Contents

Organic Restaurant Business Plan

This business plan is for Studio67, a medium-sized restaurant in Portland, Oregon. Studio67 focuses on organic and creative ethnic food, demonstrating dedication to sustainable development. The restaurant also prioritizes local sourcing to reduce reliance on fossil fuels for transportation.

Services

Studio67 offers Portlanders a trendy, fun place to enjoy great food in a social environment. Chef Mario Langostino brings a diverse range of ethnic ingredients and recipes to the table. Studio67 anticipates that customers will largely rely on the chef’s recommendations. The menu will feature unique and diverse ethnic dishes, with an emphasis on healthy cuisine to cater to the growing demand for health-conscious options within the restaurant industry.

Customers

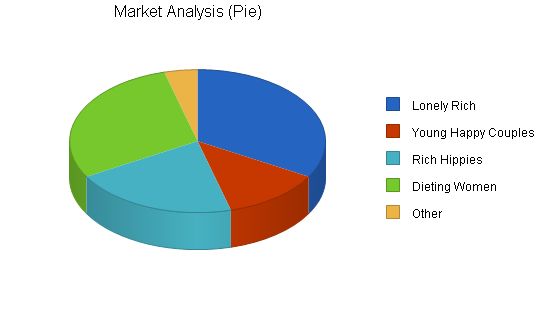

Studio67 targets four distinct customer segments. The first is the wealthy individuals, totaling 400,000 people. The second segment includes young customers, with an annual growth rate of 8% and a potential customer base of 150,000. The third segment comprises of environmentally conscious consumers who prefer organic and ethnic foods. Lastly, dieting women, totaling 350,000 in the Portland area, are particularly interested in the menu’s healthy options.

Management

Studio67 boasts a strong management team. Andrew Flounderson serves as the general manager, with extensive experience managing organizations with six to 45 people. Jane Flap handles finance and accounting, leveraging her seven years of experience as an Arthur Andersen CPA. Chef Marion Langostino, a well-known figure in the Portland community with over 12 years of experience, oversees the culinary production.

Studio67 prioritizes financial success through rigorous financial control. The restaurant also ensures high-quality service, clean and non-greasy food, and unique twists on traditional dishes. As the restaurant becomes more popular, menu prices will increase to reflect its exclusivity.

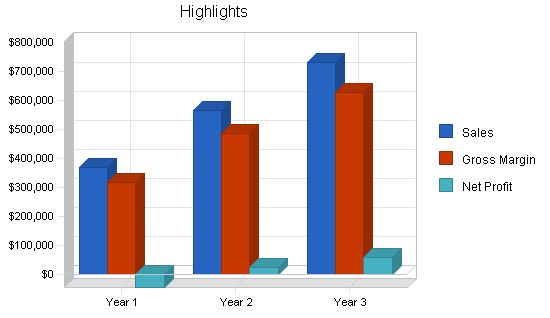

Market and financial analyses project that Studio67, with a start-up expenditure of $141,000, can generate sales of over $365,000 in the first year, $565,000 by the end of the second year, and achieve net profits of over 7.5% on sales by the end of the third year, reaching profitability by the second year.

Objectives

- Sales of $350K in the first year, over half a million in the second.

- Personnel costs under $300K in the first year, under $400K in the second year.

- Profitable in year two, with profits exceeding 7.5% of sales by year three.

Mission

Studio67 is a great place to eat, offering an intriguing atmosphere and excellent, interesting food that is also very healthy. We aim to provide fair profit for the owners and a rewarding workplace for employees.

Company Summary

Studio67 is a medium-sized restaurant located in a prime neighborhood of Portland. We specialize in organic and creative food. Our priority is achieving financial success by delivering high-quality service and exceptionally clean, non-greasy food with unique twists.

Company Ownership

The restaurant will initially operate as a sole proprietorship, owned by its founders.

Start-up Summary

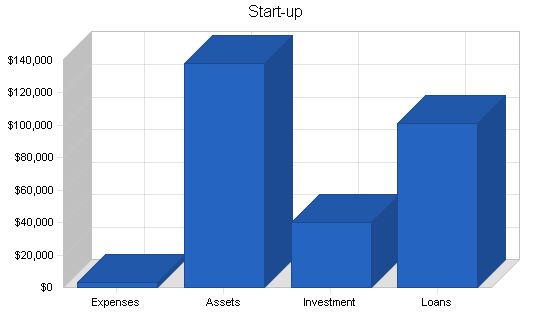

The company’s founders, Andrew Flounderson and Jane Flap, handle financial and personnel matters, respectively. Jane holds an undergraduate degree in business from the University of Berkeley.

