Gifts and Collectibles Retail Shop Business Plan

Classique Gifts Etc. is a retail store offering fine gifts, collectible dolls, and doll accessories. The store will be located in Lexington, Kentucky, catering to middle- and upper-class consumers seeking a unique shopping experience. In addition to a wide array of quality products, customers will receive friendly and knowledgeable customer service at a convenient location.

This business plan aims to secure $50,000 in financing for inventory and first-year operational expenses. We also request a $10,000 credit line to manage low cash flow periods. Brenda and Charles Gajdik will jointly own and operate the store, contributing $40,000 in cash as equity investment for start-up costs, equipment purchases, and operating capital.

The sales forecasts in this plan are conservative compared to a similar establishment in Lexington. Brenda has identified areas for improvement, confident that the store can outperform its competition.

1.1 Objectives:

– Develop Classique Gifts Etc. into the premier gift retail store in Central Kentucky.

– Maintain a gross profit margin above 40% for the first year.

– Acquire a customer base of 4,000 by the end of the second year using personal customer service and marketing.

– Achieve a substantial net profit by the end of Year 3.

1.2 Mission:

Classique Gifts Etc. will be a retail store specializing in fine gifts, collectible dolls, and accessories. We will provide products from quality suppliers and offer professional customer service in a friendly environment.

1.3 Keys to Success:

To succeed in this business, we must:

– Sell high-quality products desired by customers.

– Provide friendly customer service.

– Establish excellent vendor/supplier relations for quick shipment of orders.

– Advertise and promote our store to take advantage of the Christmas shopping season.

– Continuously review inventory and adjust levels based on records.

Classique Gifts Etc. is a sole-proprietorship owned by Brenda and Charles Gajdik, offering unique gifts and elegant collectible dolls. Located in Lexington, Kentucky, we cater to customers seeking unique items to supplement their doll collection or find exclusive gifts not found in national chain stores.

2.1 Company Ownership:

Classique Gifts Etc. will operate as a sole-proprietorship owned by Charles and Brenda Gajdik.

2.2 Start-up Summary:

Total current and long-term assets make up 78% of the start-up requirements, with the remaining 22% ($20,058) comprising start-up expenses.

Funding:

$90,000 funding, including a $10,000 line of credit, is required for Classique Gifts Etc. It will be funded as follows:

– Owners’ investment: $40,000 from Charles and Brenda.

– Commercial loan: $50,000 at 7% interest for seven years.

– Line of credit: $10,000 available as needed.

Details of other start-up expenses include:

– Research and Development:

– Buying trip expenses to Columbus, OH: $133

– Buying trip expenses to Atlanta, GA: $430

– Internet provider service paid in July for Year 1: $120

– Total: $683

– 1st Month Rent & Deposit (proposed location):

– Rent: $9.50/square foot, $1,425/mo, $17,100/yr

– Common Area Maintenance (CAM): $1.50/square foot, $225/mo, $2,700/yr

– Total Rent and CAM: $1,650/mo, $19,800/yr

– Leasehold Improvements:

– Slatwall Panels and Accessories: 50 panels @ $50 each, $2,500

– Ceiling Tiles: 1,400 sq ft @ $0.50/sq ft, $700

– Carpet with Pad: 1,400 sq ft @ $2.50/sq ft, $3,500

– Carpenter Estimate: Display Risers and Counter, $300

– Total: $7,000

– Phone line installation: Single line installation, $100

– Insurance: Medical insurance for Brenda and Charles, $650 first month

– Advertising & Promotion:

– Newspaper: $76/week for 26 weeks (Community Section on Wednesday), $1,976

– TV: Shopping with Santa in the Bluegrass, $1,500

– Total: $3,476

Start-up Funding:

Start-up expenses to fund: $20,058

Start-up assets to fund: $69,942

Total funding required: $90,000

Assets:

– Non-cash Assets from Start-up: $57,757

– Cash Requirements from Start-up: $12,185

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $12,185

– Total Assets: $69,942

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $50,000

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $50,000

– Capital:

– Planned Investment:

– Charles & Brenda Gajdik: $40,000

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $40,000

– Loss at Start-up (Start-up Expenses): ($20,058)

– Total Capital: $19,942

– Total Capital and Liabilities: $69,942

– Total Funding: $90,000

2.2.1 Start-up Current & Long-term Asset Listing

2.3 Location: Proposed

Our most desirable location is in Imperial Plaza Shopping Center, soon to be renamed Waller Center. The property manager estimates that 20,000 cars pass by daily.

