Resort Hotel Ski Lodge Business Plan

The Silver Bear Lodge is located three blocks from Crest Lake Village, mid-mountain at Bear Valley Resort and on the free shuttle system. Situated in the recently expanded Crest Canyon area, Silver Bear Lodge will offer customers 12 two-bedroom units with underground parking, fully-equipped kitchens, laundry facilities, and stone fireplaces. Additionally, Silver Bear Lodge will provide a common-area outdoor hot tub, an on-site store, and on-site front desk service.

Each year, more than 150,000 skiers and nature lovers visit the Bear Valley Resort area. On average, visitors spend $250 million annually on lodging, food, and recreational activities there.

Marty Snyderman and Luke Roth, co-owners of the Silver Bear Lodge, will operate the lodge as a ski resort from November to April. During the Spring and Summer months (May to August), the Silver Bear Lodge will function as a summer resort. The lodge will be closed in September and October.

Contents

1.1 Objectives

The objectives of Silver Bear Lodge for the first three years include:

- Exceeding customer expectations for luxury apres ski accommodations.

- Maintaining a 90% occupancy rate during peak periods.

- Assembling an experienced and effective staff.

1.2 Mission

Silver Bear Lodge aims to be the top choice for visitors to Bear Valley Resort.

Company Summary

Silver Bear Lodge, in Crest Canyon, offers 12 two-bedroom units with underground parking, fully-equipped kitchens, laundry facilities, and stone fireplaces. It also features an outdoor hot tub, on-site store, and front desk service.

2.1 Company Ownership

Marty Snyderman and Luke Roth co-own Silver Bear Lodge.

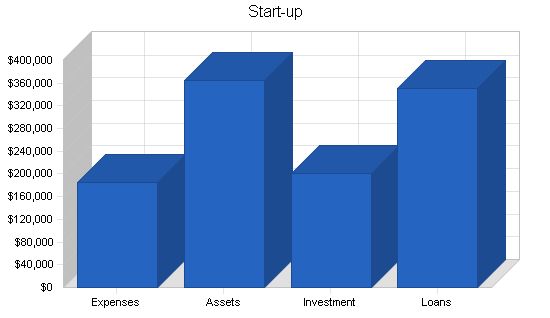

2.2 Start-up Summary

Marty Snyderman and Luke Roth will each invest $100,000. They will also secure a $250,000 mortgage and a $100,000 SBA loan to purchase the property.

Start-up Funding:

– Start-up Expenses to Fund: $185,400

– Start-up Assets to Fund: $364,600

– Total Funding Required: $550,000

Assets:

– Non-cash Assets from Start-up: $350,000

– Cash Requirements from Start-up: $14,600

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $14,600

– Total Assets: $364,600

Liabilities and Capital:

– Liabilities

– Current Borrowing: $0

– Long-term Liabilities: $350,000

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $350,000

– Capital

– Planned Investment

– Marty Snyderman: $100,000

– Luke Roth: $100,000

– Additional Investment Requirement: $0

– Total Planned Investment: $200,000

– Loss at Start-up (Start-up Expenses): ($185,400)

– Total Capital: $14,600

Total Capital and Liabilities: $364,600

Total Funding: $550,000

Start-up Requirements:

– Start-up Expenses

– Legal: $5,000

– Stationery etc.: $400

– Brochures: $6,000

– Rental Shop Setup: $50,000

– Property Downpayment: $50,000

– Lodge Setup: $20,000

– Store Setup: $50,000

– Insurance: $4,000

– Total Start-up Expenses: $185,400

Start-up Assets:

– Cash Required: $14,600

– Other Current Assets: $0

– Long-term Assets: $350,000

– Total Assets: $364,600

Total Requirements: $550,000

2.3 Company Locations and Facilities:

The charm and solitude of Bear Valley’s secluded mountain setting is found just 36 miles from the Richmond International Airport.

Products:

Silver Bear Lodge will offer customers 12 two-bedroom units, fully-equipped kitchens, laundry facilities, and stone fireplaces. The lodge will also have a common-area outdoor hot tub with on-site services including a food store, ski rental/clothing shop, and front desk service.

