Healthy Restaurant Business Plan

Kona-Q is a fast-casual restaurant, serving fast, fresh, healthy grilled meats and vegetables. The first store will be located in Salem, Oregon with aggressive growth plans of one new store every 12 months. Kona-Q is an Oregon Corporation with Kevin Anderson as the president.

Market

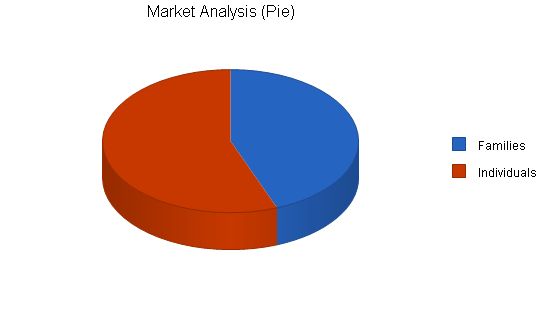

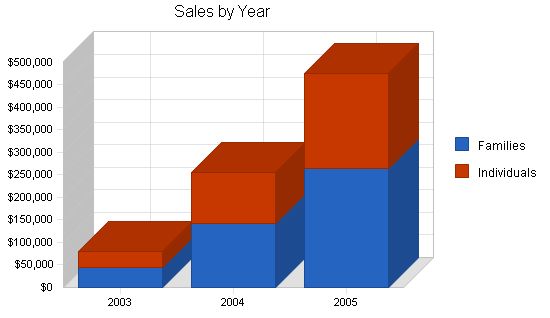

The market can be divided into two segments, families and individuals. Families will comprise the majority of dinner time business with individuals making up the majority of lunch time business. The family segment is increasing annually at 9% with 26,585 potential customers. The individuals have an 8% growth rate with 33,654 potential people within the segment. Kona-Q will be operating within the fast-casual niche of the restaurant industry, competing against fast food and sit-down restaurants.

Services and Products

Kona-Q provides an unmatched dining experience. All patrons receive excellent customer service, encouraging them to return. The menu offerings are fast, simple, healthy, and easy to prepare.

Competitive Edge

The customer experience is crucial in distinguishing Kona-Q. Having such a good experience will encourage repeat business. Another competitive edge is Kona-Q’s offering of fast, healthy food.

Management

Kevin Anderson has seven years of experience in the restaurant industry. Kevin received a dual major in accounting and entrepreneurship from Lewis and Clark College.

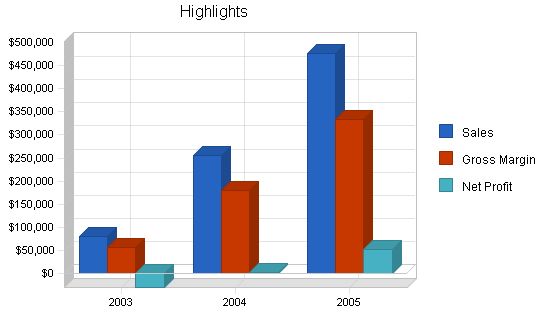

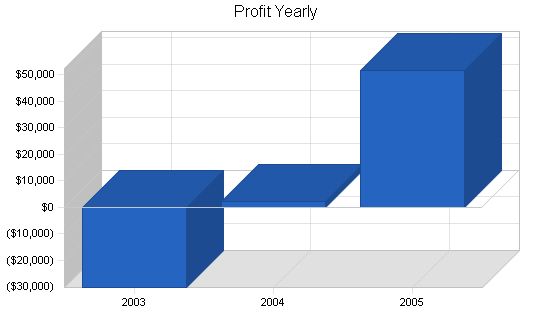

Sales are forecasted to be $255K and $475K for years two and three. Net profit will be 9.07% for year three.

Contents

1.1 Mission

Kona-Q’s mission is to be the premier fast-casual dining experience, offering an unprecedented experience with great food and reasonable prices.

1.2 Objectives

- To become the premier fast-casual restaurant in every market.

- To open a new store every 12 months.

- To offer high-quality food and a wonderful experience at reasonable prices.

1.3 Keys to Success

- Offer simple, delicious menu items.

- Treat every customer as the only customer.

- Design and employ strict financial controls.

Company Summary

Kona-Q is a new restaurant that purchased the assets of an existing one. It is an Oregon Corporation, founded by Kevin Anderson.

