Contents

Women’s Shoe Store Business Plan

Passion Soles is a women-only shoe store in Eugene, Oregon. Eugene desperately needs an upscale shoe store for women because the current stores have a limited selection. Women in need of special shoes often have to travel to Portland to find the right pair.

Passion Soles will offer an extensive selection of different shoes. Maintaining a large selection is typically expensive due to the need to stock multiple sizes per style. However, Passion Soles has a unique business model that allows them to offer a wide variety of shoes by stocking only one size per style. By establishing a special relationship with the wholesaler, Passion Soles can quickly obtain the customer’s desired size within two days. Rush overnight shipping is also available for an additional cost.

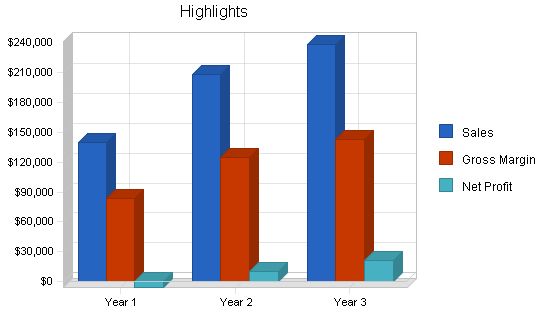

Passion Soles will leverage Holly Heels’ extensive knowledge of the women’s retail shoe industry to rapidly gain market share. The store aims to achieve profitability by month ten and generate $284,000 in revenue by the third year.

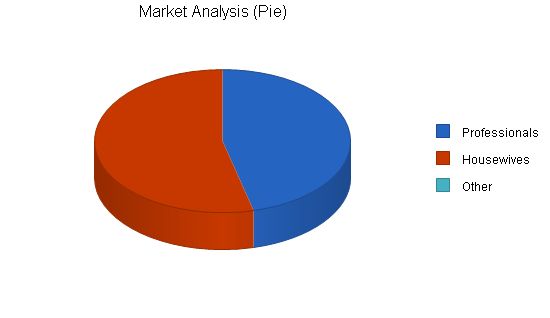

The key to success is meeting the demand for an upscale women’s shoe store with a wide selection and focused customer attention. The objectives for the first three years of operation are to create a product-based retail store that exceeds customer expectations, increase the number of clients served by 20% per year by providing outstanding selection and customer service, and develop a start-up business that survives off its own cash flow. Passion Soles’ mission is to provide Eugene with an upscale selection of women’s shoes and excellent customer service in order to attract and maintain customers. Passion Soles is an upscale women’s shoe store located in Eugene, OR, that caters to an un-serviced niche. Passion Soles offers a wide selection by typically only having one size available per style, with all other sizes available within two days. Passion Soles is a sole proprietorship owned by Holly Heels. The start-up costs for Passion Soles include a computer system with necessary software, a POS terminal/cash register, office furniture, store fixtures, and lighting. The start-up assets will be depreciated over time. Passion Soles will sell upscale women’s shoes, including sandals, stylish work shoes, loafers, dress shoes, and canvas athletic/stylish shoes, and strives to have one of the largest selections in Oregon. Passion Soles accomplishes this by having one size per style in stock as a demonstration model and ordering the style in the needed size, which arrives within two days. Passion Soles targets two groups of fashion-conscious female shoppers – professional workers and housewives. Professionals are full-time working women who earn more than $45,000 and purchase shoes for the workplace and leisure. Housewives have a household income of $60,000-$120,000 and are looking for fashionable, yet more casual shoes.

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Professionals 9% 12,457 13,578 14,800 16,132 17,584 9.00%

Housewives 8% 14,544 15,708 16,965 18,322 19,788 8.00%

Other 0% 0 0 0 0 0 0.00%

Total 8.47% 27,001 29,286 31,765 34,454 37,372 8.47%

4.2 Target Market Segment Strategy

These markets will be targeted through an attractive, eye-catching storefront in a popular mall. Most women within the target market shop at malls. Malls allow them to visit many different stores within the same vicinity. By just having a visible storefront in a well-traveled mall, Passion Soles will receive walk-through customers.

While the leased space in a mall is expensive, one of the benefits that you pay for is the mall association, which spends money on marketing the mall and the stores within the mall.

