The Nightclub will be the premier, high-energy dance and nightclub in Waldport, YourState. Our goal is to stay ahead of our competition through excellent service. We expect our guests to have more fun. We will provide more video and electronic technology than anyone else in the region. A unique themed menu and atmosphere will create a sense of ‘belonging’ for locals and tourists. Our operating credo is: “happy enthusiastic employees create happy enthusiastic guests.”

The main objectives of this venue development are:

– Capitalize on the location opportunity with swift commitment to the new Town Square development.

– Launch the venue with a highly publicized grand opening event in the summer of Year 1.

– Maintain tight control of costs, operations, and cash flow through diligent management and automated computer control.

– Maintain a food cost below 33% of food revenue.

– Maintain a total beverage cost below 25% of beverage revenue.

– Exceed $3 million in annual sales by the fourth year of plan implementation.

The keys to success in achieving our goals are:

– Provide exceptional service.

– Consistent entertainment atmosphere and product quality.

– Manage our finances and cash flow for capital growth.

– Strictly control all costs, at all times.

Company Summary

The Nightclub’s concept includes the following key elements:

- Entertainment and dance themes — The company will focus on themes with mass appeal.

- Distinctive design — The Nightclub will feature an elaborate dance club in a spectator setting that comfortably accommodates 350 guests. The area will also offer three private sky boxes, which can be combined for use in conferences or private parties. This room is intended for special events and daily use. The adjoining dining room and bar will present an inviting atmosphere, displaying a collection of musical and dance memorabilia. A live DJ will coordinate events and entertain patrons with music and games during music breaks and off-times.

- Location — The Nightclub’s location in the new, high-profile Your Town Center is a major advantage over its competition.

- Gaming — The Nightclub will provide interactive video games and pool tables for additional entertainment and revenue.

- Quality food — Special attention will be paid to the level of food quality. The menu will offer foods similar to those found at premier venues. Traditional ‘bar’ appetizers will be available for people craving nachos, wings, or quesadillas as they drink and enjoy themselves.

- Exceptional service — To maintain a unique image of quality, the Nightclub will provide attentive and friendly service through a high ratio of service personnel to customers. Additionally, the Nightclub will invest in the training and supervision of its employees. We estimate nearly one service staff member for every 35 guests.

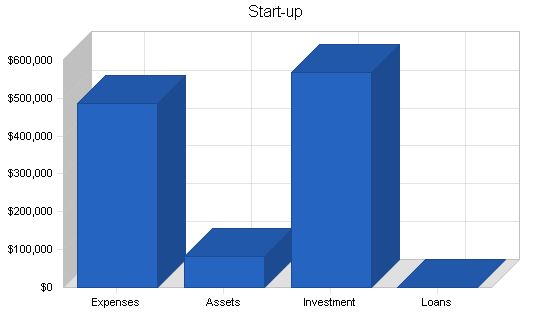

2.1 Start-up Summary

The company is seeking a loan to start a new entertainment venue in Waldport.

Funds needed for the project will be $x.x million. The applicant will require the entire $x.x million to complete the project build-out.

We will utilize the anticipated loans of $x.x million to build out the approximate 10,000 square foot space and purchase necessary equipment for the start-up of the new nightclub venue. The following tables and charts illustrate the capital requirements.

Start-up Funding:

Start-up Expenses to Fund: $485,250

Start-up Assets to Fund: $82,500

Total Funding Required: $567,750

Assets:

Non-cash Assets from Start-up: $7,500

Cash Requirements from Start-up: $75,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $75,000

Total Assets: $82,500

Liabilities and Capital:

Liabilities:

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital:

Planned Investment:

Investor 1: $250,000

Investor 2: $250,000

Other: $67,750

Additional Investment Requirement: $0

Total Planned Investment: $567,750

Loss at Start-up (Start-up Expenses): ($485,250)

Total Capital: $82,500

Total Capital and Liabilities: $82,500

Total Funding: $567,750

Start-up Requirements:

Start-up Expenses:

Air Cond. Upgrade: $25,000

Audio/Lighting Lease Payment: $2,750

Bar Equipment: $9,500

Bar Supply: $5,500

Cash Reserves: $125,000

Exterior Signage: $15,000

Fees and Permits: $35,000

FFE: $75,000

Impact Fees: $7,500

Initial Marketing: $22,500

Interior Refit: $45,000

Kitchen Upgrade: $12,500

Legal: $7,500

Opening Salaries Deposits: $25,000

Paper Products: $2,500

Point of Sales Systems: $35,000

Restroom Upgrade: $35,000

Total Start-up Expenses: $485,250

Start-up Assets:

Cash Required: $75,000

Start-up Inventory: $7,500

Other Current Assets: $0

Long-term Assets: $0

Total Assets: $82,500

Total Requirements: $567,750

Company Ownership:

The Nightclub is a privately-held LLC. The LLC consists of three principals: DD, HK, BK.

D D holds a BS in business administration and has restaurant management experience with PepsiCo Corporation. He successfully opened and managed two nightclubs and a sports bar. He currently manages a successful sales department in the hotel industry.

HK holds a BA in Industrial Media Management, with a concentration in marketing. She has experience as a financial analyst with Lockheed Martin and L3 Communications.

BK has several years of experience managing staff and is currently a successful finance manager in the automotive industry.

Services:

The Main Street area of Waldport presents a unique opportunity for a high-energy, dance-themed venue. The central location, demographics, and lack of direct competition make this project advantageous. The venue will provide a local solution to the lack of social atmosphere and live sports venues for the 21-35 age group in the area. The venue will offer beer, wine, an array of liquors and mixed drinks, non-alcoholic beverages, and a casual food menu. The hours of operation will be 11:00 P.M. to 2:00 A.M., four nights a week. The establishment will attract customers from Waldport and the surrounding cities and towns.

Market Analysis Summary:

The Nightclub has been well received and has been offered prime placement at the center of Waldport’s new First & Main Town Center development. The center spans 138 acres and has a large population base. The Nightclub will be a 10,000 square foot unit and will accommodate 750 people. With Waldport’s growing population, the Nightclub has mass appeal. The store will have state-of-the-art audio and video systems. The demographics are favorable, with minimal competition.