Market Analysis Summary:

Resort hotel development and operation in the Bear Valley Resort area has been profitable and successful due to the economic upturn in the early and mid-90s. Time-share/resort hotel development and investments into ski resorts nationwide are currently strong. Over the past two years, time-share sales in the Bear Valley Resort area have increased by over 35%. There are forty condominiums, lodges, inns, and hotels within two miles of the resort. Each year, room occupancy is close to 100% during the peak skiing season. New construction is planned in the spring for two condo complexes and a hotel.

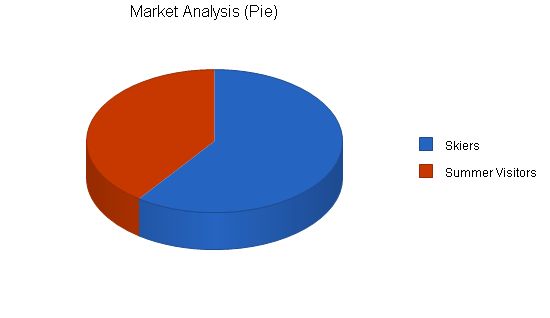

4.1 Market Segmentation:

Our customers can be broadly divided into two groups:

– Skiers: The Bear Valley Resort area is becoming one of the best ski resorts in the U.S. The resort is located 36 miles from Richmond International Airport and is easily accessible.

– Summer Visitors: During the summer months, the Bear Valley Resort area provides a beautiful wilderness retreat with over 50 hiking trails and other outdoor recreational activities.

Market Analysis

Potential Customers

Growth ` Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Skiers 15% 90,000 103,500 119,025 136,879 157,411 15.00%

Summer Visitors 15% 60,000 69,000 79,350 91,253 104,941 15.00%

Total 15.00% 150,000 172,500 198,375 228,132 262,352 15.00%

Strategy and Implementation Summary

Silver Bear Lodge will market aggressively to both winter and summer visitors of the Bear Valley Resort area, which offers activities year-round. During winter, there is skiing. In the summer months, the resort has hot-air balloon trips, white water adventures, day hikes into Bear Valley, and other recreational activities that take advantage of the valley’s spectacular beauty.

Thirteen lodges and inns are present in the Bear Valley Resort, representing only 580 room units out of the total of 4,000 in the resort area. Most room units in the area are condos.

Our customers seek a unique lodging experience that is unavailable in any of the area’s condo complexes or hotels. We will provide our customers with a comfortable, congenial environment that ensures return visits to the Silver Bear Lodge.

The lodge will cost slightly more, but we will offer all the services our customers need to make their stay memorable. We will provide a food shop that can take special orders daily. There will also be a ski rental shop where customers can outfit themselves and purchase ski passes. Each evening, guests can gather in the lodge’s main room, which features a large fireplace, drinks, and light music.

Competitive Edge

The competitive edge of Silver Bear Lodge is its first and foremost service. Co-owners Marty Snyderman and Luke Roth have over twenty years of experience in managing ski lodging facilities.

Marty is the manager-owner of the Crest Lake Inn, which he has owned for ten years.

Luke recently managed the Village Resort Hotel for the last five years. Before that, he was the manager of The Ridge, a 60-unit condo complex in Silver Lake Village.

Another significant advantage of the Silver Bear Lodge is its location, being centrally located between Crest Lake Village (0.5 miles) and the Bear Valley Resort ski area (0.5 miles) in the recently opened Crest Canyon area.

To develop effective business strategies, perform a SWOT analysis of your business. Learn how to perform a SWOT analysis with our free guide and template.

Sales Strategy

The Silver Bear Lodge’s sales strategy is to utilize the existing Bear Valley Resort booking system, which has been critical to the success of all the area’s lodges and inns. Room rates for the lodge will range from $150 to $250 per night in peak season and from $100 to $175 per night in the off-season.

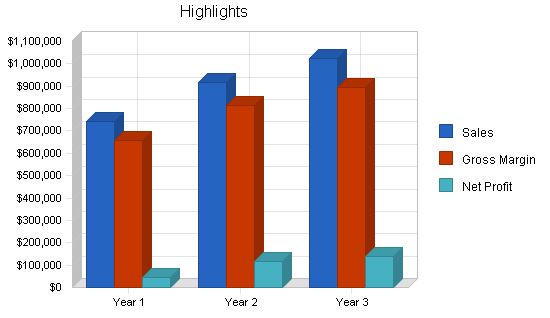

The following is the sales forecast for three years.

