Contents

Medical Scanning Lab Business Plan

Scan Lab Medical Imaging is a start-up company offering medical image scanning tests in New Bedford, Massachusetts.

The Market

Scan Lab will target insurance carriers, who play a crucial role in the billing process as 99% of scans are billed through insurance. Scan Lab understands the importance of gaining approval from insurance carriers and aims to be approved by all popular insurance plans.

Once approved, Scan Lab will rely on physician referrals. Factors influencing these referrals include geographic location, accepted insurance, and the specific type of scan. To attract referring doctors, a strong marketing and sales campaign will be implemented.

Services

Scan Lab offers a wide variety of radiology-based scanning tests. Equipped with state-of-the-art technology and expert medical training, Scan Lab provides valuable consultations to referring physicians.

Management

Dr. Carolyn Jones will lead Scan Lab, bringing her specialization in radiology and 13 years of experience practicing at a renowned Boston clinic.

1.1 Mission

Scan Lab’s mission is to become the leading medical scanning technology provider in New Bedford through friendly service, accepting various insurance plans, and delivering accurate analyses.

1.2 Objectives

– Capture 40% of local physicians’ business within two years.

– Reach profitability within two years.

– Double sales by year three.

1.3 Keys to Success

– Only purchase medical equipment in demand within the community.

– Provide fast, friendly service with accurate readings.

– Employ strict financial controls to manage expensive capital costs associated with medical imaging equipment.

Company Summary

Scan Lab is a Massachusetts corporation solely owned by Carolyn Jones.

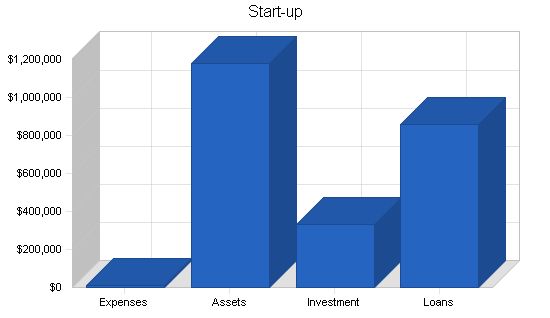

2.1 Start-up Summary

Scan Lab needs to purchase necessary equipment for the clinic.

– Office furniture for four exam rooms, purchased used in good condition as a cost-saving measure.

– Receptionist office furniture and assorted waiting room furniture, also purchased in good, used condition.

– Three computers, one with QuickBooks Pro, all with Microsoft Office, a central laser printer, and broadband Internet connection.

– Medical scanning devices:

– X-ray machine

– Ultra sound unit

– CAT scan imaging machine

– MRI imaging machine

Start-up Requirements

Start-up Expenses

Legal: $3,000

Stationery etc.: $300

Brochures: $300

Consultants: $2,000

Insurance: $3,000

Rent: $2,000

Total Start-up Expenses: $10,600

Start-up Assets

Cash Required: $317,900

Other Current Assets: $0

Long-term Assets: $861,500

Total Assets: $1,179,400

Total Requirements: $1,190,000

Start-up Funding

Start-up Expenses to Fund: $10,600

Start-up Assets to Fund: $1,179,400

Total Funding Required: $1,190,000

Assets

Non-cash Assets from Start-up: $861,500

Cash Requirements from Start-up: $317,900

Additional Cash Raised: $0

Cash Balance on Starting Date: $317,900

Total Assets: $1,179,400

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $860,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $860,000

Capital

Planned Investment

Dr. Jones: $180,000

Investor: $150,000

Additional Investment Requirement: $0

Total Planned Investment: $330,000

Loss at Start-up (Start-up Expenses): ($10,600)

Total Capital: $319,400

Total Capital and Liabilities: $1,179,400

Total Funding: $1,190,000

2.2 Company Ownership

Carolyn Jones is the sole stockholder of the Scan Lab corporation.

Services

Scan Lab offers New Bedford physicians a wide range of diagnostic scanning tests. Due to the high cost of scanning equipment for occasional use, most small clinics and practices use an outside service provider for scanning needs. The following scans will be offered:

X-Ray: An X-ray uses electromagnetic energy beams to produce images of internal tissues, bones, and organs on film. X-rays are used to find tumors or bone injuries.

