University Patents specializes in transferring technology from research universities to existing companies through patent licensing. While some universities excel in this area, many lack the resources and connections to effectively place patents. University Patents not only helps universities with technology placement, but also increases their revenue by writing more licenses. We earn income by taking a commission for each successful placement.

University-generated patents typically can’t sustain a business on their own. They are most valuable to existing companies that can use them to expand their product line or diversify their business. These patents are not of interest to most venture capital firms, and universities are reluctant to spend time on them. University Patents focuses on these smaller patents and aims to bring multiple patents to market each year.

Our business is built on collaborating with universities to place their technology patents with corporations. We research the market, develop a value model, and identify potential licensees. We then facilitate negotiations and earn a commission based on the licensing agreement and future royalties.

Contents

1.1 Objectives

First year objectives:

- Establish relationships with four university programs.

- Commercialize four patents.

- Create a contact process for approaching public and private businesses within six months.

Company Summary

"University Patents matches intellectual property owners with technology users to generate profitable outcomes for both parties."

University Patents acts as a technology transfer conduit between universities and the business sector, specializing in licensing. The company conducts active research on patented technologies to identify potential applications and reaches out to relevant companies in those sectors.

University Patents distinguishes itself through its focused approach. Firstly, it targets patents that cannot independently sustain a business, allowing it to avoid direct competition with venture capital groups. Secondly, it seeks out universities with limited or no staff dedicated to licensing within their technology office. Through its experience in researching, promoting, and writing multiple licenses a year, University Patents becomes an asset to these universities, which traditionally only produce an average of six licenses annually.

University Patents positions itself as a partner of the university, aiding in the transfer of protected technologies to the private sector. In this role, it serves as an intermediary in negotiations and receives a percentage of the annual cash flows provided by the licensing agreement.

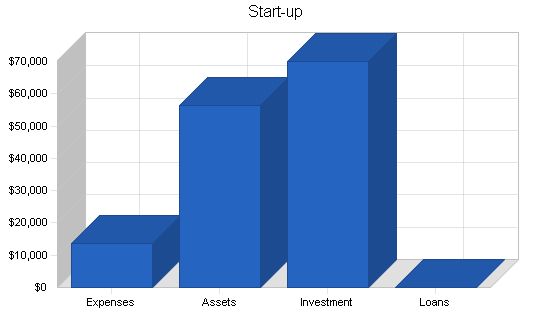

2.1 Start-up Summary

All start-up expenses will be financed by the founders personally, either out-of-pocket or through personal debt.

Start-up Funding

Start-up Expenses to Fund: $13,750

Start-up Assets to Fund: $56,250

Total Funding Required: $70,000

Assets:

Non-cash Assets from Start-up: $0

Cash Requirements from Start-up: $56,250

Additional Cash Raised: $0

Cash Balance on Starting Date: $56,250

Total Assets: $56,250

Liabilities and Capital:

Liabilities:

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital:

Planned Investment

Founders: $70,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $70,000

Loss at Start-up (Start-up Expenses): ($13,750)

Total Capital: $56,250

Total Capital and Liabilities: $56,250

Total Funding: $70,000

Start-up Requirements:

Start-up Expenses:

Computers (3): $3,600

Office Furniture (Home Offices – 3): $5,000

Business Supplies: $1,200

Legal: $2,500

ISP Installation Fees: $450

Information Sources (Access Fee): $500

Professional Logo Design: $500

Total Start-up Expenses: $13,750

Start-up Assets:

Cash Required: $56,250

Other Current Assets: $0

Long-term Assets: $0

Total Assets: $56,250

Total Requirements: $70,000

Company Ownership

University Patents will be started as a Limited Liability Corporation (LLC) owned by Anderson, Bradbeer, and Sorge. The company will initially be operated part-time by the owners in separate locations until the revenue can support a full-time staff. Funding will be provided by the founders. The founders may explore additional funding options but will retain at least 80% ownership of the company.

Services

University Patents offers one main service: brokering patented technologies to the commercial sector. The company focuses on technologies that can be licensed to multiple businesses but cannot sustain a business independently. University Patents uses two approaches to sell technology: brokering patents from client universities and conducting specific technology searches for commercial customers.

The first approach is a licensee-search service that involves analyzing the technology’s applications across various sectors, developing a list of prospective companies, and initiating contact. University Patents works with the university and potential licensee to value the technology and negotiate the agreement. The company earns a percentage of the revenue from each license.

