Contents

Seminar Business Plan

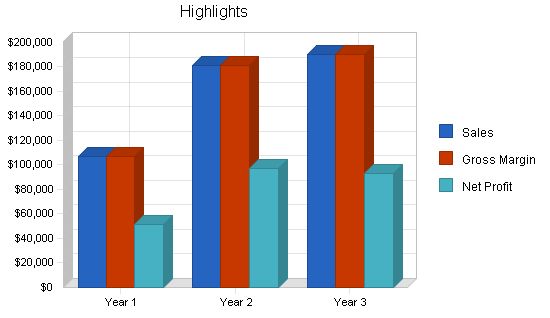

Advanced Linguistic Pontificators is a leading seminar and training program company led by best-selling author Daug Matisim. They will target medium- and large-size companies. Pontificators will quickly reach profitability and achieve $79,000 of net profit by year two.

Services

Advanced Linguistic Pontificators will provide training programs and seminars for medium- to large-size companies. They will cover advanced reading, stress management, and time management. The advanced reading course will teach speed reading with increased comprehension and memory. Stress management will teach techniques to better deal with stress, and time management will teach methods to become more efficient with limited time. The subjects will be taught in seminar or training program format. The seminar format is a presentation that concentrates on a specific topic, while the training program allows attendees to participate in the entire process.

Marketing

Advanced Linguistic Pontificators will use a three-prong strategy to generate a 15% increase in clients each year. The first prong is free public seminars, which bring together a diverse crowd of people who may not have heard of Pontificators before. The second prong is the distribution of printed material and the promotion of Daug’s published books. The last prong is networking and word of mouth advertising. Daug recognizes the small universe of seminars and training programs and will leverage this element to generate significant business from network contacts.

Management

Daug Matisim, the leading expert in the field, is the organization’s founder. He has written two best-selling books on advanced reading and time and stress management. His expert knowledge is based on a communications degree and a Master’s in Education. In addition to his impressive credentials, Daug’s enthusiasm is contagious to seminar participants.

Advanced Linguistic Pontificators will fully utilize Daug’s expertise and notoriety to achieve profitability. They have forecasted sales of $181,000 by year two.

1.1 Objectives

The objectives for the first three years of operation include:

- Create a service-based company that exceeds customer expectations.

- Utilize Advanced Linguistic Pontificators in at least five of the top 100 companies ranked by Forbes Magazine.

- Increase the number of clients by 15% per year.

- Develop a sustainable home business sustained by its own cash flow.

1.2 Mission

Advanced Linguistic Pontificators’ mission is to provide high-quality training seminars to companies. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed customer expectations.

Company Summary

Advanced Linguistic Pontificators, based in Portland, OR, offers training programs and seminars for medium to large corporations. The programs focus on advanced reading, stress management, and time management. All programs are presented by Daug Matisim, an expert in those fields. The office of Advanced Linguistic Pontificators will be located in Daug’s home, while the seminars and programs will take place nationwide.

The business is expected to reach profitability early on.

2.1 Company Ownership

Advanced Linguistic Pontificators will be an Oregon corporation owned by Daug Matisim.

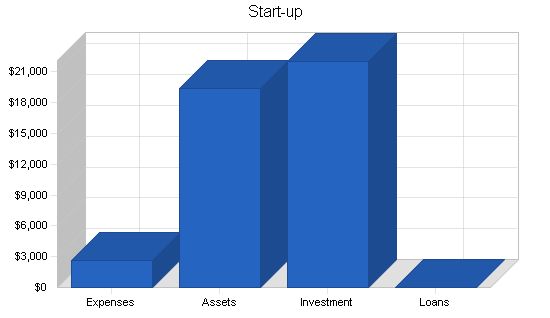

2.2 Start-up Summary

Start-up costs for Advanced Linguistic Pontificators include:

- Desk, chair, filing cabinet

- Computer with printer, CD-RW, and Internet access

- Fax machine and copier

- Pager and cell phone

- Laptop computer

- LCD computer projector

- Microsoft Office Suite and QuickBooks Pro

- Additional land phone line

Please note that all assets used for more than one year will be considered long-term and depreciated using the straight-line method.