Sales Forecast:

– Year 1:

– Year 2:

– Year 3:

– Rooms: $430,000, $560,000, $600,000

– Food: $121,000, $140,000, $180,000

– Ski Rentals: $132,000, $145,000, $160,000

– Clothing: $58,000, $70,000, $82,000

– Total Sales: $741,000, $915,000, $1,022,000

– Direct Cost of Sales:

– Year 1:

– Year 2:

– Year 3:

– Rooms: $0, $0, $0

– Food: $59,500, $71,000, $90,000

– Ski Rentals: $0, $0, $0

– Clothing: $23,700, $30,000, $38,000

– Subtotal Direct Cost of Sales: $83,200, $101,000, $128,000

The Bear Valley Resort area has its own website and advertising/promotion program that promotes the area’s lodging. Currently, 70% of the area’s visitors use the website to identify lodging and service options.

The Silver Bear Lodge is positioned as a new upscale facility that is focused on the high-income visitors to Bear Valley Resort. The area’s lodges and inns receive approximately 80% of their guests from the Bear Valley Resort booking system. Since the total number of room units are few with the area’s lodges and inns, these lodging units fill up quickly.

In addition, the Silver Bear Lodge will be highlighted in a promotional piece for Bear Valley Resort in the December issue of Ski Magazine.

Management Summary

Luke Roth will be the manager of the daily operations of the Silver Bear Lodge.

6.1 Personnel Plan

The personnel needed for the Silver Bear Lodge are the following:

– Manager

– Assistant manager

– Lodge staff (7)

– Food store staff (3)

– Ski rental/clothing store (3)

– Maintenance staff (3)

– Cleaning staff (4)

Personnel Plan:

– Year 1:

– Year 2:

– Year 3:

– Manager: $36,000, $39,000, $42,000

– Assistant Manager: $42,000, $45,000, $48,000

– Lodge Staff: $110,000, $120,000, $126,000

– Food Store Staff: $39,000, $43,000, $46,000

– Ski Rental/Clothing Store Staff: $35,000, $39,000, $42,000

– Maintenance Staff: $48,000, $52,000, $55,000

– Cleaning Staff: $72,000, $76,000, $79,000

– Total People: 9, 22, 22

– Total Payroll: $382,000, $414,000, $438,000

The following is the financial plan for the Silver Bear Lodge.

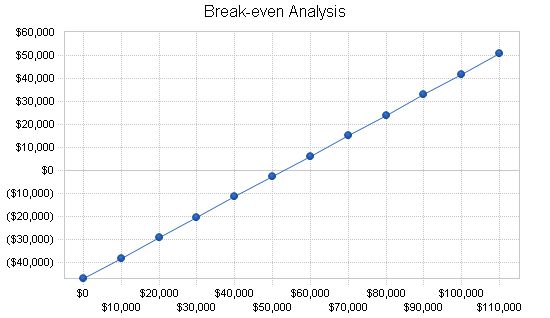

The monthly break-even point is approximately $52,900.

Break-even Analysis

Monthly Revenue Break-even: $52,905

Assumptions:

– Average Percent Variable Cost: 11%

– Estimated Monthly Fixed Cost: $46,965

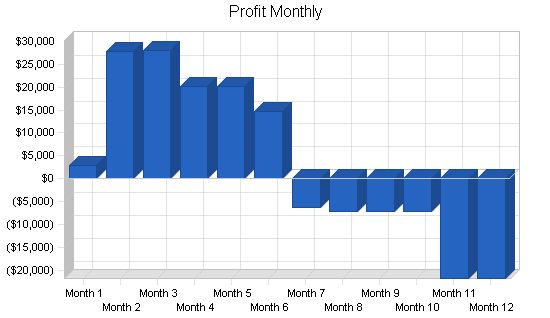

Projected Profit and Loss for three years.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $741,000 | $915,000 | $1,022,000 |

| Direct Cost of Sales | $83,200 | $101,000 | $128,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $83,200 | $101,000 | $128,000 |