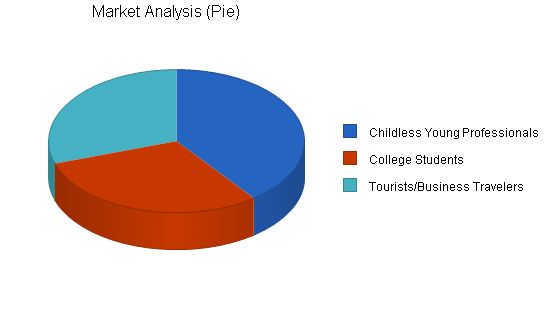

Market Segmentation:

The Nightclub appeals to three major market segments. The first segment is childless young professionals, ranging in age from 27 to 40. These customers need a place to eat or drink before or after seeing a movie at the nearby theaters. The Nightclub will cater to this segment by switching the entertainment to be more appealing to adults as the evening progresses. The Nightclub anticipates a 15% annual growth rate. The target market segments and annual growth projections are shown in the chart and table.

Market Analysis:

– Potential Customers, Growth, Year 1, Year 2, Year 3, Year 4, Year 5, CAGR

– Childless Young Professionals: 15%, 132,000, 151,800, 174,570, 200,756, 230,869, 15.00%

– College Students: 5%, 100,000, 105,000, 110,250, 115,763, 121,551, 5.00%

– Tourists/Business Travelers: 20%, 100,000, 120,000, 144,000, 172,800, 207,360, 20.00%

– Total: 13.95%, 332,000, 376,800, 428,820, 489,319, 559,780, 13.95%

4.2 Target Market Segment Strategy:

– Our strategy is based on serving our niche markets exceptionally well. The nightclub enthusiast, the tourist and business traveler, the local nightclub crowd, the local service industry as well as groups going out together, can all enjoy The Nightclub experience.

– The marketing strategy is essential to the main strategy:

– Emphasize exceptional service.

– Create awareness of The Nightclub’s unique features.

– Focus on our target markets.

– We must charge appropriately for the high-end, high-quality service and food that we offer. Our revenue structure has to match our cost structure, so the wages we pay and the training we provide to assure superior quality and service must be balanced by the fees we charge.

– Part of the superior experience we offer is the simplicity of the menu items. While being unique, they are relatively inexpensive and easy to prepare. While a premium is appropriate for the experience, the pricing has to be balanced in accordance with what we are serving.

– All menu items will be moderately priced. We expect an average guest expenditure of $12.50 for beverages and $7.50 for the percentage of our guests who choose to take advantage of our food menu. Our target customer spends more than the industry average for moderately priced establishments. This is due to our creating an atmosphere that encourages longer stays and more spending, while still allowing adequate table turns due to extended hours of appeal.

4.3 Service Business Analysis:

– High energy and dance-themed venues have significantly impacted cities from coast to coast in the nineties. Los Angeles’ Hollywood, New York’s Times Square, and Seattle’s Pioneer Square are just a few examples. Entrancing their audiences with high-powered lights, sound, music, and interactive entertainment, these venues are still one of the highest cash flow businesses in the world. Our localized studies have shown that the average person will spend three to four hours per weekend in this type of an environment and will spend an average of twenty to fifty dollars in that time frame. As we approach the new millennium, this trend shows no signs of declining.

– The typical venue of our style is open from 8:00 P.M. to 2:00 A.M., and within this time frame, the venue can achieve gross revenues anywhere from $3,500 to $25,000 nightly. The primary sources of revenue in a venue of this type are high volume traffic, coupled with comparably nominal spending. In addition to alcohol revenues, we will also generate substantial revenues from food sales that can typically range from seven to ten dollars per person and admission fees that range between five and ten dollars per admit.

– Entertainment venues in the late 1980s and 1990s focused on high-energy light and sound, multiple source video screens, and participative events. This relatively simple concept is still quite popular today. However, these concepts have greatly evolved with society. In recent years, this industry has become more sophisticated with the availability of new technology. Larger metropolitan areas have taken this technology to new heights with sound, lighting, video, and interactive designs that create an exciting and memorable experience. Fortunately, no one in Your State area has been a pioneer in this specific segment of the industry as of the date of this report.

– Additionally, the nightclub and bar industry is shifting towards a more entertainment-oriented concept. Guests of these venues are not only offered a dynamic place to gather and mingle but also a place to participate in the entertainment through interactive contests, theme nights, and other events. We intend to heavily utilize entertainment-oriented marketing in an effort to withstand the perpetual shift in trends and cater to as large a client base as possible.

– Nightclubs and other drinking establishments rely heavily on their primary suppliers. The primary suppliers are the various beverage distributors that provide the establishment with both alcoholic and non-alcoholic beverages. The alcoholic beverages (beer, wine, and liquor) are the primary sources of income in this industry. Other beverage suppliers also play a crucial role by providing non-alcoholic beverages. These are either served alone or mixed with alcohol.

– In the area, all major brands of alcoholic beverages are available, in addition to several regional brands of beer. Initial research shows that the major distributors in the market have a high rating in both product availability and delivery.

4.3.1 Main Competitors:

– The Nightclub competition lies mainly with other casual facilities and less with conventional and chain entertainment establishments. We need to effectively compete with the widely held idea that you can’t get good service anymore while maintaining the idea that being out can be a lot of fun. Our polling has indicated that consumers think of atmosphere, price, and quality respectively. Additionally, price was frequently mentioned by pointing out that if the former concerns are present then they are willing to pay more for the experience.

– Our review of the market concludes that there are four entertainment venues that can be considered direct competition to the proposed new venue. We do realize that the proposed venue will also compete indirectly for every entertainment dollar spent in the Waldport area.

– Main competitors of The Nightclub:

– Club A: Hours of Operation: 5:00 P.M.-2:00 A.M. Wednesday through Saturday, Capacity: 300, Wednesday College Night ($1 beers), -This nightclub appeals to a college crowd seeking cheap drinks, -The club is known for being dingy and dirty.

