Claremont Funding is a mortgage brokerage firm serving the lending needs of real estate professionals, builders, and individual home buyers. We have access to a full range of mortgage sources and are dedicated to finding the right loan–with the best rates, terms, and costs–to meet our clients’ needs.

This firm is capitalized by two principal investors, Joan Billings and Maureen Shoe, licensed brokers with over 30 years of combined experience in the industry.

1.1 Objectives:

– Offer comprehensive mortgage broker services.

– Provide personal and specialized services to meet each client’s specific needs.

– Become profitable in the rapidly growing old town section of the city.

– Develop a solid corporate identity in our target market area.

– Become one of the top brokerage firms in the area by our third year of operation.

– Realize a positive return on investment within the first 12 months.

1.2 Mission:

Claremont Funding offers high-quality mortgage brokerage services to residential and business customers. Our aim is to provide fair mortgage rates at reasonable prices, while keeping our clients informed and educated throughout the process. We will become friends and mentors to our customers, as well as quality service providers. Claremont provides an excellent workplace, a professional environment that is challenging, rewarding, creative, and respectful. We ultimately provide excellent value to our customers and fair reward to our owners and employees.

Claremont Funding is a new company that provides expertise. We offer superior personal service to buyers and pride ourselves on our repeat clients and referrals.

As mortgage professionals, our responsibility is to determine a customer’s financial goals, not just quote a rate. We have access to hundreds of loan programs to arrange the most beneficial solution for the buyer’s needs.

The owners and brokers of Claremont Funding are Joan Billings and Maureen Shoe.

Our start-up costs include website design, office equipment, a main computer station with mortgage information for brokers, stationery, legal costs, furnishings, office advertising, and services. The start-up costs will be financed by direct owner investment and credit. Office space averages $1.10 – $1.60 per square foot, with a three to five year lease agreement.

Our personal goal is to break through barriers to homeownership and help buyers find the best mortgage loan for their needs. We match buyers to loan programs based on their wants and needs.

Due to the area’s strengthening economy and lower interest rates, more home buyers are looking to purchase homes. Residential construction is booming in the city’s Old Town section. We expect to become a recognized and profitable entity in the real estate market.

Our targeted market area, the Old Town area, shows stability and growth. We have a beautiful office located in the Old Town area.

The first quarter home values were up 12.5 percent from the same period in 2001, reflecting an increase from the previous quarter.

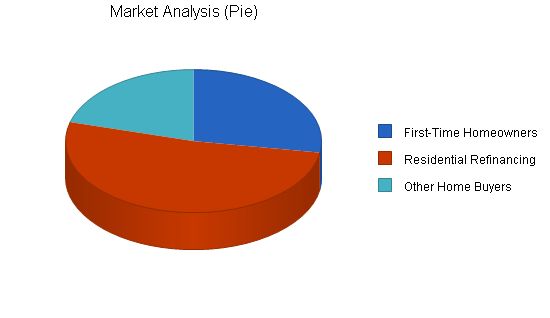

Claremont Funding serves two groups of home buyers: first-time homeowners and those seeking residential refinancing for purchasing, construction, remodeling, debt consolidation, investment properties, or refinancing.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| First-Time Homeowners | 15% | 80,000 | 92,000 | 105,800 | 121,670 | 139,921 | 15.00% |

| Residential Refinancing | 10% | 150,000 | 165,000 | 181,500 | 199,650 | 219,615 | 10.00% |

| Other Home Buyers | 7% | 60,000 | 64,200 | 68,694 | 73,503 | 78,648 | 7.00% |

| Total | 10.87% | 290,000 | 321,200 | 355,994 | 394,823 | 438,184 | 10.87% |

Contents

4.2 Target Market Segment Strategy

We must focus on specific market segments whose needs match our offerings. Focusing on targeted segments is key to our future. We need to focus our marketing message and services offered. We need to develop our message, communicate it, and fulfill it.

Strategy and Implementation Summary

Claremont Funding will focus on serving the mortgage broker needs in the Old Town section of the city and the surrounding areas. Our target customers will be first-time home buyers and existing homeowners interested in refinancing.

