Auto Repair Shop Business Plan

F & R Auto (F & R) is the desire of John Ford and Michael Ronald, who together have 30 years of auto mechanic experience. They have a dream of starting their own company and offering better service than competitors.

1.1 Objectives:

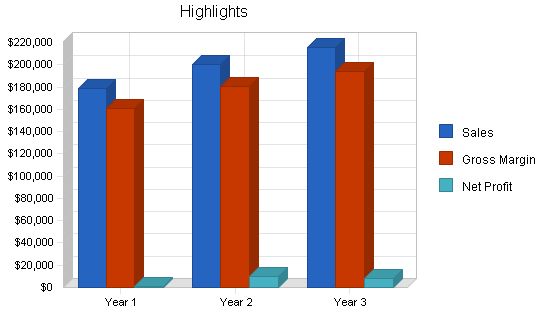

– Increase sales revenues steadily through year three.

– Establish a program of superior customer service through rigorous evaluation of service experience.

– Hire three additional mechanics.

Keys to Success:

In the auto repair industry, a company builds its client base through word-of-mouth marketing. For F & R Auto Repair, success depends on:

– High-quality work

– Regular communication with clients to keep them informed about their automobile’s state and repair progress

– Friendly and knowledgeable mechanics who take the time to explain the nature of our business and work to customers

Mission:

F & R Auto Repair aims to provide high-quality, convenient, and affordable auto repair services. The trust of our customers is paramount and we strive for 100% customer satisfaction in terms of quality, friendliness, timeliness, and exceeding expectations.

This company is a partnership between John Ford and Michael Ronald, with each owning 50%. It will be registered as a limited liability company in Washington state. Located at 1312 1st Ave NW in Seattle’s Ballard neighborhood, the facilities will include a two-bay garage, office space, and storage for tools and parts.

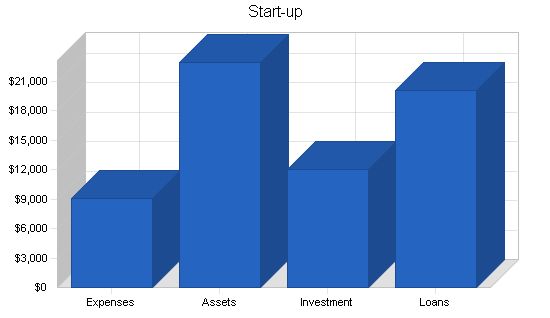

To finance the start of operations, the company is seeking a loan while the owners contribute their own capital as equity.

Start-up Summary:

Research on small mechanic shops in the Seattle area has informed the start-up estimates. Inflation has been taken into account when comparing the expenses of these establishments to current prices.

Many of the necessary equipment, such as tools and air compressors, are already owned by the partners.

Start-up

Requirements

Legal

Stationery

Advertising

Phone

Insurance

Rent

Utilities

Computer

Other

Total Start-up Expenses

Start-up Assets

Cash Required

Start-up Inventory

Other Current Assets

Long-term Assets

Total Assets

Total Requirements

Start-up Funding

Start-up Expenses to Fund

Start-up Assets to Fund

Total Funding Required

Assets

Non-cash Assets from Start-up

Cash Requirements from Start-up

Additional Cash Raised

Cash Balance on Starting Date

Total Assets

Liabilities and Capital

Liabilities

Current Borrowing

Long-term Liabilities

Accounts Payable

Other Current Liabilities

Total Liabilities

Capital

Planned Investment

John Ford

Michael Ronald

Other

Additional Investment Requirement

Total Planned Investment

Loss at Start-up

Total Capital

Total Capital and Liabilities

Total Funding

Services

F & R Auto offers a range of services, including brakes, transmission, and wheel alignment, to meet all auto servicing needs in one place.

The industry is highly competitive with suppliers setting prices and negotiating with repair shops. The customers perceive the service as undifferentiated, making buyer power high. The barriers to entry are low, resulting in a competitive pricing market. To gain an advantage, F & R Auto will focus on low cost leadership and building strong customer relationships.