The second approach is a specific technology search. University Patents searches various universities’ projects to find relevant technologies for businesses in need. If an exact match is not found, the company tries to connect the business with a university that specializes in the specific field for potential research funding. University Patents is paid a flat finders fee for these services.

Competitive Comparison

Direct:

University offices of technology – These offices perform similar functions, but University Patents believes it can perform sales and marketing more effectively and efficiently due to its industry contacts and resources. Most universities use in-house methods for licensing.

Competitive Technologies, Inc. – As a private company, CT is a direct competitor providing licensing services. However, their business model has weaknesses, evidenced by high legal expenses and losses. University Patents focuses solely on facilitating licensing agreements and does not involve itself in enforcing patent protections.

Indirect:

Venture capital groups – While venture capitalists focus on technologies that support start-up ventures, University Patents focuses on technologies that improve or supplement existing technologies. They are not a direct competitor, but there is a possibility of VC groups entering this market.

Emerging

Web-based sites – University Patents believes it has an advantage over emerging web-based sites because it has active sales, marketing, and networking staff. Passive sites do not provide these services.

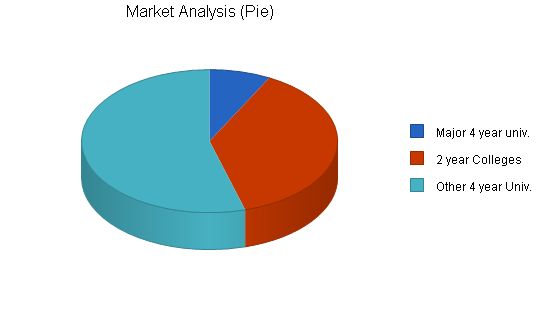

Market Analysis Summary

Market Size: According to the Association of University Technology Managers (AUTM) survey, there is a growing number of new patents and licenses each year. This indicates a need for licensing services.

Market Segmentation: There are approximately 2,920 higher learning institutions in the US, with the majority of research being done in four-year universities. Many universities have limited staff dedicated to creating licensing opportunities. These universities are prime targets for University Patents, as they generate significant revenue.

By eliminating redundant words and phrases, the text becomes more concise and easier to understand while conveying the same information.

Market Analysis:

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Major 4 year univ. 3% 224 231 238 245 252 2.99%

2 year Colleges 3% 1,106 1,139 1,173 1,208 1,244 2.98%

Other 4 year Univ. 3% 1,590 1,638 1,687 1,738 1,790 3.01%

Total 3.00% 2,920 3,008 3,098 3,191 3,286 3.00%

4.2 Target Market Segment Strategy:

With University Patents’ primary customers being universities, we will be encroaching on the responsibilities of their own offices of technology/research. However, through contacting the University of Notre Dame, Indiana University, Purdue University, the University of Idaho and researching the offices of technology at the University of Michigan and Michigan State University, we found that most university offices do not have the time and/or resources, nor the contacts in the business sector to effectively move new technology out to commercialization.

Strategy and Implementation Summary:

University Patents has identified four-year universities with research budgets under $100 million and smaller office of technology staffs as the primary target market. They are located throughout the geographic U.S. and these universities are the major source of research and patents awarded to higher-learning institutions in the U.S. There are approximately 940 institutions in this classification. University Patents will position itself not as a competitor to these universities’ offices of technology, but rather as a service provider and partner. As their partner, University Patents will use its network of business contacts to search out various uses of the new technology and customers in these fields willing to become licensees. Once a potential licensee is found, University Patents will take a mediator position and provide a base starting range for negotiations using our license calculation methods.

5.1 Competitive Edge:

University Patents’ initial competitive advantage will be its reduced cost structure. University Patents will be able to service multiple colleges and universities at a cost comparable to what each school would have to pay to effectively provide these services to only themselves. By spreading operating expenses over multiple clients, University Patents will create a competitive advantage over university technology offices.

Once University Patents has established itself, an additional competitive advantage will be its reputation for service to both the research institutions and commercial businesses. Universities will be able to contact University Patents and know that within weeks they will have a list of prospective licensees and contacts at each business. Businesses will be able to contact University Patents and know that our database will contain information about our client universities’ research projects available for licensing. University Patents will be the company to call by parties on both sides of the transaction. This is extremely important because these will be the only barriers to entry into the market.

