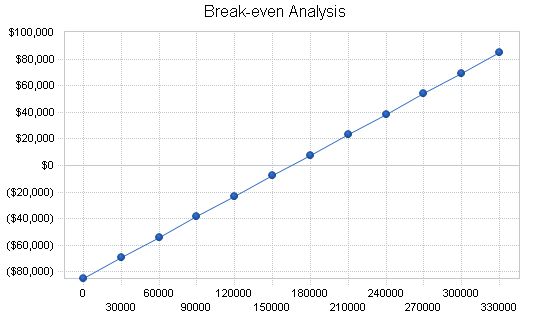

The break-even chart and table below illustrate the required monthly revenue to achieve profitability.

Break-even Analysis

Monthly Units Break-even: 165,099

Monthly Revenue Break-even: $325,729

Assumptions:

Average Per-Unit Revenue: $1.97

Average Per-Unit Variable Cost: $1.46

Estimated Monthly Fixed Cost: $84,960

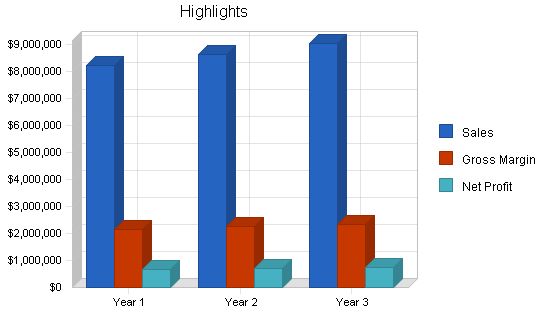

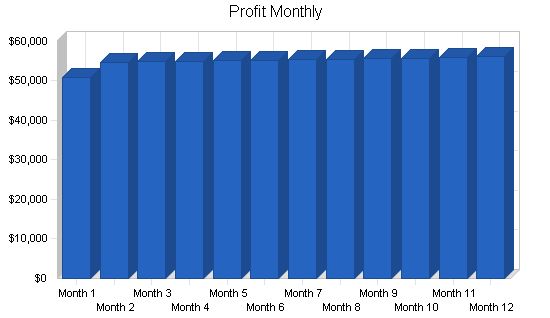

7.4 Projected Profit and Loss

The chart and table below project the yearly profit and loss for the company. For a monthly breakdown, please see the appendix.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $8,203,203 | $8,604,910 | $9,027,661 |

| Direct Cost of Sales | $6,063,555 | $6,366,533 | $6,684,784 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $6,063,555 | $6,366,533 | $6,684,784 |

| Gross Margin | $2,139,648 | $2,238,377 | $2,342,878 |

| Gross Margin % | 26.08% | 26.01% | 25.95% |

| Expenses | |||

| Payroll | $481,672 | $481,672 | $481,672 |

| Sales and Marketing and Other Expenses | $220,800 | $278,800 | $378,800 |

| Depreciation | $30,000 | $30,000 | $30,000 |

| Leased Equipment | $49,800 | $49,800 | $49,800 |

| Utilities | $49,200 | $49,200 | $49,200 |

| Insurance | $91,800 | $91,800 | $91,800 |

| Rent | $24,000 | $30,000 | $34,000 |

| Payroll Taxes | $72,251 | $72,251 | $72,251 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $1,019,523 | $1,083,523 | $1,187,523 |

| Profit Before Interest and Taxes | $1,120,125 | $1,154,854 | $1,155,355 |

| EBITDA | $1,150,125 | $1,184,854 | $1,185,355 |

| Interest Expense | $235,104 | $208,750 | $181,250 |

| Taxes Incurred | $224,890 | $236,526 | $247,585 |

| Net Profit | $660,131 | $709,578 | $726,520 |

| Net Profit/Sales | 8.05% | 8.25% | 8.05% |

7.5 Projected Balance Sheet

The following table shows our projected Balance Sheet for the next three years. We anticipate a steadily increasing Net Worth.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Cash | $739,669 | $1,220,269 | $1,706,085 |

| Inventory | $555,826 | $583,599 | $612,772 |

| Other Current Assets | $50,000 | $50,000 | $50,000 |

| Total Current Assets | $1,345,495 | $1,853,868 | $2,368,857 |

| Long-term Assets | |||

| Long-term Assets | $1,600,000 | $1,600,000 | $1,600,000 |

| Accumulated Depreciation | $30,000 | $60,000 | $90,000 |

| Total Long-term Assets | $1,570,000 | $1,540,000 | $1,510,000 |

| Total Assets | $2,915,495 | $3,393,868 | $3,878,857 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $565,364 | $609,159 | $642,628 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $565,364 | $609,159 | $642,628 |

