Oasis Juice is a successful brand in Richmond, with its natural, 100% fruit juices experiencing a 15% annual sales growth. It is currently available in over 100 store outlets in the greater Richmond area and is projected to generate $580,000 in sales this year, thanks to an initial investment of $180,000.

To further expand its operations, Oasis Juice plans to distribute its products statewide, using owner funding, internally generated cash flow, and a $100,000 short-term loan. Sales projections for the next three years are based on the company’s success in Richmond and initial contacts with retail outlets throughout the state.

The objective of Oasis Juice is to create a state-wide sales staff, establish strong sales in the state’s five metro areas by Year 2, and maintain tight cost and operational control during expansion.

The mission of Oasis Juice is to provide the highest quality and most nutritious fruit juices. The company strives to be at the forefront of the health and nutrition wave, offering innovative products, state-of-the-art manufacturing, quality assurance, and industry expertise. Oasis Juice places great importance on integrity, as its customers trust the quality of its juice products. The company is committed to delivering freshly made juice to consumers through close cooperation and mutual reliance between supplier and retailer.

By following this business plan, sales revenues for Oasis Juice are expected to reach $1.2 million by Year 2.

Oasis Juice is renowned for offering delicious, nutritious, 100% natural juices without artificial flavors, colors, or preservatives.

Tama Gardner and William Harris are the owners of Oasis Juice.

The story of Oasis Juice began in Tama Gardner’s kitchen, where she and William Harris first created the fruit drinks that would later become the foundation of the company.

Initially, the fruit drinks were sold at Richmond’s weekend craft fair. Their immense popularity led to the formation of Oasis Juice, which has since established itself as a symbol of a healthy lifestyle in the city.

Over the past three years, Oasis Juice has experienced significant growth. Currently, the company employs ten staff members in the areas of production, delivery, and sales.

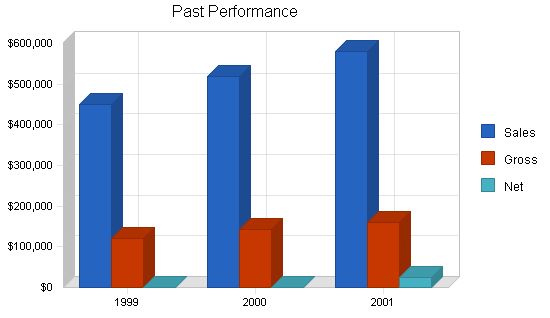

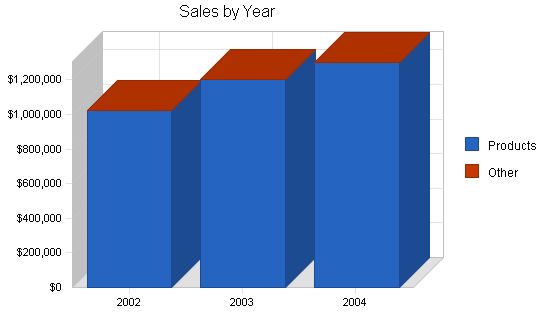

The table and chart below demonstrate the rapid sales success of Oasis Juice.

Past Performance:

Sales:

1999: $450,000

2000: $520,000

2001: $580,000

Gross Margin:

1999: $120,000

2000: $143,000

2001: $160,000

Gross Margin %:

1999: 26.67%

2000: 27.50%

2001: 27.59%

Operating Expenses:

1999: $200,000

2000: $240,000

2001: $280,000

Collection Period (days):

1999: 0

2000: 0

2001: 76

Inventory Turnover:

1999: 15.00

2000: 15.00

2001: 15.00

Current Assets:

Cash:

1999: $20,000

2000: $30,000

2001: $40,000

Accounts Receivable:

1999: $49,000

2000: $58,000

2001: $80,000

Inventory:

1999: $10,000

2000: $10,000

2001: $10,000

Other Current Assets:

1999: $5,000

2000: $5,000

2001: $5,000

Total Current Assets:

1999: $84,000

2000: $103,000

2001: $135,000

Long-term Assets:

Long-term Assets:

1999: $70,000

2000: $50,000

2001: $50,000

Accumulated Depreciation:

1999: $4,000

2000: $8,000

2001: $12,000

Total Long-term Assets:

1999: $66,000

2000: $42,000

2001: $38,000

Total Assets:

1999: $150,000

2000: $145,000

2001: $173,000

Current Liabilities:

Accounts Payable:

1999: $30,000

2000: $20,000

2001: $20,000

Current Borrowing:

1999: $0

2000: $0

2001: $0

Other Current Liabilities (interest free):

1999: $0

2000: $0

2001: $0

Total Current Liabilities:

1999: $30,000

2000: $20,000

2001: $20,000

Long-term Liabilities:

1999: $60,000

2000: $40,000

2001: $40,000

Total Liabilities:

1999: $90,000

2000: $60,000

2001: $60,000

Paid-in Capital:

1999: $30,000

2000: $40,000

2001: $80,000

Retained Earnings:

1999: $30,000

2000: $45,000

2001: $9,000

Earnings:

1999: $0

2000: $0

2001: $24,000

Total Capital:

1999: $60,000

2000: $85,000

2001: $113,000

Total Capital and Liabilities:

1999: $150,000

2000: $145,000

2001: $173,000

Other Inputs:

Payment Days:

1999: 0

2000: 0

2001: 12

Sales on Credit:

1999: $0

2000: $0

2001: $330,000

Receivables Turnover:

1999: 0.00

2000: 0.00

2001: 4.13

2.3 Company Locations and Facilities:

Oasis Juice is located on 1234 Main St.

Products:

Oasis Juice offers the following products:

– Fruit and vegetable juices

– Smoothies

– Superfood drinks

– Fruit and vegetable shakes

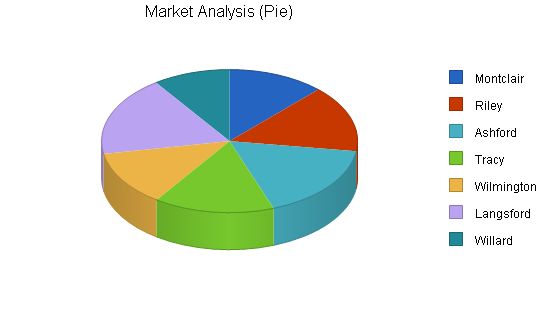

Market Analysis Summary:

The demographics of Oasis Juice customers are as follows:

– Young professionals, ages 25 – 45

– Average income of $40,000+ a year

– Involved in athletic activity

– Shop in upscale health/natural food stores

4.1 Market Segmentation:

Oasis Juice has identified seven metro locations within the state where we can reach our target customers:

– Montclair

– Riley

– Ashford

– Tracy

– Wilmington

– Langsford

– Willard

Market Analysis:

Potential Customers – Growth – 2002 – 2003 – 2004 – 2005 – 2006 – CAGR

Montclair – 10% – 60,000 – 66,000 – 72,600 – 79,860 – 87,846 – 10.00%

Riley – 10% – 75,000 – 82,500 – 90,750 – 99,825 – 109,808 – 10.00%

Ashford – 10% – 85,000 – 93,500 – 102,850 – 113,135 – 124,449 – 10.00%

Tracy – 10% – 75,000 – 82,500 – 90,750 – 99,825 – 109,808 – 10.00%

Wilmington – 10% – 62,000 – 68,200 – 75,020 – 82,522 – 90,774 – 10.00%

Langsford – 10% – 90,000 – 99,000 – 108,900 – 119,790 – 131,769 – 10.00%

Willard – 10% – 48,000 – 52,800 – 58,080 – 63,888 – 70,277 – 10.00%

Total – 10.00% – 495,000 – 544,500 – 598,950 – 658,845 – 724,731 – 10.00%

Strategy and Implementation Summary:

The strategy of Oasis Juice is to focus on our niche market, health/natural food stores that serve the young active professional.