| Gross Margin | $657,800 | $814,000 | $894,000 |

| Gross Margin % | 88.77% | 88.96% | 87.48% |

| Expenses | |||

| Payroll | $382,000 | $414,000 | $438,000 |

| Sales and Marketing and Other Expenses | $60,000 | $80,000 | $100,000 |

| Depreciation | $14,280 | $14,280 | $14,280 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $26,000 | $26,000 | $26,000 |

| Insurance | $24,000 | $24,000 | $24,000 |

| Lease | $0 | $0 | $0 |

| Payroll Taxes | $57,300 | $62,100 | $65,700 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $563,580 | $620,380 | $667,980 |

| Profit Before Interest and Taxes | $94,220 | $193,620 | $226,020 |

| EBITDA | $108,500 | $207,900 | $240,300 |

| Interest Expense | $33,375 | $30,500 | $27,500 |

| Taxes Incurred | $18,254 | $48,936 | $59,556 |

| Net Profit | $42,592 | $114,184 | $138,964 |

| Net Profit/Sales | 5.75% | 12.48% | 13.60% |

7.3 Projected Balance Sheet

The following is the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Cash | $31,437 | $118,555 | $165,584 |

| Other Current Assets | $14,000 | $32,000 | $53,000 |

| Total Current Assets | $45,437 | $150,555 | $218,584 |

| Long-term Assets | |||

| Long-term Assets | $350,000 | $370,000 | $430,000 |

| Accumulated Depreciation | $14,280 | $28,560 | $42,840 |

| Total Long-term Assets | $335,720 | $341,440 | $387,160 |

| Total Assets | $381,157 | $491,995 | $605,744 |

| Liabilities and Capital | |||

| Current Liabilities | |||

| Accounts Payable | $3,965 | $30,619 | $35,405 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $3,965 | $30,619 | $35,405 |

| Long-term Liabilities | $320,000 | $290,000 | $260,000 |

| Total Liabilities | $323,965 | $320,619 | $295,405 |

| Paid-in Capital | $200,000 | $200,000 | $200,000 |

| Retained Earnings | ($185,400) | ($142,809) | ($28,625) |

| Earnings | $42,592 | $114,184 | $138,964 |

| Total Capital | $57,192 | $171,376 | $310,340 |

| Total Liabilities and Capital | $381,157 | $491,995 | $605,744 |

| Net Worth | $57,192 | $171,376 | $310,340 |

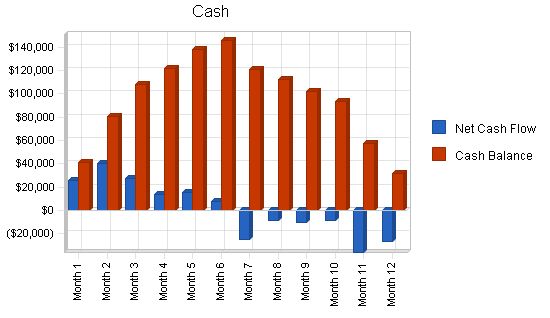

7.4 Projected Cash Flow

The following is the projected cash flow for three years.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $741,000 $915,000 $1,022,000

Subtotal Cash from Operations $741,000 $915,000 $1,022,000

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $741,000 $915,000 $1,022,000

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $382,000 $414,000 $438,000

Bill Payments $298,163 $345,882 $425,971

Subtotal Spent on Operations $680,163 $759,882 $863,971

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $30,000 $30,000 $30,000

Purchase Other Current Assets $14,000 $18,000 $21,000

Purchase Long-term Assets $0 $20,000 $60,000

Dividends $0 $0 $0

Subtotal Cash Spent $724,163 $827,882 $974,971

Net Cash Flow $16,837 $87,118 $47,029

Cash Balance $31,437 $118,555 $165,584

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7011, Hotels and Motels, are shown for comparison.

