The landscape products market is evolving, with a more affluent customer base and expanding opportunities. In the past seven years, the number of U.S. households grew 10% to 140.9 million. This year, the National Association of Home Builders forecasts 903,000 new home starts, while the National Association of Realtors expects over 4.5 million sales of existing homes. Baby boomers, who dominate the housing market, will see a 54% increase in the 45-56 age bracket in the next four years, according to the U.S. Department of Commerce. The nursery industry’s primary buyers are now 45-60-year-olds, who account for 50% of retail sales. Last year, a quarter of U.S. households spent an average of $500 on landscaping, resulting in over $5 billion in sales. Glen Mar Forest Products aims to tap into this growing customer base by offering Rainbow Mulch™, a color-enhanced shredded hardwood mulch that is environmentally safe, colorfast, and does not blow or wash away. The product, made from virgin wood, is 100% organic, and customers can choose from five rainbow colors: Gold, Brown, Green, Grey, and White. Rainbow Mulch™ is a game-changing landscaping tool that can transform any ordinary lawn into a beautiful landscape.

Contents

1.1 Objectives

- Establish Glen Mar Forest Products as the regional leader in color enhanced mulch production.

- Increase the number of retail outlets carrying Glen Mar Forest Products by 20% in the next two years.

- Build a solid working relationship with all the region’s landscape product wholesale distributors.

1.2 Mission

Glen Mar’s mission is to introduce innovative landscaping products to its target customers. Charles Marshall, owner of Glen Mar, will use his landscaping background, wood products industry experience, and contacts with wholesale distributors to create products that will revolutionize landscaping.

1.3 Keys to Success

The keys to Glen Mar’s success are:

- Offering innovative landscaping products, essential for maintaining the niche market sectors mentioned in the mission statement.

- Reliable and timely deliveries, ensuring that Glen Mar fulfills all delivery promises.

- A reliable administration that serves customers, prepares accurate billing, follows up on orders and other documentation, and closely monitors expenses and accounts receivable collection.

Company Summary

Glen Mar Forest Products creates landscaping products and is located in Springfield, Oregon. This location provides access to wood for manufacturing and excellent shipping resources.

2.1 Company Ownership

Glen Mar is owned by Charles Marshall, who has ten years of landscaping experience and seven years of wood by-product experience.

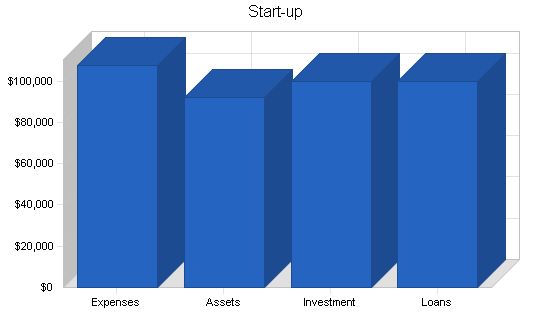

2.2 Start-up Summary

The start-up cost of Glen Mar Forest Products consists primarily of equipment and inventory. Charles Marshall and a silent partner will make equal investments, and Charles will secure a substantial long-term commercial loan matching the partners’ investment.

Start-up Funding:

Start-up Expenses: $107,800

Start-up Assets: $92,200

Total Funding Required: $200,000

Assets:

Non-cash Assets from Start-up: $70,000

Cash Requirements from Start-up: $22,200

Additional Cash Raised: $0

Cash Balance on Starting Date: $22,200

Total Assets: $92,200

Liabilities and Capital:

Liabilities:

Current Borrowing: $0

Long-term Liabilities: $100,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $100,000

Capital:

Planned Investment:

Charles Marshall: $50,000

Silent Partner: $50,000

Additional Investment Requirement: $0

Total Planned Investment: $100,000

Loss at Start-up (Start-up Expenses): ($107,800)

Total Capital: ($7,800)

Total Capital and Liabilities: $92,200

Total Funding: $200,000

Start-up Requirements:

Start-up Expenses:

Legal: $1,000

Stationery etc.: $800

Brochures: $2,000

Insurance: $1,000

Rent: $3,000

Expensed Equipment: $80,000

Truck: $20,000

Total Start-up Expenses: $107,800

Start-up Assets:

Cash Required: $22,200

Start-up Inventory: $20,000

Other Current Assets: $0

Long-term Assets: $50,000

Total Assets: $92,200

Total Requirements: $200,000

Products

Our product, Rainbow Mulch™, is color enhanced shredded hardwood mulch. It is colorfast, environmentally safe, and does not blow or wash away. It is safe for all plants and animals. The product is 100% organic and made from virgin wood products.