2.1 Company History

Kona-Q acquired Litto’s Bento in Salem, Oregon to quickly enter the market and leverage the goodwill of the former business.

Kevin was friends with the former owner and the menu and equipment suited Kona-Q’s needs. Litto’s Bento was purchased for $75,000, including equipment.

Kona-Q forecasts aggressive growth, opening a new store approximately every 12 months.

Each location will be around 1,000 square feet, serving about 50,000 people. Location is key for restaurant success, so Kona-Q has developed criteria for future site locations.

Target locations should have traffic counts of 20,000 or greater and be near a national anchor. New store openings will depend on ideal location availability, not strictly every 12 months.

For each new location, Kona-Q will incur the following expenses:

- $75K in build-out expenses.

- $10K in equipment including BBQ, rice cooker, refrigerator, small wares, tables, and chairs.

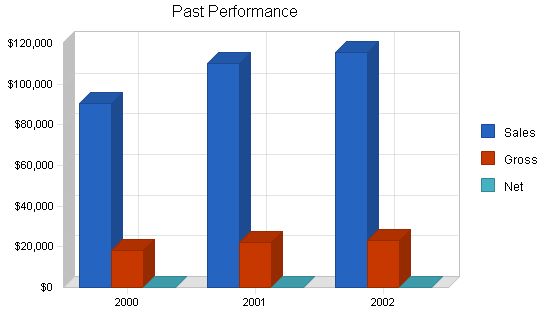

Past Performance:

2000 2001 2002

Sales $90,401 $110,214 $115,454

Gross Margin $18,080 $22,043 $23,091

Gross Margin % 20.00% 20.00% 20.00%

Operating Expenses $72,321 $88,171 $92,363

Balance Sheet:

2000 2001 2002

Current Assets:

Cash $4,546 $5,252 $4,989

Other Current Assets $0 $0 $0

Total Current Assets $4,546 $5,252 $4,989

Long-term Assets:

Long-term Assets $19,898 $21,112 $22,141

Accumulated Depreciation $6,565 $7,887 $8,989

Total Long-term Assets $13,333 $13,225 $13,152

Total Assets $17,879 $18,477 $18,141

Current Liabilities:

Accounts Payable $2,332 $3,252 $4,242

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Total Current Liabilities $2,332 $3,252 $4,242

Long-term Liabilities:

$4,000 $3,252 $2,858

Total Liabilities $6,332 $6,504 $7,100

Paid-in Capital $0 $0 $0

Retained Earnings $11,547 $11,973 $11,041

Earnings $0 $0 $0

Total Capital $11,547 $11,973 $11,041

Total Capital and Liabilities $17,879 $18,477 $18,141

Other Inputs:

Payment Days 0 0 30

2.2 Company Ownership

Kevin Anderson is the main shareholder in the Oregon-based corporation. The corporation was formed to create liability protection for the owners.

Services

Kona-Q offers an unmatched dining experience in the fast-casual niche of the restaurant industry. All patrons receive exceptional customer attention, encouraging repeat visits. The menu offerings are fast, simple, healthy, and easy to prepare.

– Chicken skewer, teriyaki or curry – $5.00

– Beef skewer, teriyaki or curry – $5.00

– Vegetable skewers, teriyaki or curry – $4.00

– Add rice, white or brown – $1.50

– Add vegetables – $2.00

– Green salad with soy ginger vinaigrette – $2.50

– Beverages (including iced teas, hot teas, soft drinks, coffee, and bottled water)

– Assorted pre-prepared desserts

All dishes come with a signature pineapple slice for decoration and enjoyment. The meats are marinated in a sweet soy ginger sauce overnight.

Market Analysis Summary

The market can be divided into two segments: families and individuals. Families make up the majority of dinner time business, while individuals constitute the majority of lunch time business.

Kona-Q operates within the fast-casual niche of the restaurant industry, competing against fast food and traditional sit-down restaurants.

4.1 Target Market Segment Strategy

Kona-Q focuses on families and individuals for specific reasons. Most dinner service is for families. As more households become dual-income families, adults have less time to prepare meals. Going out to dinner eliminates the need for meal preparation and provides time for family bonding.

The lunch business is driven by individuals. Many people go out to lunch to escape the work setting or have business meetings. This creates a large market of potential customers that is highly attractive.

4.2 Market Segmentation

The market has been divided into two distinct groups.