Imperial Plaza: This location offers 1,800 sq. ft. priced at $9.50 per sq. ft. with CAM expenses at $1.50 per sq. ft. The back room of approximately 350 sq ft can be used as work space and storage. The sales counter and drop-down ceiling panels need renovation, and the floor and walls need improvements. Monthly rent is $1,425 with CAM of $225 for a total of $1,650. The owner is flexible and helpful.

Other potential sites are Southland Drive and Chinoe Center, with details provided.

Products:

Classique Gifts Etc. plans to carry special occasion gifts and merchandise from quality suppliers such as the San Francisco Music Box Company, Swarovski crystal, Lennox crystal, Outback Chair Company, Traditions Artglass Company, Harvest House children’s books, and well-known collectible doll manufacturers including Steiff, Madame Alexander, Turner Dolls, Lee Middleton, Wendy Lawton, Susan Wakeen, Kish Dolls, Lloyd Middleton, and others.

Market Analysis Summary:

The collectible doll industry generated $3 billion in retail sales in 2000. The gift industry, including general gifts, collectibles, stationery, and greeting cards, generated $54 billion in sales in 2002. Unity Marketing predicts a positive future for the gifts and home accents market.

4.1 Market Segmentation:

The ideal customer we expect to serve is middle to upper class, primarily female, aged 30-75, educated, homeowners, quality and value conscious, and family-oriented. We will attract these customers by offering unique and uncommon product selections.

4.2 Industry Analysis:

– Consumers seek independent retailers that offer a personalized shopping experience.

– Consumers value stores with quality service offerings equal to their products.

4.2.1 Competition and Buying Patterns:

Brand name products sell well in stores with good selection, location, and knowledgeable employees. There is minimal competition in the Lexington area for collectible dolls. Other stores carry limited doll lines, while the Internet offers discounted retired or discontinued merchandise. Classique Gifts Etc. plans to develop a web page in year three to market merchandise online.

Strategy and Implementation Summary:

Classique Gifts Etc. will develop product offerings and marketing strategies to increase customer base, sales, and profit.

5.1 Marketing Strategy:

Marketing efforts will focus on advertising in the Lexington Herald-Leader and Insight Media Advertising on cable TV. Seasonal postcard and newsletter mailings will promote special events or holiday specials. $5 coupons will be offered for every $100 spent for future visits.

5.2 Sales Strategy:

Classique Gifts Etc. will prioritize sales through personalized customer assistance. Gathering customer information and feedback will target marketing efforts, enhance the shopping experience, and develop future sales opportunities.

5.2.1 Sales Forecast:

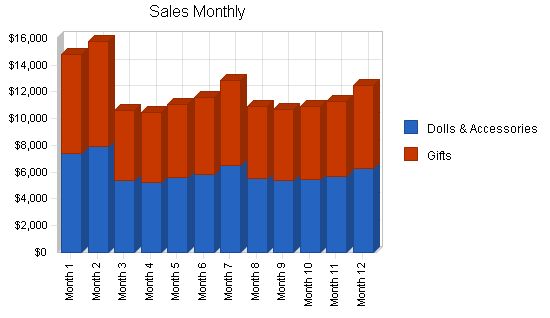

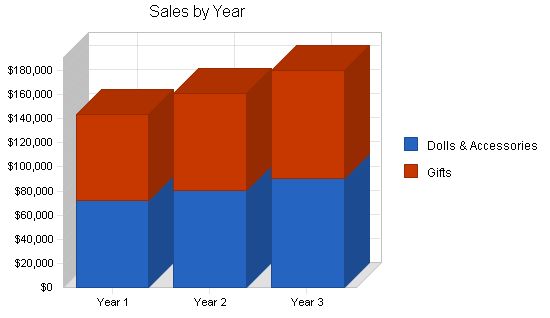

Retail gift and collectible doll sales are enhanced by seasonal holidays and special gift giving occasions. The sales forecast includes seasonal dips in sales during slower months.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Dolls & Accessories | $72,105 | $80,758 | $90,449 |

