Contents

Plumbing Business Plan

Water Tubes Plumbing is an Eugene-based plumbing company specializing in residential new homes. They are able to handle any plumbing service request for volume home builds or custom new homes. By focusing on this specific market, Water Tubes can quickly gain market share and showcase their expertise and professionalism.

Water Tubes will prioritize professionalism and high-quality work by training all their employees and impressing customers who are accustomed to lackadaisical plumbers. They will have a team of four employees and aim to become profitable by month eight.

1.1 Objectives

The objectives for the first three years of operation include:

– Develop a company exceeding customer’s expectations.

– Increase sales to hire another master plumber.

– Create a sustainable business surviving off its own cash flow.

1.2 Mission

Water Tubes Plumbing’s mission is to provide the finest new house plumbing installation, attracting and maintaining customers. Our services will exceed customer expectations.

1.3 Keys to Success

The keys to success are fair pricing and outstanding service.

Water Tubes Plumbing, located in Eugene, OR, offers plumbing services for residential new houses and custom new houses. The business operates from Don Roto’s house and has four employees.

2.1 Start-up Summary

Water Tubes requires the following equipment and materials:

– Two used trucks with a pipe rack.

– Assorted pipes, fittings, and a 30-gallon bucket.

– Pipe wrenches, reciprocating saw, circular saw, and a whole hog.

– Cordless screw gun, propane torch, and cast iron pipe cutter.

– Extension cords and pipe dope.

– Computer with CD-RW, printer, Microsoft Office, QuickBooks Pro.

– Desk, chair, filing cabinet, and assorted stationary.

– Mobile phone.

Note: Long-term assets will be depreciated using the straight-line method.

2.2 Company Ownership

Water Tubes Plumbing is owned by Don Roto.

Services

Water Tubes offers residential home plumbing construction and custom new home construction. Residential construction is chosen for its accuracy and minimal on-call hours. New construction is typically bid at $1 per foot plus $400 per fixture. Professionalism and trim quality are emphasized.

Market Analysis Summary

Water Tubes focuses on the plumbing market for new homes, targeting volume builders and custom builders. The company will increase visibility through networking activities and advertisements.

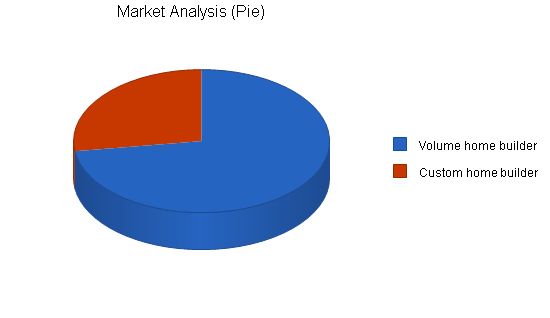

4.1 Market Segmentation

Water Tubes targets two segments in the plumbing market:

1. Volume residential home builders who need professional and reliable plumbers.

2. Custom home builders who require plumbing services for their unique projects.

Market Analysis:

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Volume home builder 7% 120 128 137 147 157 6.95%

Custom home builder 7% 45 48 51 55 59 7.01%

Total 6.97% 165 176 188 202 216 6.97%

4.2 Target Market Segment Strategy:

The plumbing market is highly networked, and jobs are won or lost based on relationships. Don will establish himself as an experienced plumber focusing on residential new builds. Networking with home builders will increase visibility for Water Tubes, as builders value professional, high-quality plumbers. Water Tubes will advertise in the local home builders journal.

4.3 Service Business Analysis:

The plumbing industry is state regulated based on the Universal Building Code. Plumbers have three skill levels: apprentice, journeyman, and master plumber. Work in the state requires a deposit into the workers’ compensation fund, acting as a bond for newly formed companies.

The work timetable for this niche involves rough-in, top-out, and trim stages.

Note: Water Tubes’ forecasted gross margin differs from industry averages due to repair plumbing skewing the ratio.

