Rockin’ Roll is a bowling alley, karaoke lounge, gaming parlor, and restaurant owned by Pelvis Restley, the king of Rockin’ Roll. It specializes in legendary bowling, quality food, and an extensive collection of video games.

Bowling in Seattle has seen a decline in popularity over the past few decades, especially among senior citizens. The Baby-Boomers turned away from bowling, causing a decrease in the customer base. This lack of innovation led to the closure of many bowling alleys in Seattle, resulting in the loss of community centers and athletic events.

To revive the culture of bowling, Pelvis Restley recognizes the need for innovation and a reminder of its forgotten importance. He draws inspiration from his own experience as a participant in bowling and his work in the Professional Bowling Association.

At Rockin’ Roll, senior citizens are offered affordable prices through discounts, aimed at attract them to the establishment. By providing nostalgic features like plastic molded seats and playing the King’s music, the bowling alley aims to remind them of their childhood. Seniors will also have the opportunity to participate in organizing adult and teenage bowling leagues, recognizing their value and leadership potential.

Rockin’ Roll understands that customers in the entertainment industry are drawn to comfortable and affordable places. The establishment offers separate environments for seniors, youths, and bowling leaguers in the restaurant, lounge, gaming room, and bowling alley.

Affordability is a key aspect of Rockin’ Roll’s pricing strategy. Senior citizens receive discounts, youths enjoy low-cost foods and video games, and bowling leaguers benefit from tournament rates for nine games at a time.

Pelvis Restley’s experience as a bowler and a marketing and business analyst for the Professional Bowling Association gives him the ability to recruit local and national bowlers for leagues.

Customers are likely to visit Rockin’ Roll at the suggestion of their friends, as they tend to frequent familiar and comfortable places. Bowling leaguers, for example, may discover Rockin’ Roll when their friends invite them to join a nine-game league.

Once customers enter Rockin’ Roll, they will receive a royal treatment from Pelvis Restley. Their subsequent visits will be driven by the desire to meet friends and enjoy the comfortable environment of the bowling alley, restaurant, and lounge.

Pelvis Restley also plans to leverage his contacts within the Professional Bowling Association to organize televised touring tournaments. By the second year of operation, regular bowlers will introduce their friends to Rockin’ Roll. The establishment will further reward its loyal patrons during year two by offering them fame and fortune in the Bowling for Dollars televised tournament.

Teenagers are attracted to fun places where they can socialize with peers. Rockin’ Roll will cater to this demographic by hosting a teenagers’ bowling league on Saturday mornings. The establishment will also provide a sound-proofed fishbowl room with the latest video games, allowing teenagers to listen to their favorite tunes on the jukebox while their parents can keep an eye on them from the bowling lanes.

Parents will encourage their children to visit Rockin’ Roll because they can listen to their preferred music, bowl, and be confident that their children are in a safe environment. The restaurant will cater to youthful tastes, offering a variety of fried foods and healthy snacks.

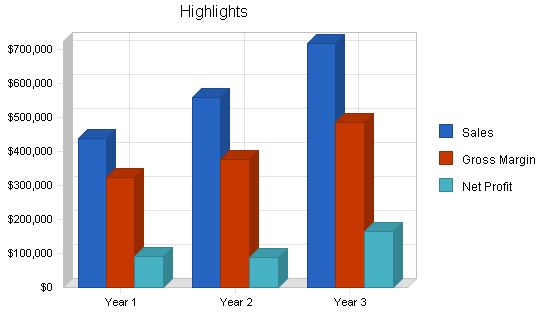

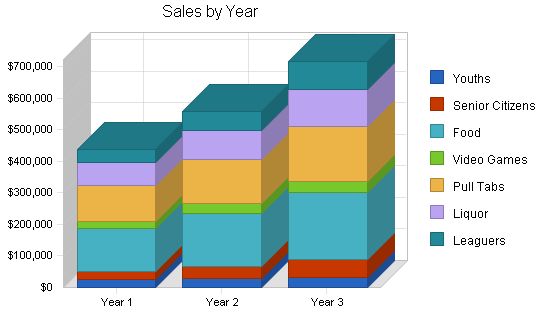

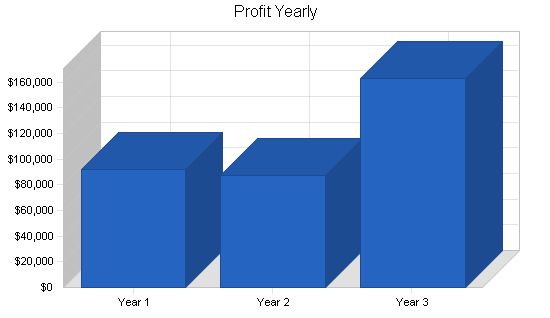

After three years of operation, Rockin’ Roll Bowling Lanes is projected to generate approximately $718,000 in total sales. As it gains popularity, the business will become more efficient and increase its profit margin, putting bowling back on the map as a popular form of entertainment in Fremont.