– Bar B: Hours of Operation: 10:00 A.M.- 2:00 A.M. Monday through Sunday, Capacity: 400, Thursday College/Ladies Nights, -This club appeals to 25-35 year-olds, -Pool and video games are the central focus, -Dancing is pushed to the back of the club.

– Grill C: Hours of Operation: 6:00 P.M.-2:00 A.M. Wednesday through Saturday, Capacity: 250, -This club’s target customer is 25 to 45 years old / middle class or above, -This club is known for its older, dressed-up crowd and cramped space.

– Club D: Hours of Operation: 11:00 A.M.-2:00 A.M. Monday through Sunday, Capacity: 350, -This club’s target customer is 25 to 45 years old, -This club is known for live jazz and blues entertainment and their draught beers.

4.3.2 Business Participants:

– The Nightclub will be part of the restaurant and bar industry, which includes several kinds of businesses:

– Locally Operated Bars and Nightclubs: This genre usually appeals to the local neighborhood clientele. This same client base dictates that the average price structure be drastically scaled down to create “regulars.”

– Nightclub Entertainment Complexes: This type of complex represents the concept we will most closely compete with. They are typically placed in high traffic locations and are normally treated as destination entertainment. An admission charge is usually in place, and the associated price structure is also most like our proposed structure. Thankfully there is not an abundance of this type of entertainment within our region.

– Conventional Dining: Primarily owned by large national chains, usually less than 10,000 square feet, focused on serving good quality food in a reasonable amount of time in a dining room setting. The service and food quality are superior to that of a fast food establishment. People go there to eat and leave when they’re done eating since there’s rarely a reason to stay.

– Formal Dining: Similar to conventional dining yet offering a higher quality of food and service for the added expense. As with the conventional dining facilities, there is little interaction, and when people are done eating, they leave.

– Casual Dining: Commonly building upon conventional dining with the addition of a bar, playing of music, and sporting events on numerous televisions. Some establishments offer their own brand of beer made on the premises. The food quality and service are at best similar to that found in a conventional dining experience.

– Chain Entertainment: Typically manifested in each market through the Hard Rock Cafes, the Planet Hollywoods, etc. We expect to create an atmosphere that thrives on its trendy feel. These chain entertainment venues cannot hope to draw the same “hip” clientele.

Strategy and Implementation Summary:

– In order to place emphasis on exceptional service, our main tactics are bi-monthly service training, employee recognition, and higher service employee to customer ratios. Our specific programs for training include employee for life training for management, customer for life training for employees, and the sharing of success stories among employees and management. Our specific employee recognition programs include employee of the month with a personal parking space, service excellence recognition awards of specific employees attached to advertising. To achieve higher service employee to customer ratios, we include separate beverage servers and bussing personnel, as well as maintaining a comfortable table count for the wait staff.

– Our second strategy is emphasizing entertainment. The tactics are interactive entertainment, constant sensory appeal, and unique event viewing. Our specific programs for interactive entertainment and constant sensory appeal are frequent contests, games, music, and karaoke all hosted by an in-house DJ who is also in charge of event programming for the main room and lounge. A billiard room will overlook the main area. Billiards was selected due to its widespread popularity (fifth most popular sport in the world, according to CNN). A limited number of video and pinball games, as well as computer dart boards, will complement the billiard tables to offer a less interactive entertainment option. With an adjoining bar and plenty of seating, yet another unique experience could be carved out of a visit to The Nightclub.

– Our promise fulfillment strategy may be our most important. The necessary tactics are ongoing value-based training, maintenance, and attention to detail, especially after popularity has been established. Through the empowerment of service employees to solve problems without making a customer wait for management consultation, we create a win-win situation for the customer and the restaurant. Continuous and never-ending improvement is the order of the day through our regular training sessions and meetings. Since value is equal to service rendered minus the price charged, it is crucial to go beyond the mere serving of food in a room full of lights and sound, you have to create a long-lasting impression.

– Emphasize exceptional service — We must prove to guests that exceptional service is still available and should be expected as part of a dining experience. We need to differentiate ourselves from the mediocre service venues.

– Emphasize an entertaining experience — By assuring that all guests will enjoy themselves, we would be securing market share through repeat business.

– Focus on target markets — Our marketing and themes of mass appeal and music-based entertainment will attract our target market segments.

– Differentiate and fulfill the above promises.

– We can’t just market and sell another dance club, we must actually deliver on our promise of quality, service, and a unique guest experience. We need to make sure we have the fun and service-intensive staff that we claim to have.

5.1 Marketing Strategy:

– A high growth area, such as Waldport, has an annual influx of new residents from many other parts of the country. This trend is true for Your State in general.

– Many new residents, as well as many existing ones, are members of clubs in other markets. The Nightclub is a place for all. The enabling technology will be an inherent part of The Nightclub’s image.

– Advertising budgets and event promotion are ongoing processes of management geared to promote the brand name and keep The Nightclub at the forefront of the dance theme establishments in Waldport’s marketing area.

– We depend on radio advertising as our main way to reach new customers. Our strategies and practices will remain constant, as will the way we promote ourselves:

– Advertising — We’ll be developing a core positioning message.

– Grand Opening — We will concentrate a substantial portion of our early advertising budget towards the ‘Grand Opening Event.’

– Direct Marketing — We’ll directly market to local hotels surrounding the powers and the local airport.

– The Nightclub will create an identity-oriented marketing strategy with executions particularly in radio media, alongside print ads, and in-store promotions.

– A grand opening event will be held to launch The Nightclub in the summer of 2001. A radio advertising blitz will precede the event for three weeks, with ambiguous teasers about an “event like no other” in the city’s history and the forthcoming opening date. Contests will be held on the target radio stations giving away V.I.P. passes (coupons) to the event while at the same time creating excitement about the opening. We will leverage our relationship with the Dallas Cowboy Cheerleaders to be present on the night of the grand opening. The opening date is tentative at this point and dependent upon construction completion. The budget for the event will be $10,000, and the milestone date will parallel the available opening date, currently June of 2001.

– Achievement of the following campaigns will be measured by the polling of customers as to how they heard of The Nightclub for the first ninety days of operation. Budget adjustments will be made as the results dictate.

