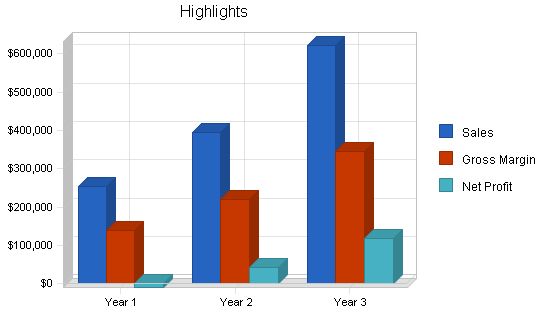

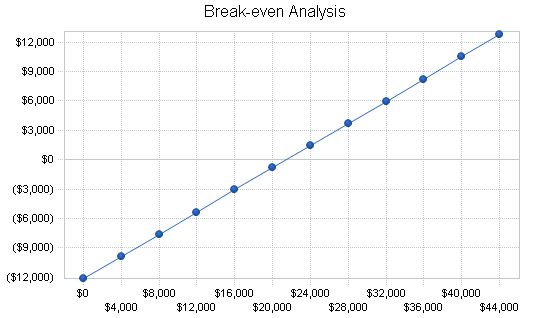

Bride’s Entourage is a unique wedding attire shop that differs from most retail bridal shops. Instead of solely focusing on selling wedding gowns, our shop caters to a wider demographic. We provide attire and accessories for the mothers of the bride and groom, bridesmaids, and flower girls. This single-member LLC, owned by Dorina Thaker, is registered in Oregon. The primary objective of this business plan is to secure start-up financing. Our projected timeline shows that we will reach the break-even point in the fourth month of operations. The financial projections outlined in this plan indicate that we will have enough funds to repay the requested loan.

Bride’s Entourage Objectives:

1. To be the primary one-stop-shop for female members of a bridal party after the bride purchases her gown.

2. To achieve strong sales in the first year of operation.

3. In Year 3, to double first-year sales and achieve a net income of at least 10% of sales.

Bride’s Entourage Mission:

Bride’s Entourage is a boutique that offers attire and accessories for female bridal attendants. We prioritize exceptional customer service and aim to create a relaxed and enjoyable shopping experience. We also strive to provide a professional and enjoyable working environment for our employees, empowering them as valuable resources for our customers.

Keys to Success:

1. Build a reputation as the go-to shop for all bridal purchases beyond wedding gowns.

2. Establish a strong referral network within the bridal industry.

3. Provide exceptional customer service.

4. Maintain a fresh inventory mix.

Bride’s Entourage is a new retail boutique that complements existing bridal shops in the Portland area. While most shops focus on wedding gowns, our focus is on everything else. Our core products include attire for the mother of the bride and groom, bridesmaids, flower girls, bridal footwear, and accessories such as veils, headpieces, and jewelry. Our goal is to be the go-to shop for items beyond the wedding gown and offer a satisfying shopping experience.

Company Ownership:

Bride’s Entourage is a privately held single-member LLC registered in Oregon, owned by Dorina Thaker.

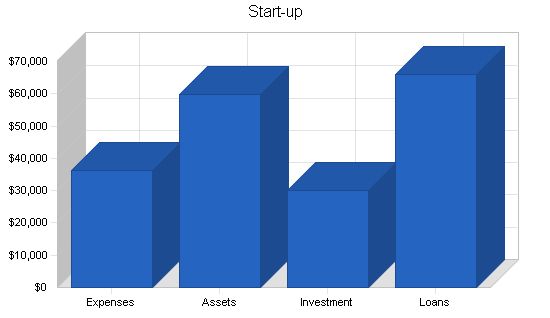

Start-up Summary:

The following table and charts depict the estimated start-up costs. The largest expenses are inventory (30%), cash-on-hand (23%), and equipment and leasehold improvements (19%). We will finance these costs through owner investment and long-term loans.

