Contents

Bridal Gown Shop Business Plan

Recycled Dreams is a Portland, OR-based bridal dress and accessory rental shop. Founded by Connie Jugal, Recycled Dreams aims to meet the demand for rented wedding wear. Traditionally, members of the bride’s wedding party are required to purchase their dresses without any input on the design. Often, these dresses are unattractive and end up collecting dust after the event. Renting a dress is a practical and cost-effective alternative, as it will only be worn once. Recycled Dreams also offers tuxedo rentals for men.

The Services

Recycled Dreams rents dresses, shoes, headpieces, and veils. Customers have the option to purchase these items if they choose. In addition, Recycled Dreams has partnered with top local wedding service providers such as invitations, flowers, catering, and photographers. These alliances create a one-stop shopping experience for customers and generate additional revenue through referrals.

The Market and Competition

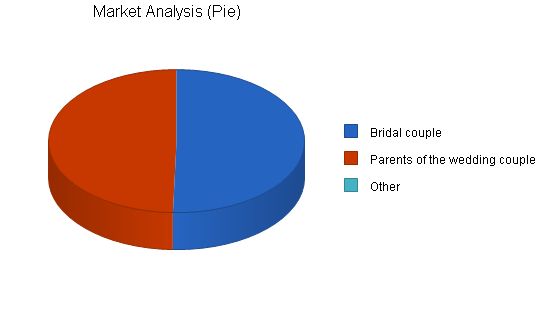

Recycled Dreams targets two market segments: couples and parents of the bridal couple. The couple segment is growing at a rate of 9% annually, with 114,584 potential customers. The parents segment has an 8% growth rate, with over 112,000 potential customers.

While traditional bridal shops that sell wedding attire are competitors, Recycled Dreams considers them as indirect competitors. Renting dresses is a valuable service that sets Recycled Dreams apart. In Portland, there are currently no other bridal rental facilities, making Recycled Dreams the pioneer of this concept in the city.

Competitive Edge

Recycled Dreams has two competitive advantages. Firstly, the concept of renting women’s bridal wear is logical due to its one-time use. The social stigma associated with renting clothing does not apply, as it is not apparent that the dress is rented. Secondly, Recycled Dreams prioritizes exceptional customer service. They guide clients through the entire event, meeting all their needs.

Management

Recycled Dreams is led by Connie Jugal, a seasoned retail manager with years of experience at the Salvation Army. Connie’s track record includes achieving growth rates of up to 46% per year per store. She will leverage her expertise to ensure the success of Recycled Dreams.

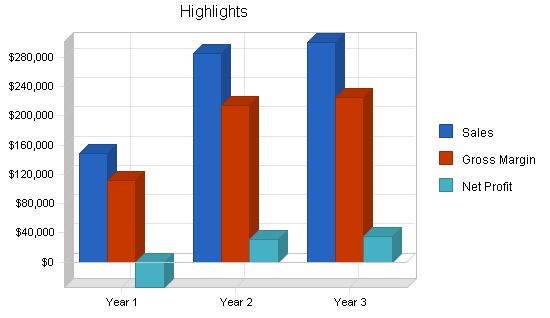

Recycled Dreams addresses the need for more affordable and practical options for bridal attire. The company projects profitability by month 10, with strong sales in the first year and significant growth by the end of year three.

1.1 Objectives

The objectives for the first three years include:

- To create a service-based company that exceeds customer expectations.

- To increase client numbers by 20% annually through superior service.

- To develop a sustainable start-up business providing cost-effective bridal dresses.

1.2 Mission

Recycled Dreams’ mission is to provide cost-effective bridal dresses and accessories for weddings, surpassing customer expectations.

Company Summary

Recycled Dreams is a bridal wear store that offers rental dresses for the Portland, Oregon market. Bridesmaids dresses, often considered unattractive and only worn once, are our focus. Recycled Dreams provides bridal gowns (for sale and rent), as well as dresses for bridesmaids, matron of honor, maid of honor, and flower girls, along with rental shoes for the special event.

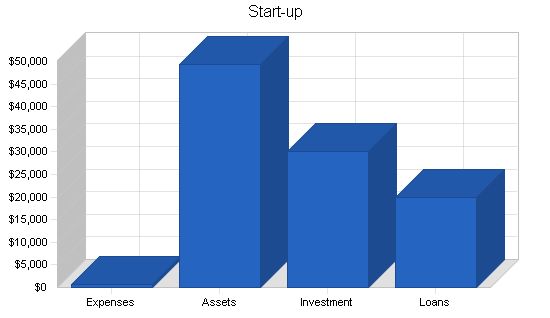

2.1 Start-up Summary

Recycled Dreams will incur the following start-up costs:

- Computer with a point of sale terminal.

