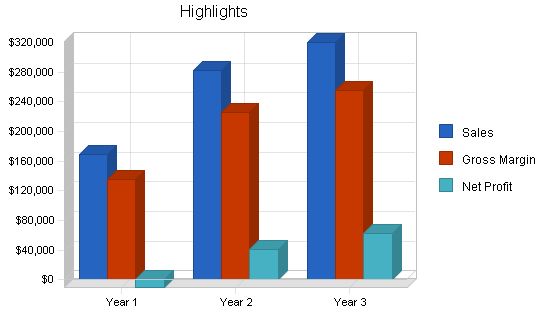

Premier Airport Transportation Service (PATS) is a Cleveland-based airport transportation service. PATS provides affordable luxury transportation using late model high-end vehicles. Sam Brougham, a transportation industry veteran, leads Premier Airport Transportation. PATS expects strong sales by year three.

Cleveland currently has four limousine service providers and four taxi services. In addition, there are short and long-term airport parking options and a rapid transit public train system for airport service. Premier Airport Transportation aims to fill the gap between average taxi service and expensive limousine service. By offering a middle price point, PATS appeals to both families and business travelers. Families see it as a reasonable and convenient alternative to driving and parking at the airport. Business travelers who need a deluxe solution at a reasonable cost will choose Premier Airport Transportation. These two market segments are growing at an average rate of 8.5% per year, providing a potential customer base of over a million.

PATS understands that providing unmatched customer service will be crucial to their success. They incentivize their drivers to excel in customer service, ensuring a high level of service at every interaction.

Sam Brougham, the founder of Premier Airport Transportation, began his transportation career as a taxi driver. He then gained experience in logistics and customer service at the Yellow Freight Company. This expertise in operations and customer care will be essential to PATS’ success.

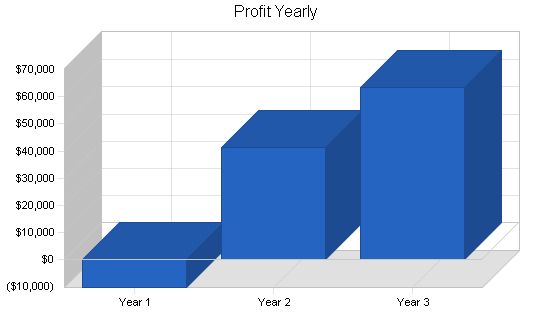

Premier Airport Transportation fulfills Cleveland’s need for a reasonably priced, high-service airport transportation service. They expect to break even by month eight and double their sales by year three. While they may face a loss in their first year, they project a substantial net profit by year three.

1.1 Objectives

The objectives for the first three years of operation:

- To create a service-based company that exceeds customer’s expectations.

- To increase customers by 20% per year through superior performance and word-of-mouth referrals.

- To develop a sustainable transportation company serving the Cleveland Metropolitan Area.

1.2 Mission

The mission of Premier Airport Transportation Service is to provide the finest airport transportation service available. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed customer expectations.

Company Summary

Premier Airport Transportation Service, located in Bedford Hts, OH, offers transportation service for the greater Cleveland metropolitan area. PATS operates 24 hours a day, serving most neighborhoods in Cleveland. PATS is priced competitively between limousine and group shuttle services.

Sam Brougham will work full-time as the dispatcher and back office person, overseeing four employees.

2.1 Company Ownership

PATS is an Ohio corporation founded and owned by Sam Brougham.

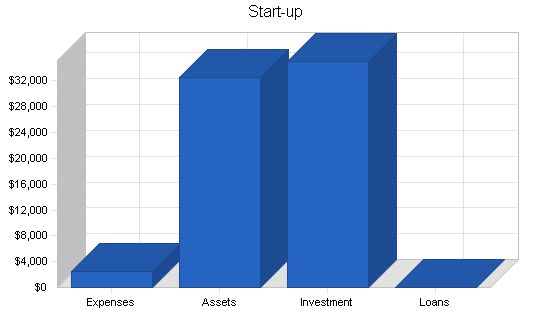

2.2 Start-up Summary

PATS’ start-up costs include equipment for the home-based office, legal fees, website creation, and start-up advertising.