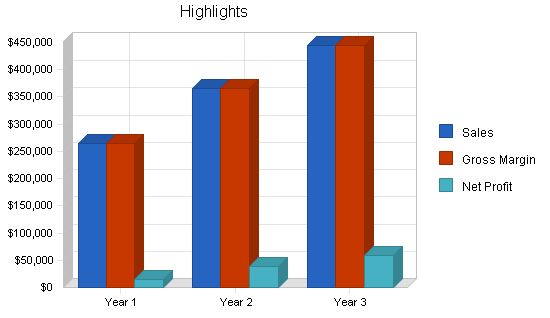

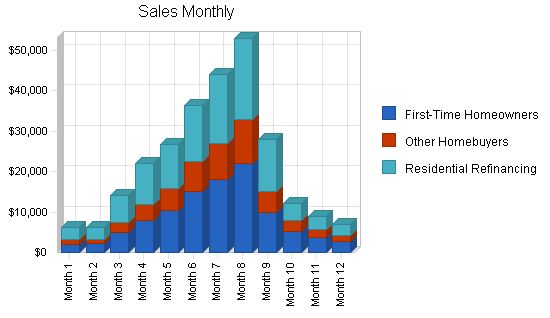

5.1 Sales Forecast

The following table and chart provide a forecast of sales. We expect sales to grow between January and March, with the most significant growth from March to August. Sales are expected to decline from September until the end of the year.

To develop effective business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| First-Time Homeowners | $104,672 | $150,000 | $180,000 |

| Other Homebuyers | $52,336 | $75,000 | $90,000 |

| Residential Refinancing | $107,839 | $140,000 | $175,000 |

| Total Sales | $264,847 | $365,000 | $445,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| First-Time Homeowners | $0 | $0 | $0 |

| Other Homebuyers | $0 | $0 | $0 |

| Residential Refinancing | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

5.2 Milestones

The table below lists important program milestones, with dates, managers in charge, and budgets for each. The milestone schedule emphasizes planning for implementation.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Lease Office Space | 12/15/2001 | 12/28/2001 | $3,000 | Maureen | Marketing |

| Purchase Office Equipment/Computer, etc. | 12/1/2001 | 12/15/2001 | $3,000 | Maureen | Marketing |

| Office Utilities | 12/20/2001 | 12/21/2001 | $250 | Joan | Web |

| Answering Service | 12/13/2001 | 12/23/2001 | $200 | Joan | Web |

| Stationary | 12/1/2001 | 12/10/2001 | $2,000 | Joan | Admin |

| Business Software | 12/15/2001 | 12/28/2001 | $2,000 | Joan | Admin |

| Advertising | 12/1/2001 | 12/30/2001 | $2,500 | Maureen | Marketing |

| Totals | $12,950 | ||||

5.3 Competitive Edge

Claremont Funding’s competitive edge is that both Joan and Maureen are highly visible lecturers to new homeowners in the city. Joan has a weekly column in the city’s newspaper, and Maureen lectures weekly to neighborhood councils and civic groups. Together, they represent the most recognizable faces in the city on the subject of homeownership and refinancing.

They have a base of 6,000 satisfied customers who continue to make referrals to the brokers.

The city has been growing at a rate of 15% annually for the past 10 years. With a current population of 1.3 million, the new construction in the Old Town section is valued at two billion dollars in home sales next year alone. Claremont Funding is well-positioned to capture a large share of the mortgage services demanded by the city’s growth in Old Town.

Management Summary

Claremont Funding is a two-member mortgage brokerage firm, with both brokers as equal partners.

6.1 Personnel Plan

The following table shows the personnel plan for Claremont Funding.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Joan Billings | $60,000 | $80,000 | $90,000 |

| Maureen Shoe | $60,000 | $80,000 | $90,000 |

| Admin Assistants | $46,000 | $60,000 | $80,000 |

| Total People | 3 | 4 | 4 |

| Total Payroll | $166,000 | $220,000 | $260,000 |

We aim to finance growth mainly through cash flow.

The closing sales days are crucial for Claremont Funding. These dates are determined by the Seller and the Buyer, and a move-out/move-in schedule is followed.

7.1 Important Assumptions

The financial plan is based on important assumptions, most of which are shown in the following table as annual assumptions. Monthly assumptions are included in the appendix. We recognize that collection days are critical but not easily influenced. We are prepared to address this issue. Interest rates, tax rates, and personnel burden are based on conservative assumptions. Some of the key underlying assumptions include:

– A strong economy without major recession

– No unforeseen changes in the economy that would alter our estimations

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

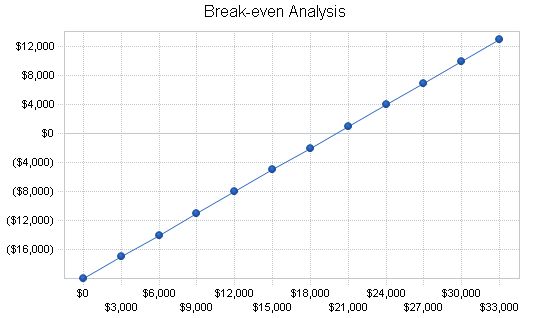

The following table and chart summarize our break-even analysis.