- Back office terminal with printer, CD-RW.

- Microsoft Office, QuickBooks Pro, POS software.

- Display racks and shelving.

- Three couches.

- Desk, chair, and filing cabinets.

- Materials to construct plush changing rooms.

- Full-length mirrors.

- Website development.

- Inventory of dresses, shoes, headpieces, and veils.

Note: Long-term assets, such as the above items, will be depreciated using G.A.A.P. approved straight-line depreciation method.

Start-up Requirements:

– Start-up Expenses

– Legal: $100

– Stationery etc.: $100

– Website development: $500

– Other: $0

– Total Start-up Expenses: $700

– Start-up Assets

– Cash Required: $31,300

– Other Current Assets: $0

– Long-term Assets: $18,000

– Total Assets: $49,300

– Total Requirements: $50,000

Start-up Funding:

– Start-up Expenses to Fund: $700

– Start-up Assets to Fund: $49,300

– Total Funding Required: $50,000

– Assets

– Non-cash Assets from Start-up: $18,000

– Cash Requirements from Start-up: $31,300

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $31,300

– Total Assets: $49,300

– Liabilities and Capital

– Liabilities

– Current Borrowing: $0

– Long-term Liabilities: $20,000

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $20,000

– Capital

– Planned Investment

– Investor 1: $30,000

– Investor 2: $0

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $30,000

– Loss at Start-up (Start-up Expenses): ($700)

– Total Capital: $29,300

– Total Capital and Liabilities: $49,300

– Total Funding: $50,000

2.2 Company Ownership:

Recycled Dreams is owned by Connie Jugal.

Services:

Recycled Dreams will provide rentals for all necessary dresses required for a wedding, including the bridal gown, bridesmaid, matron or maid of honor, and flower girl dresses. Shoes can also be rented. Bridesmaid’s dresses are ideal for rental since bridesmaids usually do not have a choice in the dress and it is often only worn once. Recycled Dreams has an on-staff seamstress for alterations. The bridal dress, headpiece, and veil can be rented or purchased based on the bride’s preference. Recycled Dreams has strategic partnerships with local service providers for invitations, flowers, cake, catering, photographer, and honeymoon travel arrangements. Referrals to these partners earn Recycled Dreams a commission.

Market Analysis Summary:

Recycled Dreams targets two groups: the bridal couple and the parents of the bride. The bridal couple typically has limited financial resources and wants to maximize their wedding budget. The parents of the bride also have a limited budget and rely on the couple’s input. Renting attendee’s bridal wear is appealing to both groups as it saves money and is a practical choice since attendees typically don’t care about owning the dress. By renting, the saved money can be used for other meaningful expenses or to reduce overall wedding costs.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Potential Customers

Growth

Bridal couple 9% 114,584 124,897 136,138 148,390 161,745 9.00%

Parents of the wedding couple 8% 112,547 121,551 131,275 141,777 153,119 8.00%

Other 0% 0 0 0 0 0 0.00%

Total 8.51% 227,131 246,448 267,413 290,167 314,864 8.51%

Target Market Segment Strategy

Recycled Dreams will target its segments with an advertising campaign in the local newspaper since weddings are social occasions and people often look at wedding announcements and use the newspaper as a resource guide.

The yellow pages will also be used for advertising since it is a useful resource guide, despite its limitations in searching for information.

The website will be utilized to increase visibility and raise awareness of Recycled Dreams’ services.

Competition and Buying Patterns

The main competition for Recycled Dreams comes from traditional bridal stores, which can be categorized as franchise stores or sole proprietor shops.

Currently, there are no bridal wear rental facilities in Portland, which presents an opportunity for Recycled Dreams. Women are becoming more willing to rent a dress to save money, even if it’s not considered fashionable.

Strategy and Implementation Summary

Recycled Dreams will meet the demand for bridal wear rentals in Portland by providing exceptional customer service. The success of the business depends on meeting customers’ needs and generating positive word-of-mouth referrals.

Competitive Edge

Recycled Dreams’ competitive advantage lies in offering a service that meets latent demand in the Portland market. Superior customer service is also a key factor for success, as repeat customers are rare in the bridal industry.