The office equipment, such as a computer system, fax machine, and office supplies, represents the largest portion of start-up expenses. The computer should have a minimum 500 megahertz Celeron/Pentium processor, 64 megabytes of RAM (preferably 128), a 6 gigabyte hard drive, and a rewritable CD-ROM for system backup. Additionally, a DSL line and Nextel phones for two-way communication between the base and cars will be required.

The office will also require furniture such as a desk and file cabinets. Legal fees cover the business formation and review/generation of standard client contracts.

Start-up Requirements:

– Legal: $1,000

– Stationery etc.: $125

– Brochures: $400

– Office equipment: $500

– Website creation: $500

– Other: $0

– Total Start-up Expenses: $2,525

Start-up Assets:

– Cash Required: $30,975

– Other Current Assets: $0

– Long-term Assets: $1,500

– Total Assets: $32,475

Total Requirements: $35,000

Start-up Funding:

– Start-up Expenses to Fund: $2,525

– Start-up Assets to Fund: $32,475

– Total Funding Required: $35,000

Assets:

– Non-cash Assets from Start-up: $1,500

– Cash Requirements from Start-up: $30,975

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $30,975

– Total Assets: $32,475

Liabilities and Capital:

Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

Capital:

– Planned Investment:

– Investor 1: $35,000

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $35,000

– Loss at Start-up (Start-up Expenses): ($2,525)

– Total Capital: $32,475

Total Capital and Liabilities: $32,475

Total Funding: $35,000

Services:

PATS provides airport transportation in the Cleveland metropolitan area. They offer both on-demand and reservation-based travel. To utilize the service, customers provide flight information in advance. PATS then schedules the pick-up time and confirms it via call and email. At the airport, PATS meets the customer outside of baggage claim and drives them home.

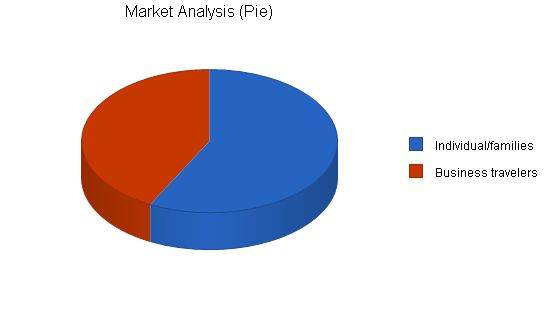

Market Analysis Summary:

PATS targets families and business travelers. Families choose PATS for its convenience and cost-effectiveness compared to driving and long-term parking. Business travelers appreciate the reliable service at a lower price than traditional limousine services. In the current economic downturn, companies encourage employees to use PATS as a cost-saving measure. Cleveland currently has four limousine services and four taxi-type providers.

4.1 Market Segmentation:

PATS divides its customers into two groups: pleasure travelers (individuals or families) and business travelers.

Pleasure travelers have the options of driving and parking, taking a taxi, or using a limousine service. They value a seamless and worry-free transportation solution. By making a reservation, they can rely on PATS to get them to the airport hassle-free.

Business travelers used to rely on limousine services which were covered by their companies. PATS offers a comparable experience at a lower cost. As companies aim to reduce expenses, PATS becomes an attractive option in terms of comfort and affordability. The only difference is that PATS doesn’t provide a limousine, but a spacious and comfortable car.

Market Analysis:

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | CAGR | ||||||

| Individual/families | 9% | 578,000 | 630,020 | 686,722 | 748,527 | 815,894 | 9.00% |

| Business travelers | 8% | 425,000 | 459,000 | 495,720 | 535,378 | 578,208 | 8.00% |

| Total | 8.58% | 1,003,000 | 1,089,020 | 1,182,442 | 1,283,905 | 1,394,102 | 8.58% |

4.2 Target Market Segment Strategy:

PATS will target two groups as they consistently travel and our solution makes traveling easy for them. While a slow economy impacts travel, Americans tend to travel more each year, a trend starting in the early 1980s. PATS finds these groups attractive as they will always need to get to the airport and are willing to pay a bit extra for the luxury of someone taking them there. Note that PATS is only slightly more expensive for trips under four days; over four days, it is more cost-effective compared to driving and long-term parking.