| Long-term Liabilities | $2,225,000 | $1,950,000 | $1,675,000 |

| Total Liabilities | $2,790,364 | $2,559,159 | $2,317,628 |

| Paid-in Capital | $250,000 | $250,000 | $250,000 |

| Retained Earnings | ($785,000) | ($124,869) | $584,709 |

| Earnings | $660,131 | $709,578 | $726,520 |

| Total Capital | $125,131 | $834,709 | $1,561,229 |

| Total Liabilities and Capital | $2,915,495 | $3,393,868 | $3,878,857 |

| Net Worth | $125,131 | $834,709 | $1,561,229 |

7.6 Business Ratios

The table below outlines industry profile statistics for the gas and service station industry, as determined by the Standard Industry Classification (SIC) Index code 5541, Gasoline Service Stations. These statistics show a comparison of the industry standards and key ratios for this plan.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 4.90% | 4.91% | 10.80% |

| Percent of Total Assets | ||||

| Inventory | 19.06% | 17.20% | 15.80% | 13.30% |

| Other Current Assets | 1.71% | 1.47% | 1.29% | 25.60% |

| Total Current Assets | 46.15% | 54.62% | 61.07% | 49.50% |

| Long-term Assets | 53.85% | 45.38% | 38.93% | 50.50% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 13.31 | 12.17 | 12.17 | n.a |

| Long-term Liabilities | 0.20 | 0.24 | 0.28 | n.a |

| Total Liabilities | 95.71% | 75.41% | 59.75% | 54.70% |

| Net Worth | 4.29% | 24.59% | 40.25% | 45.30% |

| Percent of Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 26.08% | 26.01% | 25.95% | 16.50% |

| Selling, General & Administrative Expenses | 17.99% | 17.77% | 17.86% | 10.40% |

| Advertising Expenses | 2.34% | 2.32% | 2.77% | 0.20% |

| Profit Before Interest and Taxes | 13.65% | 13.42% | 12.80% | 0.50% |

| Main Ratios | ||||

| Current | 2.38 | 3.04 | 3.69 | 1.55 |

| Quick | 1.40 | 2.09 | 2.73 | 0.91 |

| Total Debt to Total Assets | 95.71% | 75.41% | 59.75% | 54.70% |

| Pre-tax Return on Net Worth | 707.28% | 113.35% | 62.39% | 2.50% |

| Pre-tax Return on Assets | 30.36% | 27.88% | 25.11% | 5.50% |

| Net Profit Margin | 8.05% | 8.25% | 8.05% | n.a |

| Return on Equity | 527.55% | 85.01% | 46.54% | n.a |

| Inventory Turnover | 10.91 | 11.17 | 11.18 | n.a |

| Accounts Payable Turnover | 27 | 29 | 29 | n.a |

| Payment Days | 2.81 | 2.54 | 2.33 | n.a |

| Total Asset Turnover | 22.30 | 3.07 | 1.48 | n.a |

| Debt to Net Worth | 19% | 18% | 17% | n.a |

| Current Liab. to Liab. | 0.36 | 0.39 | 0.43 | n.a |

| Acid Test | 1.40 | 2.09 | 2.73 | n.a |

| Sales/Net Worth | 65.56 | 10.31 | 5.78 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

Sales Forecast

Diesel (212,500 gallons per month)

Gasoline (87,500 gallons per month)

Travel Store (19,167 units per month)

Interstate Travel Restaurant (6,773 units per month)

Rebates, allowances, etc. (20,550 units per month)

Total Unit Sales (346,490 units per month)

Unit Prices

Diesel ($1.75 per gallon)

Gasoline ($1.50 per gallon)

Travel Store ($3.75 per unit)

Interstate Travel Restaurant ($13.00 per unit)

Rebates, allowances, etc. ($1.00 per unit)

Total Sales ($683,600 per month)

Direct Unit Costs

Diesel (8.00% of cost, $1.67 per gallon)

Gasoline (0.00% of cost, $1.40 per gallon)

Travel Store (0.00% of cost, $0.75 per unit)

Interstate Travel Restaurant (0.00% of cost, $2.00 per unit)

Rebates, allowances, etc. (0.00% of cost, $0.00 per unit)

Subtotal Direct Cost of Sales ($505,296 per month)

Direct Cost of Sales

Diesel ($354,875 per month)

Gasoline ($122,500 per month)

Travel Store ($14,375 per month)

Interstate Travel Restaurant ($13,546 per month)

Rebates, allowances, etc. ($0 per month)

