Nonprofit Food Bank Business Plan

Helping Hand is a tax-exempt not-for-profit food bank that serves Johnson County, Washington. Our goal is to alleviate hunger by soliciting, collecting, growing, and packaging food for distribution through service agencies and programs. Our services include food box programs, emergency food programs, and a youth farm for "at risk" youth. We receive support from the county, charitable organizations, and corporate sponsorship.

Approximately 20% of Johnson County residents qualify for assistance. Our client base is low-income families who need emergency food help. Half of those served are children. We operate a warehouse where we store donated or rescued food for distribution. We actively solicit food from local growers, retailers, wholesalers, and processors. Additionally, we collect food donations from restaurants for immediate distribution.

The number of children needing our services is expected to increase in the next five years due to the county’s growth and the influx of new families seeking employment. Helping Hand is an important resource for these families because we can quickly provide one of their most essential needs: food.

Our services improve families’ ability to care for children and achieve self-sufficiency goals. They are a small investment compared to the cost of ignoring the problem of hunger and its impact on health and crime issues in the county.

Helping Hands’ mission is to alleviate hunger in Johnson County by collecting, growing, and distributing food through various programs. Our services include food box programs, emergency shelters, meal sites, treatment services, and children’s programs.

Our new initiative aims to establish a food bank serving all of Johnson County. Our objectives are:

1. Establish a donation network of local growers, retailers, wholesalers, and processors.

2. Create a youth farm employing "at-risk" youth.

3. Collect over four million pounds of food in the first year, increasing by 20% annually.

4. Effectively distribute food to low-income families representing over 20% of the county’s population.

5. Acquire $200,000 of start-up funding from corporate sponsors, private charities, and government support.

6. Raise an additional $100,000 through fundraising activities.

Helping Hand is a food bank in Johnson County that identifies and utilizes local resources to combat hunger among low-income individuals and families.

The program involves soliciting and distributing food to community programs, as well as operating a youth farm for "at-risk" young people.

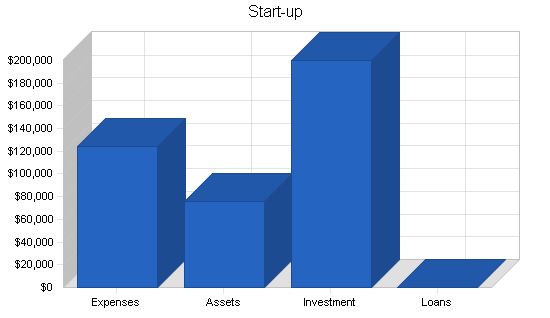

The start-up cost for Helping Hand is $200,000, which includes donated trucks, collection vehicles, and storage facilities. The remaining expenses are associated with setting up an office. The program is funded by ten corporate sponsors, a private philanthropic trust grant, and Johnson County.

Start-up Expenses to Fund: $124,000

Start-up Assets to Fund: $76,000

Total Funding Required: $200,000

Assets:

Non-cash Assets from Start-up: $7,000

Cash Requirements from Start-up: $69,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $69,000

Total Assets: $76,000

Liabilities and Capital:

Liabilities:

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital:

Planned Investment:

Corporate Sponsorship: $100,000

Philanthropic Trust: $50,000

Jefferson County: $50,000

Additional Investment Requirement: $0

Total Planned Investment: $200,000

Loss at Start-up (Start-up Expenses): ($124,000)

Total Capital: $76,000

Total Capital and Liabilities: $76,000

Total Funding: $200,000

Start-up

Requirements

Start-up Expenses

Legal: $700

Stationery etc.: $500

Brochures: $800

Food Collection Supplies: $10,000

Insurance: $1,000

Rent: $1,000

Trucks and Vehicles: $50,000

Warehouse Equipment: $40,000

Harvesting/Farm Equipment: $20,000

Total Start-up Expenses: $124,000

Start-up Assets

Cash Required: $69,000

Start-up Inventory: $0

Other Current Assets: $0

Long-term Assets: $7,000

Total Assets: $76,000

Total Requirements: $200,000

2.2 Legal Entity

Helping Hand is a Washington nonprofit corporation.

Services

Approximately 20% of Johnson County residents qualify for assistance from Helping Hand. Low-income people, mostly families, who need emergency help to put food on the table will be helped by this new program. Nearly half of the people we serve are children and nearly one-fifth are senior citizens. In the families we serve, there is at least one working person.