Regarding business customers, it is common practice for companies to provide transportation for their employees. For trips over four days, PATS is unquestionably more cost-effective. Under four days, PATS is slightly more expensive than driving and parking, but companies are willing to pay extra as their employees sacrifice their free time for work trips. For companies willing to pay limousine prices, PATS appears as a way to reduce travel costs without compromising service quality.

4.3 Competition and Buying Patterns:

In Cleveland, there are several competing airport transportation systems:

1. Public transportation: RTA provides inexpensive rapid transit service to the airport. However, the service has disadvantages, such as limited operating hours and requiring travelers to change trains downtown. It also requires travelers to manage their own luggage.

2. Taxi service: Taxis provide service to and from the airport, but travelers cannot book in advance. Service quality and pricing vary among taxi companies. Taxis can be expensive for city dwellers traveling to the suburbs.

3. Airport parking: Cost-effective for trips under four days. Driving oneself eliminates the need to rely on others, but travelers must handle all tasks themselves. There is also a risk of car damage, for which parking facilities are not liable.

4. Shuttle service: Less expensive option but takes longer due to other customers. Personalized service is compromised compared to PATS or a limousine service.

Buying patterns for these services depend on trip length, payer, and timing. Longer trips make transportation options more economically viable than airport parking. Business travelers tend to use upscale transportation solutions like PATS or limousine services. Cost-conscious vacationers usually choose public transportation. Last-minute trips may require a taxi, but PATS offers last-minute rides if cars are available.

Strategy and Implementation Summary:

PATS’ marketing/sales strategy will be two-pronged, targeting families/individuals and business travelers separately.

1. For families/individuals: PATS will work with associations like AAA and other community groups to build a network of users. Referrals from trusted association members will be powerful. Offering association members a discount will attract them. PATS will emphasize total convenience comparable to parking lot costs. One phone call for home and airport pick-up scheduling is a major selling point.

2. For business travelers: PATS will contact travel departments of Cleveland companies with frequent employee travel. A letter/brochure describing services and pricing along with an introductory discount will be sent. PATS aims to provide a cost-effective alternative to limo services.

Competitive Edge:

PATS’ competitive advantage is an incentive system that rewards drivers for good service, repeat customers, and teamwork instead of competition. Drivers are rewarded when:

1. Positive feedback is received via a feedback system.

2. A customer becomes a repeat client.

3. The driver brings in new customers.

4. The driver prioritizes teamwork over individual gain.

Additionally, PATS has drivers lease cars through the company for several reasons:

1. PATS can obtain volume discounts for leases, passing on the cost to drivers.

2. Leasing through PATS encourages long-term commitment, as breaking a lease incurs fees. The lease agreement prohibits drivers from using the cars for more than two months after employment termination.

3. Drivers have an economic incentive to maintain the cars, as they are financially responsible for damage beyond reasonable wear and tear.

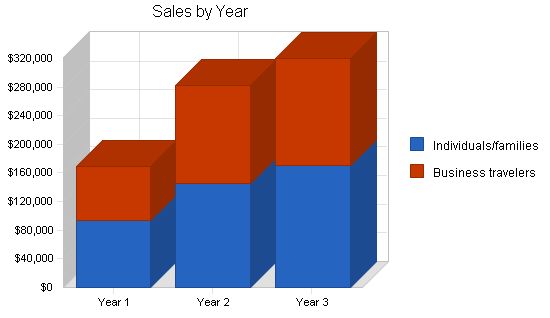

Sales Strategy:

PATS will pursue a different strategy for families/individuals and business travelers. For individuals, PATS will work with membership associations and clubs to build a customer base. Association members tend to trust providers aligned with the association. Offering discounts for association members will create a following. PATS will emphasize total convenience at competitive costs compared to parking fees. The ability to schedule home and airport pick-ups in advance is a major selling point.

To target business travelers, PATS will reach out to travel departments of local companies. A letter/brochure with service description and pricing will be sent, followed by a phone call to secure commitment. Including pricing information in the brochure catches the attention of travel departments aware of current costs. PATS aims to provide a similar service to limo companies at a reduced rate.