University Patents will not bring the actual license writing in-house, as that would both entail further hiring of legal resources, which is not a core competency of this company, and possibly require University Patents to litigate in cases of patent infringement and/or license enforcement. University Patents will remain a patent broker.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

5.2 Marketing Strategy:

University Patents will initially target colleges and universities that have a current supply of marketable patents but a small office of technology (~five staff members or less). During the first year, University Patents would like to have at least four institutions from which to license patents. The benefits that University Patents will focus on providing these institutions are: income from previously dormant patents, status and recognition for their research, and a cost-effective way to transfer new technologies to the marketplace.

Initial contact to universities will be made through references from the University of Notre Dame Office of Research or other similar departments. This will provide the credibility that University Patents will need in the start-up phase of business. Contacts with commercial businesses will be made through any means necessary, as University Patents will begin compiling a database of contacts within multiple industries. It is at this point where we believe the technology and the developer will help with the eventual sale of the license. Assuming University Patents has a desirable technology to sell, the licensing income will soon follow.

Once University Patents has established itself as a legitimate player in the marketplace, University Patents expects to fund a full-time staff. University Patents will expand the number of universities that it will target and will be able to promote the network it has recently established. To these new customers, University Patents will provide value on two different levels. First, the network of private industry contacts will decrease the time-to-license and the number of licenses possible. Secondly, by using University Patents as an outsourcing resource, the universities can avoid the costs of a full-time staff.

The future vision for University Patents includes regional offices, each with their own expertise, such as pharmaceutical/chemistry, electronics, computer sciences, etc. This allows each office to provide a local point of contact to University Patents but also to avoid the duplication of services that would arise if it tried to service all industries in each office.

5.3 Sales Strategy:

University Patents will use the detailed information provided by the technology analysis to create a list of possible licensees. Using any personal contacts in the industry, we will make initial contact to set up a more formal meeting. Even for those contacts that do not become licensees, we will use the contact time for both contact mining for further possible license outlets and attempt to set up an informal relationship for future information gathering opportunities and licensee searches.

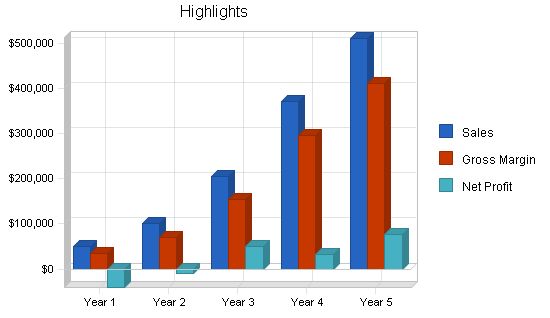

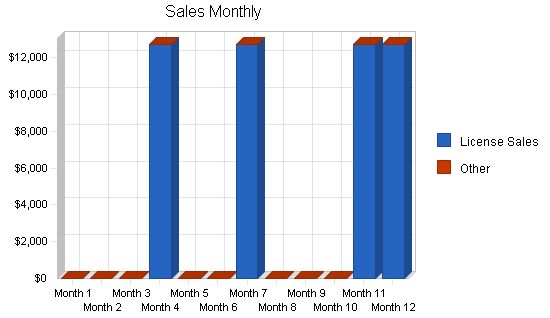

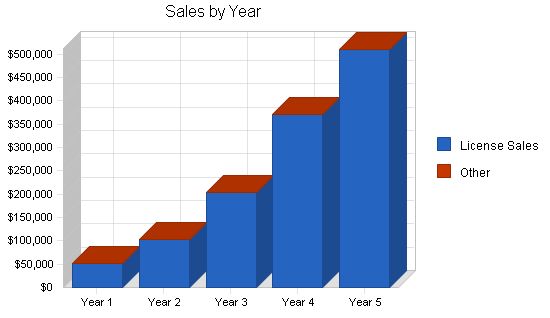

5.3.1 Sales Forecast:

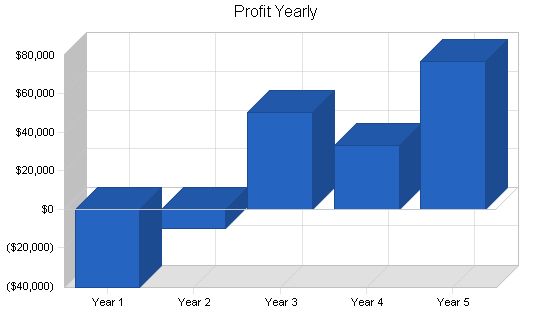

University Patents is planning on initial sales of four licenses written during Year 1. During Year 2, eight new licenses will be written and in Year 3, 16 new licenses. Years 4 and 5 expect growth of 13 and 11 additional new licenses per year respectively. This is possible as management begins concentrating on this business full-time.

