Creating a Cash Flow Forecast

Creating a cash flow forecast is a crucial aspect of managing the finances of any business. It enables you to anticipate and plan for the inflows and outflows of cash in your company, ensuring that you have enough liquidity to cover your expenses and invest in growth opportunities.

To create a cash flow forecast, start by gathering all the necessary financial information, such as sales records, expense reports, and payment schedules. This data will serve as the foundation for your forecast and allow you to make accurate projections.

Next, identify and categorize your sources of cash inflows. These can include sales revenue, loans, investments, or any other form of capital injection into your business. By analyzing your past financial performance and market trends, you can estimate the timing and amount of these inflows.

Similarly, analyze and categorize your cash outflows. This may include expenses such as rent, salaries, inventory purchases, and loan repayments. Consider both recurring and one-time expenses and remember to account for any seasonal or fluctuating costs.

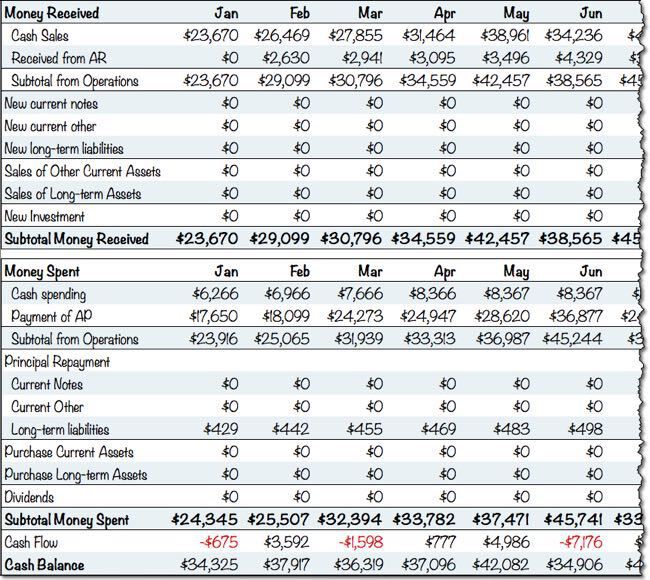

Once you have determined your inflows and outflows, create a cash flow projection for a specific time period, typically monthly or quarterly. This projection should include the opening cash balance, projected inflows, projected outflows, and the closing cash balance for each period. By doing so, you can identify potential cash shortages or surpluses and take preemptive measures to address them.

It is essential to regularly update your cash flow forecast as new information becomes available or circumstances change. This will ensure that you have an accurate and up-to-date picture of your business’s cash position and allow you to make informed financial decisions.

In summary, creating a concise and impactful cash flow forecast involves gathering accurate financial information, analyzing past performance, projecting inflows and outflows, and regularly updating the forecast. By doing so, you can effectively manage your cash flow and make informed decisions to drive the success of your business.

A cash flow forecast is crucial for a business plan as it predicts the financial needs of a company. Without sufficient funds, all strategies, tactics, and ongoing business activities are meaningless.

Cash refers to money available for spending, including funds in checking accounts, savings, and liquid securities. It is not limited to coins and bills.

It is important to note that profits and cash are not the same. Even profitable companies can run out of cash if they do not effectively manage their finances. Certain expenses, such as inventory, debt repayment, new equipment, and asset purchases, reduce cash but not profitability. Additionally, sales revenue may not immediately reflect in the bank account if customers delay payment.

This is why a cash flow forecast holds significant value. It helps predict the monthly cash balance, regardless of business profitability.

Two methods can be used to create a cash flow forecast: the direct method and the indirect method. Both methods are accurate, and the choice depends on personal preference and understanding.

The direct method, although less popular, is easier to use. However, it cannot be generated from standard reports in accounting software. If creating a forward-looking forecast, relying on accounting reports may not be necessary.

While some individuals may prefer the indirect method, the direct method is just as accurate. The direct method relies on the formula: Cash Flow = Cash Received – Cash Spent.

In conclusion, a cash flow forecast is indispensable for effective financial management. Understanding the different methods available allows businesses to make informed decisions about their financial future.

Estimate your cash received, then move on to the other sections of the cash flow forecast.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!