Start-up Requirements

Start-up Expenses:

– Legal: $1,000

– Stationery: $800

– Other Supplies: $1,150

– Consultants: $1,500

– Insurance: $1,000

– Rent: $8,800

– Leasehold Improvements (Expensed): $10,000

– Expensed Equipment: $8,000

– Other: $4,000

– Total Start-up Expenses: $36,250

Start-up Assets:

– Cash Required: $21,900

– Start-up Inventory: $28,350

– Other Current Assets: $1,000

– Long-term Assets: $8,500

– Total Assets: $59,750

Total Requirements: $96,000

Start-up Funding

Start-up Expenses to Fund: $36,250

Start-up Assets to Fund: $59,750

Total Funding Required: $96,000

Assets:

– Non-cash Assets from Start-up: $37,850

– Cash Requirements from Start-up: $21,900

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $21,900

– Total Assets: $59,750

Liabilities and Capital

Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $65,000

– Accounts Payable (Outstanding Bills): $1,000

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $66,000

Capital:

– Planned Investment: $30,000

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $30,000

– Loss at Start-up (Start-up Expenses): ($36,250)

– Total Capital: ($6,250)

Total Capital and Liabilities: $59,750

Total Funding: $96,000

Products

Bride’s Entourage will carry mother-of-the-bride, mother-of-the-groom, bridesmaid, and flower girl attire. Additionally, we will offer bridal footwear and accessories such as veils, headpieces, and jewelry. Our goal is to provide a wide variety of styles and price ranges from reputable designers.

The dresses will be sold primarily on a made-to-order basis. We will keep a sample dress of each style in-store for customers to try on. Once they decide on a style, we will order their size and preferred color. If a customer is satisfied with the floor sample, they can purchase it.

A fifty percent, non-refundable deposit will be required for made-to-order dresses. The deposit will be applied toward the balance when the dress arrives. Full payment is due before the customer can take the dress. Veils, headpieces, shoes, and jewelry will primarily be sold off the floor.

Bridal inventory is typically purchased in two seasons: fall and spring. Most designers have "minimums" that require a certain number of sample dresses to be purchased each season. We will adjust our buying pattern based on designer requirements and customer demand.

We will track the success rate of each dress. If a dress is selling poorly, it will be discounted and sold off the rack to make room for new inventory.

Market Analysis Summary

Multnomah County has approximately twelve thousand weddings annually. The number of females is projected to increase by about three percent over the next five years. These statistics indicate a solid customer base that will slightly grow in the future.

Bride’s Entourage focuses on wedding purchases that are often overlooked, such as mother-of-the-bride/groom attire, attendants’ attire, and accessories. These items collectively make up 7.8% of total wedding expenditures, which is our target market.

Bride’s Entourage creates a shopping environment that caters to the mothers, bridesmaids, flower girls, and brides. We understand that the shopping experience is just as important as making a purchase.

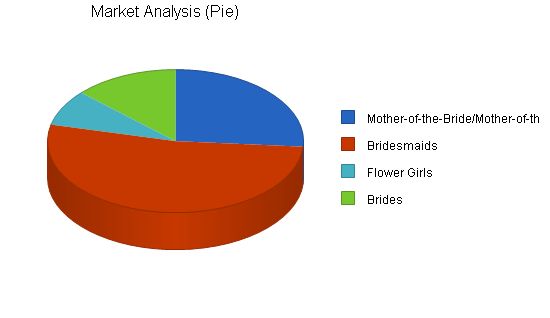

Market Segmentation

Bride’s Entourage serves three major market segments:

1. Mother-of-the-bride/mother-of-the-groom.

2. Attendants (bridesmaids and flower girls).

3. Brides.

It is crucial to provide a fun and pampering experience for customers as they value the overall shopping experience. Mothers play a significant role in the upcoming wedding and prioritize the style of their gown. Bridesmaids are cost-conscious and often shop as a group. Flower girls’ attire is decided by the bride, but their parents usually pay for it. Brides who still need accessories will also find what they need at Bride’s Entourage.