– Income per license = $12,750

– First-year sales = 4 licenses

Sales Forecast:

| Sales Forecast | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| $51,000 | $102,000 | $204,000 | $369,750 | $510,000 | |

| $8,400 | $16,800 | $25,200 | $37,800 | $50,400 | |

| $4,000 | $8,000 | $12,000 | $18,000 | $24,000 | |

| $16,400 | $32,800 | $49,200 | $73,800 | $98,400 | |

5.4 Milestones:

– Four patents written in first year.

– Twelve active patents by end of Year 2 (this will provide University Patents with a positive cash flow for the fiscal year).

– Twenty nine active patents by end of Year 4 (provides enough future to sustain full-time employment for founders).

Management Summary:

Advisory Board

– Mr. Michael Edwards, ND Office of Technology: Experience with technology transfer between the university and the private sector. Also experienced with licensing patents and negotiations. Potential conflict of interest with being a future customer.

– Mr. James O’Brien, lawyer and ND professor: Expertise with intellectual property rights.

– Mr. Jeffrey Bernel, ND Professor and Gigot Center Advisor: Experience as a start-up business advisor and general management expertise. Also brings valuable perspective from the manufacturer sector, a group that we hope to include as future customers.

Advisory Board Gaps

– Technology Application: An individual with commercial network contacts from prior work in this field.

– Business-to-Business Marketing Advisor: Unidentified Sales/Marketing Representative.

6.1 Management Team:

– Tom Bradbeer, president, Southwest region director and founding partner. Nine years of high-tech experience with Intel Corp, including project management, database management, web application development, and customer support roles. Also has experience coaching Junior Olympic Volleyball teams and is completing an MBA at the University of Notre Dame.

– Jason Sorge, VP of market/sales, Northwest/Midwest region director and founding partner. Two years of finance experience at Agilent Technologies, creating financial models, training corporate personnel in asset accounting procedures, and researching and analyzing financial data supporting forecasting. Also involved in the development of a centralized customer service center at the University of Idaho. Currently completing an MBA at the University of Notre Dame.

– Matt Anderson, VP of finance/accounting, Southeast region director and founding partner. Three years of management in financial services, responsible for maintaining service relationships for 401(k) plans in excess of $2 billion at Merrill Lynch. Managed the Merrill Lynch stock options trading center for two years, receiving recognition and awards. Holds NASD Series 7 and 63 licenses and volunteers as a Certified Youth Minister for local parishes. Currently completing an MBA at the University of Notre Dame.

6.2 Management Team Gaps:

– Technical Knowledge: The current management team lacks an individual with an engineering/scientific background to help understand and effectively market the patented technology.

– Legal Expertise: The current management team lacks an individual with a legal background, which could impact the company’s ability to recognize possible forms of patent infringement.

– Marketing Experience: The current management team lacks an individual with extensive experience in B2B marketing.

6.3 Personnel Plan:

For the first four years, only the founding members will be employed by University Patents. Starting in Year 4, part-time or full-time help will be needed to allow management face time with universities and prospective licensees.

| Personnel Plan | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| $60,000 | $63,000 | $66,150 | $210,000 | $255,500 | |

| $0 | $0 | $0 | $0 | $0 | |

| 4 | 4 | 4 | 4 | 5 | |

| $60,000 | $63,000 | $66,150 | $210,000 | $255,500 | |

Important Assumptions

– University Patents will operate with regional offices out of the founders’ homes, without a formal brick and mortar location, into Year 4.

– The founders will be the only employees and work on a part-time basis during Years 1-3.

– The average license value to University Patents will be $12,750 (15% of the predicted $85,000 average revenue to the university).

– There will be a 10% loss of revenue from year to year due to un-renewed licenses.

| General Assumptions | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| 1 | 2 | 3 | 4 | 5 | |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| 0 | 0 | 0 | 0 | 0 | |

