Accounting & Bookkeeping Business Plan

The Sorcerer’s Accountant is a successful accounting and tax preparation service owned by Max Greenwood, CPA in Chicago, Illinois. The firm offers tax accounting, management accounting, and QuickBooks set-up and training for small businesses. To expand the business, bookkeeping services will be added, requiring investment in marketing and staff. This business plan outlines the strategy and objectives for growth over the next three years.

The business will offer clients affordable bookkeeping services overseen by a CPA. This involves hiring undergraduate student bookkeepers and a graduate student manager, minimizing fixed costs, and showcasing Sorcerer’s Accountant’s expertise through its website. Sales are expected to more than double over three years as 8 part-time bookkeepers are deployed to client businesses as needed, resulting in substantial increases in salary and dividends for Greenwood.

The Sorcerer’s Accountant aims to launch new services – small business bookkeeping – to its existing client base.

Objectives:

1. Launch bookkeeping services gradually with two part-time bookkeepers.

2. Achieve bookkeeping service revenues equal to or greater than current total revenues within three years.

3. Attain a net profit of $60,000 in three years.

4. Employ eight part-time bookkeepers in three years.

Mission:

The Sorcerer’s Accountant provides comprehensive tax and management accounting services for small businesses in Chicago, Illinois. This enables business owners to save money, ensure compliance with tax laws, and make informed management decisions.

Keys to Success:

1. Build client trust.

2. Maintain up-to-date CPA certification and accounting education.

3. Offer revenue-increasing suggestions to clients.

4. Practice legal and ethical transparency, reporting, and tax practices.

The Sorcerer’s Accountant, founded by Max Greenwood in 2006, is a one-person CPA firm. It offers tax, management and cost consulting, and QuickBooks sales and services to small businesses in the Chicago area. The company plans to add bookkeeping services to its offerings.

Company Ownership:

Max Greenwood is the sole proprietor and founder of The Sorcerer’s Accountant.

Company History:

Founded in 2006 with $10,000 in start-up capital, The Sorcerer’s Accountant began as a tax service. In subsequent years, management and cost accounting services were added in 2007, followed by QuickBooks reselling and services in 2008. Client retention has been positive, with 75% of 2008 clients returning in 2009. The business operates from a small rented office space, primarily conducting client meetings at their offices.

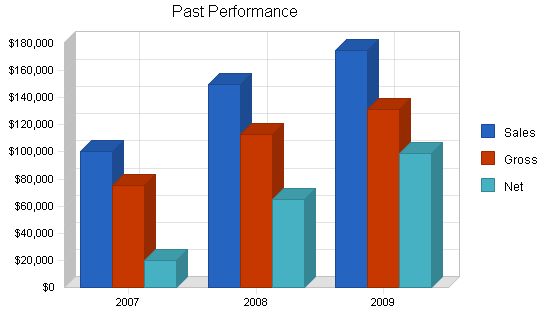

Past Performance:

2007 2008 2009

Sales $100,000 $150,000 $175,000

Gross Margin $75,000 $112,500 $131,250

Gross Margin % 75.00% 75.00% 75.00%

Operating Expenses $55,000 $67,500 $82,750

Collection Period 30 25 28

Balance Sheet:

2007 2008 2009

Current Assets

Cash $15,000 $17,500 $20,000

Accounts Receivable $4,167 $6,250 $7,292

Other Current Assets $5,000 $5,000 $5,000

Total Current Assets $24,167 $28,750 $32,292

Long-term Assets

Long-term Assets $0 $0 $0

Accumulated Depreciation $0 $0 $0

Total Long-term Assets $0 $0 $0

Total Assets $24,167 $28,750 $32,292

Current Liabilities

Accounts Payable $4,583 $5,625 $6,896

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Total Current Liabilities $4,583 $5,625 $6,896

Long-term Liabilities $0 $0 $0

Total Liabilities $4,583 $5,625 $6,896

Paid-in Capital $10,000 $10,000 $10,000

Retained Earnings ($10,417) ($51,875) ($83,554)

Earnings $20,000 $65,000 $98,950

Total Capital $19,583 $23,125 $25,396

Total Capital and Liabilities $24,167 $28,750 $32,292

Other Inputs:

Payment Days 30 30 30

Sales on Credit $50,000 $75,000 $87,500

Receivables Turnover 12.00 12.00 12.00

Services

Current services offered by The Sorcerer’s Accountant include:

Tax Services:

– Tax preparation

– Tax planning

– Addressing tax problems (audit representation, back taxes owed, payroll tax problems, IRS issues, bankruptcy)

Management/Cost Accountant Services:

– Audits

– Cost and Margin Analysis

– Financial Projection

– Setup for credit card processing

QuickBooks Services

– QuickBooks sales and setup

– QuickBooks training

– QuickBooks tips (via website)

– QuickBooks "quicktune" service (audit and fix of QuickBooks files)

Current services are either provided entirely by Max Greenwood or available through resources on The Sorcerer’s Accountant website. Greenwood will provide referrals to credit card processing companies or some specialty consultants when needed but focuses on general small business services.

The Sorcerer’s Accountant plans to add the following bookkeeping services:

– Payroll processing

– Accounts payable (entry, bill paying)

– Accounts receivable (entry, invoicing, deposits, collection)

– Sales tax processing

– Bank reconciliations

– Inventory management

– Financial statement preparation

– Other financial reporting

These bookkeeping services will be offered at a rate of $30 per hour per bookkeeper for clients. Clients would pay $20 – $25, once benefits and taxes are factored in, for an in-house, part-time bookkeeper. The Sorcerer’s Accountant’s rate is economical considering these factors.

The new services will be performed by part-time student bookkeepers who are current undergraduate accounting majors with up to 20 hours per week available to work. Each business will have a consistent bookkeeper assigned to it. The bookkeepers will be trained by Max Greenwood directly. They will all be students in the top 20% of their class with at least one professional recommendation and one educational recommendation. This business model has been successful in other cities with ample student labor.

To add value, the bookkeeping manager, a graduate student pursuing an MBA in accounting, will supervise and audit the work of the bookkeepers, answering their questions and providing quality assurance. The bookkeeping manager will review the QuickBooks files and reports to ensure they are prepared correctly.

Market Analysis Summary

The small business accounting market consists of virtually every small business in the United States. As businesses grow larger than one-person sole proprietorships, they generally require expert help with tax preparation and often with additional bookkeeping and accounting services. Even many non-employer sole proprietorships will use accounting help at some point. While some small businesses hire bookkeepers or CFOs directly, many successfully outsource these types of services.

The accounting service market as a whole includes:

– Corporate accounting and auditing firms: The "Big Four" (PricewaterhouseCoopers, Ernst & Young, Deloitte Touche Tohmatsu, and KPMG) and their competitors

– Small business accounting

– Personal accounting (by H & R Block and similar companies)

The National Society of Accountants represents more than 30,000 independent practitioners who provide services to 19 million individuals and businesses. The continuing evolution of U.S. tax laws guarantees work for tax accountants. The market is somewhat recession-proof, as businesses which are contracting use accountants to help cut spending and limit tax liability just as growing businesses will use accountants to launch and prepare financials for expansion, mergers, and acquisitions.

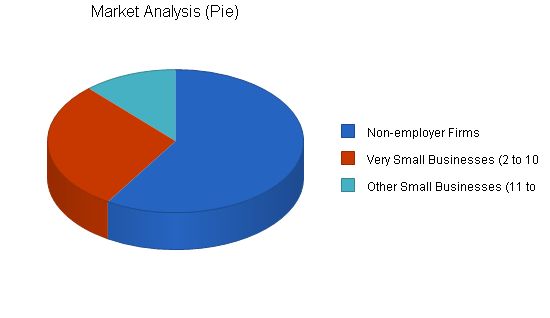

Market Segmentation

The market of small businesses in Chicago for The Sorcerer’s Accountant represents approximately 85,000 businesses in 2010. It has been divided into three groups:

Non-employer firms: These firms do not have many concerns but must protect their tax liability and sort out how their personal and business tax returns intersect. These firms generally require QuickBooks services and tax preparation services. As they grow, this group becomes ripe for outsourced bookkeeping services before they can hire a full-time in-house bookkeeper.

Very small businesses: These businesses require payroll services, bookkeeping, and tax preparation. They can generally be convinced to use outsourced accounting and bookkeeping with cost analysis. With greater stakes, these businesses can make greater use of management accounting services, especially as most cannot afford a dedicated CFO. Many do not need a full-time bookkeeper but can make do with part-time help.

