Wedding Consultant Business Plan

TLC Wedding Consultants provides complete consulting services for weddings, holy unions, and anniversaries. Our experienced and dedicated professionals give clients our undivided attention, listening to their needs and working with them to create their dream event. Whether clients want a Western, Tropical, Las Vegas, or traditional wedding, we can assist with weddings, honeymoons, receptions, anniversary consultations, budget planning, etiquette questions, and referrals to florists, hair stylists, entertainers, musicians, etc.

Mission

TLC Wedding Consultants is a full-service company that provides consulting services for weddings, holy unions, and anniversaries. Our consultants are experienced professionals who listen to clients’ needs and work with them to create their dream event. Whether clients want a Western, Tropical, Las Vegas, or traditional wedding or anniversary party, we can assist with weddings, honeymoons, receptions, anniversary consultations, budget planning, etiquette questions, and referrals to florists, hair stylists, entertainers, musicians, etc.

Objectives

Our goal is for every detail of our clients’ weddings, vow renewals, or anniversaries to be a pleasurable and memorable experience. We offer packages and services tailored to the needs of each couple. We anticipate a modest increase in net income by the second year.

Keys to Success

Our success depends on:

1. Prompt and efficient service to meet clients’ needs.

2. Maintaining excellent relationships with vendors such as florists, hair salons, and bridal shops.

3. Maintaining a professional image at all times.

TLC Wedding Consultants is a start-up company providing wedding, holy union, and anniversary consulting services. Our full-service bridal consulting group aims to make wedding planning enjoyable and stress-free. Our experienced, professional consultants create events that reflect our clients’ unique style and relationship.

Company Ownership

This business begins as a simple proprietorship owned by founders Darla and Micah Johnson. As the business grows, the owners will consider re-registering as a limited liability company or corporation to better suit future needs.

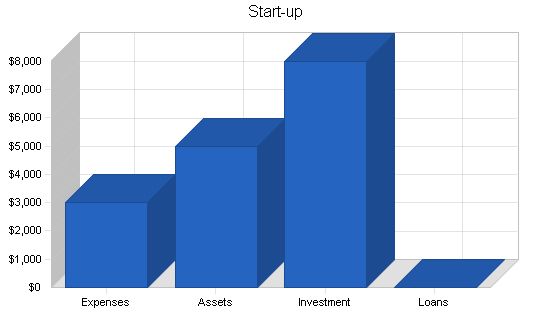

Start-up Summary

Founders Darla and Micah Johnson will handle day-to-day operations collaboratively to ensure the success of the business. Start-up costs, including legal fees, logo design, advertising, direct mail, and related expenses, are estimated at $3,000. An additional $5,000 will be required as operating capital for the first two months, financed equally by the owners’ personal funds.

Start-up Requirements:

– Legal: $200

– Stationery etc.: $450

– Brochures: $450

– Insurance: $300

– Research and development: $200

– Expensed equipment: $900

– Other: $500

– Total Start-up Expenses: $3,000

Start-up Assets:

– Cash Required: $5,000

– Other Current Assets: $0

– Long-term Assets: $0

– Total Assets: $5,000

Total Requirements: $8,000

Start-up Funding:

– Start-up Expenses to Fund: $3,000

– Start-up Assets to Fund: $5,000

– Total Funding Required: $8,000

Assets:

– Non-cash Assets from Start-up: $0

– Cash Requirements from Start-up: $5,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $5,000

– Total Assets: $5,000

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

– Capital:

– Planned Investment:

– Darla Johnson: $4,000

– Micah Johnson: $4,000

– Additional Investment Requirement: $0

– Total Planned Investment: $8,000

– Loss at Start-up (Start-up Expenses): ($3,000)

– Total Capital: $5,000

Total Capital and Liabilities: $5,000

Total Funding: $8,000

2.3 Company Locations and Facilities:

Initially, this will be a home-based business; however, by Year 5, we intend to expand our facilities into a well-equipped and operational office.

Services:

We are a full-service wedding consultant group and provide etiquette advice, event scheduling, discounted invitations and products, vendor confirmation, rehearsal attendance, supervision of both ceremony and reception setup, and budget planning.