| Gifts | $71,405 | $79,974 | $89,570 |

| Total Sales | $143,510 | $160,731 | $180,019 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Dolls & Accessories | $40,871 | $42,915 | $45,060 |

| Gifts | $40,885 | $42,929 | $45,076 |

| Subtotal Direct Cost of Sales | $81,756 | $85,844 | $90,136 |

Contents

5.3 Competitive Edge

Classique Gifts Etc. will distinguish itself as a unique retail environment through product offering and friendly, personal customer service. Located near St. Joseph Hospital, medical offices, the Kentucky Inn, the University of Kentucky, and the Campbell House, we will cater to this diverse population and doll collectors alike.

5.4 Milestones

The following table lists important milestone dates.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan | 11/1/2003 | 11/18/2003 | $0 | Charles | Department |

| Secure Funding | 11/18/2003 | 12/31/2003 | $0 | Charles | Department |

| Negotiate and Sign Lease | 11/18/2003 | 12/31/2003 | $0 | Charles | Department |

| Business Setup | 11/18/2003 | 12/31/2003 | $0 | Charles | Department |

| Leasehold Improvements | 11/18/2003 | 12/31/2003 | $0 | Charles | Department |

| Purchase Start-up Equipment | 11/18/2003 | 12/31/2003 | $0 | Charles | Department |

| Advertising Developed | 1/1/2004 | 2/1/2004 | $0 | Charles/Brenda | Department |

| Store Open For Business | 2/1/2004 | 2/2/2004 | $0 | Charles/Brenda | Department |

| Totals | $0 | ||||

Management Summary

Classique Gifts Etc. will be managed by Brenda and Charles Gajdik. Brenda, currently the assistant store manager at Schwab’s Collectibles in Lexington, will oversee merchandising, sales, customer relations, and part-time staff. Charles will handle finances, operations, data processing, and assist in all other areas of the business. His experience in accounting and information technology will be invaluable.

6.1 Personnel Plan

The personnel plan is as follows, including the owners’ salaries and one part-time employee as needed.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Brenda Owner/Manager-Sales & Merchandising | $14,600 | $16,000 | $16,000 |

| Charles Owner/Manager-Operations & Finance | $9,000 | $14,000 | $14,000 |

| Part-Time as Needed ($7 per hour) | $3,120 | $4,120 | $5,120 |

| Total People | 3 | 3 | 3 |

| Total Payroll | $26,720 | $34,120 | $35,120 |

Financial Plan

- Growth will be moderate.

- Costs will be managed and future needs will be forecasted regularly.

- By finding the right product at the right price, we will meet planned margins and maintain acceptable inventory levels.

7.1 Important Assumptions

Our key assumptions are:

- We do not offer credit sales.

- We expect continued popularity of collectibles.

- We have access to sufficient financing to support our financial plan.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 6.00% | 6.00% | 6.00% |

| Long-term Interest Rate | 7.00% | 7.00% | 7.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