The customer can choose from 5 rainbow colors:

– Rainbow Gold

– Rainbow Brown

– Rainbow Green

– Rainbow Grey

– Rainbow White

Rainbow Mulch™ gives the customer a new landscaping tool that can transform a dull lawn into a beautiful landscape. It is available in either a 25 lb or a 50 lb bag.

Market Analysis Summary

Last year, a quarter of U.S. households spent an average of $500 each on landscaping. This resulted in over $5 billion in sales for retailers.

The expanding upscale landscaping market creates more demand for specialty nursery products. Landscaping is a high priority project for new homeowners, with an average expenditure of $3,500. Five percent of them estimate spending $10,000 or more.

Fifty-one percent of landscape customers are male, 56 percent are 30 to 49 years old, and 46 percent are married with children. Forty-nine percent have a college education. Fifty-one percent hold business or professional jobs, and 56 percent earn $30,000 or more. Half of them live in the suburbs.

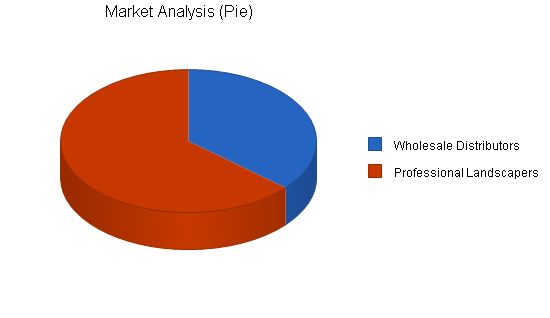

Market Segmentation:

Glen Mar Forest Products will focus on two customer groups:

1. Wholesale Distributors: This group is crucial for the success of Rainbow Mulch™ as they supply retail outlets.

2. Landscaping Professionals: Rainbow Mulch™ is an invaluable tool for landscaping professionals, enhancing their range of options for projects.

Market Analysis:

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers

Growth CAGR

Wholesale Distributors 4.00%

20,000 20,800 21,632 22,497 23,397

Professional Landscapers 6.00%

35,000 37,100 39,326 41,686 44,187

Total 5.29%

55,000 57,900 60,958 64,183 67,584

Strategy and Implementation Summary:

Glen Mar Forest Products aims to be the leading provider of color-enhanced mulch products.

5.1 Competitive Edge:

Charles Marshall sets Glen Mar Forest Products apart. Charles has worked for Acme Forest Products and Wilson Landscaping for the past fourteen years.

In his previous position with Acme Forest Products, Charles sold wood by-products to various West Coast markets, generating over $4 million in annual sales. His strength lies in customer relations, successfully expanding the product range purchased by wholesale distributors in his sales region.

Before joining Acme Forest Products, Charles worked as a sales representative for Wilson Landscaping for six years. Wilson Landscaping is the largest landscaping firm in Lane County, with annual sales exceeding $4 million.

Throughout his tenure at Acme Forest Products and Wilson Landscaping, Charles established valuable connections with wholesale distributors, landscaping professionals, and commercial retail outlets. This gives Glen Mar Forest Products a competitive edge in introducing new products to its target customers.

To develop effective business strategies, perform a SWOT analysis of your business. Our free guide and template make performing a SWOT analysis easy. Learn more about performing a SWOT analysis.

5.2 Sales Strategy:

Glen Mar Forest Products will employ two sales approaches:

– For Wholesale Distributors: We will offer a 20% discount on wholesale purchases for the first three months of operation.

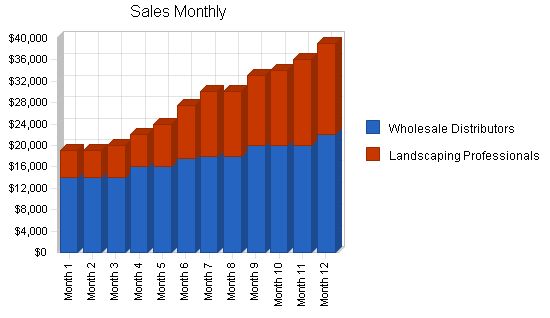

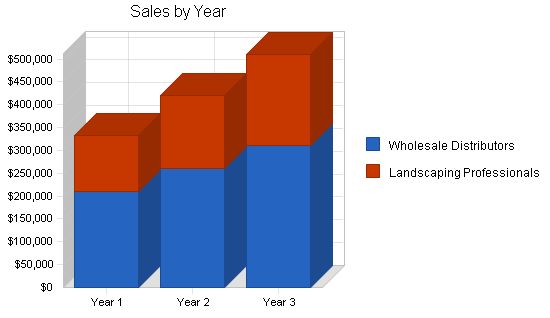

5.2.1 Sales Forecast:

Here is the sales forecast for three years.