– We will be running regular local radio and newspaper ads to create brand awareness. Our radio ads will be concentrated strongly on Magic FM, the city’s top radio station among our target market segments. Through commercial repetition, a teaser campaign, and the use of catchy phrases, we hope to obtain intellectual ownership of our target market segments: when they think dance club and bar, they’ll have to think The Nightclub. Drink specials will also be staples of our radio advertising to bring people in. HK will be responsible for ongoing radio ads with a monthly budget of $12,000 per month for the first ninety days, followed by an ongoing budget of $6500 per month.

– We will advertise directly to local hotel guests in the local airport and surrounding Boulevard areas to attract business travelers and tourists with no knowledge of where to go in the evening. Through the use of fliers and table tents to place in hotel rooms, we hope to create visitor awareness of our location and event promotion. Promos such as ‘show your room key and get a free drink’ in conjunction with the room ads would be relatively inexpensive from an advertising standpoint and require limited ongoing maintenance and expense. BK will be responsible for direct advertising with a start-up budget of $3,000 and a maintenance budget of $1,000 per month. The milestone date will be thirty days after the grand opening event.

– Ads will also go into the college newspapers for the local campuses of Your State College and the University of Your State. HK will be responsible for this program. The monthly budget for these ads will be $300. The event date will be in tandem with the grand opening.

– Shirts, ball caps, and bumper stickers bearing The Nightclub’s logo will be marketed, as well as given away as prizes, to further spread brand awareness. Artistic design will be HK’s responsibility, and merchandising will be headed by DD. A start-up budget of $1,800 will be in place, and a monthly promotional (giveaway) budget will also exist.

5.2 Sales Strategy:

– Sales projections for this plan are presented in the following chapter.

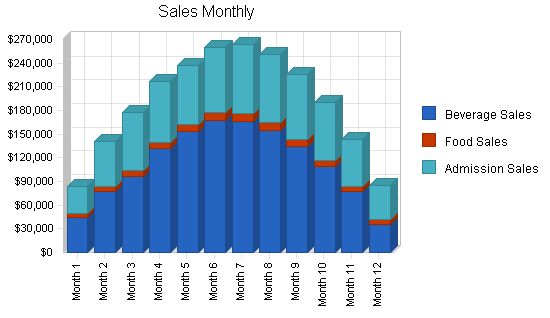

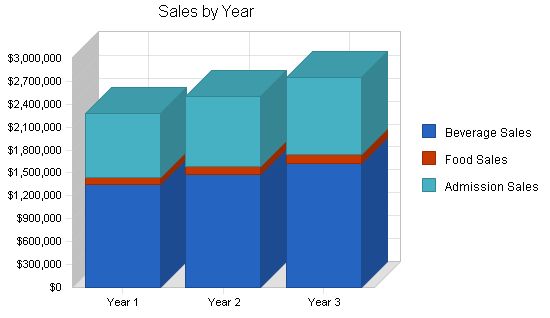

5.2.1 Sales Forecast:

– This chart represents our forecast for income on a monthly basis. The table presents yearly expected sales. Complete monthly forecast figures for the first year are presented in the appendix.

Sales Forecast

Year 1 Year 2 Year 3

Sales

Beverage Sales $1,346,100 $1,480,710 $1,628,781

Food Sales $93,500 $102,850 $113,135

Admission Sales $836,740 $920,414 $1,012,455

Total Sales $2,276,340 $2,503,974 $2,754,371

Direct Cost of Sales

Year 1 Year 2 Year 3

Beverage Sales $336,525 $370,178 $407,196

Food Sales $30,855 $33,941 $37,335

Admission Sales $0 $0 $0

Subtotal Direct Cost of Sales $367,380 $404,119 $444,531

5.2.2 Daily Revenue Forecast

This table illustrates our daily revenue forecast for X,xxx total square feet.

We assume a seating capacity for said space of XXX guests. Additionally, we expect just less than one complete rotation of this space for food and beverage guests alike.

Daily Revenue Breakdown **

**based on 750-person capacity

Management Summary

The management team is especially close. One of the presidents has been married to the vice president for seven years. The two co-presidents have worked directly together for three and a half years at four positions. One of the presidents has worked with the bar manager in the past and has known him for nearly ten years. Together we share a single vision: to provide a unique and entertaining experience through exceptional service.

The company will have six managers, including the two presidents, and three managers who have yet to be recruited.

6.1 Management Team

DD, Co-President. D has a bachelors degree in business management, five years management in the restaurant/bar business, consultative experience opening other bars, six subsequent years management in the car industry ending currently with his current position as department manager. D’s specific responsibilities will lie primarily with the coordination of events and oversight of the operations and evening activities of the restaurant and bar.

BK, Co-President. B is pursuing a life-long ambition of restaurant/nightclub ownership. Three years of restaurant kitchen experience and nearly eight years of experience managing people ending with three and a half years of finance management. B is committed to not only creating a successful business but also successfully running it. Even though his hands-on experience in business management is extensive through the finance business, he has spent the last year and a half researching business and business ownership in his spare time. B’s specific responsibilities will be administrative management to include inventory management, accounts payable, purchasing, payroll, and public relations with limited marketing involvement (mostly direct) to other companies.

HK, Vice President. H has a bachelor’s degree in industrial media management. Her experience ranges from radio marketing sales to three years as a financial analyst for L3 Communications. H is a born leader to whom people of all levels flock. H’s responsibilities will be limited to marketing with local radio and newspaper and her day-to-day role in the restaurant will be a mostly silent one.

MC, Bar Manager. M has more than fifteen years bartending and bar management experience. M is eagerly awaiting the opportunity to work at a restaurant/bar where things are done correctly and the customer is put first. In addition to managing the bar, its personnel, and the djs, M will also be third in command under the two co-presidents.

The positions of office, kitchen and dining room managers have yet to be filled at this time. These positions will be openly sought along with the remainder of the staff.

6.2 Management Team Gaps

We believe we have a solid team constructed in order to cover the main points of the business plan. Management growth through training will be an ongoing component of The Nightclub’s priorities.