Market Analysis Summary:

Nearly $35 billion is spent every year on weddings and receptions. Therefore, professional wedding consultants are a commodity. TLC Wedding Consultants are full-service wedding consultants that offer a variety of services. We pride ourselves on being professional and courteous at all times, and we have packages to suit everyone’s needs.

As stated, marriage is a billion-dollar industry. Therefore, just about everyone we meet is a potential client. However, we mostly advertise to brides, grooms, and family members.

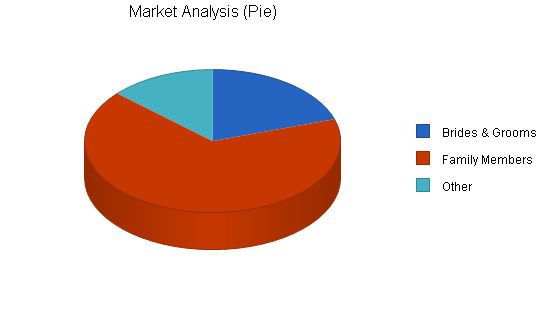

4.1 Market Segmentation:

The flash and excitement of impending nuptials can be intoxicating, but it can also be overwhelming. Therefore, we primarily market our services to brides and grooms. In 1997, 2.4 million marriages took place in the United States. The US marriage rate of nine marriages per 1,000 people is the highest rate among industrialized countries. This marriage rate is expected to remain the same in the near future. In the Eugene, OR area where TLC Wedding Consultants plans to operate, over 1,500 marriages are registered each year, creating a sizable market potential.

Another customer segment is represented by the numerous family members and guests attending weddings, anniversaries, and similar events. This segment requires event preparation services like gift ideas and etiquette tips.

Besides wedding arrangements, which TLC Wedding Consultants believe to be their major client assignments, the company will also provide services for corporate retreats and etiquette training. This customer segment is estimated to have an annual volume of 1,000 orders in the Eugene, OR area.

Market Analysis:

[table]

[tr]

[td]Year 1[/td]

[td]Year 2[/td]

[td]Year 3[/td]

[td]Year 4[/td]

[td]Year 5[/td]

[td]CAGR[/td]

[/tr]

[tr]

[td]Brides & Grooms[/td]

[td]1,500[/td]

[td]1,575[/td]

[td]1,654[/td]

[td]1,737[/td]

[td]1,824[/td]

[td]5.01%[/td]

[/tr]

[tr]

[td]Family Members[/td]

[td]5,000[/td]

[td]5,250[/td]

[td]5,513[/td]

[td]5,789[/td]

[td]6,078[/td]

[td]5.00%[/td]

[/tr]

[tr]

[td]Other[/td]

[td]1,000[/td]

[td]1,050[/td]

[td]1,103[/td]

[td]1,158[/td]

[td]1,216[/td]

[td]5.01%[/td]

[/tr]

[tr]

[td]Total[/td]

[td]7,500[/td]

[td]7,875[/td]

[td]8,270[/td]

[td]8,684[/td]

[td]9,118[/td]

[td]5.00%[/td]

[/tr]

[/table]

Contents

4.2 Target Market Segment Strategy

TLC Wedding Consultants will offer its services mainly to brides, grooms, and family members. The company will position itself as an experienced provider of wedding planning services. Unlike competitors, TLC will offer a full range of services, providing the convenience of one-stop shopping. This will reduce customers’ time and efforts in preparing for weddings. Additionally, TLC Wedding Consultants, with its established supplier contacts and economies of scale, will pass on significant cost savings to customers.

4.2.1 Market Needs

The market for wedding planning services is driven by customers’ desire for perfectly planned and executed wedding ceremonies. Both brides, grooms, and family members plan and budget for weddings well in advance, often realizing that they cannot make all necessary preparations themselves in a cost-effective manner. These customers seek professional advice to ensure that all aspects of the wedding ceremony meet or exceed expectations shaped by social values.

4.3 Service Business Analysis

The wedding services market is fragmented, with most companies offering only a limited line of services. There are numerous options for florists, hair stylists, and caterers. However, there are almost no companies that provide the full range of services associated with wedding planning and execution.