F & R Auto will hire trained and certified mechanics with superior customer awareness. The company’s largest expenses will be in labor costs.

3.1 Service Description

F & R Auto provides scheduled maintenance, wheel alignments, tires and rims, brake repair, comprehensive engine repair, and transmission services. Most jobs are reservation-based, with a small percentage of walk-in repairs.

3.2 Competitive Comparison

The auto repair industry is highly competitive with high capital costs, low margins, and intense competition. Suppliers hold power in setting prices, and buyers value price and acceptable service.

The barriers to entry and exit are moderately low, resulting in a competitive pricing market. F & R Auto aims to differentiate by providing quality service and building customer relations.

3.3 Technology

F & R Auto utilizes computer diagnostic equipment to enhance its abilities in diagnosing and repairing clients’ vehicles. The company will continue seeking new ways to improve its service through technology.

3.4 Future Services

The company currently does not have plans to offer additional services.

Market Analysis Summary

F & R Auto can service any vehicle in Seattle, making market segmentation unnecessary. The industry does not have any seasonality that affects it.

4.1 Market Segmentation

The market analysis shows the potential number of cars in Seattle to be approximately 145,833 in Year 1, with a projected growth rate of 3% annually.

4.2 Service Business Analysis

This section is covered in the Competitive Comparison section of the Plan.

4.2.1 Competition and Buying Patterns

Customers prioritize building a relationship of trust with their service provider rather than price. F & R Auto aims to provide quality service to gain a loyal customer base.

4.2.2 Main Competitors

The main competitors in the auto repair industry are high-quality dealerships and licensed service reps. F & R Auto’s immediate competitors are Rodham’s Toyota, Lester Ford, and Woodmark’s Chrysler, which dominate the market. F & R Auto will initially compete based on low cost strategy and customer satisfaction, with plans to differentiate and charge higher prices in the future.

4.2.3 Business Participants

The auto repair industry is highly fragmented and operates in a purely competitive environment. F & R Auto plans to establish a reputation for quality and customer satisfaction before considering a differentiation strategy.

Strategy and Implementation Summary

F & R Auto’s competitive edge lies in its focus on the entire service experience, from the first interaction with the client to providing quality repairs. The company aims to build customer satisfaction and create a self-sustaining company culture centered on customer service.

5.1 Competitive Edge

F & R Auto aims to become the local leader in quality and service experience among small automotive repair firms in Seattle. The company initially focuses on low cost while providing superior customer satisfaction. Once a reputation is established, F & R Auto will evaluate a differentiation strategy.

5.1.1 Positioning Statement

F & R Auto’s goal is to provide excellent service experience and low cost initially, building a loyal customer base. The company plans to re-evaluate its strategy and positioning in the market to potentially implement a differentiation strategy and expand its operations.

F & R Auto utilizes low-cost marketing approaches such as flyers, direct mailers, discounts, newspaper ads, yellow pages, and referrals. The company plans to explore local radio and TV ads in the future.

5.2.1 Promotion Strategy

F & R Auto expects to attract clients from their previous companies initially. The company utilizes flyers, direct mailers, price discounts, newspaper ads, and word-of-mouth marketing. A grand opening program is also being considered.

5.2.2 Pricing Strategy

F & R Auto operates in a purely competitive environment and must charge market prices or lower. The average price in the industry is approximately $400 per vehicle. The company strives to maximize short-term profits by servicing automobiles at maximum capacity.