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 23.48% 11.69% 5.90%

Percent of Total Assets

Other Current Assets 3.67% 6.50% 8.75% 26.00%

Total Current Assets 11.92% 30.60% 36.09% 32.00%

Long-term Assets 88.08% 69.40% 63.91% 68.00%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 1.04% 6.22% 5.84% 19.40%

Long-term Liabilities 83.95% 58.94% 42.92% 34.60%

Total Liabilities 85.00% 65.17% 48.77% 54.00%

Net Worth 15.00% 34.83% 51.23% 46.00%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 88.77% 88.96% 87.48% 0.00%

Selling, General & Administrative Expenses 83.02% 76.48% 73.88% 75.10%

Advertising Expenses 8.10% 8.74% 9.78% 1.90%

Profit Before Interest and Taxes 12.72% 21.16% 22.12% 2.50%

Main Ratios

Current 11.46 4.92 6.17 1.45

Quick 11.46 4.92 6.17 1.05

Total Debt to Total Assets 85.00% 65.17% 48.77% 54.00%

Pre-tax Return on Net Worth 106.39% 95.18% 63.97% 1.70%

Pre-tax Return on Assets 15.96% 33.15% 32.77% 3.70%

Additional Ratios

Net Profit Margin 5.75% 12.48% 13.60% n.a

Return on Equity 74.47% 66.63% 44.78% n.a

Activity Ratios

Accounts Payable Turnover 76.19 12.17 12.17 n.a

Payment Days 27 17 28 n.a

Total Asset Turnover 1.94 1.86 1.69 n.a

Debt Ratios

Debt to Net Worth 5.66 1.87 0.95 n.a

Current Liab. to Liab. 0.01 0.10 0.12 n.a

Liquidity Ratios

Net Working Capital $41,472 $119,936 $183,180 n.a

Interest Coverage 2.82 6.35 8.22 n.a

Additional Ratios

Assets to Sales 0.51 0.54 0.59 n.a

Current Debt/Total Assets 1% 6% 6% n.a

Acid Test 11.46 4.92 6.17 n.a

Sales/Net Worth 12.96 5.34 3.29 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

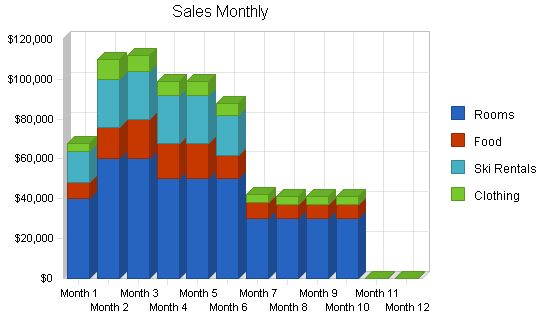

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales

Rooms 0% $40,000 $60,000 $60,000 $50,000 $50,000 $50,000 $30,000 $30,000 $30,000 $30,000 $0 $0

Food 0% $8,000 $16,000 $20,000 $18,000 $18,000 $12,000 $8,000 $7,000 $7,000 $7,000 $0 $0

Ski Rentals 0% $16,000 $24,000 $24,000 $24,000 $24,000 $20,000 $0 $0 $0 $0 $0 $0

Clothing 0% $4,000 $10,000 $8,000 $7,000 $7,000 $6,000 $4,000 $4,000 $4,000 $4,000 $0 $0

Total Sales

$68,000 $110,000 $112,000 $99,000 $99,000 $88,000 $42,000 $41,000 $41,000 $41,000 $0 $0

Direct Cost of Sales

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Rooms $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Food $4,000 $8,000 $10,000 $9,000 $9,000 $6,000 $3,000 $3,500 $3,500 $3,500 $0 $0

Ski Rentals $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Clothing $1,400 $4,000 $3,600 $3,000 $3,000 $2,700 $1,500 $1,500 $1,500 $1,500 $0 $0

Subtotal Direct Cost of Sales

$5,400 $12,000 $13,600 $12,000 $12,000 $8,700 $4,500 $5,000 $5,000 $5,000 $0 $0

Personnel Plan

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Manager 0% $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

Assistant Manager 0% $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500

Lodge Staff 0% $13,000 $13,000 $13,000 $13,000 $13,000 $13,000 $8,000 $8,000 $8,000 $8,000 $0 $0

Food Store Staff 0% $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $3,000 $3,000 $3,000 $3,000 $0 $0

Ski Rental/Clothing Store Staff 0% $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $2,000 $2,000 $2,000 $2,000 $0 $0