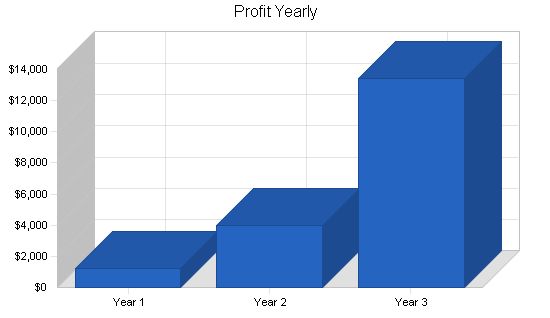

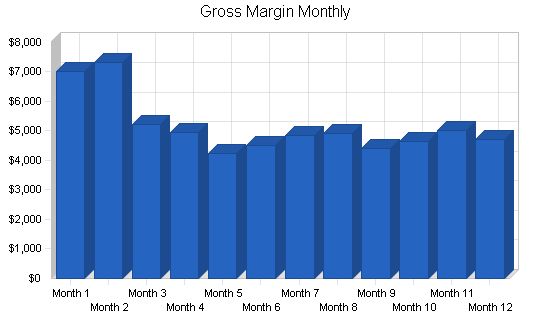

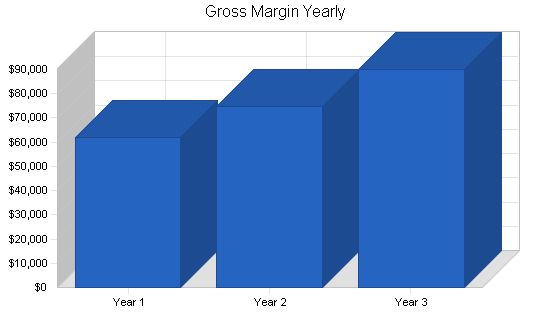

7.2 Projected Profit and Loss

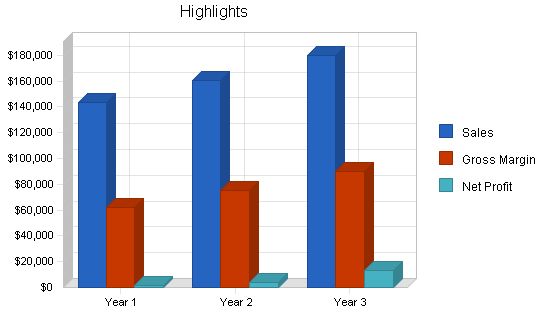

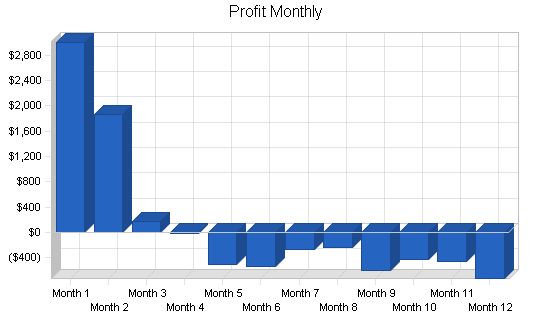

The following table shows our three-year profit and loss estimates. We expect a gross margin of over 40% in the first year, which will continue to grow in the following years. The associated charts demonstrate a negative profit/sales percentage for the first two years but a positive net profit by year three.

Pro Forma Profit and Loss:

Year 1 | Year 2 | Year 3

—— | —— | ——

Sales | $143,510 | $160,731 | $180,019

Direct Cost of Sales | $81,756 | $85,844 | $90,136

Other Costs of Goods | $0 | $0 | $0

Total Cost of Sales | $81,756 | $85,844 | $90,136

Gross Margin | $61,754 | $74,887 | $89,883

Gross Margin % | 43.03% | 46.59% | 49.93%

Expenses:

– Payroll: $26,720 | $34,120 | $35,120

– Sales and Marketing and Other Expenses: $600 | $1,200 | $2,400

– Depreciation: $0 | $0 | $0

– Rent and CAM Expense: $18,150 | $18,150 | $18,150

– Utilities: $3,600 | $3,600 | $3,600

– Liability Insurance:Store: $0 | $2,400 | $2,400

– Insurance (medical Brenda & Charles): $7,800 | $7,150 | $7,150

– Payroll Taxes: $0 | $0 | $0

– Other: $0 | $0 | $0

– Total Operating Expenses: $56,870 | $66,620 | $68,820

Profit Before Interest and Taxes: $4,884 | $8,267 | $21,063

EBITDA: $4,884 | $8,267 | $21,063

Interest Expense: $3,156 | $2,549 | $1,915

Taxes Incurred: $518 | $1,716 | $5,745

Net Profit: $1,209 | $4,003 | $13,404

Net Profit/Sales: 0.84% | 2.49% | 7.45%

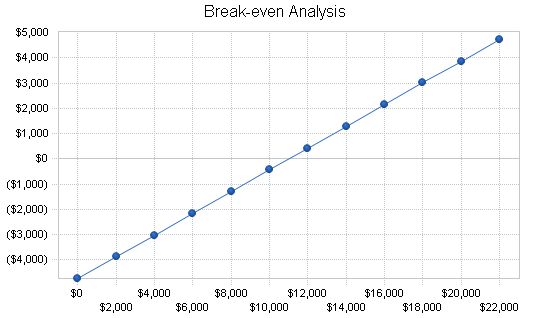

7.3 Break-even Analysis:

The following table and chart display our estimated monthly revenue break-even point.