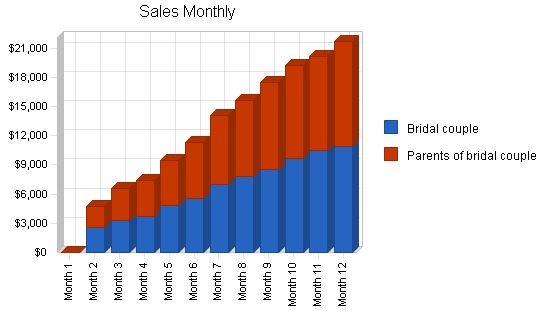

Sales Strategy

Recycled Dreams’ sales strategy focuses on educating prospective clients about the cost savings and dispelling the misconception that rental dresses are a fashion faux pas. Employees will not receive sales commissions, but will instead be rewarded for positive customer feedback.

First month: set up store front, hire employees, and start media campaign to build awareness.

Second month: limited sales activity as awareness grows.

Fourth month and beyond: increasing sales based on previous months’ activity.

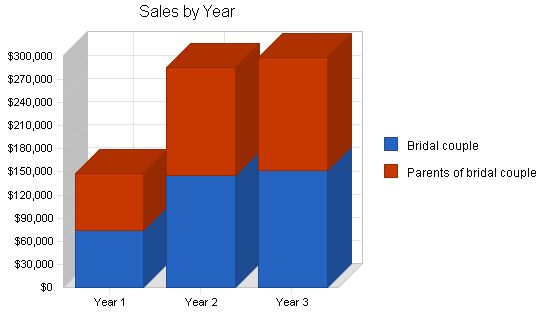

Sales Forecast

Year 1 Year 2 Year 3

Sales

Bridal couple $74,208 $145,744 $151,474

Parents of bridal couple $73,636 $139,874 $147,875

Total Sales $147,844 $285,618 $299,349

Direct Cost of Sales

Year 1 Year 2 Year 3

Bridal couple $18,552 $36,436 $37,869

Parents of bridal couple $18,409 $34,969 $36,969

Subtotal Direct Cost of Sales $36,961 $71,405 $74,837

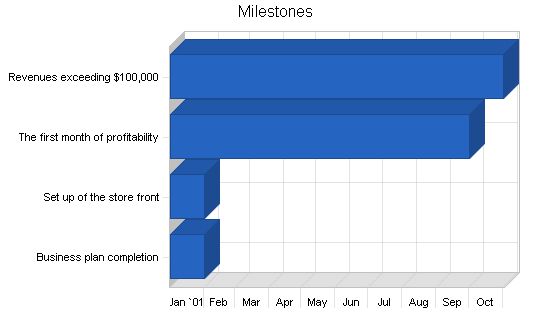

5.3 Milestones

Recycled Dreams will have several early milestones including:

1. Business plan completion: a roadmap for the organization and an indispensable tool for ongoing performance and improvement.

2. Store front setup.

3. First month of profitability.

4. Revenues exceeding $100,000.

Table: Milestones

—————————————————

Milestone Start Date End Date Budget Manager Department

—————————————————

Business plan completion 1/1/2001 2/1/2001 $0 ABC Marketing

Set up of the store front 1/1/2001 2/1/2001 $0 ABC Department

The first month of profitability 1/1/2001 10/1/2001 $0 ABC Department

Revenues exceeding $100,000 1/1/2001 11/1/2001 $0 ABC Department

Totals $0

Management Summary

—————————————————

Connie Jugal received her undergraduate degree in communications from Portland State University. She supported herself financially by working at the Salvation Army thrift store. Initially, Connie worked as a register attendant and quickly advanced to assistant manager and then manager due to her attention to detail, interpersonal skills, and general management ability.

After graduating, Connie was offered a regional manager position overseeing three different stores. While she didn’t plan on staying at the Salvation Army long-term, she saw this opportunity as unique, especially at her age. As the regional manager, Connie significantly increased revenues through sophisticated marketing and merchandising strategies. Store one saw a 46% revenue growth from the previous year, store two saw a 33% growth, and store three saw a 23% growth, compared to the 1-5% growth of all Oregon stores over the past eight years. Impressed by her success, Connie was offered an even larger management territory the following year. However, recognizing her desire to start her own business and be her own boss, she decided to establish Recycled Dreams.

