Contents

Managing Cash Flow in a Crisis

Amidst the ongoing COVID-19 pandemic and accompanying economic crisis, it is crucial for businesses to not only survive but also find ways to thrive. This necessitates having readily available cash.

Cash flow management is especially vital for small businesses during a crisis, as it can determine whether your business stabilizes or falls behind.

To gain control, focus on activities that generate cash. While lowering expenses and acknowledging declining sales are obvious steps, the first priority should be stabilizing and maintaining your operating cash flow.

Here are five suggestions to improve your cash flow:

- Monitor your accounts receivable: Keep a close eye on customers who owe you money. In a downturn, some customers may delay payment or default, while credit card customers may dispute charges. Monitor these closely and plan how to address any issues that may arise.

- Encourage prompt payment: Offer customers a discount for paying immediately, rather than waiting for the standard 30-day payment period. Consider shifting from invoicing to prepayment, offering discounts to incentivize early payment and generate cash quickly.

- Delay bill payments: Similar to managing customer payments, extending the payment period for your bills will allow you to keep more cash in the bank. However, be mindful of maintaining good relationships with vendors and finding a balance between delayed payments and prompt settlements.

- Reduce inventory: Evaluate whether your business can operate with less inventory and order only when necessary. Selling unnecessary inventory at discounted prices can also help free up cash.

- Negotiate for discounts: Contact your major vendors and try to secure lower prices by negotiating or signing longer-term agreements. Remember that this crisis will eventually end, and your goal is to navigate the short-term challenges.

Long-term solutions for cash flow problems:

- Utilize existing lines of credit: If you already have a line of credit, withdraw cash to handle potential future situations. It’s difficult to predict how long the recovery process will take, so having cash available for worst-case scenarios is prudent.

- Apply for a business loan or line of credit: Despite the challenges, consider applying for credit using assets like real estate or tangible assets as collateral. For small businesses, personal guarantees may be necessary, such as securing a loan with your own home.

- Explore SBA Disaster Assistance Loans: The SBA is offering low-interest loans specifically designed for small businesses affected by the crisis. Consult our guide to SBA Economic Injury Disaster Loans to learn about the requirements and application process.

Using cash flow planning for strategic decision-making

Let me share a real-world example from the last recession:

During the 2008 recession, companies with solid business plans and effective planning processes were able to adjust quickly to the sudden drop in sales. By employing their existing plans, they promptly adapted their costs, expenses, and marketing strategies. Meanwhile, those without robust planning had to delve into the details during the crisis to understand the connections and navigate accordingly. With planning in place, adjusting becomes easier as the connections are preestablished.

If you already have a budget and forecast for your business, these tools can help you predict cash flow and analyze the potential impacts of sales changes.

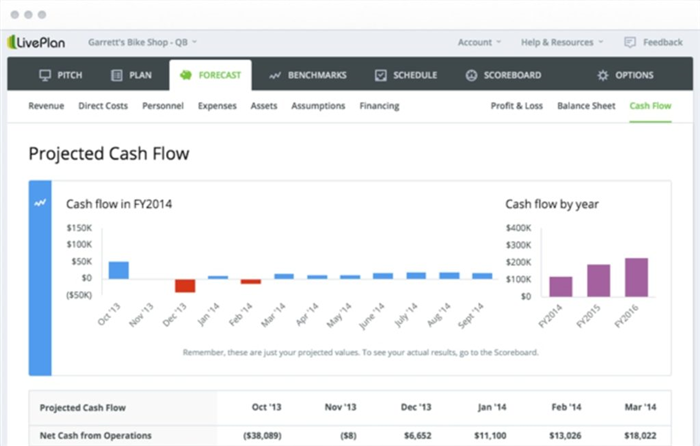

If you don’t have a forecast yet, now is the opportune time to create one. We offer various free forecasting and business planning resources to help you get started. Alternatively, consider using LivePlan for automated budgeting and forecasting.

Having a forecast allows you to anticipate how quickly you will consume your cash reserves and establish an action plan. Review your marketing programs, assess payroll options, and scrutinize discretionary spending to identify areas where you can reduce costs.

With a well-designed plan, you can swiftly adjust sales forecasts, expense budgets, and proactively address cash flow challenges. By forecasting your cash flow, you can identify potential issues in advance and devise suitable solutions.

Don’t worry about having all the right answers when you start forecasting. Make your best guess at future sales and explore scenarios with your plan to help you make decisions about expenses.

Plan for the future and know that the crisis will not last forever.

Every small business owner is currently experiencing the negative effects of the coronavirus. This is both a health and economic crisis, but it will not be forever and we’re all in this together. No one wants to see businesses fail or people struggle, and you may find support amongst your customers and vendors.

I remember when I hit a wall with my own business and had to tell my vendors my payments would be slower. I learned that information and transparency are crucial for surviving a crisis. While they would prefer your money, it’s better to hear from you with explanations and promises than silence. By reviewing your financial statements and forecasting potential scenarios, you can go to them with a plan.

If you need your customers to pay faster, everything is tightening up and they may be in a similar situation. Talk to them, change terms, offer discounts, and protect your long-term relationships.

Consider looking for extra working capital. Keep an eye out for government measures and talk to your favorite banks. Don’t panic, there are opportunities to not just survive this crisis but emerge with a stronger business.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!