Helping Hand collects food at its centralized facility in the city of Monroe and distributes the food to nonprofit social service agencies and programs in the county. The majority of the food we distribute is in the form of emergency boxes. Individuals or families can receive up to 15 boxes a year. Each box contains a 3-5 day supply of high-quality food. The remaining resources are dedicated to providing food to residential treatment facilities, dinner programs, youth service centers, foster homes, children’s programs, and more.

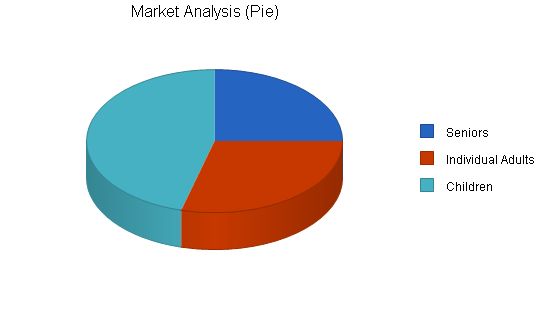

Market Analysis Summary

The population base for Johnson County is 600,000. Approximately 20% of the county’s population can be characterized as low-income. This represents 120,000 residents that are potentially in need of services from Helping Hand.

This group can be broken down into three segments:

– Seniors (30,000)

– Individual Adults (35,000)

– Children (55,000)

Children represent 45% of the county residents in need of Helping Hand services. The program has identified children and their families as its primary target customers. It is projected that the number of low-income children will increase in Johnson County by 20% over the next four years. By 2006, children will represent 52% of Helping Hand’s client base. With effective intervention, the debilitating effects of hunger can be eliminated. Consequently, the families will be better able to provide for their children.

4.1 Market Segmentation

Service Geographics

Helping Hand serves the Johnson County area with a total population in excess of 600,000 people. Over 50% of the county’s population lives in Monroe. The remaining bulk of the county’s population resides in Lewisville, Drain, Fremont, and Lakespurs.

Service Demographics

It is estimated that 20% of the county’s residents are low-income. Of the county’s 120,000 low-income residents, 25% are seniors, 30% are individual adults, and 45% are children. Family groupings represent over 64% of low-income residents in Johnson County. Over 90% of these families have at least one family member working full-time. This is why children and their families are the focus of the program.

Service Psychographics

One typical profile of families interested in this type of program can be described as follows:

– At least one parent/guardian works full-time.

– The average family size is five, with three or four children.

– The family has made contact with one or more social service agency or program in the last 12 months.

– The families are most receptive to receiving food assistance through social service programs that are working with the families in other concerns.

Service Behaviors

Helping Hand has established that the most effective method to distribute food is through the network of existing social service programs and agencies serving the target population groups. There are 25 programs and agencies that provide services to low-income seniors, adults, and children. On average, clients visit one or more of these programs or agencies on a weekly basis. In addition, these programs have an excellent volunteer base that can be mobilized to distribute food.

Market Analysis: Year 1 – Year 5

Potential Customers: Growth CAGR

Seniors: 7% 30,000 32,100 34,347 36,751 39,324 7.00%

Individual Adults: 8% 35,000 37,800 40,824 44,090 47,617 8.00%

Children: 15% 55,000 63,250 72,738 83,649 96,196 15.00%

Total: 11.15% 120,000 133,150 147,909 164,490 183,137 11.15%

4.2 Target Market Segment Strategy

The primary target population for Helping Hand is children (from birth to 16 years) and their families. This group is the fastest growing segment that needs food bank services. Food assistance is most critical during the first five years of a child’s life, representing 50% of the children served by the program.

Strategy and Implementation Summary

Helping Hand will focus on establishing an effective collection network with local growers, retailers, wholesalers, and processors. Another goal is to create a youth farm that employs "at risk" youth. The program will also start a fundraising campaign with area retail markets, banks, and credit unions to raise an additional $100,000. Helping Hand will advertise its services to the target populations through the agencies that serve them.

Helping Hand’s marketing program aims to increase its visibility in the community. Participating food retail stores will carry information about Helping Hand and how they are helping the community. Award plaques will be distributed to stores each year, and additional methods to raise the profile of assisting stores will be explored. Program brochures will be distributed by local social service programs and agencies that serve the target population groups. These programs and agencies will advocate for using Helping Hand in response to the need for emergency food.