Market Analysis:

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Mother-of-the-Bride/Mother-of-the-Groom 3% 24,000 24,720 25,462 26,226 27,013 3.00%

Bridesmaids 3% 48,000 49,440 50,923 52,451 54,025 3.00%

Flower Girls 3% 7,440 7,663 7,893 8,130 8,374 3.00%

Brides 3% 12,000 12,360 12,731 13,113 13,506 3.00%

Total 3.00% 91,440 94,183 97,009 99,920 102,918 3.00%

4.2 Target Market Segment Strategy:

Bride’s Entourage focuses on “everything but the wedding gown.” There are almost 40 bridal shops in the greater Portland area that primarily specialize in selling wedding gowns. However, for each bride, there are typically five other females who need outfits, and the bride herself will require additional accessories. Most bridal shops neglect these other necessary items. Bride’s Entourage gives the "other items" their own significance. By eliminating the bridal gown as a distraction, the "other items" will no longer be overlooked. Mothers and bridal attendants can have their own unique shopping experience, and brides can have a fresh environment to find their accessories.

4.3 Industry Analysis:

There are over two million weddings annually in the United States, with twelve thousand taking place in Multnomah County alone. The average cost of a first wedding is currently around $20,000, increasing by about 5% each year. Approximately 6.1% of the total wedding budget is allocated for the wedding gown, while 7.8% is spent on mothers’ attire, attendants’ attire, and accessories.

There are numerous bridal shops across the country, most of which are locally-owned. However, more chains are entering the market. The primary focus of these shops is the wedding gown, with only a limited selection of other items. Therefore, there is currently a lack of places to find a good variety of the other necessary items.

4.3.1 Competition and Buying Patterns:

Multnomah County has about 40 bridal shops, but their primary focus is wedding dresses. As a result, they offer a limited selection of mothers’ attire, attendants’ attire, bridal footwear, and other bridal accessories. Bride’s Entourage is unique in its focus on everything except the wedding gown.

Building a reputation for a great selection and superior customer service is crucial. Brides typically visit around six stores before purchasing their wedding gown. The same mindset may apply to other members of the bridal party, emphasizing the need to provide a unique selection in a memorable environment. Offering competitive pricing is essential for cost-conscious bridesmaids. Providing a wide variety of styles at different price points will assure the bridal party members that they have a comprehensive selection and won’t feel the need to shop around.

Strategy and Implementation Summary:

Bride’s Entourage has a clear advantage as the only store of its kind in the market. The marketing and sales strategies emphasize the unique advantages for the Multnomah County wedding party:

– Wide range of clothing styles, designers, and accessories

– Attention to all female members of the wedding party

– Prime location in a destination shopping area

The marketing strategy includes print and online listings in wedding media, as well as networking with wedding consultants. The location next to complementary shops and an upscale mall will generate additional foot traffic.

The sales strategy aims to prioritize customer needs from the moment they enter the store. The goal is to create an atmosphere where shopping for "other items" is as important as shopping for the wedding gown. At Bride’s Entourage, mothers, bridesmaids, and other wedding party members will receive the same level of attention and prominence as the bride.

5.1 Competitive Edge:

Bride’s Entourage stands out as the only store of its kind in Oregon state. Most bridal shops primarily focus on selling wedding gowns and offer limited selection in other areas. At Bride’s Entourage, the focus is on everything except the wedding gown. Customers can expect a wide selection and personalized attention. The store’s location in downtown Portland, across from an upscale mall, adds to its competitive advantage.

5.2 Marketing Strategy:

The marketing efforts for Bride’s Entourage will involve local wedding publications, bridal consultants, TheKnot.com, web links, and Yellow Pages listing under the "bridal" section. These mediums will help target the desired market and increase visibility.

5.3 Sales Strategy:

Customers must be acknowledged and attended to promptly, as they are preparing for a significant event. Every potential customer should feel taken seriously from the moment they step into the store.