4.3.1 Competition and Buying Patterns:

The plumbing market is competitive, and builders typically give plumbers a trial job before forming long-term relationships. Competitors include chains, private companies, and large commercial and residential firms.

5.1 Competitive Edge:

Water Tubes leverages professionalism and trim quality as competitive advantages. The company ensures that all interactions with customers are positive and focuses on delivering high-quality finishes.

5.2 Marketing Strategy:

Water Tubes’ marketing campaign involves networking with builders and advertising in the local home builders journal, which has a targeted readership.

5.3 Sales Strategy:

Water Tubes aims to secure at least one job with a new builder to showcase their work. The company’s competitive edges in professionalism and trim quality are expected to turn prospective customers into long-term relationships.

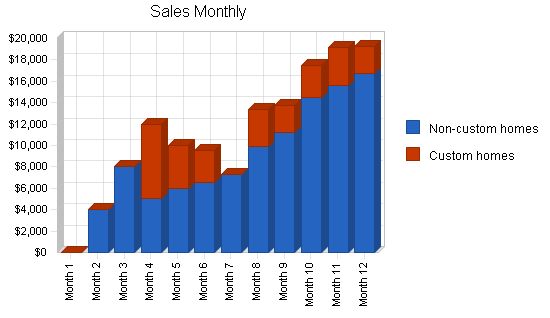

5.3.1 Sales Forecast:

The first month is for setting up the business, followed by training employees and undertaking multiple jobs. By the fourth month, Water Tubes expects to have volume relationships with builders and see a steady increase in sales activity.

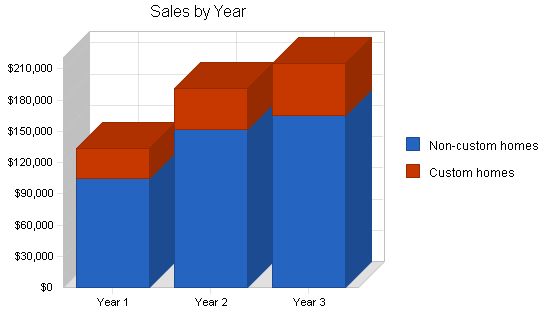

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Non-custom homes | $104,858 | $151,987 | $165,454 |

| Custom homes | $29,000 | $38,765 | $49,876 |

| Total Sales | $133,858 | $190,752 | $215,330 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Non-custom homes | $10,486 | $15,199 | $16,545 |

| Custom homes | $2,900 | $3,877 | $4,988 |

| Subtotal Direct Cost of Sales | $13,386 | $19,075 | $21,533 |

5.4 Milestones

Water Tubes will have several milestones:

- Business plan completion.

- Office set-up.

- Training of all employees.

- The establishment of the second volume home builder.

- Profitability.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 2/1/2001 | $0 | ABC | Marketing |

| Office set-up | 1/1/2001 | 2/1/2001 | $0 | ABC | Department |

| Training of all employees | 1/1/2001 | 4/1/2001 | $0 | ABC | Department |

| The establishment of the second volume home builder | 1/1/2001 | 7/1/2001 | $0 | ABC | Department |

| Profitability | 1/1/2001 | 9/1/2001 | $0 | ABC | Department |

| Totals | |||||

Management Summary

Don Roto received his Bachelor of Arts from the University of Portland. After college, Dan decided to learn more about plumbing, one of the odd jobs that he did in college. After six months of inconsistent work Don landed a job with a larger plumbing company that did both residential and commercial work. Don started as an apprentice, but within four months had passed his journeymen exam. Don continued to work for this company for ten years, receiving his master plumbing designation right at the ten year mark. At this point Don decided that he wanted to try operating his own company, leveraging skills learned in college as well as providing him the flexibility of being his own boss. It was at this point that he started writing the business plan for Water Tubes and eventually quit his job.