Diagnostic scanning requires analysis by a radiologist.

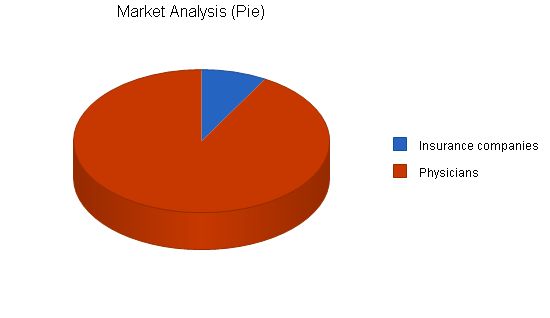

Market Analysis Summary

Scan Lab has identified two customer segments: medical insurance carriers and physicians. Insurance companies often dictate who can provide scanning services, making attracting large insurance carriers crucial. Scan Lab has informally accepted bid proposals from the three largest carriers in the state.

Physicians have the choice to recommend their patients to a preferred lab.

4.1 Market Segmentation

Scan Lab will target the three largest medical insurance carriers: Aetna, Cigna, and Prudential. Smaller carriers will be targeted later.

Scan Lab is in negotiations with these carriers to become an approved facility. The lab must agree to the carriers’ rates and adhere to specific filing and billing procedures.

Physicians make referrals based on factors such as familiarity, patient insurance, scan type, and location convenience.

Market Analysis:

[table]

[tr]

[td]Year 1[/td]

[td]Year 2[/td]

[td]Year 3[/td]

[td]Year 4[/td]

[td]Year 5[/td]

[/tr]

[tr]

[td]Potential Customers[/td]

[td]Growth[/td]

[td]CAGR[/td]

[/tr]

[tr]

[td]Insurance companies[/td]

[td]1%[/td]

[td]21[/td]

[td]21[/td]

[td]21[/td]

[td]21[/td]

[td]21[/td]

[td]0.00%[/td]

[/tr]

[tr]

[td]Physicians[/td]

[td]4%[/td]

[td]235[/td]

[td]244[/td]

[td]254[/td]

[td]264[/td]

[td]275[/td]

[td]4.01%[/td]

[/tr]

[tr]

[td]Total[/td]

[td]3.70%[/td]

[td]256[/td]

[td]265[/td]

[td]275[/td]

[td]285[/td]

[td]296[/td]

[td]3.70%[/td]

[/tr]

[/table]

Target Market Segment Strategy:

The insurance companies approve scanning facilities for their insurance plans, typically for one to two years.

Physicians direct patients to Scan Lab due to the convenience of its location.

Service Business Analysis:

The medical imaging industry operates under two models: large clinics/practices that buy equipment for their physicians, and outside service providers.

Small clinics/practices find equipment cost prohibitive and opt for outside service providers.

Scan Lab’s competitors typically offer limited services beyond medical imaging tests and radiologist analysis.

A profitable capacity is having five MRIs per 100,000 people; New Bedford has 12 for its population of 300,000.

Competition and Buying Patterns:

Nine direct competitors exist in the area.

Scan Lab also competes indirectly with clinics and large practices with their own equipment.

Strategy and Implementation Summary:

Scan Lab’s competitive edge lies in its advanced equipment and experienced, nationally recognized radiologist, Dr. Carolyn Jones.

Marketing efforts are focused on creating awareness of Scan Lab’s strengths and distinctiveness.

Insurance companies are targeted through sales campaigns, while doctors are targeted to become referring doctors.

Competitive Edge:

Dr. Carolyn Jones is a nationally recognized radiology expert, offering valuable consultations to referring doctors.

Scan Lab communicates its advanced technology and expert analysis through various methods, including the Yellow Pages.

Sales Strategy:

Scan Lab aims to convert qualified leads into referring physicians by emphasizing Dr. Jones’ expertise.

Convenient and pleasant experiences for patients and high-quality radiologist analysis for physicians are prioritized.