5.2 Fundraising Strategy

Helping Hand will start a Fall Fundraising campaign using the local banks and credit unions to collect donations to fight hunger. Donation bins will be placed in participating banks and credit unions, and customers in local retail food stores can donate money at the checkout stand.

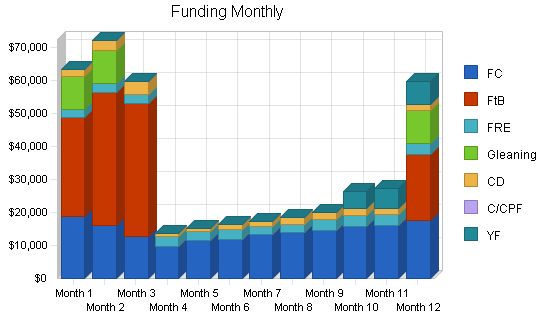

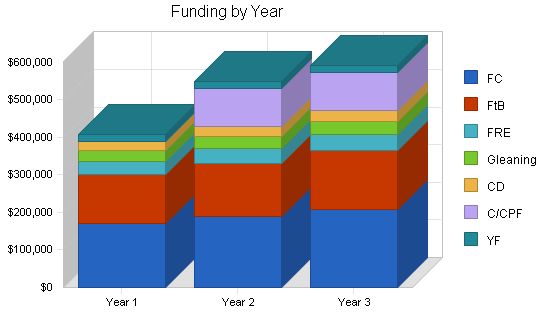

5.2.1 Funding Forecast

Helping Hand’s monthly revenues for the 2002-2003 calendar year will fluctuate based on the seasons. During Fall, the program will have its major fundraiser, and the summer months are expected to be weak food collection months.

The following are Helping Hand’s fundraising and food collection programs:

Food Collection (FC): Participating retailers, wholesalers, and processors will donate food on a monthly basis.

Fill the Bucket (FtB): Each Fall, Helping Hand will run a fundraiser through local banks and credit unions. Small containers resembling the Helping Hand food bins will be placed at each teller counter.

Food Rescue Express (FRE): Helping Hand will collect donated food from local restaurants to be immediately distributed to programs in the area that will distribute the food to their clients.

Gleaning: Helping Hand will collect harvest leftovers and unsold produce from farmers’ fields. Gleaning reduces waste while feeding people. Helping Hand recruits gleaning crews from local support programs.

Youth Farm (YF): The youth farm utilizes kids in diversion programs or local programs serving "at risk" kids to provide a learning environment that turns their lives around. The produce is sold by the youth farm crew members at an on-site produce stand, and all proceeds support Helping Hand programs.

Editor’s Note: To maximize the chart size for the Funding Monthly and Funding By Year charts below, the fundraising categories have been abbreviated as C/CPF in the table and charts.

Funding Forecast:

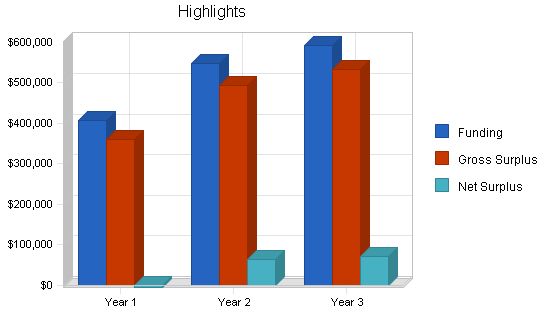

Year 1 Year 2 Year 3

Funding

FC $171,770 $188,947 $207,842

FtB $130,000 $143,000 $157,300

FRE $34,590 $38,049 $41,854

Gleaning $30,000 $33,000 $36,300

CD $24,000 $26,400 $29,040

C/CPF $0 $100,000 $100,000

YF $18,000 $18,900 $19,845

Total Funding $408,360 $548,296 $592,181

Direct Cost of Funding:

Year 1 Year 2 Year 3

FC $19,356 $21,000 $23,400

FtB $6,647 $7,300 $8,100

FRE $3,331 $5,200 $5,800

Gleaning $4,800 $5,400 $6,000

CD $4,627 $5,100 $5,600

YF $8,970 $9,800 $10,800

Subtotal Cost of Funding $47,730 $53,800 $59,700

Management Summary:

Helping Hand’s management team includes a board of directors and an executive director. The program will have five service coordinators.