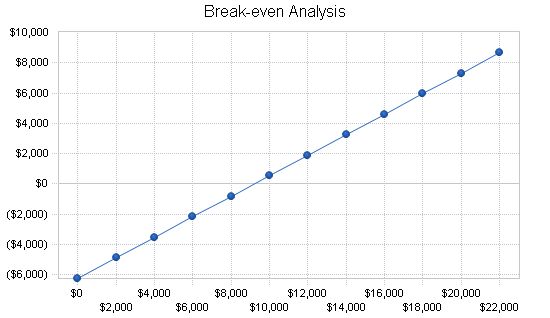

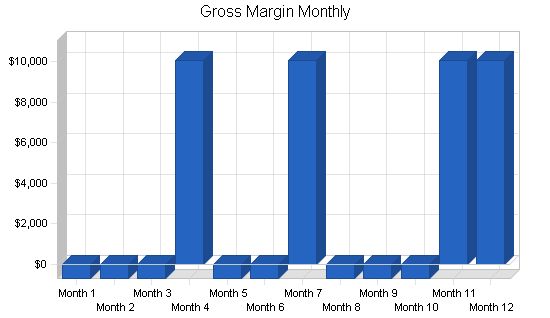

Break-even Analysis

The break-even point for University Patents is shown below.

Break-even Analysis

Monthly Revenue Break-even: $9,232

Assumptions:

– Average Percent Variable Cost: 32%

– Estimated Monthly Fixed Cost: $6,263

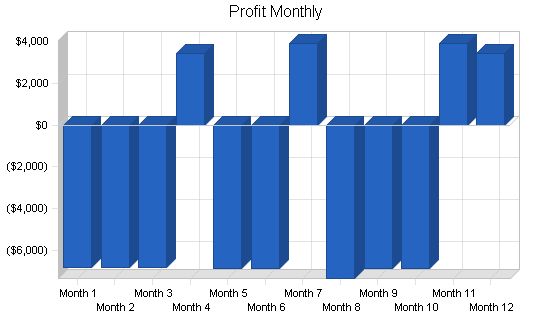

7.3 Projected Profit and Loss

The following is the Projected Profit and Loss for University Patents.

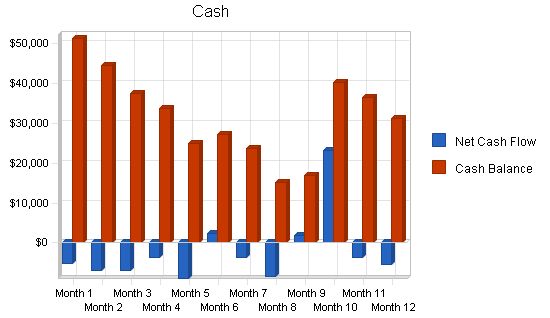

Projected Cash Flow for University Patents.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash Sales | $12,750 | $25,500 | $51,000 | $92,438 | $127,500 |

| Cash from Receivables | $19,444 | $57,694 | $115,388 | $216,192 | $330,783 |

| Subtotal Cash from Operations | $32,194 | $83,194 | $166,388 | $308,630 | $458,283 |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $30,000 | $30,000 | $0 | $0 | $0 |

| Subtotal Cash Received | $62,194 | $113,194 | $166,388 | $308,630 | $458,283 |

| Cash Spending | $60,000 | $63,000 | $66,150 | $210,000 | $255,500 |

| Bill Payments | $27,360 | $48,845 | $84,203 | $123,250 | $173,299 |

| Subtotal Spent on Operations | $87,360 | $111,845 | $150,353 | $333,250 | $428,799 |

| Net Cash Flow | ($25,166) | $1,349 | $16,034 | ($24,620) | $29,484 |

| Cash Balance | $31,084 | $32,433 | $48,467 | $23,847 | $53,331 |

Projected Balance Sheet

7.5 Projected Balance Sheet

The following is the Projected Balance Sheet for University Patents.

| Pro Forma Balance Sheet | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash | $31,084 | $32,433 | $48,467 | $23,847 | $53,331 |

| Accounts Receivable | $18,806 | $37,613 | $75,225 | $136,345 | $188,063 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $49,890 | $70,045 | $123,692 | $160,192 | $241,393 |

| Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $49,890 | $70,045 | $123,692 | $160,192 | $241,393 |

| Current Liabilities | $4,200 | $3,998 | $7,183 | $10,394 | $14,588 |

| Total Liabilities | $4,200 | $3,998 | $7,183 | $10,394 | $14,588 |

| Paid-in Capital | $100,000 | $130,000 | $130,000 | $130,000 | $130,000 |

| Retained Earnings | ($13,750) | ($54,310) | ($63,953) | ($13,491) | $19,798 |

| Total Capital | $45,690 | $66,047 | $116,509 | $149,798 | $226,805 |

| Total Liabilities and Capital | $49,890 | $70,045 | $123,692 | $160,192 | $241,393 |

| Net Worth | $45,690 | $66,047 | $116,509 | $149,798 | $226,805 |

7.6 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 8748, [Business Consulting, nec], are shown for comparison.