Contents

1.1 Mission

Rockin’ Roll aims to provide top-notch entertainment and quality dining to the Seattle community. We offer bowling, gambling, gaming, drinking, and singing.

1.2 Objectives

- Achieve sales of $437,570 in year one and $718,370 by year three.

- Maintain a gross margin higher than 65%.

- Attain a net income above 10% of sales by the third year.

1.3 Keys to Success

- Excellence in entertainment.

- Developing a loyal customer base.

- Expanding from a single league of bowlers to a city-wide following.

Company Summary

Rockin’ Roll is a classic bowling alley, karaoke lounge, gaming parlor, and restaurant owned by Pelvis Restley. Known as the king of Rockin’ Roll, Pelvis Restley’s establishment specializes in legendary bowling, quality food, and an extensive collection of video games.

2.1 Company Ownership

Rockin’ Roll is an incorporated, closely held corporation based in the state of Washington. It operates in King County with Pelvis Restley as its principal shareholder.

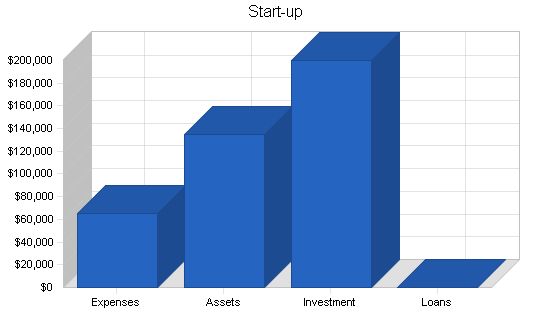

2.2 Start-up Summary

The start-up costs for Rockin’ Roll will cover all bowling alley equipment, restaurant supplies, inventory, and daily bank transactions to cover winnings from pull-tabs. The bowling lanes and restaurant equipment will comprise the majority of the start-up expenses, including 16 hardwood bowling lanes, 180 pins, 8 electronic scoring terminals, a commercial range and oven, a walk-in refrigerator, video games, pull tab equipment, and a sink with dishwasher. Advertising expenses will include television ads and Yellow Pages advertisements.

Start-up Requirements

Start-up Expenses:

– Legal Costs: $1,000

– Consulting: $1,000

– Construction: $20,000

– Advertising: $3,000

– Rent: $40,000

– Total Start-up Expenses: $65,000

Start-up Assets:

– Cash Required: $50,000

– Start-up Inventory: $7,000

– Other Current Assets: $0

– Long-term Assets: $77,900

– Total Assets: $134,900

Total Requirements: $199,900

Start-up Funding

Start-up Expenses to Fund: $65,000

Start-up Assets to Fund: $134,900

Total Funding Required: $199,900

Assets

– Non-cash Assets from Start-up: $84,900

– Cash Requirements from Start-up: $50,000

– Additional Cash Raised: $100

– Cash Balance on Starting Date: $50,100

– Total Assets: $135,000

Liabilities and Capital

Liabilities

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

Capital

– Planned Investment

– Investor 1: $100,000

– Investor 2: $100,000

– Additional Investment Requirement: $0

– Total Planned Investment: $200,000

– Loss at Start-up (Start-up Expenses): ($65,000)

– Total Capital: $135,000

Total Capital and Liabilities: $135,000

Total Funding: $200,000

Services

Rockin’ Roll will provide services to three groups:

1. Bowling Leaguers: Rockin’ Roll will offer nine game leagues to local bowling teams and host televised tournaments.

2. Youths: Rockin’ Roll will introduce the bowling league experience to youths through Saturday morning teen leagues and provide video games and snacks.

3. Elders: Rockin’ Roll will offer senior discounts and create a comfortable and nostalgic atmosphere for seniors.

Market Analysis Summary

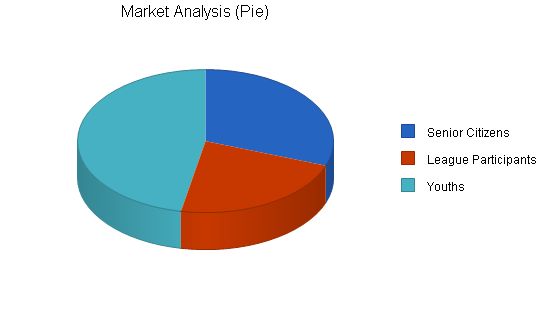

Rockin’ Roll customers can be divided into three groups: bowling leaguers, youths, and seniors.