Break-even Analysis

Monthly Revenue Break-even: $11,013

Assumptions:

– Average Percent Variable Cost: 57%

– Estimated Monthly Fixed Cost: $4,739

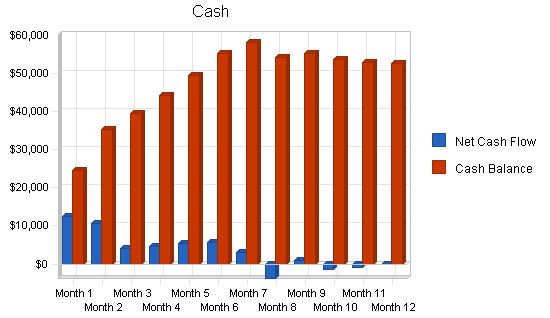

7.4 Projected Cash Flow

The table and chart below show the projected cash flow.

Pro Forma Cash Flow

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $143,510 | $160,731 | $180,019 |

| Subtotal Cash from Operations | $143,510 | $160,731 | $180,019 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $143,510 | $160,731 | $180,019 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $26,720 | $34,120 | $35,120 |

| Bill Payments | $67,291 | $124,798 | $131,213 |

| Subtotal Spent on Operations | $94,011 | $158,918 | $166,333 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $9,060 | $9,060 | $9,060 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $103,071 | $167,978 | $175,393 |

| Net Cash Flow | $40,439 | ($7,247) | $4,625 |

| Cash Balance | $52,624 | $45,378 | $50,003 |

7.5 Projected Balance Sheet

The table below shows our projected Balance Sheet.

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $52,624 | $45,378 | $50,003 |

| Inventory | $8,583 | $9,012 | $9,463 |

| Other Current Assets | $12,757 | $12,757 | $12,757 |

| Total Current Assets | $73,964 | $67,147 | $72,223 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $73,964 | $67,147 | $72,223 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $11,873 | $10,113 | $10,845 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $11,873 | $10,113 | $10,845 |

| Long-term Liabilities | $40,940 | $31,880 | $22,820 |

| Total Liabilities | $52,813 | $41,993 | $33,665 |

| Paid-in Capital | $40,000 | $40,000 | $40,000 |

| Retained Earnings | ($20,058) | ($18,849) | ($14,846) |

| Earnings | $1,209 | $4,003 | $13,404 |

| Total Capital | $21,151 | $25,154 | $38,558 |

| Total Liabilities and Capital | $73,964 | $67,147 | $72,223 |

| Net Worth | $21,151 | $25,154 | $38,558 |

7.6 Business Ratios

The table below outlines some important ratios from the Gift Shop industry. The final column, Industry Profile, details ratios specific to the industry based on the Standard Industry Classification (SIC) code 5947.

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 12.00% | 12.00% | 3.34% |

| Percent of Total Assets | ||||

| Inventory | 11.60% | 13.42% | 13.10% | 40.42% |

| Other Current Assets | 17.25% | 19.00% | 17.66% | 23.99% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 80.29% |

