Justin Seafood Market has been providing customers with high-quality seafood for five years. The business primarily serves area restaurants, sourcing seafood directly from local fishermen and contacts along the Florida panhandle. This allows us to choose from the finest selection available. Currently, we supply over sixty restaurants, a 10% increase from last year, and anticipate gaining more customers next year.

Our plan is to expand our storefront and sell directly to the public, bringing our commitment to quality, freshness, and great prices to a wider audience. By purchasing in large quantities, we can pass the savings on to our customers.

The planned renovation will cost $150,000. We will also hire additional service staff to assist customers. Bill Justin, owner of Justin Seafood Market, will invest $50,000 in the expansion and secure a $100,000 short-term loan.

1.1 Objectives

– Establish Justin Seafood Market as the leading provider of fresh seafood to the public.

– Increase the customer base by 10% over the next two years.

– Create a Seafood Discount Club to foster customer loyalty.

1.2 Mission

The mission of Justin Seafood Market is to offer customers the best seafood prices without compromising on quality.

1.3 Keys to Success

– Superior products to build customer loyalty.

– Strategic location for foot traffic.

– Loyalty program to foster customer retention.

Company Summary

Justin Seafood Market is primarily a wholesaler to area restaurants. Bill Justin, the owner, has utilized his wholesale background, restaurant industry experience, and contacts with local fishermen to build a loyal customer base.

Bill plans to renovate the building’s storefront and open the seafood market to the public.

2.1 Company Ownership

Bill Justin is the owner of Justin Seafood Market.

2.2 Company History

Bill Justin started Justin Seafood Market in response to the dramatic growth of the Florida panhandle. Over the past five years, the population has increased by 30% in panhandle communities. Tourists have also returned to the area, spending over 400 million dollars with local businesses last year. Currently, there are over 1,350 restaurants in the area, and that number grows by 15% annually.

Against this backdrop of growth, Bill Justin launched his market, initially serving ten customers but now serving sixty restaurants.

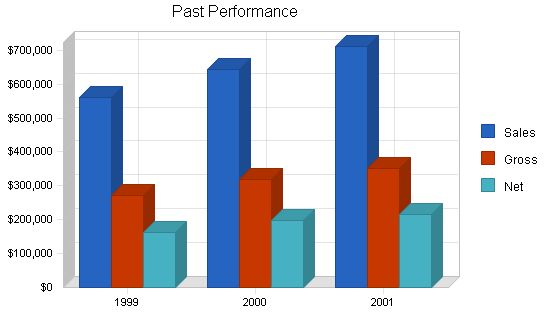

Past Performance:

1999 | 2000 | 2001

Sales: $560,000 | $644,000 | $710,600

Gross Margin: $270,000 | $320,000 | $350,000

Gross Margin %: 48.21% | 49.69% | 49.25%

Operating Expenses: $150,000 | $170,000 | $190,000

Collection Period (days): 0 | 0 | 15

Inventory Turnover: 0.00 | 0.00 | 0.00

1999 | 2000 | 2001

Current Assets:

Cash: $40,000 | $50,000 | $50,000

Accounts Receivable: $0 | $0 | $23,686

Inventory: $0 | $0 | $30,050

Other Current Assets: $20,000 | $30,000 | $50,000

Total Current Assets: $60,000 | $80,000 | $153,736

Long-term Assets:

Long-term Assets: $80,000 | $80,000 | $80,000

Accumulated Depreciation: $5,000 | $10,000 | $15,000

Total Long-term Assets: $75,000 | $70,000 | $65,000

Total Assets: $135,000 | $150,000 | $218,736

Current Liabilities:

Accounts Payable: $10,000 | $12,000 | $20,000

Current Borrowing: $0 | $0 | $0

Other Current Liabilities (interest free): $0 | $0 | $0

Total Current Liabilities: $10,000 | $12,000 | $20,000

Long-term Liabilities: $30,000 | $20,000 | $20,000

Total Liabilities: $40,000 | $32,000 | $40,000

Paid-in Capital: $0 | $0 | $0

Retained Earnings: ($67,000) | ($80,000) | ($37,964)

Earnings: $162,000 | $198,000 | $216,700

Total Capital: $95,000 | $118,000 | $178,736

Total Capital and Liabilities: $135,000 | $150,000 | $218,736

Other Inputs:

Payment Days: 0 | 0 | 30

Sales on Credit: $0 | $0 | $284,240

Receivables Turnover: 0.00 | 0.00 | 12.00

2.3 Company Locations and Facilities:

Justin Seafood Market is located at 3456 Main Street, Tallahassee, Florida. After renovation, the market will have an additional 5,000 ft. of floor space for the new retail operation.