Personnel Plan:

The following table summarizes the program’s personnel expenditures for the first three years.

The staff will consist of five coordinators:

– Volunteer coordinator

– Food solicitation coordinator

– Distribution coordinator

– Warehouse coordinator

– Youth farm coordinator

The detailed monthly personnel plan for the first year is included in the appendix.

Personnel Plan:

Year 1 Year 2 Year 3

Volunteer Coordinator $21,600 $21,600 $21,600

Food Solicitation Coordinator $21,600 $21,600 $21,600

Distribution Coordinator $21,600 $21,600 $21,600

Warehouse Coordinator $21,600 $21,600 $21,600

Youth Farm Coordinator $21,600 $21,600 $21,600

Executive Director $24,000 $24,000 $24,000

Total People 6 6 6

Total Payroll $132,000 $132,000 $132,000

Helping Hand is funded from a variety of sources, public and private. We anticipate a 15% increase in funding over the next three years. The executive director and the board of directors will review program expenditures and make adjustments to ensure solvency.

Important Assumptions:

The financial plan depends on important assumptions, most of which are shown in the following table.

The key underlying assumptions are:

– We assume a slow-growth economy, without a major recession.

– We assume population growth in the county will contribute to additional low-income clients.

– We assume there are no unforeseen changes in funding availability.

– We assume a continued need for emergency food services in the county.

General Assumptions:

Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 0.00% 0.00% 0.00%

Other 0 0 0

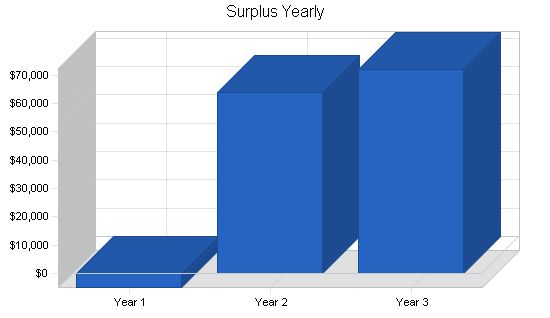

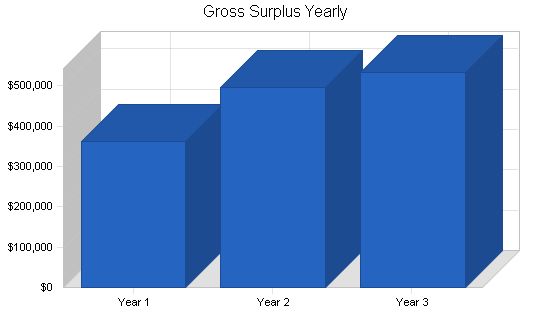

Projected Surplus or Deficit:

Helping Hand’s Projected Surplus and Deficit is shown in the following table. The detailed monthly projections are included in the appendix.

Surplus and Deficit

[table]

[tr]

[td colspan="4" style="text-align: left"]Surplus and Deficit[/td]

[/tr]

[tr]

[td style="text-align: left"]/td]

[td style="text-align: right"]Year 1[/td]

[td style="text-align: right"]Year 2[/td]

[td style="text-align: right"]Year 3[/td]

[/tr]

[tr]

[td style="text-align: left"]Funding[/td]

[td]$408,360[/td]

[td]$548,296[/td]

[td]$592,181[/td]

[/tr]

[tr]

[td style="text-align: left"]Direct Cost[/td]

[td]$47,730[/td]

[td]$53,800[/td]

[td]$59,700[/td]

[/tr]

[tr]

[td style="text-align: left"]Other Costs of Funding[/td]

[td]$0[/td]

[td]$0[/td]

[td]$0[/td]

[/tr]

[tr]

[td style="text-align: left"]Total Direct Cost[/td]

[td]$47,730[/td]

[td]$53,800[/td]

[td]$59,700[/td]

[/tr]

[tr]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[/tr]

[tr]

[td style="text-align: left"]Gross Surplus[/td]

[td]$360,630[/td]

[td]$494,496[/td]

[td]$532,481[/td]

[/tr]

[tr]

[td style="text-align: left"]Gross Surplus %[/td]

[td]88.31%[/td]

[td]90.19%[/td]

[td]89.92%[/td]

[/tr]

[tr]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[/tr]

[tr]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[/tr]

[tr]

[td style="text-align: left"]Expenses[/td]