6.1 Personnel Plan

Don will be the only employee for the first month. Don will bring on board a second employee during month two, and two more employees on the third month. It is forecasted that Water Tubes will stay at four employees for the foreseeable future.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Don | $36,000 | $40,000 | $50,000 |

| Journeymen employee | $28,800 | $34,560 | $34,560 |

| Apprentice employee | $17,600 | $19,200 | $19,200 |

| Apprentice employee | $16,000 | $19,200 | $19,200 |

| Total People | 4 | 4 | 4 |

| Total Payroll | $98,400 | $112,960 | $122,960 |

Financial Plan

The following sections will outline important financial information.

7.1 Important Assumptions

The following table details important financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

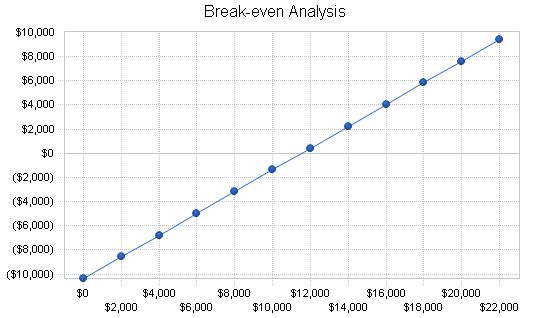

7.2 Break-even Analysis

The Break-even Analysis indicates what will be needed in monthly revenue to reach the break-even point.

Break-even Analysis:

Monthly Revenue Break-even: $11,520.

Assumptions:

– Average Percent Variable Cost: 10%.

– Estimated Monthly Fixed Cost: $10,368.

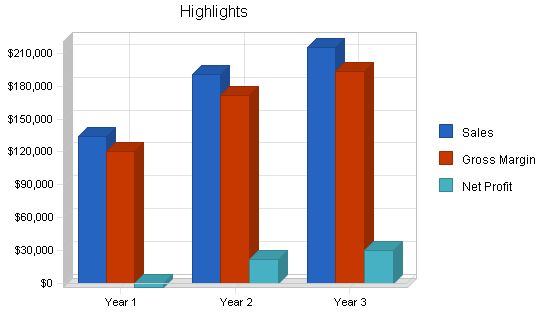

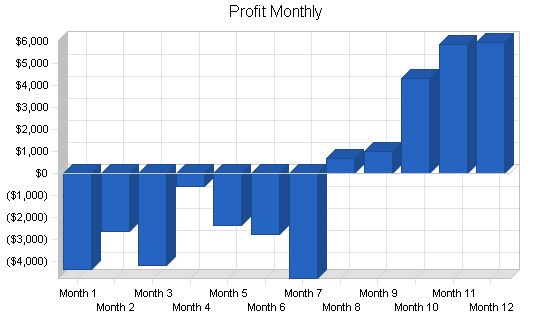

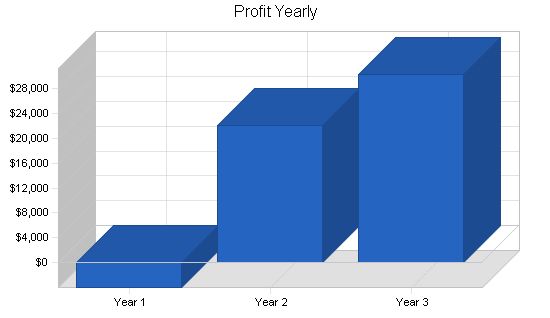

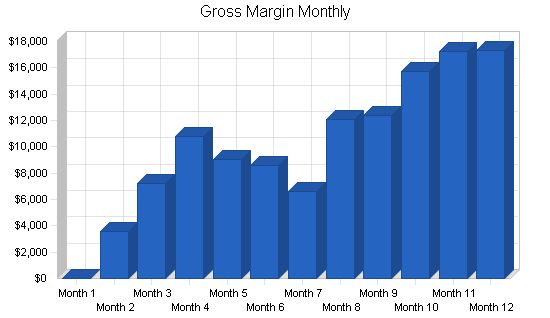

Projected Profit and Loss:

The table and charts present the projected profit and loss.