We have secured a location and a lease for $2,000 per month. By the end of the eleventh month, we will be ready to generate profits and expect to achieve profitability in the second year. The premises are already equipped as a restaurant, so our startup capital will total $40,000, supplemented by a $100,000 SBA-guaranteed loan.

Start-up Funding:

– Start-up Expenses to Fund: $3,000

– Start-up Assets to Fund: $138,000

– Total Funding Required: $141,000

Assets:

– Non-cash Assets from Start-up: $50,000

– Cash Requirements from Start-up: $88,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $88,000

– Total Assets: $138,000

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $100,000

– Accounts Payable (Outstanding Bills): $1,000

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $101,000

– Capital:

– Planned Investment:

– Investor 1: $25,000

– Investor 2: $15,000

– Additional Investment Requirement: $0

– Total Planned Investment: $40,000

– Loss at Start-up (Start-up Expenses): ($3,000)

– Total Capital: $37,000

– Total Capital and Liabilities: $138,000

– Total Funding: $141,000

Services:

The Menu:

The menu will be simple but change daily. We will have a small group of constants and feature a chef’s recommendation that we expect 85% of customers to order. This will reduce waste and help with ingredient planning.

Organic Ingredients:

The use of organic ingredients will allow us to target wealthy internet entrepreneurs who are willing to spend a lot of money for peace of mind. We will also emphasize our commitment to ecological consciousness. Dining at Studio67 will feel like contributing to the environment.

Ethnic Ingredients and Recipes:

Our chef will have the freedom to create menu offerings from various world cultures. We will source authentic ingredients to stay true to these unique recipes.

Interior Accoutrements:

Our artwork will reflect the diverse influences that shape the Studio67 chef’s attitude.

Market Analysis Summary:

Because of the founders’ connections in Portland, we have an excellent understanding of the area and its target customers. The core group of customers share a sense of being part of the "in crowd" and having a successful life. Each segment of our customer base complements the others. As the restaurant becomes more popular, we plan to raise menu prices and capitalize on the exclusivity of being part of the "in crowd."

Market Segmentation:

The Lonely Rich:

Most lonely rich individuals are tech workers, particularly those in the internet industry. Their lives revolve around their work and the people in their professional circle. They have disposable income and are willing to spend on drinks, appetizers, and tips.

Young Happy Couples:

Studio67 will have an inviting atmosphere for couples and encourage social interaction. We aim to create a social gathering place where people can meet and build connections. Young couples, who are successful and balanced, may not spend as much on drinks.

The Rich Hippies:

Portland has a large group of rich hippies who have significant influence in the city. They maintain an ecological ideology and seek to make a difference. We will cater to their values and contribute to causes that resonate with them.

Dieting Women:

Our organic food menu will always include delicious, low-fat options. Studio67 will be a gathering spot for women, reminiscent of shows like "Sex and the City," where they can discuss various topics while feeling good about the food they eat.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Lonely Rich 10% 400,000 440,000 484,000 532,400 585,640 10.00%

Young Happy Couples 8% 150,000 162,000 174,960 188,957 204,074 8.00%

Rich Hippies 6% 250,000 265,000 280,900 297,754 315,619 6.00%

Dieting Women 7% 350,000 374,500 400,715 428,765 458,779 7.00%

Other 5% 50,000 52,500 55,125 57,881 60,775 5.00%

Total 7.87% 1,200,000 1,294,000 1,395,700 1,505,757 1,624,887 7.87%

Strategy and Implementation Summary

Our strategy is simple: give people great, healthy, interesting food and an environment that attracts “trendy” people. Implementation isn’t simple, but that’s in the doing, not in the plan.

Competitive Edge

Our competitive edge is the menu, the chef, the environment, and the tie-in to what’s trendy.

To develop good business strategies, perform a SWOT analysis of your business. Use our free guide and template to learn how to perform a SWOT analysis.