4.3.1 Competition and Buying Patterns

An analysis of competitors has shown that 20 companies in the Eugene area offer some form of wedding planning services. However, the majority of these competitors only offer limited services such as catering, flower arrangements, or gifts. Only three of the 25 competitors offer a range of services comparable to TLC Wedding Consultants. The major competitors with brief descriptions of their services are:

- Rent-An-Action – offers ceremony preparation, rehearsing, and execution services.

- Cross & Reeves – provides flower and catering arrangements and wedding consulting services.

- Lafayette Wedding – offers entertaining, catering, floral design, and hair styling services.

Market research has indicated that customers expect complete wedding consulting services to be expensive, and they budget accordingly. Lower prices are often associated with poor service quality. By offering a complete range of wedding services under one roof, TLC Wedding Consultants will provide customers with the convenience of one-stop shopping.

Strategy and Implementation Summary

Our strategy is simple: provide customers with a wide range of services tailored to their individual needs. Whether they require a complete package or consulting on a particular service, we can help.

5.1 Competitive Edge

By offering a complete range of wedding services under one roof, TLC Wedding Consultants will provide customers with the convenience of one-stop shopping. The company will leverage its owners’ expertise in planning events to position itself as a premier provider of wedding services. Both owners have strong communication skills that will help generate positive word-of-mouth about the high quality of TLC Wedding Consultants’ services.

To develop effective business strategies, perform a SWOT analysis of your business. Learn how to perform a SWOT analysis with our free guide and template.

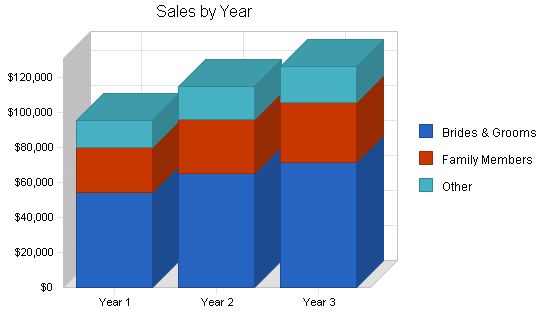

5.2 Sales Strategy

The company’s sales strategy will include:

- Advertising in the Yellow Pages with a two-inch by three-inch ad describing services

- Placing advertisements in local press, including The Register Guard, Eugene Weekly, and The Oregon Daily Emerald

- Developing affiliate relationships with other service providers, such as florists, hair stylists, and caterers

- Generating sales leads through word-of-mouth referrals in the local community

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Brides & Grooms | $54,200 | $65,040 | $71,544 |

| Family Members | $25,800 | $30,960 | $34,056 |

| Other | $15,300 | $18,360 | $20,196 |

| Total Sales | $95,300 | $114,360 | $125,796 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Row 1 | $0 | $0 | $0 |

| Row 1 | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

Management Summary

Our wedding consultants, Darla and Micah Johnson, collectively have planned and serviced over 150 weddings and receptions. They are well-versed in all aspects of planning, decorating, and budgeting. Darla holds a BS in Communications and a minor in Interior Decorating. She has been a wedding consultant for five years and became interested in providing consultant services after successfully planning her first five weddings for family and friends. Darla has received extensive training in wedding planning and is certified by the National Association of Wedding Consultants and Professional Wedding Planners. Micah has an Associates Degree in Fashion Design and, like Darla, became interested in becoming a consultant after successfully planning her first three weddings. Micah is certified by the National Association of Wedding Consultants and has been a wedding planner for three years. Micah enjoys planning both traditional and nontraditional weddings.

6.1 Personnel Plan

Initially, TLC Wedding Consultants will only have the two owners working full time. According to the personnel plan, we expect to hire an additional wedding consultant in the next year. This person will work full time but will not be involved in the management decisions.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Owner | $53,100 | $76,200 | $85,800 |

| Other | $0 | $0 | $0 |

| Total People | 0 | 0 | 0 |

| Total Payroll | $53,100 | $76,200 | $85,800 |

Financial Plan

The financial plan of TLC Wedding Consultants includes the following subtopics.

