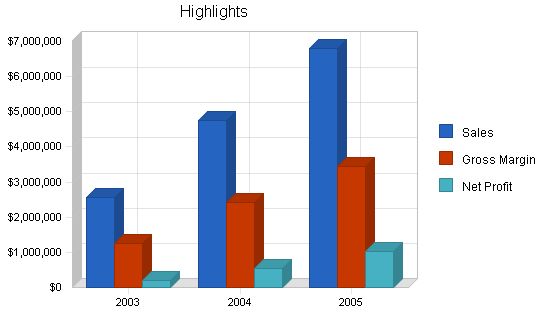

Cresta Testing, Inc. is a global professional services company specializing in testing and quality assurance. Cresta reduces risk, cuts software development costs, and improves time to market. With experienced management, Cresta plans to grow by over 40% per year through great customer service, a strong sales plan, competitive strategies, and energetic staff. Cresta’s financials are realistic and conservative.

In today’s flooded market of low-cost service providers, Cresta differentiates itself by offering exclusive quality assurance technology services. Our identity is clear and easy for customers to understand. Our team consists of experienced QA specialists skilled in leading QA technologies. We provide the right service at the right time.

Current challenges like job insecurity, financial scrutiny, regulatory compliance, and global terrorism require the adoption of risk management strategies. Cresta contributes significantly to risk mitigation by guaranteeing the functionality, performance, and scalability of critical business applications and supporting technology infrastructure. We educate our clients to be self-sufficient in these efforts or execute QA activities for them to achieve service and financial objectives.

Cresta is rooted in the global financial services industry, our largest client base. We aim to become a trusted advisor to each client by demonstrating our value-add.

Cresta’s mission is to offer specialized, reliable, high-quality, and sophisticated QA and testing methodologies on an international scale. We provide a professional, less risky alternative to in-house resources. Our focus is on developing and implementing QA and testing strategies that minimize risk, improve time to market, optimize ROI, and ensure the scalability and reliability of IT systems environments.

Our objectives are to achieve sustained profitability, build a strong repeat customer base, provide formal training to our consulting team, and maintain a balanced team with expertise in our defined products and services.

1.3 Keys to Success

- Use Cresta’s positive reputation and client references to close large opportunities.

- Specialize in the industry to gain a competitive advantage.

- Maintain a pool of certified consultants for all tools and technologies in Cresta’s target marketplace.

Company Summary

Since 1995, the Cresta Group has helped global leaders in various industries develop quality assurance and testing methodologies and infrastructures. Cresta enables clients to achieve their technical, operational, and financial objectives through quality assurance and testing techniques and technologies. With affiliated offices in New York, London, Dublin, and Stockholm, Cresta employs approximately 100 QA/test professionals across the globe. The company collaborates with leading testing tool software manufacturers like Mercury Interactive, Empirix, Rational, and Compuware.

Cresta is more than a source of testing consultants. Its success, SSTM™ methodology (defined below), and global track record ensure service capabilities and successful projects.

2.1 Company Ownership

Cresta Testing, Inc. is a C corporation incorporated in Delaware in October 1999. Its headquarters are located at 142 West 36th Street, Suite 601, New York, New York 10018. Contact Cresta via telephone at (212) 564-7774 or fax at (212) 564-6875. The Company’s e-mail address is [email protected]. Access Cresta’s website at www.cresta-group.com.

Initially, Cresta was a wholly-owned subsidiary of its UK parent, Cresta Group, Ltd. As of December 18, 2002, Dr. Samuel Waithe, the Company’s CTO and key developer of the SSTM™ methodology, became the majority owner of Cresta Testing, Inc. Cresta Group, Ltd. continues to hold a minority interest in the company.