Sales Forecast:

– Wholesale Distributors:

– Year 1: $209,500

– Year 2: $260,000

– Year 3: $310,000

– Landscaping Professionals:

– Year 1: $124,000

– Year 2: $160,000

– Year 3: $200,000

– Total Sales:

– Year 1: $333,500

– Year 2: $420,000

– Year 3: $510,000

Direct Cost of Sales:

– Wholesale Distributors:

– Year 1: $85,900

– Year 2: $110,000

– Year 3: $130,000

– Landscaping Professionals:

– Year 1: $18,300

– Year 2: $23,000

– Year 3: $24,000

– Subtotal Direct Cost of Sales:

– Year 1: $104,200

– Year 2: $133,000

– Year 3: $154,000

Management Summary:

Charles Marshall will be responsible for sales and marketing. Glen Mar Forest Products will have a Production Manager for the daily manufacturing operation.

Personnel Plan:

– Owner/sales and marketing manager

– Production manager

– Production staff (3)

Total Payroll:

– Year 1: $124,800

– Year 2: $140,000

– Year 3: $166,000

The financial plan for Glen Mar Forest Products is as follows.

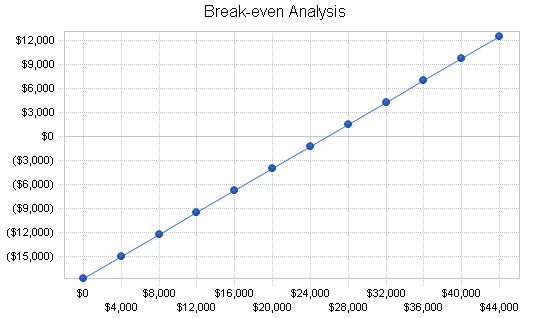

The monthly break-even point is calculated and displayed in the table and chart.

Break-even Analysis

Monthly Revenue Break-even: $25,743

Assumptions:

– Average Percent Variable Cost: 31%

– Estimated Monthly Fixed Cost: $17,700

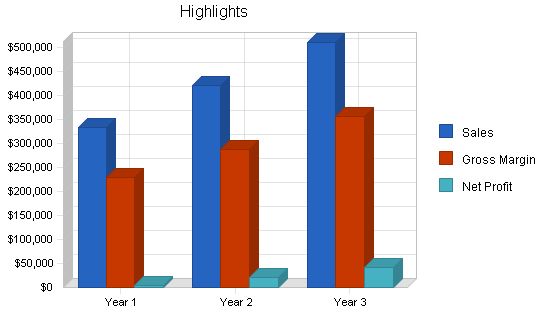

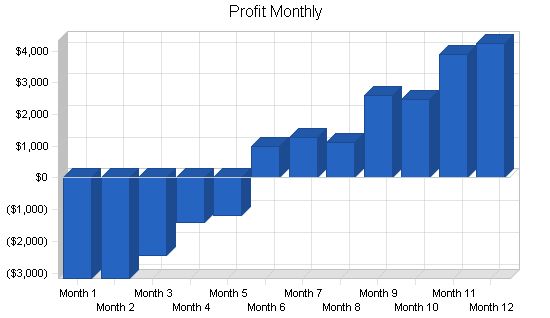

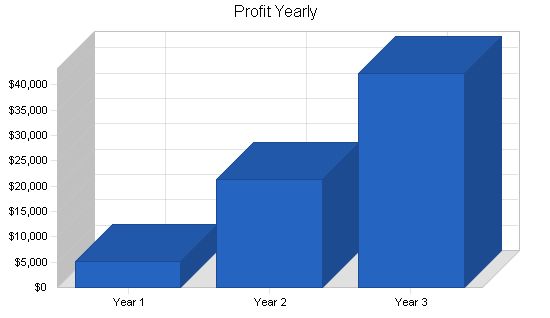

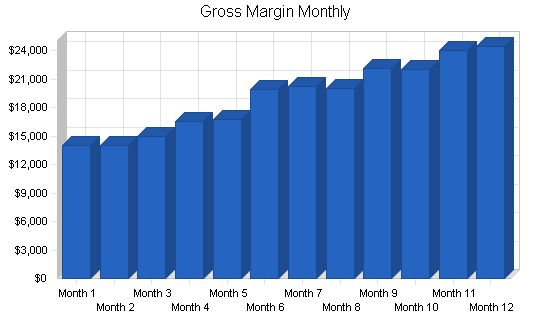

7.2 Projected Profit and Loss

The table and chart below display projected profit and loss for the next three years.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $333,500 $420,000 $510,000