However, we do realize that we may not have the hands on specific knowledge that may be required to execute pre-opening and opening phases of the venture. We also realize that we may benefit greatly from the retention of a hospitality industry consultant to guide us through the aforementioned time frames, as well as consult with us through the first two years of our operation.

To this end we have contracted with a hospitality industry specialist consultant. They have over 12 years of experience in the hospitality industry and have assisted many first-time operators in getting their proposed venues launched successfully. They will assist in the development of the design, concept, and strategies of the new business. In addition, they will assist in the hiring process of the management staff, DJs, bartenders, waitresses, and security staff. They will also provide educational services for management-level personnel who will be responsible for the day-to-day operations of the club.

Interviews for a general manager, operations manager, and all other personnel will be conducted with the assistance of the consultant. The co-presidents, Mr. D and Mr. K, will make final decisions for each position.

These gaps will be filled as the opening date draws closer.

6.3 Personnel Plan

The Personnel Plan reflects the objective of providing an ample amount of service personnel. Our headcount will remain at thirty unless any unforeseen demands dictate otherwise. Assume a burden rate of 17%.

DAILY STAFFING (750-person capacity)

Hourly Employees

Day Position Quantity Rate Avg Hrs Sub-total Burden Total

Monday Staff Cost/Mon. 0 $0 0 $0 $0 $0

Tuesday Staff Cost/Tues. – – – $0 $0 $0

Wednesday Waitress 2 $5.00 7.5 $75 – –

Wednesday Security 4 $7.00 6.5 $195 – –

Wednesday Bartender 2 $5.00 7.5 $75 – –

Wednesday Barback 1 $4.50 7 $31 – –

Wednesday Police Detail 1 $15.00 0 $0 – –

Wednesday Misc. – $8.00 0 $0 – –

Wednesday Staff Cost/Wed. – – – $376 $64 $441

Thursday Waitress 3 $5.00 7.5 $113 – –

Thursday Security 5 $7.50 6.5 $244 – –

Thursday Bartender 3 $5.00 7.5 $113 – –

Thursday Barback 1.5 $4.50 7 $47 – –

Thursday Police Detail 0 $15.00 0 $0 – –

Thursday Misc. 0 $15.00 0 $0 – –

Thursday Staff Cost/Thur. – – – $516 $88 $604

Friday Waitress 4 $5.00 7.5 $150 – –

Friday Security 7 $7.50 6.5 $341 – –

Friday Bartender 4 $5.00 7.5 $150 – –

Friday Barback 2 $4.50 7 $63 – –

Friday Police Detail 0 $15.00 0 $0 – –

Friday Misc. 0 $15.00 0 $0 – –

Friday Staff Cost/Fri. – – – $704 $120 $824

Saturday Waitress 4 $5.00 7.5 $150 – –

Saturday Security 9 $7.50 6.5 $439 – –

Saturday Bartender 5 $5.00 7.5 $188 – –

Saturday Barback 2 $4.50 7 $63 – –

Saturday Police Detail 0 $15.00 0 $0 – –

Saturday Misc. 0 $15.00 0 $0 – –

Saturday Staff Cost/Sat. – – – $839 $143 $982

Sunday Staff Cost/Sun. 0 $0 0 $0 $0 $0

Ttl Wkly/Hrly – – – – $2,436 $414 $2,850

Salaried Staff

Position Salary Yearly Weekly Burden Total

Manager #1 Oper Prtnr $55,000 $877 $179 –

Manager #2 Oper Prtnr $55,000 $877 $179 –

Manager #3 General Mgr $50,000 $798 $163 –

Manager #4 PR Mgr $45,000 $718 $147 –

Manager #5 Bar Mgr $35,000 $558 $114 –

Manager #6 Asst. $25,000 $399 $81 –

Entertainmnt DJ $65,000 – – –

Ttl Salaried – – $5,480 $866 $6,346

Ttl Weekly Staff – – – – $9,196

Personnel Plan

Year 1 Year 2 Year 3

Salaried Staff $284,736 $298,968 $313,916

Hourly Staff $107,200 $112,560 $118,188

Total People 0 0 0

Total Payroll $391,936 $411,528 $432,104

The financial projections for this plan are presented in the tables and charts of the following subtopics.

7.1 Important Assumptions

The financial plan depends on important assumptions, most of which are illustrated in the following table.

The key underlying assumptions are:

– We assume a slow-growth economy of five percent the first year, and three percent thereafter, without major recession.

– We assume that we will grow as managers during the process, this growth will manifest itself as flat line expense growth over the five-year period, leading to increased annual cash flow.

– We assume access to equity capital and financing sufficient to maintain our financial plan as shown in the tables.

– We assume continued popularity of nightclubs in America and the growing demand for high-energy themed and casual dining venues.

General Assumptions

Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 25.42% 25.00% 25.42%

Other 0 0 0

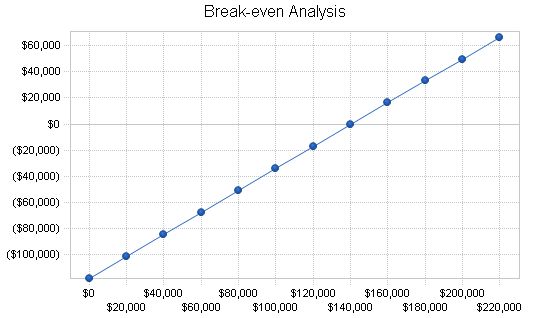

Example Break-Even Analysis formulas are presented in the text below. Business Plan Pro’s interactive table and chart are still linked to the program spreadsheets.