1. Bowling Leaguers: These customers will be introduced to Rockin’ Roll bowling by friends and will become regulars. Rockin’ Roll will also access contacts within the Professional Bowling Association for touring tournaments.

2. Youths: Teenagers will be attracted to Rockin’ Roll for the bowling leagues and video games. Parents will feel secure knowing their children are nearby.

3. Seniors: Seniors will visit Rockin’ Roll for the affordable prices and nostalgic atmosphere. They will be reminded of their youth and can participate in organizing the leagues.

Market Segmentation

Bowling Leaguers will be recruited from workplaces, social events, and clubs. They will be of varying age ranges.

Youths will be under twenty-one years old and provide a consistent customer base.

Seniors will be over sixty-two years old and contribute to the customer base and league organization.

Market Analysis:

Potential Customers Growth CAGR

Senior Citizens 50% 15,000 22,500 33,750 50,625 75,938 50.00%

League Participants 50% 11,000 16,500 24,750 37,125 55,688 50.00%

Youths 8% 23,000 24,840 26,827 28,973 31,291 8.00%

Total 35.03% 49,000 63,840 85,327 116,723 162,917 35.03%

4.2 Target Market Segment Strategy

Rockin’ Roll Bowling Lanes will target bowling leaguers for two reasons:

1. Bowling leagues develop a core group of customers who identify with Rockin’ Roll Bowling Lanes for social and athletic events. This group will introduce their friends to the venue for other occasions.

2. Rockin’ Roll’s expertise lies in bowling packaged with its unique flavor. The nine game bowling league tournament will create an atmosphere of athletic competition and give winners fame and spending cash. Increased interest will support more tournaments, leading to further growth. The tournaments will culminate in a Bowling for Dollars televised tournament by year two.

Rockin’ Roll will also focus on youths for two reasons:

1. Bowling alleys are few places where underage customers can congregate and find entertainment.

2. Targeting youths and teaching them to bowl will develop a future customer base.

Rockin’ Roll will cater to senior citizens because they are consistent customers. Once they find an affordable and comfortable place, seniors will return. Seniors also tend to congregate together, which will lead to exponential growth as the Baby-Boomers become the majority of the population. An added value is that senior citizens may contribute low-cost labor as volunteers for bowling league events.

4.3 Service Business Analysis

Bowling in Seattle has seen a decline in customer base over the past few decades, with the Baby-Boomers turning away from the sport. Rockin’ Roll Bowling Lanes aims to revitalize the bowling culture by offering comfort, affordability, and reminders of the forgotten culture of bowling. Pelvis Restley’s experience in the Professional Bowling Association and as a participant in local bowling championships gives him an advantage in understanding the trend of revitalization.

Customers in the entertainment industry flock to the most comfortable and affordable place they know. Rockin’ Roll offers separate environments for seniors, youths, and bowlers. It also provides affordable prices through senior citizen discounts, low-cost foods, and video games. Pelvis’ contacts in the local bowling community and the Professional Bowling Association further contribute to Rockin’ Roll’s advantage.

4.3.1 Competition and Buying Patterns

Competition among bowling alleys for local customers is localized. Each urban district can support its own bowling alley. Being located in Fremont, Rockin’ Roll will enjoy the advantage of having no local competition in a densely populated, mixed-age area with good public transportation.

Bowling leaguers will contribute to the success and reputation of Rockin’ Roll Bowling Lanes as they consistently choose the venue for their social events and athletic activities. Seniors will provide a consistent customer base. Youths will come for the video games and bring their parents. National competition depends on the reputation of the bowling alleys and bowlers. Pelvis’ experience in the Professional Bowling Association may lead to televised bowling tournaments, enhancing Rockin’ Roll’s reputation.

Strategy and Implementation Summary

Rockin’ Roll will focus on Fremont initially and then promote itself on a nationwide level as a venue for televised tournaments in the future. The target customers are bowling leaguers, senior citizens, and youths.

5.1 Competitive Edge

Rockin’ Roll’s competitive edge will be based on experience and reputation:

1. Pelvis has experience in the local bowling community and as a marketing and business analyst for the Professional Bowling Association. This allows him to contact local and national bowlers for recruitment.

2. Rockin’ Roll will have the reputation of being the most affordable, comfortable, and convenient entertainment venue.

Marketing will focus on reputation for quality bowling facilities and entertainment. Pelvis’ contacts in the bowling industry and efforts to develop reputation in local communities will be key. A database of people in bowling leagues will be maintained for regular contact through mailings, additional tournaments, and market research reports.