Start-up Requirements:

– Legal: $500

– Stationery etc.: $300

– Brochures: $300

– Consultants: $500

– Web development costs: $1,000

– Rent: $0

– Research and development: $0

– Expensed equipment: $0

– Other: $0

– Total Start-up Expenses: $2,600

Start-up Assets:

– Cash Required: $7,900

– Other Current Assets: $0

– Long-term Assets: $11,500

– Total Assets: $19,400

Total Requirements: $22,000

Start-up Funding:

– Start-up Expenses to Fund: $2,600

– Start-up Assets to Fund: $19,400

– Total Funding Required: $22,000

Assets:

– Non-cash Assets from Start-up: $11,500

– Cash Requirements from Start-up: $7,900

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $7,900

– Total Assets: $19,400

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

– Capital:

– Planned Investment:

– Daug: $22,000

– Investor 2: $0

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $22,000

– Loss at Start-up (Start-up Expenses): ($2,600)

– Total Capital: $19,400

Total Capital and Liabilities: $19,400

Total Funding: $22,000

Services:

Advanced Linguistic Pontificators will provide medium- to large-size companies with training programs and seminars on advanced reading, stress management, and time management. The advanced reading course will teach speed reading with increased comprehension and memory. Stress management will teach techniques to better deal with stress, and time management will teach methods to become more efficient. The subjects will be taught in either seminar format or training program format. Additionally, Daug will offer seminars to the public to increase awareness of Advanced Linguistic Pontificators.

Market Analysis Summary:

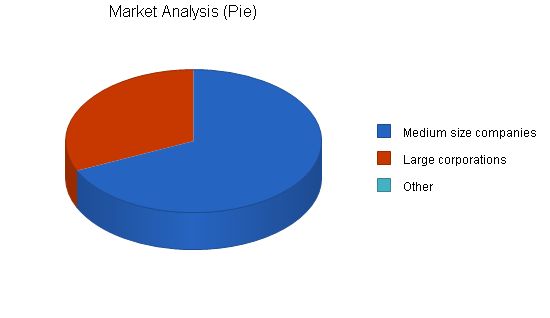

Advanced Linguistic Pontificators’ market is Corporate America, specifically medium- and large-size companies. These customers typically have a steady need for seminars and training programs. Advanced Linguistic Pontificators will reach these customers through public seminars, word-of-mouth referrals, and recognition of expertise through publications on the subject.

4.1 Market Segmentation:

Advanced Linguistic Pontificators is targeting two segments: large corporations (100 or more employees) and medium size companies (less than 100 employees). Large corporations usually have specific divisions that purchase training seminars, while medium size companies usually have the HR manager or training manager make the purchases. These segments are ideal customers because they recognize the value of intellectual capital and the need for future investments in training. Economic downturns do not greatly affect business from these sources because companies understand that it is more cost-effective to have training done by a third party rather than in-house.

Market Analysis:

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| 5,687 | 6,256 | 6,882 | 7,570 | 8,327 | |||

| 2,654 | 2,893 | 3,153 | 3,437 | 3,746 | |||

| 0 | 0 | 0 | 0 | 0 | |||

| 8,341 | 9,149 | 10,035 | 11,007 | 12,073 | |||

4.2 Target Market Segment Strategy

Advanced Linguistic Pontificators has a three part strategy for targeting the two chosen segments. The first part is through public seminars. A public seminar is a presentation on a subject that is offered to the public. They are typically held in a library or some other public building. While public seminars are not big money makers (and sometimes you will lose money), they bring together a diverse audience to view the seminar. This is quite valuable because within the diverse crowd are people that work in companies that would would otherwise have never heard about Advanced Linguistic Pontificators. It becomes a wonderful advertising tool.

The second way the Pontificators will reach their target market is through visibility of printed material, specifically books. Daug has published two books, one on advanced reading, the other on stress and time management. Having the speaker published adds invaluable amounts of credibility and authenticity. These books are typically toward managers so it is not unusual that a manager will have read the book and then become inspired into having the author come and provide a training session for the the company.