Fixed Costs $X,xxx,xxx

Variable Costs $Xxx,xxx

Revenue (Estimated)$X,xxx,xxx

*S = Gross Sales

S = $ + [($Xxx,xxx/ $X,xxx,xxx) x S]

S = $X,xxx,xxx + [(.xxxx) x S]

Break Even Point = $X,xxx,xxx

Average Nightly Break Even Revenues – approximately $ X,xxx

Minimum Nightly Required Spending Per Person – $8.75 + $9.75 = $18.50

Minimum Nightly Required Incoming Traffic – Xxx

Break-even Analysis:

Monthly Revenue Break-even: $140,703

Assumptions:

– Average Percent Variable Cost: 16%

– Estimated Monthly Fixed Cost: $117,995

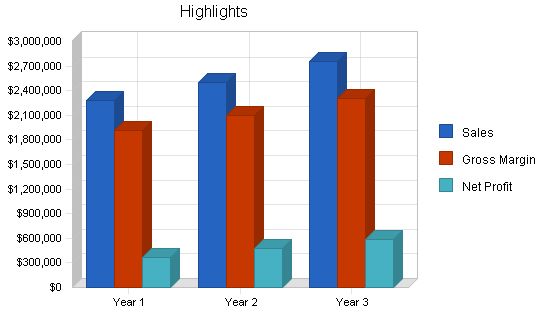

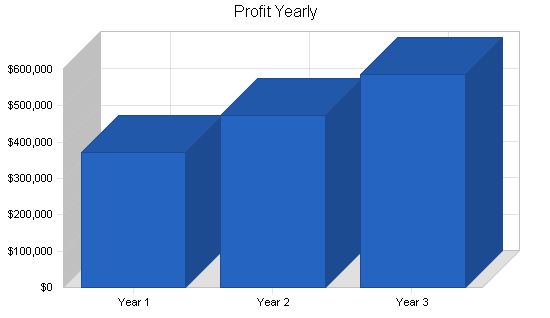

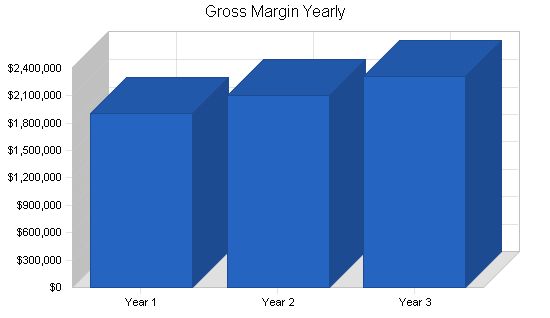

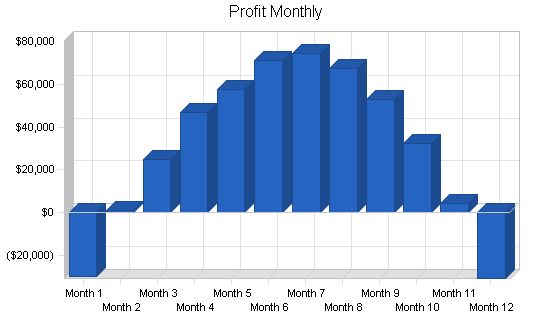

Projected Profit and Loss:

The nightclub’s projected profit and loss statement is as follows. The annual totals for three years are shown below. The monthly breakdown for year one can be found in the appendix.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $2,276,340 | $2,503,974 | $2,754,371 |

| Direct Cost of Sales | $367,380 | $404,119 | $444,531 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $367,380 | $404,119 | $444,531 |

| Gross Margin | $1,908,960 | $2,099,855 | $2,309,840 |

| Gross Margin % | 83.86% | 83.86% | 83.86% |

| Expenses | |||

| Payroll | $391,936 | $411,528 | $432,104 |

| Sales and Marketing and Other Expenses | $411,576 | $430,574 | $451,284 |

| Depreciation | $0 | $0 | $0 |

| Fees–Credit Card | $10,764 | $10,982 | $11,202 |

| Fees–Professional | $7,500 | $7,650 | $7,803 |

| Taxes–Admission | $0 | $0 | $0 |

| Taxes–Excise | $391,536 | $399,368 | $407,355 |

| Taxes–Property | $0 | $0 | $0 |

| Leased Equipment | $2,496 | $2,550 | $2,601 |

| Utilities | $36,000 | $36,720 | $37,454 |

| Insurance | $22,500 | $22,950 | $23,409 |

| Rent | $75,000 | $75,000 | $76,500 |

| Payroll Taxes | $66,629 | $69,960 | $73,458 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $1,415,937 | $1,467,282 | $1,523,170 |

| Profit Before Interest and Taxes | $493,023 | $632,573 | $786,670 |

| EBITDA | $493,023 | $632,573 | $786,670 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $121,122 | $158,143 | $199,945 |

| Net Profit | $371,901 | $474,430 | $586,725 |

| Net Profit/Sales | 16.34% | 18.95% | 21.30% |

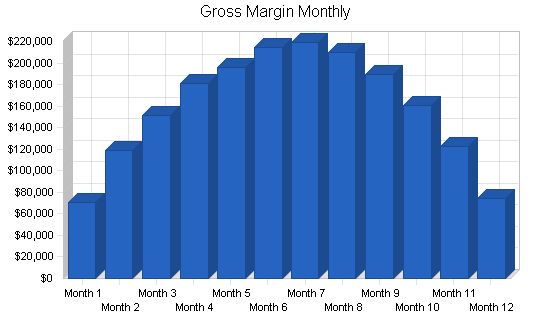

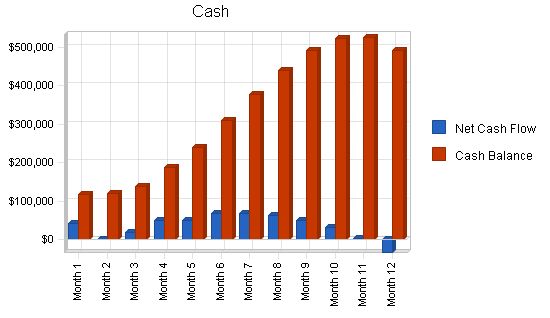

7.4 Projected Cash Flow

The chart illustrates our monthly cash flow for year one. The table shows three years of annual totals. First year monthly figures are presented in the appendix. The months are weighted based on the number of weeks in a typical calendar year.