Networking with insurance carriers is essential to understanding bid expectations.

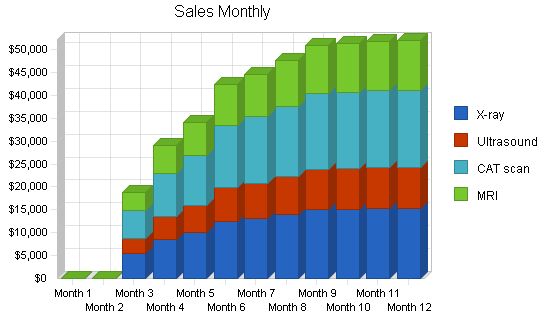

Scan Lab projects conservative sales growth, with steady growth starting in the seventh month.

The provided text has been condensed and streamlined to enhance readability and reduce redundancy while maintaining the integrity and tone of the original content.

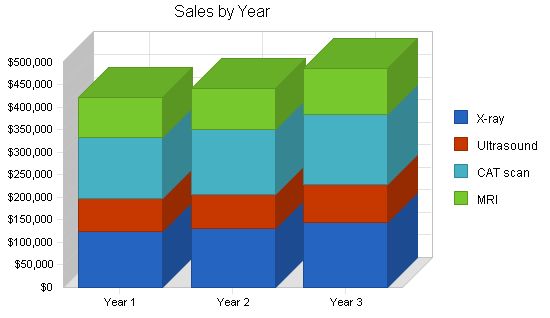

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| X-ray | $124,292 | $130,500 | $143,550 |

| Ultrasound | $73,332 | $77,000 | $84,700 |

| CAT scan | $136,721 | $143,000 | $157,300 |

| MRI | $87,999 | $92,000 | $101,200 |

| Total Sales | $422,344 | $442,500 | $486,750 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| X-ray | $28,587 | $30,000 | $30,900 |

| Ultrasound | $16,866 | $18,000 | $18,540 |

| CAT scan | $31,446 | $33,000 | $34,000 |

| MRI | $20,240 | $21,300 | $22,000 |

| Subtotal Direct Cost of Sales | $97,139 | $102,300 | $105,440 |

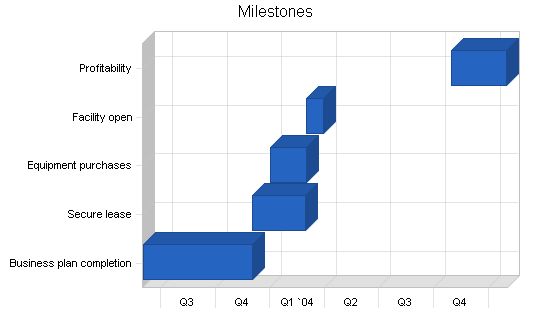

5.4 Milestones

Scan Lab has chosen quantifiable milestones as goals for the organization. The following table details the specific milestones, estimated time frames, and responsible employees.

Milestones

Milestone Start Date End Date Budget Manager Department

Business plan completion 6/1/2003 12/1/2003 $0 Carolyn Business Development

Secure lease 12/1/2003 2/28/2004 $0 Carolyn Operations

Equipment purchases 1/1/2004 3/1/2004 $0 Carolyn Operations

Facility open 3/1/2004 3/30/2004 $0 Carolyn Operations

Profitability 10/30/2004 1/31/2005 $0 Carolyn Accounting

Totals $0

Web Plan Summary

Scan Lab will have a website providing information on services offered and Dr. Jones’ professional experience.

6.1 Website Marketing Strategy

Scan Lab will use two marketing techniques to alert prospective customers to the site. The first is displaying the Web address on all literature. The second is submitting the website URL to multiple search engines. This ensures that when a customer searches for "New Bedford MRI," they will be directed to www.scanlab.com.

6.2 Development Requirements

The website will be designed and built by a local computer science student.

Management Summary

Dr. Carolyn Jones will lead Scan Lab. She received her medical degree from The University of California San Diego, known for their radiology. Dr. Jones completed her residency at John Hopkins and worked at a large clinic in Boston.