5.3 Sales Strategy

Organizing nine-game league tournaments and advertising senior citizen discounts will broaden the market to customers outside the traditional bowling market. A database of contact information and sales data will optimize services to our target customers during league hours. Reduced prices will be offered to senior citizens during low-volume hours. Advertisements targeting teenagers will be placed in local papers.

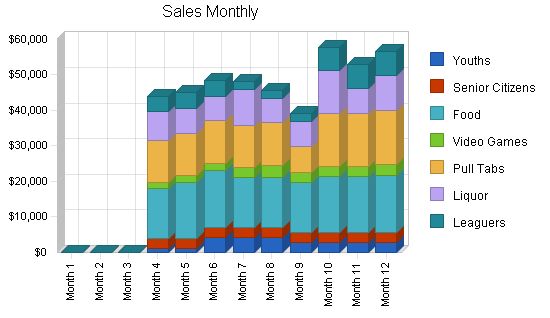

5.3.1 Sales Forecast

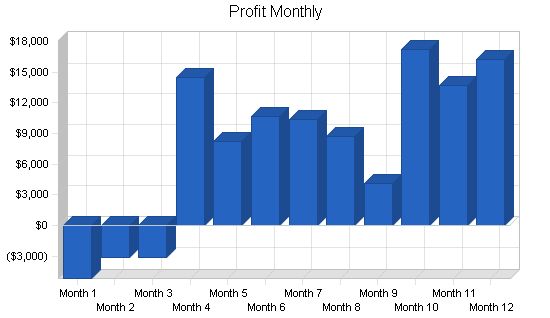

The first month will be spent setting up the bowling alley, gaming room, restaurant, and lounge. By month four, Rockin’ Roll Bowling Lanes will be servicing actual customers and hosting bowling leagues.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Youths | $26,200 | $28,296 | $30,560 |

| Senior Citizens | $25,920 | $38,880 | $58,320 |

| Food | $135,250 | $169,063 | $211,328 |

| Video Games | $23,100 | $28,875 | $36,094 |

| Pull Tabs | $112,500 | $140,625 | $175,781 |

| Liquor | $75,000 | $93,750 | $117,188 |

| Leaguers | $39,600 | $59,400 | $89,100 |

| Total Sales | $437,570 | $558,889 | $718,370 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Youths | $4,320 | $7,074 | $7,640 |

| Senior Citizens | $3,816 | $9,720 | $14,580 |

| Food | $90,000 | $84,531 | $105,664 |

| Video Games | $4,500 | $7,219 | $9,023 |

| Pull Tabs | $3,600 | $35,156 | $43,945 |

| Liquor | $864 | $23,438 | $29,297 |

| Leaguers | $5,850 | $14,850 | $22,275 |

| Subtotal Direct Cost of Sales | $112,950 | $181,988 | $232,425 |

5.4 Milestones

The table lists program milestones, managers in charge, and budgets for each. The milestone schedule emphasizes planning for implementation. Our business plan includes provisions for plan-vs.-actual analysis, and we will hold monthly follow-up meetings to discuss variance and course corrections.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan Completion | 1/1/2003 | 2/1/2003 | $0 | President Pelvis | Executive |

| Lease Complete for Property | 1/1/2003 | 4/1/2003 | $0 | President Pelvis | Executive |

| Completion of First Nine Game League | 4/1/2003 | 6/15/2003 | $0 | President Pelvis | Marketing |

| Completion of First Marketing Campaign | 1/1/2003 | 4/1/2003 | $500 | Bowling League Organizer | Marketing |

| Profitability | 1/1/2003 | 1/1/2004 | $0 | President Pelvis | Accounting |

| First 1,000 Customers | 4/1/2003 | 6/1/2003 | $0 | President Pelvis | Marketing |

| Totals | $500 | ||||

Management Summary

Rockin’ Roll Bowling Lanes is a Washington Corporation founded and run by Pelvis Restley. Pelvis Restley graduated from the University of Washington with degrees in Business and Communications. While at the University of Washington, Pelvis was president of both the bowling club and his fraternity, Delta Tau Delta. Through the University of Washington bowling club, Pelvis gained local notoriety as a champion bowler. Since graduation, Pelvis joined the Professional Bowler’s Association and worked as its treasurer for three years. While working for the Professional Bowler’s Association, Pelvis developed budgets and marketing campaigns with television networks and bowling leagues.

One of Pelvis Restley’s strengths was drawing crowds and increasing local league membership. After three years, Pelvis decided to retire from the Professional Bowling Association and start his own bowling alley. Pelvis brought fellow leaguers over to his alley, helping Rockin’ Roll Bowling Lanes start from the beginning.