The last method of reaching the target market is word of mouth. Although the industry of training programs and seminars is large, those that are good and concentrate on certain areas form a group of well known service providers. This is quite intuitive. The experts in the field rise to the top and people that are in the “know” are familiar with these people. Word of mouth marketing is incredibly efficient once you have established yourself as one of the best.

4.3 Service Business Analysis

There are many different competitors in this space:

- Seminar production companies that act only as producers of the events, they do not make the actual presentation. These companies typically have a list of different presenters that they use.

- Independent seminar presenters.

- Independent training program presenters.

- Both presenter and promoter–just like Advanced Linguistic Pontificators.

The competition is on a national scale. Being local is insignificant in this industry. Companies will fly in the speaker from wherever they are in the country.

Buying habits are based on word-of-mouth referrals, reputation, topic/skill needed, availability, etc.

Strategy and Implementation Summary

Advanced Linguistic Pontificators will win sales by virtue of their service/product, in essence the product will speak for itself. Daug Matisim is an expert in the field of advanced reading and time and stress management. This expertise provides Pontificators a competitive advantage. Prospective customers will be able to get a sampling of Daug’s work from him book, from excerpts of his writing, or excerpts of his presentations via streaming media from his website.

5.1 Sales Strategy

Advanced Linguistic Pontificators’ sales strategy is relatively straight forward. Let the customer see part of a presentation in addition to the information contained in Daug’s book and the product/service will sell it self. The customer will see examples of Daug’s work through three avenues.

- Purchase a copy of Daug’s book.

- Receive an excerpt of the book from Advanced Linguistic Pontificators office.

- View an example of one of Daug’s presentations via streaming media from the Pontificators’ website.

These examples of Daug’s work will speak for themselves. Once the customer is interested they would only need to contact the office and determine availability, and set up an event.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis

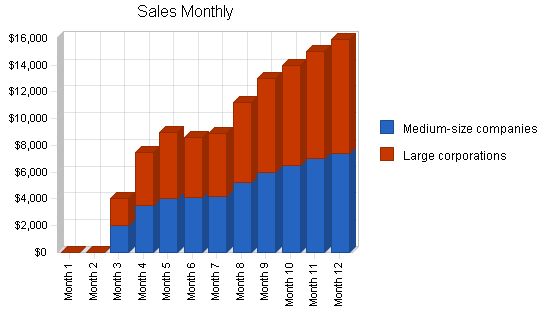

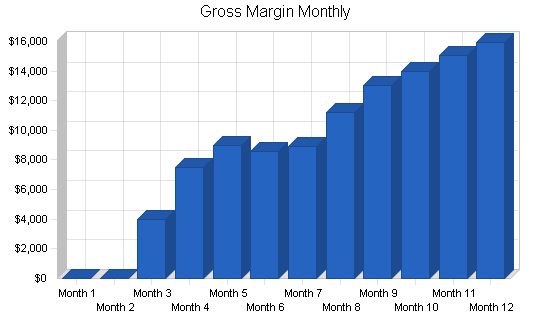

5.1.1 Sales Forecast

The first month will be used to set up the office and schedule public seminars for month two. There will be some sales activity during months three through seven. Starting with month eight, things will begin to pick up nicely as word gets out that Daug is on the circuit.

Year 1 Year 2 Year 3

Sales

Medium-size companies $49,925 $84,000 $90,000

Large corporations $57,200 $97,000 $100,000

Total Sales $107,125 $181,000 $190,000

Direct Cost of Sales:

Year 1 Year 2 Year 3

Medium-size companies $0 $0 $0

Large corporations $0 $0 $0

Subtotal Direct Cost of Sales $0 $0 $0

5.2 Competitive Edge

Advanced Linguistic Pontificators’ competitive edge is expertise. Daug is a nationally recognized expert in the fields he presents. Much of the recognition was derived from the publication of his books. As an engaging presenter/trainer, Daug offers sessions that leave customers feeling informed and eager to sign up for another one.