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3

Sales $133,858 $190,752 $215,330

Direct Cost of Sales $13,386 $19,075 $21,533

Other Production Expenses $0 $0 $0

Total Cost of Sales $13,386 $19,075 $21,533

Gross Margin $120,472 $171,677 $193,797

Gross Margin % 90.00% 90.00% 90.00%

Expenses

Payroll $98,400 $112,960 $122,960

Sales and Marketing and Other Expenses $1,800 $1,800 $1,800

Depreciation $3,456 $3,456 $3,456

Insurance/ License/ Bonds $6,000 $5,000 $4,000

Rent $0 $0 $0

Payroll Taxes $14,760 $16,944 $18,444

Other $0 $0 $0

Total Operating Expenses $124,416 $140,160 $150,660

Profit Before Interest and Taxes ($3,944) $31,517 $43,137

EBITDA ($488) $34,973 $46,593

Interest Expense $0 $0 $0

Taxes Incurred $0 $9,455 $12,941

Net Profit ($3,944) $22,062 $30,196

Net Profit/Sales -2.95% 11.57% 14.02%

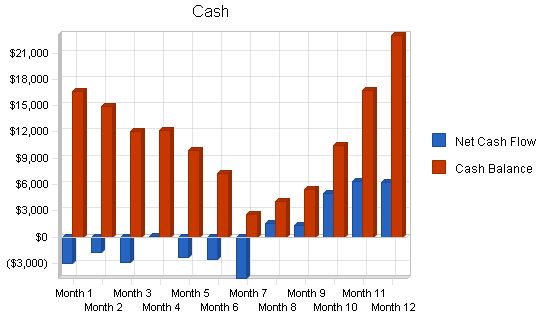

7.4 Projected Cash Flow:

The following chart and table display the projected cash flow.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash Sales $133,858 $190,752 $215,330

Subtotal Cash from Operations $133,858 $190,752 $215,330

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $133,858 $190,752 $215,330

Expenditures

Expenditures from Operations

Cash Spending $98,400 $112,960 $122,960

Bill Payments $32,139 $51,785 $58,188

Subtotal Spent on Operations $130,539 $164,745 $181,148

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $130,539 $164,745 $181,148

Net Cash Flow $3,319 $26,007 $34,182

Cash Balance $22,969 $48,976 $83,158

Projected Balance Sheet

Assets

Current Assets

Cash $22,969 $48,976 $83,158

Other Current Assets $0 $0 $0

Total Current Assets $22,969 $48,976 $83,158

Long-term Assets

Long-term Assets $24,000 $24,000 $24,000

Accumulated Depreciation $3,456 $6,912 $10,368

Total Long-term Assets $20,544 $17,088 $13,632

Total Assets $43,513 $66,064 $96,790

Liabilities and Capital

Current Liabilities

Accounts Payable $3,807 $4,297 $4,826

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $3,807 $4,297 $4,826

Long-term Liabilities $0 $0 $0

Total Liabilities $3,807 $4,297 $4,826

Paid-in Capital $44,000 $44,000 $44,000

Retained Earnings ($350) ($4,294) $17,768

Earnings ($3,944) $22,062 $30,196

Total Capital $39,706 $61,768 $91,964

Total Liabilities and Capital $43,513 $66,064 $96,790

Net Worth $39,706 $61,768 $91,964

Sales Growth 0.00% 42.50% 12.88% 6.60%

Percent of Total Assets

Other Current Assets 0.00% 0.00% 0.00% 29.30%

Total Current Assets 52.79% 74.13% 85.92% 84.40%

Long-term Assets 47.21% 25.87% 14.08% 15.60%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 8.75% 6.50% 4.99% 47.20%

Long-term Liabilities 0.00% 0.00% 0.00% 9.10%

Total Liabilities 8.75% 6.50% 4.99% 56.30%

Net Worth 91.25% 93.50% 95.01% 43.70%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 90.00% 90.00% 90.00% 26.50%