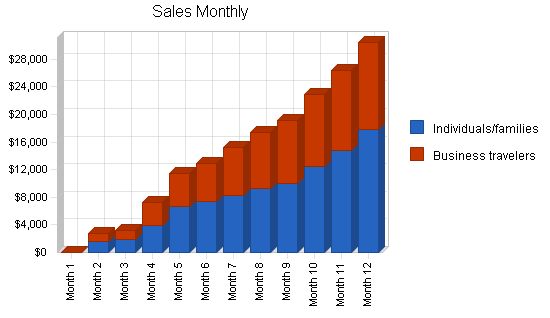

Month 1 will focus on setting up the business. While fares may not be immediately available, the office, brochures, and association partnerships will be in order. Two drivers will be paid a base monthly wage, even if there aren’t enough fares initially.

By month 2, fares will increase steadily. Month 5 will require hiring a third driver. It will be the 11th month when a fourth and final driver will be added.

| Sales Forecast | |||

| Sales | Year 1 | Year 2 | Year 3 |

| Individuals/families | $94,061 | $145,885 | $169,874 |

| Business travelers | $74,763 | $136,874 | $149,874 |

| Total Sales | $168,824 | $282,759 | $319,748 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Individuals/families | $18,812 | $29,177 | $33,975 |

| Business travelers | $14,953 | $27,375 | $29,975 |

| Subtotal Direct Cost of Sales | $33,765 | $56,552 | $63,950 |

5.3 Milestones

PATS will have several milestones to aim for:

- Business plan completion. This will be done as a road map for the organization. While we do not need a business plan to raise capital, it will be an indispensable tool for the ongoing performance and improvement of the company.

- Set up office.

- Profitability.

- Bringing on board the fourth driver.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 1/1/2001 | $0 | ABC | Sam |

| Set up office | 1/1/2001 | 1/1/2001 | $0 | ABC | Sam |

| Profitability | 1/1/2001 | 8/30/2001 | $0 | ABC | everyone |

| Fourth driver hired | 1/1/2001 | 11/1/2001 | $0 | ABC | everyone |

| Totals | $0 |

Management Summary

Premier Airport Transportation Service is owned and operated by Sam Brougham. Sam will be incorporating in Ohio. Sam has a degree in business and mathematics from Case Western Reserve University. While at Case, Sam worked as a taxi driver to cover expenses for his education. Upon graduation, Sam went to work for Yellow Freight Company as a manager for the Logistics Department. In this position, Sam was responsible for devising systems that utilized Yellow’s truck fleet to its maximum capacity. After developing systems for the efficient use of the equipment, Sam applied and was accepted to transfer over to the customer service department. Same felt that he did not have sufficient “people” skills and was determined to develop these skills. For three years Sam worked in the department, eventually being promoted to leader of a call center group.

Once Sam had developed the skills that he deemed necessary to run his own business, he left Yellow and decided to open up his own transportation business. The logistic skills coupled with an outstanding ability to communicate with others provide Sam with the necessary foundation to run PATS.

6.1 Personnel Plan

The staff will consist of Sam working full time in the back office. Sam will be responsible for setting up appointments as well as marketing to develop customers. By month two, Sam will be bringing on board a part-time employee to help him answer phones and set up appointments for fares. Month two will also bring two drivers to PATS. The head count will remain the same until month five when a third driver will be brought on board. Lastly, month 11 will see a fourth driver brought on board.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Sam | $36,000 | $36,000 | $36,000 |

| Part-time employee | $16,500 | $16,500 | $16,500 |

| Driver | $20,600 | $21,600 | $21,600 |

| Driver | $20,600 | $21,600 | $21,600 |

| Driver | $14,400 | $21,600 | $21,600 |

| Driver | $3,600 | $21,600 | $21,600 |

| Total People | 6 | 6 | 6 |

| Total Payroll | $111,700 | $138,900 | $138,900 |

Financial Plan

The following sections will detail important financial information.