5.3 Milestones

Advanced Linguistic Pontificators will have several milestones early on:

1. Business plan completion as a road map for the organization’s ongoing performance and improvement.

2. Set up office.

3. Finish the fifth public seminar.

4. Finish the tenth seminar/training program.

5. Profit exceeding $50,000.

Milestones:

Milestone Start Date End Date Budget Manager Department

Business plan completion 1/1/2001 2/1/2001 $0 ABC Marketing

Set up office 3/1/1999 2/1/2001 $0 ABC Department

Finish the fifth public seminar 2/1/2001 3/1/2001 $0 ABC Department

Finish the tenth seminar/training program2/1/2001 5/1/2001 $0 ABC Department

Profit exceeding $50,000 1/1/2001 3/1/2002 $0 ABC Department

Totals $0

Management Summary

Advanced Linguistic Pontificators is owned and operated by Daug Matisim. Daug has a degree in communications from Reed College and a Master’s in Education from the University of California, Berkeley. After graduate school, Daug wrote two books: "Read Fast, Comprehend More, Remember Lots, and Ignore the Fluff," a top seller in advanced reading, and "Efficiency Gains in Time and Stress Management: Why the Snail is Faster Than the Hare." These books brought Daug notoriety and led to the development of a comprehensive seminar and training program in Costa Rica. Advanced Linguistic Pontificators was then established.

6.1 Personnel Plan

Advanced Linguistic Pontificators will be a one-man show. Daug will be responsible for arranging and performing all seminars. PowerPoint presentations and travel arrangements will be outsourced, with travel costs covered by the client.

Personnel Plan:

Year 1 Year 2 Year 3

Daug Matism $24,000 $36,000 $50,000

Other $0 $0 $0

Total People 0 0 0

Total Payroll $24,000 $36,000 $50,000

The following sections outline the important financial data.

7.1 Important Assumptions

General Assumptions:

Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 25.42% 25.00% 25.42%

Other 0 0 0

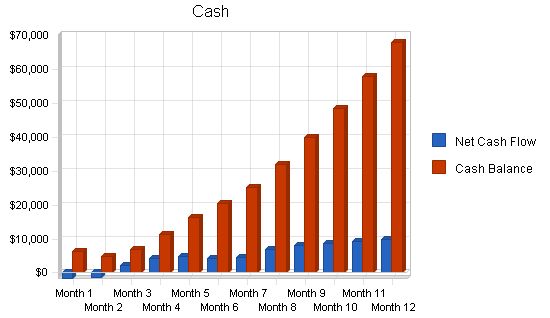

7.2 Projected Cash Flow

The following chart and table indicate projected cash flow.

Pro Forma Cash Flow Table:

| Pro Forma Cash Flow | ||||

| Year 1 | Year 2 | Year 3 | ||

| Cash Received | ||||

| Cash from Operations | ||||

| Cash Sales | $107,125 | $181,000 | $190,000 | |

| Subtotal Cash from Operations | $107,125 | $181,000 | $190,000 | |

| Additional Cash Received | ||||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | |

| Subtotal Cash Received | $107,125 | $181,000 | $190,000 | |

| Expenditures | ||||

| Expenditures from Operations | ||||

| Cash Spending | $24,000 | $36,000 | $50,000 | |

| Bill Payments | $23,153 | $45,002 | $43,397 | |

| Subtotal Spent on Operations | $47,153 | $81,002 | $93,397 | |

| Additional Cash Spent | ||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | |

| Subtotal Cash Spent | $47,153 | $81,002 | $93,397 | |

| Net Cash Flow | $59,972 | $99,998 | $96,603 | |

| Cash Balance | $67,872 | $167,869 | $264,473 | |

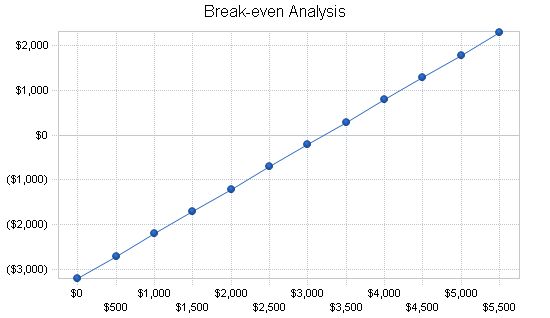

7.3 Break-even Analysis

Below is the Break-even Analysis.