Direct Cost of Sales $104,200 $133,000 $154,000

Other Production Expenses $0 $0 $0

Total Cost of Sales $104,200 $133,000 $154,000

Gross Margin $229,300 $287,000 $356,000

Gross Margin % 68.76% 68.33% 69.80%

Expenses

Payroll $124,800 $140,000 $166,000

Sales and Marketing and Other Expenses $18,000 $36,000 $46,000

Depreciation $2,880 $2,880 $2,880

Leased Equipment $0 $0 $0

Utilities $6,000 $6,000 $6,000

Insurance $6,000 $6,000 $6,000

Rent $36,000 $36,000 $36,000

Payroll Taxes $18,720 $21,000 $24,900

Other $0 $0 $0

Total Operating Expenses $212,400 $247,880 $287,780

Profit Before Interest and Taxes $16,900 $39,120 $68,220

EBITDA $19,780 $42,000 $71,100

Interest Expense $9,480 $8,760 $7,940

Taxes Incurred $2,226 $9,108 $18,084

Net Profit $5,194 $21,252 $42,196

Net Profit/Sales 1.56% 5.06% 8.27%

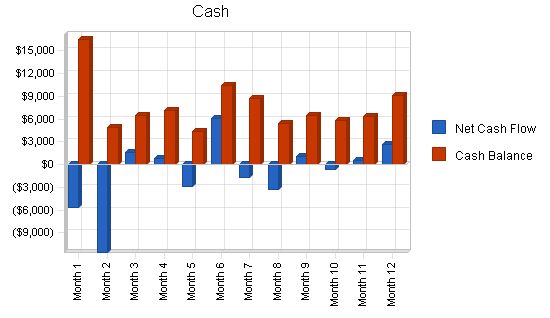

7.3 Projected Cash Flow

The following table and chart highlight the projected cash flow for three years.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $100,050 | $126,000 | $153,000 |

| Cash from Receivables | $181,790 | $280,601 | $343,059 |

| Subtotal Cash from Operations | $281,840 | $406,601 | $496,059 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $4,000 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $10,000 | $0 | $0 |

| Subtotal Cash Received | $291,840 | $410,601 | $496,059 |

Projected Balance Sheet

The following table highlights the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $9,045 | $5,181 | $25,742 |

| Accounts Receivable | $51,660 | $65,059 | $79,000 |

| Inventory | $15,950 | $20,358 | $23,573 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $76,655 | $90,599 | $128,315 |

| Long-term Assets | |||

| Long-term Assets | $50,000 | $50,000 | $50,000 |

| Accumulated Depreciation | $2,880 | $5,760 | $8,640 |

| Total Long-term Assets | $47,120 | $44,240 | $41,360 |

| Total Assets | $123,775 | $134,839 | $169,675 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $25,981 | $21,393 | $24,833 |

| Current Borrowing | $0 | $4,000 | $2,800 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $25,981 | $25,393 | $27,633 |

| Long-term Liabilities | $90,400 | $80,800 | $71,200 |

| Total Liabilities | $116,381 | $106,193 | $98,833 |

| Paid-in Capital | $110,000 | $110,000 | $110,000 |

| Retained Earnings | ($107,800) | ($102,606) | ($81,354) |

| Earnings | $5,194 | $21,252 | $42,196 |

| Total Capital | $7,394 | $28,646 | $70,842 |

| Total Liabilities and Capital | $123,775 | $134,839 | $169,675 |

| Net Worth | $7,394 | $28,646 | $70,842 |

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 2493, Reconstituted Wood Products, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 25.94% | 21.43% | 8.10% |

| Percent of Total Assets | ||||

| Accounts Receivable | 41.74% | 48.25% | 46.56% | 22.10% |

| Inventory | 12.89% | 15.10% | 13.89% | 16.70% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 27.00% |