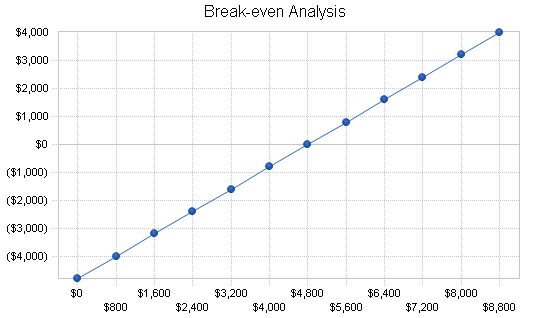

7.1 Break-even Analysis

The following table and chart summarize our break-even analysis.

| Break-even Analysis | |

| Monthly Revenue Break-even | $4,804 |

| Assumptions: | |

| Average Percent Variable Cost | 0% |

| Estimated Monthly Fixed Cost | $4,804 |

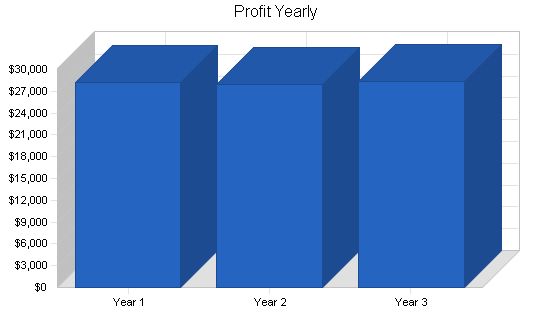

7.2 Projected Profit and Loss

The projected profit and loss are shown in the table below.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $95,300 $114,360 $125,796

Direct Cost of Sales $0 $0 $0

Other $0 $0 $0

Total Cost of Sales $0 $0 $0

Gross Margin $95,300 $114,360 $125,796

Gross Margin % 100.00% 100.00% 100.00%

Expenses

Payrоll $53,100 $76,200 $85,800

Sales and Marketing and Other Expenses $4,550 $1,000 $2,000

Depreciation $0 $0 $0

Leased Equipment $0 $0 $0

Utilities $0 $0 $0

Insurance $0 $0 $0

Rent $0 $0 $0

Payroll Taxes $0 $0 $0

Other $0 $0 $0

Total Operating Expenses $57,650 $77,200 $87,800

Profit Before Interest and Taxes $37,650 $37,160 $37,996

EBITDA $37,650 $37,160 $37,996

Interest Expense $0 $0 $0

Taxes Incurred $9,443 $9,290 $9,657

Net Profit $28,208 $27,870 $28,339

Net Profit/Sales 29.60% 24.37% 22.53%

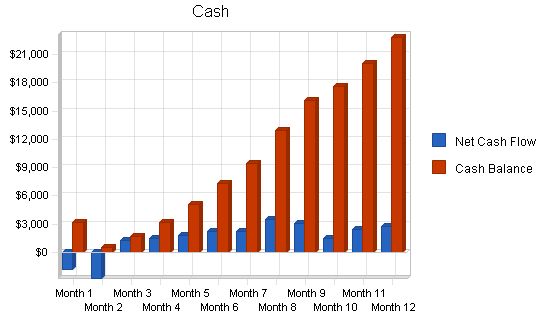

7.3 Projected Cash Flow

The following chart and table present our cash flow projections.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $38,120 | $45,744 | $50,318 |

| Cash from Receivables | $45,494 | $66,279 | $74,075 |

| Subtotal Cash from Operations | $83,614 | $112,023 | $124,394 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $83,614 | $112,023 | $124,394 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $53,100 | $76,200 | $85,800 |

| Bill Payments | $12,748 | $10,689 | $11,545 |

| Subtotal Spent on Operations | $65,848 | $86,889 | $97,345 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $65,848 | $86,889 | $97,345 |

| Net Cash Flow | $17,766 | $25,134 | $27,049 |

| Cash Balance | $22,766 | $47,900 | $74,949 |

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

7.4 Projected Balance Sheet

Three years of annual totals are presented in the Projected Balance Sheet below. First year monthly figures are included in the appendix.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $22,766 | $47,900 | $74,949 |