Personnel Plan

—————————————————

Connie will work full-time for Recycled Dreams. In month two, she will hire one full-time person and one part-time person. The headcount will remain at four until month five, when an additional full-time person will be hired. Recycled Dreams has been designed as a decentralized organization, where all employees share responsibility for most tasks. Additionally, a part-time seamstress will be hired starting in month two to handle necessary alterations.

Table: Personnel Plan

—————————————————

Year 1 Year 2 Year 3

Connie $42,000 $45,000 $48,000

Full-time employee $21,120 $22,000 $22,000

Part-time employee $10,560 $11,000 $11,000

Seamstress $12,200 $14,400 $14,400

Full-time employee $13,440 $22,000 $22,000

Total People 5 5 5

Total Payroll $99,320 $114,400 $117,400

Financial Plan

—————————————————

The following sections provide important financial information.

Important Assumptions

—————————————————

Table: General Assumptions

—————————————————

Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00%

Other 0 0 0

—————————————————

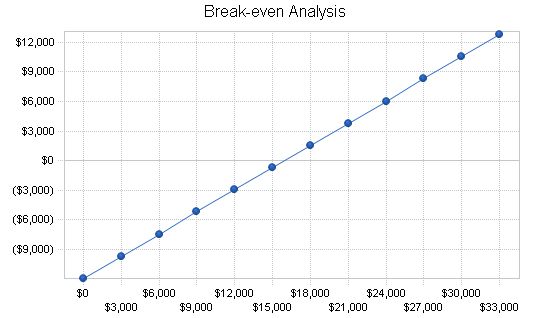

The Break-even Analysis calculates the monthly revenue required to reach the break-even point.

Break-even Analysis:

Monthly Revenue Break-even: $15,944.

Assumptions:

– Average Percent Variable Cost: 25%.

– Estimated Monthly Fixed Cost: $11,958.

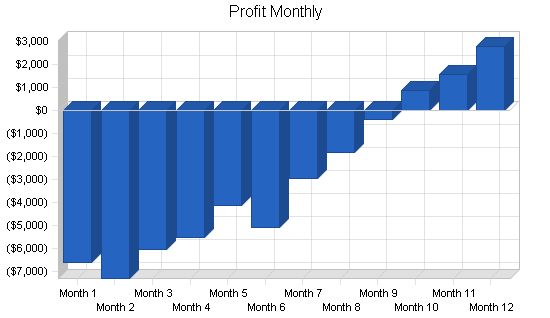

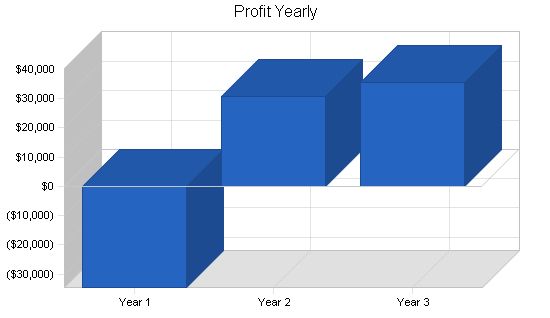

Projected Profit and Loss:

The table and charts below show the projected profit and loss.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $147,844 $285,618 $299,349

Direct Cost of Sales $36,961 $71,405 $74,837

Other Production Expenses $0 $0 $0

Total Cost of Sales $36,961 $71,405 $74,837

Gross Margin $110,883 $214,214 $224,512

Gross Margin % 75.00% 75.00% 75.00%

Expenses

Payroll $99,320 $114,400 $117,400

Sales and Marketing and Other Expenses $3,600 $11,200 $11,200

Depreciation $7,728 $7,728 $7,728

Leased Equipment $0 $0 $0

Utilities $1,750 $1,750 $1,750

Insurance $1,800 $1,800 $1,800

Rent $14,400 $14,400 $14,400

Payroll Taxes $14,898 $17,160 $17,610

Other $0 $0 $0

Total Operating Expenses $143,496 $168,438 $171,888

Profit Before Interest and Taxes ($32,613) $45,776 $52,624

EBITDA ($24,885) $53,504 $60,352

Interest Expense $1,934 $1,809 $1,671

Taxes Incurred $0 $13,190 $15,286

Net Profit ($34,547) $30,777 $35,667

Net Profit/Sales -23.37% 10.78% 11.91%

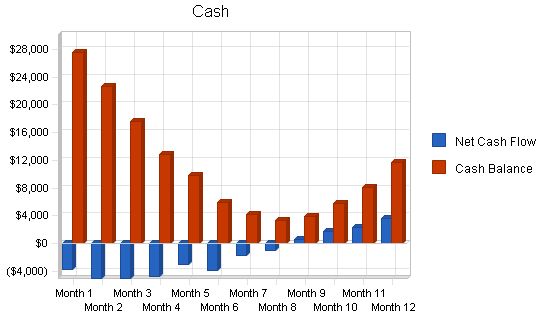

7.4 Projected Cash Flow

The following chart and table indicate projected cash flow.