5.1 Marketing Strategy:

Oasis Juice will introduce its products at 20% off the regular price during the first month. Additionally, Oasis Juice will co-sponsor local athletic charitable events to increase brand visibility.

To develop effective business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

5.2 Sales Strategy:

The sales strategy is to build customer loyalty in new markets. Oasis Juice will increase its sales force to focus on these markets.

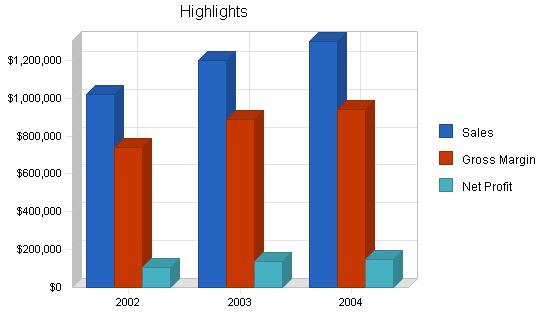

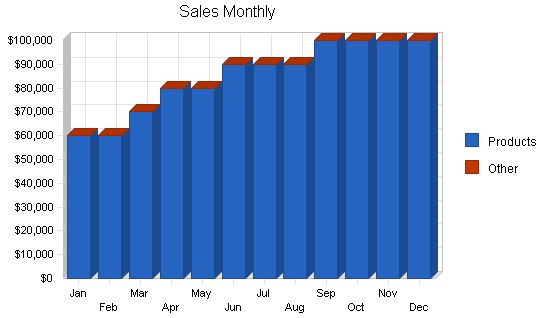

5.2.1 Sales Forecast:

The following table and charts depict the rapid sales growth during the first twelve months of operation.

Sales Forecast

2002 2003 2004

Sales

Products $1,020,000 $1,200,000 $1,300,000

Other $0 $0 $0

Total Sales $1,020,000 $1,200,000 $1,300,000

Direct Cost of Sales

2002 2003 2004

Products $278,000 $310,000 $360,000

Other $0 $0 $0

Subtotal Direct Cost of Sales $278,000 $310,000 $360,000

Management Summary

Co-owners, Tama Gardner and William Harris, currently manage the daily operations of Oasis Juice. Tama and William have fifteen years of experience working in natural food stores. Tama is in charge of production and distribution. William is the Sales Manager for Oasis Juice.

Tama Gardner was a founding member of Mason Peak Natural Grocery, located at 4th and Tyler. The grocery was established in 1992 by the non-profit NEDCO, the Neighborhood Economic Development Corporation, and concerned neighbors who wanted to save the historic Mason Peak Market from being destroyed. Tama started as a cashier and became Store Manager in 1996. The grocery has become a community fixture under her management.

William Harris ran the now defunct Natural Food Collective at the University for three years before the program lost funding. The small on-campus store provided natural food products to students. Sales increased by 20% each year under his leadership. Unfortunately, the state budget shortfall affected the program’s funding. Prior to this position, William worked as a Buyer at Sunburst Natural Foods for four years.

Personnel Plan

The following table shows the personnel plan for Oasis Juice.

2002 2003 2004

Tama Gardner $36,000 $40,000 $44,000

William Harris $36,000 $40,000 $44,000

Production Staff $120,000 $130,000 $140,000

Distribution Staff $120,000 $130,000 $140,000

Sales Staff $72,000 $76,000 $80,000

Total People 13 13 13

Total Payroll $384,000 $416,000 $448,000

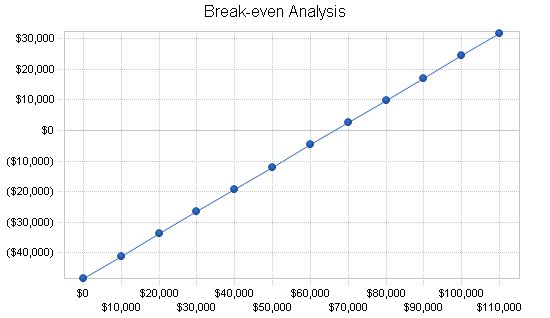

This is the financial plan for Oasis Juice.