Selling, General & Administrative Expenses 92.95% 78.43% 75.98% 14.60%

Advertising Expenses 0.45% 0.31% 0.28% 0.40%

Profit Before Interest and Taxes -2.95% 16.52% 20.03% 2.20%

Main Ratios

Current 6.03 11.40 17.23 1.87

Quick 6.03 11.40 17.23 1.47

Total Debt to Total Assets 8.75% 6.50% 4.99% 56.30%

Pre-tax Return on Net Worth -9.93% 51.02% 46.91% 6.80%

Pre-tax Return on Assets -9.06% 47.71% 44.57% 15.50%

Additional Ratios

Net Profit Margin -2.95% 11.57% 14.02% n.a

Return on Equity -9.93% 35.72% 32.83% n.a

Accounts Payable Turnover 9.44 12.17 12.17 n.a

Payment Days 27 28 28 n.a

Total Asset Turnover 3.08 2.89 2.22 n.a

Debt to Net Worth 0.10 0.07 0.05 n.a

Current Liab. to Liab. 1.00 1.00 1.00 n.a

Net Working Capital $19,162 $44,680 $78,332 n.a

Interest Coverage 0.00 0.00 0.00 n.a

Assets to Sales 0.33 0.35 0.45 n.a

Current Debt/Total Assets 9% 7% 5% n.a

Acid Test 6.03 11.40 17.23 n.a

Sales/Net Worth 3.37 3.09 2.34 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales

Non-custom homes $0 $4,000 $8,000 $5,000 $6,000 $6,545 $7,332 $9,876 $11,232 $14,454 $15,654 $16,765

Custom homes $0 $0 $0 $7,000 $4,000 $3,000 $0 $3,500 $2,500 $3,000 $3,500 $2,500

Total Sales $0 $4,000 $8,000 $12,000 $10,000 $9,545 $7,332 $13,376 $13,732 $17,454 $19,154 $19,265

Direct Cost of Sales

Non-custom homes $0 $400 $800 $500 $600 $655 $733 $988 $1,123 $1,445 $1,565 $1,677

Custom homes $0 $0 $0 $700 $400 $300 $0 $350 $250 $300 $350 $250

Subtotal Direct Cost of Sales $0 $400 $800 $1,200 $1,000 $955 $733 $1,338 $1,373 $1,745 $1,915 $1,927

Personnel Plan

Don $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

Journeymen employee $0 $0 $2,880 $2,880 $2,880 $2,880 $2,880 $2,880 $2,880 $2,880 $2,880 $2,880

Apprentice employee $0 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600

Apprentice employee $0 $0 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600

Total People 1 2 4 4 4 4 4 4 4 4 4 4 4

Total Payroll $3,000 $4,600 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080

General Assumptions:

Plan Month: 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate: 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate: 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate: 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00%

Other: 0 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss:

Sales: $0 $4,000 $8,000 $12,000 $10,000 $9,545 $7,332 $13,376 $13,732 $17,454 $19,154 $19,265

Direct Cost of Sales: $0 $400 $800 $1,200 $1,000 $955 $733 $1,338 $1,373 $1,745 $1,915 $1,927

Other Production Expenses: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales: $0 $400 $800 $1,200 $1,000 $955 $733 $1,338 $1,373 $1,745 $1,915 $1,927

Gross Margin: $0 $3,600 $7,200 $10,800 $9,000 $8,591 $6,599 $12,038 $12,359 $15,709 $17,239 $17,339

Gross Margin %: 0.00% 90.00% 90.00% 90.00% 90.00% 90.00% 90.00% 90.00% 90.00% 90.00% 90.00% 90.00% 90.00%

Expenses:

Payroll: $3,000 $4,600 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080 $9,080

Sales and Marketing and Other Expenses: $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150