Sales Strategy

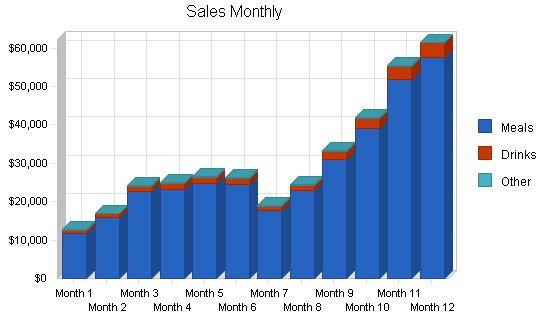

The table shows that we intend to achieve sales of about $350K in the first year and double that by the third year of the plan.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | |||

| Meals | 22,822 | 35,000 | 45,000 |

| Drinks | 11,415 | 17,500 | 22,500 |

| Other | 240 | 500 | 1,000 |

| Total Unit Sales | 34,477 | 53,000 | 68,500 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Meals | $15.00 | $15.00 | $15.00 |

| Drinks | $2.00 | $2.00 | $2.00 |

| Other | $10.00 | $10.00 | $10.00 |

| Sales | |||

| Meals | $342,330 | $525,000 | $675,000 |

| Drinks | $22,830 | $35,000 | $45,000 |

| Other | $2,400 | $5,000 | $10,000 |

| Total Sales | $367,560 | $565,000 | $730,000 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Meals | $2.00 | $2.00 | $2.00 |

| Drinks | $0.50 | $0.50 | $0.50 |

| Other | $1.00 | $1.00 | $1.00 |

| Direct Cost of Sales | |||

| Meals | $45,644 | $70,000 | $90,000 |

| Drinks | $5,708 | $8,750 | $11,250 |

| Other | $240 | $500 | $1,000 |

| Subtotal Direct Cost of Sales | $51,592 | $79,250 | $102,250 |

Management Summary

Andrew has extensive experience managing personnel and we are confident in his ability to find the best staff. Our chef, Mario Langostino, already has a published cookbook that will immediately add prestige to the restaurant. We will look for a young, ultra-hip staff to ensure Studio67 is trendy.

Personnel Plan

According to the personnel plan, we expect to invest in a well-compensated team. The planned staff is in good proportion to the restaurant’s size and projected revenues.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Manager | $60,000 | $65,000 | $70,000 |

| Hostess | $42,000 | $45,000 | $50,000 |

| Chef | $54,000 | $60,000 | $65,000 |

| Cleaning | $30,000 | $35,000 | $40,000 |

| Waiters | $72,000 | $100,000 | $130,000 |

| Other | $24,000 | $52,000 | $55,000 |

| Total People | 8 | 10 | 12 |

| Total Payroll | $282,000 | $357,000 | $410,000 |

Financial Plan

We expect to raise $40,000 of our own capital and borrow $100,000 guaranteed by the SBA as a 10-year loan. This provides the majority of the required start-up financing.

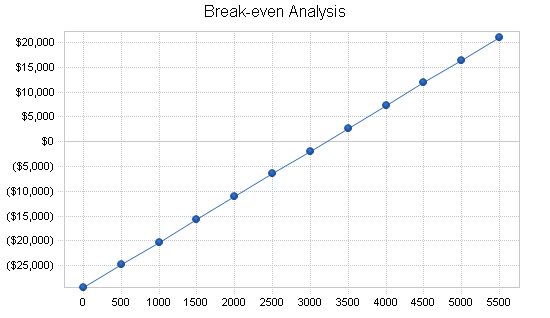

Break-even Analysis

Our break-even analysis is based on the average first-year numbers for total sales, costs of sales, and operating expenses per meal served. These are presented as per-unit revenue, per-unit cost, and fixed costs. We acknowledge that fixed costs may not be exactly the same, but these assumptions allow for a better estimation of real risk.

Break-even Analysis:

Monthly Units Break-even: 3,205

Monthly Revenue Break-even: $34,171

Assumptions:

Average Per-Unit Revenue: $10.66

Average Per-Unit Variable Cost: $1.50

Estimated Monthly Fixed Cost: $29,375

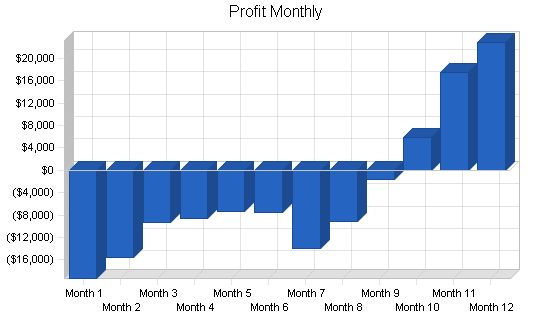

Projected Profit and Loss:

According to the profit and loss table, we anticipate reaching breakeven in the second year and achieving a satisfactory profit in the third year.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $367,560 $565,000 $730,000

Direct Cost of Sales $51,592 $79,250 $102,250

Other $0 $0 $0

Total Cost of Sales $51,592 $79,250 $102,250

Gross Margin $315,969 $485,750 $627,750

Gross Margin % 85.96% 85.97% 85.99%

Expenses

Payroll $282,000 $357,000 $410,000

Sales and Marketing and Other Expenses $27,000 $35,830 $72,122

Depreciation $0 $0 $0

Utilities $1,200 $1,260 $1,323

Payroll Taxes $42,300 $53,550 $61,500

Other $0 $0 $0

Total Operating Expenses $352,500 $447,640 $544,945

Profit Before Interest and Taxes ($36,532) $38,110 $82,806

EBITDA ($36,532) $38,110 $82,806

Interest Expense $9,673 $8,887 $7,637

Taxes Incurred $0 $7,306 $19,105

Net Profit ($46,204) $21,917 $56,063

Net Profit/Sales -12.57% 3.88% 7.68%

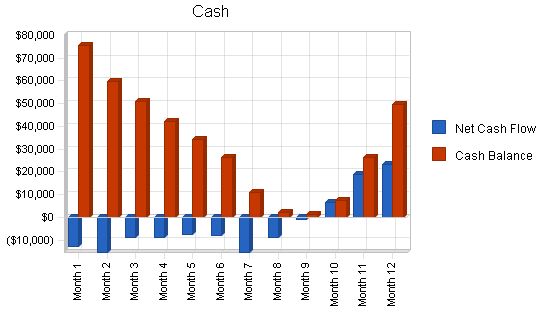

Projected Cash Flow

The cash flow projection shows that starting cost and provisions for ongoing expenses are adequate to meet our needs until the business itself generates its own cash flow sufficient to support operations.

Pro Forma Cash Flow

| | Year 1 | Year 2 | Year 3 |

| ———————– | ——– | ——– | ——– |

| Cash Received | | | |

| Cash from Operations | | | |

| Cash Sales | $367,560 | $565,000 | $730,000 |

| Subtotal Cash from Operations | $367,560 | $565,000 | $730,000 |

| Additional Cash Received | | | |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $367,560 | $565,000 | $730,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | | | |

| Cash Spending | $282,000 | $357,000 | $410,000 |

| Bill Payments | $117,968 | $185,584 | $257,538 |

| Subtotal Spent on Operations | $399,968 | $542,584 | $667,538 |

| Additional Cash Spent | | | |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $6,133 | $10,000 | $15,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $406,101 | $552,584 | $682,538 |

| Net Cash Flow | ($38,541) | $12,416 | $47,462 |

| Cash Balance | $49,459 | $61,875 | $109,337 |

Projected Balance Sheet

The table shows projected balance sheet for three years.

Pro Forma Balance Sheet

| | Year 1 | Year 2 | Year 3 |

| ——————— | ——– | ——– | ——– |

| Assets | | | |

| Current Assets | | | |

| Cash | $49,459 | $61,875 | $109,337 |

| Other Current Assets | $50,000 | $50,000 | $50,000 |

| Total Current Assets | $99,459 | $111,875 | $159,337 |

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $99,459 | $111,875 | $159,337 |

Liabilities and Capital

| | Year 1 | Year 2 | Year 3 |

| ————————— | ——– | ——– | ——– |

| Current Liabilities | | | |

| Accounts Payable | $14,796 | $15,294 | $21,693 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities| $14,796 | $15,294 | $21,693 |

| Long-term Liabilities | $93,867 | $83,867 | $68,867 |

| Subtotal Liabilities | $108,663 | $99,161 | $90,560 |

| Paid-in Capital | $40,000 | $40,000 | $40,000 |

| Retained Earnings | ($3,000) | ($49,204) | ($27,287) |

| Earnings | ($46,204)| $21,917 | $56,063 |

| Total Capital | ($9,204) | $12,713 | $68,776 |

| Total Liabilities and Capital | $99,459 | $111,875 | $159,337 |

| Net Worth | ($9,204) | $12,713 | $68,776 |

Business ratios for the years of this plan are shown below. Industry Profile ratios based on the Standard Industrial Classification (SIC) code 5813, Eating Places, are shown for comparison.