Families account for 67% of dinner time revenue. They have an average of 2.4 children, a household income of over $50,000, and a high level of education. They eat out 1.6 times a week and rely on dinners out as a meal replacement due to lack of time for cooking at home. These sophisticated families live within a three-mile radius of the restaurant.

Individuals make up 69% of lunch time revenue. They are aged 19-47, have an average individual income of $36,000, and a high level of education. They eat out 2.3 times a week and consist of young professionals who live near the restaurant and shoppers who frequent nearby high-end stores.

Market Analysis

| Market Analysis | |||||||

| 2003 | 2004 | 2005 | 2006 | 2007 | |||

| Potential Customers | Growth | CAGR | |||||

| Families | 9% | 26,585 | 28,978 | 31,586 | 34,429 | 37,528 | 9.00% |

| Individuals | 8% | 33,654 | 36,346 | 39,254 | 42,394 | 45,786 | 8.00% |

| Total | 8.45% | 60,239 | 65,324 | 70,840 | 76,823 | 83,314 | 8.45% |

4.3 Service Business Analysis

Kona-Q operates within the restaurant industry. While the industry has its ups and downs, the variance is less than the economy itself. People need to eat, they can eat in and save money, but the convenience of dining out creates a significant incentive. Restaurants are less affected by the general state of the economy.

Within the restaurant industry, there are different segments:

– Fast food: McDonalds, Burger King

– Pizza: delivery and dine in

– Buffets: all you can eat

– Lounges: combining food and alcohol

– Fine dining: at the highest price point

– Fast-casual: fast service and sit down dining

Kona-Q operates within the fast-casual segment. This segment has grown in response to the increased need for quality food in a sit-down environment, but with fast service. Customers dine out because they do not have the time to cook themselves.

4.3.1 Competition and Buying Patterns

Kona-Q faces competition from various competitors:

– Fast food: Offers fast service. The food product is not competitive, but people are often willing to sacrifice quality for convenience.

– Take out: Allows customers to enjoy already prepared food at home.

– Sit down dining: For customers who have the time for a leisurely meal. Food service takes longer, and the menu options are extensive.

– Sandwich shops: Considered part of the fast-food segment, they are a direct competitor of Kona-Q as their food product is healthier than fast food. This competition primarily occurs during lunch hours.

– Grocery markets: Serving prepared foods.

Customer buying patterns typically revolve around several factors:

– Location: The restaurant is near work or home.

– Convenience: People eat out because it is quicker than preparing a meal themselves. Factors of convenience relative to sit-down restaurants are the time it takes to be seated, served, and the hours of operation.

– Quality: The menu items must meet minimum levels of quality for people to be willing to spend money on the food, especially with numerous options available.

Strategy and Implementation Summary

Kona-Q will leverage its two-pronged competitive edge to gain market share quickly. The competitive edge consists of an experience focus (ensuring that the customer’s experience is top-notch) and offering a fast, healthy dining-out alternative. Kona-Q’s marketing effort will focus on communicating the message that it offers a convenient, healthy dining experience. This will be accomplished through various ways detailed in the Marketing Strategy section. Kona-Q’s sales strategy will aim to convert potential and first-time customers into long-term customers.

5.1 Competitive Edge

Kona-Q will rely on a two-part competitive advantage to become the premier fast-casual offering.

– The importance of the experience. When a customer has a good experience at a restaurant, there is a significant chance that they will become a repeat customer. It is this experience that remains in the customer’s mind well after they have consumed their food. This memory is what is communicated to their friends and colleagues.

– Fast, healthy food alternative. Kona-Q offers vegetables and meats that are grilled with or without healthy marinades and sauces that add flavor, not fat. White or brown rice is offered as the starch of the meal. In addition to the plentiful amount of vegetables offered, green salads are also available.

5.2 Marketing Strategy

The goal of the marketing strategy is to raise awareness levels regarding Kona-Q and its offerings and value. The message will be that Kona-Q is a convenient, healthy fast-casual alternative restaurant. Kona-Q will employ several marketing outlets:

– Print media advertising: The Willamette Week, a weekly entertainment guide. Similar weekly entertainment guides will be used with expansion to different cities.

– Flyers: Passed around to local businesses with coupons attached to introduce the community to Kona-Q and create an economic incentive to try it.