7.5 Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $147,844 | $285,618 | $299,349 |

| Subtotal Cash from Operations | $147,844 | $285,618 | $299,349 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $147,844 | $285,618 | $299,349 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $99,320 | $114,400 | $117,400 |

| Bill Payments | $66,822 | $130,326 | $138,074 |

| Subtotal Spent on Operations | $166,142 | $244,726 | $255,474 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $1,237 | $1,345 | $1,421 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $167,380 | $246,071 | $256,895 |

| Net Cash Flow | ($19,536) | $39,547 | $42,454 |

| Cash Balance | $11,764 | $51,311 | $93,766 |

7.6 Projected Balance Sheet

The following table indicates the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $11,764 | $51,311 | $93,766 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $11,764 | $51,311 | $93,766 |

| Long-term Assets | |||

| Long-term Assets | $18,000 | $18,000 | $18,000 |

| Accumulated Depreciation | $7,728 | $15,456 | $23,184 |

| Total Long-term Assets | $10,272 | $2,544 | ($5,184) |

| Total Assets | $22,036 | $53,855 | $88,582 |

7.6 Business Ratios

The following table shows a variety of standard business analysis ratios, as calculated for the years of this plan. The Industry Profile column shows typical ratios for other businesses in the Formal Wear and Costume Rental industry, NAICS code 532220.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 93.19% | 4.81% | 11.37% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 49.84% |

| Total Current Assets | 53.39% | 95.28% | 105.85% | 64.51% |

| Long-term Assets | 46.61% | 4.72% | -5.85% | 35.49% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 8.521 | 10.908 | 11.388 | |

| Current Borrowing | ($1,237) | ($2,582) | ($4,003) | |

| Other Current Liabilities | $0 | $0 | $0 | |

| Subtotal Current Liabilities | $7,283 | $8,326 | $7,385 | |

| Long-term Liabilities | $20,000 | $20,000 | $20,000 | |

| Total Liabilities | $27,283 | $28,326 | $27,385 | |

| Paid-in Capital | $30,000 | $30,000 | $30,000 | |

| Retained Earnings | ($700) | ($35,247) | ($4,470) | |

| Earnings | ($34,547) | $30,777 | $35,667 | |

| Total Capital | ($5,247) | $25,530 | $61,197 | |

| Total Liabilities and Capital | $22,036 | $53,855 | $88,582 | |

| Net Worth | ($5,247) | $25,530 | $61,197 | |

Appendix

Sales Forecast

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Bridal couple | 0% | $0 | $2,547 | $3,254 | $3,654 | $4,789 | $5,587 | $6,987 | $7,845 | $8,547 | $9,654 | $10,457 | $10,887 |

| Parents of bridal couple | 0% | $0 | $2,214 | $3,356 | $3,785 | $4,678 | $5,687 | $7,125 | $7,765 | $8,978 | $9,545 | $9,658 | $10,845 |

| Total Sales | $0 | $4,761 | $6,610 | $7,439 | $9,467 | $11,274 | $14,112 | $15,610 | $17,525 | $19,199 | $20,115 | $21,732 | |

Personnel Plan

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Connie | 0% | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 |

| Full-time employee | 0% | $0 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 |

| Part-time employee | 0% | $0 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 |

| Seamstress | 0% | $0 | $800 | $900 | $1,000 | $1,100 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 |

| Full-time employee | 0% | $0 | $0 | $0 | $0 | $0 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 |

| Total People | 1 | ||||||||||||

| Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Pro Forma Profit and Loss:

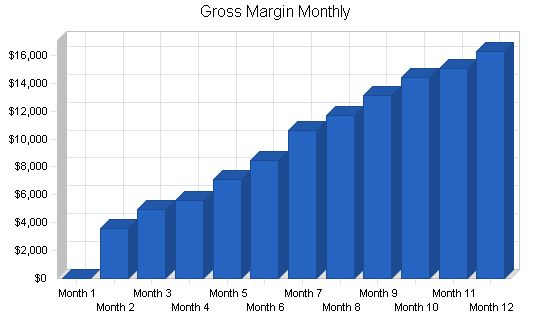

| Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Sales | $0 | $4,761 | $6,610 | $7,439 | $9,467 | $11,274 | $14,112 | $15,610 | $17,525 | $19,199 | $20,115 | $21,732 | |

| Direct Cost of Sales | $0 | $1,190 | $1,653 | $1,860 | $2,367 | $2,819 | $3,528 | $3,903 | $4,381 | $4,800 | $5,029 | $5,433 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $1,190 | $1,653 | $1,860 | $2,367 | $2,819 | $3,528 | $3,903 | $4,381 | $4,800 | $5,029 | $5,433 | |

| Gross Margin | $0 | $3,571 | $4,958 | $5,579 | $7,100 | $8,456 | $10,584 | $11,708 | $13,144 | $14,399 | $15,086 | $16,299 | |

| Gross Margin % | 0.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | |

| Expenses | |||||||||||||

| Payroll | $3,500 | $7,180 | $7,280 | $7,380 | $7,480 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | |

| Sales and Marketing and Other Expenses | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Depreciation | $644 | $644 | $644 | $644 | $644 | $644 | $644 | $644 | $644 | $644 | $644 | $644 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $100 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | |

| Insurance | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | |

| Rent | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | |

| Payroll Taxes | 15% | $525 | $1,077 | $1,092 | $1,107 | $1,122 | $1,425 | $1,425 | $1,425 | $1,425 | $1,425 | $1,425 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $6,419 | $10,701 | $10,816 | $10,931 | $11,046 | $13,369 | $13,369 | $13,369 | $13,369 | $13,369 | $13,369 | $13,369 | |

| Profit Before Interest and Taxes | ($6,419) | ($7,130) | ($5,859) | ($5,352) | ($3,946) | ($4,914) | ($2,785) | ($1,662) | ($225) | $1,030 | $1,717 | $2,930 | |

| EBITDA | ($5,775) | ($6,486) | ($5,215) | ($4,708) | ($3,302) | ($4,270) | ($2,141) | ($1,018) | $419 | $1,674 | $2,361 | $3,574 | |

| Interest Expense | $166 | $165 | $164 | $163 | $162 | $162 | $161 | $160 | $159 | $158 | $157 | $156 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($6,585) | ($7,295) | ($6,023) | ($5,515) | ($4,108) | ($5,075) | ($2,946) | ($1,821) | ($384) | $872 | $1,560 | $2,774 | |

| Net Profit/Sales | 0.00% | -153.23% | -91.11% | -74.14% | -43.40% | -45.02% | -20.87% | -11.67% | -2.19% | 4.54% | 7.76% | 12.76% |

Pro Forma Cash Flow

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $4,761 | $6,610 | $7,439 | $9,467 | $11,274 | $14,112 | $15,610 | $17,525 | $19,199 | $20,115 | $21,732 | |

| Subtotal Cash from Operations | $0 | $4,761 | $6,610 | $7,439 | $9,467 | $11,274 | $14,112 | $15,610 | $17,525 | $19,199 | $20,115 | $21,732 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $4,761 | $6,610 | $7,439 | $9,467 | $11,274 | $14,112 | $15,610 | $17,525 | $19,199 | $20,115 | $21,732 | |

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $3,500 | $7,180 | $7,280 | $7,380 | $7,480 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | |

| Bill Payments | $81 | $2,501 | $4,248 | $4,716 | $4,947 | $5,476 | $6,229 | $6,926 | $7,303 | $7,779 | $8,191 | $8,424 | |

| Subtotal Spent on Operations | $3,581 | $9,681 | $11,528 | $12,096 | $12,427 | $14,976 | $15,729 | $16,426 | $16,803 | $17,279 | $17,691 | $17,924 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $98 | $99 | $100 | $101 | $102 | $103 | $103 | $104 | $105 | $106 | $107 | $108 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $3,680 | $9,780 | $11,628 | $12,197 | $12,529 | $15,079 | $15,832 | $16,531 | $16,909 | $17,385 | $17,797 | $18,032 | |

| Net Cash Flow | ($3,680) | ($5,019) | ($5,018) | ($4,758) | ($3,062) | ($3,805) | ($1,720) | ($921) | $616 | $1,814 | $2,318 | $3,700 | |

| Cash Balance | $27,620 | $22,601 | $17,583 | $12,825 | $9,763 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!