2.2 Company History

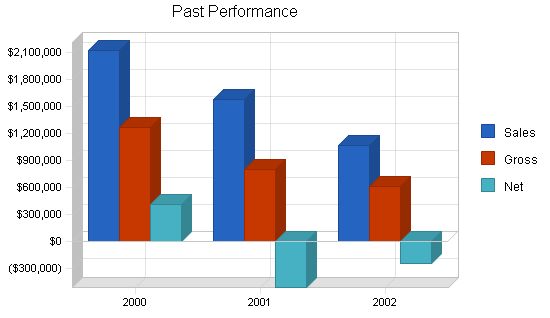

Cresta, founded in 1999 as a subsidiary of UK company Cresta Group, Ltd., primarily served the U.S. divisions of its global client base. Although the company had excellent product knowledge and delivery ability, it lacked market research and exposure to the New York and U.S. marketplace. While the revenue forecast for the year was $1 million US, the company earned $0 in the first quarter. The first job was sold in March 2000, marking the beginning of revenue earnings. At the year-end, total revenue exceeded projections by approximately 200%, reaching $2,117,574.00.

However, the company experienced a downturn in 2001 due to events like the September 11, 2001 attacks and accounting scandals in the U.S. equity markets. Business continued to decline in 2002 but stabilized towards the end of the year. At this time, the CTO of Cresta acquired a majority interest in the U.S. entity, and the former UK parent retained a 16% equity stake in the company.

The following table and chart illustrate the Company’s progress in regaining its historic gross margin percentage and moving towards break-even and profitability. These trends continued into 2003, demonstrating a steady recovery from the events of September 11, 2001.

Past Performance:

Sales:

– 2000: $2,124,814

– 2001: $1,580,038

– 2002: $1,066,916

Gross Margin:

– 2000: $1,267,800

– 2001: $801,474

– 2002: $612,571

Gross Margin %:

– 2000: 59.67%

– 2001: 50.72%

– 2002: 57.42%

Operating Expenses:

– 2000: $562,391

– 2001: $1,529,496

– 2002: $823,571

Collection Period (days):

– 2000: 136

– 2001: 125

– 2002: 71

Balance Sheet:

Current Assets:

– Cash:

– 2000: $173,057

– 2001: $96,198

– 2002: $152,690

– Accounts Receivable:

– 2000: $791,007

– 2001: $292,413

– 2002: $121,711

– Other Current Assets:

– 2000: $13,848

– 2001: $304,173

– 2002: $15,933

– Total Current Assets:

– 2000: $977,912

– 2001: $692,784

– 2002: $290,334

Long-term Assets:

– Long-term Assets:

– 2000: $70,767

– 2001: $83,570

– 2002: $92,595

– Accumulated Depreciation:

– 2000: $2,604

– 2001: $8,305

– 2002: $15,496

– Total Long-term Assets:

– 2000: $68,163

– 2001: $75,265

– 2002: $77,099

Total Assets:

– 2000: $1,046,075

– 2001: $768,049

– 2002: $367,433

Current Liabilities:

– Accounts Payable:

– 2000: $138,415

– 2001: $332,970

– 2002: $58,718

– Current Borrowing:

– 2000: $322,772

– 2001: $385,301

– 2002: $27,515

– Other Current Liabilities (interest free):

– 2000: $22,000

– 2001: $0

– 2002: $84,483

– Total Current Liabilities:

– 2000: $483,187

– 2001: $718,271

– 2002: $170,716

Long-term Liabilities:

– 2000: $0

– 2001: $0

– 2002: $0

Total Liabilities:

– 2000: $483,187

– 2001: $718,271

– 2002: $170,716

Paid-in Capital:

– 2000: $150,000

– 2001: $150,000

– 2002: $544,732

Retained Earnings:

– 2000: $0

– 2001: $412,888

– 2002: ($106,521)

Earnings:

– 2000: $412,888

– 2001: ($513,110)

– 2002: ($241,494)

Total Capital:

– 2000: $562,888

– 2001: $49,778

– 2002: $196,717

Total Capital and Liabilities:

– 2000: $1,046,075

– 2001: $768,049

– 2002: $367,433

Other Inputs:

– Payment Days:

– 2000: 30

– 2001: 30

– 2002: 30

– Sales on Credit:

– 2000: $2,124,814

– 2001: $1,580,038

– 2002: $1,066,916

– Receivables Turnover:

– 2000: 2.69

– 2001: 5.40

– 2002: 8.77

Services:

Cresta is a global IT services organization specializing in leading QA and testing methodologies and infrastructures. Cresta offers crisp project execution, skilled test professionals, and formal test analysis and reporting through their proprietary Structured System Testing Methodology™ (SSTM™). SSTM™ ensures repeatable testing activities and deliverables, providing consistency and high-quality work for clients.