| Total Current Assets | 61.93% | 67.19% | 75.62% | 65.80% |

| Long-term Assets | 38.07% | 32.81% | 24.38% | 34.20% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 20.99% | 18.83% | 16.29% | 36.60% |

| Long-term Liabilities | 73.04% | 59.92% | 41.96% | 15.70% |

| Total Liabilities | 94.03% | 78.76% | 58.25% | 52.30% |

| Net Worth | 5.97% | 21.24% | 41.75% | 47.70% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 68.76% | 68.33% | 69.80% | 31.60% |

| Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Sales $19,000 $19,000 $20,000 $22,000 $24,000 $27,500 $30,000 $30,000 $33,000 $34,000 $36,000 $39,000 Direct Cost of Sales $5,000 $5,000 $5,000 $5,480 $7,200 $7,580 $9,700 $9,940 $10,800 $12,000 $12,000 $14,500 Other Production Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales $5,000 $5,000 $5,000 $5,480 $7,200 $7,580 $9,700 $9,940 $10,800 $12,000 $12,000 $14,500 Gross Margin $14,000 $14,000 $15,000 $16,520 $16,800 $19,920 $20,300 $20,060 $22,200 $22,000 $24,000 $24,500 Gross Margin % 73.68% 73.68% 75.00% 75.09% 70.00% 72.44% 67.67% 66.87% 67.27% 64.71% 66.67% 62.82% Expenses Payroll $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 $10,400 Sales and Marketing and Other Expenses $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Depreciation $240 $240 $240 $240 $240 $240 $240 $240 $240 $240 $240 $240 Leased Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Utilities $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 Insurance $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 Rent $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Payroll Taxes 15% $1,560 $1,560 $1,560 $1,560 $1,560 $1,560 $1,560 $1,560 $1,560 $1,560 $1,560 $1,560 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Operating Expenses $17,700 $17,700 $17,700 $17,700 $17,700 $17,700 $17,700 $17,700 $17,700 $17,700 $17,700 $17,700 Profit Before Interest and Taxes ($3,700) ($3,700) ($2,700) ($1,180) ($900) $2,220 $2,600 $2,360 $4,500 $4,300 $6,300 $6,800 EBITDA ($3,460) ($3,460) ($2,460) ($940) ($660) $2,460 $2,840 $2,600 $4,740 $4,540 $6,540 $7,040 Interest Expense $827 $820 $813 $807 $800 $793 $787 $780 $773 $767 $760 $753 Taxes Incurred ($1,358) ($1,356) ($1,054) ($596) ($510) $428 $544 $474 $1,118 $1,060 $1,662 $1,814 Net Profit ($3,169) ($3,164) ($2,459) ($1,391) ($1,190) $999 $1,269 $1,106 $2,609 $2,473 $3,878 $4,233 Net Profit/Sales -16.68% -16.65% -12.30% -6.32% -4.96% 3.63% 4.23% 3.69% 7.91% 7.27% 10.77% 10.85% Pro Forma Cash Flow [table] [tr] [td]Pro Forma Cash Flow[/td] [/tr] [tr] [td]Months[/td] [td]1[/td] [td]2[/td] [td]3[/td] [td]4[/td] [td]5[/td] [td]6[/td] [td]7[/td] [td]8[/td] [td]9[/td] [td]10[/td] [td]11[/td] [td]12[/td] [/tr] [tr] [td]Cash Received[/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [/tr] [tr] [td]Cash from Operations[/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [/tr] [tr] [td]Cash Sales[/td] [td]$5,700[/td] [td]$5,700[/td] [td]$6,000[/td] [td]$6,600[/td] [td]$7,200[/td] [td]$8,250[/td] [td]$9,000[/td] [td]$9,000[/td] [td]$9,900[/td] [td]$10,200[/td] [td]$10,800[/td] [td]$11,700[/td] [/tr] [tr] [td]Cash from Receivables[/td] [td]$0[/td] [td]$443[/td] [td]$13,300[/td] [td]$13,323[/td] [td]$14,047[/td] [td]$15,447[/td] [td]$16,882[/td] [td]$19,308[/td] [td]$21,000[/td] [td]$21,070[/td] [td]$23,123[/td] [td]$23,847[/td] [/tr] [tr] [td]Subtotal Cash from Operations[/td] [td]$5,700[/td] [td]$6,143[/td] [td]$19,300[/td] [td]$19,923[/td] [td]$21,247[/td] [td]$23,697[/td] [td]$25,882[/td] [td]$28,308[/td] [td]$30,900[/td] [td]$31,270[/td] [td]$33,923[/td] [td]$35,547[/td] [/tr] [tr] [td]Additional