– Entertainment book coupons: Presented within the first eight months of entering a market. The effectiveness of these books diminishes after approximately eight months, and Kona-Q will turn to more cost-effective marketing expenditures.

5.3 Sales Strategy

The strategy of the sales effort is to convert potential and first-time customers into long-term customers. This will be accomplished using several techniques.

– Punch cards: After 10 meals purchased, the 11th will be free. Punch cards are an effective way of increasing sales from a specific customer. They provide the customer with a sense of additional value and the feeling of value with the free entree.

– Concentrating on the customer’s experience: All employees go through a comprehensive training process that includes training on offering the customer the finest experience. The employees are empowered to resolve issues and are encouraged to seek assistance from the manager for a conflict they are unable to resolve.

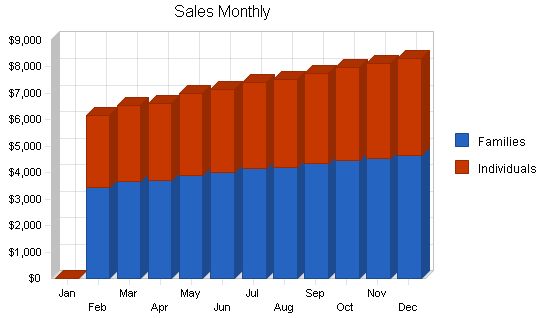

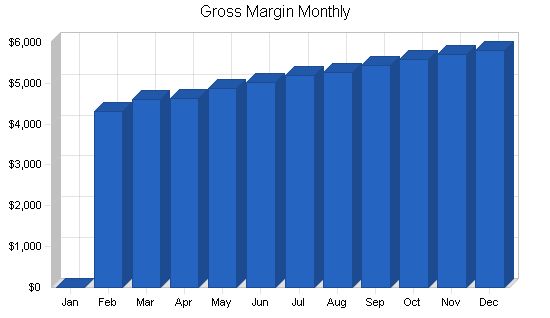

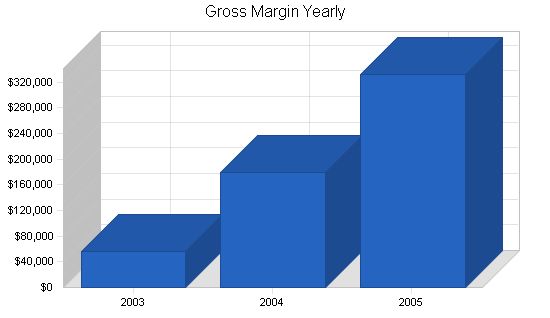

5.3.1 Sales Forecast

Sales will be modest during the first few months but will grow incrementally.

The second store is forecasted to open on month 13, subsequent new stores will open at the earlier indicated 12-month intervals.

Please note that the sales forecast for the first year reflects store number one. For years two and three, the sales forecasts represent the company-wide sales figures. Please review the following table and charts for additional detail of the sales forecasts, broken down into monthly and annual increments.

Sales Forecast:

Sales:

Families: $45,026, $142,545, $265,454

Individuals: $35,571, $112,611, $209,709

Total Sales: $80,597, $255,156, $475,163

Direct Cost of Sales:

Families: $13,508, $42,764, $79,636

Individuals: $10,671, $33,783, $62,913

Subtotal Direct Cost of Sales: $24,179, $76,547, $142,549

5.4 Milestones:

Kona-Q has identified four milestones for the organization, chosen to develop achievable yet lofty performance goals. The milestones are easy to measure. Detailed information regarding the milestones is provided in the table.

Milestones:

Milestone, Start Date, End Date, Budget, Manager, Department

Completion of the business plan, 1/1/2003, 2/15/2003, $0, Kevin, Operations

Opening of the second store, 1/1/2003, 1/30/2004, $0, Kevin, Business development

Profitability, 1/1/2003, 4/30/2005, $0, Kevin, Accounting

Expansion into a new market, 1/1/2003, 02/30/06, $0, Kevin, Business development

Totals, , , $0, ,

Web Plan Summary:

Kona-Q will have a user-friendly website for menu information, contact and location information, and background on the story of Kona-Q. Currently, there are no plans for online menu ordering, but this decision may be reconsidered based on customer demand.

6.1 Website Marketing Strategy:

The website will rely on two methods of marketing to develop awareness and increase visitors:

– Search engine submission: The website will be submitted to various search engines.