Other small businesses: Many of these businesses have in-house financial management and bookkeeping help but may save money by outsourcing these services. These businesses may be comfortable as cash producers for their owners or intent on growing or positioning themselves for sale.

Market Analysis:

[table]

[tr]

[td colspan="8" style="text-align: left; width: 24%"]Market Analysis[/td]

[/tr]

[tr]

[td style="text-align: left; width: 24%"]Year[/td]

[td style="text-align: right; width: 11%"]2010[/td]

[td style="text-align: right; width: 11%"]2011[/td]

[td style="text-align: right; width: 11%"]2012[/td]

[td style="text-align: right; width: 11%"]2013[/td]

[td style="text-align: right; width: 11%"]2014[/td]

[td style="text-align: right; width: 11%"]CAGR[/td]

[/tr]

[tr]

[td style="text-align: left; width: 24%"]Non-employer Firms[/td]

[td style="text-align: right; width: 11%"]50,000[/td]

[td style="text-align: right; width: 11%"]52,000[/td]

[td style="text-align: right; width: 11%"]54,080[/td]

[td style="text-align: right; width: 11%"]56,243[/td]

[td style="text-align: right; width: 11%"]58,493[/td]

[td style="text-align: right; width: 11%"]4.00%[/td]

[/tr]

[tr]

[td style="text-align: left; width: 24%"]Very Small Businesses (2 to 10 employees)[/td]

[td style="text-align: right; width: 11%"]25,000[/td]

[td style="text-align: right; width: 11%"]26,000[/td]

[td style="text-align: right; width: 11%"]27,040[/td]

[td style="text-align: right; width: 11%"]28,122[/td]

[td style="text-align: right; width: 11%"]29,247[/td]

[td style="text-align: right; width: 11%"]4.00%[/td]

[/tr]

[tr]

[td style="text-align: left; width: 24%"]Other Small Businesses (11 to 99 employees)[/td]

[td style="text-align: right; width: 11%"]10,000[/td]

[td style="text-align: right; width: 11%"]10,400[/td]

[td style="text-align: right; width: 11%"]10,816[/td]

[td style="text-align: right; width: 11%"]11,249[/td]

[td style="text-align: right; width: 11%"]11,699[/td]

[td style="text-align: right; width: 11%"]4.00%[/td]

[/tr]

[tr]

[td style="text-align: left; width: 24%"]Total[/td]

[td style="text-align: right; width: 11%"]85,000[/td]

[td style="text-align: right; width: 11%"]88,400[/td]

[td style="text-align: right; width: 11%"]91,936[/td]

[td style="text-align: right; width: 11%"]95,614[/td]

[td style="text-align: right; width: 11%"]99,439[/td]

[td style="text-align: right; width: 11%"]4.00%[/td]

[/tr]

[/table]

Target Market Segment Strategy:

The Sorcerer’s Accountant will focus on the “very small business” target group for its bookkeeping services. These businesses may hire student bookkeepers who lack proper oversight and training. The Sorcerer’s Accountant can provide a solution to these problems.

Service Business Analysis:

The small business accounting industry consists of many independent accountants and bookkeepers. Larger firms tend to focus on medium and large businesses.

Competition and Buying Patterns:

Major competitors in the Chicago market include Corporate Bookkeeping Services and MasterType Accounting Business Services, P.C. However, businesses also compete against the prospect of hiring their own bookkeepers. It is generally more cost-effective to use a bookkeeping service in the long run.

To market the website, tactics include expanding Google Adwords, listing on databases and other websites for small businesses, promoting the services to small business blogs, and referencing the website in print ads and brochures.

Web Plan Summary:

The website for The Sorcerer’s Accountant presents a simple look with detailed information about services offered. It aims to inspire clients to contact the company for a consultation.

Development Requirements:

The website redevelopment will require creating new pages based on the existing template. Max Greenwood will write the copy, and design elements will be added by the marketing partner. No additional functionality is needed for the website.

Strategy and Implementation Summary:

To promote the business to its target market of businesses with 2 to 10 employees, The Sorcerer’s Accountant will expand its web presence, initiate a client referral program, and use print ads in local business publications.