[/tr]

[tr]

[td style="text-align: left"]Payroll[/td]

[td]$132,000[/td]

[td]$132,000[/td]

[td]$132,000[/td]

[/tr]

[tr]

[td style="text-align: left"]Sales and Marketing Costs[/td]

[td]$0[/td]

[td]$0[/td]

[td]$0[/td]

[/tr]

[tr]

[td style="text-align: left"]Depreciation[/td]

[td]$840[/td]

[td]$840[/td]

[td]$840[/td]

[/tr]

[tr]

[td style="text-align: left"]Rent[/td]

[td]$12,000[/td]

[td]$12,000[/td]

[td]$12,000[/td]

[/tr]

[tr]

[td style="text-align: left"]Utilities[/td]

[td]$2,400[/td]

[td]$2,400[/td]

[td]$2,400[/td]

[/tr]

[tr]

[td style="text-align: left"]Insurance[/td]

[td]$3,600[/td]

[td]$3,600[/td]

[td]$3,600[/td]

[/tr]

[tr]

[td style="text-align: left"]Payroll Taxes[/td]

[td]$19,800[/td]

[td]$19,800[/td]

[td]$19,800[/td]

[/tr]

[tr]

[td style="text-align: left"]Food Distribution[/td]

[td]$195,000[/td]

[td]$260,000[/td]

[td]$290,000[/td]

[/tr]

[tr]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[/tr]

[tr]

[td style="text-align: left"]Total Operating Expenses[/td]

[td]$365,640[/td]

[td]$430,640[/td]

[td]$460,640[/td]

[/tr]

[tr]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[/tr]

[tr]

[td style="text-align: left"]Surplus Before Interest and Taxes[/td]

[td]($5,010)[/td]

[td]$63,856[/td]

[td]$71,841[/td]

[/tr]

[tr]

[td style="text-align: left"]EBITDA[/td]

[td]($4,170)[/td]

[td]$64,696[/td]

[td]$72,681[/td]

[/tr]

[tr]

[td style="text-align: left"]Interest Expense[/td]

[td]$0[/td]

[td]$0[/td]

[td]$0[/td]

[/tr]

[tr]

[td style="text-align: left"]Taxes Incurred[/td]

[td]$0[/td]

[td]$0[/td]

[td]$0[/td]

[/tr]

[tr]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[td style="text-align: left"]/td]

[/tr]

[tr]

[td style="text-align: left"]Net Surplus[/td]

[td]($5,010)[/td]

[td]$63,856[/td]

[td]$71,841[/td]

[/tr]

[tr]

[td style="text-align: left"]Net Surplus/Funding[/td]

[td]-1.23%[/td]

[td]11.65%[/td]

[td]12.13%[/td]

[/tr]

[/table]

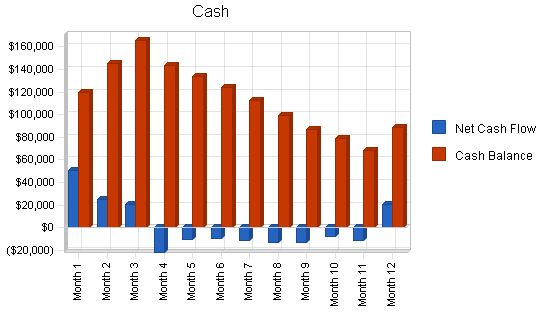

7.3 Projected Cash Flow

Helping Hand’s cash flow is represented as funding dollars and collected food and monetary donations. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month, and the other the monthly cash balance. The annual cash flow figures are included here, and the more important detailed monthly numbers are included in the appendix.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Funding $408,360 $548,296 $592,181

Subtotal Cash from Operations $408,360 $548,296 $592,181

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $408,360 $548,296 $592,181

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $132,000 $132,000 $132,000

Bill Payments $257,132 $354,348 $385,465

Subtotal Spent on Operations $389,132 $486,348 $517,465

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $389,132 $486,348 $517,465

Net Cash Flow $19,228 $61,948 $74,716

Cash Balance $88,228 $150,176 $224,892

7.4 Projected Balance Sheet

The following table represents the Project Balance Sheet for Helping Hand.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $88,228 $150,176 $224,892