Pro Forma Cash Flow

Cash Received

Cash from Operations

Cash Sales

$2,048,706

$2,253,577

$2,478,934

Cash from Receivables

$205,193

$248,153

$272,969

Subtotal Cash from Operations

$2,253,899

$2,501,730

$2,751,903

Additional Cash Received

Sales Tax, VAT, HST/GST Received

$0

$0

$0

New Current Borrowing

$0

$0

$0

New Other Liabilities (interest-free)

$0

$0

$0

New Long-term Liabilities

$0

$0

$0

Sales of Other Current Assets

$0

$0

$0

Sales of Long-term Assets

$0

$0

$0

New Investment Received

$0

$0

$0

Subtotal Cash Received

$2,253,899

$2,501,730

$2,751,903

Expenditures

Year 1

Year 2

Year 3

Expenditures from Operations

Cash Spending

$391,936

$411,528

$432,104

Bill Payments

$1,445,416

$1,583,120

$1,731,944

Subtotal Spent on Operations

$1,837,352

$1,994,648

$2,164,048

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out

$0

$0

$0

Principal Repayment of Current Borrowing

$0

$0

$0

Other Liabilities Principal Repayment

$0

$0

$0

Long-term Liabilities Principal Repayment

$0

$0

$0

Purchase Other Current Assets

$0

$0

$0

Purchase Long-term Assets

$0

$0

$0

Dividends

$0

$0

$0

Subtotal Cash Spent

$1,837,352

$1,994,648

$2,164,048

Net Cash Flow

$416,547

$507,082

$587,855

Cash Balance

$491,547

$998,629

$1,586,484

7.5 Projected Balance Sheet

The following Balance Sheet indicates healthy growth of net worth and a strong financial position. The monthly estimates are included in the appendix.

Pro Forma Balance Sheet

Assets

Current Assets

Cash

$491,547

$998,629

$1,586,484

Accounts Receivable

$22,441

$24,685

$27,153

Inventory

$12,653

$40,820

$44,902

Other Current Assets

$0

$0

$0

Total Current Assets

$526,640

$1,064,134

$1,658,539

Long-term Assets

Long-term Assets

$0

$0

$0

Accumulated Depreciation

$0

$0

$0

Total Long-term Assets

$0

$0

$0

Total Assets

$526,640

$1,064,134

$1,658,539

Liabilities and Capital

Current Liabilities

Accounts Payable

$72,239

$135,303

$142,983

Current Borrowing

$0

$0

$0

Other Current Liabilities

$0

$0

$0

Subtotal Current Liabilities

$72,239

$135,303

$142,983

Long-term Liabilities

$0

$0

$0

Total Liabilities

$72,239

$135,303

$142,983

Paid-in Capital

$567,750

$567,750

$567,750

Retained Earnings

($485,250)

($113,349)

$361,081

Earnings

$371,901

$474,430

$586,725

Total Capital

$454,401

$928,831

$1,515,556

Total Liabilities and Capital

$526,640

$1,064,134

$1,658,539

Net Worth

$454,401

$928,831

$1,515,556

7.6 Business Ratios

The Ratios table below outlines important ratios for this Nightclub. The last column, Industry Profile, is derived from the Standard Industrial Classification (SIC) Index code 5813, for Drinking Places.

Ratio Analysis

Sales Growth

n.a.

10.00%

10.00%

1.90%

Percent of Total Assets

Accounts Receivable

4.26%

2.32%

1.64%

4.60%

Inventory

2.40%

3.84%

2.71%

3.10%

Other Current Assets

0.00%

0.00%

0.00%

44.60%

Total Current Assets

100.00%

100.00%

100.00%

52.30%

Long-term Assets

0.00%

0.00%

0.00%

47.70%

Total Assets

100.00%

100.00%

100.00%

100.00%

Current Liabilities

13.72%

12.71%

8.62%

28.20%

Long-term Liabilities

0.00%

0.00%

0.00%

23.10%

Total Liabilities

13.72%

12.71%

8.62%

51.30%

Net Worth

86.28%

87.29%

91.38%

48.70%

Percent of Sales

Sales

100.00%

100.00%

100.00%

100.00%

Gross Margin

83.86%

83.86%

83.86%

42.30%

Selling, General & Administrative Expenses

67.36%

64.67%

62.20%

23.40%

…

Additional Ratios

Net Profit Margin

16.34%

18.95%

21.30%

n.a

Return on Equity

81.84%

51.08%

38.71%

n.a

Activity Ratios

Accounts Receivable Turnover

10.14

10.14

10.14

n.a

Collection Days

59

34

34

n.a

Inventory Turnover

10.89

15.12

10.37

n.a

Accounts Payable Turnover

21.01

12.17

12.17

n.a

Payment Days

27

23

29

n.a

Total Asset Turnover

4.32

2.35

1.66

n.a

Debt Ratios

Debt to Net Worth

0.16

0.15

0.09

n.a

Current Liab. to Liab.

1.00

1.00

1.00

n.a

Liquidity Ratios

Net Working Capital

$454,401

$928,831

$1,515,556

n.a

Interest Coverage

0.00

0.00

0.00

n.a

Additional Ratios

Assets to Sales

0.23

0.42

0.60

n.a

Current Debt/Total Assets

14%

13%

9%

n.a

Acid Test

6.80

7.38

11.10

n.a

Sales/Net Worth

5.01

2.70

1.82

n.a

Dividend Payout

0.00

0.00

0.00

n.a

Appendix

Sales Forecast

Month 1

Month 2

Month 3

Month 4

Month 5

Month 6

Month 7

Month 8

Month 9

Month 10

Month 11

Month 12

Sales

$83,600

$140,200

$178,000

$216,500

$237,000

$259,900

$264,140

$251,600

$226,000

$190,200

$143,800

$85,400

Direct Cost of Sales

Month 1

Month 2

Month 3

Month 4

Month 5

Month 6

Month 7

Month 8

Month 9

Month 10

Month 11

Month 12

Beverage Sales

25%

$11,150

$19,275

$24,075

$32,925

$38,200

$41,775

$41,425

$38,800

$33,725

$27,125

$19,200

$8,850

Food Sales

33%

$1,617

$2,079

$2,343

$2,607

$3,003

$3,267

$3,300

$3,102

$2,871

$2,475

$2,178

$2,013

Subtotal Direct Cost of Sales

$12,767

$21,354

$26,418

$35,532

$41,203

$45,042

$44,725

$41,902

$36,596

$29,600

$21,378

$10,863

| Personnel Plan | |||||||||||||

| Salaried Staff | 0% | $23,728 | $23,728 | $23,728 | $23,728 | $23,728 | $23,728 | $23,728 | $23,728 | $23,728 | $23,728 | $23,728 | $23,728 |