Break-even Analysis

Monthly Revenue Break-even: $3,211

Assumptions:

– Average Percent Variable Cost: 0%

– Estimated Monthly Fixed Cost: $3,211

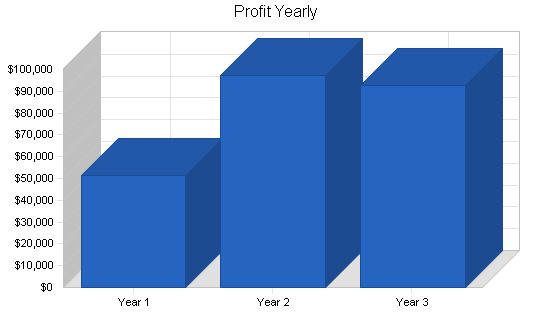

7.4 Projected Profit and Loss

The table below shows projected profit and loss.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $107,125 | $181,000 | $190,000 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 |

| Gross Margin | $107,125 | $181,000 | $190,000 |

| Gross Margin % | 100.00% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $24,000 | $36,000 | $50,000 |

| Sales and Marketing and Other Expenses | $6,800 | $7,800 | $7,800 |

| Depreciation | $3,828 | $3,828 | $3,828 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $2,400 | $2,400 | $2,400 |

| Insurance | $1,500 | $1,500 | $1,500 |

| Rent | $0 | $0 | $0 |

| Payroll Taxes | $0 | $0 | $0 |

| Total Operating Expenses | $38,528 | $51,528 | $65,528 |

| Profit Before Interest and Taxes | $68,597 | $129,472 | $124,472 |

| EBITDA | $72,425 | $133,300 | $128,300 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $17,010 | $32,368 | $31,637 |

| Net Profit | $51,587 | $97,104 | $92,835 |

| Net Profit/Sales | 48.16% | 53.65% | 48.86% |

Projected Balance Sheet:

7.5 Projected Balance Sheet

The following table indicates the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $67,872 | $167,869 | $264,473 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $67,872 | $167,869 | $264,473 |

| Long-term Assets | |||

| Long-term Assets | $11,500 | $11,500 | $11,500 |

| Accumulated Depreciation | $3,828 | $7,656 | $11,484 |

| Total Long-term Assets | $7,672 | $3,844 | $16 |

| Total Assets | $75,544 | $171,713 | $264,489 |

7.6 Business Ratios

The following table outlines important ratios from the Professional and Management Development Training industry. The Industry Profile column details ratios based on the NAICS code, 611430.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 68.96% | 4.97% | 9.50% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 45.60% |

| Total Current Assets | 89.84% | 97.76% | 99.99% | 62.40% |

| Long-term Assets | 10.16% | 2.24% | 0.01% | 37.60% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 6.03% | 2.11% | 1.35% | 43.30% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 17.30% |

| Total Liabilities | 6.03% | 2.11% | 1.35% | 60.60% |

| Net Worth | 93.97% | 97.89% | 98.65% | 39.40% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 100.00% | 100.00% | 100.00% | 0.00% |

| Selling, General & Administrative Expenses | 68.78% | 56.30% | 62.71% | 73.80% |

| Advertising Expenses | 1.68% | 0.99% | 0.95% | 5.00% |

| Profit Before Interest and Taxes | 64.03% | 71.53% | 65.51% | 3.20% |

| Main Ratios | ||||

| Current | 14.90 | 46.35 | 74.25 | 1.33 |

| Quick | 14.90 | 46.35 | 74.25 | 1.11 |

| Total Debt to Total Assets | 6.03% | 2.11% | 1.35% | 60.60% |

| Pre-tax Return on Net Worth | 96.63% | 77.02% | 47.70% | 5.50% |

| Pre-tax Return on Assets | 90.80% | 75.40% | 47.06% | 14.00% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 48.16% | 53.65% | 48.86% | n.a |