Dr. Jones has published 14 articles and frequently presents her papers at conferences.

7.1 Personnel Plan

Scan Lab requires the following positions/responsibilities:

– Dr. Jones: Resident radiologist, responsible for business development, marketing, and sales.

Personnel Plan

Year 1 Year 2 Year 3

Dr. Jones $60,000 $61,800 $63,654

Technicians $48,000 $49,440 $50,923

Other $19,200 $19,776 $20,269

Total People 5 5 5

Total Payroll $127,200 $131,016 $134,846

The following sections outline Scan Lab’s financial planning.

8.1 Important Assumptions

The table below details important financial assumptions.

General Assumptions

Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00%

Other 0 0 0

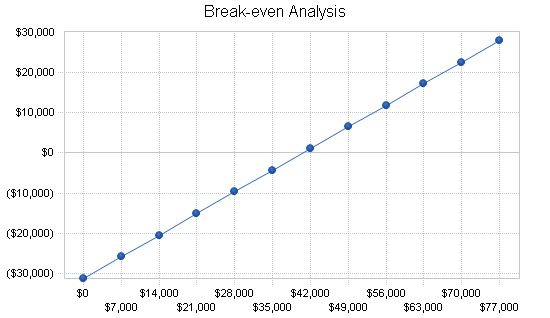

The Break-even Analysis indicates the monthly revenue needed to reach the break-even point.

Break-even Analysis:

Monthly Revenue Break-even: $40,582.

Assumptions:

– Average Percent Variable Cost: 23%.

– Estimated Monthly Fixed Cost: $31,248.

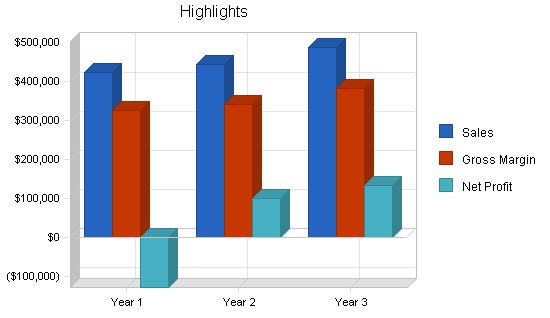

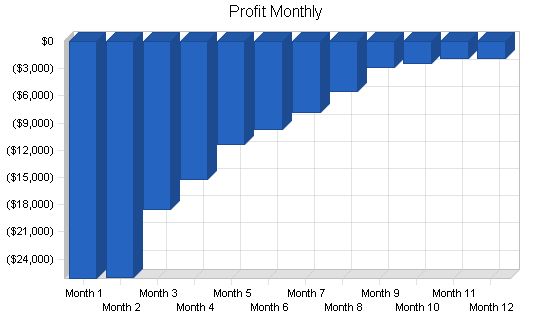

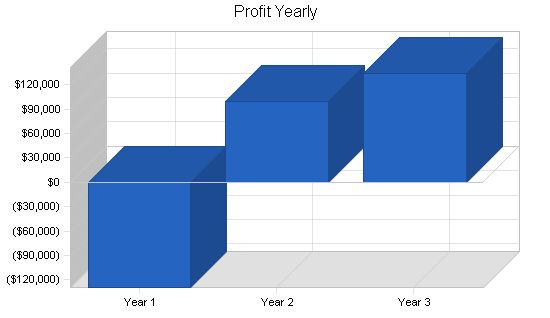

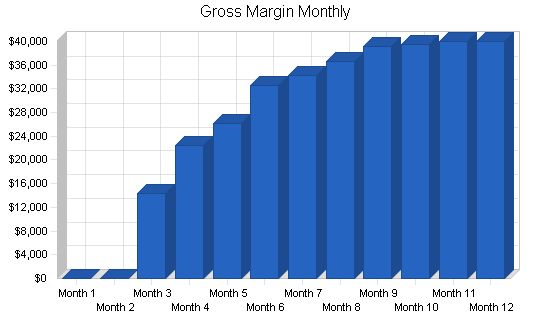

8.3 Projected Profit and Loss:

The following table and charts will indicate Projected Profit and Loss.