Depreciation: $288 $288 $288 $288 $288 $288 $288 $288 $288 $288 $288 $288 $288

Insurance/ License/ Bonds: $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500

Rent: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Payroll Taxes: 15% $450 $690 $1,362 $1,362 $1,362 $1,362 $1,362 $1,362 $1,362 $1,362 $1,362 $1,362 $1,362

Other: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Operating Expenses: $4,388 $6,228 $11,380 $11,380 $11,380 $11,380 $11,380 $11,380 $11,380 $11,380 $11,380 $11,380 $11,380

Profit Before Interest and Taxes: ($4,388) ($2,628) ($4,180) ($580) ($2,380) ($2,790) ($4,781) $658 $979 $4,329 $5,859 $5,959

EBITDA: ($4,100) ($2,340) ($3,892) ($292) ($2,092) ($2,502) ($4,493) $946 $1,267 $4,617 $6,147 $6,247

Interest Expense: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Taxes Incurred: $0 $0 $0 $0 $0 $0 $0 $0 $0

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Cash | $19,650 | $16,613 | $14,892 | $12,036 | $12,131 | $9,846 | $7,300 | $2,593 | $4,124 | $5,425 | $10,401 | $16,712 | $22,969 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $19,650 | $16,613 | $14,892 | $12,036 | $12,131 | $9,846 | $7,300 | $2,593 | $4,124 | $5,425 | $10,401 | $16,712 | $22,969 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 |

| Accumulated Depreciation | $0 | $288 | $576 | $864 | $1,152 | $1,440 | $1,728 | $2,016 | $2,304 | $2,592 | $2,880 | $3,168 | $3,456 |

| Total Long-term Assets | $24,000 | $23,712 | $23,424 | $23,136 | $22,848 | $22,560 | $22,272 | $21,984 | $21,696 | $21,408 | $21,120 | $20,832 | $20,544 |

| Total Assets | $43,650 | $40,325 | $38,316 | $35,172 | $34,979 | $32,406 | $29,572 | $24,577 | $25,820 | $26,833 | $31,521 | $37,544 | $43,513 |

| Liabilities and Capital | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $1,063 | $1,682 | $2,718 | $3,105 | $2,912 | $2,868 | $2,654 | $3,238 | $3,272 | $3,632 | $3,796 | $3,807 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $1,063 | $1,682 | $2,718 | $3,105 | $2,912 | $2,868 | $2,654 | $3,238 | $3,272 | $3,632 | $3,796 | $3,807 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $1,063 | $1,682 | $2,718 | $3,105 | $2,912 | $2,868 | $2,654 | $3,238 | $3,272 | $3,632 | $3,796 | $3,807 |

| Paid-in Capital | $44,000 | $44,000 | $44,000 | $44,000 | $44,000 | $44,000 | $44,000 | $44,000 | $44,000 | $44,000 | $44,000 | $44,000 | $44,000 |

| Retained Earnings | ($350) | ($350) | ($350) | ($350) | ($350) | ($350) | ($350) | ($350) | ($350) | ($350) | ($350) | ($350) | ($350) |

| Earnings | $0 | ($4,388) | ($7,016) | ($11,196) | ($11,776) | ($14,156) | ($16,946) | ($21,727) | ($21,068) | ($20,090) | ($15,761) | ($9,902) | ($3,944) |

| Total Capital | $43,650 | $39,262 | $36,634 | $32,454 | $31,874 | $29,494 | $26,705 | $21,923 | $22,582 | $23,560 | $27,889 | $33,748 | $39,706 |

| Total Liabilities and Capital | $43,650 | $40,325 | $38,316 | $35,172 | $34,979 | $32,406 | $29,572 | $24,577 | $25,820 | $26,833 | $31,521 | $37,544 | $43,513 |

| Net Worth | $43,650 | $39,262 | $36,634 | $32,454 | $31,874 | $29,494 | $26,705 | $21,923 | $22,582 | $23,560 | $27,889 | $33,748 | $39,706 |

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!