– Printed material: The website address will be referenced on all printed material, including menus, business cards, and advertising media.

6.2 Development Requirements:

Kona-Q has identified a skilled Web designer with impressive credentials to design and develop the website. They have negotiated a below-market bid for the website.

Management Summary:

Kevin Anderson is the driving force behind Kona-Q, with seven years of experience in the restaurant industry. Kevin holds an undergraduate degree in accounting and entrepreneurship from Lewis and Clark in Portland, Oregon.

7.1 Personnel Plan:

Personnel:

– Kevin: New site searches, project management, accounting, and grill operation.

– Cook: Food preparation and cooking.

– Misc.: Busing, dishwashing, cleaning, and other activities.

– Manager: Assigned to each store.

Personnel Plan:

Kevin, Cook, Manager, Misc.

2003: $24,000, $12,650, $0, $9,900

2004: $30,000, $27,600, $20,000, $21,600

2005: $34,000, $41,400, $40,000, $32,400

Total People: 3, 6, 9

Total Payroll: $46,550, $99,200, $147,800

The following sections outline important financial information.

8.1 Important Assumptions:

The following section details important financial assumptions.

General Assumptions:

Plan Month: 1, 2, 3

Current Interest Rate: 10.00%

Long-term Interest Rate: 10.00%

Tax Rate: 30.00%

Other: 0

8.2 Projected Cash Flow:

The following chart and table indicate projected cash flow.

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||

| 2003 | 2004 | 2005 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $80,597 | $255,156 | $475,163 |

| Subtotal Cash from Operations | $80,597 | $255,156 | $475,163 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $20,000 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $75,000 | $75,000 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $10,000 | $0 | $0 |

| Subtotal Cash Received | $110,597 | $330,156 | $550,163 |

| Expenditures | 2003 | 2004 | 2005 |

| Expenditures from Operations | |||

| Cash Spending | $46,550 | $99,200 | $147,800 |

| Bill Payments | $50,960 | $127,404 | $242,199 |

| Subtotal Spent on Operations | $97,510 | $226,604 | $389,999 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $5,500 | $5,500 | $5,500 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $7,500 | $7,500 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $75,000 | $75,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $103,010 | $314,604 | $477,999 |

| Net Cash Flow | $7,586 | $15,552 | $72,164 |

| Cash Balance | $12,575 | $28,127 | $100,291 |

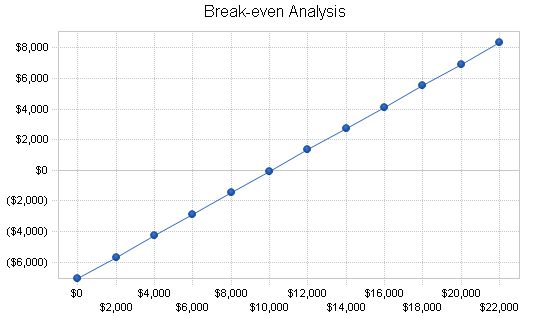

8.3 Break-even Analysis

The Break-even Analysis indicates that $10,099 is needed in monthly revenue to reach the break-even point.

Break-even Analysis

Monthly Revenue Break-even: $10,099

Assumptions:

– Average Percent Variable Cost: 30%

– Estimated Monthly Fixed Cost: $7,069

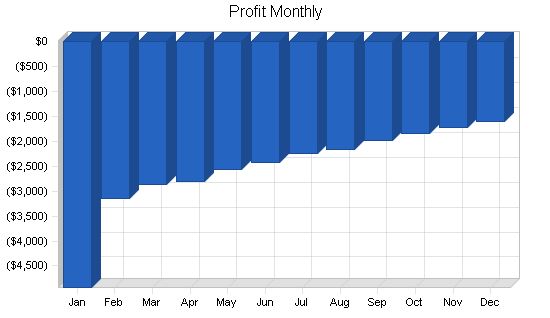

Projected Profit and Loss:

The table below shows the projected profit and loss.