| Ratio Analysis | ||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Industry Profile | |

| Sales Growth | 0.00% | 100.00% | 100.00% | 81.25% | 37.93% | 8.18% |

| Accounts Receivable | 37.70% | 53.70% | 60.82% | 85.11% | 77.91% | 29.59% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 41.37% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 75.36% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 24.64% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 8.42% | 5.71% | 5.81% | 6.49% | 6.04% | 31.49% |

| Total Liabilities | 8.42% | 5.71% | 5.81% | 6.49% | 6.04% | 48.34% |

| Net Worth | 91.58% | 94.29% | 94.19% | 93.51% | 93.96% | 51.66% |

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 67.84% | 67.84% | 75.88% | 80.04% | 80.71% | 100.00% |

| Selling, General & Administrative Expenses | 147.37% | 77.30% | 51.15% | 71.04% | 65.61% | 82.59% |

| Profit Before Interest and Taxes | -79.53% | -9.45% | 35.34% | 12.86% | 21.57% | 1.47% |

| Net Profit Margin | -79.53% | -9.45% | 24.74% | 9.00% | 15.10% | n.a |

| Return on Equity | -88.77% | -14.60% | 43.31% | 22.22% | 33.95% | n.a |

|

License Sales: 0%, $0, $0, $0, $12,750, $0, $0, $12,750, $0, $0, $0, $12,750, $12,750 Other: 0%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Total Sales: $0, $0, $0, $12,750, $0, $0, $12,750, $0, $0, $0, $12,750, $12,750 Direct Cost of Sales Travel Cost Per License: $700, $700, $700, $700, $700, $700, $700, $700, $700, $700, $700, $700, $700 Demo Model: $0, $0, $0, $1,000, $0, $0, $1,000, $0, $0, $0, $1,000, $1,000 Legal: $0, $0, $0, $1,000, $0, $0, $1,000, $0, $0, $0, $1,000, $1,000 Subtotal Direct Cost of Sales: $700, $700, $700, $2,700, $700, $700, $2,700, $700, $700, $700, $2,700, $2,700 Personnel Plan Total Payroll: 0%, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000 Other: 0%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Total People: 4, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4 Total Payroll: $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000 Pro Forma Profit and Loss Sales: $0, $0, $0, $12,750, $0, $0, $12,750, $0, $0, $0, $12,750, $12,750 Direct Cost of Sales: $700, $700, $700, $2,700, $700, $700, $2,700, $700, $700, $700, $2,700, $2,700 Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Total Cost of Sales: $700, $700, $700, $2,700, $700, $700, $2,700, $700, $700, $700, $2,700, $2,700 Gross Margin: ($700), ($700), ($700), $10,050, ($700), ($700), $10,050, ($700), ($700), ($700), $10,050, $10,050 Gross Margin %: 0.00%, 0.00%, 0.00%, 78.82%, 0.00%, 0.00%, 78.82%, 0.00%, 0.00%, 0.00%, 78.82%, 78.82% Expenses Payroll: $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000 Sales and Marketing and Other Expenses: $0, $0, $0, $500, $0, $0, $0 Pro Forma Cash Flow Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Cash Received Cash Sales $0 $0 $0 $3,188 $0 $0 $3,188 $0 $0 $0 $3,188 $3,188 Cash from Receivables $0 $0 $0 $0 $319 $9,244 $0 $319 $9,244 $0 $0 $319 Subtotal Cash from Operations $0 $0 $0 $3,188 $319 $9,244 $3,188 $319 $9,244 $0 $3,188 $3,506 Additional Cash Received Sales Tax, VAT, HST/GST Received 0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Other Liabilities (interest-free) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Long-term Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Sales of Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Sales of Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 New Investment Received $0 $0 $0 $0 $0 $0 $0 $0 $0 $30,000 $0 $0 Subtotal Cash Received $0 $0 $0 $3,188 $319 $9,244 $3,188 $319 $9,244 $30,000 $3,188 $3,506 Expenditures Expenditures from Operations Cash Spending $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 Bill Payments $61 $1,830 $1,830 $1,913 $4,247 $1,840 $1,907 $3,790 $2,324 $1,845 $1,912 $3,862 Subtotal Spent on Operations $5,061 $6,830 $6,830 $6,913 $9,247 $6,840 $6,907 $8,790 $7,324 $6,845 $6,912 $8,862 Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Principal Repayment of Current Borrowing $0 $0 $0 $0 $

Business Plan Outline

|

||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!