Products:

Justin Seafood Market provides a variety of seafood products to Florida panhandle restaurants. The market’s new retail outlet will focus on popular seafood selections.

Justin Seafood Market will offer the following retail products:

– Jumbo Fresh Gulf Shrimp

– Alaskan King Crab

– Florida Lobster

– Sea Scallops

– Fresh Gulf Fish Fillets

– Yellowfin Tuna

– Grouper

– Snapper

– Amberjack

Market Analysis Summary:

Tallahassee has a population of over 160,000 residents and attracts thousands of day tourists annually. Justin Seafood Market is located in a busy commercial area with high foot traffic. Expanding the market’s storefront by 5,000 ft. will create an inviting environment for the public. The market’s interior design will resemble an open air fish market, and we will promote it as a place to buy quality seafood at wholesale prices.

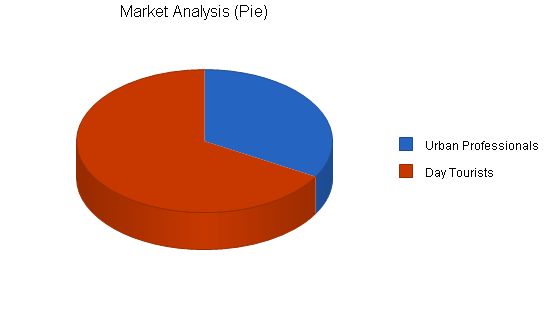

4.1 Market Segmentation:

Justin Seafood Market targets two customer groups:

– Urban professionals working downtown.

– Day tourists.

Market Analysis:

Potential Customers Growth 2002 2003 2004 2005 2006 CAGR

Urban Professionals 10% 30,000 33,000 36,300 39,930 43,923 10.00%

Day Tourists 0% 60,000 60,000 60,000 60,000 60,000 0.00%

Total 3.66% 90,000 93,000 96,300 99,930 103,923 3.66%

Strategy and Implementation Summary

Justin Seafood Market will expand its storefront and sell directly to the public. We will leverage our identity as a wholesale operation to promote the new service with the slogan, "Why pay retail when you can get better quality at wholesale prices!" Additional staff will be hired to serve customers.

5.1 Competitive Edge

The competitive edge of Justin Seafood Market is its commitment to quality, freshness, and great prices. The market’s location ensures high foot traffic from both tourists and residents.

To develop effective business strategies, conduct a SWOT analysis of your business. Use our free guide and template to learn how.

5.2 Sales Strategy

Justin Seafood Market will employ two sales approaches for its target customers:

– For Urban Professionals: The market will promote membership in its Seafood Discount Club. Residents can join for $20 annually and receive a $1 discount per pound on all purchases. This offers significant savings for regular shoppers.

– For Day Tourists: The market will offer free 24-hour shipping for purchases over $100. Customers can choose the shipping day and will receive a regular newsletter with an invitation to make another purchase with the same free shipping option.

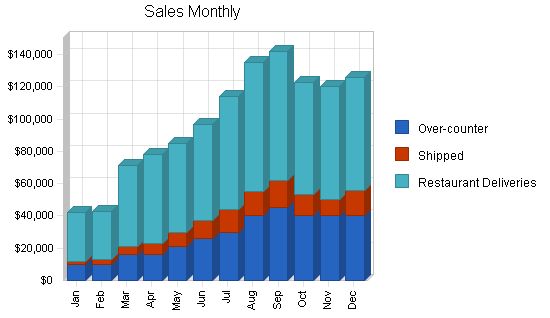

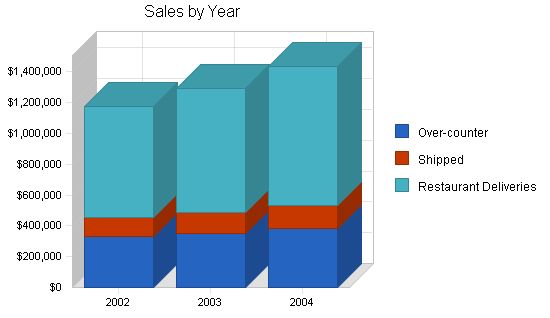

5.2.1 Sales Forecast

The following is a conservative sales forecast for the next three years. We anticipate higher sales after the renovation, but we want to plan for potential contingencies.