The women’s shoe retail industry is made up of several different types of companies:

– Shoe-only stores: These stores only sell shoes. Generally, they will either sell athletic shoes for men and women or dress shoes for only one sex.

– Large department stores: These types of stores sell everything, including shoes.

– Small women’s retail stores: These types of stores cater to women by only selling women’s clothing and shoes.

4.3.1 Competition and Buying Patterns

Passion Soles has three direct competitors in Eugene:

– (name omitted): This is a women’s only clothing and shoe store. They have a nice selection of clothing but a poor selection of shoes. The shoe styles are not cutting edge. The price point for the shoes is $30-$120.

– (name omitted): This is a large, complete, department store. The store, however, suffers from cluttered displays and a general sense of disorganization. Shoes here are $30-$120.

– (name omitted): This is a national franchise that only sells shoes, for both men and women. This company will sell knock-offs, shoes just like name brands, but with their name on it. While this store has a huge selection, the quality of the shoes leaves a lot to be desired. This is somewhat understandable as the shoes typically sell for $13-$50. While the shoes are often good copies of famous brands, the execution is sometimes off. Many of the shoes are made out of pleather and look like they were dipped in wax, giving them a tacky appearance.

An indirect competitor is a shoesmith that will dye shoes. The shoes are typically dyed to match a specific dress. Not all colors can be dyed, and dying, in general, is not the ideal situation. Dying shoes creates a new shoe color that is acceptable only 20% of the time.

The two major competitors in Portland are:

– Nordstroms: A mid- to high-end department store known for their outstanding customer service. The shoe price point is $60-$300.

– Saks: This department store caters to the high class, older crowd. Shoes range from $75-$400.

The buying habits for fashion-conscious women consist of typically buying at least one pair of shoes per month. Women generally purchase a pair of shoes to go with a specific dress. Once the woman purchases the dress, she will then begin the sometimes long search for the perfect pair of shoes.

Strategy and Implementation Summary

Passion Soles will leverage their competitive edge of an extensive selection to drive sales. This is a competitive edge because it is typically cost prohibitive for a store to have as much of a selection that Passion Soles will offer. Because of a unique business model, Passion Soles is able to leverage their financial resources and offer an unmatched selection. This is done by carrying a large selection of styles by only stocking one size per style. Once the customer has chosen the style, Passion Soles will have the customer’s shoes in one to two days.

5.1 Sales Strategy

Passion Soles’ sales strategy will be based on display and visibility. A highly visible store with attractive product displays located in the mall will get a high percentage of foot traffic. This is especially the case for a women’s shoe store. Women love to shop for shoes. Some women even use shoe shopping as a form of therapy, similar to eating chocolate. These activities can make them feel better.

The sales strategy will simply be to have the most complete selection of shoes. Assuming the prices are reasonable, having an extensive selection will drive sales because we believe our target markets of fashion-conscious females are always looking for the perfect pair of shoes to coordinate with their fashion style.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

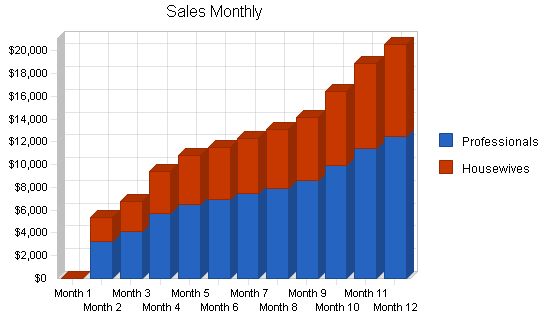

5.1.1 Sales Forecast

The first month will be used to set up the storefront. The first employee will be hired and display inventory will be purchased. There will be no sales activity during the first month. The second month will begin to see sales activity, and it is forecasted that around month four sales will really begin to pick up. The reason for this is that word will get out about Passion Soles and more and more people will be coming in to check out the extensive selection. A third employee will be hired in December for the holiday season.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Professionals | $84,402 | $118,745 | $135,454 |

| Housewives | $54,861 | $89,184 | $102,095 |

| Total Sales | $139,263 | $207,929 | $237,549 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Professionals | $33,761 | $47,498 | $54,182 |

| Housewives | $21,945 | $35,674 | $40,838 |

| Subtotal Direct Cost of Sales | $55,705 | $83,172 | $95,020 |

5.2 Milestones

Passion Soles will have several milestones early on:

- Business plan completion. This will be done as a road map for the organization. This will be an indispensable tool for the ongoing performance and improvement of the company.