7.1 Important Assumptions

The following table highlights some of the important financial assumptions for PATS.

| General Assumptions | |||

| Plan Month | Year 1 | Year 2 | Year 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

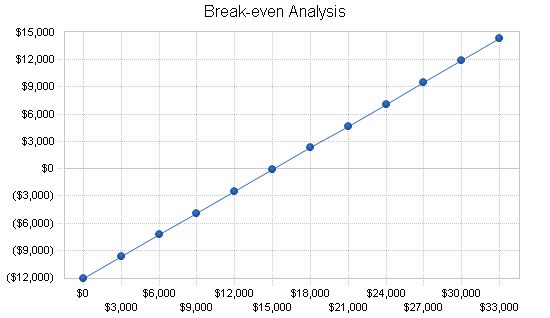

7.2 Break-even Analysis

The Break-even Analysis indicates what PATS must have in averaged monthly revenue to break even.

Break-even Analysis:

Monthly Revenue Break-even: $15,131

Assumptions:

– Average Percent Variable Cost: 20%

– Estimated Monthly Fixed Cost: $12,105

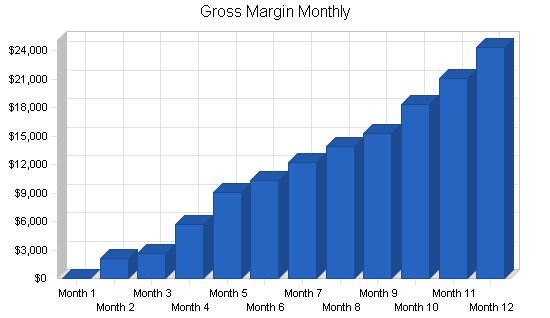

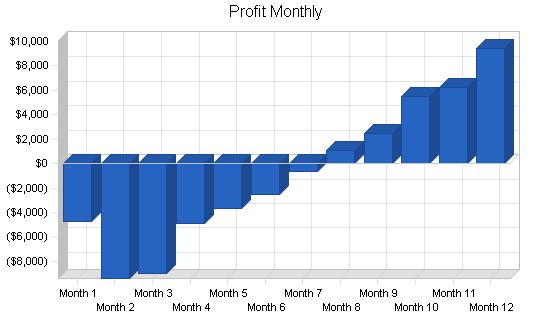

Projected Profit and Loss:

The table below illustrates the projected profit and loss.

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3

Sales: $168,824 $282,759 $319,748

Direct Cost of Sales: $33,765 $56,552 $63,950

Other: $0 $0 $0

Total Cost of Sales: $33,765 $56,552 $63,950

Gross Margin: $135,059 $226,207 $255,798

Gross Margin %: 80.00% 80.00% 80.00%

Expenses:

Payroll: $111,700 $138,900 $138,900

Sales and Marketing and Other Expenses: $3,100 $3,600 $3,600

Depreciation: $504 $498 $498

Web site maintenance: $600 $600 $600

Utilities: $1,200 $1,200 $1,200

Insurance: $5,400 $5,400 $5,400

Rent: $6,000 $0 $0

Payroll Taxes: $16,755 $20,835 $20,835

Other: $0 $0 $0

Total Operating Expenses: $145,259 $171,033 $171,033

Profit Before Interest and Taxes: ($10,200) $55,174 $84,765

EBITDA: ($9,696) $55,672 $85,263

Interest Expense: $0 $0 $0

Taxes Incurred: $0 $13,794 $21,545

Net Profit: ($10,200) $41,381 $63,221

Net Profit/Sales: -6.04% 14.63% 19.77%

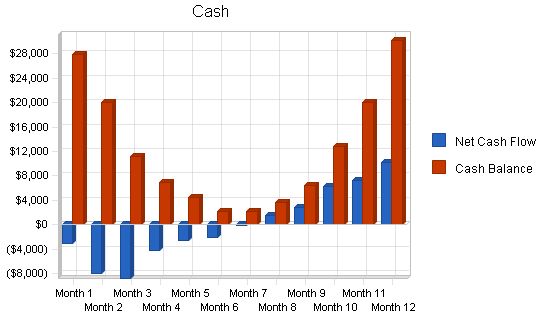

7.4 Projected Cash Flow:

The chart and table below display the projected cash flow.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $168,824 | $282,759 | $319,748 |

| Subtotal Cash from Operations | $168,824 | $282,759 | $319,748 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $168,824 | $282,759 | $319,748 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $111,700 | $138,900 | $138,900 |