SSTM™ is a specialized testing methodology compliant with general development methods and project management methodologies such as PRINCE 2, and compatible with the Institute of Electrical and Electronics Engineers standards.

3.1 Service Description:

Managed Resourcing:

– Cresta’s most important engagement, clients delegate entire QA responsibilities for a specific project to a Cresta-managed team of QA specialists. Led by a Cresta Principal Consultant, the team handles creation, execution, and management reporting of results and conclusions of QA activities. These engagements often include the creation of an enterprise-wide testing strategy.

QA Outsourcing:

– Similar to Managed Resourcing, clients extend their commitment beyond a single project. Cresta becomes their trusted QA organization, offering on-site, off-site, or offshore services.

Staff Augmentation:

– Cresta’s highly-skilled QA specialists assist with testing activities, fix projects in distress, or fill skill or competency gaps within client organizations.

Specific Engagements:

– QA Capabilities Assessment

– Disaster/Recoverability Validation

– Server Consolidation Quality Assurance

– Application Development/Migration/Integration Quality Assurance

3.2 Competitive Comparison:

Competition comes in several forms:

1. In-house QA and testing:

– Companies choosing to do QA and testing in-house face the challenge of overloaded managers and limited technological expertise. Cresta offers the advantage of experienced consultants and specialized skills.

2. Big 5 and equivalent consulting firms:

– Accenture, Andersen, Cap Gemini/EYT, IBM Testing, etc. These competitors are international in scope but lack the specialization in QA and testing that Cresta offers. Cresta competes as experts in their specific fields, ensuring top-level professionals deliver the work.

3. Regional specialists in the QA and testing space:

– QA Associates, Genilogix, CSA, Sky IT Group, Mondial, Ltd., etc. Cresta differentiates itself with its branded SSTM™ methodology, industry knowledge, and expertise, positioning as the leading QA and testing experts.

3.3 Technology:

Cresta consultants blend the best toolsets with organizational strategies and requirements for testing. They work with leading tools partners in the testing business and respective industry sectors. Cresta aims to develop and strengthen business partnerships and alternate sales channels with these partners.

Existing/suggested technology partners:

– Mercury Interactive

– Compuware

– Ixia

– Segue

– Rational

– @stake

– Empirix

– Radview

Existing/suggested channel partners:

– Accenture

– CS Technology

– IBM

– KPMG

– RTP Technology Corporation

– Sybase/Financial Fusion

– Various Application Manufacturers

3.4 Fulfillment:

Cresta aims to develop its service delivery organization in an effective and cost-controlled manner. They utilize a mix of employee and independent contractor consultants, with independent contractors representing approximately 60% of the service delivery organization.

Cresta recruits, qualifies, trains, and certifies consultants in their services, methodologies, and procedures to ensure consistent high-quality service delivery.

3.5 Future Services:

Cresta plans to enhance current service offerings by developing competencies in and offering QA services related to industry-specific business applications. They are particularly interested in targeting market-leading financial services companies and identifying qualified vendors and products in that space.

Cresta also plans to increase customer awareness through targeted e-mail campaigns, public advertising campaigns, industry user groups, conferences, and seminars.

Market Analysis Summary:

According to a June 25, 2002, Computer World Federal Study, software bugs cost the U.S. approximately $59.5 billion per year. Improvements in testing can reduce this cost by approximately $22.5 billion per year. Cresta focuses on the finance, banking, insurance, biotech, and life science industries. These industries require the highest standards and rely on Cresta for managing risks through testing.