| Return on Equity | 72.67% | 57.77% | 35.58% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 6.08 | 12.17 | 12.17 | n.a |

| Payment Days | 34 | 34 | 30 | n.a |

| Total Asset Turnover | 1.42 | 1.05 | 0.72 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.06 | 0.02 | 0.01 | n.a |

| Current Liabilities to Liabilities | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $63,315 | $164,247 | $260,911 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.71Pro Forma Profit and Loss:

Sales: Month 1: $0 Month 2: $0 Month 3: $4,000 Month 4: $7,500 Month 5: $9,000 Month 6: $8,600 Month 7: $8,900 Month 8: $11,200 Month 9: $13,000 Month 10: $14,000 Month 11: $15,025 Month 12: $15,900 Direct Cost of Sales: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Other: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Total Cost of Sales: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Gross Margin: Month 1: $0 Month 2: $0 Month 3: $4,000 Month 4: $7,500 Month 5: $9,000 Month 6: $8,600 Month 7: $8,900 Month 8: $11,200 Month 9: $13,000 Month 10: $14,000 Month 11: $15,025 Month 12: $15,900 Gross Margin %: Month 1: 0.00% Month 2: 0.00% Month 3: 100.00% Month 4: 100.00% Month 5: 100.00% Month 6: 100.00% Month 7: 100.00% Month 8: 100.00% Month 9: 100.00% Month 10: 100.00% Month 11: 100.00% Month 12: 100.00% Expenses: Payroll: Month 1: $2,000 Month 2: $2,000 Month 3: $2,000 Month 4: $2,000 Month 5: $2,000 Month 6: $2,000 Month 7: $2,000 Month 8: $2,000 Month 9: $2,000 Month 10: $2,000 Month 11: $2,000 Month 12: $2,000 Sales and Marketing and Other Expenses: Month 1: $150 Month 2: $150 Month 3: $650 Month 4: $650 Month 5: $650 Month 6: $650 Month 7: $650 Month 8: $650 Month 9: $650 Month 10: $650 Month 11: $650 Month 12: $650 Depreciation: Month 1: $319 Month 2: $319 Month 3: $319 Month 4: $319 Month 5: $319 Month 6: $319 Month 7: $319 Month 8: $319 Month 9: $319 Month 10: $319 Month 11: $319 Month 12: $319 Leased Equipment: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Utilities: Month 1: $200 Month 2: $200 Month 3: $200 Month 4: $200 Month 5: $200 Month 6: $200 Month 7: $200 Month 8: $200 Month 9: $200 Month 10: $200 Month 11: $200 Month 12: $200 Insurance: Month 1: $125 Month 2: $125 Month 3: $125 Month 4: $125 Month 5: $125 Month 6: $125 Month 7: $125 Month 8: $125 Month 9: $125 Month 10: $125 Month 11: $125 Month 12: $125 Rent: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Payroll Taxes: Month 1: 15% Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Other: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Total Operating Expenses: Month 1: $2,794 Month 2: $2,794 Month 3: $3,294 Month 4: $3,294 Month 5: $3,294 Month 6: $3,294 Month 7: $3,294 Month 8: $3,294 Month 9: $3,294 Month 10: $3,294 Month 11: $3,294 Month 12: $3,294 Profit Before Interest and Taxes: Month 1: ($2,794) Month 2: ($2,794) Month 3: $706 Month 4: $4,206 Month 5: $5,706 Month 6: $5,306 Month 7: $5,606 Month 8: $7,906 Month 9: $9,706 Month 10: $10,706 Month 11: $11,731 Month 12: $12,606 EBITDA: Month 1: ($2,475) Month 2: ($2,475) Month 3: $1,025 Month 4: $4,525 Month 5: $6,025 Month 6: $5,625 Month 7: $5,925 Month 8: $8,225 Month 9: $10,025 Month 10: $11,025 Month 11: $12,050 Month 12: $12,925 Interest Expense: Month 1: $0 Month 2: $0 Month 3: $0 Month 