| Bill Payments | $57,893 | $102,525 | $115,884 |

| Subtotal Spent on Operations | $169,593 | $241,425 | $254,784 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $169,593 | $241,425 | $254,784 |

| Net Cash Flow | ($769) | $41,334 | $64,964 |

| Cash Balance | $30,206 | $71,540 | $136,504 |

7.5 Projected Balance Sheet

The following table details the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $30,206 | $71,540 | $136,504 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $30,206 | $71,540 | $136,504 |

| Long-term Assets | |||

| Long-term Assets | $1,500 | $1,500 | $1,500 |

| Accumulated Depreciation | $504 | $1,002 | $1,500 |

| Total Long-term Assets | $996 | $498 | $0 |

| Total Assets | $31,202 | $72,038 | $136,504 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $8,927 | $8,382 | $9,627 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $8,927 | $8,382 | $9,627 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $8,927 | $8,382 | $9,627 |

| Paid-in Capital | $35,000 | $35,000 | $35,000 |

| Retained Earnings | ($2,525) | ($12,725) | $28,656 |

| Earnings | ($10,200) | $41,381 | $63,221 |

| Total Capital | $22,275 | $63,656 | $126,877 |

| Total Liabilities and Capital | $31,202 | $72,038 | $136,504 |

| Net Worth | $22,275 | $63,656 | $126,877 |

7.6 Business Ratios

The business ratios table below is generated by the planning software using the interconnected tables. Standard industry ratios, based upon Standard Industrial Classification Code (SIC) 4111, Local and Suburban Transit, are shown for comparison.

| Ratio Analysis | |||||||||||||

| Year 1 | Year 2 | Year 3 | Industry Profile | ||||||||||

| Sales Growth | 0.00% | 67.49% | 13.08% | 3.70% | |||||||||

| Percent of Total Assets | |||||||||||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 45.30% | |||||||||

| Total Current Assets | 96.81% | 99.31% | 100.00% | 64.40% | |||||||||

| Long-term Assets | 3.19% | 0.69% | 0.00% | 35.60% | |||||||||

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||

| Current Liabilities | 28.61% | 11.64% | 7.05% | 31.20% | |||||||||

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 25.20% | |||||||||

| Total Liabilities | 28.61% | 11.64% | 7.05% | 56.40% | |||||||||

| Net Worth | 71.39% | 88.36% | 92.95% | 43.60% | |||||||||

| Percent of Sales | |||||||||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||

| Gross Margin | 80.00% | 80.00% | 80.00% | 66.70% | |||||||||

| Selling, General & Administrative Expenses | 86.04% | 65.37% | 60.12% | 46.50% | |||||||||

| Advertising Expenses | 0.36% | 0.21% | 0.19% | 0.50% | |||||||||

| Profit Before Interest and Taxes | -6.04% | 19.51% | 26.51% | 2.90% | |||||||||

| Main Ratios | |||||||||||||

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $30,975 | $27,918 | $19,962 | $11,141 | $6,920 | $4,404 | $2,237 | $2,109 | $3,644 | $6,481 | $12,761 | $19,971 | $30,206 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $30,975 | $27,918 | $19,962 | $11,141 | $6,920 | $4,404 | $2,237 | $2,109 | $3,644 | $6,481 | $12,761 | $19,971 | $30,206 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 |

| Accumulated Depreciation | $0 | $42 | $84 | $126 | $168 | $210 | $252 | $294 | $336 | $378 | $420 | $462 | $504 |

| Total Long-term Assets | $1,500 | $1,458 | $1,416 | $1,374 | $1,332 | $1,290 | $1,248 | $1,206 | $1,164 | $1,122 | $1,080 | $1,038 | $996 |

| Total Assets | $32,475 | $29,376 | $21,378 | $12,515 | $8,252 | $5,694 | $3,485 | $3,315 | $4,808 | $7,603 | $13,841 | $21,009 | $31,202 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $1,643 | $3,043 | $3,172 | $3,844 | $4,944 | $5,275 | $5,736 | $6,150 | $6,483 | $7,219 | $8,156 | $8,927 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $1,643 | $3,043 | $3,172 | $3,844 | $4,944 | $5,275 | $5,736 | $6,150 | $6,483 | $7,219 | $8,156 | $8,927 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!