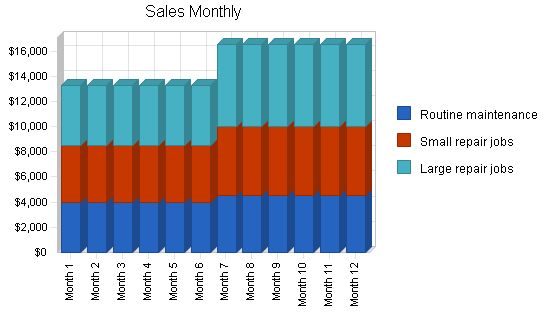

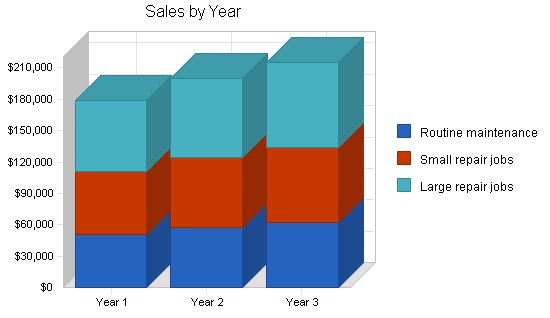

5.3 Sales Forecast

Sales in the automotive repair industry are steady year-round with little seasonality. The sales forecast is based on attracting clients from previous companies, planned promotions, current prices and costs, and the types of automobiles and jobs expected each month.

Sales Forecast

Sales

Year 1 Year 2 Year 3

Routine maintenance $51,000 $57,120 $62,261

Small repair jobs $60,000 $67,200 $71,904

Large repair jobs $67,800 $75,936 $81,252

Total Sales $178,800 $200,256 $215,417

Direct Cost of Sales

Year 1 Year 2 Year 3

Routine maintenance $5,100 $5,712 $6,226

Small repair jobs $6,000 $6,720 $7,190

Large repair jobs $6,780 $7,594 $8,125

Subtotal Direct Cost of Sales $17,880 $20,026 $21,542

Management Summary

John Ford began working as an apprentice mechanic in his father’s shop in 1984. Since then, he has worked for various automotive shops and dealerships and has numerous certificates in automobile repair. During the past two years, Mr. Ford attended Bellevue Community College where he received an Associates degree in business administration in June of 2000.

Michael Ronald attended ITT Technical Institute where he received a certificate in electronics repair in 1980. In 1983, Mr. Ronald went to work for Jim Click Ford Dealership in Tucson AZ, where he worked on automotive electrical and electronic systems. Desiring to expand his skills, Mr. Ronald received a mechanic’s certificate in 1988 and since then has become certified in various automotive fields. In anticipation of F & R’s business needs, Mr. Ronald is taking night classes at Seattle University in marketing.

Personnel Plan

F & R’s initial staffing will consist of Ford and Ronald, plus Ronald’s wife who will act as a part-time office manager. The company will seek two entry level mechanics to be hired within a few months after the company is operating. Accounting, bookkeeping, and marketing services will be outsourced. The company’s intermediate goal is to have four full-time, fully trained mechanics at the original facility, plus a full-time office manager. However, management has decided to await future developments before determining the best time to bring on such personnel.

Year 1 Year 2 Year 3

Mr. Ford $36,000 $36,000 $36,000

Mr. Ronald $36,000 $36,000 $36,000

Office manager (part-time) $14,400 $15,000 $15,000

Apprentice mechanic (part-time) $6,900 $15,000 $15,000

Apprentice mechanic (part-time) $0 $0 $15,000

Apprentice mechanic (part-time) $0 $0 $0

Total People 4 4 5

Total Payroll $93,300 $102,000 $117,000

The following sections outline the financial plan for F & R Auto Repair.

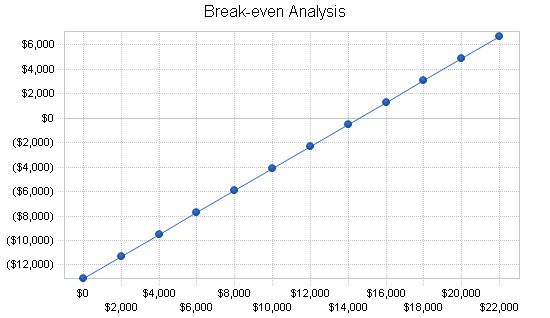

Break-even Analysis

The company’s Break-even Analysis is based on an average company’s running costs within this industry, including payroll, and its fixed costs for items such as rent and utilities.