| | Year 1 | Year 2 | Year 3 | Industry Profile |

| ————————- | —— | —— | —— | —————- |

| Sales Growth | n.a. | 53.72% | 29.20% | 7.60% |

| Percent of Total Assets | | | | |

| Other Current Assets | 50.27% | 44.69% | 31.38% | 35.60% |

| Total Current Assets | 100.00%| 100.00%| 100.00%| 43.70% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 56.30% |

| Total Assets | 100.00%| 100.00%| 100.00%| 100.00% |

| Current Liabilities | 14.88% | 13.67% | 13.61% | 32.70% |

| Long-term Liabilities | 94.38% | 74.97% | 43.22% | 28.50% |

| Total Liabilities | 109.25%| 88.64% | 56.84% | 61.20% |

| Net Worth | -9.25% | 11.36% | 43.16% | 38.80% |

| Percent of Sales | | | | |

| Sales | 100.00%| 100.00%| 100.00%| 100.00% |

| Gross Margin | 85.96% | 85.97% | 85.99% | 60.50% |

| Selling, General & Administrative Expenses | 98.90% | 82.32% | 78.45% | 39.80% |

| Advertising Expenses | 0.65% | 1.77% | 6.16% | 3.20% |

| Profit Before Interest and Taxes | -9.94% | 6.75% | 11.34% | 0.70% |

| Main Ratios | | | | |

| Current | 6.72 | 7.31 | 7.34 | 0.98 |

| Quick | 6.72 | 7.31 | 7.34 | 0.65 |

| Total Debt to Total Assets | 109.25%| 88.64% | 56.84% | 61.20% |

| Pre-tax Return on Net Worth| 501.98%| 229.87%| 109.29%| 1.70% |

| Pre-tax Return on Assets | -46.46%| 26.12% | 47.18% | 4.30% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -12.57%| 3.88% | 7.68% | n.a. |

| Return on Equity | 0.00% | 172.40%| 81.52% | n.a. |

| Activity Ratios | | | | |

| Accounts Payable Turnover | 8.91 | 12.17 | 12.17 | n.a. |

| Payment Days | 27 | 30 | 26 | n.a. |

| Total Asset Turnover | 3.70 | 5.05 | 4.58 | n.a. |

| Debt Ratios | | | | |

| Debt to Net Worth | 0.00 | 7.80 | 1.32 | n.a. |

| Current Liab. to Liab. | 0.14 | 0.15 | 0.24 | n.a. |

| Liquidity Ratios | | | | |

| Net Working Capital | $84,663| $96,580| $137,643| n.a. |

| Interest Coverage | -3.78 | 4.29 | 10.84 | n.a. |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Assets to Sales | 0.27 | 0.20 | 0.22 | n.a. |

| Current Debt/Total Assets | 15% | 14% | 14% | n.a. |

| Acid Test | 6.72 | 7.31 | 7.34 | n.a. |

| Sales/Net Worth | 0.00 | 44.44 | 10.61 | n.a. |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a. |

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Meals 779 1,053 1,505 1,553 1,652 1,633 1,173 1,520 2,066 2,602 3,451 3,835

Drinks 390 527 753 777 826 817 587 760 1,033 1,301 1,726 1,918

Other 20 20 20 20 20 20 20 20 20 20 20 20

Total Unit Sales 1,189 1,600 2,278 2,350 2,498 2,470 1,780 2,300 3,119 3,923 5,197 5,773

Unit Prices

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Meals $15.00 $15.00 $15.00 $15.00 $15.00 $15.00 $15.00 $15.00 $15.00 $15.00 $15.00 $15.00

Drinks $2.00 $2.00 $2.00 $2.00 $2.00 $2.00 $2.00 $2.00 $2.00 $2.00 $2.00 $2.00

Other $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00

Sales

Meals $11,685 $15,795 $22,575 $23,295 $24,780 $24,495 $17,595 $22,800 $30,990 $39,030 $51,765 $57,525

Drinks $780 $1,054 $1,506 $1,554 $1,652 $1,634 $1,174 $1,520 $2,066 $2,602 $3,452 $3,836