Sales Forecast

| Sales Forecast | |||

| 2002 | 2003 | 2004 | |

| Sales | |||

| Over-counter | $334,000 | $350,000 | $380,000 |

| Shipped | $122,000 | $140,000 | $155,000 |

| Restaurant Deliveries | $720,000 | $800,000 | $900,000 |

| Total Sales | $1,176,000 | $1,290,000 | $1,435,000 |

| Direct Cost of Sales | 2002 | 2003 | 2004 |

| Over-counter | $166,500 | $173,000 | $188,000 |

| Shipped | $64,100 | $74,000 | $81,000 |

| Restaurant Deliveries | $359,000 | $409,000 | $459,000 |

| Subtotal Direct Cost of Sales | $589,600 | $656,000 | $728,000 |

Management Summary

Prior to Justin Seafood Market, Bill Justin worked as an account manager for William’s Wholesale Foods and Wilson Seafood for ten years. In his last position with Wilson Seafood, Bill developed a network of fishing contacts in the Florida panhandle, generating annual sales in excess of $2 million. His strength has always been customer relations.

Bill Justin has a BA in marketing from Florida State University. After graduation, his first position was as a shift manager with Johnson Seafood Restaurant. In three years, he was promoted to manager, demonstrating the ability to effectively manage a large staff.

6.1 Personnel Plan

The personnel for Justin Seafood Market is as follows:

– Manager

– Market staff (4 by year end)

– Delivery crew (4 by year end)

– Sales staff (4 by year end)

– Cleanup crew (2)

| Personnel Plan | |||

| 2002 | 2003 | 2004 | |

| Manager | $36,000 | $38,000 | $40,000 |

| Market Staff (2-4) | $71,750 | $90,000 | $96,000 |

| Clean-up Crew (2) | $45,600 | $47,000 | $49,000 |

| Delivery Staff (2-4) | $82,000 | $102,000 | $108,000 |

| Sales Staff (3-4) | $110,000 | $130,000 | $140,000 |

| Total People | 15 | 15 | 15 |

| Total Payroll | $345,350 | $407,000 | $433,000 |

The following is the financial plan for the expansion of Justin Seafood Market to include a new retail market space.

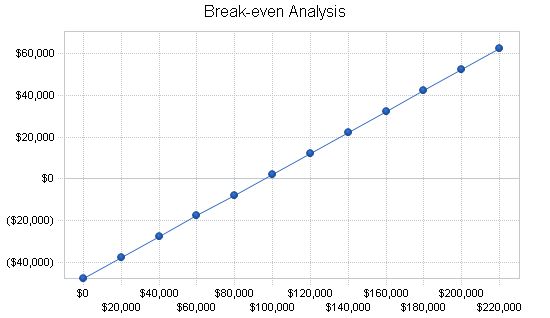

The following table and chart show our break-even analysis for the coming year.

Break-even Analysis

Monthly Revenue Break-even: $95,418

Assumptions:

– Average Percent Variable Cost: 50%

– Estimated Monthly Fixed Cost: $47,579

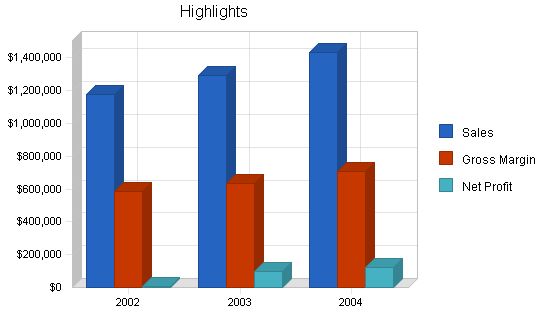

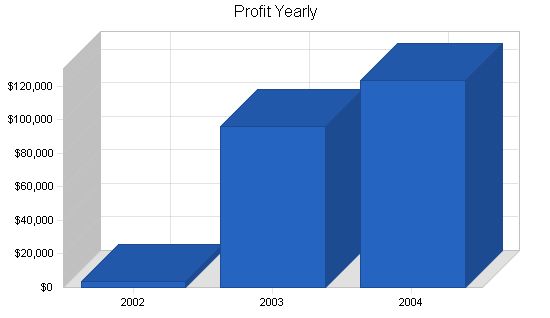

Projected Profit and Loss:

The table and charts below illustrate the projected profit and loss for three years.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Sales | $1,176,000 | $1,290,000 | $1,435,000 |

| Direct Cost of Sales | $589,600 | $656,000 | $728,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $589,600 | $656,000 | $728,000 |

| Gross Margin | $586,400 | $634,000 | $707,000 |

| Gross Margin % | 49.86% | 49.15% | 49.27% |

| Expenses | |||

| Payroll | $345,350 | $407,000 | $433,000 |

| Sales and Marketing and Other Expenses | $24,000 | $30,000 | $40,000 |

| Depreciation | $9,600 | $9,600 | $9,600 |

| Renovation Expenses | $150,000 | $0 | $0 |

| Utilities | $6,000 | $6,000 | $6,000 |

| Insurance | $0 | $0 | $0 |

| Rent | $36,000 | $36,000 | $36,000 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $570,950 | $488,600 | $524,600 |

| Profit Before Interest and Taxes | $15,450 | $145,400 | $182,400 |

| EBITDA | $25,050 | $155,000 | $192,000 |

| Interest Expense | $10,675 | $8,331 | $5,885 |

| Taxes Incurred | $1,432 | $41,121 | $52,955 |

| Net Profit | $3,342 | $95,948 | $123,561 |

| Net Profit/Sales | 0.28% | 7.44% | 8.61% |

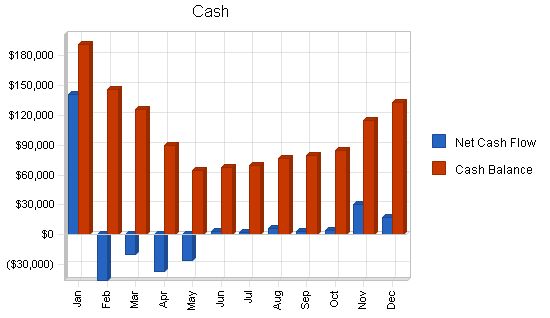

Projected Cash Flow

The following table and chart highlight the projected cash flow for three years.

Pro Forma Cash Flow

Year: 2002 2003 2004

Cash Received:

Cash from Operations

– Cash Sales: $705,600 $774,000 $861,000

– Cash from Receivables: $397,286 $506,616 $562,065

– Total Cash from Operations: $1,102,886 $1,280,616 $1,423,065

Additional Cash Received:

– Sales Tax, VAT, HST/GST Received: $0 $0 $0

– New Current Borrowing: $100,000 $0 $0

– New Other Liabilities (interest-free): $0 $0 $0

– New Long-term Liabilities: $0 $0 $0

– Sales of Other Current Assets: $0 $0 $0

– Sales of Long-term Assets: $0 $0 $0

– New Investment Received: $50,000 $0 $0

– Total Cash Received: $1,252,886 $1,280,616 $1,423,065

Expenditures:

Expenditures from Operations:

– Cash Spending: $345,350 $407,000 $433,000

– Bill Payments: $800,535 $797,744 $869,803

– Total Spent on Operations: $1,145,885 $1,204,744 $1,302,803

Additional Cash Spent:

– Sales Tax, VAT, HST/GST Paid Out: $0 $0 $0

– Principal Repayment of Current Borrowing: $21,600 $21,600 $21,600

– Other Liabilities Principal Repayment: $0 $0 $0

– Long-term Liabilities Principal Repayment: $2,860 $2,860 $2,860

– Purchase Other Current Assets: $0 $0 $0

– Purchase Long-term Assets: $0 $0 $0

– Dividends: $0 $0 $0

– Total Cash Spent: $1,170,345 $1,229,204 $1,327,263

Net Cash Flow: $82,541 $51,412 $95,801

Cash Balance: $132,541 $183,953 $279,754

Projected Balance Sheet

Year: 2002 2003 2004

Assets:

Current Assets:

– Cash: $132,541 $183,953 $279,754

– Accounts Receivable: $96,800 $106,184 $118,119

– Inventory: $69,850 $77,716 $86,246

– Other Current Assets: $50,000 $50,000 $50,000

– Total Current Assets: $349,191 $417,853 $534,120

Long-term Assets:

– Long-term Assets: $80,000 $80,000 $80,000

– Accumulated Depreciation: $24,600 $34,200 $43,800

– Total Long-term Assets: $55,400 $45,800 $36,200

Total Assets: $404,591 $463,653 $570,320

Liabilities and Capital:

Current Liabilities:

– Accounts Payable: $76,973 $64,547 $72,113

– Current Borrowing: $78,400 $56,800 $35,200

– Other Current Liabilities: $0 $0 $0

– Subtotal Current Liabilities: $155,373 $121,347 $107,313

Long-term Liabilities: $17,140 $14,280 $11,420

Total Liabilities: $172,513 $135,627 $118,733

Paid-in Capital: $50,000 $50,000 $50,000

Retained Earnings: $178,736 $182,078 $278,027

Earnings: $3,342 $95,948 $123,561

Total Capital: $232,078 $328,027 $451,587

Total Liabilities and Capital: $404,591 $463,653 $570,320

Years: 2002 2003 2004

Sales Growth: 65.49% 9.69% 11.24%

Percent of Total Assets:

– Accounts Receivable: 23.93% 22.90% 20.71%

– Inventory: 17.26% 16.76% 15.12%

– Other Current Assets: 12.36% 10.78% 8.77%

– Total Current Assets: 86.31% 90.12% 93.65%

– Long-term Assets: 13.69% 9.88% 6.35%

– Total Assets: 100.00% 100.00% 100.00%

Current Liabilities:

– Accounts Payable: 38.40% 26.17% 18.82%

– Long-term Liabilities: 4.24% 3.08% 2.00%

– Total Liabilities: 42.64% 29.25% 20.82%

– Net Worth: 57.36% 70.75% 79.18%

Percent of Sales:

– Gross Margin: 49.86% 49.15% 49.27%

– Selling, General & Administrative Expenses: 46.23% 45.05% 43.86%

– Advertising Expenses: 1.02% 1.16% 1.39%

– Profit Before Interest and Taxes: 1.31% 11.27% 12.71%

Main Ratios:

– Current: 2.25 3.44 4.98

– Quick: 1.80 2.80 4.17

– Total Debt to Total Assets: 42.64% 29.25% 20.82%

– Pre-tax Return on Net Worth: 2.06% 39.79% 39.09%

– Pre-tax Return on Assets: 1.18% 29.56% 30.95%

Additional Ratios:

– Net Profit Margin: 0.28% 7.44% 8.61%

– Return on Equity: 1.44% 29.25% 27.36%

Activity Ratios:

– Accounts Receivable Turnover: 4.86 4.86 4.86

– Collection Days: 57 72 71

– Inventory Turnover: 10.91 8.89 8.88

– Accounts Payable Turnover: 11.14 12.17 12.17

– Payment Days: 28 33 28

– Total Asset Turnover: 2.91 2.78 2.52

Debt Ratios:

– Debt to Net Worth: 0.74 0.41 0.26

– Current Liab. to Liab.: 0.90 0.89 0.90

Liquidity Ratios:

– Net Working Capital: $193,818 $296,507 $426,807

– Interest Coverage: 1.45 17.45 30.99

Additional Ratios:

– Assets to Sales: 0.34 0.36 0.40

– Current Debt to Total Assets: 38% 26% 19%

– Acid Test: 1.17 1.93 3.07

– Sales/Net Worth: 5.07 3.93 3.18

– Dividend Payout: 0.00 0.00 0.00

Appendix

Sales Forecast

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Sales

– Over-counter $10,000 $10,000 $16,000 $16,000 $21,000 $26,000 $30,000 $40,000 $45,000 $40,000 $40,000 $40,000

– Shipped $2,000 $3,000 $5,000 $7,000 $9,000 $11,000 $14,000 $15,000 $17,000 $13,000 $10,000 $16,000

– Restaurant Deliveries $30,000 $30,000 $50,000 $55,000 $55,000 $60,000 $70,000 $80,000 $80,000 $70,000 $70,000 $70,000

– Total Sales $42,000 $43,000 $71,000 $78,000 $85,000 $97,000 $114,000 $135,000 $142,000 $123,000 $120,000 $126,000

Direct Cost of Sales

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

– Over-counter $5,000 $5,000 $8,000 $8,000 $10,000 $13,000 $15,000 $20,000 $22,500 $20,000 $20,000 $20,000

– Shipped $1,100 $1,600 $2,600 $3,800 $4,500 $5,500 $7,500 $8,000 $8,500 $6,500 $6,000 $8,500