Break-even Analysis:

Monthly Revenue Break-even: $14,564

Assumptions:

– Average Percent Variable Cost: 10%

– Estimated Monthly Fixed Cost: $13,107

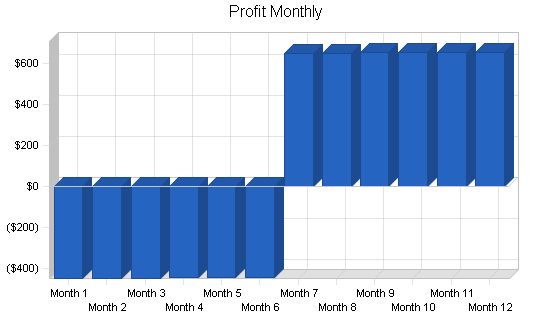

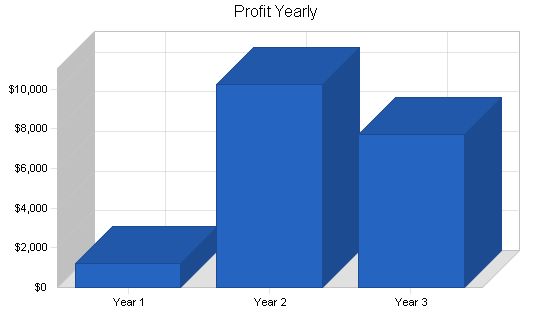

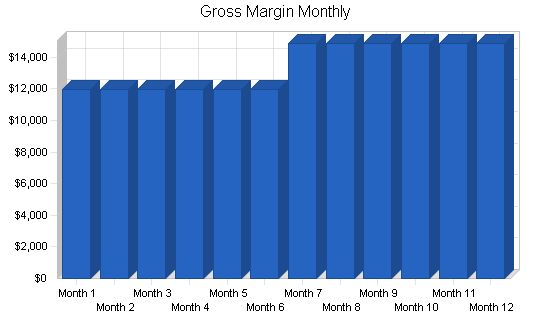

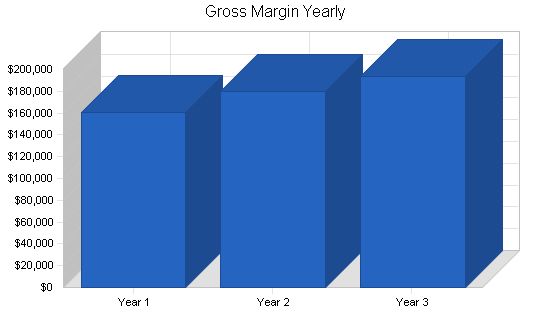

7.2 Projected Profit and Loss:

The table and chart below display the projected profit and loss for F & R Auto Repair.

Pro Forma Profit and Loss:

Sales: $178,800 (Year 1), $200,256 (Year 2), $215,417 (Year 3)

Direct Cost of Sales: $17,880 (Year 1), $20,026 (Year 2), $21,542 (Year 3)

Other Production Expenses: $0

Total Cost of Sales: $17,880 (Year 1), $20,026 (Year 2), $21,542 (Year 3)

Gross Margin: $160,920 (Year 1), $180,230 (Year 2), $193,875 (Year 3)

Gross Margin %: 90.00%

Expenses:

Payroll: $93,300 (Year 1), $102,000 (Year 2), $117,000 (Year 3)

Sales and Marketing and Other Expenses: $6,000 (Year 1), $7,200 (Year 2), $7,400 (Year 3)

Depreciation: $1,992 (Year 1), $2,000 (Year 2), $2,000 (Year 3)

Leased Equipment: $6,000 (Year 1), $1,000 (Year 2), $1,000 (Year 3)

Utilities: $4,800 (Year 1), $5,000 (Year 2), $5,000 (Year 3)