Other $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200

Total Sales $12,665 $17,049 $24,281 $25,049 $26,632 $26,329 $18,969 $24,520 $33,256 $41,832 $55,417 $61,561

Personnel Plan

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Manager $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000

Hostess $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500

Chef $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500

Cleaning $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500

Waiters $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000

Other $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000

Total People 8 8 8 8 8 8 8 8 8 8 8 8

Total Payroll $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500

General Assumptions

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 30.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00%

Other 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales $12,665 $17,049 $24,281 $25,049 $26,632 $26,329 $18,969 $24,520 $33,256 $41,832 $55,417 $61,561

Direct Cost of Sales $1,773 $2,390 $3,407 $3,515 $3,737 $3,695 $2,660 $3,440 $4,669 $5,875 $7,785 $8,649

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales $1,773 $2,390 $3,407 $3,515 $3,737 $3,695 $2,660 $3,440 $4,669 $5,875 $7,785 $8,649

Gross Margin $10,892 $14,660 $20,875 $21,535 $22,895 $22,635 $16,310 $21,080 $28,588 $35,958 $47,632 $52,912

Gross Margin % 86.00% 85.98% 85.97% 85.97% 85.97% 85.97% 85.98% 85.97% 85.96% 85.96% 85.95% 85.95%

Expenses

Payroll $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500 $23,500

Sales and Marketing and Other $2,250 $2,250 $2,250 $2,250 $2,250 $2,250 $2,250 $2,250 $2,250 $2,250 $2,250 $2,250

Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Utilities $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100

Payroll Taxes $3,525 $3,525 $3,525 $3,525 $3,525 $3,525 $3,525 $3,525 $3,525 $3,525 $3,525 $3,525

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Operating Expenses $29,375 $29,375 $29,375 $29,375 $29,375 $29,375 $29,375 $29,375 $29,375 $29,375 $29,375 $29,375

Profit Before Interest and Taxes ($18,483) ($14,716) ($8,501) ($7,841) ($6,480) ($6,741) ($13,066) ($8,295) ($788) $6,583 $18,257 $23,537

EBITDA ($18,483) ($14,716) ($8,501) ($7,841) ($6,480) ($6,741) ($13,066) ($8,295) ($788) $6,583 $18,257 $23,537

Interest Expense $829 $825 $821 $817 $813 $808 $804 $800 $795 $791 $787 $782

Taxes Incurred $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Net Profit ($19,312) ($15,541) ($9,322) ($8,657) ($7,293) ($7,549) ($13,870) ($9,095) ($1,583) $5,791 $17,470 $22,755

Net Profit/Sales -152.49% -91.15% -38.39% -34.56% -27.38% -28.67% -73.12% -37.09% -4.76% 13.84% 31.53% 36.96%

Pro Forma Cash Flow

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $12,665 | $17,049 | $24,281 | $25,049 | $26,632 | $26,329 | $18,969 | $24,520 | $33,256 | $41,832 | $55,417 | $61,561 | |

| Subtotal Cash from Operations | $12,665 | $17,049 | $24,281 | $25,049 | $26,632 | $26,329 | $18,969 | $24,520 | $33,256 | $41,832 | $55,417 | $61,561 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $12,665 | $17,049 | $24,281 | $25,049 | $26,632 | $26,329 | $18,969 | $24,520 | $33,256 | $41,832 | $55,417 | $61,561 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $23,500 | $23,500 | $23,500 | $23,500 | $23,500 | $23,500 | $23,500 | $23,500 | $23,500 | $23,500 | $23,500 | $23,500 | |

| Bill Payments | $1,283 | $8,498 | $9,123 | $10,106 | $10,214 | $10,423 | $10,343 | $9,365 | $10,156 | $11,379 | $12,604 | $14,475 | |

| Subtotal Spent on Operations | $24,783 | $31,998 | $32,623 | $33,606 | $33,714 | $33,923 | $33,843 | $32,865 | $33,656 | $34,879 | $36,104 | $37,975 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $488 | $492 | $496 | $500 | $505 | $509 | $513 | $517 | $522 | $526 | $530 | $535 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $25,271 | $32,490 | $33,119 | $34,106 | $34,219 | $34,432 | $34,356 | $33,382 | $34,178 | $35,405 | $36,634 | $38,510 | $0 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!