| Accounts Receivable | $11,686 | $14,023 | $15,426 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $34,452 | $61,923 | $90,374 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $34,452 | $61,923 | $90,374 |

| Liabilities and Capital | |||

| Year 1 | Year 2 | Year 3 | |

| Current Liabilities | |||

| Accounts Payable | $1,245 | $846 | $958 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $1,245 | $846 | $958 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $1,245 | $846 | $958 |

| Paid-in Capital | $8,000 | $8,000 | $8,000 |

| Retained Earnings | ($3,000) | $25,208 | $53,078 |

| Earnings | $28,208 | $27,870 | $28,339 |

| Total Capital | $33,208 | $61,078 | $89,416 |

| Total Liabilities and Capital | $34,452 | $61,923 | $90,374 |

| Net Worth | $33,207 | $61,078 | $89,416 |

7.5 Business Ratios

The following table outlines some of the more important ratios from the Personal Services industry. The final column, Industry Profile, details specific ratios based on the industry as it is classified by the Standard Industry Classification (SIC) code, 7299.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 20.00% | 10.00% | 17.90% |

| Percent of Total Assets | ||||

| Accounts Receivable | 33.92% | 22.65% | 17.07% | 11.10% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 37.10% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 52.80% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 47.20% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 3.61% | 1.37% | 1.06% | 33.90% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 28.00% |

| Total Liabilities | 3.61% | 1.37% | 1.06% | 61.90% |

| Net Worth | 96.39% | 98.63% | 98.94% | 38.10% |

| Percent of Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 100.00% | 100.00% | 100.00% | 0.00% |

| Selling, General & Administrative Expenses | 70.37% | 75.63% | 77.35% | 72.70% |

| Advertising Expenses | 3.52% | 0.87% | 1.59% | 2.20% |

| Profit Before Interest and Taxes | 39.51% | 32.49% | 30.20% | 4.00% |

| Main Ratios | ||||

| Current | 27.68 | 73.22 | 94.32 | 1.81 |

| QuickPersonnel Plan:

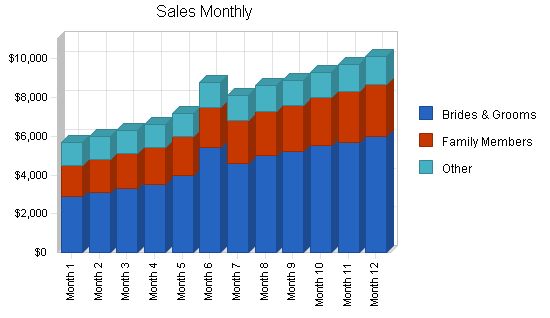

Owner: 0% – $4,000 (Months 1-12) Other: 0% – $0 (Months 1-12) Total People: 0 (Months 1-12) Total Payroll: $4,000 (Months 1-12) General Assumptions: Plan Month: 1-12 Current Interest Rate: 10.00% (Months 1-12) Long-term Interest Rate: 10.00% (Months 1-12) Tax Rate: 30.00% (Month 1), 25.00% (Months 2-12) Other: 0 Pro Forma Profit and Loss: Sales: $5,700 (Month 1), $6,000 (Month 2), $6,300 (Month 3), $6,600 (Month 4), $7,200 (Month 5), $8,800 (Month 6), $8,100 (Month 7), $8,600 (Month 8), $8,900 (Month 9), $9,300 (Month 10), $9,700 (Month 11), $10,100 (Month 12) Direct Cost of Sales: $0 (Months 1-12) Other: $0 (Months 1-12) Total Cost of Sales: $0 (Months 1-12) Gross Margin: $5,700 (Month 1), $6,000 (Month 2), $6,300 (Month 3), $6,600 (Month 4), $7,200 (Month 5), $8,800 (Month 6), $8,100 (Month 7), $8,600 (Month 8), $8,900 (Month 9), $9,300 (Month 10), $9,700 (Month 11), $10,100 (Month 12) Gross Margin %: 100.00% (Months 1-12) Expenses: Payroll: $4,000 (Months 1-12) Sales and Marketing and Other Expenses: $1,100 (Month 1), $250 (Months 2-3, 5-12), $600 (Month 4) Depreciation: $0 (Months 1-12) Leased Equipment: $0 (Months 1-12) Utilities: $0 (Months 1-12) Insurance: $0 (Months 1-12) Rent: $0 (Months 1-12) Payroll Taxes: 15% Other: $0 (Months 1-12) Total Operating Expenses: $5,100 (Month 1), $4,250 (Months 2-9), $5,950 (Months 10-12) Profit Before Interest and Taxes: $600 (Month 1), $1,750 (Month 2), $2,050 (Month 3), $2,350 (Month 4), $2,600 (Month 5), $4,550 (Month 6), $3,850 (Month 7), $4,350 (Month 8), $4,300 (Month 9), $3,350 (Month 10), $3,750 (Month 11), $4,150 (Month 12) EBITDA: $600 (Month 1), $1,750 (Month 2), $2,050 (Month 3), $2,350 (Month 4), $2,600 (Month 5), $4,550 (Month 6), $3,850 (Month 7), $4,350 (Month 8), $4,300 (Month 9), $3,350 (Month 10), $3,750 (Month 11), $4,150 (Month 12) Interest Expense: $0 (Months 1-12) Taxes Incurred: $180 (Month 1), $438 (Month 2), $513 (Month 3), $588 (Month 4), $650 (Month 5), $1,138 (Month 6), $963 (Month 7), $1,088 (Month 8), $1,075 (Month 9), $838 (Month 10), $938 (Month 11), $1,038 (Month 12) Net Profit: $420 (Month 1), $1,313 (Month 2), $1,538 (Month 3), $1,763 (Month 4), $1,950 (Month 5), $3,413 (Month 6), $2,888 (Month 7), $3,263 (Month 8), $3,225 (Month 9), $2,513 (Month 10), $2,813 (Month 11), $3,113 (Month 12) Net Profit/Sales: 7.37% (Month 1), 21.88% (Month 2), 24.40% (Month 3), 26.70% (Month 4), 27.08% (Month 5), 38.78% (Month 6), 35.65% (Month 7), 37.94% (Month 8), 36.24% (Month 9), 27.02% (Month 10), 28.99% (Month 11), 30.82% (Month 12) Pro Forma Cash Flow |

||||

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| $2,280 | $2,400 | $2,520 | $2,640 | $2,880 | $3,520 | $3,240 | $3,440 | $3,560 | $3,720 | $3,880 | $4,040 | ||

| Cash from Operations | |||||||||||||

| Cash Sales | $2,280 | $2,400 | $2,520 | $2,640 | $2,880 | $3,520 | $3,240 | $3,440 | $3,560 | $3,720 | $3,880 | $4,040 | |

| Cash from Receivables | $0 | $114 | $3,426 | $3,606 | $3,786 | $3,972 | $4,352 | $5,266 | $4,870 | $5,166 | $5,348 | $5,588 | |

| Subtotal Cash from Operations | $2,280 | $2,514 | $5,946 | $6,246 | $6,666 | $7,492 | $7,592 | $8,706 | $8,430 | $8,886 | $9,228 | $9,628 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | |||||||||||||

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | |||||||||||||

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Long-term Liabilities | |||||||||||||

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Other Current Assets | |||||||||||||

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Long-term Assets | |||||||||||||

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Investment Received | |||||||||||||

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Received | $2,280 | $2,514 | $5,946 | $6,246 | $6,666 | $7,492 | $7,592 | $8,706 | $8,430 | $8,886 | $9,228 | $9,628 | |

| Expenditures | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $5,700 | $5,700 | $5,700 | |

| Bill Payments | $43 | $1,260 | $690 | $765 | $851 | $1,255 | $1,382 | $1,217 | $1,349 | $1,655 | $1,091 | $1,191 | |

| Subtotal Spent on Operations | $4,043 | $5,260 | $4,690 | $4,765 | $4,851 | $5,255 | $5,382 | $5,217 | $5,349 | $7,355 | $6,791 | $6,891 | |

| Additional Cash Spent | |||||||||||||

Business Plan Outline

|

|||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!