Break-even Analysis:

Monthly Revenue Break-even: $19,975.

Assumptions:

– Average Percent Variable Cost: 0%.

– Estimated Monthly Fixed Cost: $19,975.

Projected Profit and Loss:

– Please refer to the table below for our projected profit and loss.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $264,847 | $365,000 | $445,000 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 |

| Gross Margin | $264,847 | $365,000 | $445,000 |

| Gross Margin % | 100.00% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $166,000 | $220,000 | $260,000 |

| Sales and Marketing and Other Expenses | $7,800 | $13,000 | $19,000 |

| Depreciation | $0 | $0 | $0 |

| Leased Equipment | $200 | $0 | $0 |

| Utilities | $2,400 | $2,400 | $2,400 |

| Insurance | $2,400 | $2,400 | $2,400 |

| Rent | $36,000 | $36,000 | $36,000 |

| Payroll Taxes | $24,900 | $33,000 | $39,000 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $239,700 | $306,800 | $358,800 |

| Profit Before Interest and Taxes | $25,147 | $58,200 | $86,200 |

| EBITDA | $25,147 | $58,200 | $86,200 |

| Interest Expense | $2,950 | $2,550 | $2,250 |

| Taxes Incurred | $6,659 | $16,695 | $25,185 |

| Net Profit | $15,538 | $38,955 | $58,765 |

| Net Profit/Sales | 5.87% | 10.67% | 13.21% |

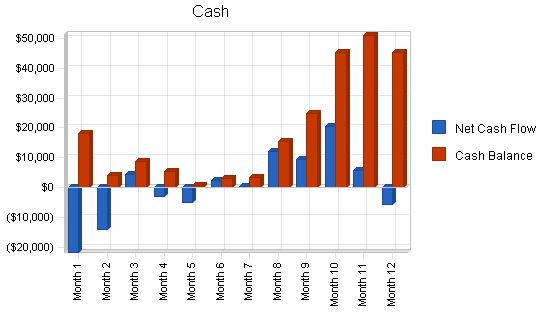

7.4 Projected Cash Flow

Cash flow projections are critical to our success. The annual cash flow figures are included here, and the detailed monthly numbers are included in the appendix.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $66,212 | $91,250 | $111,250 |

| Cash from Receivables | $187,004 | $269,352 | $330,237 |

| Subtotal Cash from Operations | $253,216 | $360,602 | $441,487 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $4,500 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $12,000 | $0 | $0 |

| Subtotal Cash Received | $269,716 | $360,602 | $441,487 |

7.5 Projected Balance Sheet

The balance sheet in the table below shows managed but sufficient growth of net worth and a healthy financial position.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $45,287 | $83,129 | $137,040 |

| Accounts Receivable | $11,631 | $16,030 | $19,543 |

| Other Current Assets | $20,000 | $20,000 | $20,000 |

| Total Current Assets | $76,918 | $119,159 | $176,583 |

| Long-term Assets | $0 | $0 | $0 |

| Total Assets | $76,918 | $119,159 | $176,583 |

| Liabilities and Capital | |||

| Year 1 | Year 2 | Year 3 | |

| Current Liabilities | |||

| Accounts Payable | $2,430 | $8,716 | $10,375 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $2,430 | $8,716 | $10,375 |

| Long-term Liabilities | $27,000 | $24,000 | $21,000 |

| Total Liabilities | $29,430 | $32,716 | $31,375 |

| Paid-in Capital | $52,000 | $52,000 | $52,000 |

| Retained Earnings | ($20,050) | ($4,512) | $34,443 |

| Earnings | $15,538 | $38,955 | $58,765 |

| Total Capital | $47,488 | $86,443 | $145,208 |

| Total Liabilities and Capital | $76,918 | $119,159 | $176,583 |

| Net Worth | $47,488 | $86,443 | $145,208 |

7.6 Business Ratios

The table below provides important ratios for the industry, according to the Standard Industry Classification (SIC) Index, 7389, Business Services.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 37.82% | 21.92% | 8.50% |