6.1 Personnel Plan

Initially, the staff will consist of Pelvis working full-time. In addition, a full-time bartender, kitchen manager, cashier, part-time lane maintenance specialist, and part-time league manager will join Pelvis for the opening of the bowling alley, restaurant, and lounge.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Pelvis | $36,000 | $36,000 | $36,000 |

| Kitchen Manager | $18,000 | $24,000 | $24,000 |

| Lane Maintenance | $5,760 | $7,680 | $7,680 |

| League Manager | $5,760 | $7,680 | $7,680 |

| Cashier | $10,080 | $13,440 | $13,440 |

| Bartender | $10,080 | $13,440 | $13,440 |

| Total People | 6 | 6 | 6 |

| Total Payroll | $85,680 | $102,240 | $102,240 |

– Rockin’ Roll Bowling Lanes aims to attract local bowling leaguers, youths, and senior citizens. This will require advertising on local radio shows, cable networks, and reaching out to businesses, clubs, and bowlers.

– The most important factor is getting customers in the door. Once they come in, they will be personally greeted by Pelvis Restley to make them feel comfortable and keep them coming back.

– Start-up capital is assumed to be $200,000.

7.1 Important Assumptions

The financial plan depends on important assumptions, most of which are shown in the following table as annual assumptions. Monthly assumptions are included in the appendix. We recognize the criticality of attracting youths and seniors but acknowledge the challenge in influencing them. We plan to advertise to seniors and youths and address this issue. Bowling league participation rates are based on conservative assumptions.

Two important underlying assumptions are:

1. Youths, seniors, and adult bowlers will gather at Rockin’ Roll Bowling Lanes in separate environments to enjoy their preferences in music.

2. There will be no unforeseen changes in the local bowling community that increase competition in Fremont.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

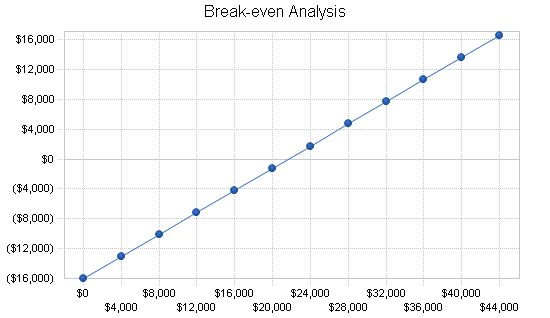

7.2 Break-even Analysis

The chart and table below summarize our break-even analysis. With fixed costs of $16,000 per month initially, we need to generate approximately $21,600 to break even, although we don’t expect to reach break-even until a few months into the business operation. The break-even assumes variable costs amounting to 25 percent of revenue.

Break-even Analysis

Monthly Revenue Break-even: $21,644

Assumptions:

– Average Percent Variable Cost: 26%

– Estimated Monthly Fixed Cost: $16,057

7.3 Projected Balance Sheet

The balance sheet in the table shows managed but sufficient growth of net worth and a healthy financial position. The monthly estimates are included in the appendix.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $174,603 $260,324 $431,807

Inventory $13,805 $22,243 $28,407

Other Current Assets $0 $0 $0

Total Current Assets $188,408 $282,567 $460,214

Long-term Assets

Long-term Assets $77,900 $77,900 $77,900

Accumulated Depreciation $7,788 $15,576 $23,364

Total Long-term Assets $70,112 $62,324 $54,536

Total Assets $258,520 $344,891 $514,750

Liabilities and Capital Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $31,162 $30,427 $37,094

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $31,162 $30,427 $37,094

Long-term Liabilities $0 $0 $0

Total Liabilities $31,162 $30,427 $37,094

Paid-in Capital $200,000 $200,000 $200,000

Retained Earnings ($65,000) $27,358 $114,464

Earnings $92,358 $87,106 $163,192

Total Capital $227,358 $314,464 $477,656

Total Liabilities and Capital $258,520 $344,891 $514,750

Net Worth $227,358 $314,464 $477,656

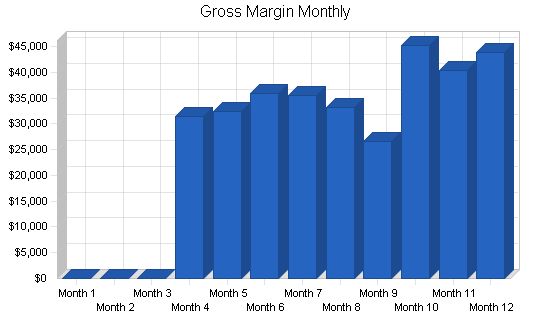

7.4 Projected Profit and Loss

The following table indicates the projected profit and loss.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $437,570 $558,889 $718,370