Pro Forma Profit and Loss

2003 2004 2005

Sales $80,597 $255,156 $475,163

Direct Cost of Sales $24,179 $76,547 $142,549

Other Costs of Sales $0 $0 $0

Total Cost of Sales $24,179 $76,547 $142,549

Gross Margin $56,418 $178,609 $332,614

Gross Margin % 70.00% 70.00% 70.00%

Expenses

Payroll $46,550 $99,200 $147,800

Sales and Marketing and Other Expenses $3,600 $7,200 $10,000

Depreciation $12,996 $20,000 $24,000

Rent $9,000 $18,000 $27,000

Utilities $2,400 $4,800 $7,200

Insurance $2,400 $4,800 $7,200

Payroll Taxes $6,983 $14,880 $22,170

Other $900 $1,800 $2,700

Total Operating Expenses $84,829 $170,680 $248,070

Profit Before Interest and Taxes ($28,411) $7,929 $84,544

EBITDA ($15,415) $27,929 $108,544

Interest Expense $1,867 $4,836 $11,036

Taxes Incurred $0 $928 $22,052

Net Profit ($30,278) $2,165 $51,456

Net Profit/Sales -37.57% 0.85% 10.83%

Projected Balance Sheet

Assets 2003 2004 2005

Current Assets $12,575 $28,127 $100,291

Long-term Assets $22,141 $97,141 $172,141

Accumulated Depreciation $21,985 $41,985 $65,985

Total Long-term Assets $156 $55,156 $106,156

Total Assets $12,731 $83,283 $206,447

Liabilities and Capital 2003 2004 2005

Current Liabilities $19,110 $19,996 $24,205

Long-term Liabilities $2,858 $70,358 $137,858

Total Liabilities $21,968 $90,354 $162,063

Paid-in Capital $10,000 $10,000 $10,000

Retained Earnings $11,041 ($19,237) ($17,071)

Earnings ($30,278) $2,165 $51,456

Total Capital ($9,237) ($7,071) $44,384

Total Liabilities and Capital $12,731 $83,283 $206,447

Net Worth ($9,237) ($7,071) $44,384

Ratio Analysis 2003 2004 2005 Industry Profile

Sales Growth -30.19% 216.58% 86.22% 6.96%

Percent of Total Assets

Other Current Assets 0.00% 0.00% 0.00% 28.39%

Total Current Assets 98.77% 33.77% 48.58% 37.68%

Long-term Assets 1.23% 66.23% 51.42% 62.32%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 150.10% 24.01% 11.72% 19.17%

Long-term Liabilities 22.45% 84.48% 66.78% 29.21%

Total Liabilities 172.55% 108.49% 78.50% 48.38%

Net Worth -72.55% -8.49% 21.50% 51.62%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 70.00% 70.00% 70.00% 59.31%

Selling, General & Administrative Expenses 105.61% 70.92% 60.97% 39.09%

Advertising Expenses 0.00% 0.00% 0.00% 2.75%

Profit Before Interest and Taxes -35.25% 3.11% 17.79% 1.59%

Main Ratios

Current 0.66 1.41 4.14 1.26

Quick 0.66 1.41 4.14 0.87

Total Debt to Total Assets 172.55% 108.49% 78.50% 3.27%

Pre-tax Return on Net Worth 327.79% -43.75% 165.62% 54.38%

Pre-tax Return on Assets -237.82% 3.71% 35.61% 7.17%

Additional Ratios 2003 2004 2005

Net Profit Margin -37.57% 0.85% 10.83% n.a

Return on Equity 0.00% 0.00% 115.93% n.a

Activity Ratios

Accounts Payable Turnover 11.13 12.17 12.17 n.a

Payment Days 29 21 23 n.a

Total Asset Turnover 6.33 3.06 2.30 n.a

Debt Ratios

Debt to Net Worth 0.00 0.00 3.65 n.a

Current Liab. to Liab. 0.87 0.22 0.15 n.a

Liquidity Ratios

Net Working Capital ($6,535) $8,131 $76,086 n.a

Interest Coverage -15.22 1.64 7.66 n.a

Additional Ratios 2003 2004 2005

Assets to Sales 0.16 0.33 0.43 n.a

Current Debt/Total Assets 150% 24% 12% n.a

Acid Test 0.66 1.41 4.14 n.a

Sales/Net Worth 0.00 0.00 10.71 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Sales Forecast

2003 2004 2005

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Sales $0 $6,167 $6,560 $6,625 $6,977 $7,156 $7,412 $7,522 $7,761 $7,973 $8,136 $8,307

Direct Cost of Sales

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Families $0 $1,034 $1,100 $1,110 $1,169 $1,199 $1,242 $1,261 $1,301 $1,336 $1,364 $1,392