Competitive Edge:

The Sorcerer’s Accountant has a competitive edge due to its combination of CPA oversight with lower-level, inexpensive labor. Clients receive the advantage of having a CPA review their books without paying much more than hiring a part-time bookkeeper.

Sales Strategy:

The sales strategy is to sell predominantly to existing clients and ask for referrals. Cold-calling will be done if necessary. The goal is to have at least five clients within the first couple of months.

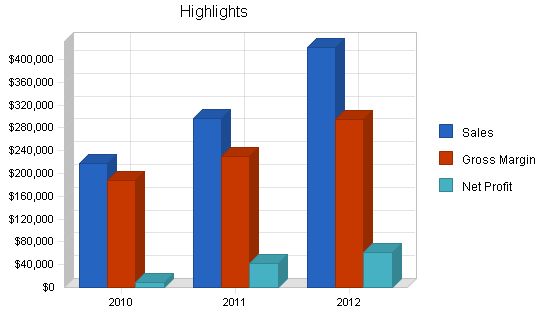

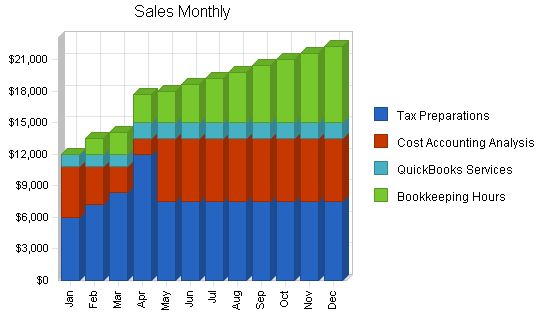

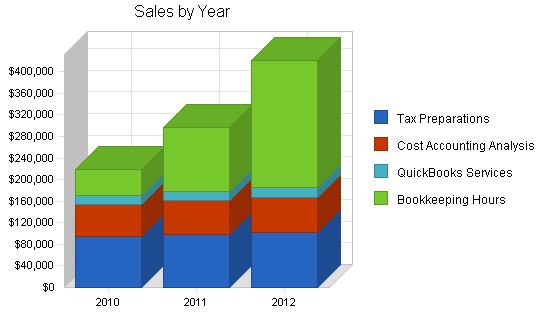

Total sales are expected to rise significantly with the success of the bookkeeping services. Revenues from existing streams are projected to grow slowly, while bookkeeping services will experience rapid growth. The sales forecast assumes part-time bookkeepers working 20 hours per week.