|

– Month 1 to Month 12, Plan Month: 1 to 12 – Current Interest Rate: 6.00% – Long-term Interest Rate: 7.00% – Tax Rate: 30.00% – Other: 0 Pro Forma Profit and Loss: – Month 1 to Month 12, Sales: $14,800 to $12,500 – Month 1 to Month 12, Direct Cost of Sales: $7,800 to $7,803 – Month 1 to Month 12, Other Costs of Goods: $0 to $0 – Month 1 to Month 12, Total Cost of Sales: $7,800 to $7,803 – Month 1 to Month 12, Gross Margin: $7,000 to $4,697 – Month 1 to Month 12, Gross Margin %: 47.30% to 37.58% – Month 1 to Month 12, Expenses: – Month 1 to Month 12, Payroll: $1,480 to $2,600 – Month 1 to Month 12, Sales and Marketing and Other Expenses: $0 to $300 – Month 1 to Month 12, Depreciation: $0 to $0 – Month 1 to Month 12, Rent and CAM Expense: $0 to $1,650 – Month 1 to Month 12, Utilities: $300 to $300 – Month 1 to Month 12, Liability Insurance: Store: $0 to $0 – Month 1 to Month 12, Insurance (medical Brenda & Charles): $650 to $650 – Month 1 to Month 12, Payroll Taxes: 15% of Payroll – Month 1 to Month 12, Other: $0 to $0 – Month 1 to Month 12, Total Operating Expenses: $2,430 to $5,500 – Month 1 to Month 12, Profit Before Interest and Taxes (EBITDA): $4,570 to ($803) – Month 1 to Month 12, Interest Expense: $287 to $239 – Month 1 to Month 12, Taxes Incurred: $1,285 to ($313) – Month 1 to Month 12, Net Profit: $2,998 to ($729) – Month 1 to Month 12, Net Profit/Sales: 20.26% to (-5.83%) Pro Forma Cash Flow: |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash Sales | $14,800 | $15,800 | $10,600 | $10,460 | $11,100 | $11,600 | $12,850 | $10,900 | $10,700 | $10,900 | $11,300 | $12,500 | |

| Subtotal Cash from Operations | $14,800 | $15,800 | $10,600 | $10,460 | $11,100 | $11,600 | $12,850 | $10,900 | $10,700 | $10,900 | $11,300 | $12,500 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $14,800 | $15,800 | $10,600 | $10,460 | $11,100 | $11,600 | $12,850 | $10,900 | $10,700 | $10,900 | $11,300 | $12,500 | |

| Expenditures | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $1,480 | $1,760 | $2,100 | $2,100 | $2,100 | $2,400 | $2,400 | $2,420 | $2,420 | $2,420 | $2,520 | $2,600 | |

| Bill Payments | $84 | $2,561 | $3,658 | $2,948 | $2,857 | $2,785 | $6,757 | $11,529 | $6,607 | $9,234 | $8,872 | $9,399 | |

| Subtotal Spent on Operations | $1,564 | $4,321 | $5,758 | $5,048 | $4,957 | $5,185 | $9,157 | $13,949 | $9,027 | $11,654 | $11,392 | $11,999 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $755 | $755 | $755 | $755 | $755 | $755 | $755 | $755 | $755 | $755 | $755 | $755 | $755 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $2,319 | $5,076 | $6,513 | $5,803 | $5,712 | $5,940 | $9,912 | $14,704 | $9,782 | $12,409 | $12,147 | $12,754 | |

| Net Cash Flow | $12,481 | $10,724 | $4,087 | $4,657 | $5,388 | $5,660 | $2,938 | ($3,804) | $918 | ($1,509) | ($847) | ($254) | |

| Cash Balance | $24,666 | $35,390 | $39,477 | $44,134 | $49,522 | $55,182 | $58,120 | $54,315 | $55,234 | $53,725 | $52,878 | $52,624 |

Pro Forma Balance Sheet:

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | |||||||||||||

| Current Assets | |||||||||||||

| Cash | $12,185 | $24,666 | $35,390 | $39,477 | $44,134 | $49,522 | $55,182 | $58,120 | $54,315 | $55,234 | $53,725 | $52,878 | $52,624 |

| Inventory | $45,000 | $37,200 | $28,707 | $23,327 | $17,809 | $10,959 | $7,810 | $8,785 | $6,574 | $6,930 | $6,875 | $6,930 | $8,583 |

| Other Current Assets | $12,757 | $12,757 | $12,757 | $12,757 | $12,757 | $12,757 | $12,757 | $12,757 | $12,757 | $12,757 | $12,757 | $12,757 | $12,757 |

| Total Current Assets | $69,942 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!