– Restaurant Deliveries $15,000 $15,000 $25,000 $27,000 $27,000 $30,000 $35,000 $40,000 $40,000 $35,000 $35,000 $35,000

– Subtotal Direct Cost of Sales $21,100 $21,600 $35,600 $38,800 $41,500 $48,500 $57,500 $68,000 $71,000 $61,500 $61,000 $63,500

Personnel Plan

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

– Manager $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

– Market Staff (2-4) $3,500 $3,500 $3,500 $5,250 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000 $7,000

– Clean-up Crew (2) $3,800 $3,800 $3,800 $3,800 $3,800 $3,800 $3,800 $3,800 $3,800 $3,800 $3,800 $3,800 $3,800

– Delivery Staff (2-4) $4,000 $4,000 $4,000 $6,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000

– Sales Staff (3-4) $7,500 $7,500 $7,500 $7,500 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000

Total People: 10 10 10 12 15 15 15 15 15 15 15 15 15

Total Payroll: $21,800 $21,800 $21,800 $25,550 $31,800 $31,800 $31,800 $31,800 $31,800 $31,800 $31,800 $31,800 $31,800

| General Assumptions | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | ||

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| $42,000 | $43,000 | $71,000 | $78,000 | $85,000 | $97,000 | $114,000 | $135,000 | $142,000 | $123,000 | $120,000 | $126,000 | $42,000 | |

| $21,100 | $21,600 | $35,600 | $38,800 | $41,500 | $48,500 | $57,500 | $68,000 | $71,000 | $61,500 | $61,000 | $63,500 | $21,100 | |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| $21,100 | $21,600 | $35,600 | $38,800 | $41,500 | $48,500 | $57,500 | $68,000 | $71,000 | $61,500 | $61,000 | $63,500 | $21,100 | |

| $20,900 | $21,400 | $35,400 | $39,200 | $43,500 | $48,500 | $56,500 | $67,000 | $71,000 | $61,500 | $59,000 | $62,500 | $20,900 | |

| 49.76% | 49.77% | 49.86% | 50.26% | 51.18% | 50.00% | 49.56% | 49.63% | 50.00% | 50.00% | 49.17% | 49.60% | 49.76% | |

| $20,900 | $21,400 | $35,400 | $39,200 | $43,500 | $48,500 | $56,500 | $67,000 | $71,000 | $61,500 | $59,000 | $62,500 | $20,900 | |

| 49.76% | 49.77% | 49.86% | 50.26% | 51.18% | 50.00% | 49.56% | 49.63% | 50.00% | 50.00% | 49.17% | 49.60% | 49.76% | |

| $88,100 | $68,100 | $48,100 | $61,850 | $38,100 | $38,100 | $38,100 | $38,100 | $38,100 | $38,100 | $38,100 | $38,100 | $38,100 | |

| $21,800 | $21,800 | $21,800 | $25,550 | $31,800 | $31,800 | $31,800 | $31,800 | $31,800 | $31,800 | $31,800 | $31,800 | $31,800 | |

| $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| $88,100 | $68,100 | $48,100 | $61,850 | $38,100 | $38,100 | $38,100 | $38,100 | $38,100 | $38,100 | $38,100 | $38,100 | $38,100 | |

| $67,200 | $46,700 | $12,700 | $22,650 | $5,400 | $10,400 | $18,400 | $28,900 | $32,900 | $23,400 | $20,900 | $24,400 | $67,200 | |

| ($66,400) | ($45,900) | ($11,900) | ($21,850) | $6,200 | $11,200 | $19,200 | $29,700 | $33,700 | $24,200 | $21,700 | $25,200 | ($66,400) | |

| $983 | $966 | $949 | $932 | $915 | $898 | $881 | $864 | $847 | $830 | $813 | $796 | $983 | |

| ($20,455) | ($14,300) | ($4,095) | ($7,075) | $1,345 | $2,851 | $5,256 | $8,411 | $9,616 | $6,771 | $6,026 | $7,081 | ($20,455) | |

| ($47,728) | ($33,366) | ($9,554) | ($16,507) | $3,139 | $6,651 | $12,263 | $19,625 | $22,437 | $15,799 | $14,061 | $16,523 | ($47,728) | |

| -113.64% | -77.60% | -13.46% | -21.16% | 3.69% | 6.86% | ||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!