Individuals $0 $816 $869 $877 $924 $948 $981 $996 $1,028 $1,056 $1,077 $1,100

Subtotal Direct Cost of Sales

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

$0 $1,850 $1,968 $1,987 $2,093 $2,147 $2,224 $2,256 $2,328 $2,392 $2,441 $2,492

Personnel Plan

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Kevin 0% $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000

Cook 0% $0 $1,150 $1,150 $1,150 $1,150 $1,150 $1,150 $1,150 $1,150 $1,150 $1,150 $1,150

Manager 0% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Misc. 0% $0 $900 $900 $900 $900 $900 $900 $900 $900 $900 $900 $900

Total People

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1 3 3 3 3 3 3 3 3 3 3 3 3

Total Payroll

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

$2,000 $4,050 $4,050 $4,050 $4,050 $4,050 $4,050 $4,050 $4,050 $4,050 $4,050 $4,050 $4,050

General Assumptions

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss

Sales: $0, $6,167, $6,560, $6,625, $6,977, $7,156, $7,412, $7,522, $7,761, $7,973, $8,136, $8,307

Direct Cost of Sales: $0, $1,850, $1,968, $1,987, $2,093, $2,147, $2,224, $2,256, $2,328, $2,392, $2,441, $2,492

Other Costs of Sales: $0

Total Cost of Sales: $0, $1,850, $1,968, $1,987, $2,093, $2,147, $2,224, $2,256, $2,328, $2,392, $2,441, $2,492

Gross Margin: $0, $4,317, $4,592, $4,637, $4,884, $5,009, $5,189, $5,265, $5,433, $5,581, $5,695, $5,815

Gross Margin %: 0.00%, 70.00%, 70.00%, 70.00%, 70.00%, 70.00%, 70.00%, 70.00%, 70.00%, 70.00%, 70.00%, 70.00%

Expenses

Payroll: $2,000, $4,050

Sales and Marketing and Other Expenses: $300

Depreciation: $1,083

Rent: $750

Utilities: $200

Insurance: $200

Payroll Taxes: 15%, $300, $608, $608, $608, $608, $608, $608, $608, $608, $608, $608

Other: $75

Total Operating Expenses: $4,908, $7,266, $7,266, $7,266, $7,266, $7,266, $7,266, $7,266, $7,266, $7,266, $7,266, $7,266

Profit Before Interest and Taxes: ($4,908), ($2,949), ($2,673), ($2,628), ($2,381), ($2,256), ($2,077), ($2,000), ($1,832), ($1,685), ($1,571), ($1,450)

EBITDA: ($3,825), ($1,866), ($1,590), ($1,545), ($1,298), ($1,173), ($994), ($917), ($749), ($602), ($488), ($367)

Interest Expense: $24, $190, $186, $181, $177, $172, $168, $163, $158, $154, $149, $145

Taxes Incurred: $0

Net Profit: ($4,932), ($3,139), ($2,859), ($2,809), ($2,558), ($2,428), ($2,244), ($2,163), ($1,991), ($1,838), ($1,720), ($1,595)

Net Profit/Sales: 0.00%, -50.91%, -43.58%, -42.41%, -36.66%, -33.93%, -30.28%, -28.76%, -25.65%, -23.06%, -21.14%, -19.20%

Pro Forma Cash Flow

Cash Received

Cash from Operations: $0, $6,167, $6,560, $6,625, $6,977, $7,156, $7,412, $7,522, $7,761, $7,973, $8,136, $8,307

Subtotal Cash from Operations: $0, $6,167, $6,560, $6,625, $6,977, $7,156, $7,412, $7,522, $7,761, $7,973, $8,136, $8,307

Additional Cash Received

Sales Tax, VAT, HST/GST Received: 0.00%

New Current Borrowing: $0, $20,000

New Investment Received: $10,000

Subtotal Cash Received: $10,000, $26,167, $6,560, $6,625, $6,977, $7,156, $7,412, $7,522, $7,761, $7,973, $8,136, $8,307

Expenditures

Expenditures from Operations

Cash Spending: $2,000, $4,050

Bill Payments: $4,304, $1,926, $4,177, $4,287, $4,305, $4,404, $4,454, $4,525, $4,554, $4,621, $4,680, $4,724

Subtotal Spent on Operations: $6,304, $5,976, $8,227, $8,337, $8,355, $8,454, $8,504, $8,575, $8,604, $8,671, $8,730, $8,774