Maintenance Staff 0% $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000

Cleaning Staff 0% $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000

Total People

22 22 22 22 22 22 18 18 18 18 9 9

Total Payroll

$38,500 $38,500 $38,500 $38,500 $38,500 $38,500 $29,500 $29,500 $29,500 $29,500 $16,500 $16,500

General Assumptions

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss

Sales:

Month 1: $68,000

Month 2: $110,000

Month 3: $112,000

Month 4: $99,000

Month 5: $99,000

Month 6: $88,000

Month 7: $42,000

Month 8: $41,000

Month 9: $41,000

Month 10: $41,000

Month 11: $0

Month 12: $0

Direct Cost of Sales:

Month 1: $5,400

Month 2: $12,000

Month 3: $13,600

Month 4: $12,000

Month 5: $12,000

Month 6: $8,700

Month 7: $4,500

Month 8: $5,000

Month 9: $5,000

Month 10: $5,000

Month 11: $0

Month 12: $0

Other Production Expenses:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Total Cost of Sales:

Month 1: $5,400

Month 2: $12,000

Month 3: $13,600

Month 4: $12,000

Month 5: $12,000

Month 6: $8,700

Month 7: $4,500

Month 8: $5,000

Month 9: $5,000

Month 10: $5,000

Month 11: $0

Month 12: $0

Gross Margin:

Month 1: $62,600

Month 2: $98,000

Month 3: $98,400

Month 4: $87,000

Month 5: $87,000

Month 6: $79,300

Month 7: $37,500

Month 8: $36,000

Month 9: $36,000

Month 10: $36,000

Month 11: $0

Month 12: $0

Gross Margin %:

Month 1: 92.06%

Month 2: 89.09%

Month 3: 87.86%

Month 4: 87.88%

Month 5: 87.88%

Month 6: 90.11%

Month 7: 89.29%

Month 8: 87.80%

Month 9: 87.80%

Month 10: 87.80%

Month 11: 0.00%

Month 12: 0.00%

Expenses:

Payroll:

Month 1: $38,500

Month 2: $38,500

Month 3: $38,500

Month 4: $38,500

Month 5: $38,500

Month 6: $38,500

Month 7: $29,500

Month 8: $29,500

Month 9: $29,500

Month 10: $29,500

Month 11: $16,500

Month 12: $16,500

Sales and Marketing and Other Expenses:

Month 1: $5,000

Month 2: $5,000

Month 3: $5,000

Month 4: $5,000

Month 5: $5,000

Month 6: $5,000

Month 7: $5,000

Month 8: $5,000

Month 9: $5,000

Month 10: $5,000

Month 11: $5,000

Month 12: $5,000

Depreciation:

Month 1: $1,190

Month 2: $1,190

Month 3: $1,190

Month 4: $1,190

Month 5: $1,190

Month 6: $1,190

Month 7: $1,190

Month 8: $1,190

Month 9: $1,190

Month 10: $1,190

Month 11: $1,190

Month 12: $1,190

Leased Equipment:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Utilities:

Month 1: $3,000

Month 2: $3,000

Month 3: $3,000

Month 4: $3,000

Month 5: $3,000

Month 6: $3,000

Month 7: $1,500

Month 8: $1,300

Month 9: $1,300

Month 10: $1,300

Month 11: $1,300

Month 12: $1,300

Insurance:

Month 1: $2,000

Month 2: $2,000

Month 3: $2,000

Month 4: $2,000

Month 5: $2,000

Month 6: $2,000

Month 7: $2,000

Month 8: $2,000

Month 9: $2,000

Month 10: $2,000

Month 11: $2,000

Month 12: $2,000

Lease:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Payroll Taxes:

Month 1: 15%, $5,775

Month 2: 15%, $5,775

Month 3: 15%, $5,775

Month 4: 15%, $5,775

Month 5: 15%, $5,775

Month 6: 15%, $5,775

Month 7: 15%, $4,425

Month 8: 15%, $4,425

Month 9: 15%, $4,425

Month 10: 15%, $4,425

Month 11: 15%, $2,475

Month 12: 15%, $2,475

Other:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Total Operating Expenses:

Month 1: $55,465

Month 2: $55,465

Month 3: $55,465

Month 4: $55,465

Month 5: $55,465

Month 6: $55,465

Month 7: $43,615

Month 8: $43,415

Month 9: $43,415

Month 10: $43,415

Month 11: $28,465

Month 12: $28,465

Profit Before Interest and Taxes:

Month 1: $7,135

Month 2: $42,535

Month 3: $42,935

Month 4: $31,535

Month 5: $31,535

Month 6: $23,835

Month 7: ($6,115)

Month 8: ($7,415)

Month 9: ($7,415)

Month 10: ($7,415)

Month 11: ($28,465)

Month 12: ($28,465)

EBITDA:

Month 1: $8,325

Month 2: $43,725

Month 3: $44,125

Month 4: $32,725

Month 5: $32,725

Month 6: $25,025

Month 7: ($4,925)

Month 8: ($6,225)

Month 9: ($6,225)

Month 10: ($6,225)

Month 11: ($27,275)

Month 12: ($27,275)

Interest Expense:

Month 1: $2,896

Month 2: $2,875

Month 3: $2,854

Month 4: $2,833

Month 5: $2,813

Month 6: $2,792

Month 7: $2,771

Month 8: $2,750

Month 9: $2,729

Month 10: $2,708

Month 11: $2,688

Month 12: $2,667

Taxes Incurred:

Month 1: $1,272

Month 2: $11,898

Month 3: $12,024

Month 4: $8,611

Month 5: $8,617

Month 6: $6,313

Month 7: ($2,666)

Month 8: ($3,050)

Month 9: ($3,043)

Month 10: ($3,037)

Month 11: ($9,346)

Month 12: ($9,340)

Net Profit:

Month 1: $2,967

Month 2: $27,762

Month 3: $28,057

Month 4: $20,091

Month 5: $20,106

Month 6: $14,730

Month 7: ($6,220)

Month 8: ($7,116)

Month 9: ($7,101)

Month 10: ($7,086)

Month 11: ($21,807)

Month 12: ($21,792)

Net Profit/Sales:

Month 1: 4.36%

Month 2: 25.24%

Month 3: 25.05%

Month 4: 20.29%

Month 5: 20.31%

Month 6: 16.74%

Month 7: -14.81%

Month 8: -17.35%

Month 9: -17.32%

Month 10: -17.28%

Month 11: 0.00%

Month 12: 0.00%

Pro Forma Cash Flow

Cash Received:

Cash from Operations:

Month 1: $68,000

Month 2: $110,000

Month 3: $112,000

Month 4: $99,000

Month 5: $99,000

Month 6: $88,000

Month 7: $42,000

Month 8: $41,000

Month 9: $41,000

Month 10: $41,000

Month 11: $0

Month 12: $0

Subtotal Cash from Operations:

Month 1: $68,000

Month 2: $110,000

Month 3: $112,000

Month 4: $99,000

Month 5: $99,000

Month 6: $88,000

Month 7: $42,000

Month 8: $41,000

Month 9: $41,000

Month 10: $41,000

Month 11: $0

Month 12: $0

Additional Cash Received:

Sales Tax, VAT, HST/GST Received:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

New Current Borrowing:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

New Other Liabilities (interest-free):

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

New Long-term Liabilities:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Sales of Other Current Assets:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Sales of Long-term Assets:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

New Investment Received:

Month 1: $0

Month 2: $0

Month 3: $0

Month 4: $0

Month 5: $0

Month 6: $0

Month 7: $0

Month 8: $0

Month 9: $0

Month 10: $0

Month 11: $0

Month 12: $0

Subtotal Cash Received:

Month 1: $68,000

Month 2: $110,000

Month 3: $112,000

Month 4: $99,000

Month 5: $99,000

Month 6: $88,000

Month 7: $42,000

Month 8: $41,000

Month 9: $41,000

Month 10: $41,000

Month 11: $0

Month 12: $0

Expenditures:

Expenditures from Operations:

Month 1: $38,500

Month 2: $38,500

Month 3: $38,500

Month 4: $38,500

Month 5: $38,500

Month 6: $38,500

Month 7: $29,500

Month 8: $29,500

Month 9: $29,500

Month 10: $29,500

Month 11: $16,500

Month 12: $16,500

Bill Payments:

Month 1: $845

Month

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!