Direct Cost of Sales $112,950 $181,988 $232,425

Hidden Row $0 $0 $0

Total Cost of Sales $112,950 $181,988 $232,425

Gross Margin $324,620 $376,901 $485,946

Gross Margin % 74.19% 67.44% 67.65%

Expenses

Payroll $85,680 $102,240 $102,240

Sales and Marketing and Other Expenses $3,000 $3,000 $3,000

Depreciation $7,788 $7,788 $7,788

Rent $80,000 $120,000 $120,000

Utilities $3,360 $3,600 $3,900

Insurance $0 $500 $550

Payroll Taxes $12,852 $15,336 $15,336

Total Operating Expenses $192,680 $252,464 $252,814

Profit Before Interest and Taxes $131,940 $124,437 $233,132

EBITDA $139,728 $132,225 $240,920

Interest Expense $0 $0 $0

Taxes Incurred $39,582 $37,331 $69,940

Other Income

Interest Income $0 $0 $0

Other Income Account Name $0 $0 $0

Total Other Income $0 $0 $0

Other Expense

Account Name $0 $0 $0

Other Expense Account Name $0 $0 $0

Total Other Expense $0 $0 $0

Net Other Income $0 $0 $0

Net Profit $92,358 $87,106 $163,192

Net Profit/Sales 21.11% 15.59% 22.72%

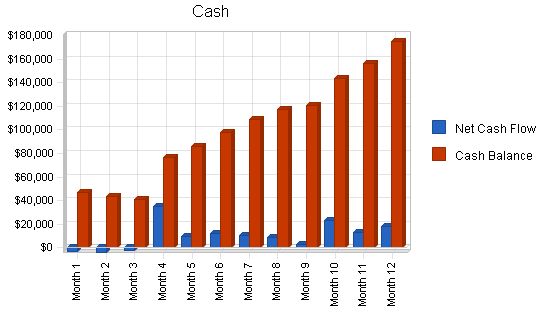

7.5 Projected Cash Flow

The following cash flow projections show the initial investment ($200,000).

Cash flow projections are critical to Rockin’ Roll’s success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month, and the other the monthly cash balance. The annual cash flow figures are included here and the more important detailed monthly numbers are included in the appendix.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $437,570 $558,889 $718,370

Subtotal Cash from Operations $437,570 $558,889 $718,370

Additional Cash Received

Non Operating (Other) Income $0 $0 $0

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $437,570 $558,889 $718,370

Expenditures

Expenditures from Operations

Cash Spending $85,680 $102,240 $102,240

Bill Payments $227,387 $370,928 $444,647

Subtotal Spent on Operations $313,067 $473,168 $546,887

Additional Cash Spent

Non Operating (Other) Expense $0 $0 $0

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $313,067 $473,168 $546,887

Net Cash Flow $124,503 $85,721 $171,483

Cash Balance $174,603 $260,324 $431,807

7.6 Business Ratios

The following table shows the projected businesses ratios. We expect to maintain healthy ratios for profitability, risk, and return.

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 27.73% 28.54% 0.11%

Percent of Total Assets

Inventory 5.34% 6.45% 5.52% 3.48%

Other Current Assets 0.00% 0.00% 0.00% 36.21%

Total Current Assets 72.88% 81.93% 89.41% 46.12%

Long-term Assets 27.12% 18.07% 10.59% 53.88%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 12.05% 8.82% 7.21% 15.99%

Long-term Liabilities 0.00% 0.00% 0.00% 26.89%

Total Liabilities 12.05% 8.82% 7.21% 42.88%

Net Worth 87.95% 91.18% 92.79% 57.12%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 74.19% 67.44% 67.65% 100.00%

Selling, General & Administrative Expenses 46.09% 47.32% 36.86% 75.02%

Advertising Expenses 0.00% 0.00% 0.00% 3.53%

Profit Before Interest and Taxes 30.15% 22.27% 32.45% 1.62%

Main Ratios

Current 6.05 9.29 12.41 1.74

Quick 5.60 8.56 11.64 1.18

Total Debt to Total Assets 12.05% 8.82% 7.21% 54.33%

Pre-tax Return on Net Worth 58.03% 39.57% 48.81% 1.54%

Pre-tax Return on Assets 51.04% 36.08% 45.29% 3.37%

Additional Ratios

Net Profit Margin 21.11% 15.59% 22.72% n.a

Return on Equity 40.62% 27.70% 34.17% n.a

Activity Ratios

Inventory Turnover 9.33 10.10 9.18 n.a

Accounts Payable Turnover 8.30 12.17 12.17 n.a

Payment Days 28 30 27 n.a

Total Asset Turnover 1.69 1.62 1.40 n.a

Debt Ratios

Debt to Net Worth 0.14 0.10 0.08 n.a

Current Liab. to Liab. 1.00 1.00 1.00 n.a

Liquidity Ratios

Net Working Capital $157,246 $252,140 $423,120 n.a

Interest Coverage 0.00 0.00 0.00 n.a

Additional Ratios

Assets to Sales 0.59 0.62 0.72 n.a

Current Debt/Total Assets 12% 9% 7% n.a

Acid Test 5.60 8.56 11.64 n.a

Sales/Net Worth 1.92 1.78 1.50 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales

Youths 0% $0 $0 $0 $1,200 $1,200 $4,200 $4,200 $4,200 $2,800 $2,800 $2,800 $2,800

Senior Citizens 0% $0 $0 $0 $2,880 $2,880 $2,880 $2,880 $2,880 $2,880 $2,880 $2,880 $2,880

Food 0% $0 $0 $0 $14,000 $15,750 $16,000 $14,000 $14,000 $14,000 $15,750 $15,750 $16,000

Video Games 0% $0 $0 $0 $1,500 $1,800 $2,000 $2,800 $3,400 $2,800 $2,800 $2,800 $3,200

Pull Tabs 0% $0 $0 $0 $12,000 $12,000 $12,000 $12,000 $12,000 $7,500 $15,000 $15,000 $15,000

Liquor 0% $0 $0 $0 $8,000 $7,000 $7,000 $10,000 $7,000 $7,000 $12,000 $7,000 $10,000

Leaguers 0% $0 $0 $0 $4,400 $4,400 $4,400 $2,200 $2,200 $2,200 $6,600 $6,600 $6,600

Total Sales $0 $0 $0 $43,980 $45,030 $48,480 $48,080 $45,680 $39,180 $57,830 $52,830 $56,480

Direct Cost of Sales

Youths $0 $0 $0 $480 $480 $480 $480 $480 $480 $480 $480 $480 $480

Senior Citizens $0 $0 $0 $424 $424 $424 $424 $424 $424 $424 $424 $424 $424

Food $0 $0 $0 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000

Video Games $0 $0 $0 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500

Pull Tabs $0 $0 $0 $400 $400 $400 $400 $400 $400 $400 $400 $400 $400

Liquor $0 $0 $0 $96 $96 $96 $96 $96 $96 $96 $96 $96 $96

Leaguers $0 $0 $0 $650 $650 $650 $650 $650

General Assumptions:

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $0 | $0 | $43,980 | $45,030 | $48,480 | $48,080 | $45,680 | $39,180 | $57,830 | $52,830 | $56,480 | |

| Direct Cost of Sales | $0 | $0 | $0 | $12,550 | $12,550 | $12,550 | $12,550 | $12,550 | $12,550 | $12,550 | $12,550 | $12,550 | |

| Gross Margin | $0 | $0 | $0 | $31,430 | $32,480 | $35,930 | $35,530 | $33,130 | $26,630 | $45,280 | $40,280 | $43,930 | |

| Gross Margin % | 0.00% | 0.00% | 0.00% | 71.46% | 72.13% | 74.11% | 73.90% | 72.53% | 67.97% | 78.30% | 76.24% | 77.78% | |

| Expenses | |||||||||||||

| Payroll | $3,000 | $3,000 | $3,000 | $8,520 | $8,520 | $8,520 | $8,520 | $8,520 | $8,520 | $8,520 | $8,520 | $8,520 | |

| Sales and Marketing and Other Expenses | $3,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Depreciation | $649 | $649 | $649 | $649 | $649 | $649 | $649 | $649 | $649 | $649 | $649 | $649 | |

| Rent | $0 | $0 | $0 | $0 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Utilities | $280 | $280 | $280 | $280 | $280 | $280 | $280 | $280 | $280 | $280 | $280 | $280 | |

| Insurance | 15% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Payroll Taxes | 15% | $450 | $450 | $450 | $1,278 | $1,278 | $1,278 | $1,278 | $1,278 | $1,278 | $1,278 | $1,278 | $1,278 |

| Total Operating Expenses | $7,379 | $4,379 | $4,379 | $10,727 | $20,727 | $20,727 | $20,727 | $20,727 | $20,727 | $20,727 | $20,727 | $20,727 | |

| Profit Before Interest and Taxes | ($7,379) | ($4,379) | ($4,379) | $20,703 | $11,753 | $15,203 | $14,803 | $12,403 | $5,903 | $24,553 | $19,553 | $23,203 | |