The monthly break-even point is $66,534.

Break-even Analysis:

Monthly Revenue Break-even: $66,534

Assumptions:

– Average Percent Variable Cost: 27%

– Estimated Monthly Fixed Cost: $48,400

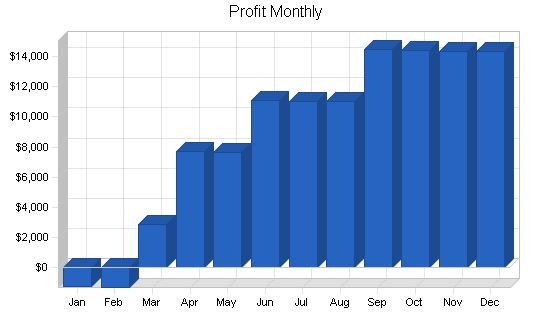

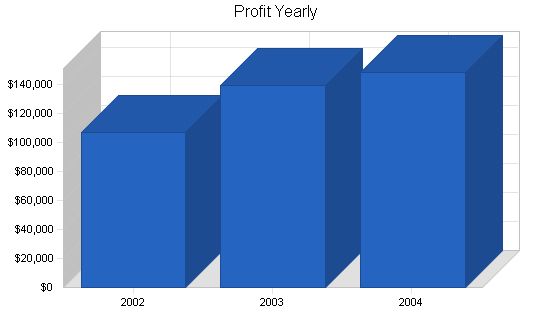

7.2 Projected Profit and Loss:

The table and charts below show the projected profit and loss for three years.

Pro Forma Profit and Loss

2002 2003 2004

Sales $1,020,000 $1,200,000 $1,300,000

Direct Cost of Sales $278,000 $310,000 $360,000

Other Production Expenses $0 $0 $0

Total Cost of Sales $278,000 $310,000 $360,000

Gross Margin $742,000 $890,000 $940,000

Gross Margin % 72.75% 74.17% 72.31%

Expenses

Payroll $384,000 $416,000 $448,000

Sales and Marketing and Other Expenses $72,000 $132,000 $132,000

Depreciation $9,600 $9,600 $9,600

Leased Equipment $0 $0 $0

Utilities $12,000 $12,000 $12,000

Insurance $9,600 $9,600 $9,600

Rent $36,000 $36,000 $36,000

Payroll Taxes $57,600 $62,400 $67,200

Other $0 $0 $0

Total Operating Expenses $580,800 $677,600 $714,400

Profit Before Interest and Taxes $161,200 $212,400 $225,600

EBITDA $170,800 $222,000 $235,200

Interest Expense $9,310 $13,703 $14,203

Taxes Incurred $45,567 $59,609 $63,419

Net Profit $106,323 $139,088 $147,978

Net Profit/Sales 10.42% 11.59% 11.38%

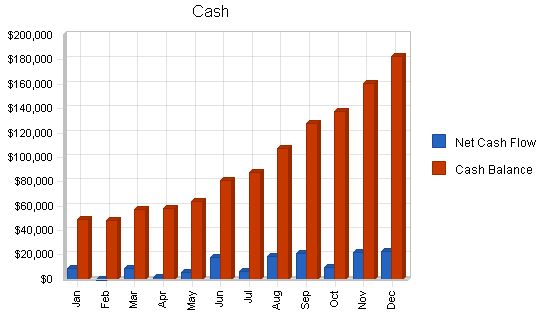

Projected Cash Flow

The following table and chart represent the projected cash flow for three years.