Total Cost of Sales ($505,296 per month)

Personnel Plan

Steve Smith ($4,167 per month)

Janet Smith ($4,167 per month)

Convenience store/Gas station Manager ($2,600 per month)

Restaurant Manager ($3,000 per month)

Assist Manager – Cook ($2,400 per month)

Cook 2 ($2,240 per month)

Cook 3 ($2,240 per month)

Cook 4 ($2,240 per month)

Cook 5 ($2,240 per month)

Cook 6 ($2,240 per month)

Waitress/Waiter (multiple) ($984 per month)

Assist. Manager – Cashier ($750 per month)

Cashier (multiple) ($500 per month)

Maintenance ($800 per month)

Total Payroll ($40,139 per month)

General Assumptions

Plan Month: 1 to 12

Current Interest Rate: 10.00%

Long-term Interest Rate: 10.00%

Tax Rate: 30.00% (Month 1), 25.00% (Month 2 onwards)

Other: 0

Pro Forma Profit and Loss

Sales:

Month 1: $683,600

Month 2: $683,600

Month 3: $683,600

Month 4: $683,600

Month 5: $683,600

Month 6: $683,600

Month 7: $683,600

Month 8: $683,600

Month 9: $683,600

Month 10: $683,600

Month 11: $683,600

Month 12: $683,600

Direct Cost of Sales:

Month 1: $505,296

Month 2: $505,296

Month 3: $505,296

Month 4: $505,296

Month 5: $505,296

Month 6: $505,296

Month 7: $505,296

Month 8: $505,296

Month 9: $505,296

Month 10: $505,296

Month 11: $505,296

Month 12: $505,296

Other:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Total Cost of Sales:

Month 1: $505,296

Month 2: $505,296

Month 3: $505,296

Month 4: $505,296

Month 5: $505,296

Month 6: $505,296

Month 7: $505,296

Month 8: $505,296

Month 9: $505,296

Month 10: $505,296

Month 11: $505,296

Month 12: $505,296

Gross Margin:

Month 1: $178,304

Month 2: $178,304

Month 3: $178,304

Month 4: $178,304

Month 5: $178,304

Month 6: $178,304

Month 7: $178,304

Month 8: $178,304

Month 9: $178,304

Month 10: $178,304

Month 11: $178,304

Month 12: $178,304

Gross Margin %:

Month 1: 26.08%

Month 2: 26.08%

Month 3: 26.08%

Month 4: 26.08%

Month 5: 26.08%

Month 6: 26.08%

Month 7: 26.08%

Month 8: 26.08%

Month 9: 26.08%

Month 10: 26.08%

Month 11: 26.08%

Month 12: 26.08%

Expenses:

Payroll:

Month 1: $40,139

Month 2: $40,139

Month 3: $40,139

Month 4: $40,139

Month 5: $40,139

Month 6: $40,139

Month 7: $40,139

Month 8: $40,139

Month 9: $40,139

Month 10: $40,139

Month 11: $40,139

Month 12: $40,139

Sales and Marketing and Other Expenses:

Month 1: $18,400

Month 2: $18,400

Month 3: $18,400

Month 4: $18,400

Month 5: $18,400

Month 6: $18,400

Month 7: $18,400

Month 8: $18,400

Month 9: $18,400

Month 10: $18,400

Month 11: $18,400

Month 12: $18,400

Depreciation:

Month 1: $2,500

Month 2: $2,500

Month 3: $2,500

Month 4: $2,500

Month 5: $2,500

Month 6: $2,500

Month 7: $2,500

Month 8: $2,500

Month 9: $2,500

Month 10: $2,500

Month 11: $2,500

Month 12: $2,500

Leased Equipment:

Month 1: $4,150

Month 2: $4,150

Month 3: $4,150

Month 4: $4,150

Month 5: $4,150

Month 6: $4,150

Month 7: $4,150

Month 8: $4,150

Month 9: $4,150

Month 10: $4,150

Month 11: $4,150

Month 12: $4,150

Utilities:

Month 1: $4,100

Month 2: $4,100

Month 3: $4,100

Month 4: $4,100

Month 5: $4,100

Month 6: $4,100

Month 7: $4,100

Month 8: $4,100

Month 9: $4,100

Month 10: $4,100

Month 11: $4,100

Month 12: $4,100

Insurance:

Month 1: $7,650

Month 2: $7,650

Month 3: $7,650

Month 4: $7,650

Month 5: $7,650

Month 6: $7,650

Month 7: $7,650

Month 8: $7,650

Month 9: $7,650

Month 10: $7,650

Month 11: $7,650

Month 12: $7,650

Rent:

Month 1: $2,000

Month 2: $2,000

Month 3: $2,000

Month 4: $2,000

Month 5: $2,000

Month 6: $2,000

Month 7: $2,000

Month 8: $2,000

Month 9: $2,000

Month 10: $2,000

Month 11: $2,000

Month 12: $2,000

Payroll Taxes:

Month 1: 15%

Month 2: $6,021

Month 3: $6,021

Month 4: $6,021

Month 5: $6,021

Month 6: $6,021

Month 7: $6,021

Month 8: $6,021

Month 9: $6,021

Month 10: $6,021

Month 11: $6,021

Month 12: $6,021

Other:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Total Operating Expenses:

Month 1: $84,960

Month 2: $84,960

Month 3: $84,960

Month 4: $84,960

Month 5: $84,960

Month 6: $84,960

Month 7: $84,960

Month 8: $84,960

Month 9: $84,960

Month 10: $84,960

Month 11: $84,960

Month 12: $84,960

Profit Before Interest and Taxes:

Month 1: $93,344

Month 2: $93,344

Month 3: $93,344

Month 4: $93,344

Month 5: $93,344

Month 6: $93,344

Month 7: $93,344

Month 8: $93,344

Month 9: $93,344

Month 10: $93,344

Month 11: $93,344

Month 12: $93,344

EBITDA:

Month 1: $95,844

Month 2: $95,844

Month 3: $95,844

Month 4: $95,844

Month 5: $95,844

Month 6: $95,844

Month 7: $95,844

Month 8: $95,844

Month 9: $95,844

Month 10: $95,844

Month 11: $95,844

Month 12: $95,844

Interest Expense:

Month 1: $20,642

Month 2: $20,451

Month 3: $20,260

Month 4: $20,069

Month 5: $19,878

Month 6: $19,688

Month 7: $19,497

Month 8: $19,306

Month 9: $19,115

Month 10: $18,924

Month 11: $18,733

Month 12: $18,542

Taxes Incurred:

Month 1: $21,810

Month 2: $18,223

Month 3: $18,271

Month 4: $18,319

Month 5: $18,366

Month 6: $18,414

Month 7: $18,462

Month 8: $18,510

Month 9: $18,557

Month 10: $18,605

Month 11: $18,653

Month 12: $18,701

Net Profit:

Month 1: $50,891

Month 2: $54,669

Month 3: $54,813

Month 4: $54,956

Month 5: $55,099

Month 6: $55,242

Month 7: $55,385

Month 8: $55,529

Month 9: $55,672

Month 10: $55,815

Month 11: $55,958

Month 12: $56,102

Net Profit/Sales:

Month 1: 7.44%

Month 2: 8.00%

Month 3: 8.02%

Month 4: 8.04%

Month 5: 8.06%

Month 6: 8.08%

Month 7: 8.10%

Month 8: 8.12%

Month 9: 8.14%

Month 10: 8.16%

Month 11: 8.19%

Month 12: 8.21%

Pro Forma Cash Flow

Cash Received:

Month 1: $683,600

Month 2: $683,600

Month 3: $683,600

Month 4: $683,600

Month 5: $683,600

Month 6: $683,600

Month 7: $683,600

Month 8: $683,600

Month 9: $683,600

Month 10: $683,600

Month 11: $683,600

Month 12: $683,600

Cash from Operations:

Month 1: $683,600

Month 2: $683,600

Month 3: $683,600

Month 4: $683,600

Month 5: $683,600

Month 6: $683,600

Month 7: $683,600

Month 8: $683,600

Month 9: $683,600

Month 10: $683,600

Month 11: $683,600

Month 12: $683,600

Cash Sales:

Month 1: $683,600

Month 2: $683,600

Month 3: $683,600

Month 4: $683,600

Month 5: $683,600

Month 6: $683,600

Month 7: $683,600

Month 8: $683,600

Month 9: $683,600

Month 10: $683,600

Month 11: $683,600

Month 12: $683,600

Subtotal Cash from Operations:

Month 1: $683,600

Month 2: $683,600

Month 3: $683,600

Month 4: $683,600

Month 5: $683,600

Month 6: $683,600

Month 7: $683,600

Month 8: $683,600

Month 9: $683,600

Month 10: $683,600

Month 11: $683,600

Month 12: $683,600

Additional Cash Received:

Sales Tax, VAT, HST/GST Received:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

New Current Borrowing:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

New Other Liabilities (interest-free):

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

New Long-term Liabilities:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Sales of Other Current Assets:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Sales of Long-term Assets:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

New Investment Received:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!