Cash Received[/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [td][/td] [/tr] [tr] [td]Sales Tax, VAT, HST/GST Received[/td] [td]0.00%[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [/tr] [tr] [td]New Current Borrowing[/td] [td][/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [/tr] [tr] [td]New Other Liabilities (interest-free)[/td] [td][/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [/tr] [tr] [td]New Long-term Liabilities[/td] [td][/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [/tr] [tr] [td]Sales of Other Current Assets[/td] [td][/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td] [td]$0[/td> [td>$0[/td] [td>$0[/td] [td>$0[/td] [td>$0[/td] [/tr] [tr] [td]Sales of Long-term Assets[/td] [td][/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [/tr] [tr> [td]New Investment Received[/td> [td][/td] [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$10,000[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [/tr] [tr> [td]Subtotal Cash Received[/td] [td>$5,700[/td> [td>$6,143[/td> [td>$19,300[/td> [td>$19,923[/td> [td>$21,247[/td> [td>$33,697[/td> [td>$25,882[/td> [td>$28,308[/td> [td>$30,900[/td> [td>$31,270[/td> [td>$33,923[/td> [td>$35,547[/td> [/tr] [tr> [td]Expenditures[/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td] [/tr] [tr> [td]Expenditures from Operations[/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td> [td][/td] [td][/td] [td][/td] [/tr] [tr> [td]Cash Spending[/td> [td>$10,400[/td> [td>$10,400[/td> [td>$10,400[/td> [td>$10,400 [/td> [td>$10,400[/td> [td>$10,400[/td> [td>$10,400[/td> [td>$10,400[/td> [/tr] [tr> [td]Bill Payments[/td> [td>$218[/td> [td>$6,529[/td> [td>$6,567[/td> [td>$7,985[/td> [td>$12,901[/td> [td>$16,437[/td> [td>$16,417[/td> [td>$20,359[/td] [/tr] [tr> [td]Subtotal Spent on Operations[/td] [td>$10,618[/td> [td>$16,929[/td> [td>$16,967[/td> [td>$18,385[/td> [td>$23,301[/td> [td>$26,837[/td> [td>$26,817[/td> [td>$30,759[/td] [/tr] [tr> [td]Additional Cash Spent[/td] [td][/td] [td][/td] [td][/td> [td][/td] [td][/td> [td][/td> [td][/td> [td][/td] [td][/td] [td][/td> [td][/td> [td][/td] [td][/td] [td][/td] [/tr] [tr> [td]Sales Tax, VAT, HST/GST Paid Out[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td] [td>$0[/td] [td>$0[/td] [td>$0[/td] [td>$0[/td] [/tr] [tr> [td]Principal Repayment of Current Borrowing[/td> [td][/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td] [/tr] [tr] [td]Other Liabilities Principal Repayment[/td] [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td] [/tr] [tr> [td]Long-term Liabilities Principal Repayment[/td> [td>$800[/td> [td>$800[/td> [td>$800[/td> [td>$800[/td> [td>$800[/td> [td>$800[/td> [td>$800[/td> [/tr] [tr> [td]Purchase Other Current Assets[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [/tr] [tr> [td]Purchase Long-term Assets[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [/tr] [tr> [td]Dividends[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [td>$0[/td> [/tr] [tr> [td]Subtotal Cash Spent[/td> [td>$11,418[/td> [td>$17,729[/td> [td>$17,767[/td> [td>$19,185[/td> [td>$24,101[/td> [td>$27,637[/td> [td>$27,617[/td] [/tr] [tr] [td]Net Cash Flow[/td] [td]($5,718)[/td] [td]($11,585)[/td] [td]$1,533[/td> [td]$739[/td> [td]($2,854)[/td> [td]$6,060[/td] [td]($1,736)[/td] [td]($3,251)[/td] [td]$1,109[/td] [td]($678)[/td] [td]$541[/td] [td]$2,685[/td] [/tr] [tr> [td]Cash Balance[/td> [td>$16,482[/td> [td>$4,897[/td> [td>$6,430[/td> [td>$7,169[/td> [td>$4,315[/td> [td>$10,375[/td] [td>$8,639[/td] [/tr] [/table] “> |

||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!