- Set up the store front.

- Revenues exceeding $75,000.

- Profitability.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 2/1/2001 | $0 | ABC | Marketing |

| Set up the store front | 1/1/2001 | 2/1/2001 | $0 | ABC | Department |

| Revenues exceeding $75,000 | 1/1/2001 | 9/31/2001 | $0 | ABC | Department |

| Profitability | 1/1/2001 | 10/31/2001 | $0 | ABC | Department |

| Totals | $0 | ||||

5.3 Competitive Edge

Passion Soles’ competitive edge is an unmatched selection in Eugene. This selection will be achieved in two ways. The first way is a very specific effort to carry as many styles of shoes as possible. Passion Soles recognizes that Eugene currently does not have a single store that offers a wide selection of decent quality shoes for the fashion-conscious female consumer. The competitive edge is the recognition of this unserved niche and the serving of this demand.

Passion Soles will be able to offer a large selection through a unique inventory model that stocks only one size per style. The advantage is that for the same amount of money that Passion Soles invests in overhead, they can offer far more styles.

This model is effective because women are willing to order a pair of shoes sight seen but not fitted. Passion Soles offers two day delivery with an additional expense rush overnight option.

Management Summary

Holly Heels, the founder and owner received her Bachelor of Arts in marketing from the University of Portland. Throughout college, and full time after graduation, Holly worked at Nordstroms. She started out as a sales person in the Nordstroms outerwear department, where Holly was named employee of the month five times. This caught the attention of her supervisors and after one year of full-time work at Nordstroms, she was offered a position as the assistant manager of the women’s shoe department.

Holly worked as the assistant manager for one and a half years before receiving a promotion to manager of the department, a huge responsibility and honor. Holly learned all of the “ins and outs” of the Nordstroms retail shoe industry in this job. After three years, Holly decided to leave and seek another job. She had always wanted to live in a smaller town and, upon visiting a friend in Eugene, began to do some market research about the women’s shoe industry in Eugene. She realized that there was an unmet demand for fashionable shoes and she began to write a business plan to serve this need. She was confident that she would be able to leverage all of her industry knowledge and create a store in Eugene serving fashion-conscious women.

6.1 Personnel Plan

Holly will be working full time at Passion Soles. She will be in charge of all administrative details, hiring, inventory management, etc. Beginning with month two, Holly will hire a full-time sales clerk to help her at the store. By December, she will hire an additional full-time employee in time for the holiday season.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Holly | $36,000 | $40,000 | $42,000 |

| Full-time employee | $17,600 | $19,200 | $19,200 |

| Full-time employee | $1,600 | $19,200 | $19,200 |

| Total People | 3 | 3 | 3 |

| Total Payroll | $55,200 | $78,400 | $80,400 |

Financial Plan

The following sections will outline important financial information.

7.1 Important Assumptions

The following table details important financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

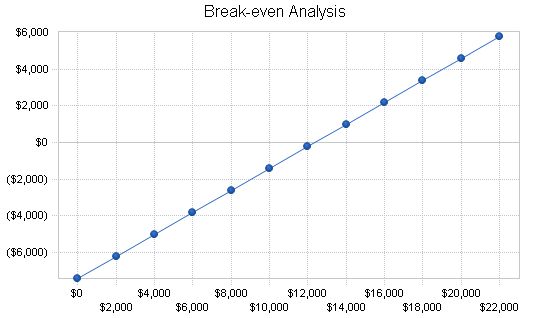

7.2 Break-even Analysis

The Break-even Analysis indicates that approximately $13,000 is needed in monthly revenue to reach the break-even point.