Inventory $7,386 $8,326 $9,239

Other Current Assets $0 $0 $0

Total Current Assets $95,614 $158,501 $234,131

Long-term Assets

Long-term Assets $7,000 $7,000 $7,000

Accumulated Depreciation $840 $1,680 $2,520

Total Long-term Assets $6,160 $5,320 $4,480

Total Assets $101,774 $163,821 $238,611

Liabilities and Capital

Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $30,784 $28,976 $31,924

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $30,784 $28,976 $31,924

Long-term Liabilities $0 $0 $0

Total Liabilities $30,784 $28,976 $31,924

Paid-in Capital $200,000 $200,000 $200,000

Accumulated Surplus/Deficit ($124,000) ($129,010) ($65,154)

Surplus/Deficit ($5,010) $63,856 $71,841

Total Capital $70,990 $134,846 $206,686

Total Liabilities and Capital $101,774 $163,821 $238,611

Net Worth $70,990 $134,846 $206,686

Appendix

Funding Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Funding $63,134 $71,926 $59,644 $13,736 $15,110 $16,240 $17,134 $18,354 $19,932 $26,204 $27,238 $59,708

Direct Cost of Funding Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

FC $2,088 $1,584 $1,320 $1,224 $1,272 $1,329 $1,395 $1,632 $1,704 $1,872 $1,944 $1,992

FtB $1,703 $1,680 $1,584 $0 $0 $0 $0 $0 $0 $0 $0 $1,680

FRE $298 $269 $283 $293 $264 $274 $278 $264 $288 $254 $278 $288

Gleaning $1,000 $1,000 $0 $0 $0 $0 $0 $0 $0 $0 $800 $1,000

CD $379 $384 $360 $360 $374 $350 $418 $398 $394 $394 $418 $398

C/CPF $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

YF $712 $703 $271 $226 $208 $268 $667 $946 $1,055 $1,284 $1,274 $1,357

Subtotal Cost of Funding $6,180 $5,620 $3,818 $2,103 $2,118 $2,220 $2,758 $3,240 $3,440 $4,604 $4,914 $6,715

Personnel Plan

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Volunteer Coordinator $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800

Food Solicitation Coordinator $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800

Distribution Coordinator $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800

Warehouse Coordinator $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800

Youth Farm Coordinator $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800

Executive Director $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000

Total People 6 6 6 6 6 6 6 6 6 6 6 6

Total Payroll $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000

General Assumptions

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0 0

Surplus and Deficit

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Funding $63,134 $71,926 $59,644 $13,736 $15,110 $16,240 $17,134 $18,354 $19,932 $26,204 $27,238 $59,708

Direct Cost $6,180 $5,620 $3,818 $2,103 $2,118 $2,220 $2,758 $3,240 $3,440 $4,604 $4,914 $6,715

Other Costs of Funding $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Direct Cost $6,180 $5,620 $3,818 $2,103 $2,118 $2,220 $2,758 $3,240 $3,440 $4,604 $4,914 $6,715

Gross Surplus $56,954 $66,306 $55,826 $11,633 $12,992 $14,020 $14,376 $15,114 $16,492 $21,600 $22,324 $52,993

Gross Surplus % 90.21% 92.19% 93.60% 84.69% 85.98% 86.33% 83.90% 82.34% 82.74% 82.43% 81.96% 88.75%

Pro Forma Cash Flow

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Cash Received

Cash from Operations $63,134 $71,926 $59,644 $13,736 $15,110 $16,240 $17,134 $18,354 $19,932 $26,204 $27,238 $59,708

Subtotal Cash from Operations $63,134 $71,926 $59,644 $13,736 $15,110 $16,240 $17,134 $18,354 $19,932 $26,204 $27,238 $59,708

Expenditures

Expenditures from Operations

Cash Spending $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000 $11,000

Bill Payments $1,204 $35,861 $28,048 $24,625 $14,162 $14,601 $17,583 $20,547 $21,951 $22,951 $27,080 $28,520

Subtotal Spent on Operations $12,204 $46,861 $39,048 $35,625 $25,162 $25,601 $28,583 $31,547 $32,951 $33,951 $38,080 $39,520

Net Cash Flow $50,930 $25,065 $20,596 ($21,889) ($10,052) ($9,361) ($11,449) ($13,193) ($13,019) ($7,747) ($10,842) $20,188

Cash Balance $119,930 $144,994 $165,590 $143,701 $133,649 $124,288 $112,840 $99,647 $86,628 $78,881 $68,039 $88,228

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!