Pro Forma Profit and Loss:

Sales:

– Year 1: $422,344

– Year 2: $442,500

– Year 3: $486,750

Direct Cost of Sales:

– Year 1: $97,139

– Year 2: $102,300

– Year 3: $105,440

Other Costs of Sales:

– Year 1-3: $0

Total Cost of Sales:

– Year 1: $97,139

– Year 2: $102,300

– Year 3: $105,440

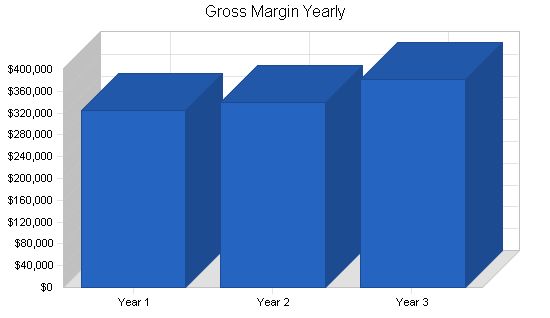

Gross Margin:

– Year 1: $325,205

– Year 2: $340,200

– Year 3: $381,310

Gross Margin %:

– Year 1: 77.00%

– Year 2: 76.88%

– Year 3: 78.34%

Expenses:

Payroll:

– Year 1: $127,200

– Year 2: $131,016

– Year 3: $134,846

Sales and Marketing and Other Expenses:

– Year 1: $6,000

– Year 2-3: $0

Depreciation:

– Year 1: $172,300

– Year 2-3: $0

Rent:

– Year 1: $24,000

– Year 2-3: $0

Utilities:

– Year 1: $6,000

– Year 2-3: $0

Insurance:

– Year 1: $18,000

– Year 2-3: $0

Payroll Taxes:

– Year 1: $19,080

– Year 2-3: $0

Other:

– Year 1: $2,400

– Year 2-3: $0

Total Operating Expenses:

– Year 1: $374,980

– Year 2: $131,016

– Year 3: $134,846

Profit Before Interest and Taxes:

– Year 1: ($49,775)

– Year 2: $209,184

– Year 3: $246,464

EBITDA:

– Year 1-3: $122,525

Interest Expense:

– Year 1: $79,500

– Year 2: $68,000

– Year 3: $56,000

Taxes Incurred:

– Year 1: $0

– Year 2: $42,355

– Year 3: $57,139

Net Profit:

– Year 1: ($129,275)

– Year 2: $98,829

– Year 3: $133,325

Net Profit/Sales:

– Year 1: -30.61%

– Year 2: 22.33%

– Year 3: 27.39%

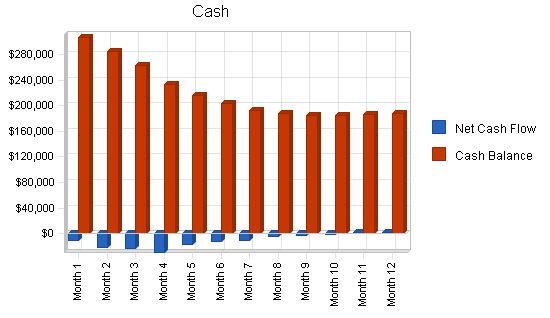

8.4 Projected Cash Flow:

The following table and chart indicate Projected Cash Flow.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $105,586 | $110,625 | $121,688 |

| Cash from Receivables | $240,226 | $328,223 | $357,044 |

| Subtotal Cash from Operations | $345,812 | $438,848 | $478,732 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $345,812 | $438,848 | $478,732 |

| Expenditures | |||

| Year 1 | Year 2 | Year 3 | |

| Expenditures from Operations | |||

| Cash Spending | $127,200 | $131,016 | $134,846 |

| Bill Payments | $227,987 | $219,308 | $218,092 |

| Subtotal Spent on Operations | $355,187 | $350,324 | $352,938 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $120,000 | $120,000 | $120,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $475,187 | $470,324 | $472,938 |

| Net Cash Flow | ($129,375) | ($31,477) | $5,793 |

| Cash Balance | $188,525 | $157,048 | $162,841 |

8.5 Projected Balance Sheet

The following table indicates the Projected Balance Sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $188,525 | $157,048 | $162,841 |