Break-even Analysis

Monthly Revenue Break-even: $12,369

Assumptions:

– Average Percent Variable Cost: 40%

– Estimated Monthly Fixed Cost: $7,421

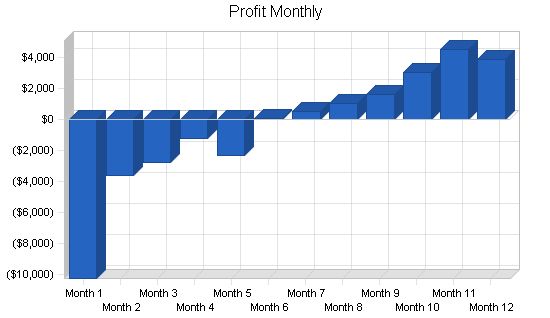

Projected Profit and Loss:

The table below shows the projected profit and loss. We anticipate purchasing new shoe display inventory, mainly for seasonal style changes. Since these are displays, we consider them as expenses. It is estimated that new styles, particularly during seasonal transitions, will necessitate regular purchase of shoe displays as part of our standard business operations.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $139,263 | $207,929 | $237,549 |

| Direct Cost of Sales | $55,705 | $83,172 | $95,020 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $55,705 | $83,172 | $95,020 |

| Gross Margin | $83,558 | $124,757 | $142,529 |

| Gross Margin % | 60.00% | 60.00% | 60.00% |

| Expenses | |||

| Payroll | $55,200 | $78,400 | $80,400 |

| Sales and Marketing and Other Expenses | $1,200 | $1,200 | $1,200 |

| Depreciation | $1,056 | $1,056 | $1,056 |

| Shoe Display Inventory | $7,000 | $5,000 | $5,000 |

| Utilities | $1,200 | $1,200 | $1,200 |

| Insurance | $1,800 | $1,800 | $1,800 |

| Rent | $21,600 | $21,600 | $21,600 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $89,056 | $110,256 | $112,256 |

| Profit Before Interest and Taxes | ($5,498) | $14,501 | $30,273 |

| EBITDA | ($4,442) | $15,557 | $31,329 |

| Interest Expense | $255 | $224 | $37 |

| Taxes Incurred | $0 | $4,283 | $9,071 |

| Net Profit | ($5,753) | $9,994 | $21,165 |

| Net Profit/Sales | -4.13% | 4.81% | 8.91% |

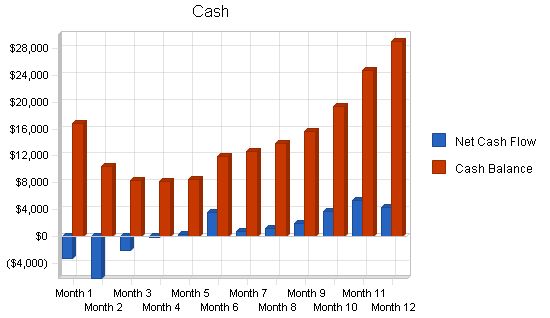

7.4 Projected Cash Flow

The following chart and table indicate projected cash flow. We anticipate borrowing $5,000 in June to cover shoe display inventory purchases and other expenses.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $139,263 $207,929 $237,549

Subtotal Cash from Operations $139,263 $207,929 $237,549

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $5,000 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $144,263 $207,929 $237,549

Expenditures

Expenditures from Operations

Cash Spending $55,200 $78,400 $80,400

Bill Payments $78,704 $118,797 $133,576

Subtotal Spent on Operations $133,904 $197,197 $213,976

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $1,260 $3,000 $740

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $135,164 $200,197 $214,716

Net Cash Flow $9,099 $7,732 $22,833

Cash Balance $29,131 $36,863 $59,697

7.5 Projected Balance Sheet

The following table indicates the projected balance sheet.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $29,131 $36,863 $59,697

Other Current Assets $0 $0 $0

Total Current Assets $29,131 $36,863 $59,697

Long-term Assets

Long-term Assets $9,368 $9,368 $9,368

Accumulated Depreciation $1,056 $2,112 $3,168

Total Long-term Assets $8,312 $7,256 $6,200

Total Assets $37,443 $44,119 $65,897

Liabilities and Capital

Current Liabilities

Accounts Payable $10,056 $9,738 $11,090

Current Borrowing $3,740 $740 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $13,796 $10,478 $11,090

Long-term Liabilities $0 $0 $0

Total Liabilities $13,796 $10,478 $11,090

Paid-in Capital $30,000 $30,000 $30,000

Retained Earnings ($600) ($6,353) $3,641

Earnings ($5,753) $9,994 $21,165

Total Capital $23,647 $33,641 $54,807

Total Liabilities and Capital $37,443 $44,119 $65,897

Net Worth $23,647 $33,641 $54,807

7.6 Business Ratios

The following table compares our ratios to Standard Industry Code #3144 (Women’s footwear, except athletic).