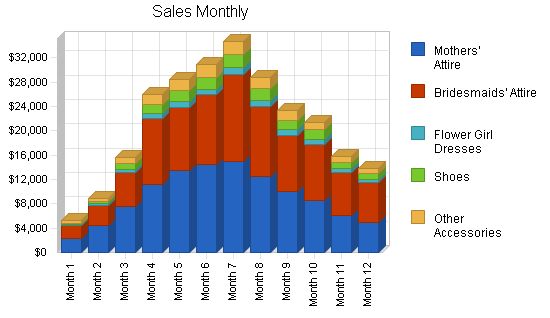

5.3.1 Sales Forecast:

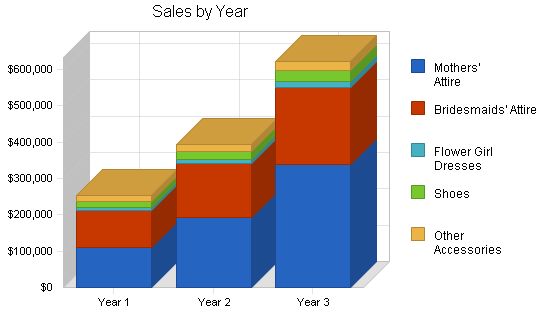

Bride’s Entourage aims to sell to slightly more than 1% of the total customer base in Multnomah County, which amounts to around 160 wedding parties in the first year of operations. The market share is expected to increase to 2% by year two and exceed 3% by year three. These estimates are based on assumptions about the number of weddings and the size of the customer base. The sales forecast reflects the projected sales when cash is received, taking into account the three-month lead time for dress orders.

The forecasted sales include projections for clothing and accessories, considering the wholesale costs and inventory timings.

Sales Forecast

Year 1 Year 2 Year 3

Sales

Mothers’ Attire $110,500 $193,375 $338,406

Bridesmaids’ Attire $101,388 $147,013 $213,168

Flower Girl Dresses $8,650 $11,245 $14,619

Shoes $16,300 $22,005 $29,707

Other Accessories $15,950 $20,735 $26,956

Total Sales $252,788 $394,373 $622,855

Direct Cost of Sales

Year 1 Year 2 Year 3

Clothing $99,096 $158,553 $253,684

Shoes and Other Accessories $10,485 $13,631 $17,720

Subtotal Direct Cost of Sales $109,581 $172,183 $271,404

5.4 Milestones

The table lists the critical milestones for Bride’s Entourage from now until the store is ready to open for business. Dorina Thaker will be in charge of completing each of these items.

Milestones:

– Milestone

– Start Date

– End Date

– Budget

– Manager

– Department

– Business Plan

– 6/30/2003

– 9/30/2003

– $0

– Dorina Thaker

– Administrative

– Licensing and Permits

– 7/1/2003

– 8/31/2003

– $0

– Dorina Thaker

– Administrative

– Site Selection and Lease Negotiations

– 7/7/2003

– 10/15/2003

– $0

– Dorina Thaker

– Administrative

– Secure Start-Up Financing

– 7/28/2003

– 10/15/2003

– $0

– Dorina Thaker

– Administrative

– Secure Line of Credit

– 7/28/2003

– 10/15/2003

– $0

– Dorina Thaker

– Administrative

– Buying Show

– 9/10/2003

– 9/13/2003

– $0

– Dorina Thaker

– Administrative

– Web Site Construction

– 10/8/2003

– 11/15/2003

– $0

– Dorina Thaker

– Administrative

– Accounting Plan

– 11/15/2003

– 1/15/2004

– $0

– Dorina Thaker

– Administrative

– Leasehold Improvements

– 1/2/2004

– 2/28/2004

-Summary

Break-even Analysis

Monthly Revenue Break-even: $21,445

Assumptions:

– Average Percent Variable Cost: 43%

– Estimated Monthly Fixed Cost: $12,149

Projected Profit and Loss

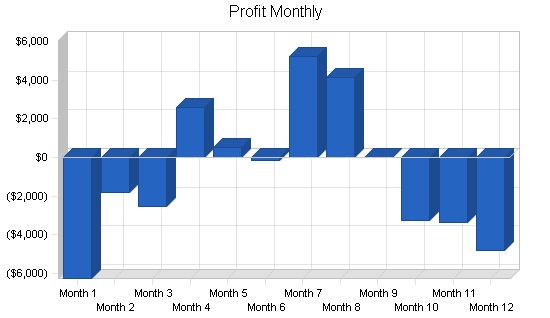

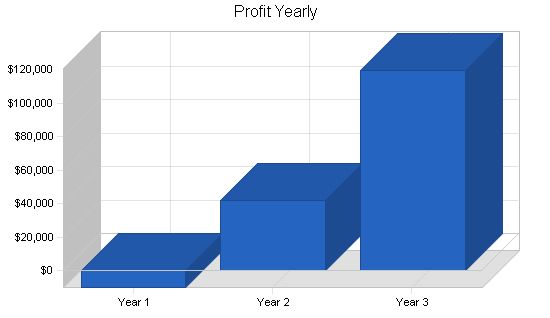

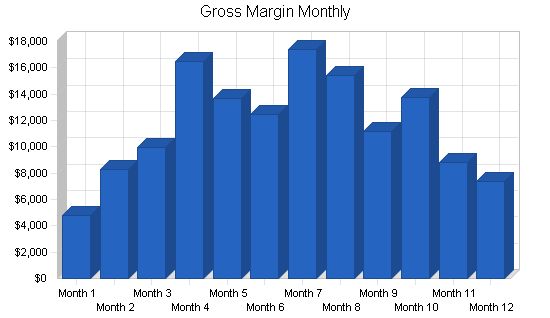

We expect losses in the first year as the store builds momentum and generates traffic. However, once sales increase, other expenses will remain fixed. In fact, sample inventory costs should decrease in future years. Some designers offer deep discounts or provide free samples once good credit terms are established, reducing annual expenditures for sample inventory.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $252,788 | $394,373 | $622,855 |

| Direct Cost of Sales | $109,581 | $172,183 | $271,404 |

| Credit Card Fees | $3,640 | $3,155 | $4,983 |

| Total Cost of Sales | $113,221 | $175,338 | $276,387 |

| Gross Margin | $139,567 | $219,034 | $346,468 |

| Gross Margin % | 55.21% | 55.54% | 55.63% |

| Expenses | |||

| Payroll | $30,720 | $41,000 | $45,000 |

| Sales and Marketing and Other Expenses | $11,900 | $12,000 | $12,000 |

| Depreciation | $2,160 | $2,160 | $2,160 |

| Rent including triple nets | $52,800 | $54,750 | $66,900 |

| Utilities | $9,000 | $9,500 | $10,000 |

| Insurance | $4,200 | $4,600 | $5,100 |

| Payroll Taxes | $4,608 | $6,150 | $6,750 |

| Supplies | $3,600 | $4,000 | $4,300 |

| Repairs and Maintenance | $2,400 | $2,600 | $2,800 |

| Professional Fees | $3,300 | $3,500 | $4,000 |

| Taxes and Licenses | $1,100 | $1,100 | $1,100 |

| New Sample Inventory | $20,000 | $15,000 | $14,000 |

| Total Operating Expenses | $145,788 | $156,360 | $174,110 |

| Profit Before Interest and Taxes | ($6,221) | $62,674 | $172,358 |

| EBITDA | ($4,061) | $64,834 | $174,518 |

| Interest Expense | $3,622 | $2,843 | $2,030 |

| Taxes Incurred | $0 | $17,950 | $51,098 |

| Net Profit | ($9,842) | $41,882 | $119,230 |

| Net Profit/Sales | -3.89% | 10.62% | 19.14% |

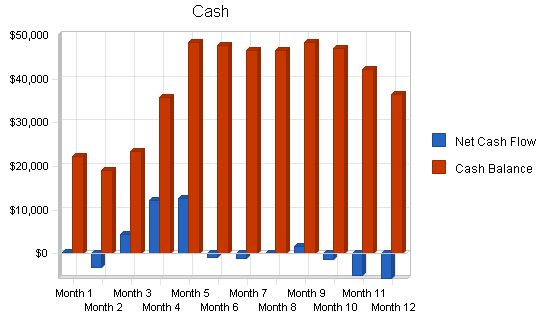

8.4 Projected Cash Flow

The cash flow of Bride’s Entourage is somewhat unique. For items sold off the floor, payment is received in full at the time of sale, and the customer takes possession of the item. This is how most shoe sales and some accessory purchases will occur.