4.1 Market Segmentation:

Automated application and system quality assurance (QA) and testing techniques have become essential in reducing costs and time-to-market. Revenue growth and market penetration of testing-related software manufacturers support the increased adoption of testing tools. The market for automated testing tools is expected to grow from $700 million to nearly $1.9 billion by 2005.

The success of outsourcing lies in developing a comprehensive and skilled QA/testing infrastructure. Many organizations lack the operational and organizational infrastructure to fully leverage testing tools, limiting achievable ROI. Cresta focuses on outsourcing as a means to deliver specialized QA/testing infrastructure and achieve substantial financial and business benefits.

4.2 Service Business Analysis:

Outsourcing segments of IT projects has become a strategy for combating project costs. Companies can leverage specialized experience without the personnel costs and cap development costs. The software industry can save up to 30% of development costs through outsourcing.

Strategy and Implementation Summary:

Cresta’s sales strategy revolves around customer satisfaction and repeat business. They aim to be the trusted advisor for their clients, offering tailored solutions and bids based on client needs. Cresta’s sales approach involves a needs analysis, followed by detailed discussions with the client to map out solutions and action points. Cresta avoids dropping fees to gain jobs and focuses on explaining the benefits of their services.

5.1 Sales Strategy:

Cresta’s sales strategy is centered around customer service and empowerment. They aim to understand the client’s needs and offer appropriate solutions. Cresta aspires to be a trusted advisor rather than a condescending sales organization. Cresta’s sales team focuses on needs analysis, discussions, and offering bid and action points to address client needs.

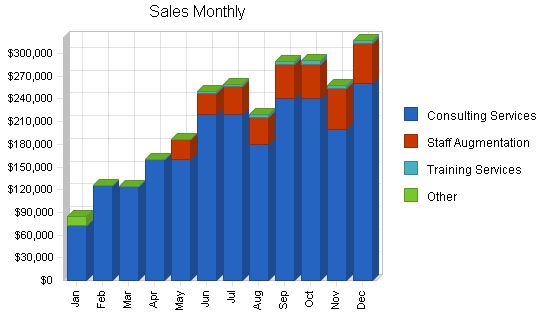

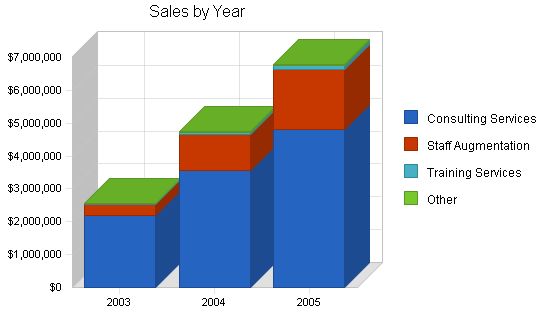

5.1.1 Sales Forecast:

The sales forecast for Cresta shows projected sales growth, with a focus on exponential growth as the company becomes more established and well-known in the market. The smaller size of Cresta allows for potential larger sales growth, especially with sound sales and marketing strategies to compete with larger consultancies.

Note: The complete sales forecast is included in the appendix, with units representing days billed.

Sales Forecast:

| Sales Forecast | |||

| 2003 | 2004 | 2005 | |

| Unit Sales | |||

| Consulting Services | 2,333 | 3,400 | 4,360 |

| Staff Augmentation | 720 | 2,269 | 3,701 |

| Training Services | 63 | 180 | 240 |

| Other | 2 | 3 | 4 |

| Total Unit Sales | 3,118 | 5,852 | 8,305 |

| Unit Prices | 2003 | 2004 | 2005 |

| Consulting Services | $944.63 | $1,050.00 | $1,102.50 |

| Staff Augmentation | $450.00 | $472.50 | $496.13 |

| Training Services | $400.00 | $420.00 | $441.00 |

| Other | $5,497.00 | $8,250.00 | $11,000.00 |

| Sales | |||

| Consulting Services | $2,203,813 | $3,570,000 | $4,806,900 |

| Staff Augmentation | $324,000 | $1,072,103 | $1,836,159 |

| Training Services | $25,200 | $75,600 | $105,840 |

| Other | $10,994 | $24,750 | $44,000 |

| Total Sales | $2,564,007 | $4,742,453 | $6,792,899 |

| Direct Unit Costs | 2003 | 2004 | 2005 |

| Consulting Services | $283.39 | $315.00 | $330.75 |

| Staff Augmentation | $135.00 | $141.75 | $148.84 |

| Training Services | $120.00 | $126.00 | $132.30 |

| Other | $0.00 | $0.00 | $0.00 |

| Direct Cost of Sales | |||

| Consulting Services | $661,144 | $1,071,000 | $1,442,070 |

| Staff Augmentation | $97,200 | $321,631 | $550,848 |

| Training Services | $7,560 | $22,680 | $31,752 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $765,904 | $1,415,311 | $2,024,670 |

Web Plan Summary:

The Cresta website will be a virtual business card and portfolio for the company. It will showcase the technical background and portfolio of Cresta consultants, as well as offer a resources area with articles, research, case studies, and white papers.

The website strategy will combine a well-designed front end with a back end capable of recording leads, proposal requests, and capturing CVs for potential consultants.

6.1 Website Marketing Strategy:

Internet Marketing is about driving sales rather than just traffic. Cresta has partnered with Single Throw, Inc. for Internet marketing expertise. The campaign will focus on "Progression Marketing" to target potential customers, capture their attention, convert them into clients, and retain them for long-term value.

6.2 Development Requirements:

The Cresta website will be redesigned with the help of Single Throw experts. This includes a market study, targeting specific customers with purchasing intent, construction of the redesigned website, and ongoing refinement to adapt to market changes.

Management Summary:

The Cresta management team consists of experienced IT and management executives, with over seventy-five combined years of related experience.

7.1 Management Team:

-Timothy Ray, CEO: Experienced in sustaining, transitioning, and building companies. Previously scaled sales from $4 million to $14 million.

-Dr. Samuel Waithe, CTO: Strong QA and testing practitioner. Developed Cresta’s consulting methodology.

-Stephen Lapthorne, VP Finance and Administration: Member of the Chartered Institute of Management Accountants with expertise in management accounting and business process re-engineering.

-Paul Gallico, VP Sales and Business Development: Seasoned technology professional with experience in designing, developing, and implementing IT systems.

-Cuan White, U.S. Business Development and Operations: Handles packaging and publicity strategies and supports sales campaigns.

Advisory Board:

To round out its operations, sales, marketing, and finance team, Cresta has created an Advisory Board of seasoned professionals including Matthew Lombardi and Rudi Valli.

7.2 Personnel Plan:

The personnel plan includes production personnel, sales and marketing personnel, and general and administrative personnel. The total payroll expenditures for the first three years are as follows:

| Personnel Plan | |||

| 2003 | 2004 | 2005 | |

| Production Personnel | |||

| People | 7 | 10 | 14 |

| Average per Person | $66,964 | $78,750 | $82,688 |

| Subtotal | $468,750 | $787,500 | $1,157,625 |

| Sales and Marketing Personnel | |||

| People | 4 | 5 | 5 |

| Average per Person | $68,750 | $105,000 | $110,250 |

| Subtotal | $275,000 | $525,000 | $551,250 |

| General and Administrative Personnel | |||

| People | 3 | 5 | 6 |

| Average per Person | $116,667 | $122,500 | $128,625 |

| Subtotal | $350,000 | $612,500 | $771,750 |

| Other Personnel | |||

| People | 0 | 0 | 0 |

| Average per Person | $0 | $0 | $0 |

| Subtotal | $0 | $0 | $0 |

| Total People | 14 | 20 | 25 |

| Total Payroll Expenditures | $1,093,750 | $1,925,000 | $2,480,625 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!