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 49.31% 14.25% 10.45%

Percent of Total Assets

Other Current Assets 0.00% 0.00% 0.00% 33.22%

Total Current Assets 77.80% 83.55% 90.59% 85.17%

Long-term Assets 22.20% 16.45% 9.41% 14.83%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities

Long-term Liabilities 0.00% 0.00% 0.00% 25.97%

Total Liabilities 36.85% 23.75% 16.83% 52.79%

Net Worth 63.15% 76.25% 83.17% 47.21%

Percent of Sales

Gross Margin 60.00% 60.00% 60.00% 22.01%

Selling, General & Administrative Expenses 74.12% 49.27% 48.20% 10.93%

Advertising Expenses 0.43% 0.23% 0.21% 1.05%

Profit Before Interest and Taxes -3.95% 6.97% 12.74% 2.49%

Main Ratios

Current 2.11 3.52 5.38 2.58

Quick 2.11 3.52 5.38 1.37

Total Debt to Total Assets 36.85% 23.75% 16.83% 57.34%

Pre-tax Return on Net Worth -24.33% 42.44% 55.17% 6.10%

Pre-tax Return on Assets -15.36% 32.36% 45.88% 14.29%

Additional Ratios

Net Profit Margin -4.13% 4.81% 8.91% n.a

Return on Equity -24.33% 29.71% 38.62% n.a

Activity Ratios

Accounts Payable Turnover 8.83 12.17 12.17 n.a

Payment Days 27 30 28 n.a

Total Asset Turnover 3.72 4.71 3.60 n.a

Debt Ratios

Debt to Net Worth 0.58 0.31 0.20 n.a

Current Liab. to Liab. 1.00 1.00 1.00 n.a

Liquidity Ratios

Net Working Capital $15,335 $26,385 $48,607 n.a

Interest Coverage -21.57 64.74 818.20 n.a

Additional Ratios

Assets to Sales 0.27 0.21 0.28 n.a

Current Debt/Total Assets 37% 24% 17% n.a

Acid Test 2.11 3.52 5.38 n.a

Sales/Net Worth 5.89 6.18 4.33 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales

Professionals 0% $0 $3,245 $4,114 $5,678 $6,545 $6,985 $7,454 $7,945 $8,569 $9,956 $11,454 $12,457

Housewives 0% $0 $2,109 $2,674 $3,691 $4,254 $4,540 $4,845 $5,164 $5,570 $6,471 $7,445 $8,097

Total Sales $0 $5,354 $6,788 $9,369 $10,799 $11,525 $12,299 $13,109 $14,139 $16,427 $18,899 $20,554

Direct Cost of Sales

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Professionals $0 $1,298 $1,646 $2,271 $2,618 $2,794 $2,982 $3,178 $3,428 $3,982 $4,582 $4,983

Housewives $0 $844 $1,070 $1,476 $1,702 $1,816 $1,938 $2,066 $2,228 $2,589 $2,978 $3,239

Subtotal Direct Cost of Sales $0 $2,142 $2,715 $3,747 $4,320 $4,610 $4,920 $5,244 $5,656 $6,571 $7,560 $8,222

Personnel Plan

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Holly 0% $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

Full-time employee 0% $0 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600 $1,600

Full-time employee 0% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $1,600

Total People 1 2 2 2 2 2 2 2 2 2 2 2 3

Total Payroll $3,000 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $6,200

General Assumptions:

Month 1 2 3 4 5 6 7 8 9 10 11 12

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss:

Month 1 2 3 4 5 6 7 8 9 10 11 12

Sales $0 $5,354 $6,788 $9,369 $10,799 $11,525 $12,299 $13,109 $14,139 $16,427 $18,899 $20,554