| Hourly Staff | 0% | $5,100 | $8,700 | $9,400 | $9,500 | $9,900 | $10,600 | $10,900 | $10,700 | $9,500 | $8,500 | $7,600 | $6,800 |

| Total People | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Total Payroll | $28,828 | $32,428 | $33,128 | $33,228 | $33,628 | $34,328 | $34,628 | $34,428 | $33,228 | $32,228 | $31,328 | $30,528 |

| General Assumptions | |||||||||||||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pro Forma Profit and Loss | |||||||||||||

| Sales | $83,600 | $140,200 | $178,000 | $216,500 | $237,000 | $259,900 | $264,140 | $251,600 | $226,000 | $190,200 | $143,800 | $85,400 | |

| Direct Cost of Sales | $12,767 | $21,354 | $26,418 | $35,532 | $41,203 | $45,042 | $44,725 | $41,902 | $36,596 | $29,600 | $21,378 | $10,863 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $12,767 | $21,354 | $26,418 | $35,532 | $41,203 | $45,042 | $44,725 | $41,902 | $36,596 | $29,600 | $21,378 | $10,863 | |

| Gross Margin | $70,833 | $118,846 | $151,582 | $180,968 | $195,797 | $214,858 | $219,415 | $209,698 | $189,404 | $160,600 | $122,422 | $74,537 | |

| Gross Margin % | 84.73% | 84.77% | 85.16% | 83.59% | 82.61% | 82.67% | 83.07% | 83.35% | 83.81% | 84.44% | 85.13% | 87.28% | |

| Expenses | |||||||||||||

| Payroll | $28,828 | $32,428 | $33,128 | $33,228 | $33,628 | $34,328 | $34,628 | $34,428 | $33,228 | $32,228 | $31,328 | $30,528 | |

| Sales and Marketing and Other Expenses | $34,298 | $34,298 | $34,298 | $34,298 | $34,298 | $34,298 | $34,298 | $34,298 | $34,298 | $34,298 | $34,298 | $34,298 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Fees–Credit Card | $897 | $897 | $897 | $897 | $897 | $897 | $897 | $897 | $897 | $897 | $897 | $897 | |

| Fees–Professional | $625 | $625 | $625 | $625 | $625 | $625 | $625 | $625 | $625 | $625 | $625 | $625 | |

| Taxes–Admission | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes–Excise | $32,628 | $32,628 | $32,628 | $32,628 | $32,628 | $32,628 | $32,628 | $32,628 | $32,628 | $32,628 | $32,628 | $32,628 | |

| Taxes–Property | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Leased Equipment | $208 | $208 | $208 | $208 | $208 | $208 | $208 | $208 | $208 | $208 | $208 | $208 | |

| Utilities | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Insurance | $1,875 | $1,875 | $1,875 | $1,875 | $1,875 | $1,875 | $1,875 | $1,875 | $1,875 | $1,875 | $1,875 | $1,875 | |

| Rent | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | |

| Payroll Taxes | 17% | $4,901 | $5,513 | $5,632 | $5,649 | $5,717 | $5,836 | $5,887 | $5,853 | $5,649 | $5,479 | $5,326 | $5,190 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $113,510 | $117,722 | $118,541 | $118,658 | $119,126 | $119,945 | $120,296 | $120,062 | $118,658 | $117,488 | $116,435 | $115,499 | |

| Profit Before Interest and Taxes | ($42,677) | $1,124 | $33,041 | $62,310 | $76,671 | $94,913 | $99,119 | $89,636 | $70,746 | $43,112 | $5,987 | ($40,962) | |

| EBITDA | ($42,677) | $1,124 | $33,041 | $62,310 | $76,671 | $94,913 | $99,119 | $89,636 | $70,746 | $43,112 | $5,987 | ($40,962) | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $

Pro Forma Cash Flow |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $75,240 | $126,180 | $160,200 | $194,850 | $213,300 | $233,910 | $237,726 | $226,440 | $203,400 | $171,180 | $129,420 | $76,860 | |

| Cash from Receivables | $0 | $279 | $8,549 | $14,146 | $17,928 | $21,718 | $23,776 | $26,004 | $26,372 | $25,075 | $22,481 | $18,865 | |

| Subtotal Cash from Operations | $75,240 | $126,459 | $168,749 | $208,996 | $231,228 | $255,628 | $261,502 | $252,444 | $229,772 | $196,255 | $151,901 | $95,725 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $75,240 | $126,459 | $168,749 | $208,996 | $231,228 | $255,628 | $261,502 | $252,444 | $229,772 | $196,255 | $151,901 | $95,725 | |

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $29,979 | $31,320 | $32,130 | $32,208 | $32,478 | $32,724 | $32,860 | $32,376 | $31,194 | $30,440 | $29,894 | $29,419 | |

| Bill Payments | $3,040 | $92,029 | $116,684 | $126,358 | $146,749 | $152,323 | $158,484 | $154,558 | $146,407 | $133,345 | $117,309 | $98,130 | |

| Subtotal Spent on Operations | $33,019 | $123,349 | $148,814 | $158,566 | $179,227 | $185,047 | $191,344 | $186,934 | $177,601 | $163,785 | $147,203 | $127,549 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $33,019 | $123,349 | $148,814 | $158,566 | $179,227 | $185,047 | $191,344 | $186,934 | $177,601 | $163,785 | $147,203 | $127,549 | |

| Net Cash Flow | $42,221 | $3,110 | $20,935 | $50,430 | $51,001 | $70,581 | $70,158 | $65,510 | $52,170 | $32,470 | $4,698 | $33,176 | |

| Cash Balance | $148,472 | $152,582 | $173,517 | $223,947 | $274,948 | $345,529 | $415,687 | $481,197 | $533,367 | $565,837 | $570,535 | $558,222 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!