| Percent of Total Assets | ||||

| Accounts Receivable | 15.12% | 13.45% | 11.07% | 20.90% |

| Other Current Assets | 26.00% | 16.78% | 11.33% | 55.70% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 81.60% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 18.40% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 2.43% | 8.72% | 10.38% | 48.20% |

| Long-term Liabilities | 35.10% | 20.14% | 11.89% | 15.50% |

| Total Liabilities | 38.26% | 27.46% | 17.77% | 63.70% |

| Net Worth | 61.74% | 72.54% | 82.23% | 36.30% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 100.00% | 100.00% | 100.00% | 0.00% |

| Selling, General & Administrative Expenses | 94.18% | 89.41% | 86.91% | 82.60% |

| Advertising Expenses | 2.27% | 2.74% | 3.37% | 0.60% |

| Profit Before Interest and Taxes | 9.49% | 15.95% | 19.37% | 1.50% |

| Main Ratios | ||||

| Current | 31.65 | 13.67 | 17.02 | 1.57 |

| Quick | 31.65 | 13.67 | 17.02 | 1.13 |

| Total Debt to Total Assets | 38.26% | 27.46% | 17.77% | 63.70% |

| Pre-tax Return on Net Worth | 46.74% | 64.38% | 57.81% | 1.90% |

| Pre-tax Return on Assets | 28.86% | 46.70% | 47.54% | 5.20% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 5.87% | 10.67% | 13.21% | n.a |

| Return on Equity | 32.72% | 45.06% | 40.47% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 17.08 | 17.08 | 17.08 | n.a |

| Collection Days | 59 | 18 | 19 | n.a |

| Accounts Payable Turnover | 34.28 | 12.17 | 12.17 | n.a |

| Payment Days | 31 | 19 | 28 | n.a |

| Total Asset Turnover | 3.44 | 3.06 | 2.52 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.62 | 0.38 | 0.22 | n.a |

| Current Liab. to Liab. | 0.08 | 0.27 | 0.33 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $74,488 | $110,443 | $166,208 | n.a |

| Interest Coverage | 8.52 | 22.82 | 38.31 | n.a |

| Additional Ratios | ||||

|

General Assumptions: Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Sales $6,150 $6,300 $14,170 $22,000 $26,750 $36,500 $44,000 $53,000 $28,033 $12,137 $8,952 $6,855 Direct Cost of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other Production Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Gross Margin $6,150 $6,300 $14,170 $22,000 $26,750 $36,500 $44,000 $53,000 $28,033 $12,137 $8,952 $6,855 Gross Margin % 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% Expenses Payroll $13,000 $13,000 $13,000 $13,000 $15,000 $15,000 $15,000 $15,000 $15,000 $13,000 $13,000 $13,000 Sales and Marketing and Other Expenses $650 $650 $650 $650 $650 $650 $650 $650 $650 $650 $650 $650 Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Leased Equipment $200 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Utilities $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 Insurance $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 Rent $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Payroll Taxes 15% $1,950 $1,950 $1,950 $1,950 $2,250 $2,250 $2,250 $2,250 $2,250 $1,950 $1,950 $1,950 Other $0 $0 $0 $ Pro Forma Cash Flow: Cash Received Cash from Operations Cash Sales Cash from Receivables Subtotal Cash from Operations Additional Cash Received Sales Tax, VAT, HST/GST Received New Current Borrowing New Other Liabilities (interest-free) New Long-term Liabilities Sales of Other Current Assets Sales of Long-term Assets New Investment Received Subtotal Cash Received Expenditures Expenditures from Operations Cash Spending Bill Payments Subtotal Spent on Operations Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out Principal Repayment of Current Borrowing Other Liabilities Principal Repayment Long-term Liabilities Principal Repayment Purchase Other Current Assets Purchase Long-term Assets Dividends Subtotal Cash Spent Net Cash Flow Cash Balance Pro Forma Balance Sheet: Assets Starting Balances Current Assets Cash Accounts Receivable Other Current Assets Total Current Assets Long-term Assets Long-term Assets Accumulated Depreciation Total Long-term Assets Total Assets Liabilities and Capital Current Liabilities Accounts Payable Current Borrowing Other Current Liabilities Subtotal Current Liabilities Long-term Liabilities Total Liabilities Paid-in Capital Retained Earnings Earnings Total Capital Total Liabilities and Capital Net Worth |

||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!