| Sales Forecast | |||

| 2010 | 2011 | 2012 | |

| Unit Sales | |||

| Tax Preparations | 125 | 130 | 135 |

| Cost Accounting Analysis | 60 | 63 | 65 |

| QuickBooks Services | 57 | 59 | 62 |

| Bookkeeping Hours | 1,570 | 3,925 | 7,850 |

| Total Unit Sales | 1,812 | 4,177 | 8,112 |

| Unit Prices | 2010 | 2011 | 2012 |

| Tax Preparations | $750.00 | $750.00 | $750.00 |

| Cost Accounting Analysis | $1,000.00 | $1,000.00 | $1,000.00 |

| QuickBooks Services | $300.00 | $300.00 | $300.00 |

| Bookkeeping Hours | $30.00 | $30.00 | $30.00 |

| Sales | |||

| Tax Preparations | $93,600 | $97,500 | $101,250 |

| Cost Accounting Analysis | $60,300 | $63,000 | $65,000 |

| QuickBooks Services | $17,100 | $17,700 | $18,600 |

| Bookkeeping Hours | $47,100 | $117,750 | $235,500 |

| Total Sales | $218,100 | $295,950 | $420,350 |

| Direct Unit Costs | 2010 | 2011 | 2012 |

| Tax Preparations | $37.50 | $37.50 | $37.50 |

| Cost Accounting Analysis | $30.00 | $30.00 | $30.00 |

| QuickBooks Services | $0.00 | $0.00 | $0.00 |

| Bookkeeping Hours | $15.00 | $15.00 | $15.00 |

| Direct Cost of Sales | |||

| Tax Preparations | $4,680 | $4,875 | $5,063 |

| Cost Accounting Analysis | $1,809 | $1,890 | $1,950 |

| QuickBooks Services | $0 | $0 | $0 |

| Bookkeeping Hours | $23,550 | $58,875 | $117,750 |

| Subtotal Direct Cost of Sales | $30,039 | $65,640 | $124,763 |

Milestones

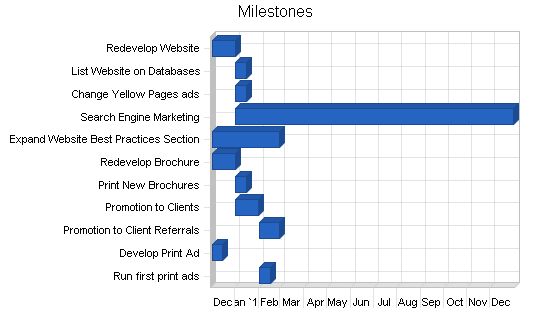

To execute the milestones listed, Max Greenwood will make use of an outside marketing service firm (OF denotes outside firm on the table) which will manage the execution of the marketing activities. Greenwood will directly execute the sales activities through his work with clients.

$4,000 of these costs will be incurred at the end of 2009 and are included in operating costs on the past performance table.

Milestones:

Milestone Start Date End Date Budget Manager Department

Redevelop Website 12/1/2009 1/1/2010 $2,500 MG (OF) Marketing

List Website on Databases 1/1/2010 1/15/2010 $500 MG (OF) Marketing

Change Yellow Pages ads 1/1/2010 1/15/2010 $500 MG (OF) Marketing

Search Engine Marketing 1/1/2010 12/31/2010 $12,000 MG (OF) Marketing

Expand Website Best Practices Section 12/1/2009 2/28/2010 $0 MG Marketing

Redevelop Brochure 12/1/2009 1/1/2010 $1,000 MG (OF) Marketing

Print New Brochures 1/1/2010 1/15/2010 $3,000 MG (OF) Marketing

Promotion to Clients 1/1/2010 1/31/2010 $0 MG Sales

Promotion to Client Referrals 2/1/2010 2/28/2010 $0 MG Sales

Develop Print Ad 12/1/2009 12/15/2009 $500 MG (OF) Marketing

Run first print ads 2/1/2010 2/15/2010 $5,000 MG (OF) Marketing

Management Summary:

Max Greenwood is CEO and sole manager of The Sorcerer’s Accountant. With the launch of bookkeeping services, Greenwood will oversee a part-time bookkeeping manager who will supervise the bookkeepers. The manager will be an MBA or MS accounting student with work experience and bookkeeping experience. Preferably at the beginning of their graduate school program so they can work through the program’s two years and then be considered for a full-time position in year three. This manager will work from the Sorcerer’s Accountant office or remotely, checking in with bookkeepers by email and phone to stay updated on their situations and problems. The manager will be present for the bookkeepers’ training by Max Greenwood to understand their responsibilities and requirements.

Periodically, the manager will visit the bookkeepers on-site and request to audit their work directly to identify any problems before they become issues for the clients. Any issues with the bookkeepers will be reported by the clients to the bookkeeping manager. He will handle them himself or report to Greenwood for help.

Greenwood will stay in close contact with the bookkeeping manager and review work samples from the bookkeepers at least once a month.

Personnel Plan:

The bookkeeping manager will transition from part-time to full-time in the third year. This position is designed for an accounting graduate student interested in being part of the organization. If this student becomes a CPA, the role can expand, and they can take on accounting work within the organization while overseeing the student bookkeepers. Offering benefits and opportunities for growth are strategies to retain this key employee.

Direct cost wages for student bookkeepers’ billable hours are listed in the Sales Forecast. The wages shown for student bookkeepers represent only training periods when new bookkeepers join the business. The business will start with two part-time bookkeepers in 2010, increase to three midyear, add a fourth in the second year, and double the student bookkeeping staff to eight in the third year.

Employee benefits are 10% of payroll and are provided only for the management.

Personnel Plan:

2010 2011 2012

Bookkeeper training-period wages $1,200 $400 $1,600

Max Greenwood $60,000 $65,000 $70,000

Bookkeeper Manager $24,000 $28,800 $48,000

Benefits $8,400 $9,380 $11,800

Total People 5 6 10

Total Payroll $93,600 $103,580 $131,400

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!