| Accounts Receivable | $76,532 | $80,184 | $88,203 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $265,057 | $237,232 | $251,044 |

| Long-term Assets | |||

| Long-term Assets | $861,500 | $861,500 | $861,500 |

| Accumulated Depreciation | $172,300 | $172,300 | $172,300 |

| Total Long-term Assets | $689,200 | $689,200 | $689,200 |

| Total Assets | $954,257 | $926,433 | $940,244 |

| Liabilities and Capital | |||

| Year 1 | Year 2 | Year 3 | |

| Current Liabilities | |||

| Accounts Payable | $24,132 | $17,479 | $17,965 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $24,132 | $17,479 | $17,965 |

| Long-term Liabilities | $740,000 | $620,000 | $500,000 |

| Total Liabilities | $764,132 | $637,479 | $517,965 |

| Paid-in Capital | $330,000 | $330,000 | $330,000 |

| Retained Earnings | ($10,600) | ($139,875) | ($41,046) |

| Earnings | ($129,275) | $98,829 | $133,325 |

| Total Capital | $190,125 | $288,954 | $422,279 |

| Total Liabilities and Capital | $954,257 | $926,433 | $940,244 |

| Net Worth | $190,125 | $288,954 | $422,279 |

8.6 Business Ratios

The following table details Business Ratios for Scan Lab and the Diagnostic Imaging Center industry (NAICS code 612512).

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 4.77% | 10.00% | 8.83% |

| Percent of Total Assets | ||||

| Accounts Receivable | 8.02% | 8.66% | 9.38% | 29.41% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 48.00% |

| Total Current Assets | 27.78% | 25.61% | 26.70% | 80.30% |

| Long-term Assets | 72.22% | 74.39% | 73.30% | 19.70% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 2.53% | 1.89% | 1.91% | 30.82% |

| Long-term Liabilities | 77.55% | 66.92% | 53.18% | 21.77% |

| Total Liabilities | 80.08% | 68.81% | 55.09% | 52.59% |

| Net Worth | 19.92% | 31.19% | 44.91% | 47.41% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 77.00% | 76.88% | 78.34% | 100.00% |

| Selling, General & Administrative Expenses | 102.84% | 0.00% | 0.00% | 66.55% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.85% |