Pro Forma Cash Flow

| Cash Flow | |||

| 2002 | 2003 | 2004 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $255,000 | $300,000 | $325,000 |

| Cash from Receivables | $697,500 | $873,971 | $960,539 |

| Subtotal Cash from Operations | $952,500 | $1,173,971 | $1,285,539 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $100,163 | $0 | $0 |

| New Other Liabilities (interest-free) | $36,000 | $36,000 | $36,000 |

| New Long-term Liabilities | $36,000 | $36,000 | $36,000 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $1,124,663 | $1,245,971 | $1,357,539 |

| Expenditures | 2002 | 2003 | 2004 |

| Expenditures from Operations | |||

| Cash Spending | $384,000 | $416,000 | $448,000 |

| Bill Payments | $511,954 | $637,704 | $695,324 |

| Subtotal Spent on Operations | $895,954 | $1,053,704 | $1,143,324 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $19,992 | $19,992 | $19,992 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $18,000 | $18,300 | $3,700 |

| Purchase Other Current Assets | $24,000 | $30,000 | $40,000 |

| Purchase Long-term Assets | $24,000 | $30,000 | $30,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $981,946 | $1,151,996 | $1,237,016 |

| Net Cash Flow | $142,717 | $93,975 | $120,524 |

| Cash Balance | $182,717 | $276,692 | $397,216 |

7.4 Projected Balance Sheet

The projected balance sheet for three years is as follows:

| Balance Sheet | |||

| 2002 | 2003 | 2004 | |

| Assets | |||

| Current Assets | |||

| Cash | $182,717 | $276,692 | $397,216 |

| Accounts Receivable | $147,500 | $173,529 | $187,990 |

| Inventory | $33,000 | $36,799 | $42,734 |

| Other Current Assets | $29,000 | $59,000 | $99,000 |

| Total Current Assets | $392,217 | $546,020 | $726,940 |

| Long-term Assets | |||

| Long-term Assets | $74,000 | $104,000 | $134,000 |

| Accumulated Depreciation | $21,600 | $31,200 | $40,800 |

| Total Long-term Assets | $52,400 | $72,800 | $93,200 |

| Total Assets | $444,617 | $618,820 | $820,140 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 5149, Groceries and related products, are shown for comparison.

| Ratio Analysis | ||||

| 2002 | 2003 | 2004 | Industry Profile | |

| Sales Growth | 75.86% | 17.65% | 8.33% | 4.60% |

| Percent of Total Assets | ||||

| Accounts Receivable | 33.17% | 28.04% | 22.92% | 33.30% |

| Inventory | 7.42% | 5.95% | 5.21% | 26.00% |

| Other Current Assets | 6.52% | 9.53% | 12.07% | 20.90% |

| Total Current Assets | 88.21% | 88.24% | 88.64% | 80.20% |

| Long-term Assets | 11.79% | 11.76% | 11.36% | 19.80% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 51,123 | 52,530 | 57,564 | |

| Current Borrowing | $80,171 | $60,179 | $40,187 | |

| Other Current Liabilities | $36,000 | $72,000 | $108,000 | |

| Subtotal Current Liabilities | $167,294 | $184,709 | $205,751 | |

| Long-term Liabilities | $58,000 | $75,700 | $108,000 | |

| Total Liabilities | $225,294 | $260,409 | $313,751 | |

| Paid-in Capital | $80,000 | $80,000 | $80,000 | |

| Retained Earnings | $33,000 | $139,323 | $278,411 | |

| Earnings | $106,323 | $139,088 | $147,978 | |

| Total Capital | $219,323 | $358,411 | $506,389 | |

| Total Liabilities and Capital | $444,617 | $618,820 | $820,140 | |

| Net Worth | $219,323 | $358,411 | $506,389 | |

Appendix

Sales Forecast

| Sales Forecast | |||||||||||||

| Products | $60,000 | $60,000 | $70,000 | $80,000 | $80,000 | $90,000 | $90,000 | $90,000 | $100,000 | $100,000 | $100,000 | $100,000 | |

| Other | $0General Assumptions:

Plan Month Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Sales Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $60,000 $60,000 $70,000 $80,000 $80,000 $90,000 $90,000 $90,000 $100,000 $100,000 $100,000 $100,000 $100,000 Direct Cost of Sales Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $13,000 $13,000 $17,000 $20,000 $20,000 $25,000 $25,000 $25,000 $30,000 $30,000 $30,000 $30,000 $30,000 Other Production Expenses Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $13,000 $13,000 $17,000 $20,000 $20,000 $25,000 $25,000 $25,000 $30,000 $30,000 $30,000 $30,000 $30,000 Gross Margin Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $47,000 $47,000 $53,000 $60,000 $60,000 $65,000 $65,000 $65,000 $70,000 $70,000 $70,000 $70,000 $70,000 Gross Margin % Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 78.33% 78.33% 75.71% 75.00% 75.00% 72.22% 72.22% 72.22% 70.00% 70.00% 70.00% 70.00% 70.00% Expenses Payroll Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 Sales and Marketing and Other Expenses Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 Depreciation Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 Leased Equipment Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Utilities Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 Insurance Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 Rent Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Payroll Taxes 15% $4,800 $4,800 $4,800 $4,800 $4,800 $4,800 $4,800 $4,800 $4,800 $4,800 $4,800 $4,800 $4,800 Other Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Operating Expenses Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $48,400 $48,400 $48,400 $48,400 $48,400 $48,400 $48,400 $48,400 $48,400 $48,400 $48,400 $48,400 $48,400 Profit Before Interest and Taxes Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($1,400) ($1,400) $4,600 $11,600 $11,600 $16,600 $16,600 $16,600 $21,600 $21,600 $21,600 $21,600 $21,600 EBITDA Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($600) ($600) $5,400 $12,400 $12,400 $17,400 $17,400 $17,400 $22,400 $22,400 $22,400 $22,400 $22,400 Interest Expense Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $401 $469 $538 $606 $674 $742 $810 $878 $946 $1,014 $1,082 $1,151 $1,151 Taxes Incurred Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($540) ($561) $1,219 $3,298 $3,278 $4,757 $4,737 $4,717 $6,196 $6,176 $6,155 $6,135 $6,135 Net Profit Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($1,261) ($1,309) $2,844 $7,696 $7,648 $11,101 $11,053 $11,006 $14,458 $14,410 $14,363 $14,314 $14,314 Net Profit/Sales Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec -2.10% -2.18% 4.06% 9.62% 9.56% 12.33% 12.28% 12.23% 14.46% 14.41% 14.36% 14.31% 14.31% Pro Forma Cash Flow: Cash Received Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $15,000 $15,000 $17,500 $20,000 $20,000 $22,500 $22,500 $22,500 $25,000 $25,000 $25,000 $25,000 $25,000 Cash from Operations Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $55,000 $56,500 $62,500 $65,250 $72,750 $82,500 $82,750 $90,000 $92,500 $92,750 $100,000 $100,000 $100,000 Additional Cash Received Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Subtotal Cash from Operations Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $55,000 $56,500 $62,500 $65,250 $72,750 $82,500 $82,750 $90,000 $92,500 $92,750 $100,000 $100,000 $100,000 Expenditures Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Cash Spending $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 Bill Payments $21,092 $32,619 $28,850 $38,891 $42,695 $39,953 $51,417 $46,148 $46,596 $58,060 $52,791 $52,839 Subtotal Spent on Operations $53,092 $64,619 $60,850 $70,891 $74,695 $71,953 $83,417 $78,148 $78,596 $90,060 $84,791 $84,839 Additional Cash Spent $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Net Cash Flow $9,075 ($952) $8,817 $1,526 $5,222 $17,714 $6,500 $19,019 $21,071 $9,857 $22,376 $22,495 Cash Balance $49,075 $48,123 $56,940 $58,465 $63,687 $81,401 $87,900 $106,919 $127,990 $137,847 $160,222 $182,717 |

||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!