However, other items in the store follow a different process. Let’s use a dress as an example. When a customer decides to purchase a dress, she will try on a sample in the store and then order it in her preferred size and color. To initiate the ordering process, the customer must provide a deposit of at least 50% of the item’s total price (note: this assumes everyone will choose the 50% deposit option). The remaining balance is due within thirty days of the item’s arrival in our store.

This timing consideration also applies to the cost of goods sold. The store will be billed for items when they are shipped, so the cash outflow for the cost of the item will closely match the cash inflow from the customer paying the balance.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $252,788 $394,373 $622,855

Subtotal Cash from Operations $252,788 $394,373 $622,855

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $252,788 $394,373 $622,855

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $30,720 $41,000 $45,000

Bill Payments $194,477 $302,314 $450,411

Subtotal Spent on Operations $225,197 $343,314 $495,411

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $13,020 $13,000 $13,000

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $238,217 $356,314 $508,411

Net Cash Flow $14,571 $38,058 $114,444

Cash Balance $36,471 $74,529 $188,973

8.5 Projected Balance Sheet

Bride’s Entourage maintains a strong current ratio throughout. While the net worth of the business is negative in year one, it makes steady gains and becomes positive in year two. By the end of year three, retained earnings is also close to being positive.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $36,471 $74,529 $188,973

Inventory $6,878 $10,808 $17,036

Other Current Assets $1,000 $1,000 $1,000

Total Current Assets $44,349 $86,337 $207,009

Long-term Assets

Long-term Assets $8,500 $8,500 $8,500

Accumulated Depreciation $2,160 $4,320 $6,480

Total Long-term Assets $6,340 $4,180 $2,020

Total Assets $50,689 $90,517 $209,029

Liabilities and Capital

Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $14,802 $25,747 $38,030

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $14,802 $25,747 $38,030

Long-term Liabilities $51,980 $38,980 $25,980

Total Liabilities $66,782 $64,727 $64,010

Paid-in Capital $30,000 $30,000 $30,000

Retained Earnings ($36,250) ($46,092) ($4,210)

Earnings ($9,842) $41,882 $119,230

Total Capital ($16,092) $25,790 $145,020

Total Liabilities and Capital $50,689 $90,517 $209,029

Net Worth ($16,092) $25,790 $145,020

8.6 Business Ratios

The following table breaks down some key financial ratios. Industry averages for Bridal Shops – SIC code 5621.0102 are shown for comparison.

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 56.01% 57.94% -0.02%

Percent of Total Assets

Inventory 13.57% 11.94% 8.15% 50.91%

Other Current Assets 1.97% 1.10% 0.48% 24.44%

Total Current Assets 87.49% 95.38% 99.03% 85.49%

Long-term Assets 12.51% 4.62% 0.97% 14.51%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities

Accounts Payable 29.20% 28.44% 18.19% 29.49%

Long-term Liabilities 102.55% 43.06% 12.43% 11.18%

Total Liabilities 131.75% 71.51% 30.62% 40.67%

Net Worth -31.75% 28.49% 69.38% 59.33%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 55.21% 55.54% 55.63% 40.07%

Selling, General & Administrative Expenses 59.10% 44.92% 36.48% 21.95%

Advertising Expenses 0.00% 0.00% 0.00% 2.92%

Profit Before Interest and Taxes -2.46% 15.89% 27.67% 2.90%

Main Ratios

Current 3.00 3.35 5.44 2.64

Quick 2.53 2.93 5.00 0.74

Total Debt to Total Assets 131.75% 71.51% 30.62% 5.31%

Pre-tax Return on Net Worth 61.16% 232.00% 117.45% 47.92%

Pre-tax Return on Assets -19.42% 66.10% 81.49% 10.20%

Additional Ratios

Net Profit Margin -3.89% 10.62% 19.14% n.a

Return on Equity 0.00% 162.40% 82.22% n.a

Activity Ratios

Inventory Turnover 6.78 19.47 19.49 n.a

Accounts Payable Turnover 14.07 12.17 12.17 n.a

Payment Days 27 24 25 n.a

Total Asset Turnover 4.99 4.36 2.98 n.a

Debt Ratios

Debt to Net Worth 0.00 2.51 0.44 n.a

Current Liab. to Liab. 0.22 0.40 0.59 n.a

Liquidity Ratios

Net Working Capital $29,548 $60,590 $168,980 n.a

Interest Coverage -1.72 22.05 84.91 n.a

Additional Ratios

Assets to Sales 0.20 0.23 0.34 n.a

Current Debt/Total Assets 29% 28% 18% n.a

Acid Test 2.53 2.93 5.00 n.a

Sales/Net Worth 0.00 15.29 4.29 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales

Mothers’ Attire $0 $2,250 $4,500 $7,500 $11,250 $13,500 $14,500 $15,000 $12,500 $10,000 $8,500 $6,000 $5,000

Bridesmaids’ Attire $0 $2,142 $3,213 $5,712 $10,710 $10,353 $11,424 $14,280 $11,424 $9,282 $9,282 $7,140 $6,426

Flower Girl Dresses $0 $200 $300 $350 $800 $900 $900 $1,050 $1,000 $950 $850 $700 $650

Shoes $0 $250 $400 $1,000 $1,500 $1,900 $2,000 $2,250 $2,100 $1,500 $1,500 $1,000 $900

Other Accessories $0 $425 $500 $1,000 $1,625 $1,700 $2,100 $2,100 $1,800 $1,550 $1,300 $1,000 $850

Total Sales $5,267 $8,913 $15,562 $25,885 $28,353 $30,924 $34,680 $28,824 $23,282 $21,432 $15,840 $13,826

Direct Cost of Sales

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Clothing $0 $0 $4,226 $7,538 $12,673 $16,687 $15,617 $12,248 $11,178 $6,843 $6,314 $5,773

Shoes and Other Accessories $405 $540 $1,200 $1,470 $1,620 $1,320 $1,140 $720 $570 $540 $480 $480

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Dorina Thaker, Owner | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Part Time Sales Associate 1 | 0% | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | |

| Part Time Sales Associate 2 | 0% | $580 | $580 | $580 | $580 | $580 | $580 | $580 | $580 | $580 | $580 | $580 | |

| Part Time Sales Associate 3 | 0% | $580 | $580 | $580 | $580 | $580 | $580 | $580 | $580 | $580 | $580 | $580 | |

| Total People | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | ||

| Total Payroll | $2,560 | $2,560 | $2,560 | $2,560 | $2,560 | $2,560 | $2,560 | $2,560 | $2,560 | $2,560 | $2,560 | $2,560 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | |

| Long-term Interest Rate | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | 6.25% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $5,267 | $8,913 | $15,562 | $25,885 | $28,353 | $30,924 | $34,680 | $28,824 | $23,282 | $21,432 | $15,840 | $13,826 | |

| Direct Cost of Sales | $405 | $540 | $5,426 | $9,008 | $14,293 | $18,007 | $16,757 | $12,968 | $11,748 | $7,383 | $6,794 | $6,253 | |

| Credit Card Fees | $76 | $128 | $224 | $373 | $408 | $445 | $499 | $415 | $335 | $309 | $228 | $199 | |

| Total Cost of Sales | $481 | $668 | $5,650 | $9,381 | $14,701 | $18,452 | $17,256 | $13,383 | $12,083 | $7,691 | $7,022 | $6,452 | |

| Gross Margin | $4,786 | $8,245 | $9,912 | $16,504 | $13,652 | $12,472 | $17,424 | $15,441 | $11,199 | $13,741 | $8,818 | $7,374 | |

| Gross Margin % | 90.87% | 92.50% | 63.69% | 63.76% | 48.15% | 40.33% | 50.24% | 53.57% | 48.10% | 64.11% | 55.67% | 53.33% | |

| This is a review of a Pro Forma Cash Flow and Pro Forma Balance Sheet. The tables present financial information for each month over a 12-month period. The Pro Forma Cash Flow table includes sections for Cash Received and Expenditures, with specific amounts listed for each month. The Pro Forma Balance Sheet table lists the Assets, including Current Assets and Long-term Assets, as well as the Liabilities and Capital. The tables provide a snapshot of the company’s financial situation and help track cash flow and net worth over time. | |||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!