4: $0 Month 5: $0 Month 6: $0 Month 7: $0 Month 8: $0 Month 9: $0 Month 10: $0 Month 11: $0 Month 12: $0 Taxes Incurred: Month 1: ($838) Month 2: ($699) Month 3: $177 Month 4: $1,052 Month 5: $1,427 Month 6: $1,327 Month 7: $1,402 Month 8: $1,977 Month 9: $2,427 Month 10: $2,677 Month 11: $2,933 Month 12: $3,152 Net Profit: Month 1: ($1,956) Month 2: ($2,096) Month 3: $530 Month 4: $3,155 Month 5: $4,280 Month 6: $3,980 Month 7: $4,205 Month 8: $5,930 Month 9: $7,280 Month 10: $8,030 Month 11: $8,798 Month 12: $9,455 Net Profit/Sales: Month 1: 0.00% Month 2: 0.00% Month 3: 13.24% Month 4: 42.06% Month 5: 47.55% Month 6: 46.27% Month 7: 47.24% Month 8: 52.94% Month 9: 56.00% Month 10: 57.35% Month 11: 58.56% Month 12: 59.46% Pro Forma Cash Flow: Cash Received: Month 1: $0 Month 2: $0 Month 3: $4,000 Month 4: $7,500 Month 5: $9,000 Month 6: $8,600 Month 7: $8,900 Month 8: $11,200 Month 9: $13,000 Month 10: $14,000 Month 11: $15,025 Month 12: $15,900 Subtotal Cash from Operations: Month 1: $0 Month 2: $0 Month 3: $4,000 Month 4: $7,500 Month 5: $9,000 Month 6: $8,600 Month 7: $8,900 Month 8: $11,200 Month 9: $13,000 Month 10: $14,000 Month 11: $15,025 Month 12: $15,900 Additional Cash Received: Sales Tax, VAT, HST/GST Received: 0.00% New Current Borrowing: $0 New Other Liabilities (interest-free): $0 New Long-term Liabilities: $0 Sales of Other Current Assets: $0 Sales of Long-term Assets: $0 New Investment Received: $0 Subtotal Cash Received: Month 1: $0 Month 2: $0 Month 3: $4,000 Month 4: $7,500 Month 5: $9,000 Month 6: $8,600 Month 7: $8,900 Month 8: $11,200 Month 9: $13,000 Month 10: $14,000 Month 11: $15,025 Month 12: $15,900 Expenditures: Expenditures from Operations: Cash Spending: Month 1: $2,000 Month 2: $2,000 Month 3: $2,000 Month 4: $2,000 Month 5: $2,000 Month 6: $2,000 Month 7: $2,000 Month 8: $2,000 Month 9: $2,000 Month 10: $2,000 Month 11: $2,000 Month 12: $2,000 Bill Payments: Month 1: ($363) Month 2: ($575) Month 3: ($178) Month 4: $1,181 Month 5: $2,039 Month 6: $2,398 Month 7: $2,304 Month 8: $2,396 Month 9: $2,967 Month 10: $3,410 Month 11: $3,660 Month 12: $3,915 Subtotal Spent on Operations: Month 1: $1,637 Month 2: $1,425 Month 3: $1,822 Month 4: $3,181 Month 5: $4,039 Month 6: $4,398 Month 7: $4,304 Month 8: $4,396 Month 9: $4,967 Month 10: $5,410 Month 11: $5,660 Month 12: $5,915 Additional Cash Spent: Sales Tax, VAT, HST/GST Paid Out: $0 Principal Repayment of Current Borrowing: $0 Other Liabilities Principal Repayment: $0 Long-term Liabilities Principal Repayment: $0 Purchase Other Current Assets: $0 Purchase Long-term Assets: $0 Dividends: $0 Subtotal Cash Spent: Month 1: $1,637 Month 2: $1,425 Month 3: $1,822 Month 4: $3,181 Month 5: $4,039 Month 6: $4,398 Month 7: $4,304 Month 8: $4,396 Month 9: $4,967 Month 10: $5,410 Month 11: $5,660 Month 12: $5,915 Net Cash Flow: Month 1: ($1,637) Month 2: ($1,425) Month 3: $2,178 Month 4: $4,319 Month 5: $4,961 Month 6: $4,202 Month 7: $4,596 Month 8: $6,804 Month 9: $8,034 Month 10: $8,590 Month 11: $9,365 Month 12: $9,985 Cash Balance: Month 1: $6,263 Month 2: $4,838 Month 3: $7,015 Month 4: $11,335 Month 5: $16,296 Month 6: $20,498 Month 7: $25,094 Month 8: $31,898 Month 9: $39,931 Month 10: $48,522 Month 11: $57,887 Month 12: $67,872 Pro Forma Balance Sheet: |