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out: $0

Principal Repayment of Current Borrowing: $0, $0, $550, $550, $550, $550, $550, $550, $550, $550, $550, $550

Subtotal Cash Spent: $6,304, $5,976, $8,777, $8,887, $8,905, $9,004, $9,054, $9,125, $9,154, $9,221, $9,280, $9,324

Net Cash Flow: $3,696, $20,190, ($2,216), ($2,262), ($1,927), ($1,848), ($1,642), ($1,603), ($1,393), ($1,249), ($1,144), ($1,017)

Cash Balance: $8,685, $28,876, $26,659, $24,397, $22,470, $20,622, $18,981, $17,377, $15,985, $14,736, $13,592, $12,575

Pro Forma Balance Sheet

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Assets | Starting Balances | ||||||||||||

| Cash | $4,989 | $8,685 | $28,876 | $26,659 | $24,397 | $22,470 | $20,622 | $18,981 | $17,377 | $15,985 | $14,736 | $13,592 | $12,575 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $4,989 | $8,685 | $28,876 | $26,659 | $24,397 | $22,470 | $20,622 | $18,981 | $17,377 | $15,985 | $14,736 | $13,592 | $12,575 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $22,141 | $22,141 | $22,141 | $22,141 | $22,141 | $22,141 | $22,141 | $22,141 | $22,141 | $22,141 | $22,141 | $22,141 | $22,141 |

| Accumulated Depreciation | $8,989 | $10,072 | $11,155 | $12,238 | $13,321 | $14,404 | $15,487 | $16,570 | $17,653 | $18,736 | $19,819 | $20,902 | $21,985 |

| Total Long-term Assets | $13,152 | $12,069 | $10,986 | $9,903 | $8,820 | $7,737 | $6,654 | $5,571 | $4,488 | $3,405 | $2,322 | $1,239 | $156 |

| Total Assets | $18,141 | $20,754 | $39,862 | $36,562 | $33,217 | $30,207 | $27,276 | $24,552 | $21,865 | $19,390 | $17,058 | $14,831 | $12,731 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $4,242 | $1,787 | $4,034 | $4,144 | $4,158 | $4,256 | $4,303 | $4,373 | $4,400 | $4,465 | $4,522 | $4,565 | $4,610 |

| Current Borrowing | $0 | $0 | $20,000 | $19,450 | $18,900 | $18,350 | $17,800 | $17,250 | $16,700 | $16,150 | $15,600 | $15,050 | $14,500 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $4,242 | $1,787 | $24,034 | $23,594 | $23,058 | $22,606 | $22,103 | $21,623 | $21,100 | $20,615 | $20,122 | $19,615 | $19,110 |

| Long-term Liabilities | $2,858 | $2,858 | $2,858 | $2,858 | $2,858 | $2,858 | $2,858 | $2,858 | $2,858 | $2,858 | $2,858 | $2,858 | $2,858 |

| Total Liabilities | $7,100 | $4,645 | $26,892 | $26,452 | $25,916 | $25,464 | $24,961 | $24,481 | $23,958 | $23,473 | $22,980 | $22,473 | $21,968 |

| Paid-in Capital | $0 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Retained Earnings | $11,041 | $11,041 | $11,041 | $11,041 | $11,041 | $11,041 | $11,041 | $11,041 | $11,041 | $11,041 | $11,041 | $11,041 | $11,041 |

| Earnings | $0 | ($4,932) | ($8,071) | ($10,930) | ($13,740) | ($16,298) | ($18,726) | ($20,970) | ($23,134) | ($25,125) | ($26,963) | ($28,683) | ($30,278) |

| Total Capital | $11,041 | $16,109 | $12,970 | $10,111 | $7,301 | $4,743 | $2,315 | $71 | ($2,093) | ($4,084) | ($5,922) | ($7,642) | ($9,237) |

| Total Liabilities and Capital | $18,141 | $20,754 | $39,862 | $36,562 | $33,217 | $30,207 | $27,276 | $24,552 | $21,865 | $19,390 | $17,058 | $14,831 | $12,731 |

| Net Worth | $11,041 | $16,109 | $12,970 | $10,111 | $7,301 | $4,743 | $2,315 | $71 | ($2,093) | ($4,084) | ($5,922) | ($7,642) | ($9,237) |

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Web Plan Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!