Direct Cost of Sales $0 $2,142 $2,715 $3,747 $4,320 $4,610 $4,920 $5,244 $5,656 $6,571 $7,560 $8,222

Other Production Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales $0 $2,142 $2,715 $3,747 $4,320 $4,610 $4,920 $5,244 $5,656 $6,571 $7,560 $8,222

Gross Margin $0 $3,213 $4,073 $5,621 $6,480 $6,915 $7,379 $7,866 $8,483 $9,856 $11,339 $12,332

Gross Margin % 0.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00%

Expenses

Payroll $3,000 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $6,200

Sales and Marketing and Other Expenses $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100

Depreciation $88 $88 $88 $88 $88 $88 $88 $88 $88 $88 $88 $88

Shoe Display Inventory $5,000 $0 $0 $0 $2,000 $0 $0 $0 $0 $0 $0 $0

Utilities $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100

Insurance $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150

Rent $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800

Payroll Taxes 15% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Operating Expenses $10,238 $6,838 $6,838 $6,838 $8,838 $6,838 $6,838 $6,838 $6,838 $6,838 $6,838 $8,438

Profit Before Interest and Taxes ($10,238) ($3,625) ($2,765) ($1,217) ($2,358) $77 $541 $1,028 $1,645 $3,018 $4,501 $3,894

EBITDA ($10,150) ($3,537) ($2,677) ($1,129) ($2,270) $165 $629 $1,116 $1,733 $3,106 $4,589 $3,982

Interest Expense $0 $0 $0 $0 $0 $42 $40 $38 $36 $35 $33 $31

Taxes Incurred $0 $0 $0 $0 $0

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $20,032 | $16,794 | $10,493 | $8,370 | $8,240 | $8,456 | $11,967 | $12,644 | $13,823 | $15,706 | $19,451 | $24,752 | $29,131 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $20,032 | $16,794 | $10,493 | $8,370 | $8,240 | $8,456 | $11,967 | $12,644 | $13,823 | $15,706 | $19,451 | $24,752 | $29,131 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $9,368 | $9,368 | $9,368 | $9,368 | $9,368 | $9,368 | $9,368 | $9,368 | $9,368 | $9,368 | $9,368 | $9,368 | $9,368 |

| Accumulated Depreciation | $0 | $88 | $176 | $264 | $352 | $440 | $528 | $616 | $704 | $792 | $880 | $968 | $1,056 |

| Total Long-term Assets | $9,368 | $9,280 | $9,192 | $9,104 | $9,016 | $8,928 | $8,840 | $8,752 | $8,664 | $8,576 | $8,488 | $8,400 | $8,312 |

| Total Assets | $29,400 | $26,074 | $19,685 | $17,474 | $17,256 | $17,384 | $20,807 | $21,396 | $22,487 | $24,282 | $27,939 | $33,152 | $37,443 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $6,912 | $4,149 | $4,703 | $5,701 | $8,187 | $6,575 | $6,873 | $7,184 | $7,581 | $8,464 | $9,418 | $10,056 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $5,000 | $4,790 | $4,580 | $4,370 | $4,160 | $3,950 | $3,740 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $6,912 | $4,149 | $4,703 | $5,701 | $8,187 | $11,575 | $11,663 | $11,764 | $11,951 | $12,624 | $13,368 | $13,796 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $6,912 | $4,149 | $4,703 | $5,701 | $8,187 | $11,575 | $11,663 | $11,764 | $11,951 | $12,624 | $13,368 | $13,796 |

| Paid-in Capital | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 |

| Retained Earnings | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) | ($600) |

| Earnings | $0 | ($10,238) | ($13,863) | ($16,629) | ($17,845) | ($20,204) | ($20,168) | ($19,667) | ($18,677) | ($17,069) | ($14,085) | ($9,616) | ($5,753) |

| Total Capital | $29,400 | $19,162 | $15,537 | $12,771 | $11,555 | $9,196 | $9,232 | $9,733 | $10,723 | $12,331 | $15,315 | $19,784 | $23,647 |

| Total Liabilities and Capital | $29,400 | $26,074 | $19,685 | $17,474 | $17,256 | $17,384 | $20,807 | $21,396 | $22,487 | $24,282 | $27,939 | $33,152 | $37,443 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!