|||

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Cash | $7,900 | $6,263 | $4,838 | $7,015 | $11,335 | $16,296 | $20,498 | $25,094 | $31,898 | $39,931 | $48,522 | $57,887 | $67,872 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $7,900 | $6,263 | $4,838 | $7,015 | $11,335 | $16,296 | $20,498 | $25,094 | $31,898 | $39,931 | $48,522 | $57,887 | $67,872 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $11,500 | $11,500 | $11,500 | $11,500 | $11,500 | $11,500 | $11,500 | $11,500 | $11,500 | $11,500 | $11,500 | $11,500 | $11,500 |

| Accumulated Depreciation | $0 | $319 | $638 | $957 | $1,276 | $1,595 | $1,914 | $2,233 | $2,552 | $2,871 | $3,190 | $3,509 | $3,828 |

| Total Long-term Assets | $11,500 | $11,181 | $10,862 | $10,543 | $10,224 | $9,905 | $9,586 | $9,267 | $8,948 | $8,629 | $8,310 | $7,991 | $7,672 |

| Total Assets | $19,400 | $17,444 | $15,700 | $17,558 | $21,559 | $26,201 | $30,084 | $34,361 | $40,846 | $48,560 | $56,832 | $65,878 | $75,544 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $0 | $351 | $1,680 | $2,526 | $2,889 | $2,792 | $2,864 | $3,420 | $3,855 | $4,097 | $4,345 | $4,556 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $0 | $351 | $1,680 | $2,526 | $2,889 | $2,792 | $2,864 | $3,420 | $3,855 | $4,097 | $4,345 | $4,556 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $0 | $351 | $1,680 | $2,526 | $2,889 | $2,792 | $2,864 | $3,420 | $3,855 | $4,097 | $4,345 | $4,556 |

| Paid-in Capital | $22,000 | $22,000 | $22,000 | $22,000 | $22,000 | $22,000 | $22,000 | $22,000 | $22,000 | $22,000 | $22,000 | $22,000 | $22,000 |

| Retained Earnings | ($2,600) | ($2,600) | ($2,600) | ($2,600) | ($2,600) | ($2,600) | ($2,600) | ($2,600) | ($2,600) | ($2,600) | ($2,600) | ($2,600) | ($2,600) |

| Earnings | $0 | ($1,956) | ($4,051) | ($3,522) | ($367) | $3,912 | $7,892 | $12,096 | $18,026 | $25,305 | $33,335 | $42,133 | $51,587 |

| Total Capital | $19,400 | $17,444 | $15,349 | $15,878 | $19,033 | $23,312 | $27,292 | $31,496 | $37,426 | $44,705 | $52,735 | $61,533 | $70,987 |

| Total Liabilities and Capital | $19,400 | $17,444 | $15,700 | $17,558 | $21,559 | $26,201 | $30,084 | $34,361 | $40,846 | $48,560 | $56,832 | $65,878 | $75,544 |

| Net Worth | $19,400 | $17,444 | $15,349 | $15,878 | $19,033 | $23,312 | $27,292 | $31,496 | $37,426 | $44,705 | $52,735 | $61,533 | $70,987 |

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!