| Profit Before Interest and Taxes | -11.79% | 47.27% | 50.63% | 5.72% |

| Main Ratios | ||||

| Current | 10.98 | 13.57 | 13.97 | 1.77 |

| Quick | 10.98 | 13.57 | 13.97 | 1.49 |

| Total Debt to Total Assets | 80.08% | 68.81% | 55.09% | 54.16% |

| Pre-tax Return on Net Worth | -67.99% | 48.86% | 45.10% | 6.71% |

| Pre-tax Return on Assets | -13.55% | 15.24% | 20.26% | 14.64% |

| Additional Ratios | Year 1 |

Personnel Plan: Dr. Jones: 0%, $0, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000 Technicians: 0%, $0, $0, $0, $3,000, $3,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000 Other: 0%, $0, $0, $0, $1,200, $1,200, $2,400, $2,400, $2,400, $2,400, $2,400, $2,400, $2,400 Total People: 0, 0, 0, 3, 3, 5, 5, 5, 5, 5, 5, 5, 5, 5 Total Payroll: $0, $0, $6,000, $10,200, $10,200, $14,400, $14,400, $14,400, $14,400, $14,400, $14,400, $14,400, $14,400 General Assumptions: Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12 Current Interest Rate: 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00% Long-term Interest Rate: 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00% Tax Rate: 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00% Other: 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0 Pro Forma Profit and Loss: Sales: $0, $0, $18,689, $29,104, $33,997, $42,319, $44,585, $47,589, $50,933, $51,357, $51,870, $51,901 Direct Cost of Sales: $0, $0, $4,298, $6,694, $7,819, $9,733, $10,255, $10,945, $11,715, $11,812, $11,930, $11,937 Other Costs of Sales: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Total Cost of Sales: $0, $0, $4,298, $6,694, $7,819, $9,733, $10,255, $10,945, $11,715, $11,812, $11,930, $11,937 Gross Margin: $0, $0, $14,391, $22,410, $26,178, $32,585, $34,331, $36,644, $39,218, $39,545, $39,940, $39,964 Gross Margin %: 0.00%, 0.00%, 77.00%, 77.00%, 77.00%, 77.00%, 77.00%, 77.00%, 77.00%, 77.00%, 77.00%, 77.00%, 77.00% Expenses: Payroll: $0, $0, $6,000, $10,200, $10,200, $14,400, $14,400, $14,400, $14,400, $14,400, $14,400, $14,400, $14,400 Sales and Marketing and Other Expenses: $500, $500, $500, $500, $500, $500, $500, $500, $500, $500, $500, $500, $500 Depreciation: $14,358, $14,358, $14,358, $14,358, $14,358, $14,358, $14,358, $14,358, $14,358, $14,358, $14,358, $14,358 Rent: $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000 Utilities: $500, $500, $500, $500, $500, $500, $500, $500, $500, $500, $500, $500, $500 Insurance: $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500 Payroll Taxes: 15%, $0, $0, $900, $1,530, $1,530, $2,160, $2,160, $2,160, $2,160, $2,160, $2,160, $2,160 Other: $200, $200, $200, $200, $200, $200, $200, $200, $200, $200, $200, $200, $200 Total Operating Expenses: $19,058, $19,058, $25,958, $30,788, $30,788, $35,618, $35,618, $35,618, $35,618, $35,618, $35,618, $35,618, $35,618 Profit Before Interest and Taxes: ($19,058), ($19,058), ($11,568), ($8,378), ($4,611), ($3,033), ($1,288), $1,025, $3,600, $3,927, $4,322, $4,346 EBITDA: ($4,700), ($4,700), $2,791, $5,980, $9,748, $11,325, $13,071, $15,384, $17,958, $18,285, $18,680, $18,704 Interest Expense: $7,083, $7,000, $6,917, $6,833, $6,750, $6,667, $6,583, $6,500, $6,417, $6,333, $6,250, $6,167 Taxes Incurred: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Net Profit: ($26,142), ($26,058), ($18,484), ($15,212), ($11,361), ($9,700), ($7,871), ($5,475), ($2,817), ($2,406), ($1,928), ($1,821) Net Profit/Sales: 0.00%, 0.00%, -98.91%, -52.27%, -33.42%, -22.92%, -17.65%, -11.50%, -5.53%, -4.69%, -3.72%, -3.51% Pro Forma Cash Flow |

||

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $0 | $4,672 | $7,276 | $8,499 | $10,580 | $11,146 | $11,897 | $12,733 | $12,839 | $12,968 | $12,975 | |

| Cash from Receivables | $0 | $0 | $0 | $467 | $14,277 | $21,950 | $25,706 | $31,796 | $33,514 | $35,775 | $38,210 | $38,531 | |

| Subtotal Cash from Operations | $0 | $0 | $4,672 | $7,743 | $22,776 | $32,530 | $36,852 | $43,693 | $46,247 | $48,615 | $51,178 | $51,506 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Received | $0 | $0 | $4,672 | $7,743 | $22,776 | $32,530 | $36,852 | $43,693 | $46,247 | $48,615 | $51,178 | $51,506 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $0 | $0 | $6,000 | $10,200 | $10,200 | $14,400 | $14,400 | $14,400 | $14,400 | $14,400 | $14,400 | $14,400 | |

| Bill Payments | $393 | $11,781 | $11,871 | $16,913 | $19,792 | $20,881 | $23,275 | $23,718 | $24,328 | $24,992 | $25,007 | $25,038 | |

| Subtotal Spent on Operations | $393 | $11,781 | $17,871 | $27,113 | $29,992 | $35,281 | $37,675 | $38,118 | $38,728 | $39,392 | $39,407 | $39,438 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Long-term Liabilities Principal Repayment | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Purchase Other Current Assets | $0 | $ | |||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!