Insurance: $7,200 (Year 1), $7,400 (Year 2), $7,400 (Year 3)

Rent: $24,000 (Year 1), $24,000 (Year 2), $24,000 (Year 3)

Payroll Taxes: $13,995 (Year 1), $15,300 (Year 2), $17,550 (Year 3)

Other: $0

Total Operating Expenses: $157,287 (Year 1), $163,900 (Year 2), $181,350 (Year 3)

Profit Before Interest and Taxes: $3,633 (Year 1), $16,330 (Year 2), $12,525 (Year 3)

EBITDA: $5,625 (Year 1), $18,330 (Year 2), $14,525 (Year 3)

Interest Expense: $1,892 (Year 1), $1,700 (Year 2), $1,500 (Year 3)

Taxes Incurred: $522 (Year 1), $4,389 (Year 2), $3,308 (Year 3)

Net Profit: $1,219 (Year 1), $10,241 (Year 2), $7,718 (Year 3)

Net Profit/Sales: 0.68% (Year 1), 5.11% (Year 2), 3.58% (Year 3)

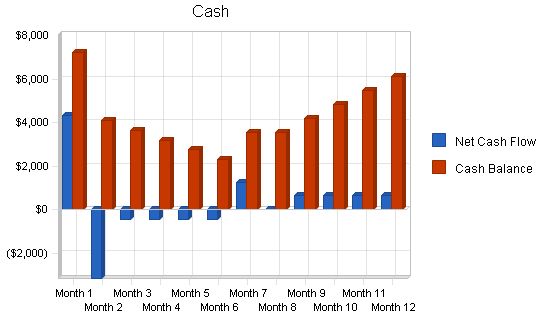

7.3 Projected Cash Flow

The following table and chart show the projected cash flow for F & R.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $160,920 | $180,230 | $193,875 |

| Cash from Receivables | $14,635 | $19,636 | $21,267 |

| Subtotal Cash from Operations | $175,555 | $199,867 | $215,142 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $175,555 | $199,867 | $215,142 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $93,300 | $102,000 | $117,000 |

| Bill Payments | $77,017 | $86,232 | $88,638 |

| Subtotal Spent on Operations | $170,317 | $188,232 | $205,638 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $2,000 | $2,000 | $2,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $172,317 | $190,232 | $207,638 |

| Net Cash Flow | $3,238 | $9,634 | $7,504 |

| Cash Balance | $6,138 | $15,773 | $23,277 |

7.4 Projected Balance Sheet

The following table shows the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $6,138 | $15,773 | $23,277 |

| Accounts Receivable | $3,245 | $3,634 | $3,910 |

| Inventory | $1,815 | $2,033 | $2,187 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $11,198 | $21,440 | $29,373 |

| Long-term Assets | |||

| Long-term Assets | $20,000 | $20,000 | $20,000 |

| Accumulated Depreciation | $1,992 | $3,992 | $5,992 |

| Total Long-term Assets | $18,008 | $16,008 | $14,008 |

| Total Assets | $29,206 | $37,448 | $43,381 |

7.5 Business Ratios

The Business ratios provide an overview of profitability and risk levels for F & R Auto. The ratio table includes both time series analysis and cross-sectional analysis by comparing industry average ratios. Differences between industry standards and F&R’s ratios are mainly due to variations in company size, assets, liabilities, financing, and net income in this industry.

Overall, the company’s projections indicate typical risks and long-term profitability. F&R has higher SG&A costs compared to competitors, but this is intentional to create a safety net in case of unforeseen problems. Pre-tax return on net worth and pre-tax return on assets are initially high due to operating with fewer assets in the beginning years until enough cash is accumulated to acquire desired tools and facilities.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 12.00% | 7.57% | 7.00% |

| Percent of Total Assets | ||||

| Accounts Receivable | 11.11% | 9.71% | 9.01% | 8.80% |

| Inventory | 6.21% | 5.43% | 5.04% | 9.60% |

| Other Current Assets | 0.00% | 0.00% | 0.00 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!