| EBITDA | ($6,730) | ($3,730) | ($3,730) | $21,352 | $12,402 | $15,852 | $15,452 | $13,052 | $6,552 | $25,202 | $20,202 | $23,852 | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes Incurred | ($2,214) | ($1,314) | ($1,314) | $6,211 | $3,526 | $4,561 | $4,441 | $3,721 | $1,771 | $7,366 | $5,866 | $6,961 | |

| Other Income | |||||||||||||

| Interest Income | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Income Account Name | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Other Income | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Expense | |||||||||||||

| Account Name | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Expense Account Name | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Other Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Other Income | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($5,165) | ($3,065) | ($3,065) | $14,492 | $8,227 | $10,642 | $10,362 | $8,682 | $4,132 | $17,187 | $13,687 | $16,242 | |

| Net Profit/Sales | 0.00% | 0.00% | 0.00% | 32.95% | 18.27% | 21.95% | 21.55% | 19.01% | 10.55% | 29.72% | 25.91% | 28.76% | |

Pro Forma Cash Flow

Cash Received

Cash Sales

• Month 4: $43,980

• Month 5: $45,030

• Month 6: $48,480

• Month 7: $48,080

• Month 8: $45,680

• Month 9: $39,180

• Month 10: $57,830

• Month 11: $52,830

• Month 12: $56,480

Subtotal Cash from Operations

• Month 4: $43,980

• Month 5: $45,030

• Month 6: $48,480

• Month 7: $48,080

• Month 8: $45,680

• Month 9: $39,180

• Month 10: $57,830

• Month 11: $52,830

• Month 12: $56,480

Additional Cash Received

Non Operating (Other) Income

• Month 4-12: $0

Sales Tax, VAT, HST/GST Received

• Month 4-12: $0

New Current Borrowing

• Month 4-12: $0

New Other Liabilities (interest-free)

• Month 4-12: $0

New Long-term Liabilities

• Month 4-12: $0

Sales of Other Current Assets

• Month 4-12: $0

Sales of Long-term Assets

• Month 4-12: $0

New Investment Received

• Month 4-12: $0

Subtotal Cash Received

• Month 4: $43,980

• Month 5: $45,030

• Month 6: $48,480

• Month 7: $48,080

• Month 8: $45,680

• Month 9: $39,180

• Month 10: $57,830

• Month 11: $52,830

• Month 12: $56,480

Expenditures

Expenditures from Operations

Cash Spending

• Month 1-3: $3,000

• Month 4-12: $8,520

Bill Payments

• Month 1: $51

• Month 2: $882

• Month 3: ($1,148)

• Month 4: $340

• Month 5: $27,141

• Month 6: $27,668

• Month 7: $28,665

• Month 8: $28,525

• Month 9: $27,764

• Month 10: $26,065

• Month 11: $31,424

• Month 12: $30,010

Subtotal Spent on Operations

• Month 1: $3,051

• Month 2: $3,882

• Month 3: $1,852

• Month 4: $8,860

• Month 5: $35,661

• Month 6: $36,188

• Month 7: $37,185

• Month 8: $37,045

• Month 9: $36,284

• Month 10: $34,585

• Month 11: $39,944

• Month 12: $38,530

Additional Cash Spent

Non Operating (Other) Expense

• Month 4-12: $0

Sales Tax, VAT, HST/GST Paid Out

• Month 4-12: $0

Principal Repayment of Current Borrowing

• Month 4-12: $0

Other Liabilities Principal Repayment

• Month 4-12: $0

Long-term Liabilities Principal Repayment

• Month 4-12: $0

Purchase Other Current Assets

• Month 4-12: $0

Purchase Long-term Assets

• Month 4-12: $0

Dividends

• Month 4-12: $0

Subtotal Cash Spent

• Month 1: $3,051

• Month 2: $3,882

• Month 3: $1,852

• Month 4: $8,860

• Month 5: $35,661

• Month 6: $36,188

• Month 7: $37,185

• Month 8: $37,045

• Month 9: $36,284

• Month 10: $34,585

• Month 11: $39,944

• Month 12: $38,530

Net Cash Flow

• Month 1: ($3,051)

• Month 2: ($3,882)

• Month 3: ($1,852)

• Month 4: $35,120

• Month 5: $9,369

• Month 6: $12,292

• Month 7: $10,895

• Month 8: $8,635

• Month 9: $2,896

• Month 10: $23,245

• Month 11: $12,886

• Month 12: $17,950

Cash Balance

• Month 1: $47,049

• Month 2: $43,167

• Month 3: $41,315

• Month 4: $76,435

• Month 5: $85,805

• Month 6: $98,096

• Month 7: $108,991

• Month 8: $117,626

• Month 9: $120,522

• Month 10: $143,767

• Month 11: $156,653

• Month 12: $174,603

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!